All You Need to Know About FIRC: A Complete Guide

Navigating international business is a puzzle, and one piece of that puzzle is the Foreign Inward Remittance Certificate or FIRC. However, many businesses aren't sure what an FIRC is or how to get one without jumping through hoops.

If you're involved in providing services globally, you have to follow certain compliance requirements. That's where the FIRC comes in. It's a document that provides proof of foreign payments and holds key information such as - how much money is involved, the currency used, the transaction date, and the sender’s name from abroad.

But here's the tricky part: getting your hands on an FIRC can be a bit of a headache. It often involves going back and forth with the bank and navigating the red tape.

This blog breaks down FIRC meaning, why it's important, and what the RBI (Reserve Bank of India) says about it. You will also learn about the documents you need and guide you on how to get your FIRC without all the fuss.

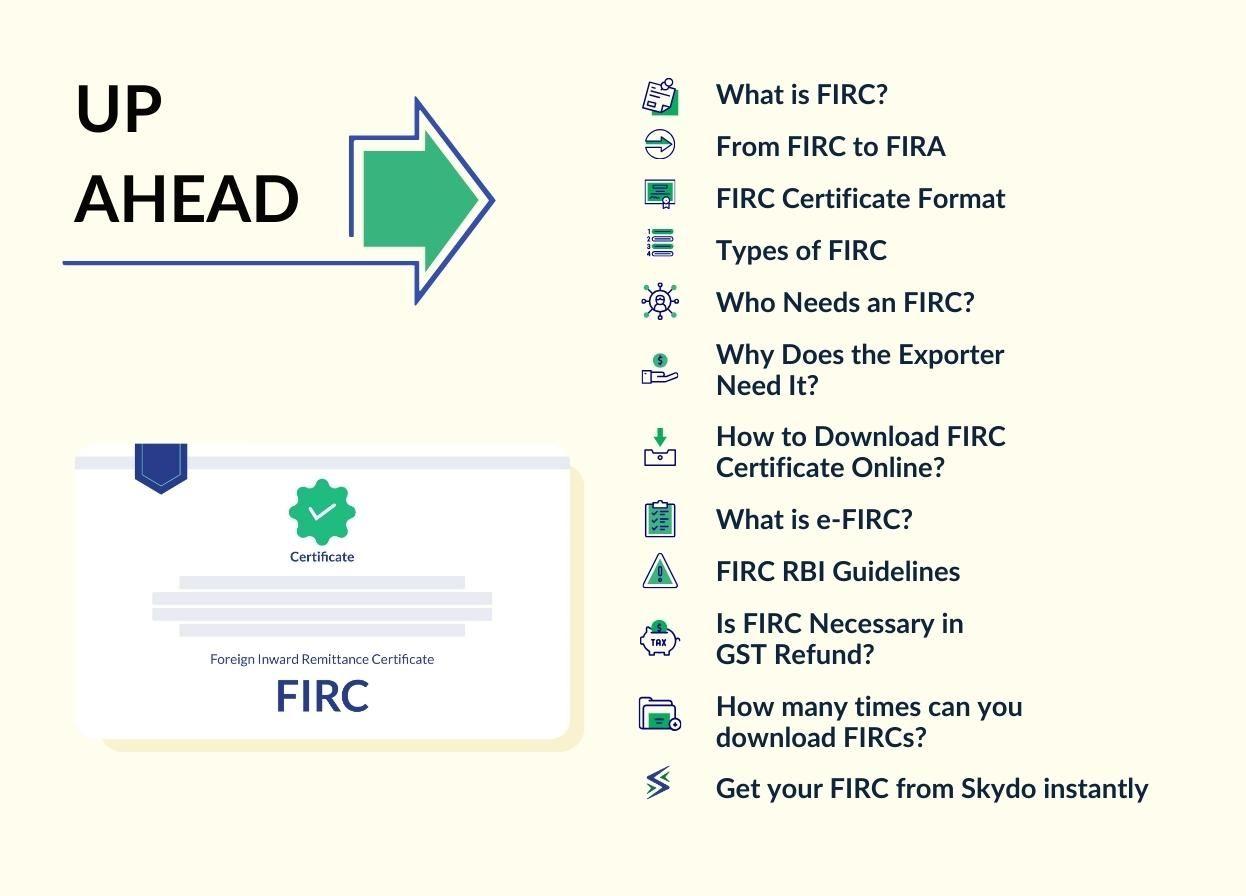

What is FIRC?

FIRC, meaning Foreign Inward Remittance Certificate, serves as evidence of foreign payments made to your business. Issued by authorised banks in India, FIRC is tangible evidence of foreign funds finding their way into the accounts of businesses within the country. Before 2016, banks used to issue this document on secured pre-printed stationery.

This certificate acts as official proof of receiving money against the exports of goods, software, or services. As a service exporter, you need to present this document to the tax department to confirm that money has been realised against their service exports.

From FIRC to FIRA

Around 2016, RBI introduced a system, Export Data Processing Management System (EDPMS), to digitally record all exported data. EDPMS is the foundational platform operated by RBI, which records two-way data.

- Goods export data (Shipping bills) recorded by customs at port locations, and Software export data (SOFTEX) recorded by Software Technology Parks of India

- Export Payments recorded by AD bank that received the Foreign Exchange

With the introduction of EDPMS, the FEDAI issued guidelines to banks to -

- Issue physical FIRCs only for capital account transactions, e.g., FDI / FII inwards

- Discontinue physical FIRCs for export inwards and instead generate IRM (Inward Remittance) number on the EDPMS system

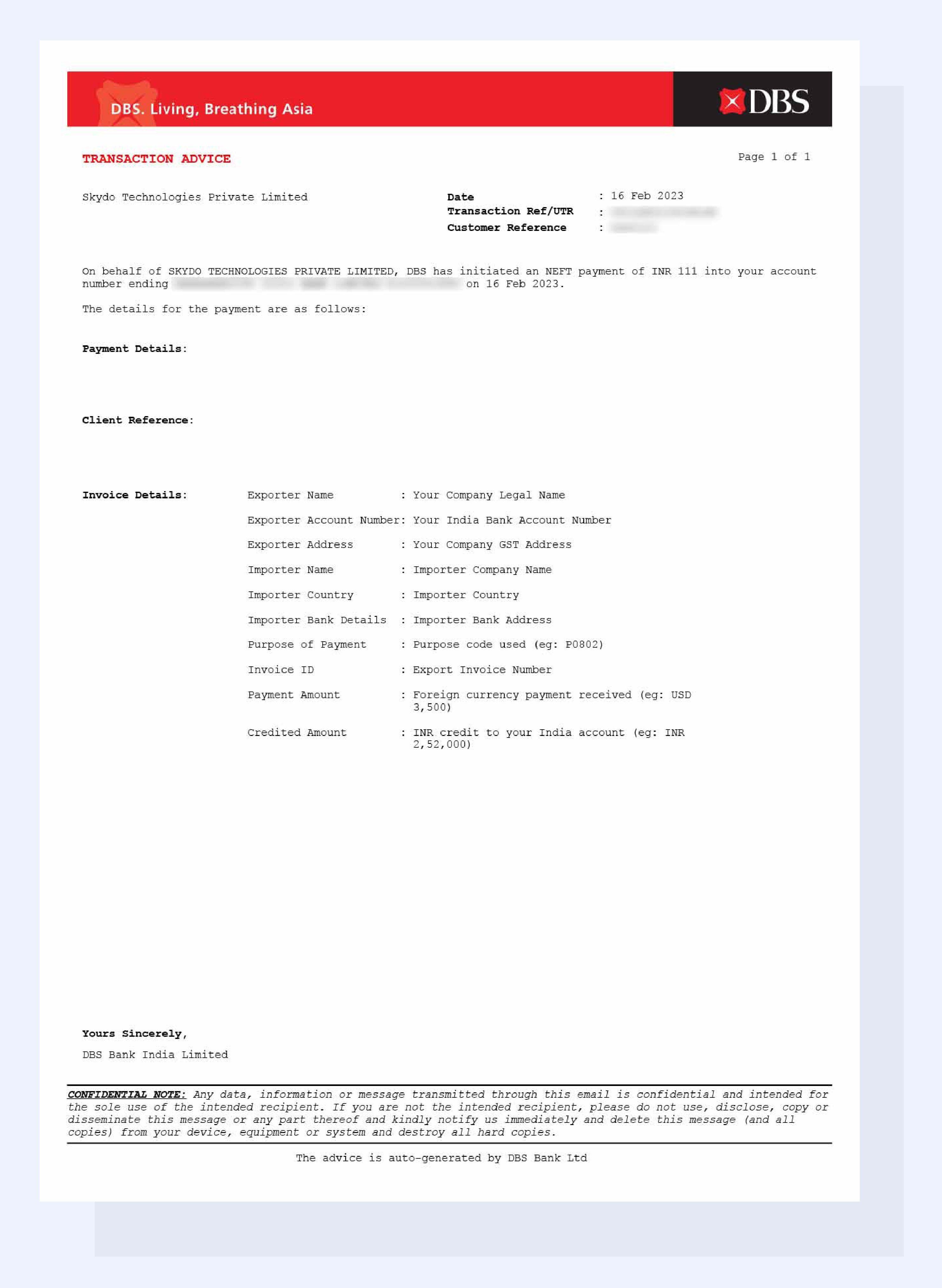

Accordingly, for amounts disbursed by foreign businesses, banks started issuing the FIRA, full form Foreign Inward Remittance Advice, to the exporter, which is a document on the bank’s letterhead consisting of details such as exporter name, export amount, INR amount, credit date, etc.

FIRA is sometimes interchangeably referred to as FIRS. FIRA is typically an on-demand process at most banks and even fintech platforms and can be hard to get, often requiring many follow-ups.

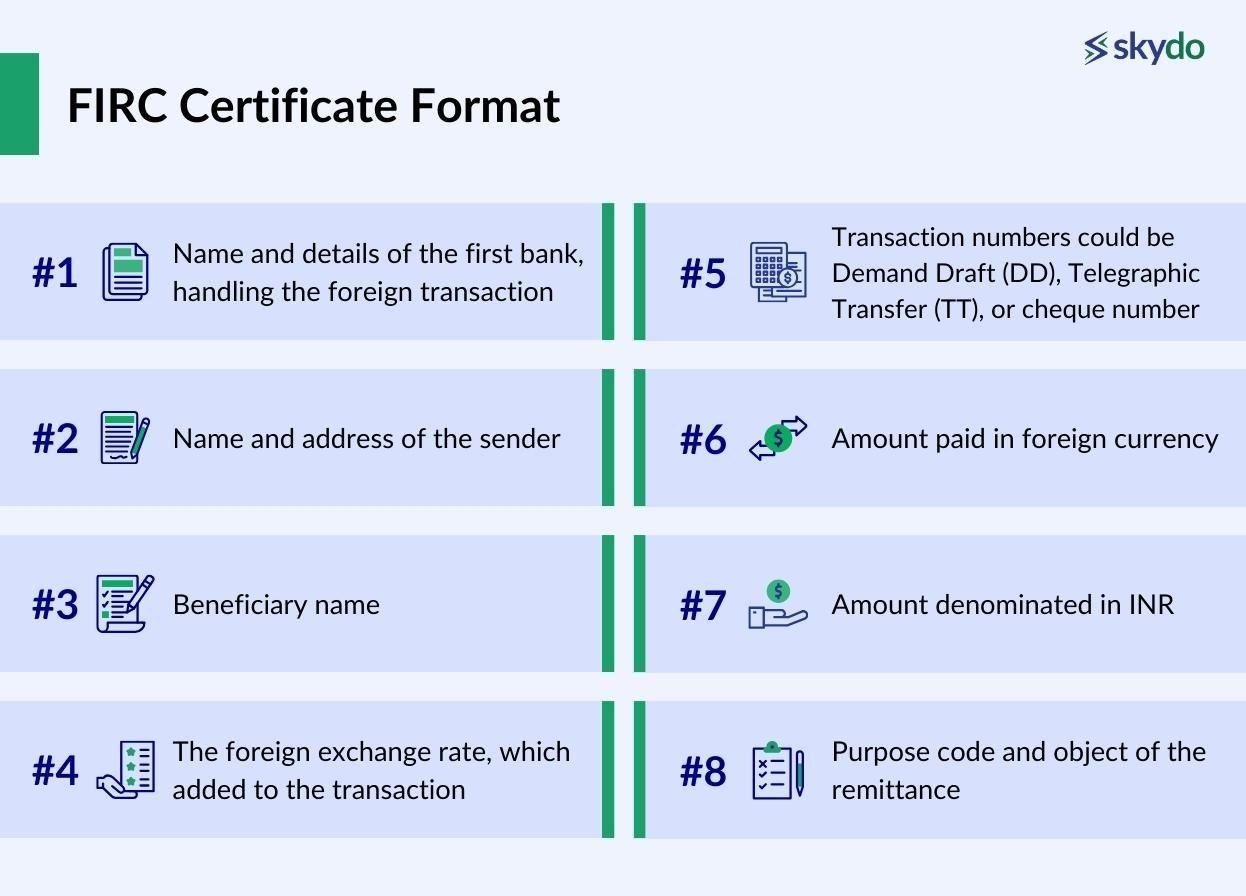

FIRC Certificate Format - What does an FIRC look like?

The FIRC format contains the following information in the document structure as shown in the image.

- Name and details of the first bank, handling the foreign transaction

- Name and address of the sender

- Beneficiary name

- Transaction numbers could be Demand Draft (DD), Telegraphic Transfer (TT), or cheque number

- The foreign exchange rate, which added to the transaction

- Amount paid in foreign currency

- Amount denominated in INR

- Purpose code and object of the remittance

Types of FIRC

There are two primary types of Foreign Inward Remittance Certificates (FIRCs).

- FIRC for inward remittances: This document is issued by banks to individuals or businesses receiving funds from abroad. It serves as proof of the money's source, aiding in compliance with tax and regulatory requirements.

- FIRC for foreign investments: Investors repatriating funds or earning dividends from their foreign investments need this certificate. It confirms the legality of their earnings, ensuring a smooth repatriation process.

Who Needs an FIRC?

In India, a FIRC is a crucial document required by various entities engaged in international financial transactions. Those who need to obtain an FIRC include:

Why Does the Exporter Need It?

Here are four reasons why an FIRC document is needed.

#1: Ensures Compliance with Regulations

The FIRC helps your business fulfil its obligations and maintain a robust regulatory framework. Some key aspects of regulatory compliance associated with export remittances are as follows.

Regulatory Compliance with RBI

For businesses involved in export remittances, compliance with RBI guidelines is mandatory to ensure smooth fund flow within and outside the country. FIRC meets these requirements by providing an official record of foreign funds received for specific export transactions.

It further offers a standardised format for recording remittance details, making it easier for businesses to meet reporting deadlines accurately.

Transparency and Legitimacy

Maintaining transparency in financial transactions prevents money laundering.

FIRC in export contributes to transparency by providing comprehensive details about each inward remittance, including the name of the overseas sender, invoice amount, remittance date, and more. This detailed record promotes trust and credibility between businesses and regulatory bodies.

Audits and Compliance Checks

Regulatory authorities may conduct periodic audits and compliance checks to ensure businesses operate within the established legal framework.

During such audits, having well-documented FIRCs helps authorities verify the accuracy and legitimacy of export remittances, further strengthening businesses' compliance with regulations.

#2: Facilitates Audit and Accounting Processes

The Foreign Inward Remittance Certificate (FIRC) provides crucial information such as the invoice amount, currency, date of remittance, and the name of the overseas buyer.

By capturing these vital transactional details, FIRC simplifies the task of businesses to reconcile their accounts effectively. With standardised and organised documentation of foreign funds received, you can match each remittance to its corresponding export transaction, ensuring accuracy and transparency in financial reporting.

#3: Ensure Credit Facility and Working Capital Management

FIRC in export activities is pivotal in facilitating credit assessments. Financial institutions and lenders often require concrete evidence of a company's export earnings and the stability of its cash flows before extending credit facilities.

FIRA is evidence of foreign funds received for specific export transactions and stable cash flow, providing lenders with a clear record of the company's export earnings.

#4: Simplifies Tax Compliance

FIRC assists businesses in determining their tax liability, including taxes such as Goods and Services Tax (GST) and income tax. With FIRC, you can accurately identify and report the income generated from export activities.

The certificate enables you to calculate your taxable income with precision and transparency. Accurate and timely tax compliance is paramount to avoid penalties and maintain good standing with tax authorities.

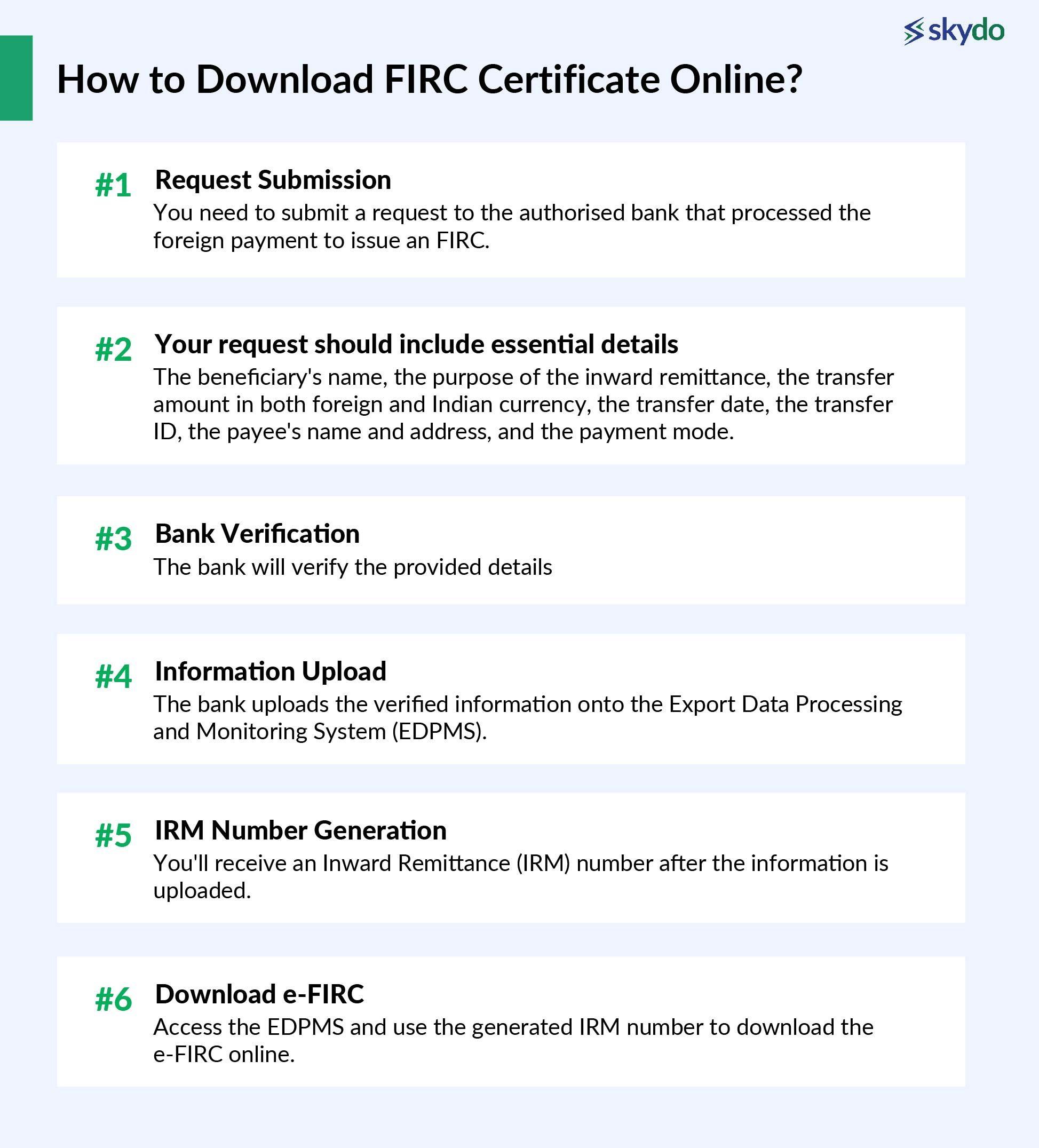

How to Download FIRC Certificate Online?

Downloading a FIRC certificate online is a multi-step process. Here's how you can get this document.

- Request Submission: You need to submit a request to the authorised bank that processed the foreign payment to issue an FIRC.

- Your request should include essential details: The beneficiary's name, the purpose of the inward remittance, the transfer amount in both foreign and Indian currency, the transfer date, the transfer ID, the payee's name and address, and the payment mode.

- Bank Verification: The bank will verify the provided details.

- Information Upload: The bank uploads the verified information onto the Export Data Processing and Monitoring System (EDPMS).

- IRM Number Generation: You'll receive an Inward Remittance (IRM) number after the information is uploaded.

- Download e-FIRC: Access the EDPMS and use the generated IRM number to download the e-FIRC online.

However, this process takes around 7-15 days, but by using a payment platform like Skydo, you can instantly download your FIRCs after each cross-border transaction.

What is e-FIRC?

An electronic Foreign Inward Remittance Certificate (e-FIRC) is a digital alternative to the traditional FIRC.

In line with RBI guidelines, e-FIRC issuance has replaced physical FIRC issuance for most transactions since 2016, excluding cases like FDI and FII.

To obtain an e-FIRC, beneficiaries must request their bank upload payment receipts on the Export Data Processing and Monitoring System (EDPMS), which ensures compliance with transparent cross-border transaction records.

Upon request, the bank uploads the receipt, generating an Inward Remittance (IRM) number, which serves as the e-FIRC number. e-FIRC streamlines remittance documentation and facilitates easy tracking of the purpose behind the money transfer.

FIRC RBI Guidelines

As per RBI and FEDAI (Foreign Exchange Dealers Association in India) guidelines, only certain banks known as AD Category I banks can issue the Foreign Inward Remittance Certificate (FIRC).

These certificates are crucial for recording international money transfers and are typically linked to import-export transactions. They involve codes like the IEC (Import-Export Code) issued by the DGFT, necessary for trade in India, and the 14-digit AD Code provided by the bank where the exporter holds an account, essential for customs clearance.

Is FIRC Necessary in GST Refund?

FIRC document is essential for claiming a GST refund on goods or services exported from India. It verifies the payments received in foreign currencies and confirms that the claim for a GST refund is legitimate and not fraudulent. FIRC is a compulsory requirement for claiming GST refunds on exports of goods and services.

How many times can you download FIRCs?

The number of times you can download Foreign Inward Remittance Certificates (FIRCs) may vary depending on the policies and procedures of the issuing bank. In many cases, you can download FIRCs multiple times if needed for record-keeping and compliance purposes.

However, it's essential to check with your specific bank and the relevant regulatory authorities to understand the exact download limits and any associated fees or conditions.

However, payment platform like Skydo allows you to download FIRCs multiple times with ease, eliminating any inconvenience of waiting for the FIRC from the bank. This makes the process highly efficient and convenient, especially for exporters handling multiple foreign clients.

Get your FIRC from Skydo instantly

Skydo simplifies the generation of Foreign Inward Remittance Certificates (FIRCs) with unmatched efficiency. It automates the process, eliminating the need for manual document creation and management, reducing errors, and offering a hassle-free solution.

You can effortlessly download all your FIRCs with just a single click through intuitive, user-friendly dashboards. This streamlines access to crucial documents, allowing businesses to efficiently monitor and manage their export remittance documentation.

Furthermore, Skydo's automated FIRC generation ensures strict compliance with Indian tax laws. It follows the prescribed formats and guidelines, helping businesses meet the regulatory requirements set by the Reserve Bank of India (RBI) and other relevant authorities. This not only eases the burden of ensuring compliance but also reinforces a business's credibility with regulatory bodies.

Conclusion

A FIRC document’s advantages are multifold, ranging from ensuring compliance with regulatory requirements and facilitating audit and accounting processes to enabling access to credit facilities. Businesses prioritising FIRC gain a competitive edge by fostering transparency, credibility, and financial efficiency in their global operations.

Explore Skydo today and unlock a world of efficiency, accuracy, and compliance in your export remittance documentation.

FIRC RBI Circulars/References

FEDAI circular SPL-04/2016 dated April 21, 2016.

RBI circular RBI/2015-16/414 A.P. (DIR Series) Circular number 74 dated May 26, 2016.

FEDAI circular SPL-09/2016 dated June 08, 2016.

FEDAI circular Letter number 16/2016 dated October 17, 2016

Frequently Asked Questions

Q1. How and where to get an FIRC certificate?

Ans: You can obtain your FIRC certificates from your payment gateway partner or bank. It requires a certain amount of back-and-forth to obtain the FIRC from a bank. However, Skydo Users can download all their FIRCs from the dashboard with a single click.

Q2. What is the FIRC number?

Ans: The FIRC (Foreign Inward Remittance Certificate) number is a unique identifier issued by banks in India to track and verify foreign currency transactions, especially for international money transfers.

Q3. Why is FIRC required, and when do I need it?

Ans: A Foreign Inward Remittance Certificate (FIRC) is required for Indian businesses to validate incoming foreign currency transactions, often needed for various purposes, like foreign exchange, business transactions, or investments.

Q4. Who issues FIRC certificates?

Ans: Foreign Inward Remittance Certificates (FIRCs) are issued by authorised AD Category I banks in India, specifically those banks categorised under the same selection, per RBI and FEDAI guidelines.

Q5. What is FIRC in banking? Or What is FIRC in banking terms?

Ans: In banking, a FIRC copy is a document issued by authorised Indian banks to confirm and record incoming foreign currency transactions for various financial and regulatory purposes.

Q6. How to get a duplicate FIRC?

Ans: To obtain a duplicate Foreign Inward Remittance Certificate (FIRC), you typically need to follow these steps:

Contact Your Bank: Reach out to the bank through which the foreign funds were received. Inform them that you need a duplicate FIRC.

Provide Details: Be ready to provide details about the original FIRC, such as the FIRC number, date of the transaction, and any other relevant information. This will help the bank locate the specific transaction.

Submit a Written Request: In most cases, the bank will require you to submit a written request for the duplicate FIRC. This request should include your contact information, the reason for needing a duplicate, and any other required details.

Pay Fees (if applicable): Some banks may charge a fee for issuing a duplicate FIRC. Ensure you inquire about any associated fees and be prepared to make the payment if necessary.

Bank's Verification: The bank will verify the information and details you provided to confirm the need for a duplicate FIRC.

Issuance of Duplicate FIRC: Once the bank has verified your request, they will issue the duplicate FIRC with the necessary information. This duplicate document should serve the same purpose as the original.

Maintain Records: Keep the duplicate FIRC as part of your financial records for compliance and transparency.

It's important to note that the specific process for obtaining a duplicate FIRC may vary from one bank to another, so it's advisable to contact your bank and inquire about their procedures and requirements for obtaining a duplicate FIRC.

Alternatively, if you are a Skydo customer, you can download the same FIRC from the dashboard if you lose the previous copy.

Q7. What are FIRC charges/do I need to pay to receive my FIRA?

Ans: Some payment service providers charge a fee for providing FIRCs. For example, Wise charges $2.5 to provide an e-FIRC for each transaction. However, if you use Skydo, you can receive an instant GST-compliant FIRC for free with each transaction.

Q8. Is FIRC mandatory for freelancers?

Ans: Yes, FIRC copy is mandatory for freelancers who receive foreign payments. They act as proof for foreign remittances. It is mandatory for freelancers and sole proprietors who receive payments from outside India.

Q9. If the company provides software exports, will it be eligible for FIRC?

Ans: Yes, a company engaged in software exports can be eligible for a Foreign Inward Remittance Certificate (FIRC) for receiving payments in foreign currency for their exported services.

Q10. What is FIRS? Foreign inward remittance statement?

Ans: A Foreign Inward Remittance Statement (FIRS) is a document issued by a bank containing details of received inward remittance.

Q11. What is purpose code?

Ans: A purpose code is a unique code that is issued by the central bank of a country. This code is mandatory for any cross-border transaction that involves foreign currency. It is assigned to each transaction and specifies the purpose for which the transaction is being made.