All You Need to Know About Letter of Undertaking (LUT)

Skydo: Hey, have you heard about the export rules in India? If we accept foreign payments in Indian currency instead of foreign currency, we'll be liable for GST!

Tech Exporter A: Really? You don't have to pay any GST if you receive international payments in a foreign currency?

Skydo: Yes, we don't. According to Indian government regulations, the export of goods and services is a zero-rated supply if you receive payments in foreign currency.

Since payments are received later, the GST department asks suppliers to pay IGST on each supply and get a refund of such IGST paid once the goods or services are exported. However, there is another option, where you can skip paying the GST.

You need to submit an LUT to the tax authorities, where you promise the government that if you fail to comply with the conditions, you will pay the applicable GST along with interest.

Tech Exporter A: That sounds interesting! How does the LUT work exactly?

Skydo: Well, the LUT is a declaration that you submit to the authorities stating that you fulfil certain criteria and will fulfil the export obligations. You can simply log in to the GST portal and submit the declaration.

Tech Exporter A: Tell me more! How do I apply for an LUT?

Let's delve deeper into understanding everything there is to know about LUTs for your technology export business!

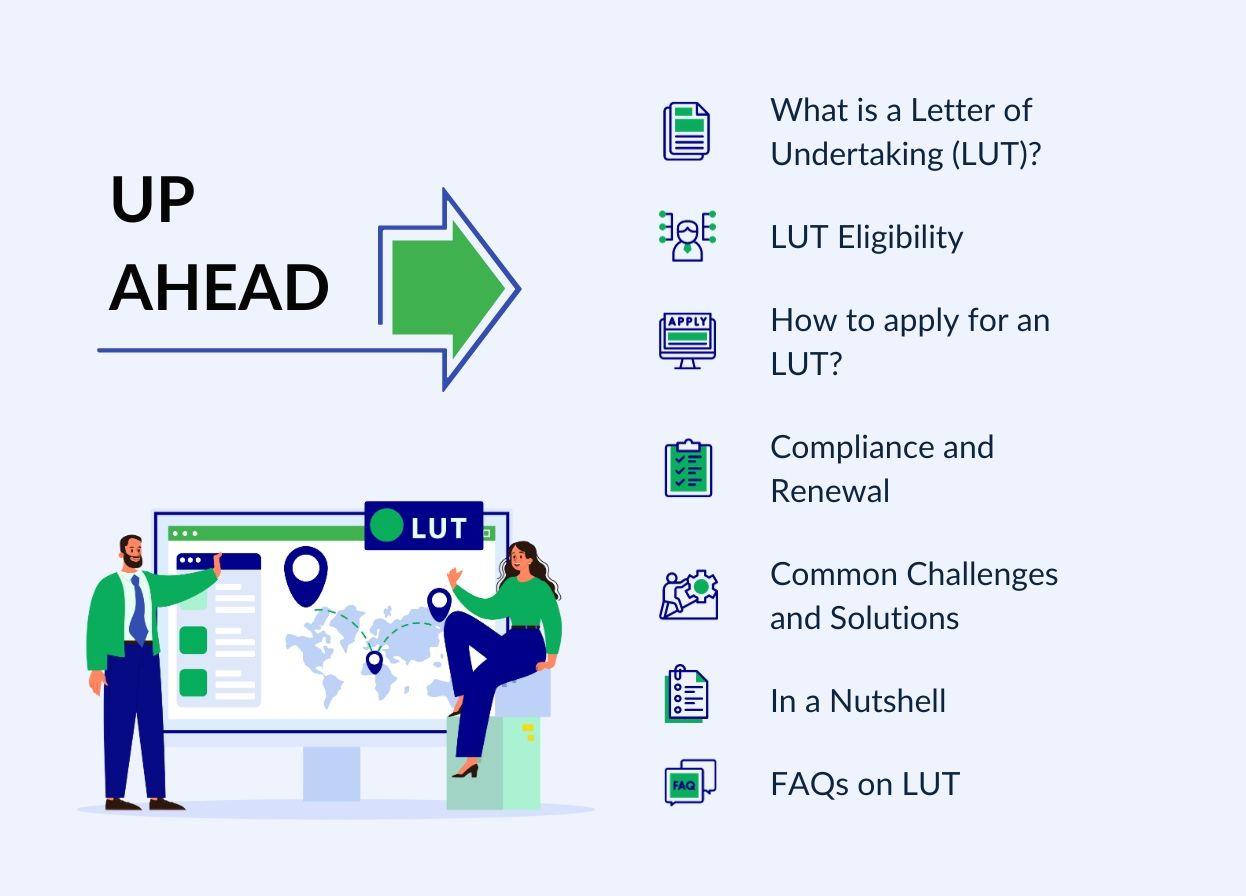

What is a Letter of Undertaking (LUT)?

The LUT meaning is a Letter of Undertaking, a formal declaration submitted by an exporter to the relevant GST authorities. It serves as a bridge wherein the exporter fulfils certain obligations and adheres to specific conditions laid down by the GST department.

This undertaking aims to establish the exporter's commitment to following the necessary rules and regulations related to exports under the GST regime. It grants you the privilege of being exempt from paying Integrated Goods and Services Tax (IGST) on your export services.

LUT Eligibility

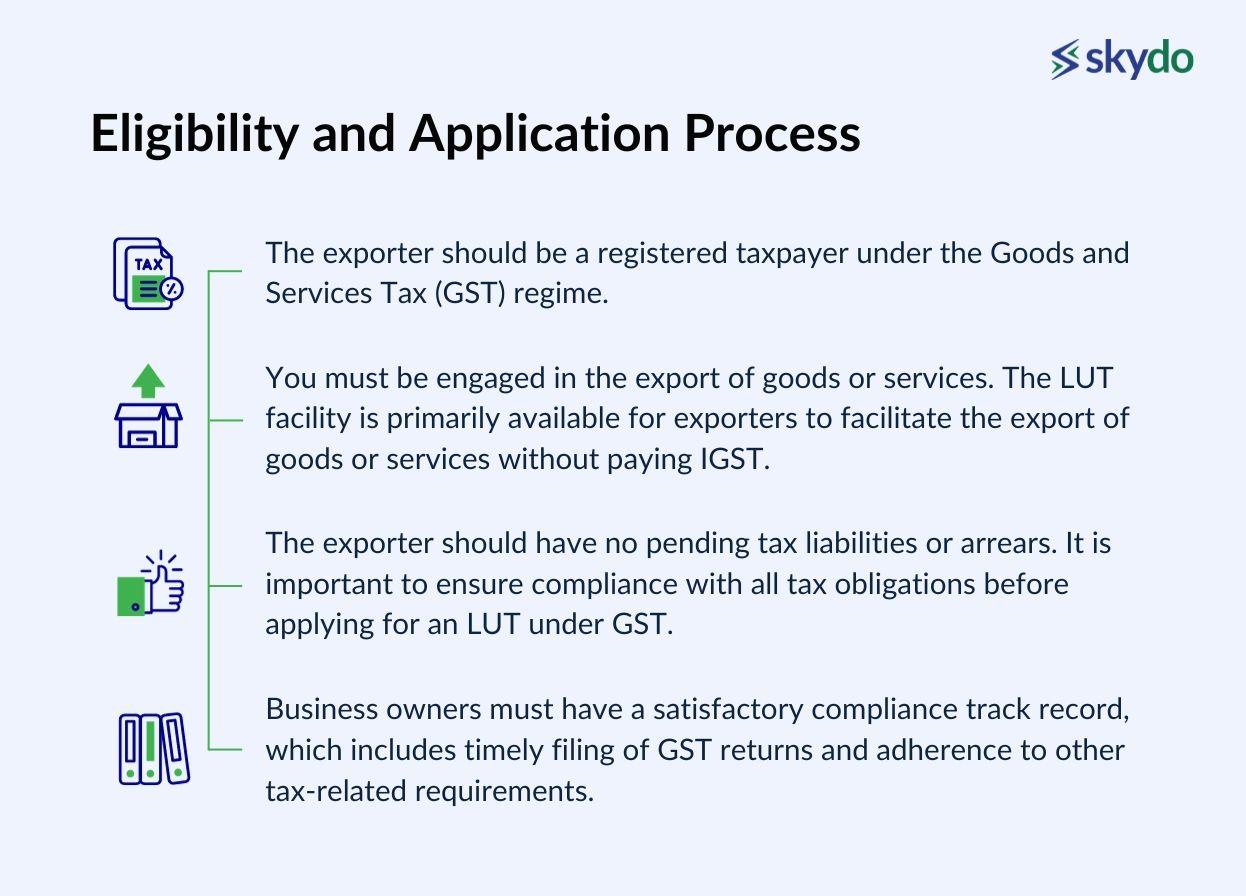

To be eligible for availing the benefits of a Letter of Undertaking (LUT), an exporter must meet the following criteria.

- The exporter should be a registered taxpayer under the Goods and Services Tax (GST) regime.

- You must be engaged in the export of goods or services. The LUT facility is primarily available for exporters to facilitate the export of goods or services without paying IGST.

- The exporter should have no pending tax liabilities or arrears. It is important to ensure compliance with all tax obligations before applying for an LUT under GST.

- Business owners must have a satisfactory compliance track record, which includes timely filing of GST returns and adherence to other tax-related requirements.

According to the CGST Rules of 2017, a registered individual can provide a LUT in the GST RFD 11 form to export goods or services without paying integrated tax as long as they meet all the eligibility requirements.

How to apply for an LUT?

Here are step-by-step instructions on how to apply for an LUT.

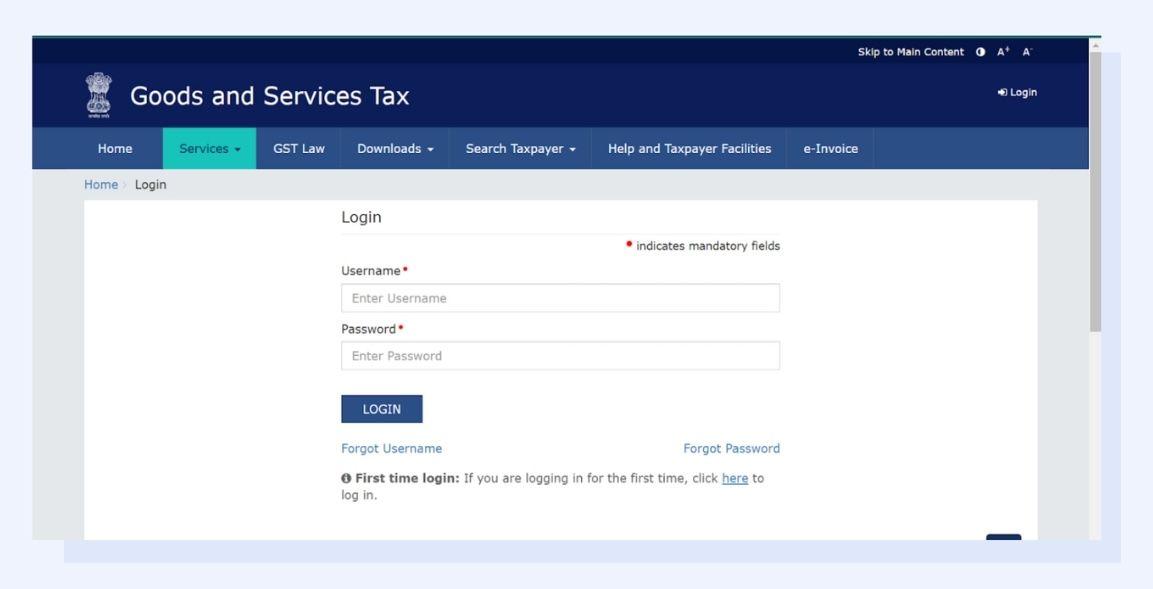

Step 1: Log in to the GST Portal

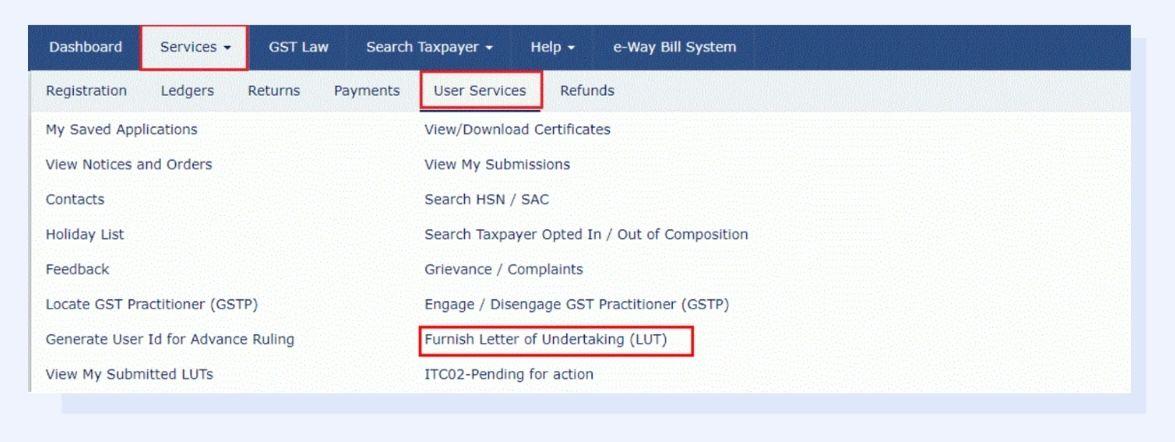

Step 2: Navigate to the 'Services' tab and click 'User Services'. From there, you can select 'Furnish Letter of Undertaking(LUT)'.

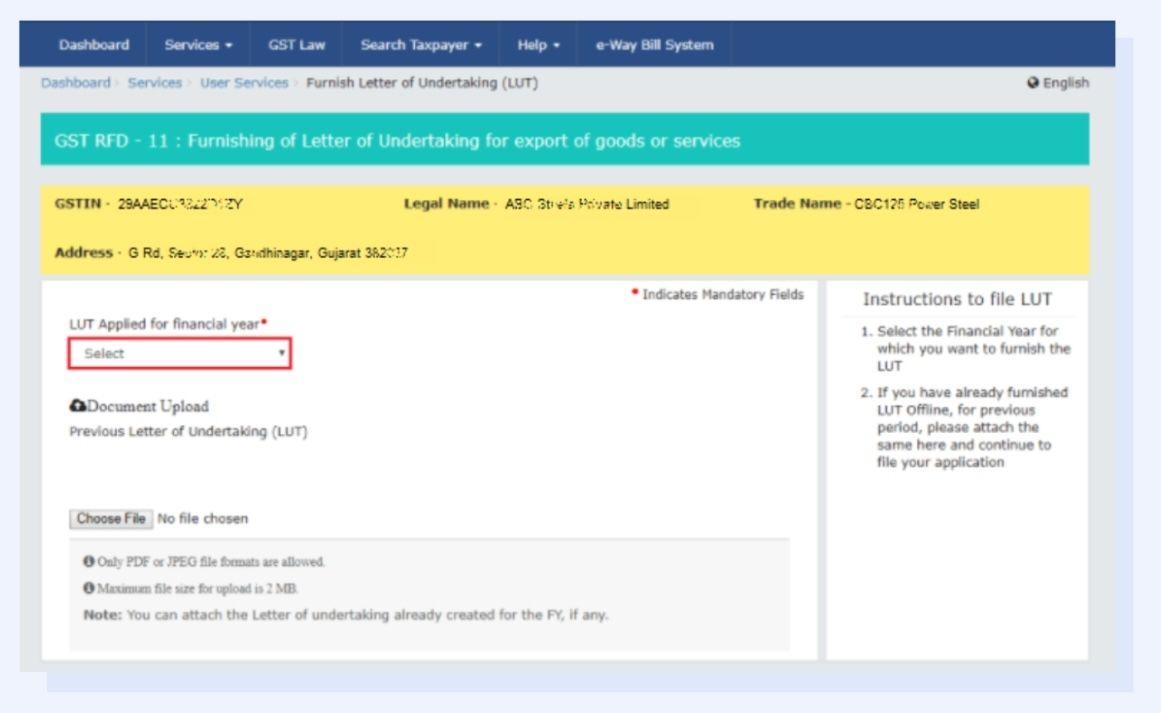

Step 3: Choose the financial year for which you are applying for the LUT from the 'LUT Applied for Financial Year' drop-down menu. For instance, you can select 2023-24.

If you have already provided a Letter of Undertaking manually for any previous periods, please upload it by clicking on the "Choose File" option.

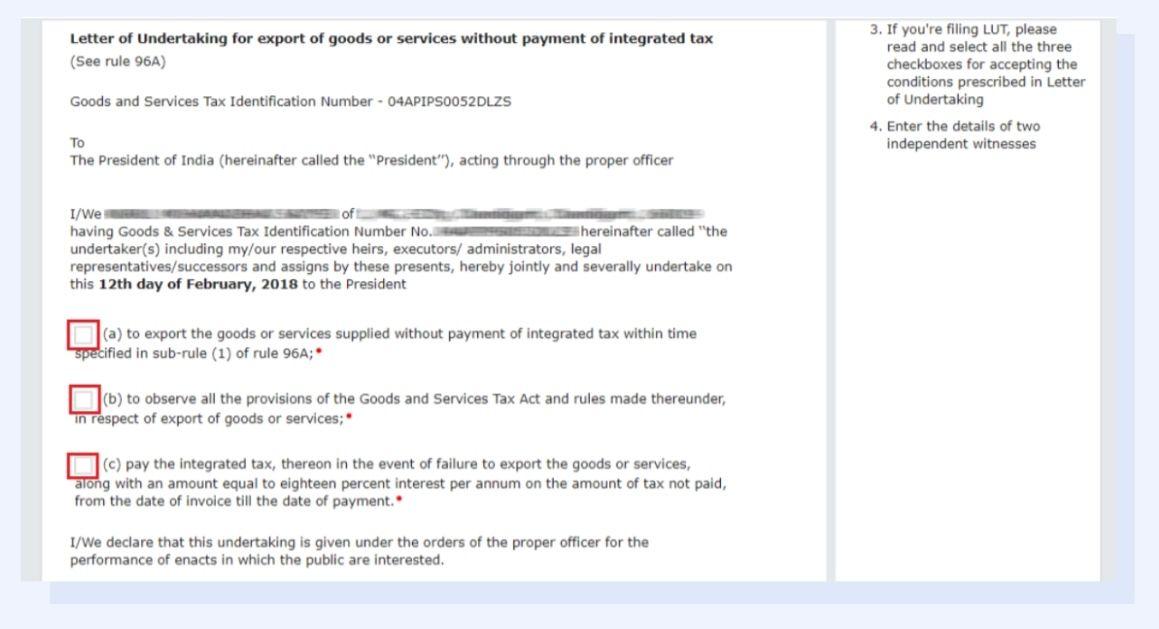

Step 4: Fill in all required fields on the Letter of Undertaking Form/GST RFD-11 displayed on your screen. Fulfil the self-declaration by ticking the box next to each option.

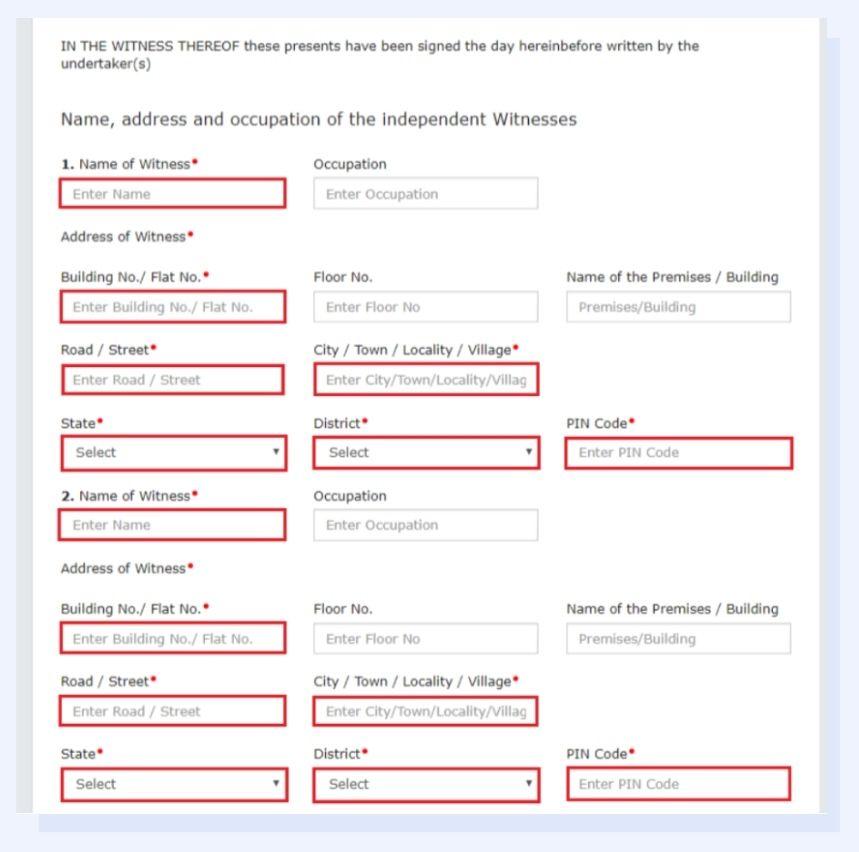

Next, you must provide the names, occupations, and addresses of two independent witnesses in the boxes. This information is mandatory.

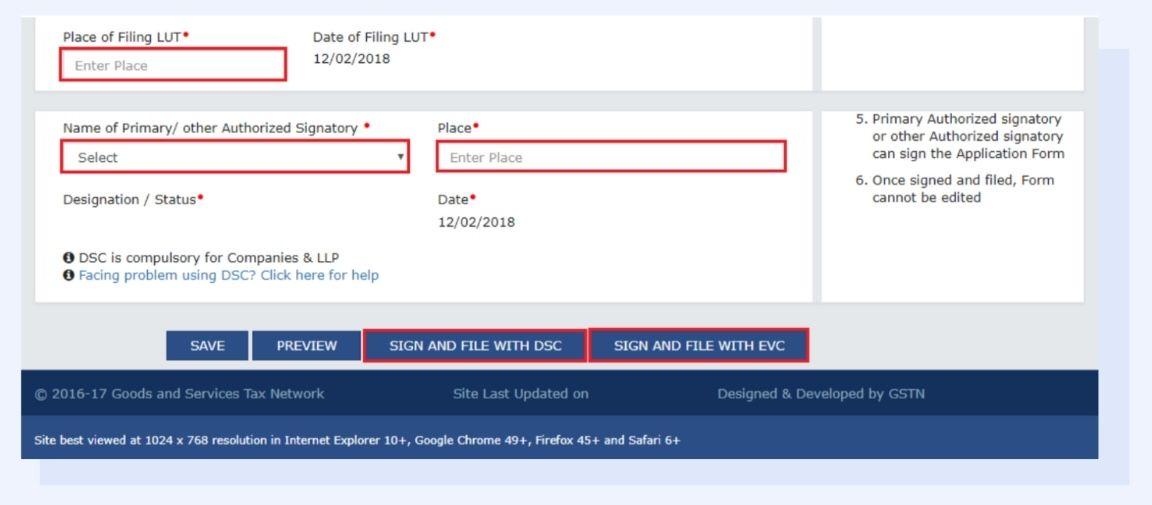

Step 5: Enter the place of filing and click on the 'Save' button. Later, click on 'Preview' to ensure the form is correct before submitting it.

Step 6: To complete the process, you can sign and file the form using either a Digital Signature Certificate (DSE) or an Electronic Verification Code (EVC).

Click ‘Sign and File with DSC’ to utilise the DSE option. Sign the application using the registered digital signature certificate of the selected authorised signatory. A warning message box will appear, then click ‘Proceed’. The system will then generate a unique ARN (Application reference number).

To sign and file with EVC, simply click on 'Sign and File with EVC'. A one-time password (OTP) will then be sent to the authorised signatory's registered mobile phone number and e-mail address. Enter the OTP in the pop-up to complete the application signing process.

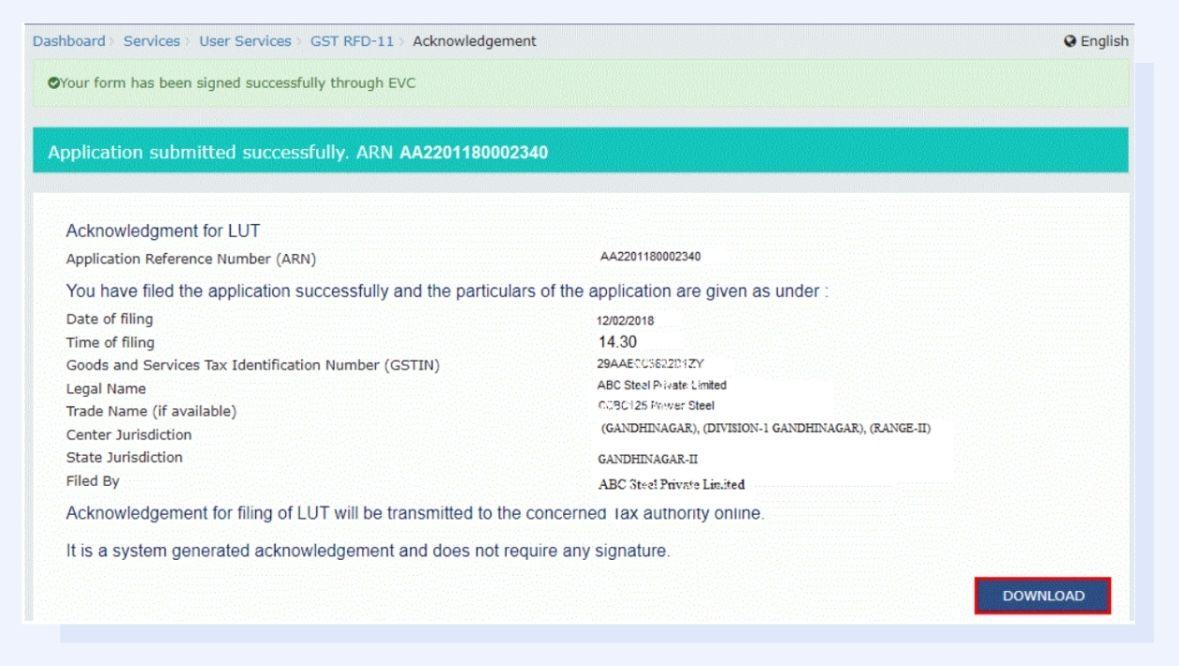

After submission, a confirmation message will display. The GST Portal will send an ARN (Application Reference Number) to the registered email and mobile of the taxpayer through email and SMS. You can click on the DOWNLOAD button to download the acknowledgement.

Compliance and Renewal

If you fail to comply with the letter of undertaking GST rules, you may be subject to penalties, depending on the nature of the violation.

For example, if you fail to submit an LUT before exporting services, you may be liable to pay the full amount of IGST. You may also be subject to a penalty of up to 100% of the IGST that you should have paid.

Moreover, A LUT copy is valid for one financial year. This means that you must renew your LUT every year if you want to continue exporting without paying IGST. Typically, the deadline for renewing your LUT falls on March 31 in the same financial year in which it expires.

If you fail to renew your LUT before the expiry date, you will no longer be able to export the services without paying IGST. You can renew your LUT hassle-free online via the GST portal by following the aforementioned steps.

Common Challenges and Solutions

You may encounter common challenges in the LUT registration process, such as delays in LUT (Letter of Undertaking) approval. The Customs authorities can take several weeks or even months to approve a LUT application.

These delays can hinder your business operations and impede timely exports. To avoid last-minute hassles, it is better to apply LUT beforehand.

Rectification and amendment procedures can also present challenges. Mistakes or changes in submitted documents may require rectification or amendment.

To tackle this, it is important to carefully review all documents before submission and promptly address any errors. Seek guidance from experts or professionals in the field to navigate through the rectification process smoothly.

In a Nutshell

The Letter of Undertaking in export is indeed essential for streamlining international transactions and easing the financial load of upfront tax payments. If you're running a tech service company, effectively utilising LUTs can optimise your processes, enhance competitiveness, and boost profits.

FAQs on LUT

Q1. What is LUT in export?

Ans: A Letter of Undertaking (LUT) in export is a formal declaration submitted by an exporter to GST authorities, ensuring compliance with export rules and regulations. It allows exporters to avoid paying Integrated Goods and Services Tax (IGST) on their export services.

Q2. In GST, what is an LUT certificate?

Ans: In GST, an LUT certificate, or Letter of Undertaking certificate, is a document that exempts exporters from paying IGST on export services. It signifies an exporter's commitment to comply with export regulations and is filed with GST authorities.

Q3. Is it necessary to register a LUT for GST?

Ans: Yes, it is necessary to register an LUT for GST if you are an exporter looking to avoid paying IGST on your export services. It helps streamline international transactions and ease the financial burden of tax payments.

Q4. Is it possible to obtain a LUT certificate through the GST portal?

Ans: Yes, you can obtain an LUT certificate through the GST portal. The process involves submitting the LUT application, and once approved, you can claim an exemption from paying IGST on your exports.

Q5. Is it mandatory to mention the LUT number on the invoice?

Ans: Yes, it is mandatory to mention the LUT number on your invoice when you are availing the benefit of LUT for GST. This helps in identifying that your export services are exempt from IGST.