Everything You Need to Know About the W-8BEN Form

The W-8BEN form is filled out by non-US residents or business entities earning an income from the US. The major benefit of filling out a W-8BEN tax form is that you avail tax benefits and exemptions in the USA despite being a non-resident. In short, this is a tax-saving form and can help you reduce your taxes significantly, especially if your country has entered a tax treaty with the US.

The complex nature of tax norms in the US makes compliance difficult. In this article, we will go through the basics of the W-8BEN tax form, why it is important, how it can benefit you, and the consequences of not filling it.

What is a W-8BEN- Form?

The W-8BEN form is issued by the Internal Revenue Service (IRS). The agency mandates that all non-US resident individuals and entities earning an income in the United States fill out this form to avail of tax exemptions. Without the W-8BEN tax form, an entity must pay tax according to the USA’s standard 30% tax rate.

The W-8BEN tax form establishes the foreign status of individuals, whereas businesses, corporations, partnerships, and other entities must use the W-8BENE form to avail their tax exemptions.

When Is Form W-8BEN Required?

According to the IRS, individuals or businesses earning income in the following ways are also required to fill the W-8BEN form:

- Interests, dividends, rents

- Royalties, premiums, annuities

- Compensations for services performed

- Substitute payments in a securities lending transaction

- Other fixed annual or periodical gains or incomes

This means non-US citizens or businesses that engage in investments, work with other businesses or partnerships in the US, own property in the US, etc., are generally the type of entities that fill this form.

To know whether you fall under this category, you must ask yourself two simple questions:

- Are you a non-US citizen?

- Are you earning any type of income from the US?

If your answer to both is yes, chances are you will need to fill out the W-8BEN tax form.

Failure to fill out the form can result in the US government withholding 30% of your income or any amount credited to you.

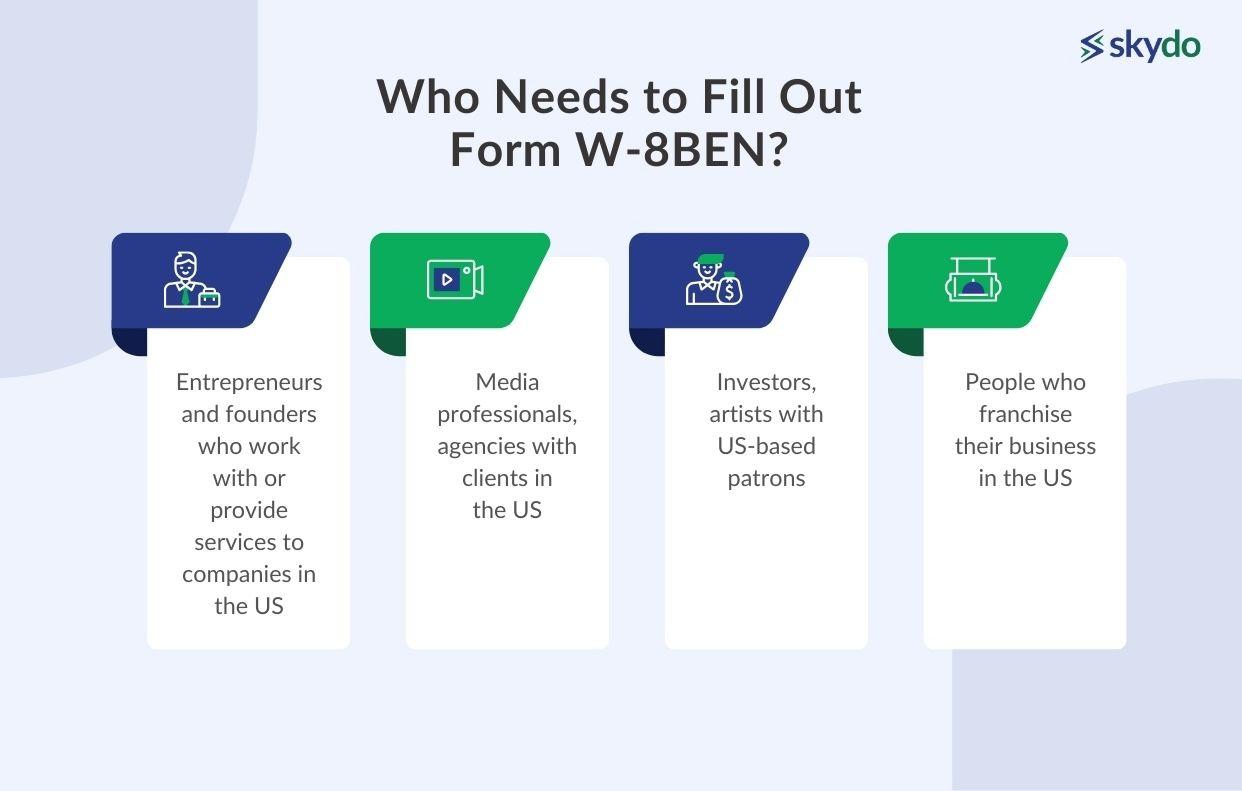

Who Needs to Fill Out Form W-8BEN?

Some entities/individuals who may be required to submit the W-8BEN form are:

- Entrepreneurs and founders who work with or provide services to companies in the US

- Media professionals, agencies with clients in the US

- Investors, artists with US-based patrons

- People who franchise their business in the US

Students who receive any income from compensatory fellowships or scholarships are exempt. These individuals must fill out a different set of forms according to the guidelines laid down by the IRS.

How to File W-8BEN Form?

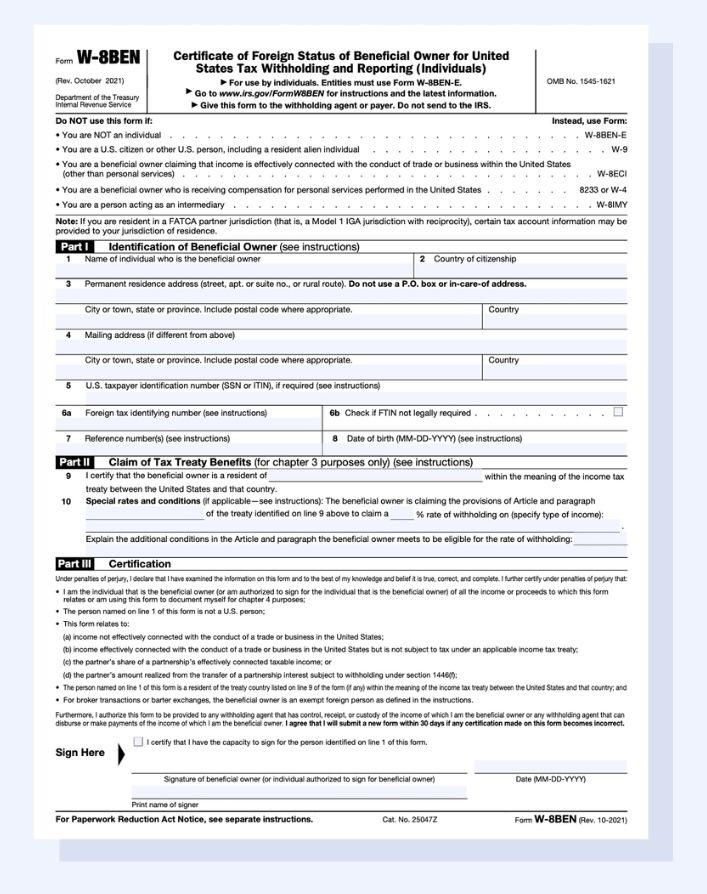

The W-8BEN tax form is a straightforward form that most people fill out themselves. Here is what the form looks like:

Section 1: Identification of Beneficial Owner

This section includes basic information about you, such as your name, country of citizenship, country of residence, date of birth, permanent residence, and mailing address.

This section has a field to enter your US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you are not a US citizen, you will not be eligible for an SSN; in that case, you must apply for an ITIN. It takes about 4-6 weeks to get the ITIN after filling out the W-7 form with the IRS.

The next field is the foreign tax identifying number (FTIN). This is an important field, and if your country does not provide a foreign tax ID, you can also enter your passport number.

While you can check a box if the FTIN is not applicable, it is not generally recommended to do so since it can result in discrepancies cropping up in your form. The reference number field can be left blank.

Section 2: Claim of Tax Treaty Benefits

This depends on your country of residence since the withholding amount depends on the country’s treatment with the US. You can try looking up your country’s treaty on the IRS website and entering the withholding amount accordingly.

The treaty is generally in the form of a PDF and contains withholding rates for different types of income. This section also requires you to enter the specific article and paragraph from the treaty that mentions the withholding amount for the type of income you are earning.

The final section includes a certification that ensures you understand the conditions of the form, followed by your date of birth, signature, and name.

It is best to get help from an agent, but if you are used to filling out this form, you should get it right. Another mistake commonly made is leaving the ITIN field blank.

Where to submit the W-8BEN?

Do not submit your form to the IRS directly. In most cases, the person who pays you the money or income you earn will ask you to submit the W-8BEN tax form. Download the form (more on that below) and submit it to them. Another option is going through a withholding agent who will receive your form after you fill it out and submit it.

You must submit the form whenever it is asked of you, even if you do not intend to file for exemption from taxes for that particular time period.

Where Can I Download Form W-8BEN?

Go to the IRS’ official website and download the latest revision of the W-8BEN form. Do not rely on third-party sites claiming to have the latest versions. The IRS website shall give you the right version.

If you submit an expired or outdated form, you may have to go through the process again and resubmit it.

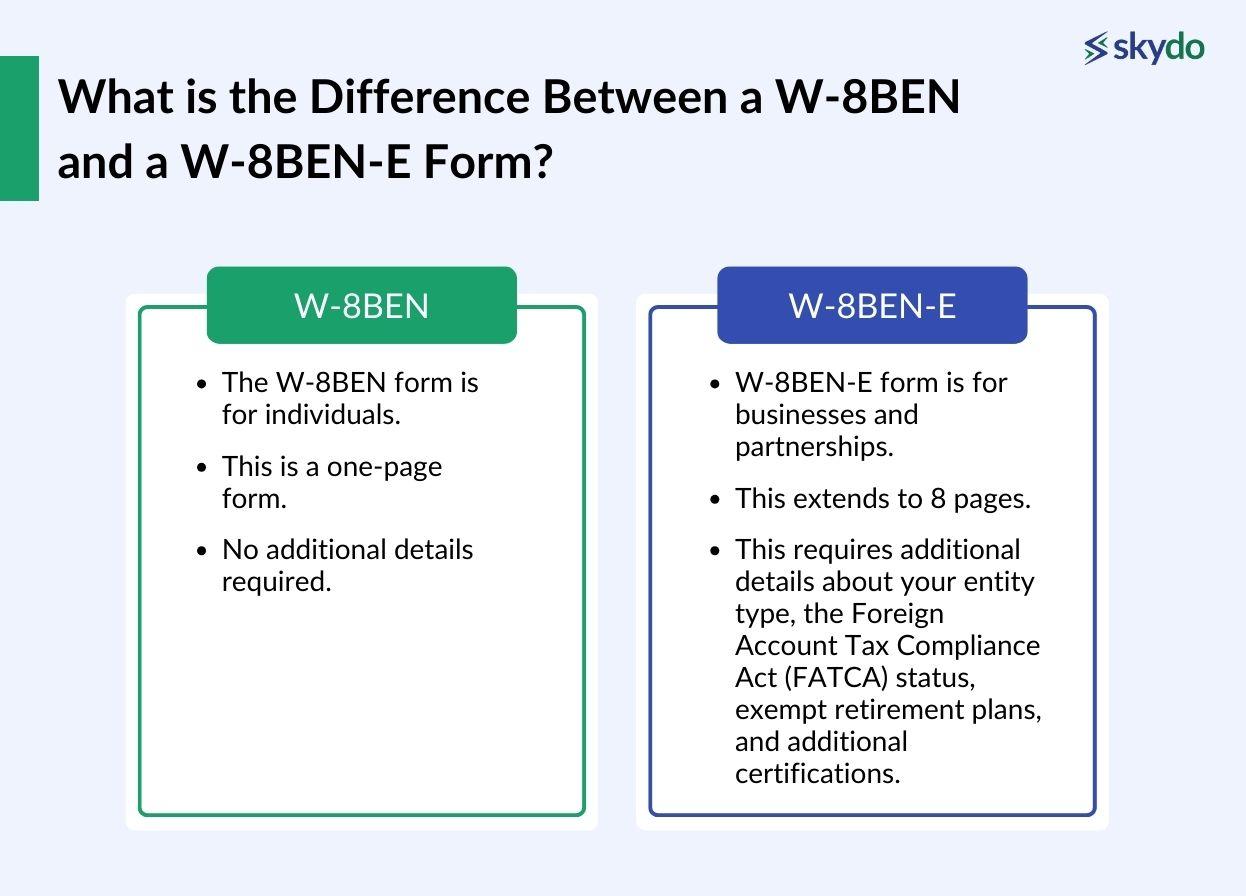

What is the Difference Between a W-8BEN and a W-8BEN-E Form?

There are two forms: W-8 BEN and W-8 BEN-E form. The W-8BEN form is for individuals, and the W-8 BEN-E is meant to be filled by entities other than individuals, such as businesses and partnerships.

While the former is a short, one-page form, the latter extends to 8 pages. The W-8BEN-E requires additional details about your entity type, the Foreign Account Tax Compliance Act (FATCA) status, exempt retirement plans, and additional certifications.

Which W8 Form Should I Use?

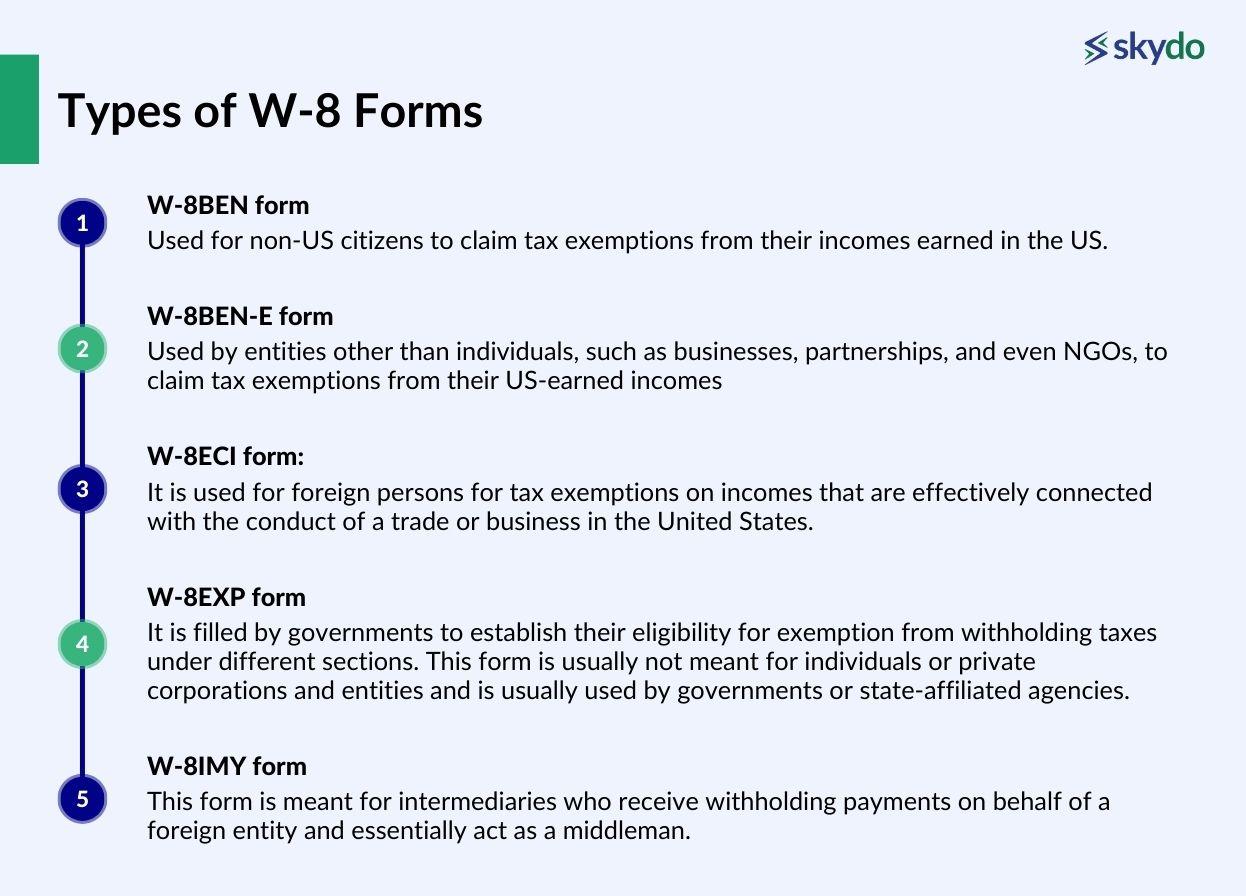

There are five types of W-8 forms, including W-8 BEN and W-8BEN-E. Here are some basic requirements they fulfill:

- W-8BEN form: Used for non-US citizens to claim tax exemptions from their incomes earned in the US.

- W-8BEN-E form: Used by entities other than individuals, such as businesses, partnerships, and even NGOs, to claim tax exemptions from their US-earned incomes.

- W-8ECI form: It is used for foreign persons for tax exemptions on incomes that are effectively connected with the conduct of a trade or business in the United States.

- W-8EXP form: It is filled by governments to establish their eligibility for exemption from withholding taxes under different sections. This form is usually not meant for individuals or private corporations and entities and is usually used by governments or state-affiliated agencies.

- W-8IMY form: This form is meant for intermediaries who receive withholding payments on behalf of a foreign entity and essentially act as a middleman.

Best practices to follow when filling a W-8BEN form

The best way to ensure you comply with all the rules and regulations is to go through an agent. Agents can also be useful to ensure that your forms are submitted and handled without any complications or errors.

However, it is absolutely your decision if you want to go solo and do it yourself. You can also be updated with all the changes by subscribing to financial newsletters or following tax consultants on LinkedIn who regularly simplify the field and its intricacies for their viewers.

Conclusion

To sum up, doing business globally or out of your country as a foreign entity is tough enough, and figuring out your tax liabilities and responsibilities can seem daunting. But if you do it right, it can save you a fortune, which is why going through this grueling process is worth it.

Whether it is the W-8BEN or W-8BEN-E, it is important to recognize what type of entity you are and what other types of forms you need to fill out to get this one right. Kindly refer to the instructions on the SEC website for more guidance.

FAQ

Q1. Do I need to submit a new W-8BEN form for each payment or transaction?

Ans: An individual W-8BEN form is required for each withholding agent, not each transaction or payment. If you have multiple sources of income, you should file a different form with each of them.

Q2. Can a tax professional help me fill out the W-8BEN form?

Ans: Yes, there are several professional agencies and freelance agents that you can contact to help you fill out your form and submit it. Most people who have been filling out the W-8BEN form for years end up doing it alone, but it is recommended you go through a professional initially.

Q3. How long is the W-8BEN form valid?

Ans: A W-8BEN form is valid from the date the form is signed to the last day of the next three calendar years. However, any changes in the conditions mentioned in the form that can deem it incorrect make it invalid.

Q4. Can I submit a W-8BEN form electronically?

Ans: Yes, you can submit the form via email after filling in the details and scanning it.