Forex and Its Impact on International Commerce

Earlier, the world operated under the golden rule – quite literally. Gold was the common standard to which all currencies were pegged. However, there has been a shift in the past half of the century.

No single reserve currency exists, and currencies no longer bow to the mighty weight of gold. Instead, each currency moves relative to the others, with a select few, such as the US Dollar (USD), emerging as the undisputed stars of this financial stage.

The Foreign Exchange (Forex) market has become the cornerstone of international commerce, which has evolved dramatically in the past few decades. This blog will be your one-stop guide for understanding forex.

What is Forex?

The forex market, also known as the foreign exchange market, is a worldwide arena where currencies are traded. This market functions around the clock, five and a half days a week, and is the largest financial market globally.

Within this marketplace, various participants, including banks, corporations, retail investors, and government entities, buy and sell currencies.

These currencies are traded in pairs and are categorised as–

- Major Currencies: The currencies traded the most in volume against the U.S. Dollar are called the major currencies. Example- EUR/USD, USD/JPY, and GBP/USD

- Minor Currencies: Also known as cross-currency pairs, they don't have a direct connection with the U.S. Dollar. Example- EUR/GBP, GBP/JPY, and EUR/CHF

- Exotic Currencies: Exotic currency pairs include currencies from emerging economies. These pairings tend to have lower liquidity and wider spreads. Example- USD/SGD, USD/SAR, and USD/MXN.

While understanding the dynamics of major, minor, and exotic currency pairs is fundamental, tech exporters encounter specific challenges with forex.

Challenges Tech Exporters Face with Forex

- Exchange Rate Volatility: For tech exporters, the revenue earned in foreign currencies can fluctuate dramatically when converted back into the domestic currency. For instance, the volatility of the dollar rate in INR can lead to losses for Indian exporters.

- Currency Conversion Costs: Currency conversion is associated with transaction fees, platform fees, and other charges. These costs eat into their profit margins.

- Market Timing: Timing is everything in the Forex market. However, effectively timing the market is challenging as a tech exporter running a business.

- Regulatory Compliance:

Understanding international trade regulations and tax laws is tough. Non-compliance can result in hefty fines and legal troubles.

- Cultural and Language Barriers: Effective communication is vital in the global tech market. Cultural and language barriers hinder partnerships with international partners and customers.

As tech exporters wrestle with the challenges presented by the forex market, it's crucial to understand the factors influencing foreign exchange rates. These factors play a key role in deciding the profitability and success of their international ventures.

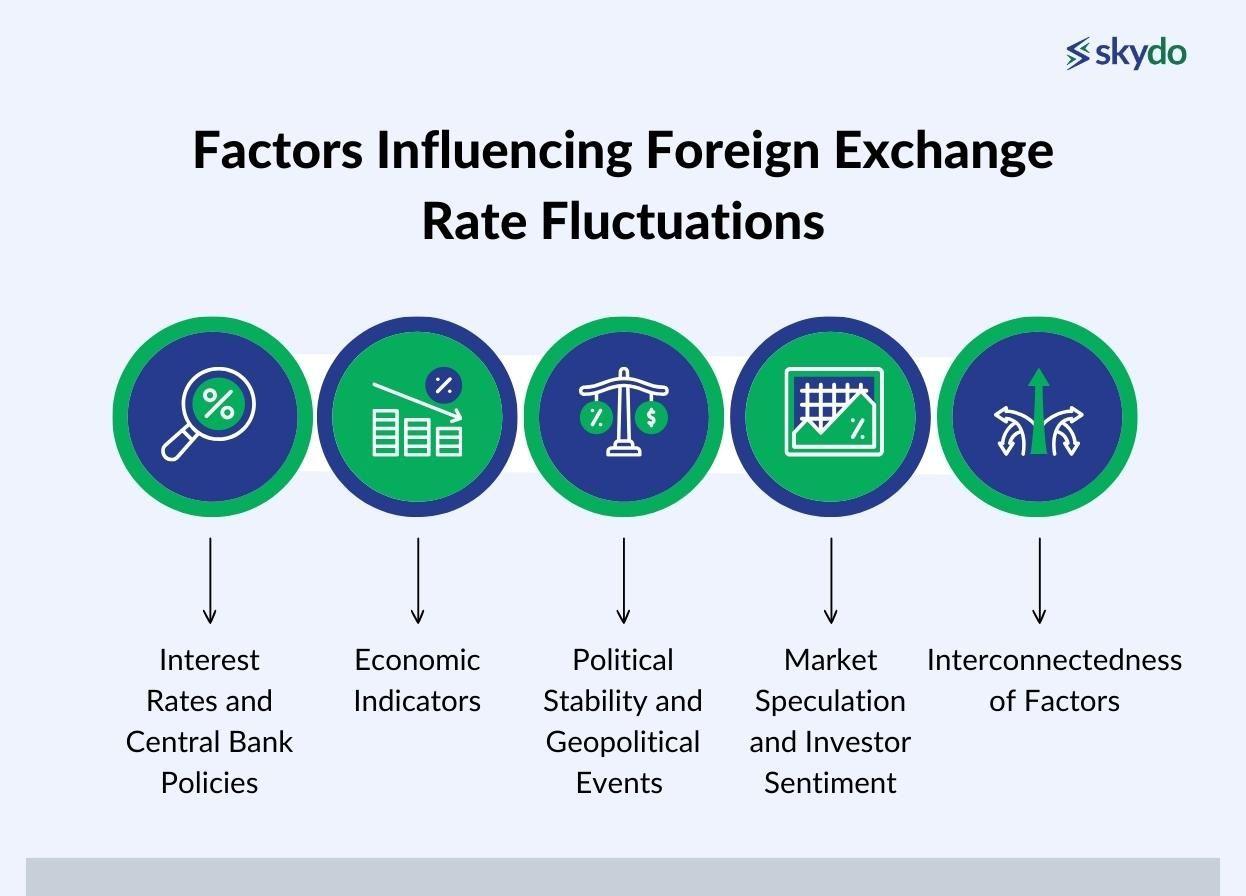

Factors Influencing Foreign Exchange Rate Fluctuations

1. Interest Rates and Central Bank Policies

Interest rates set by a country's central bank affect the return on investment denominated in that currency. Higher interest rates tend to attract foreign capital seeking better returns, driving up demand for the currency and, consequently, its value.

Central bank policies, including quantitative easing and monetary tightening, can also change foreign exchange rates by influencing the money supply.

2. Economic Indicators

Economic data, such as strong GDP growth, low inflation, and low unemployment, can boost confidence in a currency, attracting investors and driving up its value.

3. Political Stability and Geopolitical Events

Countries with stable governments and predictable policies are more likely to attract foreign investment, bolstering their currency's value. Geopolitical events, such as elections, trade disputes, or conflicts, can introduce uncertainty and volatility into exchange rates.

4. Market Speculation and Investor Sentiment

Forex markets are influenced by the perceptions and sentiments of traders and investors. Understanding market sentiment and staying informed about related news is crucial for currency traders and investors.

5. Interconnectedness of Factors

It's essential to understand that these factors are not isolated but deeply interconnected. For instance, central bank policies are influenced by economic indicators and can, in turn, impact investor sentiment.

Understanding how these factors interact is essential for a comprehensive grasp of exchange rate movements. Exchange rate mechanisms encompass the methods and systems employed to determine the value of one currency against another.

These mechanisms are key in the practical functioning of the forex market and are influenced by the very factors we've just explored.

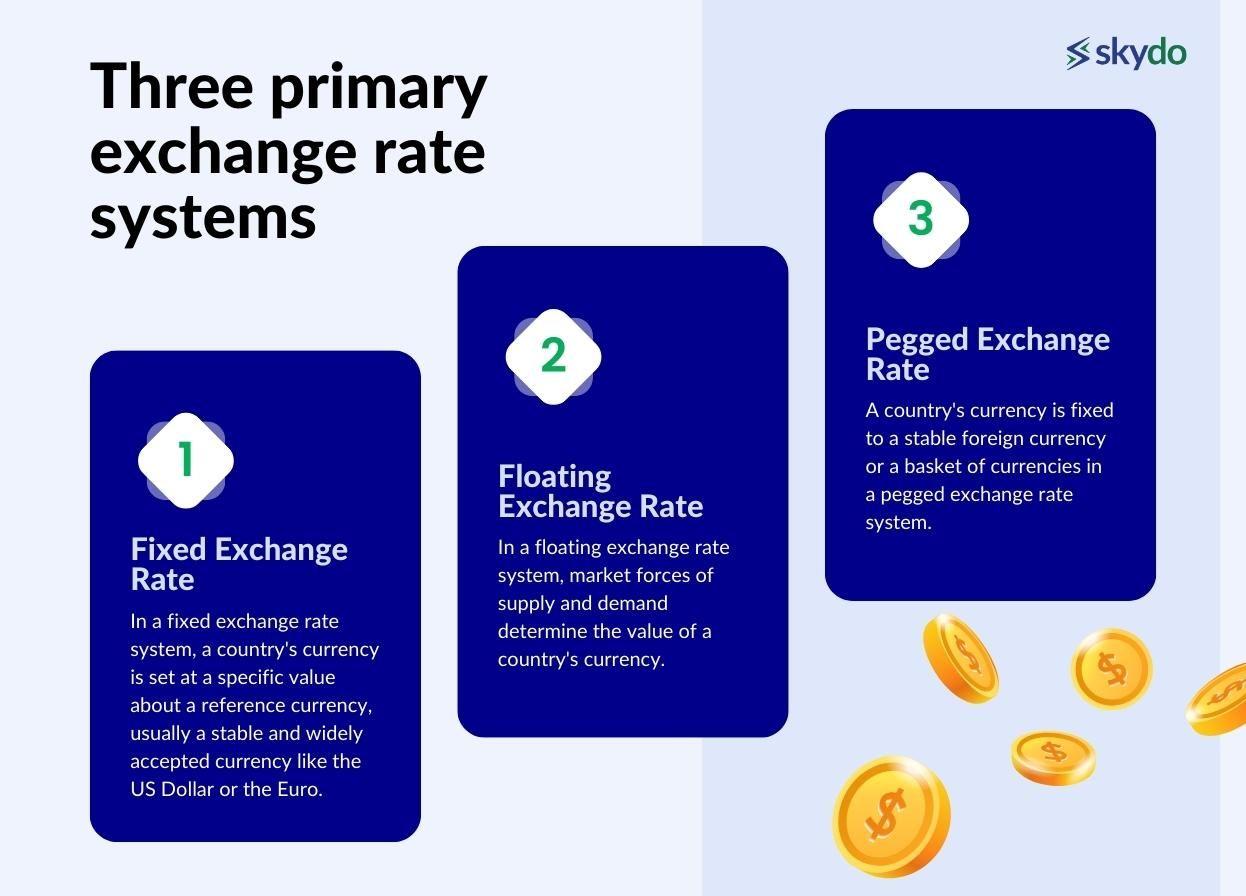

Exchange Rate Mechanisms

Foreign Exchange rate mechanisms govern how a country's currency is valued over other currencies. These mechanisms are vital in international trade, financial stability, and monetary policy.

There are three primary exchange rate systems: fixed, floating, and pegged, each with advantages and disadvantages.

1. Fixed Exchange Rate

In a fixed exchange rate system, a country's currency is set at a specific value about a reference currency, usually a stable and widely accepted currency like the US Dollar or the Euro.

The central bank actively intervenes in the foreign exchange market to maintain the currency's value at a fixed rate. This often involves buying or selling its currency to stabilise exchange rates.

2. Floating Exchange Rate

In a floating exchange rate system, market forces of supply and demand determine the value of a country's currency. Central banks do not actively intervene to stabilise exchange rates. Currency values fluctuate freely based on economic conditions, interest rates, and other factors.

3. Pegged Exchange Rate

A country's currency is fixed to a stable foreign currency or a basket of currencies in a pegged exchange rate system. Unlike a fixed system, where central banks actively intervene, pegged currencies are adjusted less frequently and often follow a predetermined rate or a band within which they can fluctuate.

The Role of Central Banks in Exchange Rates

Central banks are responsible for maintaining stability in their country's currency value and ensuring the economy's overall health.

Here's an overview of their role and the interventions they use to influence exchange rates.

1. Monetary Policy

Central banks use monetary policy tools, such as interest rates and money supply, to control the value of their currency and influence the demand for their currency. Higher interest rates attract foreign capital seeking better returns, increasing demand for the currency and pushing up its value.

2. Currency Interventions

Central banks may directly buy or sell their currency in the market to stabilise or manipulate foreign exchange rates. When a central bank buys its currency, it increases demand, leading to an appreciation of its value.

3. Foreign Exchange Reserves

Central banks maintain foreign exchange reserves, typically in major currencies like the US Dollar, Euro, or Yen. These reserves act as a buffer for central banks to stabilise their currency.

For example, if a country's currency depreciates rapidly, the central bank can sell foreign exchange reserves to buy its currency, thereby reducing depreciation.

Let’s take the case of the Swiss National Bank (SNB) Intervention in 2015.

SNB took outstanding action to influence its currency, the Swiss Franc (CHF). The SNB had maintained a peg of 1.20 CHF to 1 euro (EUR) for several years to prevent the Franc from becoming too strong and hurting Swiss exports. However, maintaining this peg became increasingly costly for the SNB.

- The Intervention: On January 15, 2015, the SNB shocked financial markets by suddenly abandoning the CHF/EUR peg. They announced they would no longer keep the exchange rate artificially low, leading to an immediate and significant appreciation of the Swiss Franc. The currency exchange rate soared, and the Euro lost nearly 30% of its value against the Franc within minutes.

- Impact on Currency Value: The sudden currency appreciation had far-reaching consequences for Swiss exporters, as their products became more expensive for foreign buyers. It also led to turmoil in the foreign exchange markets, triggering massive losses for currency traders and financial institutions that had bet on continuing the peg.

- Outcome: The SNB's intervention demonstrated the limitations of central bank actions in the face of market forces. The decision to abandon the peg was a response to mounting costs and an acknowledgement that defending a currency exchange rate peg can become unsustainable.

Considering the central bank has the power to make such decisions, what does it mean for international commerce?

Impact on International Commerce

Exchange rates drives international trade and commerce. Their fluctuations can significantly impact businesses engaged in global markets.

Here's a detailed exploration of how foreign exchange rates influence international commerce.

- Pricing and Profitability: A strong domestic currency makes exports more expensive for foreign buyers, potentially reducing demand. Conversely, a weak domestic currency can make imports more expensive, impacting a company's input costs and profitability.

- Export and Import Volumes: A weaker domestic currency may boost exports by making them more competitive while increasing the cost of imports.

- Market Expansion and Risk: Favourable exchange rates may encourage market expansion, while unfavourable rates deter international expansion. The risk arises when future cash flows are uncertain due to currency fluctuations.

- Cash Flow and Financial Statements: Currency exchange rate changes can impact a company's cash flow and financial statements, affecting revenue, expenses, and profitability.

Navigating Forex for Businesses

Engaging in international trade can be lucrative for businesses looking to expand their reach. However, the intricacies of the foreign exchange (Forex) market can introduce volatility and uncertainty.

To navigate Forex effectively and maximise your international trade success, consider the following strategies.

1. Setting Product Prices for Foreign Markets

To succeed in foreign markets, setting competitive and profitable prices for your products is crucial.

- Fluctuations in currency values can impact your pricing strategy. Monitor Forex trends and adjust prices accordingly.

- Analyse competitors in the target market to understand their pricing strategies. Your prices should be competitive while still allowing for profitability.

- Factor in local operating costs, taxes, import duties, and other expenses when determining prices. Ensure your pricing strategy accounts for these variables.

Read more on "Price It Right" for comprehensive insights into pricing strategies.

2. Importance of Hedging Strategies to Manage Currency Risk

Hedging strategies involve using financial instruments or strategies to mitigate the impact of strong currency movements on your business. It's a vital tool for managing currency risk. Various hedging strategies include the following.

- Forward Contracts allow you to lock in a currency exchange rate for a future date, providing certainty in your future transactions.

- Options Contracts provide the right but not the obligation to exchange currencies at a specific rate, offering flexibility in uncertain markets.

- Money Market Hedge involves borrowing in one currency and investing in another to offset currency risk.

- Natural Hedging aligns your foreign currency revenues and expenses to offset currency fluctuations naturally. For example, if you earn revenue in a foreign currency, consider sourcing some expenses in the same currency.

- Diversifying Currency Holdings in your accounts reduces exposure to a single currency's fluctuations.

- Seek Expert Advice as Currency risk can be complex. Consulting with financial experts or using hedging tools offered by banks or currency management firms is advisable.

Conclusion

The forex market is not just a financial facet; it's the lifeblood of the global economy. Understanding Forex is akin to unlocking the secrets of international commerce, trade dynamics, and economic stability. It's a knowledge base that empowers businesses, investors, and policymakers to make informed decisions that impact nations and economies.

Remember: the world of Forex is not only about numbers and charts. It's about understanding the economic forces that shape our world. It's about recognising central banks' pivotal role, political stability's impact, and market sentiment's influence.

With continued exploration and a commitment to staying informed, you'll be better prepared to seize opportunities and navigate the challenges that the Forex market presents as you run your tech export business.

Frequently Asked Questions

Q1. What is the forex market?

Ans: The forex market, also known as the foreign exchange market, is the global marketplace for FX trading. It's where FX transactions occur, involving businesses, banks, and investors in foreign exchange transactions.

Q2.What is an exchange rate?

Ans: An exchange rate represents the price of one currency in terms of another in the international market. It's determined by various factors, including interest rates, economic indicators, and market sentiment, affecting FX in business.

Q3. Why do Forex rates fluctuate?

Ans: Forex rates fluctuate due to factors like interest rates, economic indicators, and market sentiment, impacting foreign exchange transactions and FX currency values.

Q4. How do FX rates impact international trade?

Ans: Exchange rates can impact international trade by affecting the pricing and profitability of exports and imports, influencing market expansion decisions, and affecting cash flow in business foreign exchange.

Q5. Can exchange rates be predicted?

Ans: Predicting exchange rates is challenging due to the complexity of factors involved in determining FX rates, including interest rates and market sentiment in forex trading. While experts use analysis and models to forecast rates, they are subject to change due to unforeseen events.

Q6. Where can I find current FX rates?

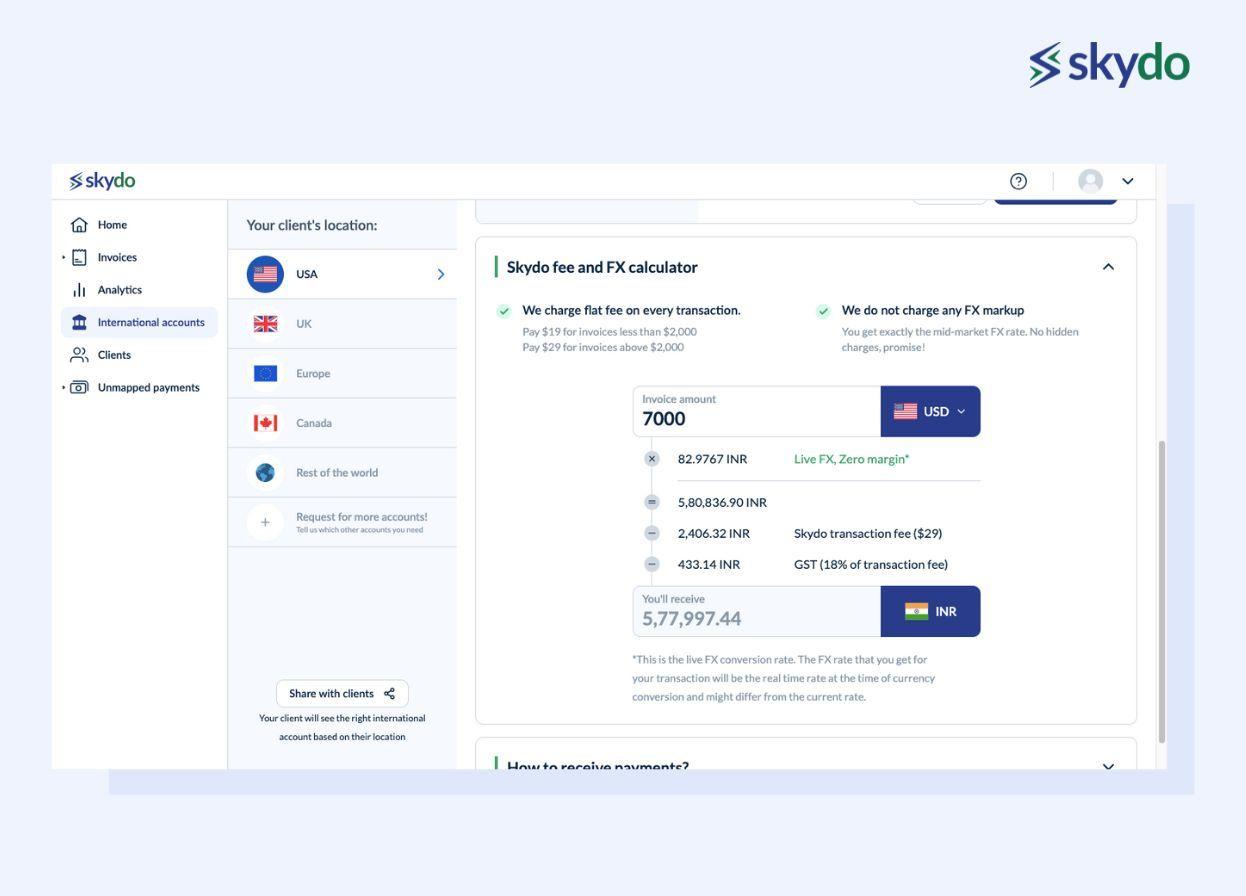

Ans: You can find current FX rates on financial news websites, currency exchange platforms, or by checking with Skydo portals. Skydo also provides real-time exchange rate information on its website.

Q7. How often do exchange rates change?

Ans: Exchange rates can change frequently, often multiple times in a day, in response to market dynamics, economic data releases, and geopolitical events, affecting forex transactions.

Q8. How is the exchange rate determined in India?

Ans: In India, the exchange rate is determined by a combination of market forces, interest rates, and central bank interventions, such as those by the Reserve Bank of India (RBI), impacting the value of the Indian Rupee (INR) against foreign currencies, particularly the US Dollar (USD).

Q9. How does currency value change?

Ans: Currency value changes due to various factors like interest rate differentials, economic performance, and market speculation, impacting the supply and demand for a specific currency in FX transactions.

Q10. How rupee value is determined against the dollar?

Ans: The value of the Indian Rupee (INR) against the US Dollar (USD) is determined by market forces, central bank policies, and economic indicators. It can fluctuate based on the relative strength of the Indian economy, interest rates, and other influencing factors in the foreign exchange market.