Basic Hedging Strategies for Global Freelancers

As a freelancer providing services to international clients, you may often encounter significant challenges when receiving payments.

However, some freelancers have tackled this problem by integrating hedging strategies into their financial planning. This shift enables them to focus on enhancing services and attracting more clients.

This blog explores various hedging strategies you can adopt as a freelancer to streamline your journey and reduce stress. However, you must first understand currency risk and the meaning of hedging.

Understanding Currency Risk

The fluctuation in the value of one currency relative to another, known as currency risk or exchange-rate risk, can impact a freelancer's overall income when converting payment currency to their local currency.

For instance, an Indian freelancer agrees to a $1,000 project with a U.S. client at an exchange rate of 75 INR per USD. Anticipating ₹75,000 (1,000 USD * 75 INR), if the USD weakens to 70 INR, the freelancer, earning the same $1,000, receives ₹70,000 (1,000 USD * 70 INR). The lower exchange rate diminishes the income in Indian Rupees, highlighting the impact of currency fluctuations on the freelancer's earnings in their local currency.

To eliminate this loss, you can consider hedging.

What is Hedging for Freelancers?

When planning a day out and the weather forecast hints at rain, tossing an umbrella into your bag is natural.

Hedging, in the freelance context, is akin to having a financial umbrella. It doesn't eliminate the possibility of unfavourable events, but it substantially reduces the impact on your income if they occur. It's a professional and strategic approach to ensuring a more stable financial journey, even when faced with payment-related issues.

Hedging strategies for currency fluctuations

Now that the concept of hedging is clear, let's explore practical techniques freelancers can use to mitigate currency risk effectively.

- Fixed Contracts: Negotiate a Fixed Exchange Rate for the Project Duration

Freelancers can secure stable income by opting for fixed contracts and negotiating a predetermined exchange rate for the project's duration. This hedging technique secures a stable income, irrespective of fluctuations in the rupee-dollar exchange rate during the project timeline.

- Currency Forward Contracts

Currency forward contracts are agreements between a bank and its customers. These contracts ensure that the conversion of currencies will happen at a predetermined rate on a future date, as specified in the contract.

For example, Priya, an Indian freelancer, is set to earn $1,000 from a project with a U.S. client. Worried about the fluctuating exchange rates, she decides to lock in a deal with her bank. They agree that in three months, when the project ends, Priya will convert her $1,000 at a fixed rate of 75 INR per USD.

The agreed rate is like a safety net. Even if the exchange rate increases or decreases in those three months, Priya still gets 75 INR for every USD.

- Diversification of Currency Holdings

An Indian freelancer who typically receives payments in U.S. dollars might consider holding a portion of their earnings in stable currencies like Euro or British Pound. In case one currency experiences a decline in value, the impact on the overall earnings is cushioned by the stability or potential appreciation of other currencies in the portfolio.

Hedging Strategies for Invoicing

Freelancers universally relate to the struggle of investing time and effort into delivering exceptional work and issuing an invoice, only to encounter a client dispute. This not only affects immediate income but also strains client relationships, potentially hurting future opportunities.

To avoid invoice-related struggles, freelancers can employ these hedging techniques.

1. Clear and detailed contracts

Clearly define payment terms, specify when invoices are due, and outline the expected deliverables. Additionally, incorporate dispute resolution methods, detailing the steps to be taken in case of payment disagreements.

2. Upfront payments

Negotiate upfront deposits or milestone payments to alleviate the impact of delayed payments. This approach ensures consistent cash flow throughout the project and reduces dependence on a single final payout.

3. Escrow services

One may also explore escrow services on freelancing platforms or through financial institutions. Acting as intermediaries, these services hold client funds until project completion and client approval.

This ensures you receive payment upon completion, and clients can trust that funds are released only when satisfied with the deliverables.

4. Professional invoicing tools

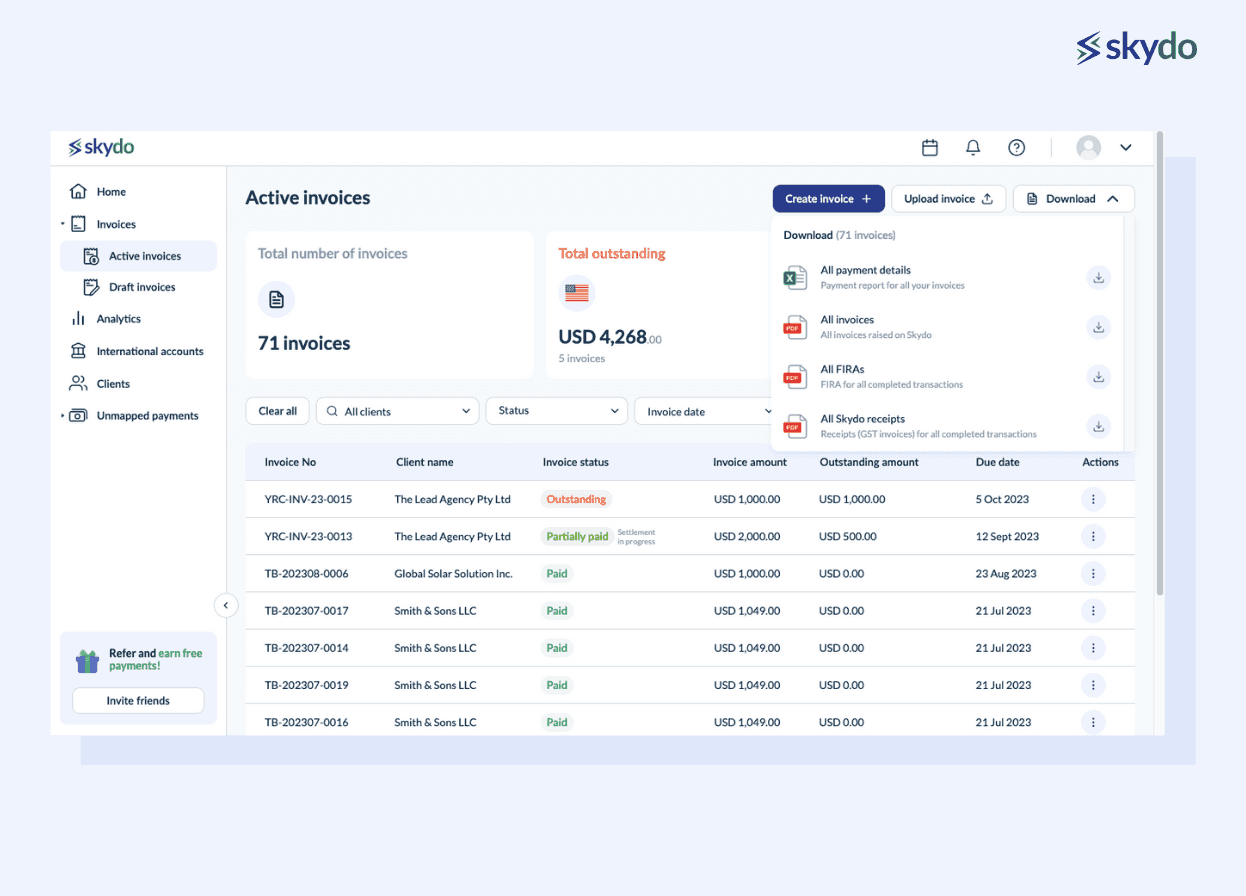

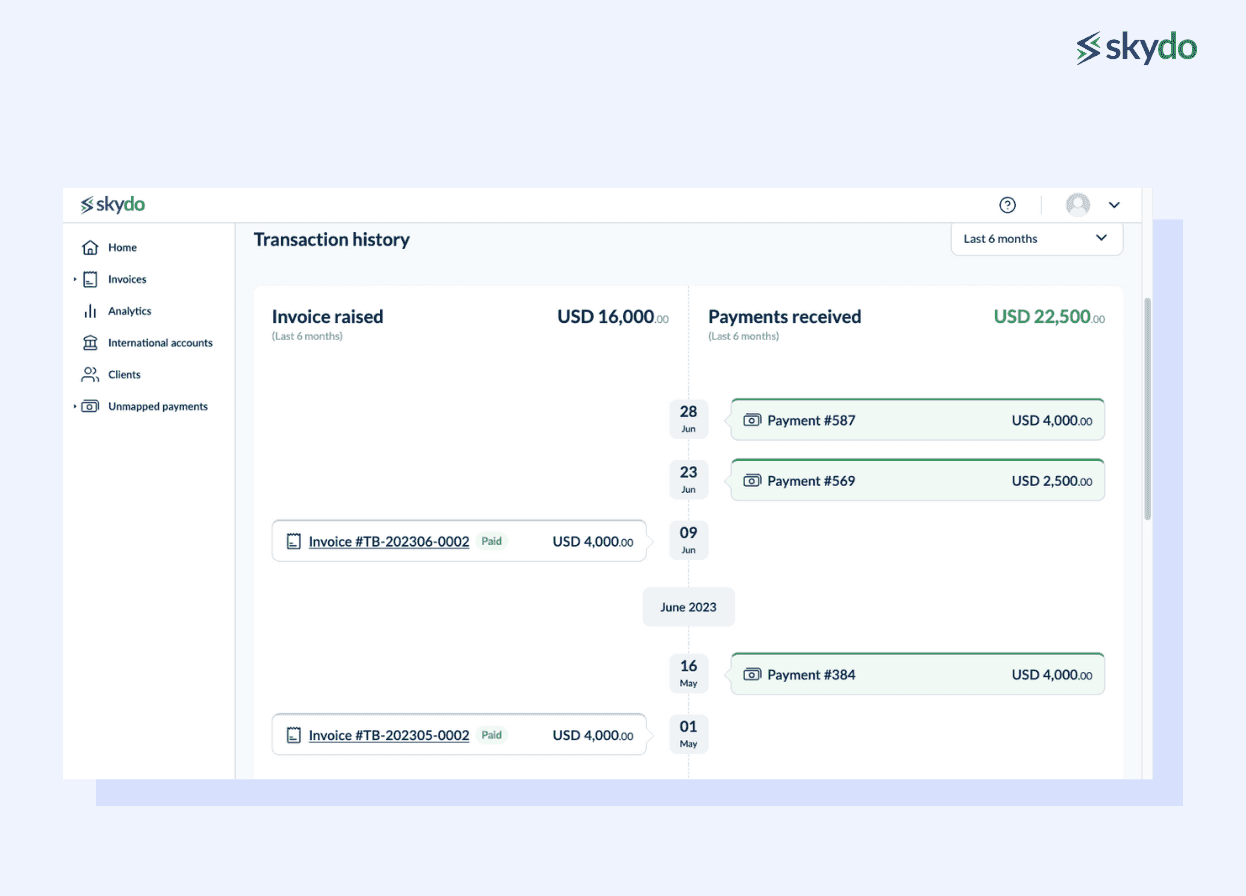

Investing in professional invoicing tools streamlines the invoicing process and enhances payment tracking.

Automation ensures timely issuance of invoices, reducing the chances of delays. Additionally, these tools often provide features for tracking payment status, allowing freelancers to monitor and follow up on outstanding payments efficiently.

Hedging Strategies for Late Payments

As a freelancer, facing delayed client payments can be exceptionally frustrating. To hedge against this issue, consider the following hedging strategies.

- Late payment penalties

Integrate late payment clauses into your contracts, specifying penalties for delayed payments. Accrued interest on overdue amounts can be a financial incentive for clients to adhere to agreed-upon payment timelines.

- Phased delivery

Structure your projects with phased delivery and corresponding payments. This approach ensures that you receive compensation as you progress through the project.

- Credit insurance

For larger projects with substantial financial implications, consider obtaining credit insurance. This type of insurance protects you against the risk of non-payment by clients. While it may involve additional costs, it provides a safety net if clients cannot fulfil their payment obligations.

- Professional collections

In cases of persistent non-payment, consider engaging professional debt collection agencies as a last resort. These agencies specialise in recovering overdue payments and can act as intermediaries. While resorting to collections is a more drastic measure, it can help recover outstanding payments.

Best Practices

1. Using online payment platforms strategically

Navigating the landscape of online payment platforms requires a thoughtful comparison.

Assess fees, conversion rates, and withdrawal options of popular platforms to determine the most cost-effective choice.

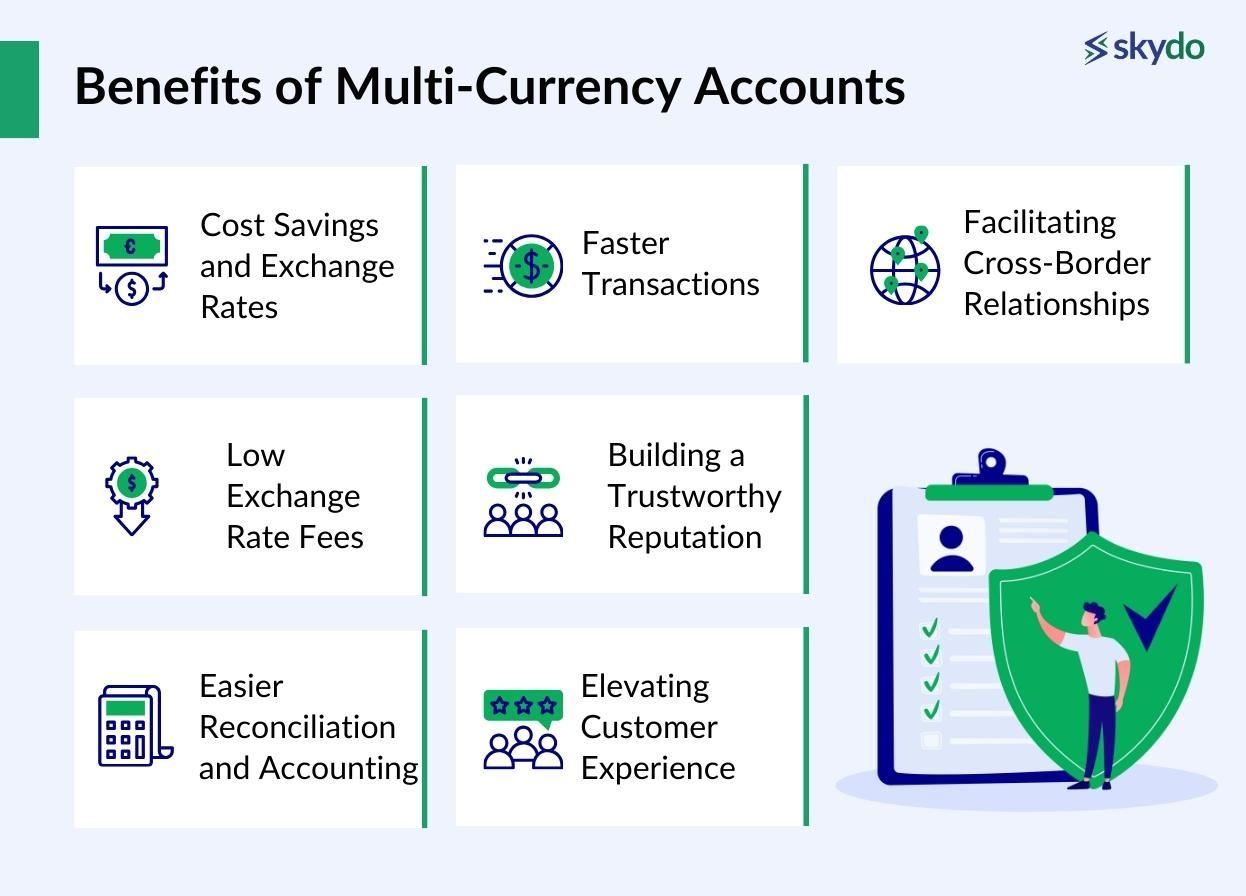

2. Opening multi-currency bank accounts

Explore the advantages of multi-currency bank accounts for freelancers.

Understand how to seamlessly link these accounts with freelancing platforms, facilitating smoother and more cost-effective cross-border transactions.

3. Risk mitigation through contractual agreements

Recognise the significance of clear payment terms in contractual agreements. Address the impact of currency fluctuations in service contracts and implement risk mitigation strategies such as fixed-rate contracts and milestone payments.

4. Monitoring and adapting

Stay proactive by regularly tracking exchange rates and economic trends. Use tools and resources to stay informed about currency markets, allowing you to adjust your hedging strategies based on real-time market conditions.

5. Common pitfalls to avoid

Avoid overreliance on a single client or currency, which can expose you to undue risks. Stay informed about market trends and economic indicators to avoid surprises.

Lastly, regularly review and update your hedging strategies to align with evolving market dynamics and protect against potential pitfalls.

Conclusion

Embarking on international freelancing as an Indian professional has its challenges, like dealing with cultural differences and payment intricacies. However, adopting simple hedging strategies is key to long-term success.

Don't overlook basic hedging strategies—like diversifying your income sources and staying aware of currency market trends. These steps ensure you tackle challenges effectively and set the stage for a resilient and prosperous freelancing career.

Frequently Asked Questions

Q1. Does hedging reduce profit?

Ans. No, hedging doesn't necessarily reduce profit. Instead, it helps manage risks, providing a safety net against potential losses.

Q2. How do you learn hedging?

Ans. Learning hedging involves understanding basic concepts like fixed-rate contracts and diversification. Online resources, tutorials, and practical experience can contribute to mastering these strategies.

Q3. What does the hedge ratio mean?

Ans. The hedge ratio is how much of an asset should be hedged to offset potential losses. It's essentially the proportion of a position covered by a hedging strategy.