The "Hidden Fees" in Your Bank Rates and How to Calculate Your Actual Fx Cost

In a world where domestic payments are as easy as a tap or scan, our aim at Skydo was to make international payments equally seamless and transparent. Our journey began with a simple objective: To challenge the hidden fees that often plague traditional banking systems, be it Swift fees, intermediary bank charges, FX markups, FIRA fees, and processing costs. These covert fees can be hard to track and even harder to understand. The FX markup, in particular, is a sneaky one. Without knowing the benchmark or timing, how are you supposed to figure out your actual costs

This is where we wanted to make a difference. By providing currency conversion at live mid-market rates and a fixed fee, we aim to demystify the process and help you keep more of your hard-earned money. We've put together a detailed breakdown to show you exactly how much you can save. If you’re short on time, feel free to skip ahead to the table in paragraph 6.

Why we started Skydo

Movin Jain and I founded Skydo in March 2022. Movin, drawing from his experience with India’s major UPI player, dreamed of making B2B payments as effortless as UPI transactions. I, on the other hand, as a long-time exporter, wanted to bring transparency to international payments. Business owners should know exactly what they’re paying without needing complicated spreadsheets.

Since launching, we’ve received fantastic feedback from our customers. This response has humbled us and strengthened our belief that we’re solving a real problem.

Pricing transparency: what does it mean?

Skydo is disrupting the industry by bringing transparency to pricing, challenging the hidden margins long enjoyed by payment service providers. As a result, many providers are lowering their prices, which is great for customers. However, some are only creating the illusion of lower prices without actually reducing them. This post aims to help customers understand the different cost elements involved in FX conversion. You’ll learn to: 1) evaluate if your payment service provider (bank or platform) is truly transparent, and 2) calculate the real FX costs your provider has charged.

How Skydo quotes its fees

When you receive a payment through Skydo, we convert your money at the live Forex rate. We don’t charge any additional fees to either the sender or the receiver nor do we levy extra fees for FIRA or transaction processing. This means your entire invoice value is converted at the live rate. We only charge a flat fee of $19 or $29 for our services. To ensure absolute transparency, we also include the date and time stamp of the FX conversion on the FIRA. With this information, you can verify through any reputable online FX platform that we have charged zero FX markup

How do Banks quote their fees?

When you receive an international payment through your bank, there's a good chance that all the applicable fees may be deducted from your invoice value. This might be zero or as high as $45 (Swift fee and intermediary bank fee), which you may end up losing.

In India, banks typically charge you 3 types of fees:

- Forex markup: Without negotiation, banks often use card rates for foreign exchange conversion, which are usually not transparent. By negotiating with your manager or RM, you might reduce this by 10 to 50 paise, but these rates are still not mid-market rates. This will be explained further in the next section

- FIRA fee: This can range anywhere from INR 150 to as high as INR 500 per transaction

- Processing fees: This can range from zero to as high as INR 800 per transaction

The final amount you receive in your bank is after these charges are deducted, leaving you with the fun task of using a spreadsheet to figure out the actual FX markup

The hidden cost in fx markup

You're surely familiar with how currencies, like traded commodities, undergo continuous fluctuations relative to each other throughout the trading day (usually 9 am to 3:30 pm). The mid-market rate represents the average between the buying and selling rates of currencies, such as INR to USD, fluctuating by up to 20-25 paise within a single trading day.

Your bank will give you a forex rate, but the tricky part is figuring out if it’s the mid-market rate or an internal bank rate. There are various rates like the inter-bank rate, cash rate, spot rate, tom rate (Tomorrow’s rate), and daily rate. These terms can be confusing—often deliberately so! Plus, banks usually don’t disclose the timing of the conversion. Without knowing the benchmark and timing, it’s hard to know the exact markup you’ve paid. So, is your bank really being transparent? I doubt it

How can you calculate your actual fx cost

I’ve included a spreadsheet below to illustrate this point. It focuses on the cheapest bank payments reported by customers. I’ve excluded payment platforms with high 4% fees and unfavorable forex rates, as well as bank rates that are only INR 1-2 off from mid-market. This comparison is based on a savvy customer who skillfully negotiated with their bank to avoid unnecessary charges. Even under these favorable conditions, Skydo proves to be more cost-effective due to our transparency.

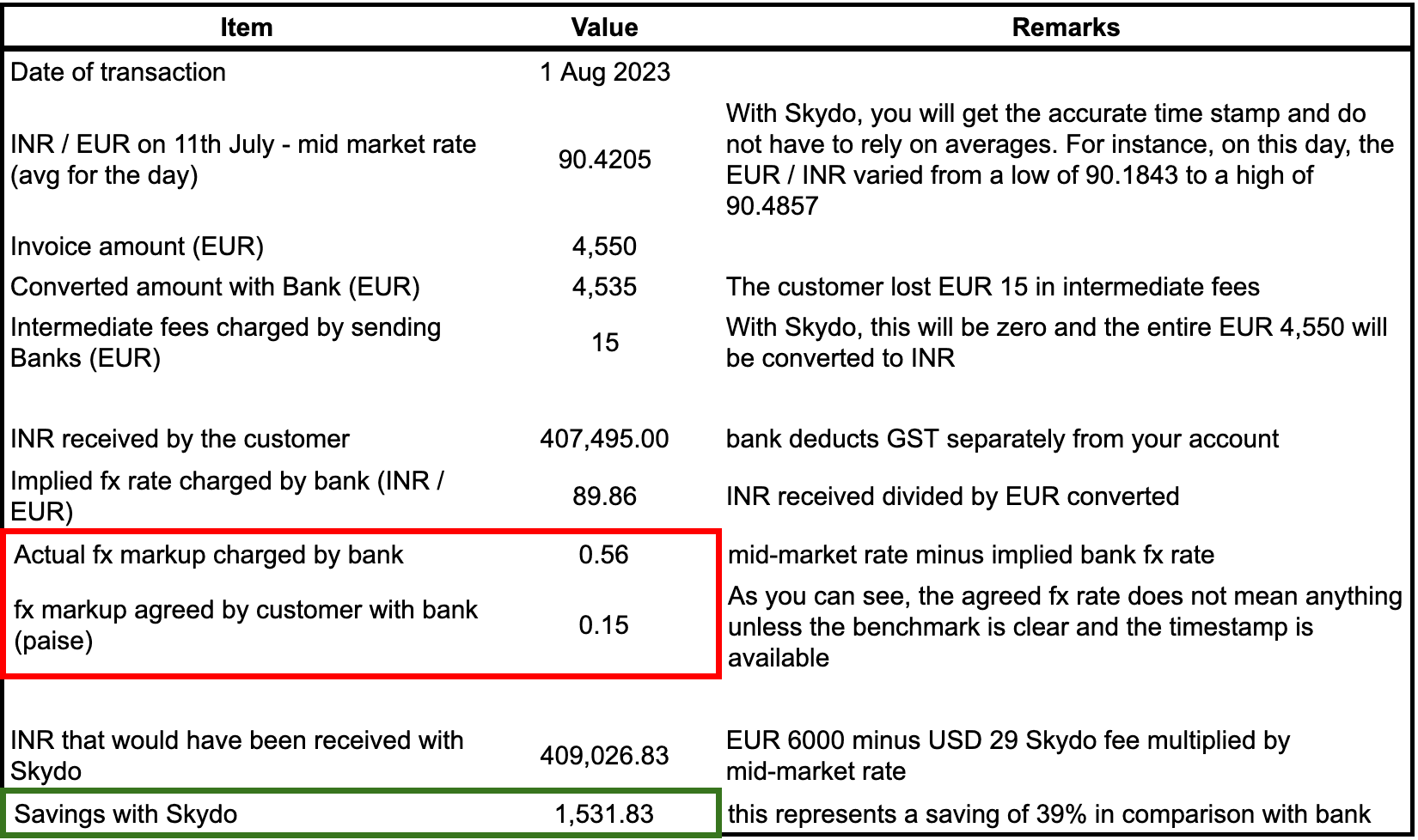

Figure 1 | INR- Euro Conversion

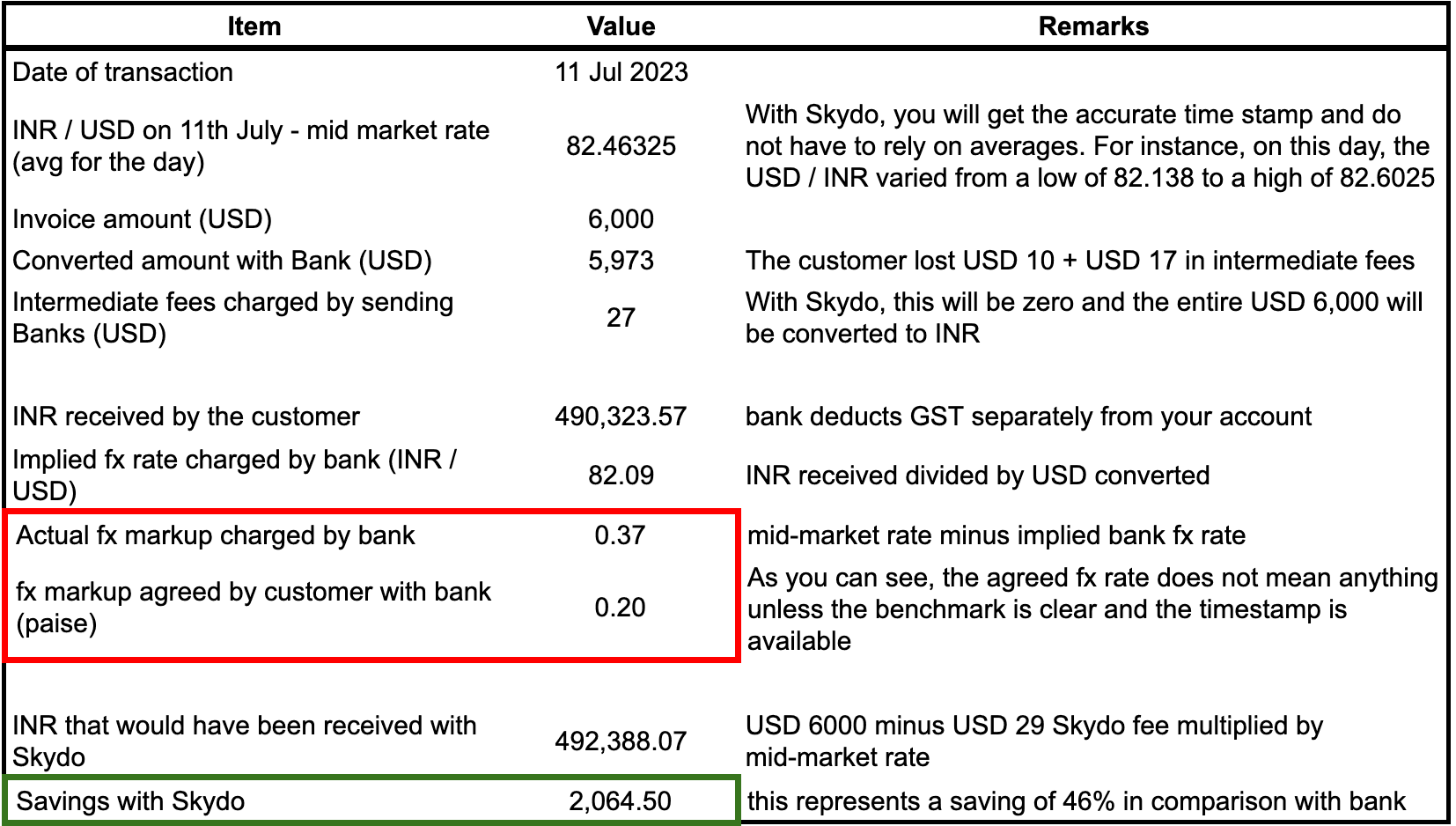

Figure 1 | INR- Euro Conversion Figure 2 | INR - USD Conversion

Figure 2 | INR - USD ConversionThe figures are sourced from our customers' payments received through their banks. Using the payment date and the agreed fx markup, we computed their expected, actual, and Skydo-estimated amounts. If you need clarifications or assistance, don't hesitate to email me. We also have a record of daily fx rates since our inception - happy to share that to help you calculate how much you paid in fx for a particular transaction.

My objective in writing this blog is to dispel myths around the “10 paise” rates that banks supposedly offer, and to help exporters calculate their real costs. For, transparency is never partial - it is either full or absent.

Srivatsan Sridhar, Founder & CEO