What are Form 15CA and 15CB, and how do you file them?

Income Tax, an unavoidable facet of your financial life, looms annually like clockwork. The tax filing process can be daunting, given the formidable 23 chapters and 298 sections of the Income Tax Act of 1961 that you must go through.

As a resident earning in India and making domestic transactions, it is relatively easier to comply with all the tax rules. But what if you are a resident with a global business presence and send international payments during the financial year?When the compliance stretches to foreign remittance, it gets tricky. If you are a resident who has sent money to a non-resident, you must file Form 15CA and 15CB to ensure tax deduction at source.This blog explains both forms and how to ensure effective compliance for foreign remittances.

What is Form 15CA?

Form 15CA is a declaration by the remitter, a resident of India, making international transactions and remitting money to a non-resident. The Income Tax Department, under Section 195 of the Income Tax Act, 1961, requires you to collect Tax Deductible at Source (TDS) from the payments made to non-residents.

Form 15CA creates an effective information processing system for the Indian Tax Department to track foreign remittances and identify your tax liability to avoid withholding taxes.

In early 2023, the Income Tax Department recently revised Rule 37BB, which entails that the authorised dealers/banks should furnish Form 15CA (from the remitter) in case of foreign remittance, failing which the department levies a duty.

The entire list of payments where you do not require filing forms 15CA and 15CB are listed in this link.

The Income Tax Department has also created an online facility for remitters to file Form 15CA online and send the submitted form’s copy to the bank as proof of tax clearance from the tax department.

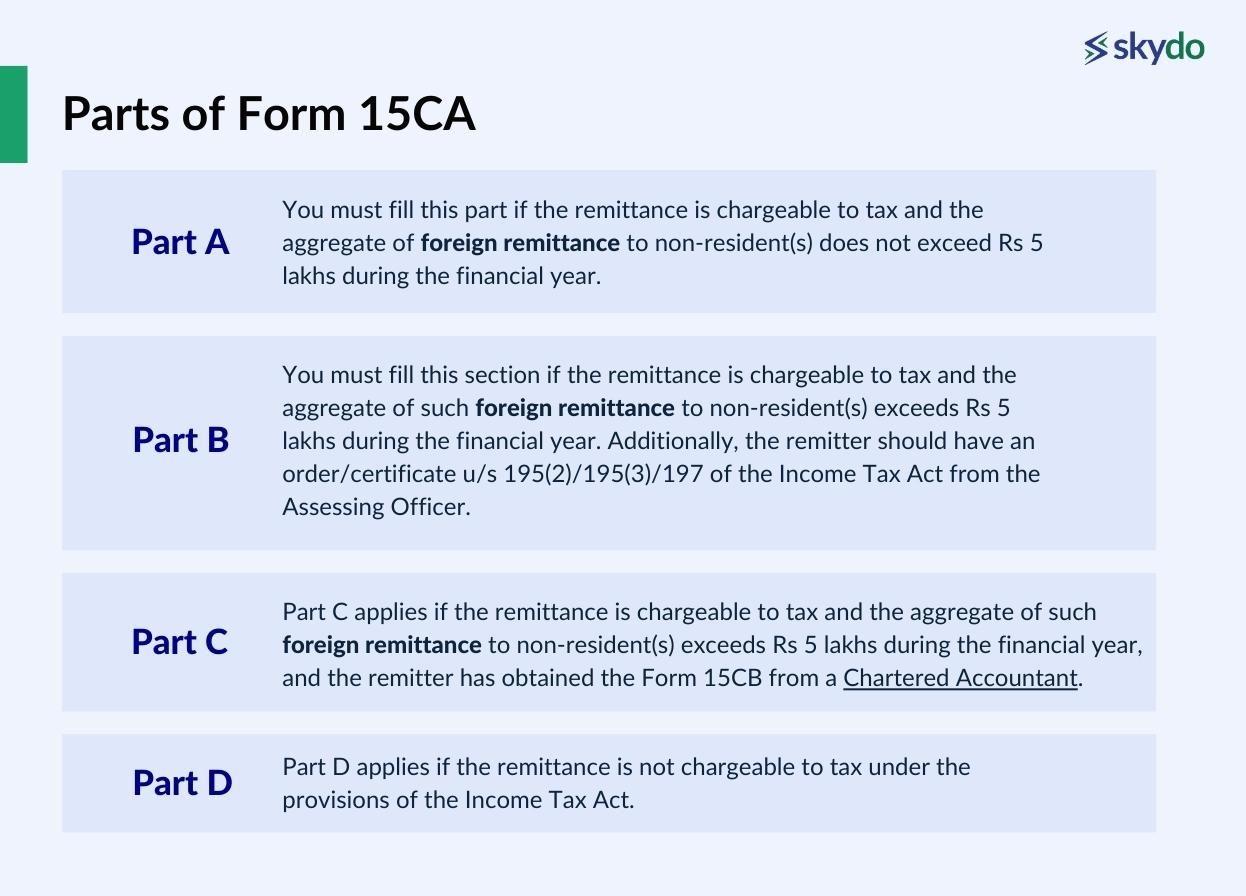

Parts of Form 15CA

Form 15CA consists of the following four parts.

Part A: You must fill this part if the remittance is chargeable to tax and the aggregate of foreign remittance to non-resident(s) does not exceed Rs 5 lakhs during the financial year.

Part B: You must fill this section if the remittance is chargeable to tax and the aggregate of such foreign remittance to non-resident(s) exceeds Rs 5 lakhs during the financial year. Additionally, the remitter should have an order/certificate u/s 195(2)/195(3)/197 of the Income Tax Act from the Assessing Officer.

Part C: Part C applies if the remittance is chargeable to tax and the aggregate of such foreign remittance to non-resident(s) exceeds Rs 5 lakhs during the financial year, and the remitter has obtained the Form 15CB from a Chartered Accountant.

Part D: Part D applies if the remittance is not chargeable to tax under the provisions of the Income Tax Act.

How to e-file form 15CA online?

Here are the steps to File Form 15CA online.

- Step 1: Log in to the e-filing portal, Navigate to the ‘e-file’ menu, and select File Forms sub-menu.

- Step 2: Select Form 15CA under the File Forms sub-menu.

- Step 3: The PAN/TAN of the assessee is auto-populated. Enter details such as Financial Year, Filing Type, and Submission Mode-‘Online.’ Select ‘Part-C’ and click proceed.

- Step 4: A pop-up will appear where you must provide the ARN of Form 15CB generated by your CA.

- Step 5: Once Form 15CB ARN is validated, Part C of Form 15CA is prefilled from Form 15CB.

- Step 6: Complete the balance fields of Part C and submit the form. The portal generates a valid acknowledgement post-submission.

What is Form 15CB?

Form 15CB is a certificate that the remitters must obtain from a licensed Chartered Accountant to certify the liability of withholding tax and the details of payments, such as rates with the Tax Deducted at Source (TDS). Form 15CB is mandatory for uploading the Part C of Form 15CA with the Income Tax Department.

The main aim of submitting Form 15CB is to seek help from a Chartered Accountant who certifies that the remitter has followed the provisions of the Income Tax Act and the Double Taxation Avoidance Agreement – DTAA concerning tax deductions while making international transactions with non-residents.

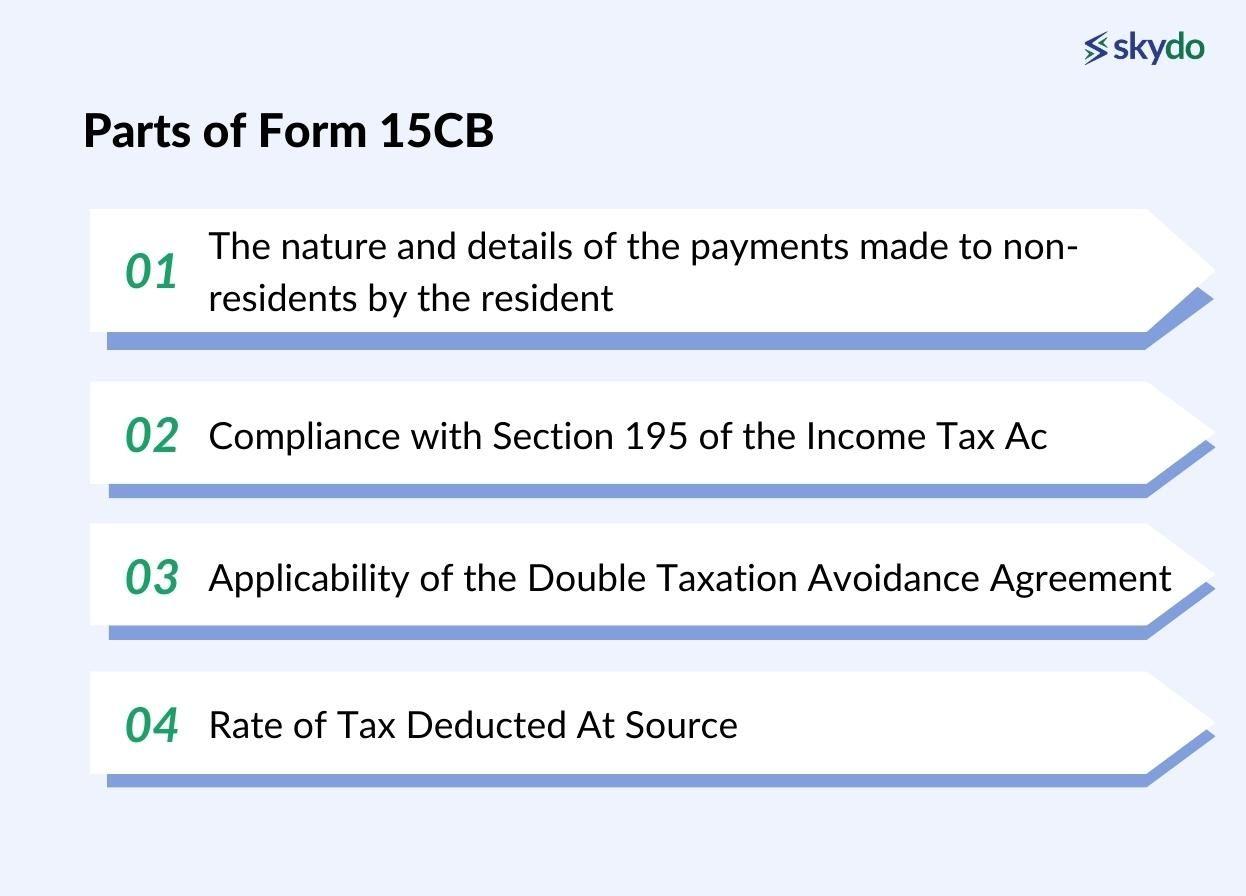

Parts of Form 15CB

Form 15CB includes the following details.

- The nature and details of the payments made to non-residents by the resident

- Compliance with Section 195 of the Income Tax Ac

- Applicability of the Double Taxation Avoidance Agreement

- Rate of Tax Deducted At Source

Who should not file Form 15CB?

There are foreign remittances that do not require the remitter to submit Form 15CB if–

- The remitter has made payments per the provisions of the Foreign Exchange Management Act, 1999, read with Schedule III to the Foreign Exchange (Current Account Transactions) Rules, 2000.

- The sum payable is not chargeable to tax under the Income Tax Act provisions.

- The remitter has obtained an order/certificate u/s 195(2)/195(3)/197 of the Income Tax Act from the Assessing Officer.

- The remitter must fill Part A of Form 15CA for cases when the payment does not exceed Rs 5 lakhs.

How to e-file form 15CB online?

The process of obtaining the 15CB form online is simple, as the taxpayer only has to add the CA on the Income Tax e-portal.

- Step 1: Log in to the e-filing portal and navigate to the ‘My Chartered Accountant(s)’ functionality under the Authorised Partners menu.

- Step 2: Enter the Chartered Account's membership number, assign the form by selecting Form 15CB, financial year, and click ‘Add.’

- Step 3: The Chartered Accountant is liable to generate the acknowledgement number and complete the rest of the actions by submitting the form under the Digital Signature Certificate (DSC).

- Step 4: The final acknowledgement is generated when the taxpayer quotes this acknowledgement number while filing Form 15CA.

Why Are Form 15CA/CB Required?

Earlier, a person remitting money to a foreign national was required to furnish a certificate as specified by the RBI, but the process was cumbersome to manage and resulted in tax withholding. Now, with Forms 15CA and 15CB, the Income Tax Department can collect information about remittances chargeable and collect taxes when the resident makes foreign remittances.

The Tax Deducted At Source (TDS) through Form 15CA helps to curb illicit outflows and money laundering activities while strengthening the government’s efforts to track cross-border transactions. Consequently, Form 15CB allows certification for the remitter with adherence to the Foreign Exchange Management Act (FEMA) and the Double Taxation Avoidance Agreement – DTAA.

Details Required For Filing Form 15CA and 15CB

Filing Forms 15CA and 15CB require some information and documents on the part of the remitter for accurate filing. If you have made international transactions, you will require the following details to fill out both forms.

1. Details of the Remitter

- Name and Address

- PAN number

- Status (Individual/Company/LLP etc.)

- Email and mobile number

2. Details of Remittee

- Name and Address

- Status (Individual/Company/LLP etc.)

- Country of Residence

3. Country of Remittance

4. Currency in which remittance is made

5. Amount of remittance in INR

6. Date of Remittance

7. Nature of Remittance

8. Bank Details of the Remitter

Revised Rules for Submitting Form 15CA and 15CB effective from April 1, 2016

The key updates are as follows.

- Individuals making remittances will not be required to furnish Forms 15CA and 15CB that do not require RBI approval.

- The list of payments specified under Rule 37BB that do not require submission of Forms 15CA and 15CB has been extended from 28 to 33, including payments for imports.

- Form 15CB will be necessary for taxable payments made to non-residents that exceed Rs. 5 lakh.

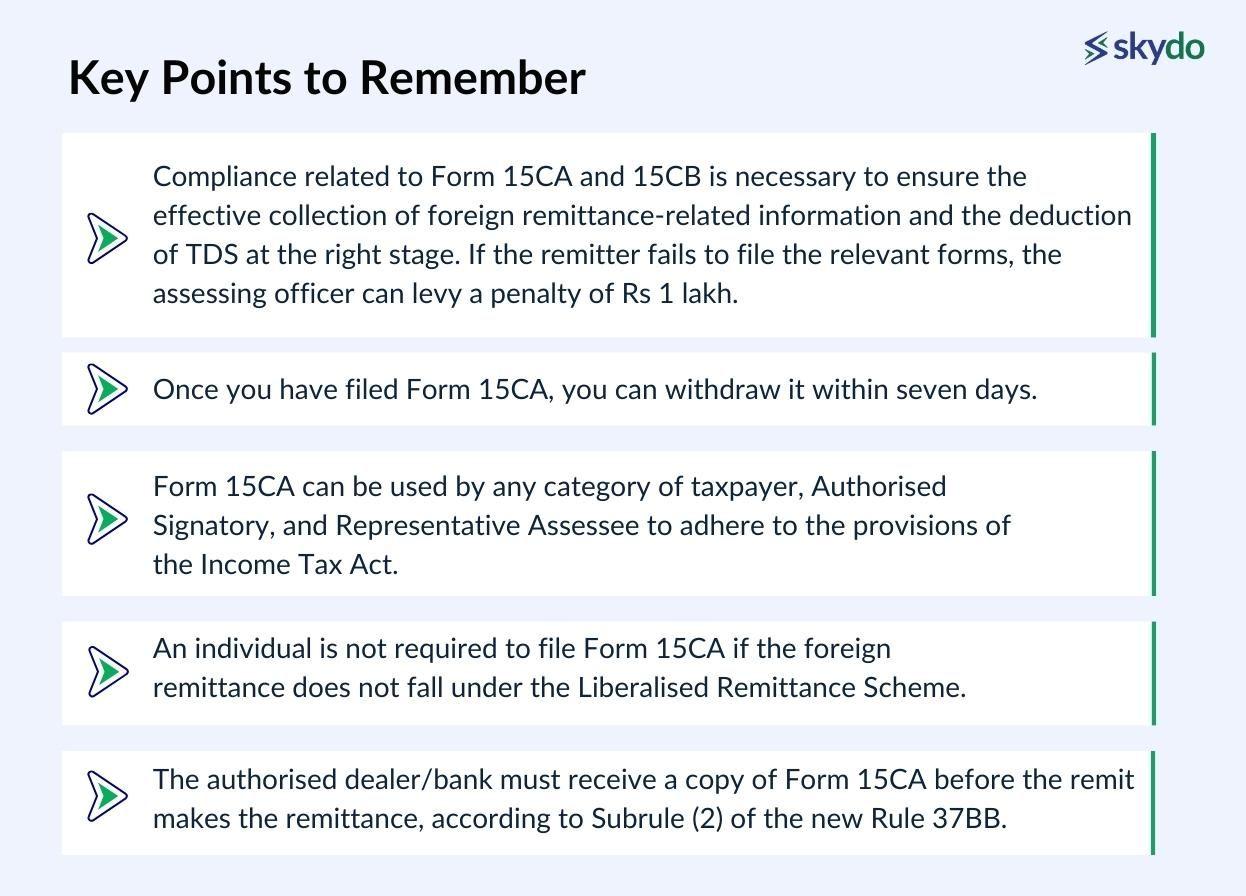

Key Points to Remember

- Compliance related to Form 15CA and 15CB is necessary to ensure the effective collection of foreign remittance-related information and the deduction of TDS at the right stage. If the remitter fails to file the relevant forms, the assessing officer can levy a penalty of Rs 1 lakh.

- Once you have filed Form 15CA, you can withdraw it within seven days.

- Form 15CA can be used by any category of taxpayer, Authorised Signatory, and Representative Assessee to adhere to the provisions of the Income Tax Act.

- An individual is not required to file Form 15CA if the foreign remittance does not fall under the Liberalised Remittance Scheme.

- The authorised dealer/bank must receive a copy of Form 15CA before the remit makes the remittance, according to Subrule (2) of the new Rule 37BB.

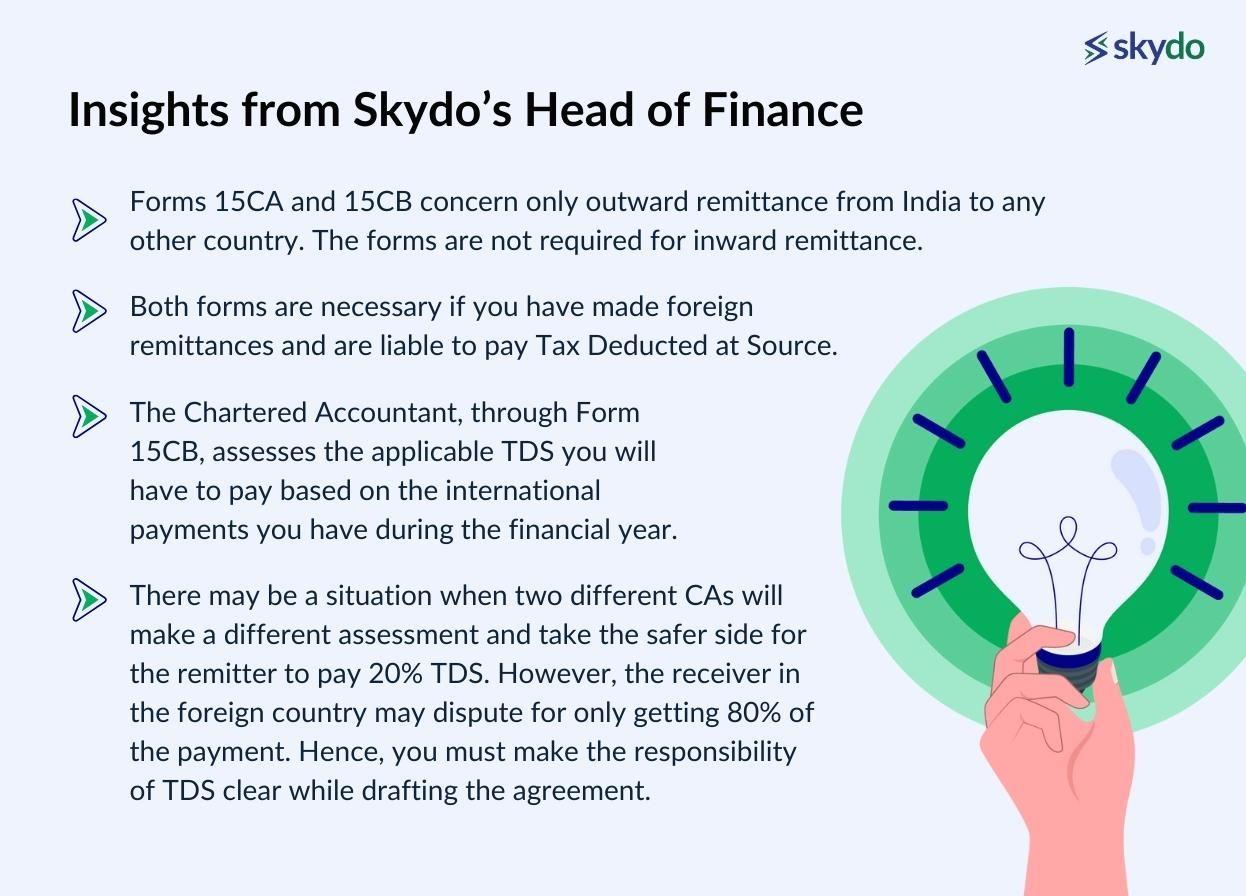

Insights from Skydo’s Head of Finance

To simplify filing both forms, we consulted with our Head of Finance and CA, Rohit Khurana, to answer all the burning questions. Here is what he had to say:

- Forms 15CA and 15CB concern only outward remittance from India to any other country. The forms are not required for inward remittance.

- Both forms are necessary if you have made foreign remittances and are liable to pay Tax Deducted at Source.

- The Chartered Accountant, through Form 15CB, assesses the applicable TDS you will have to pay based on the international payments you have during the financial year.

- There may be a situation when two different CAs will make a different assessment and take the safer side for the remitter to pay 20% TDS. However, the receiver in the foreign country may dispute for only getting 80% of the payment. Hence, you must make the responsibility of TDS clear while drafting the agreement.

Conclusion

International transactions are vitally important for an individual doing business in foreign countries or a company with a global presence. However, with earnings comes the compliance aspect, which is an integral part of the Indian tax system.

Form 15CA and 15CB ensure that a resident remitter can comply with all the relevant tax laws and continue to remit internationally. Since the Indian Tax Department has created an online method to file both forms, it has become easier to adhere to the compliance aspect and certify the TDS through a licensed CA.

FAQs on Form 15CA and 15CB

Q1. What types of documents are required while filing Form No. 15CA?

Ans: When filing Form No. 15CA for foreign remittances, you'll need to provide the following details.

- Remitter's details (Name, Address, PAN, Status, Email, Mobile)

- Remittee's details (Name, Address)

- Country of Residence

- Currency and Amount (in INR)

- Date of Remittance

- Nature of Remittance

- Remitter's Bank Details

Q2. What will happen in case of non-compliance with Form No. 15CA and Form No. 15CB?

Ans: Non-compliance with Form No. 15CA and Form No. 15CB can lead to penalties. If the remitter fails to file the relevant forms, the assessing officer can levy a penalty of Rs 1 lakh.

Q3. Who can use Form 15CB?

Ans: Form 15CB is used by remitters who are making foreign remittances and are liable to pay Tax Deducted at Source (TDS). It is a certificate issued by a Chartered Accountant to certify the withholding tax liability and payment details.

Q4. Is it compulsory to file Form 15CB before filing Part C of Form 15CA?

Ans: Yes, it is compulsory to file Form 15CB before filing Part C of Form 15CA. Part C of Form 15CA requires the remitter to have obtained Form 15CB from a Chartered Accountant to certify the withholding tax liability, and this certificate is a prerequisite for completing Part C of Form 15CA.

Q5. How can Form 15CA and 15CB be revised or cancelled?

Ans. Form 15CA can be withdrawn within 7 days from submission, with the withdrawal link accessible on the Assessee's website.

Q6. Who is mandated to file Form 15CA?

Ans. Individuals or entities, except companies, responsible for payments to non-residents or foreign companies, must provide the necessary details in Form 15CA.

Q7. What scenarios do not require filing Form 15CA?

Ans. Exceptions for filing Form 15CA include individual remittances not needing RBI approval and transactions falling under RBI-specified purposes codes.

Q8. Is submission of Form 15CB compulsory?

Ans. Form 15CB is necessary only if remittances exceed Rs. 5 lakh annually, requiring an accountant certificate as per Section 288 of the Income Tax Act, 1961.

Q9. Who can file Form 15CB?

Ans. Chartered Accountants (CAs) registered on the e-filing portal handle Form 15CB, enabled by assigning Form 15CA from the taxpayer.

Q10. How is Form 15CB validated?

Ans. Form 15CB requires e-verification using the CA's Digital Signature Certificate (DSC) registered on the e-filing portal. There's no set timeframe, but it must precede the remittance.