Monitor Receivable Payments With Skydo’s Payment Tracking Feature

When you embark on a journey via the airways, you trust that your luggage will make it to your destination. However, the system is not immune to glitches. Just as luggage can end up misplaced or delayed despite sophisticated tracking systems, international payments can encounter delays, errors, or even go missing along the way.

The uncertainty surrounding its whereabouts and the lack of control over the situation can make the situation much worse. Similarly, when international payments don't proceed as expected, the lack of payment tracking in the process can be worrying. You wonder: Has the payment been initiated? Is it stuck somewhere in the process? Will it reach the intended recipient account on time?

These uncertainties are concerning for businesses relying on timely international transactions to maintain operations and relationships.

The SWIFT Black Box: Why Tracking International Payments is Challenging

Since its establishment in the 1970s, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) has been a fundamental part of the global financial system. It has connected thousands of financial institutions around the world, allowing them to communicate quickly and easily for cross-border money transfers.

Let’s take an example.

Ravi, an entrepreneur based in India, recently won a contract with a firm in New York, US. To get paid for his services, he needs to send a transaction request via the SWIFT network so that his payment from New York is routed correctly to his Indian bank account.

Here's where things get tricky. When Ravi’s payment is sent through the SWIFT system, its movements become difficult to track. It would be like tracking a flight without being able to see any updates between departure and arrival. This "in-flight" stage, when Ravi knows his money has left New York but hasn't yet arrived in India, where most of the concerns and uncertainties arise.

Why does Ravi’s payment take a detour?

There are several potential speed bumps on the payment journey:

- Unclear Instructions: If the New York organisation leaves out important details, like Ravi’s middle name or gives an inaccurate bank address, it might cause payment delays.

- Errors in Details: A small mistake, like mistyping an account number, can cause a payment to be redirected elsewhere.

- Compliance Concerns: In case of any inconsistencies, the bank may temporarily hold the funds, similar to how passengers can be stopped for additional screening.

- Intermediary Banks: Ravi’s payment needs to make its way through the SWIFT network, but unfortunately it may go through intermediaries or "layovers" in places like London before reaching its destination in India. This can add a lot of processing time and make the journey unpredictable and convoluted

For Ravi and other individuals and businesses, navigating the SWIFT network payment journey is an unavoidable part of doing business in the global economy. Unfortunately, this journey is often unpredictable and complicated.

The Stressful Journey: Tracing Payments Manually

Let’s consider another example.

For Maria, a small business owner, dealing with the payment for her international shipment of handcrafted pottery can feel like being in an overwhelming library.

Without a streamlined process and efficient documentation between multiple banks involved in the transaction, it can take more than 3 days for her to receive her payment - 10 days in this case. A delay on any day means she cannot invest back into her business or cover necessary expenses such as staff and overhead costs.

Maria is worried about the delay in her transaction, so she reaches out to her local bank in Mexico for information. They can only tell her when they sent the payment instruction, not the current whereabouts.

So they send an inquiry to the intermediary bank in the U.S., and after checking their records, they respond that two days ago they passed on the funds to the buyer's bank in France.

The chain of inquiries goes on—each step adds more confusion and uncertainty.

The risks and repercussions in this scenario:

- Losing customers: If the buyer in France does not receive their pottery after two weeks, they may become frustrated and accuse Maria of not fulfilling her part of the bargain. This could lead to customer disputes and damage her reputation, potentially resulting in lost future sales.

- Reinitiating Payment Cycles: Maria's small business faces a double hit in the worst-case scenario if her buyer's payment becomes untraceable. She must either ask them to send it again, incurring more bank charges, or bear the loss and ship the product again.

This manual tracing of payments is time-consuming and can be financially damaging. The need for more transparency and efficient global transactions has never been more pressing.

Introducing Skydo: A Solution to Payment Tracking Woes

In the world of international transactions where payments seem to vanish into thin air, Skydo emerges as a pioneering lighthouse. It is a revolutionary financial tool that offers unparalleled clarity and security in international payments.

No more worrying about lost funds or navigating the unknown - Skydo illuminates the previously murky world of transacting money across borders, providing users with a sense of security and peace of mind.

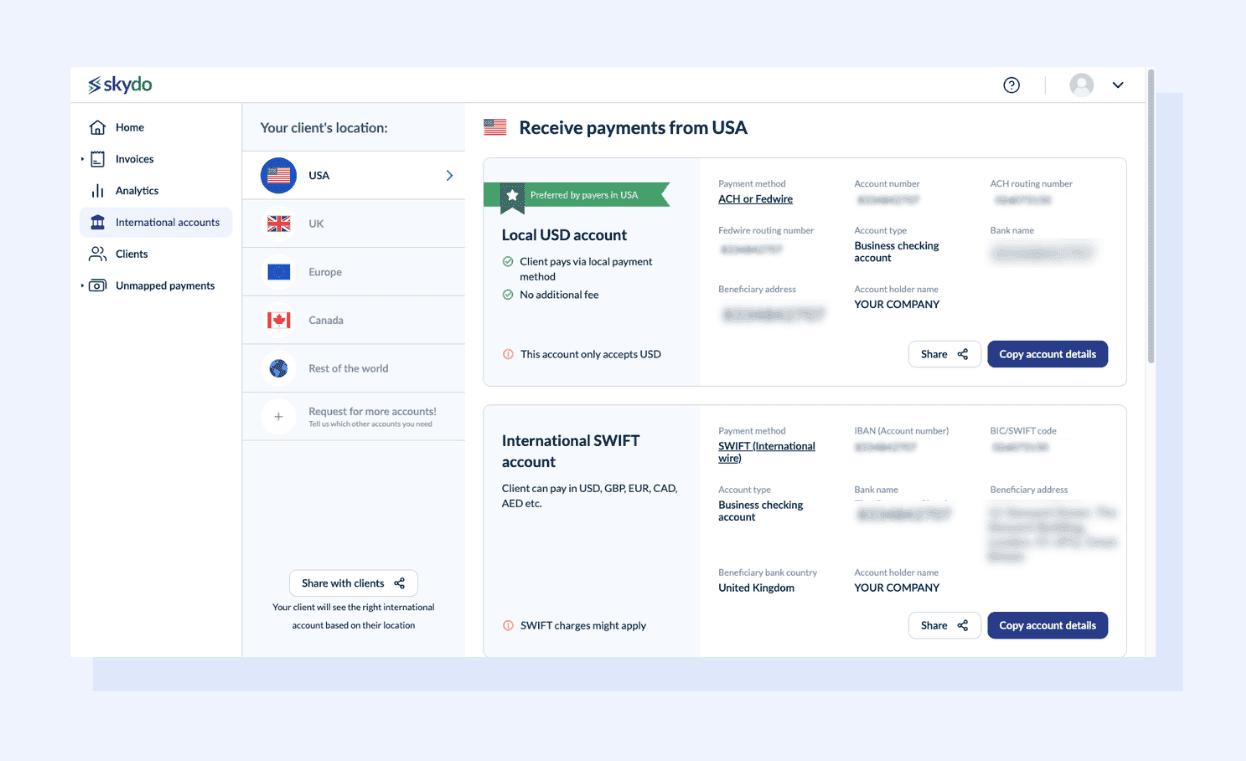

#1: Local collection accounts - bringing the world closer

Skydo's local collection accounts are designed to bridge international gaps and make global transactions easier. With local collection accounts, there is no need for international transactions from a business in Mumbai to its partner in Sydney.

Skydo takes care of the international component by creating a local Australian account for the Mumbai partner, making it feel like a domestic transaction. This simplifies the process and reduces complexities, fees, and uncertainties associated with cross-border transactions.

#2: API integration - real-time visibility into your payments

Skydo’s API integration enables you to track your money end-to-end in near real-time, giving you visibility on every step, from initiation through intermediary banks until final receipt. This provides clarity and assurance that your funds are on the right track. Skydo is like having a GPS for your money.

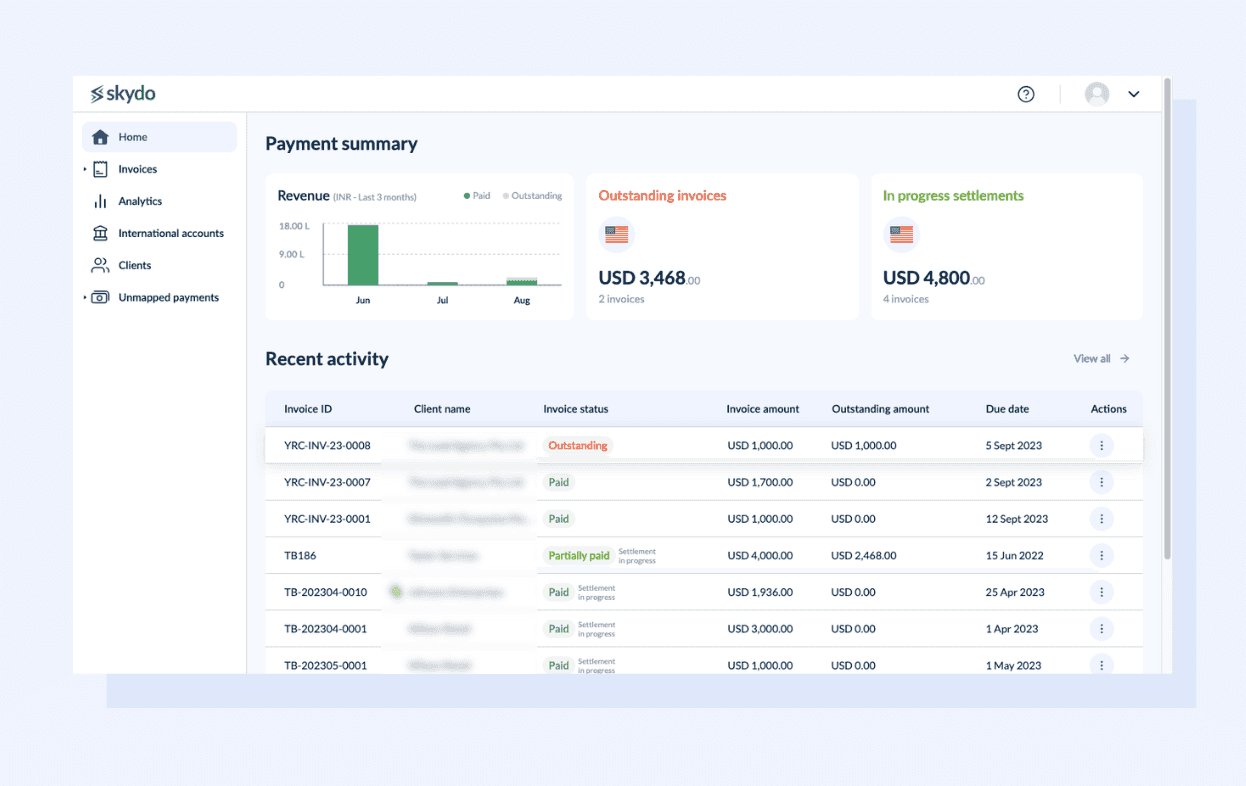

Harnessing the Power of the Skydo Dashboard

Here's a step-by-step guide on how to get the most out of Skydo’s dashboard.

Log in Using Your Credentials

Once logged in, you can see the Invoice ID, the client’s name, the status of the payment, the amount and the due date. You also get an overview of the outstanding and settled payments.

Invoices Overview

You can click on the actions tab to view more details, change the status as paid, remind the client of payment or delete the invoice as well.

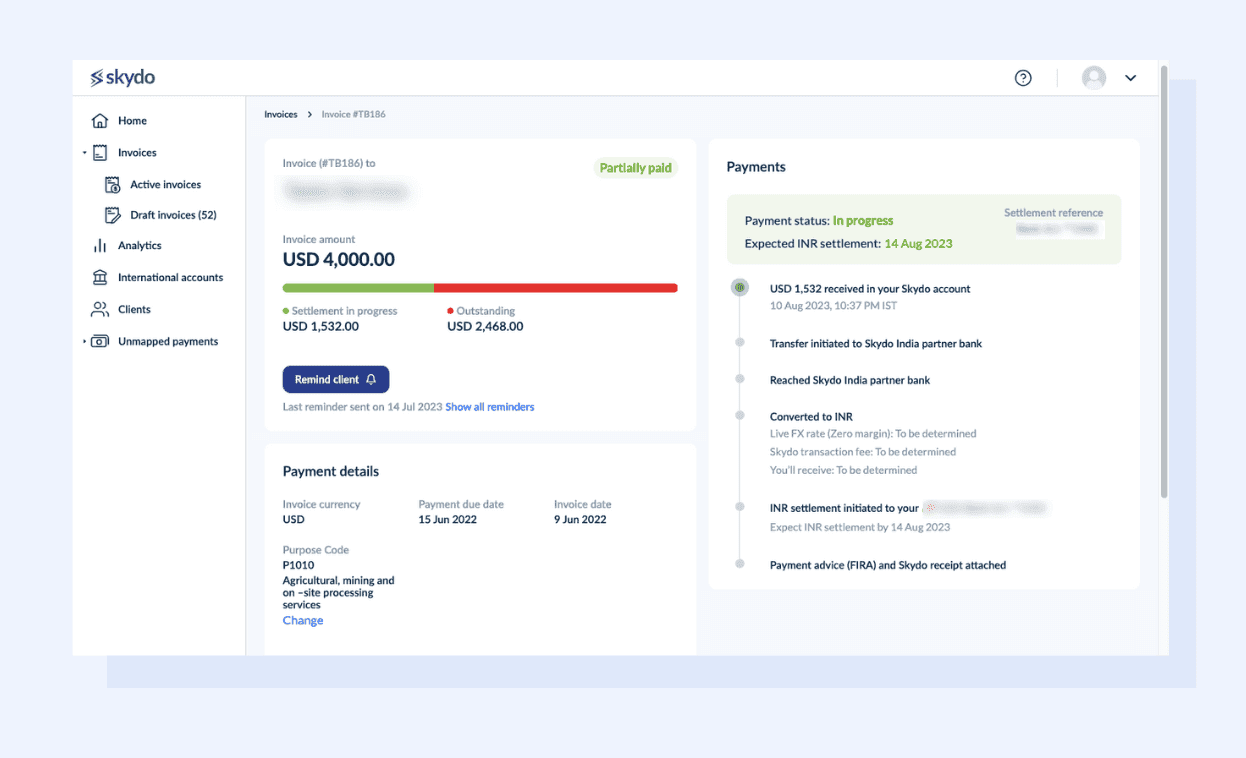

Click on a client name and it will lead to a new screen displaying all the details of the client such as amount, due date, invoice date, currency, track payment status and more.

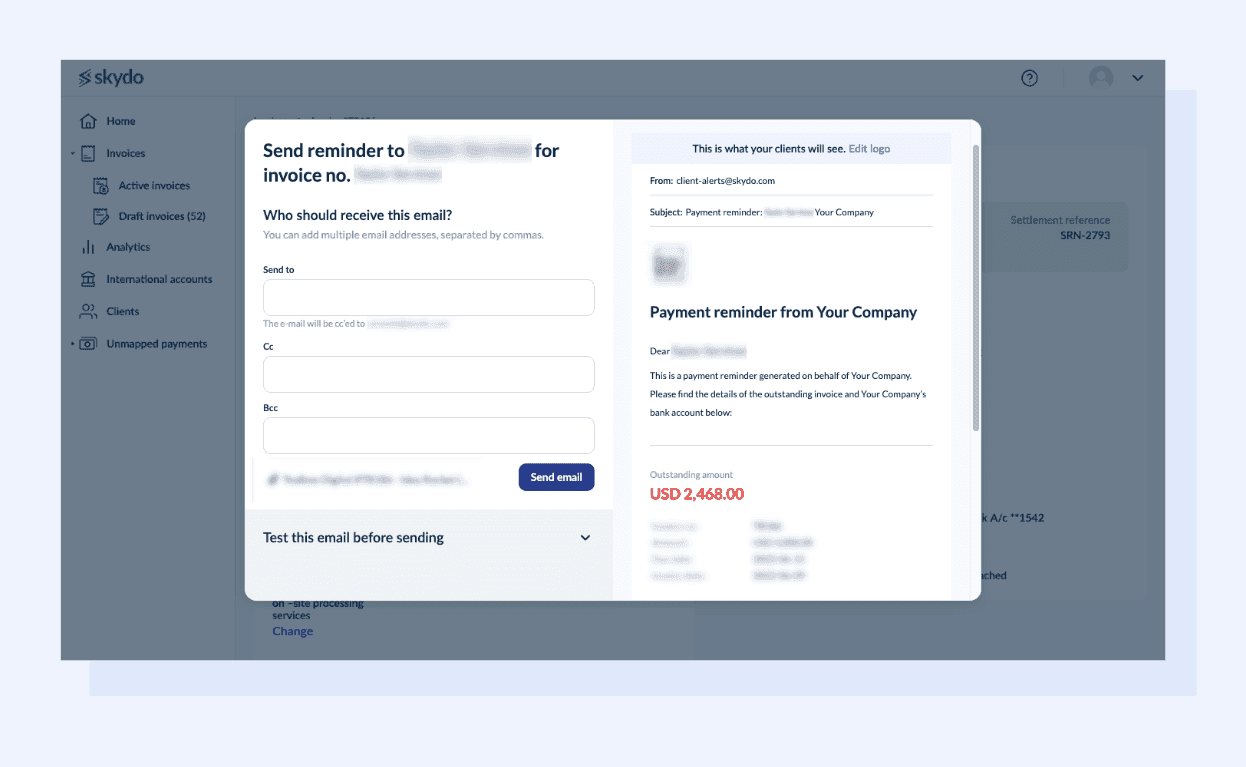

Here you can also click on ‘remind client’ to send a payment reminder.

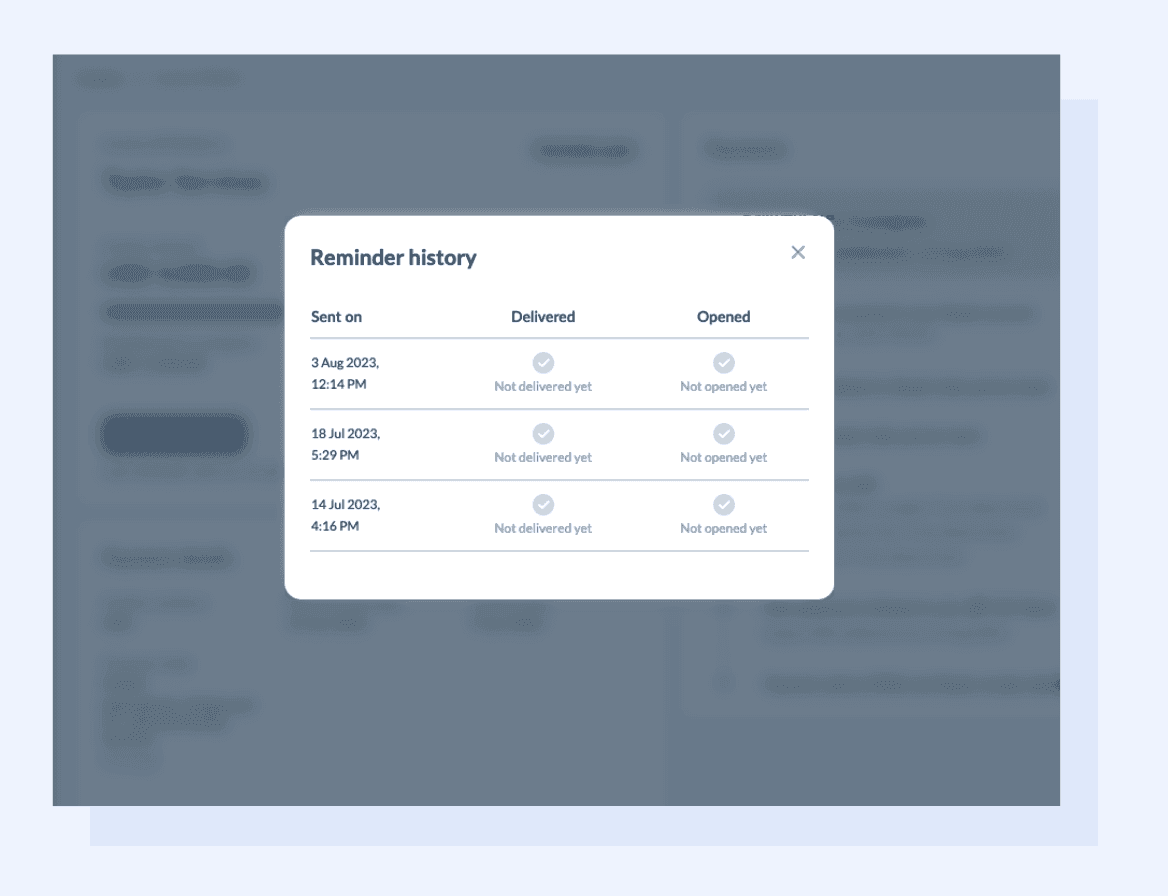

The show-all reminders option helps you track past payment reminders sent to the client along with the date and delivery status.

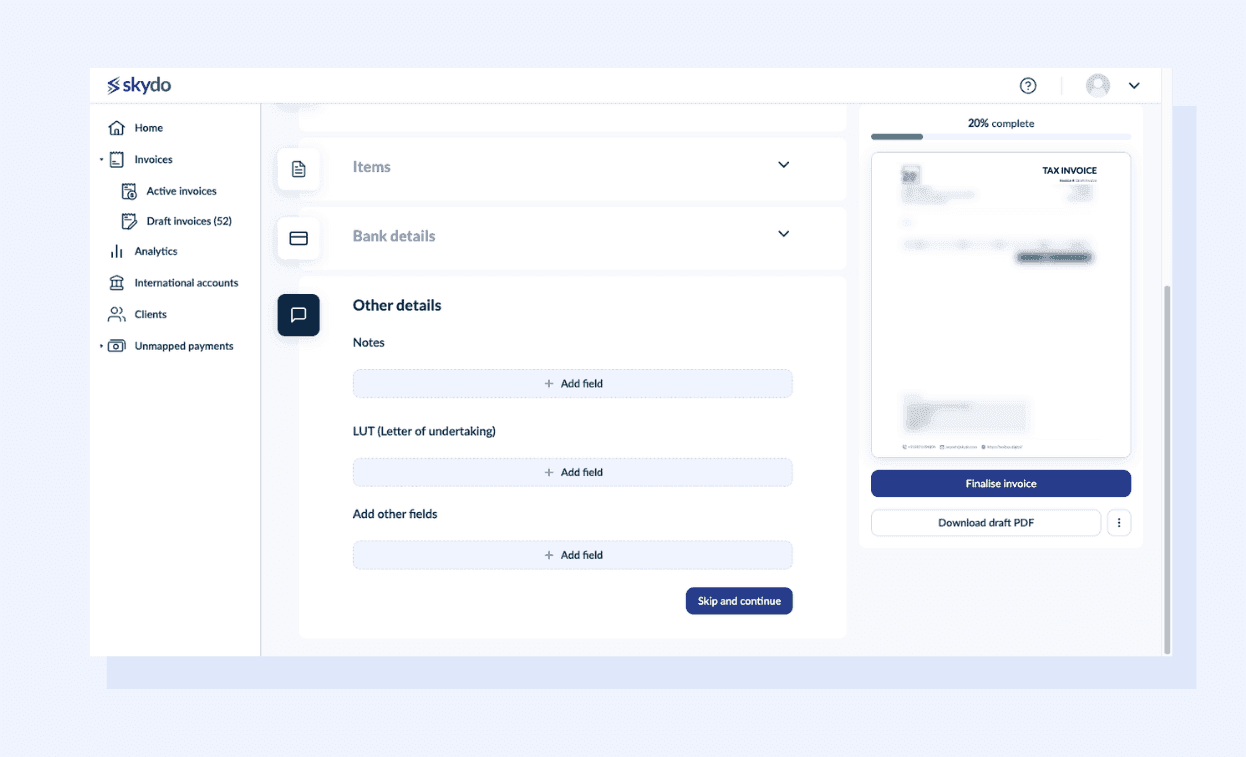

Create a New Invoice

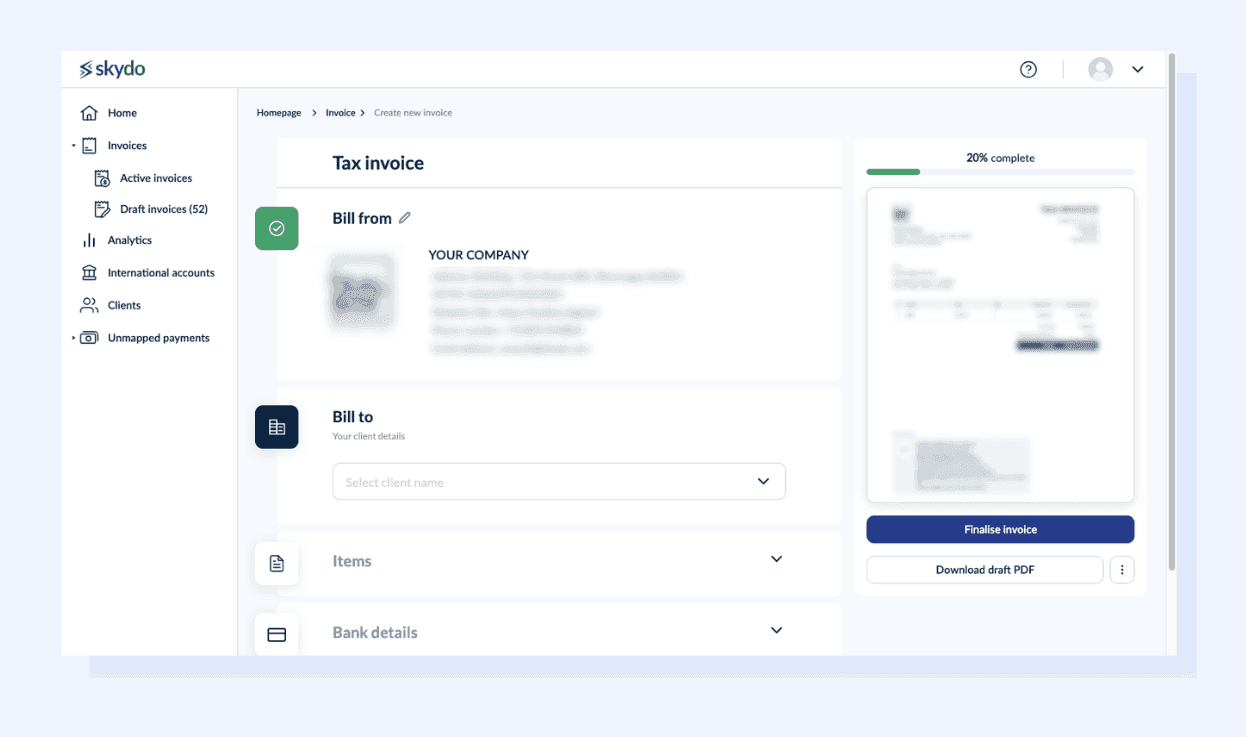

To create a new invoice, click on the new invoice option. This will open up a screen containing details such as 'Bill from' (your company address), 'Bill to' (client), items and bank details.

You can either select from the existing client list or add a new client name in the 'Bill to' field. Provide the address, select the country, and click on save and continue.

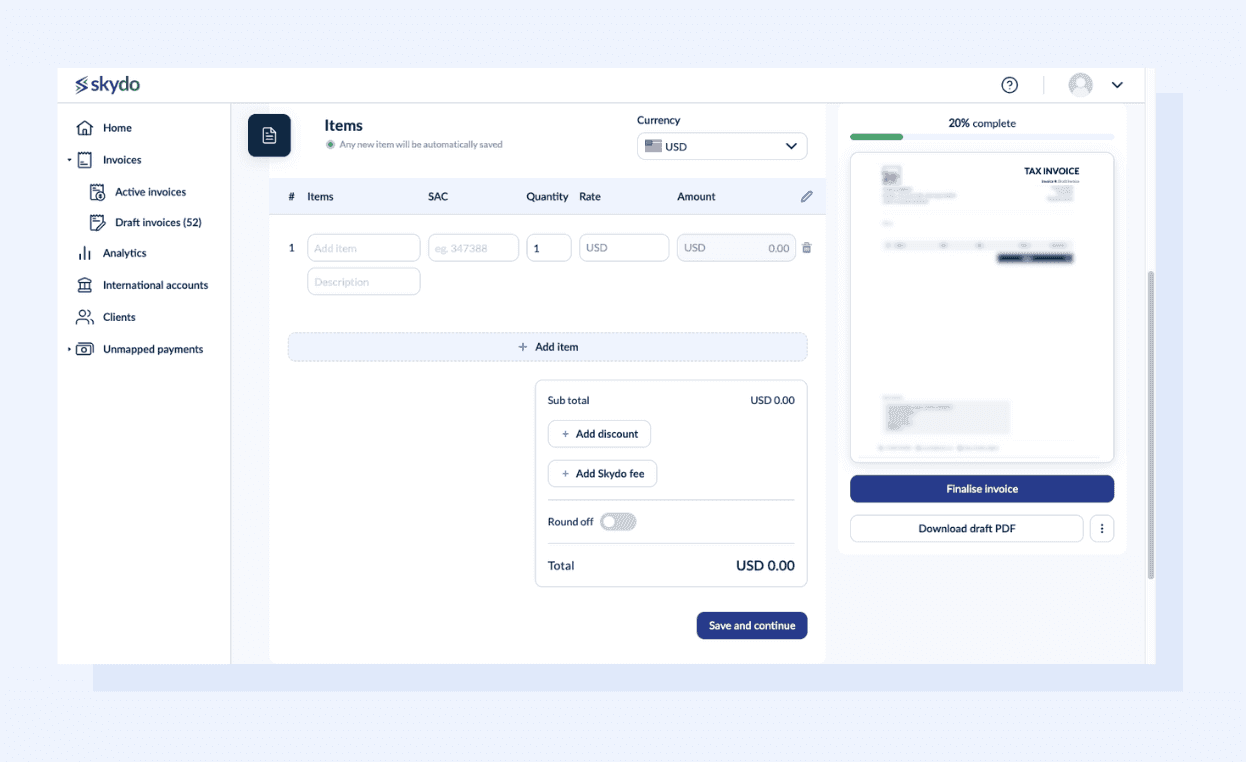

In the items tab, you must provide details such as item name, SAC, rate and amount. You can also provide a discount in percentage, and Skydo will automatically display the new amount (after the discount).

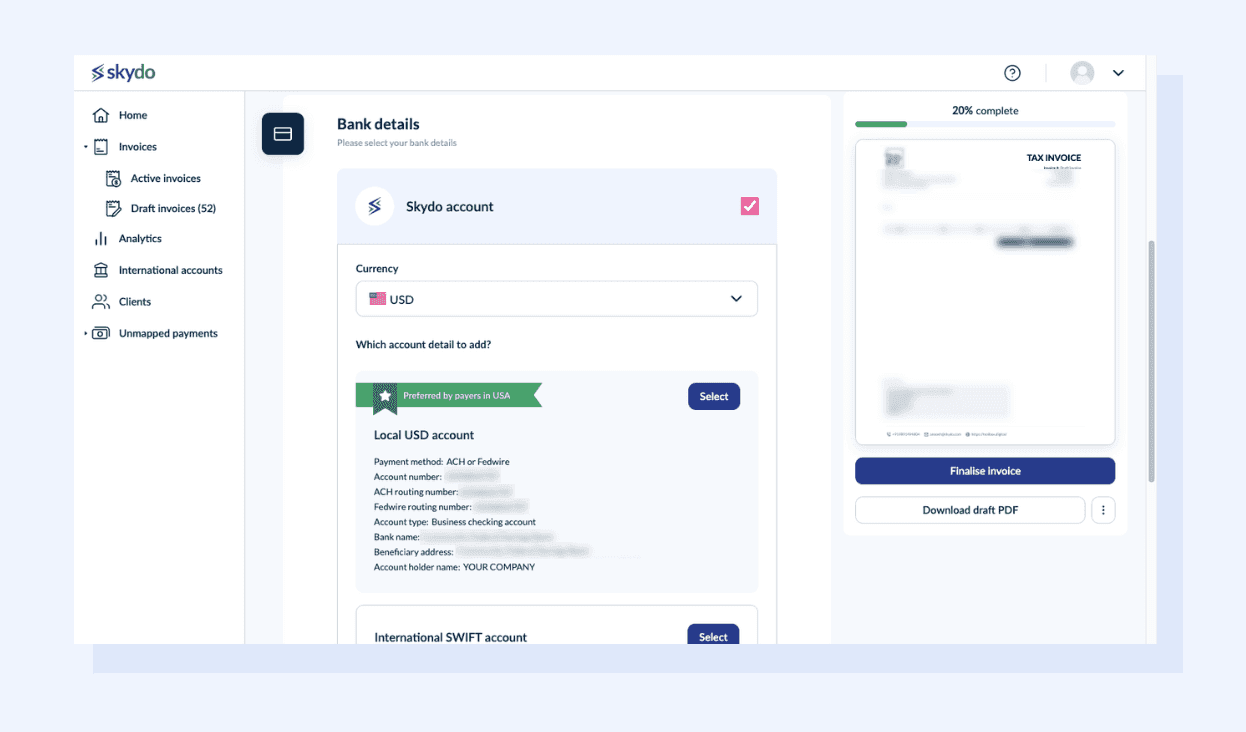

Next is the banking details, where you must enter your client's bank details and currency.

If you prefer to receive the payment in USD, Indian GST laws will apply, and you must provide LUT.

Once you enter all these details, check if they are correct, and you have three options on the right side of the screen - finalise the invoice, download the PDF or delete the invoice.

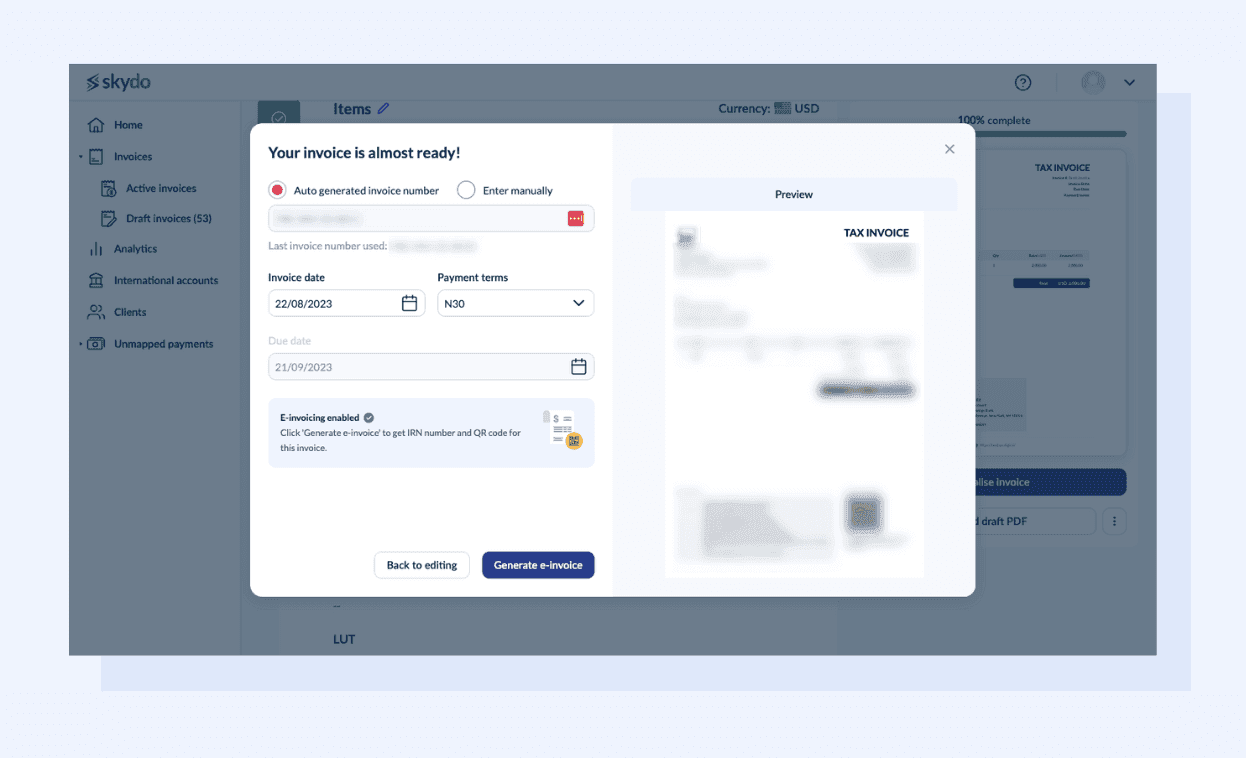

When you click on finalise invoice, the below screen appears. It has options for manually entering the invoice number and due date for payment.

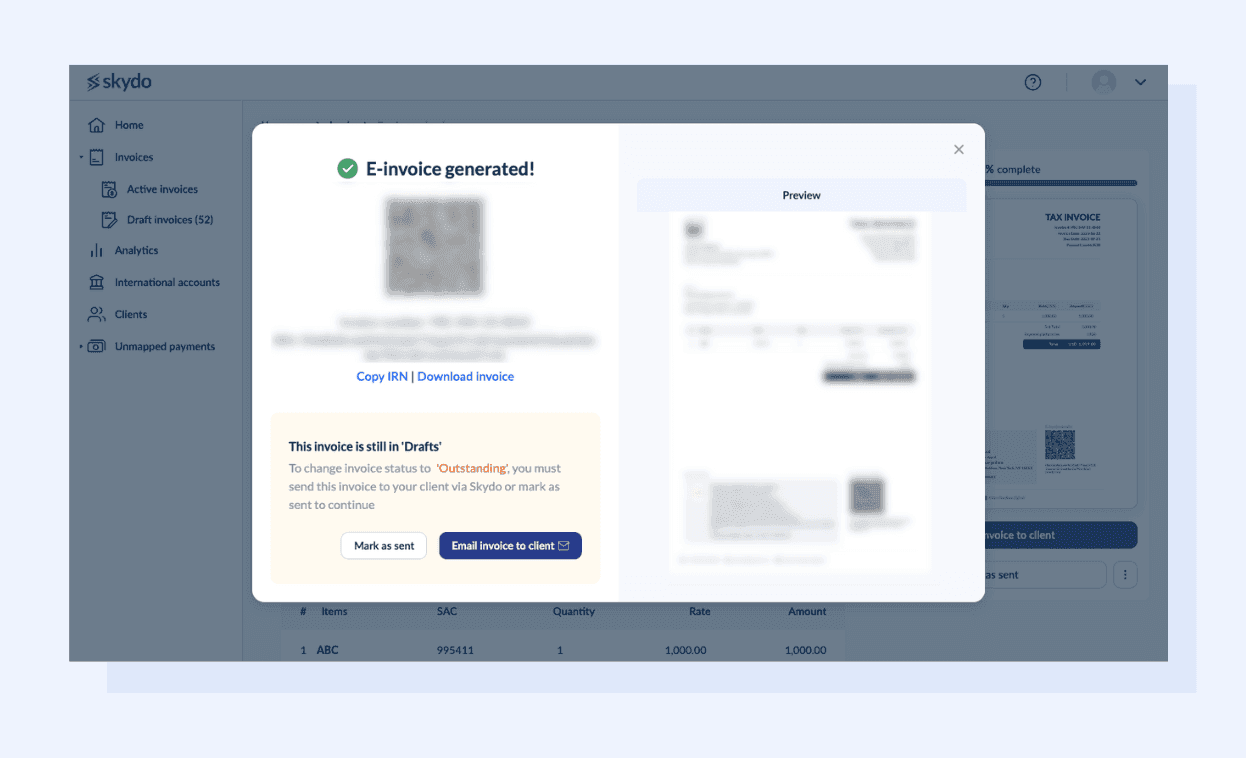

Once you click on generate E-invoice, you get the QR code and IRN. You can email the invoice to the client directly or download the invoice.

Once the invoice is sent to the client via the dashboard or email with invoices@skydo.com in CC, this is where the payment tracking begins. The right-hand section in each invoice provides detailed tracking of the payment from the moment of remittance to the final deposit in your bank account.

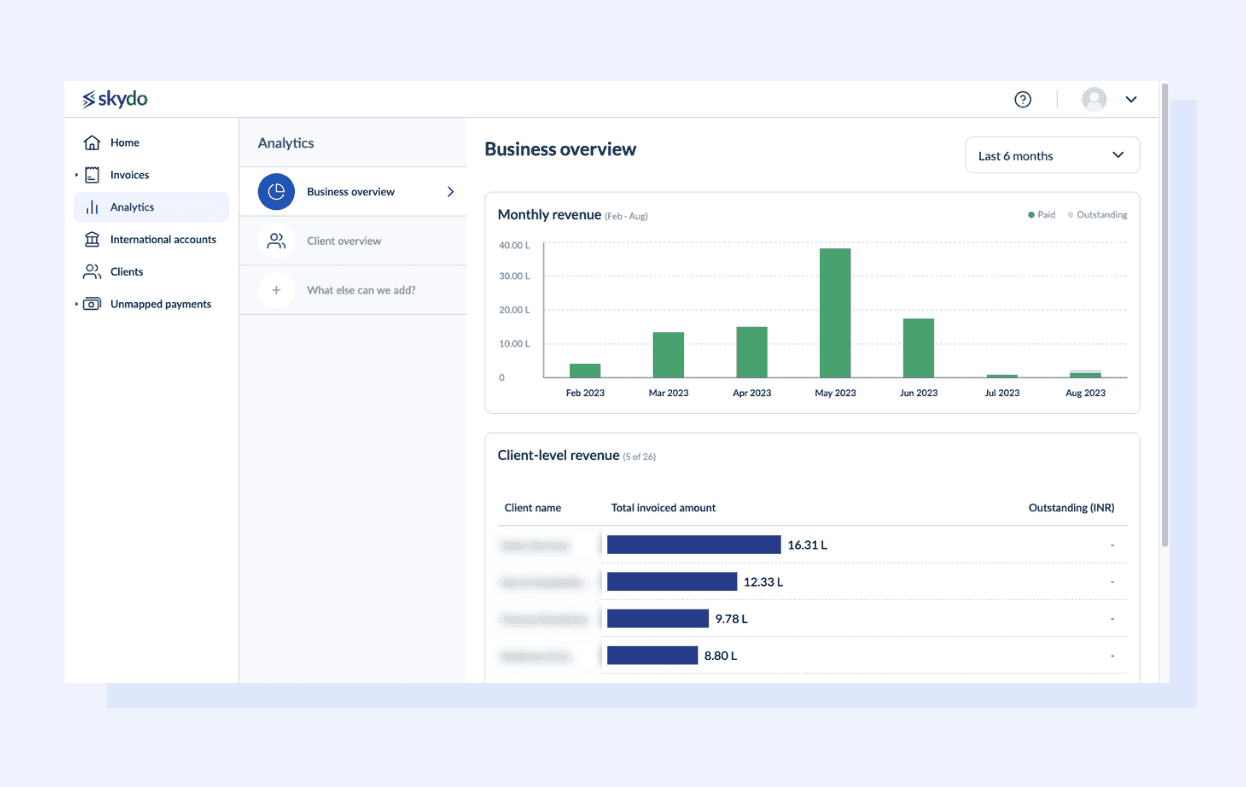

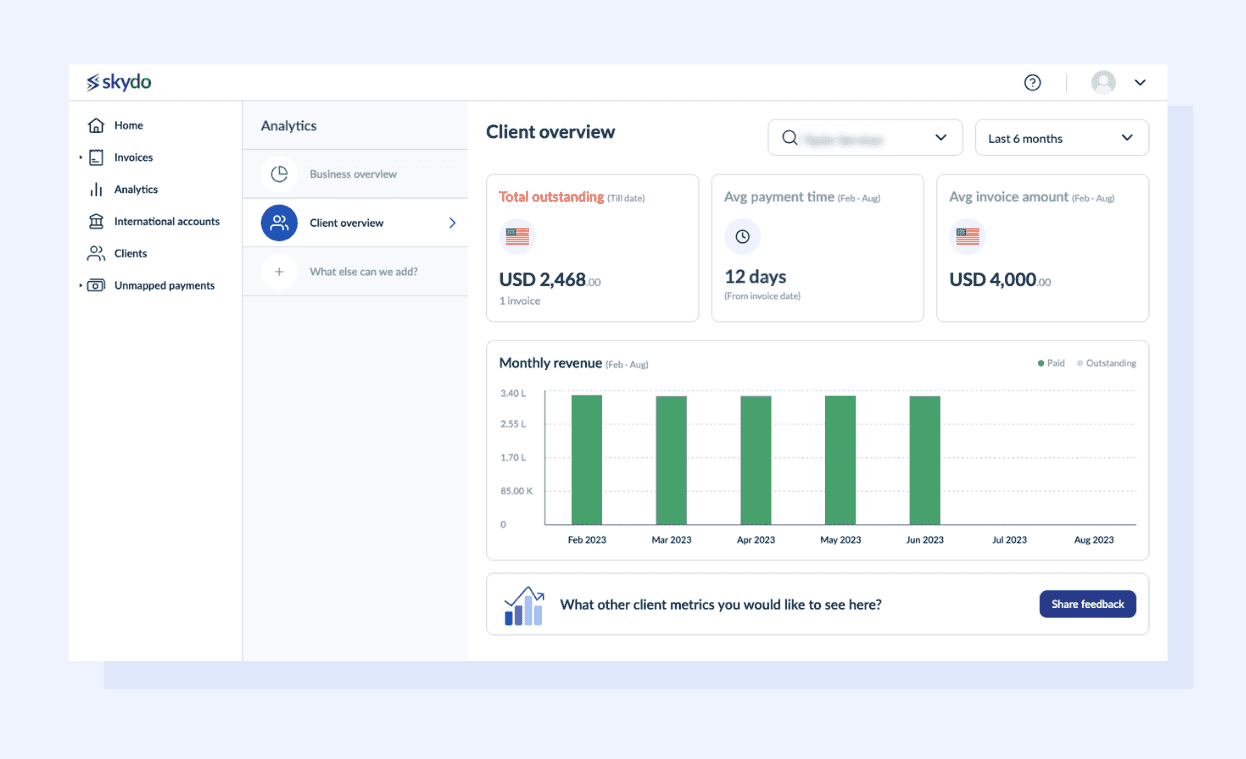

Business and Client Analytics

There are two options, business overview and client overview. The business overview talks about the monthly revenue generated per client.

The client overview talks about the revenue generated by the individual client, and their historical data on payments (6 months).

We are constantly looking to add more helpful features for our clients. So you can recommend your suggestions in the 'What else we can add' option under analytics.

International Payments

This tab has a comprehensive dashboard of the locations you can receive the payment from.

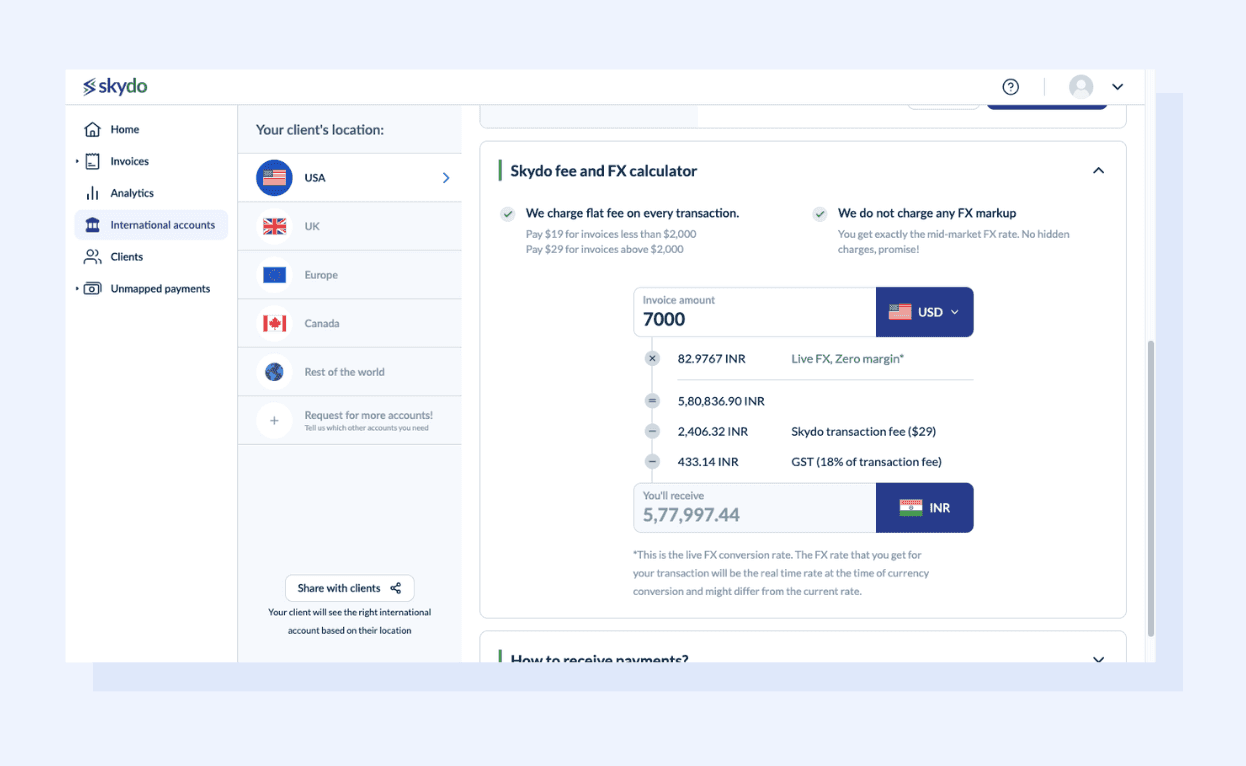

If you scroll down, there is a Skydo fee and FX calculator - an important feature that provides a complete break up of the payment. This is especially helpful for business owners who are unsure of how much they should charge, keeping into account GST and the platform fee.

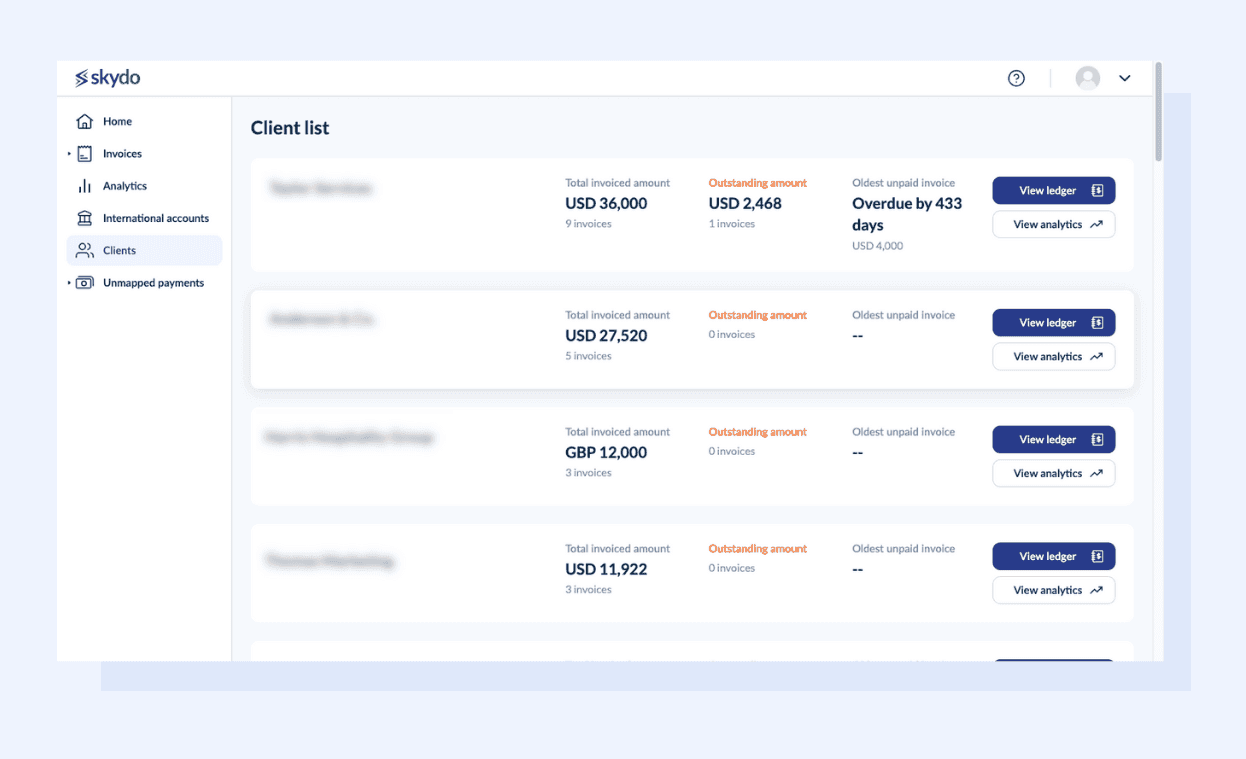

Clients Overview

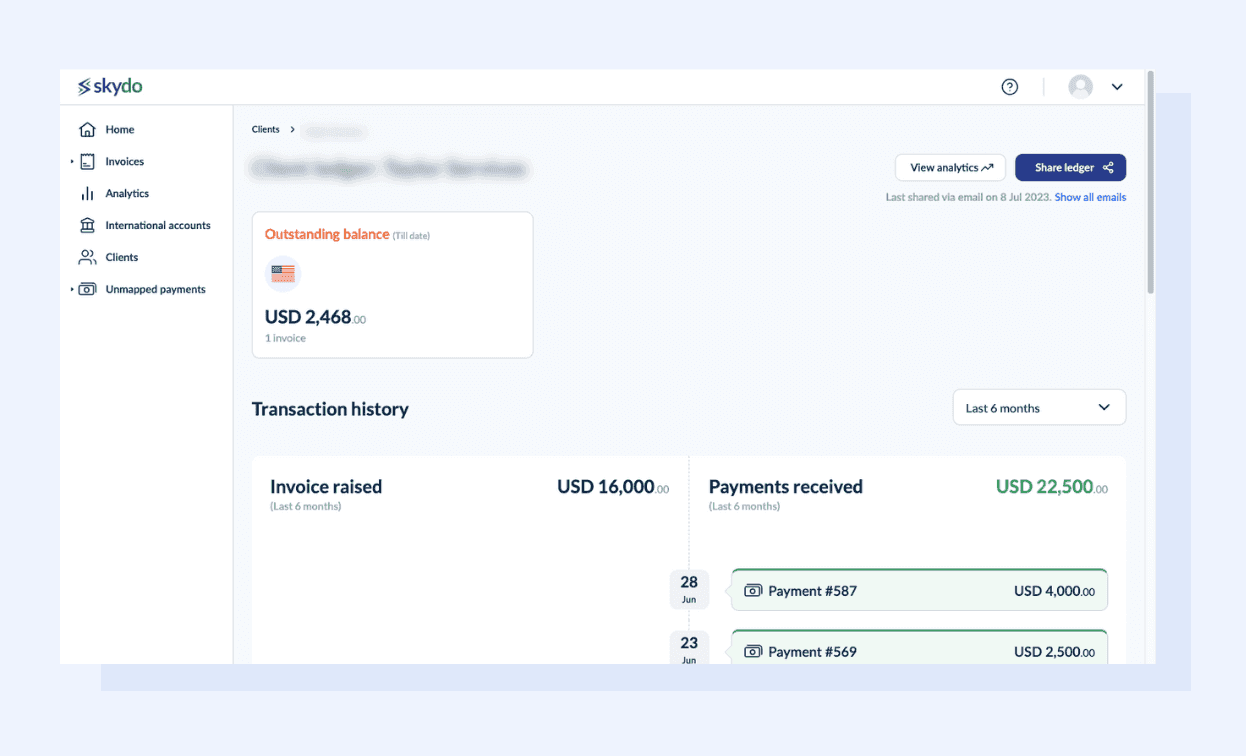

The 'Clients' tab has a comprehensive list of all the clients you have entered and their payment history. An important feature in this tab is the 'View ledger.' Here you get access to all the invoices raised and the amount pending/paid with a detailed timeline. You have the option to share the ledger with your client as well. You can also click on the analytics option to view the data related to a specific client.

Make Best Use of Skydo for International Payments

Skydo provides a modern-day solution to this age-old problem by offering unparalleled transparency in financial transactions. With Skydo, you can enjoy greater visibility into your money with reduced stress, enhanced efficiency, and minimised delays. Alerts and data insights help tackle potential issues proactively so that transactions are smoother than ever before.

Take control of your finances now with Skydo - the bridge between banking opacity and transparency.