Building a Resilient Business: Strategies for Surviving Economic Volatility

What is the common growth factor in companies like Netflix, MailChimp, Groupon, Airbnb, Microsoft, and Warby Parker? Besides being billion-dollar net-worth companies, they experienced growth during recessions or economic volatility but gained immense success.

How did this happen? According to Austrian economist, Joseph Schumpeter, during an economic downturn or what we commonly call a recession, inept businesses exit the market. This allows the availability of better resources for resilient businesses which leads to great innovation opportunities.

However, the availability of resources is not the sole deciding factor. Financial and strategic planning, digital transformation, efficient allocation of resources, restructuring and several other business elements together make resilient businesses.

This blog guides you through the challenges faced by businesses during economic volatility, and how to overcome those and build resilient businesses during recessions.

Significant business challenges posed during an economic downturn

During economic volatility, sales and profits decrease, the cost of raw materials and labour go up, consumer demand decreases, businesses lose out on cash flows, there is a lack of credit in the market, and customers demand cost reductions. All of these challenges pose business continuity risks, and many companies do not survive.

Let's see these challenges in detail and how you can manage them.

1. Reduced Demand

Customer demand for goods and services decreases during economic downturns because people are more concerned about personal finance. It leads to a steep reduction in sales and high inventory volume, thus leading to a loss of revenue.

You can tackle reduced demand by diversifying or expanding the scope of products or services and targeting different audiences or customer segments. Doing market research to analyse the latest consumer trends is further beneficial.

2. Liquidity Crunch

Because of loss in revenue and increased prices, businesses also face liquidity crunch during economic volatility. It restricts daily operations and the organisation’s capital growth.

Liquidity crunch is manageable by optimising working capital flow, renegotiating payment terms in contracts with suppliers and customers, and collecting receivables. Businesses can also use their assets as security to raise funds or liquidate their extra inventory.

3. Business Uncertainty and Continuity Risks

During an economic downturn, economists or market researchers cannot correctly estimate the duration. Thus, business uncertainties are at an all-time high.

You can mitigate business uncertainty risk by diversifying assets and investments, identifying gaps or opportunities in the market, and training the workforce. Tech export businesses can build an agile business operational model by integrating Agile methodologies and DevOps techniques.

Opportunities for businesses during downturns

Economic volatility can create a huge dent in the business growth path. However, a recession may also turn out to be a blessing in disguise for businesses.

- Availability of Resources

During periods of economic downturn, many businesses face cash flow challenges that can hinder their operations. However, these times can also offer unique opportunities to tap into market resources that are usually overlooked. Leveraging these resources can catalyse resilience and foster sustainable growth, turning challenging times into a launchpad for potential expansion.

- Innovation

High financial risk and uncertainty deter businesses from working on new ideas or plans, and they focus on marketing their existing products. However, you can use the resources to innovate new technologies or products that solve complex consumer challenges.

You can use resources to carry out research and development. One of the prime examples of a business that survived tough times through innovation is Apple. The company innovated with digital technology and introduced iPod and iTunes in the market.

- Retain Quality Talent

Many businesses execute mass layoffs during a recession. However, economic volatility is the best opportunity to retain a quality workforce in your organisation. It motivates the employee and leads to better performance and overall growth.

How to build a resilient business and what are the elements of a resilient business?

Resilience refers to a business's ability to recover its value proposition during unexpected or unfavourable circumstances.

However, building a resilient business does not necessarily happen during the downturn. These are times when contingency planning proves beneficial from the company’s inception stage.

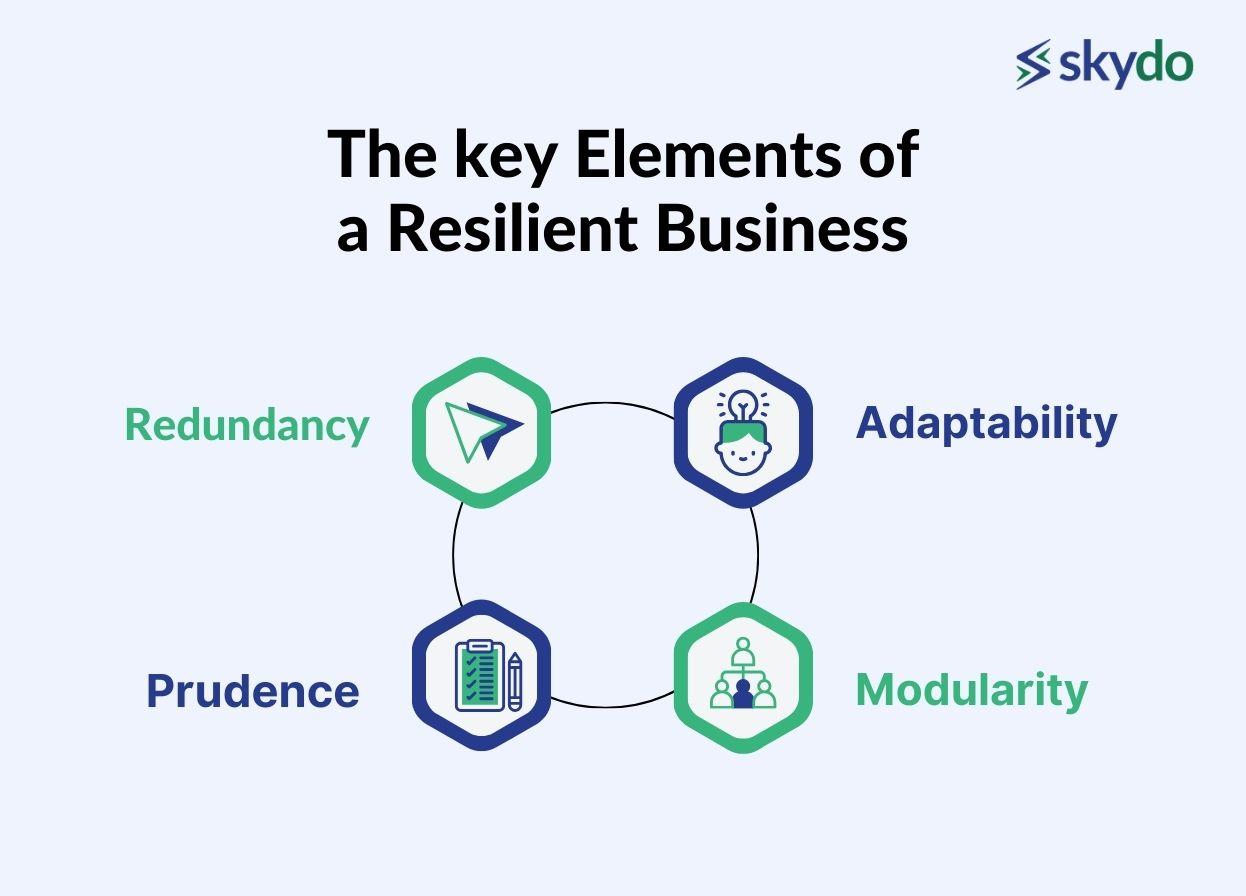

Here are the key elements of a resilient business.

- Redundancy: A slight level of redundancy can be beneficial during economic volatility. For example, having duplicate resources can improve efficiency during a recession.

- Prudence: It is the ability to plan using reasonable judgment and logic. A resilient business should have contingency plans, and risk mitigation and internal control procedures

- Adaptability: It is the process of embracing diversity. Adaptability involves trying and testing new ideas, business models, domains, and processes, and adapting to processes that suit the best.

- Modularity: It involves dividing an organisation's structure into smaller teams, units or blocks so that they can function independently. This ensures that it does not impact the rest of the business if a unit collapses during a recession.

The following are a few techniques to make your business resilient during economic volatility.

1. Retrenchment

This process of reducing business expenses ensures financial stability during economic volatility and builds economic resilience by leasing a space rather than purchasing an office for the business, for example.

In the modern world, teams can even work remotely or from a coworking space to reduce costs. It can also involve selling or renting non-essential assets to generate cash flow.

2. Tightening Credit Policies

Even though loose credit policies lead to increased sales, they can cause liquidity issues if the debtor is unable to repay. Hence, you must have a tight credit policy during a recession. It helps increase liquidity for the business which can be used to carry out necessary operational activities or other business requirements. You can tighten credit policies by sending timely invoices.

3. Cut Down Marketing Expenditures

During a recession, the first thing that you need to do to sail your business is to minimise marketing expenditures. The marketing and sales budget should be focused on customer retention, and sales promotion and not advertisements. Businesses can now run personalised digital marketing campaigns targeting niche audiences.

4. Cash Flow Management During Economic Volatility

Loss of revenue and liquidity are the two most pressing issues during economic volatility. Hence, cash flow management is essential to build economic resilience. It includes cost control and efficient resource allocation. You can manage cash flow by following these steps:

- Assess the current cash reserves and identify where the money is being spent. Learn how much cash flow is left, and how long is the cost conversion cycle. What are the sources of cash inflow and outflow? Identify any gaps or silos that can be treated.

- Tech export businesses can leverage technology for cash flow management by automating recurring expenses. It can also help keep a record of all current and future expenses.

- Cash flow can also be managed by purchasing less inventory. You can forecast future sales based on industry trends and keep the required inventory volume.

5. Embracing Digital Transformation

According to a report by Gartner, embracing digital transformation and integrating the right technology helps minimise the cost of doing business, improve customer relationships, gain competitive advantage and facilitate innovation. Hence, investing in a digital strategy can be beneficial in mitigating downturn risks.

Tech export businesses can use advanced management tools like CRM and ERP to streamline business operations and increase efficiency. You can use AI to automate business processes and reduce bottlenecks. Moreover, migrating resources to the cloud can also mitigate management costs.

How Should Businesses Handle a Downturn?

Surviving economic volatility can be scary for businesses. It involves a lot of strategic planning. However, a silver lining is that recession does not impact all global industries in one go. Therefore, as soon as you witness the early signs of recession, you must implement recovery strategies.

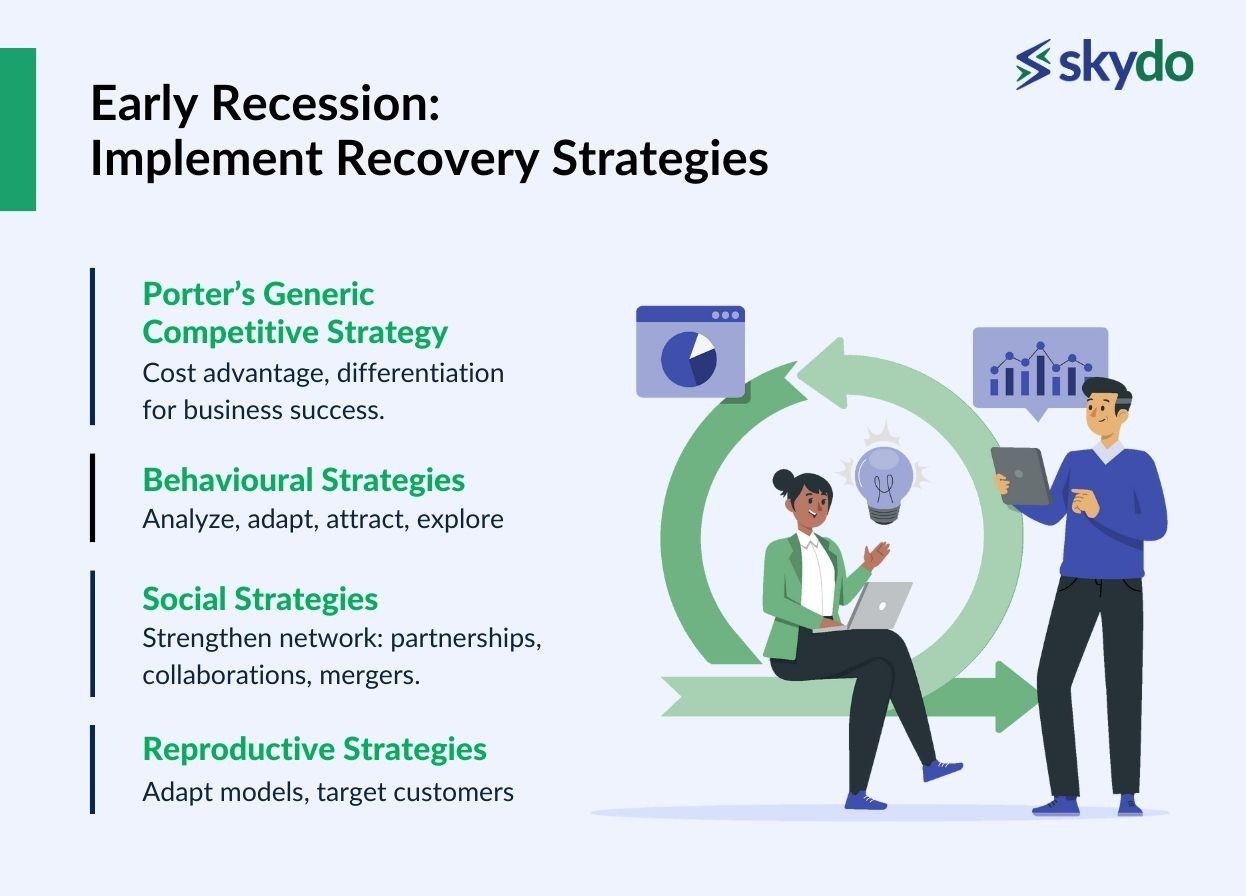

1. Porter’s Generic Competitive Strategy

Michael Porter, the father of modern strategy, states that businesses need two major strengths - cost advantage and differentiation.

The cost advantage strategy involves selling products and services for the average price in the market or even at an amount lower than the average to increase sales, gain an advantage over competitors, and gain more customers. However, the quality of such goods and services should be predetermined.

Differentiation involves capitalising on your product's unique selling point (USP). The product must have a differentiating factor to appeal to customers. This USP can be used to lure customers and demand high prices.

However, setting extremely low prices can lead the business to closure after an upturn. Hence, setting profitability goals and then using them to leverage them is essential.

2. Behavioural Strategies

These strategies involve analysing the environment and turning the situation in your favour. Two of the most common behavioural tactics used by businesses include–

- Modifying customer offerings by adding new value propositions or features to the product. This helps attract customers.

- Exploring opportunities for new market entries. Since fewer resources are available in the market during an economic downturn, entering a niche market can be beneficial.

3. Social Strategies

These involve strengthening your social network through partnerships and collaborations. During the economic downturn, businesses can bargain or partner with other suppliers to exchange services/products and launch digital marketing campaigns together.

Further, businesses can collaborate or merge with their competitors to combine skills and knowledge. This way, you can increase market share and attract more customers.

4. Reproductive Strategies

Reproductive or reorganisation strategy involves changing existing business models to cater to customers' needs and market demands. It involves analysing the segmenting the target audience into smaller groups and doing customised market campaigns to gain traction.

Economic volatility disrupts business growth and causes severe challenges like liquidity crunch, uncertainty, low demand, less cash flow, and more. However, building a resilient business can prove to be beneficial at the time of recession.

FAQs

Q1. How to do contingency business planning for economic volatility?

Ans. A contingency plan helps companies stay afloat during crises like a recession. Building a contingency plan requires strategic and financial planning. Here is how to create a plan:

- Conduct a financial audit to assess your business's financial position.

- Maintain cash flow and high reserves when the economy is booming. Keep an automated track of cash flow to ensure the time of receivables and payables is close.

- Do a SWOT analysis to know where the core strength of your business lies. Use that strength to diversify your business and generate leads.

- Plan scenarios ahead of time such as identifying redundant costs and knowing how to restructure your business.

Q2. How to optimise sales during economic volatility?

Ans. Optimising sales is one of the key challenges businesses face during a recession. However, some ways to maintain sales include offering discounts and customer incentive programs and reducing the operating cost of business to get a better profit margin.

Tech export businesses can increase B2B sales by targeting the most profitable industry and implementing custom campaigns by dividing the target audience into small segments.

Q3. How to revive your business after a recession?

Ans. Once you have survived a recession, you can revive your business by focusing on innovative solutions and domains to diversify your income streams. Sticking to budgets and analysing the market and consumer trends before launching new products is also essential. However, it is also essential to accelerate growth by leveraging technology and innovation. This will help improve efficiency and mitigate risks.