Decoding the significance of business structure for your exports business

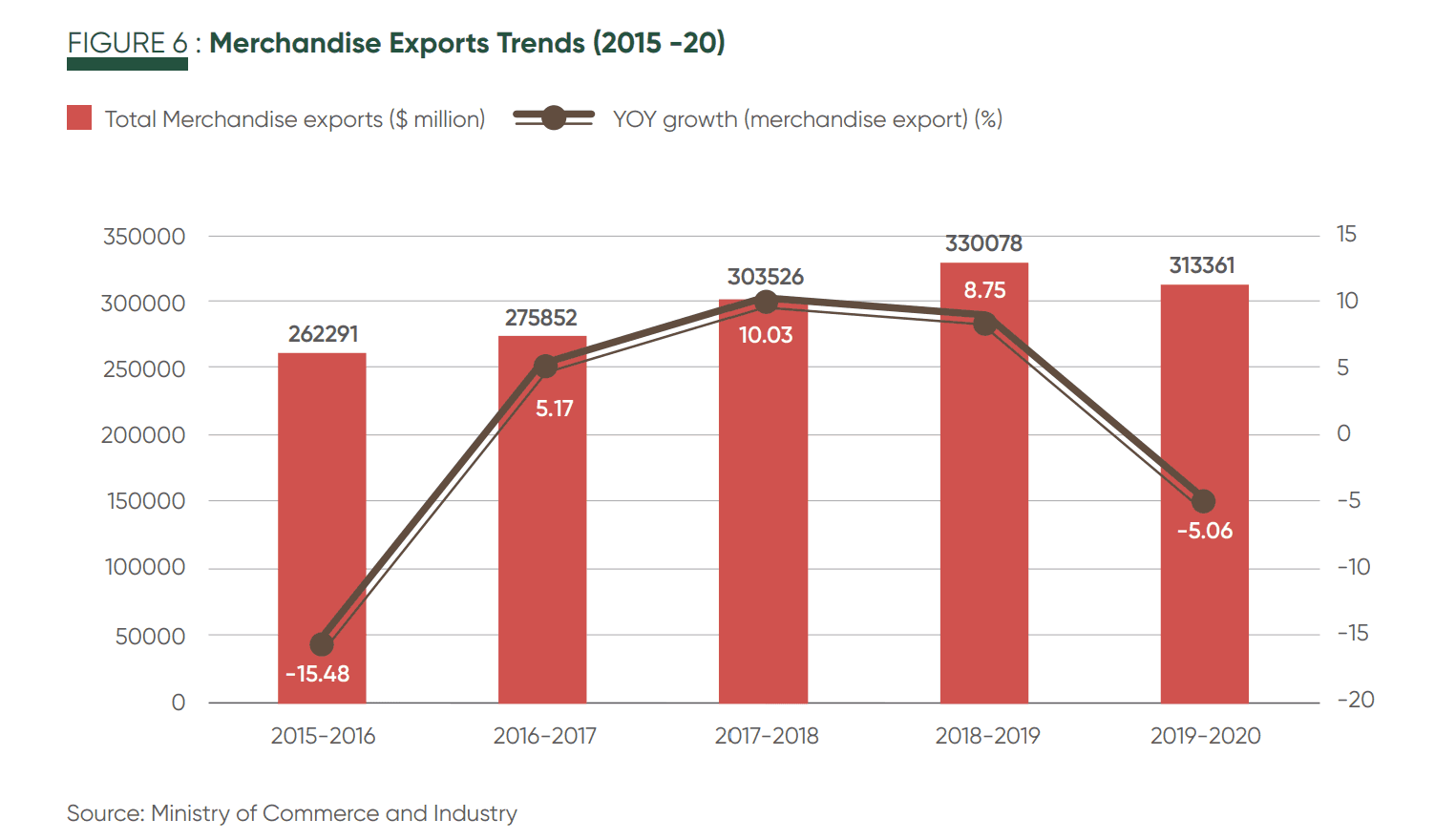

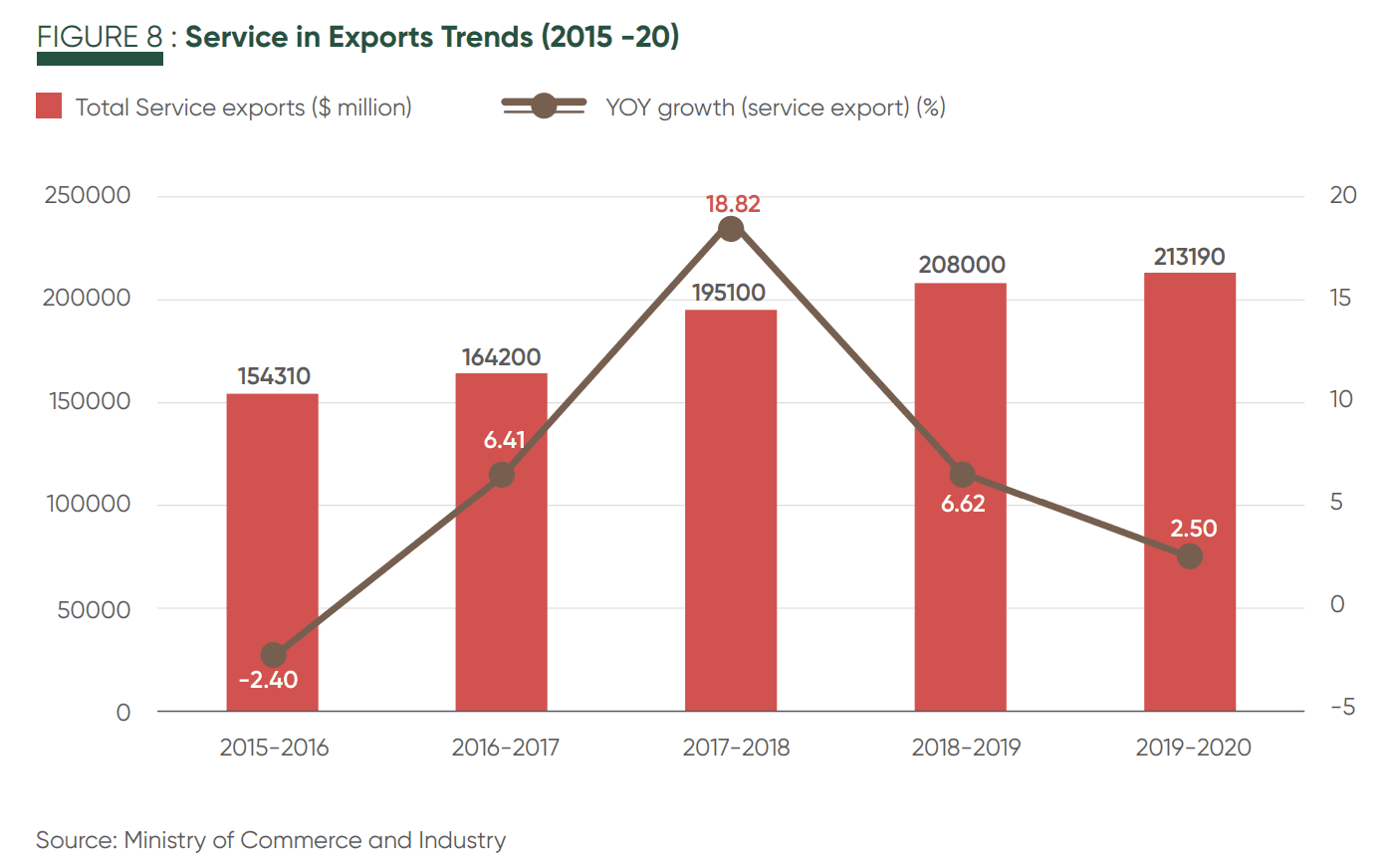

The importance of exports and foreign capital as key growth engines for an open economy, such as ours, cannot be overemphasized. Currently, India ranks as the 5th largest economy in the world and holds a 2.91% share in global trade as per the World Bank. Exports of India peaked at a record high of $422 billion in 2021-22, and are expected to cross $480-$500 billion by end of 2023, as per the Federation of Indian Exports Organisation (FIEO). The below charts indicate the major trends in merchandise and service exports between 2015-2020:

Boosting trade to continue the growth momentum

To further boost India exports, the Government of India has played the role of a catalyst and rolled out multiple favourable policies such as Make in India initiative and the PLI scheme, steps towards export promotion, entered into FTA agreements with friendly trading nations and positioned higher exports as a key goal to be achieved under India@100. The aim is to enhance the Indian exports share in global trade to 3% by 2027 and 10% by 2047.

All of this puts exporters-the real people behind exports, in the spotlight.

Leveraging the exports opportunity

As a result, exporters have a lot on their plate- battling trade protectionism, building export competitiveness, sustainably driving profits, navigating the ever-changing regulatory landscape, staying abreast of policy reforms and most importantly, growing their export business.

Like any other business, the growth strategies for an export business are directed towards enhancing incomes, managing costs or boosting profits. Some of the key aspects that would aid in furthering export revenues are as follows:

Steps to further export revenues

1. Capitalize on core competencies

Firstly, it’s important to measure one’s strengths. Since international trade is highly competitive, its imperative for exporters to develop a niche across products, services, market presence or geography.

- Specialization would also contribute to building brand equity and product differentiation.

- This would enable exporters to command a premium price compared to peers, win a greater number of deals or derive a higher sales volume.

2. Reduce Costs

Costs- be it fixed, variable or overhead costs can directly impact the net profits. By proactively adapting to the changing business scenarios owing to trade rules, currency fluctuations, geopolitical risks, economic recession etc, exporters need to respond in an agile manner- study emerging trends and then adopt suitable strategies.

- For example, by digitalizing the supply chains, manufacturer exporters can significantly save on logistics costs.

3. Conduct a deep market study

It’s vital as an exporter to thoroughly research the field before venturing into an exports business.

- Right from being familiar with international trade practices, cross-border trade opportunities and challenges to gauging customer expectations, there is a lot of homework to be done.

- Market assessment i.e. understanding the demographic profile, customer needs, competitors and demand for a product would translate into better export revenues and higher strategic bargaining power.

4. Develop long-term relationships with customers

The success of an exports business ultimately lies in the hands of the customers.

- Nurturing trusted relationships with customers, staying laser-focussed on CX and delivery of quality output would go a long way in strengthening solid business ties with clients and other critical stakeholders.

5. Avail of export-related support offered by the Government

Foreign currency is a valuable asset for every Government- the more, the better. The size of a nation’s FX reserves is often considered a key economic performance metric.

- The Indian Government offers multiple incentives including monetary fiscal sops, guidance and advisory programs and specific schemes to boost exports across sectors and encourage trade with varied countries.

6. Always comply with existing rules fully

Running an export business is no easy task.

- Along with staying up to date with domestic rules and regulations, the business needs to be compliant with export-related and international trade rules.

- This often requires the maintenance of extensive paperwork and timely submission of documentation to the regulatory authorities.

- A good idea would be to digitalise the processes and systems to ensure the smooth functioning of operations.

7. Opt for a reputed Payments provider

As it is said, the proof of the pudding lies in the eating, the receipt of seamless payments towards exports is the crux of the matter. SKYDO enables exporters to promptly receive their payments towards exports from overseas parties in a frictionless and convenient manner, with real-time status updates on the flow of funds.

The missing link in the scheme of things

While most exporters cover the above dimensions, there is one angle that is often overlooked and even completely missed in certain instances.

Making the right choice when it comes to business structure.

What is business structure?

Simply put, the business structure is the legal form adopted towards the registration of any business-domestic or exports business. Some of the commonly adopted business structure types include:

- Proprietorship

- One-person company

- Partnership firm

- Limited liability partnership

- Private limited company

Business structure matters a lot for an exports business with the potential to considerably impact the export revenues realised, especially for exporters availing trade finance.

Structure: The Make-or-break factor

Over the years trade finance has contributed significantly to accelerated international trade. As per WTO, 80-90% of world trade depends upon trade finance. As per Investopedia, trade finance, in simple terms, enables the participation of a third-party in transactions to eliminate the payment risk and supply risk.

- For example, trade finance provides receivables or payments to the exporter as per the agreement with the importer.

- Alternatively, under trade finance, the importer would be extended with credit to fulfil the payment towards the order.

Some examples of trade finance include letter of credit, invoice factoring, export financing, working capital, insurance covering shipping and delivery etc

While each of the types of business structure has its pros and cons, LLP and private limited company bring a set of unique advantages, especially for exports-oriented business entities as follows:

- Going concern: Since a pvt ltd company is a separate legal entity, there is a certain degree of assurance to the bank as to the going concern status

- Better oversight: Reduces the risk of fraud from Hawala or money laundering transactions which may occur due to a lack of independent, effective oversight in a proprietorship concern

- Perpetual succession: Since a company has perpetual succession, the death or departure of any member would not affect its existence. Thus, there is security in terms of corporate assets towards the recovery of pending dues

- Reduced liability of members: Under limited liability, the liability of the members towards LLP or company’s debts is limited to the extent of the face value of their respective shares.

- Enhanced borrowing capability: A company enjoys greater flexibility in terms of channels of borrowing funds, across secured or unsecured loans, debentures, public deposits etc

- Credibility: The financial statements and date of incorporation etc of a pvt ltd company can be accessed from MCA website. Banks can verify and validate the company records prior to lending.

To sum up, owing to the lower credit risk, banks and financial institutions prefer to sanction big-ticket financial loans to a company or LLP as against lending to partnership firms or proprietary concerns.

The emerging trade paradigm

Globalisation, liberalisation, privatisation and digitalization have fundamentally transformed cross-border trade, international regulations and in turn, the fortunes of the exporters. Besides strengthening export competitiveness, it would do well for exporters, as the first step, to opt for the most suitable business structure – one that enables and supports holistic business growth.

About SKYDO

SKYDO is an automated solution that enables exporters to conveniently and securely receive foreign payments, at any time and from anywhere.

Receive foreign payments without any hassles of follow-up or tedious KYC. What’s more enjoy real-time status updates of your payments.

Visit us to know how you can manage ALL your foreign payments like a pro.