How to Deal With Late Payments From Your Clients

Imagine this: you put a lot of effort, time, and creativity into a project for a client, only to get delayed or ignored when it comes to payment. Freelancers face this common and frustrating problem, especially when working with new or unreliable clients. A staggering 87% of businesses reported being paid late in 2022.

Late payments can hurt your cash flow, motivation, and reputation as a freelancer. Then, how can you deal with this issue and ensure you get paid on time for your work?

This blog post shares some tips and strategies that can help you prevent and handle late payments and some communication strategies to use when dealing with the same.

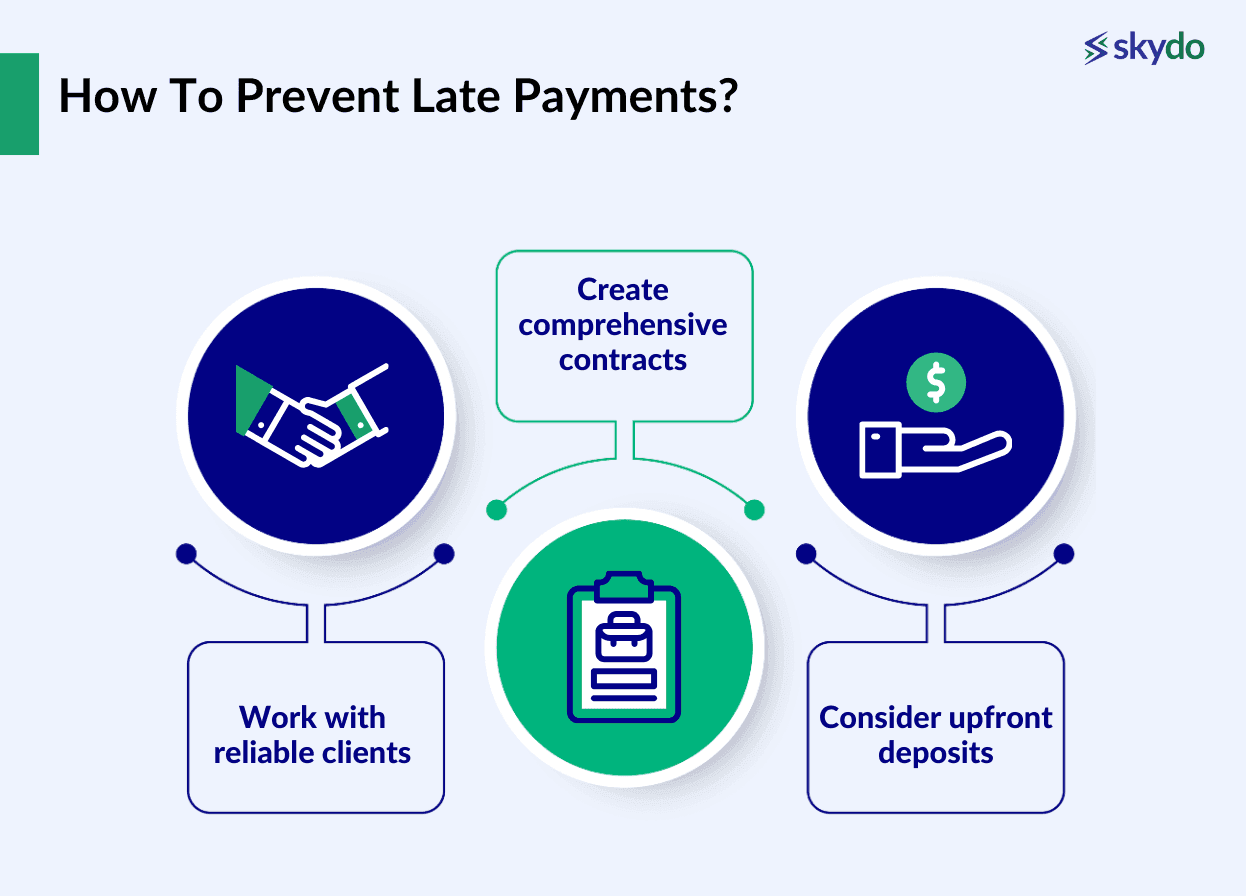

How To Prevent Late Payments In The First Place?

Here are some tips to help you avoid payment delays and ensure timely payments from your clients.

- Work with reliable clients

Before agreeing to work with a new client, research their company, reputation, and payment history. Ask for referrals from other freelancers or professionals in your network. Working with trustworthy and reputable clients will reduce the risk of delayed payment.

- Create comprehensive contracts

A contract is a legal document that outlines the terms and expectations of your work, including the scope, deliverables, deadlines, and payment details. A contract can help you avoid misunderstandings, disputes, and payment issues.

Ensure your contract specifies the payment amount, schedule, method, and late fees (if applicable).

- Consider upfront deposits

For new or large projects, ask for a partial payment upfront, such as 25% or 50% of the total fee. It can help you secure income, cover expenses, and demonstrate your client’s commitment to the project.

You can also set up milestone payments and receive a portion of the fee after completing certain project stages.

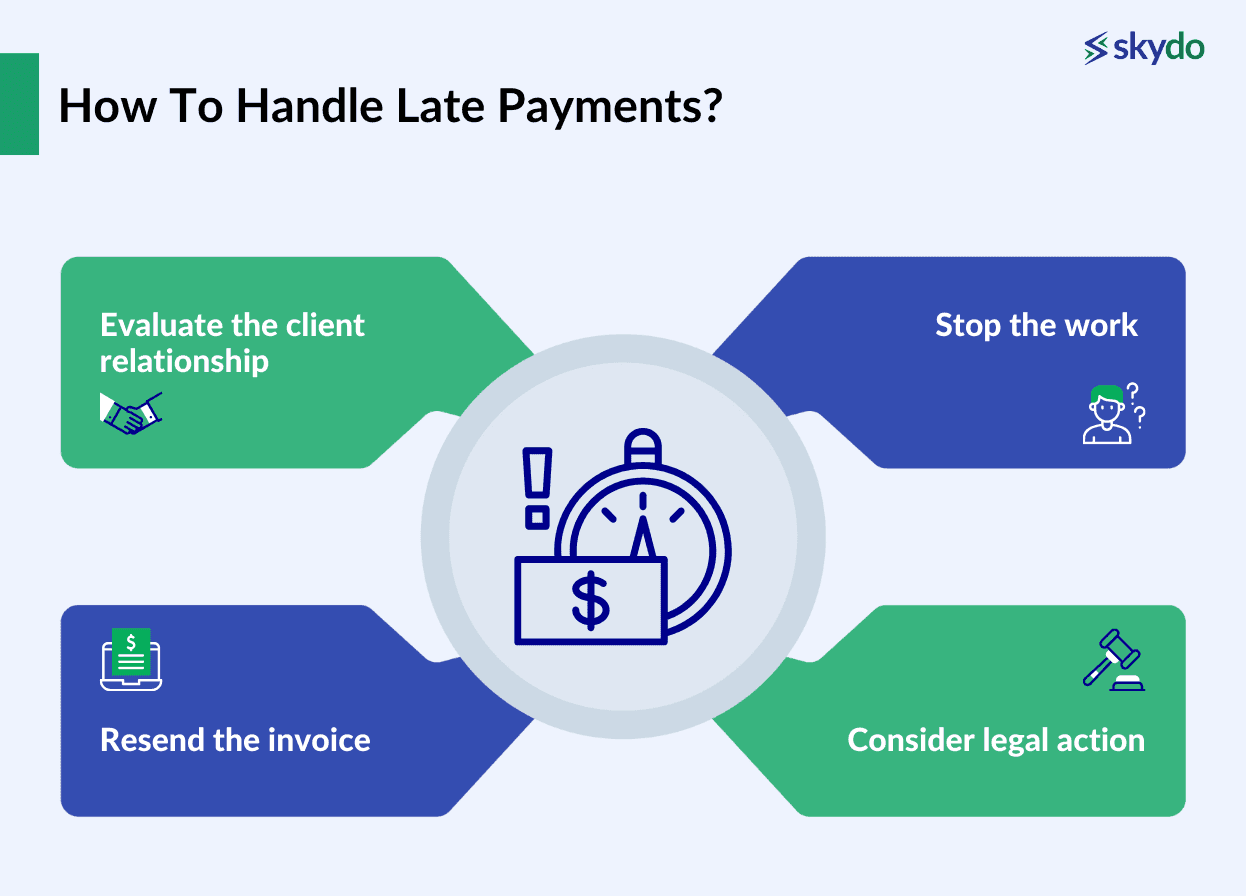

How To Handle Late Payments?

Despite your best efforts, you may still get late payments often. Follow the steps below to handle the situation professionally and effectively.

- Evaluate the client relationship

Before taking action, consider the nature and history of your relationship with the client. Have they been a loyal and long-term paying customer? Have they paid on time in the past? Are they going through a temporary financial hardship?

Based on the answers, give them some leeway or be more firm with your approach.

- Resend the invoice

In case of a delay in payment, resend the invoice to your client. It will serve as a gentle reminder and a way to confirm that they received the original invoice. You can also include a note asking them to acknowledge the receipt of the invoice and update you on the payment status.

- Stop the work

If the client is still not paying the invoice after a reasonable period, temporarily stop any ongoing work for the client until the payment is addressed.

This can help you avoid accumulating additional late invoices and show your client that you are serious about getting paid. However, communicate this decision to your client clearly and politely and explain the reasons behind it.

- Consider legal action

As a last resort, consult a lawyer and send a formal letter to your client demanding payment. This can be costly and time-consuming. Therefore, you should only use it when the amount is significant and the client is unresponsive or unwilling to pay.

Weigh the pros and cons of pursuing legal action, as it may damage your reputation and relationship with the client.

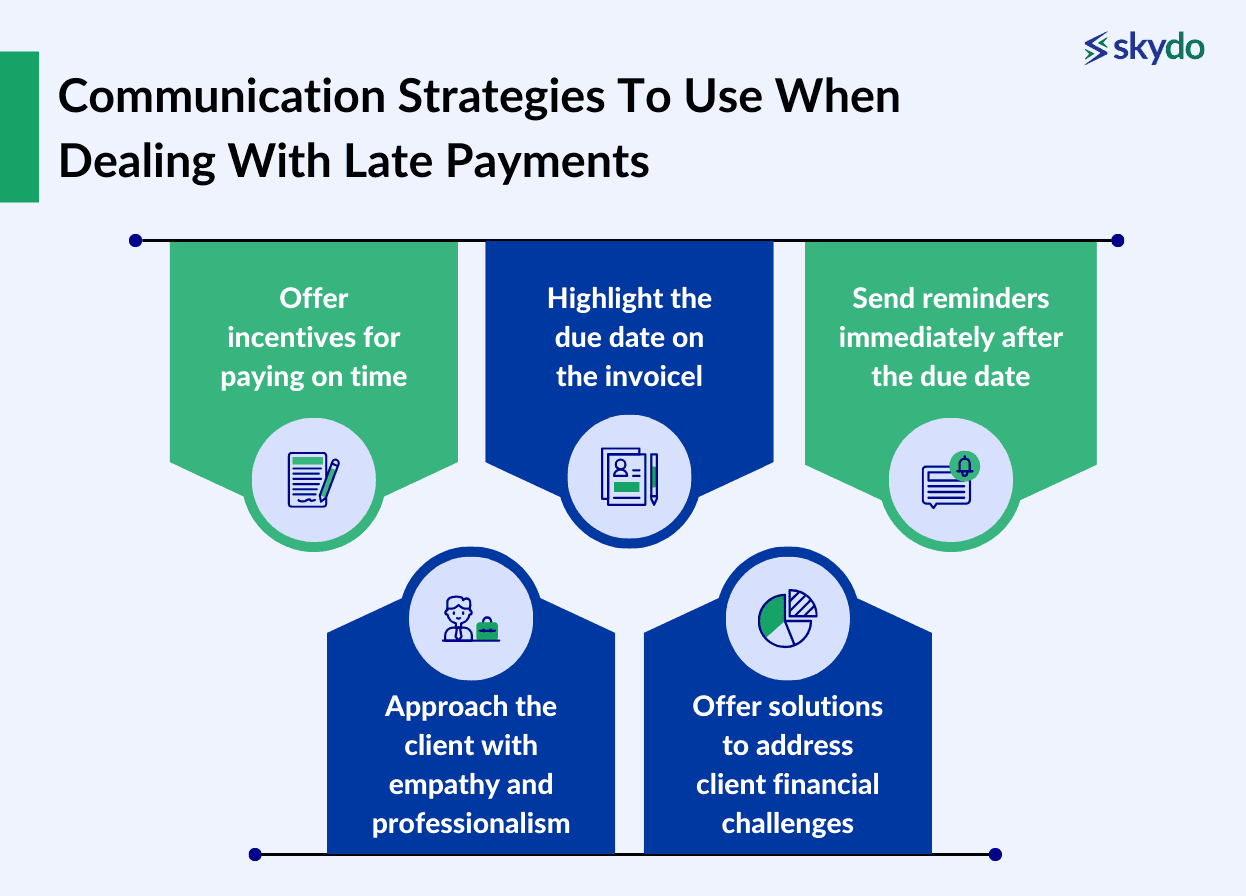

Communication Strategies To Use When Dealing With Late Payments

Communication is key to managing and resolving late payment issues. Here are some ways to communicate with your clients effectively and professionally about payments.

- Offer incentives for paying on time

One way to encourage timely payments is to offer incentives, such as discounts, rewards, or bonuses, for clients who pay on or before the due date.

For example, you can offer a 10% discount for early payments or a free consultation for repeat customers. It can help you build trust and loyalty with your clients and motivate them to pay promptly.

- Highlight the due date on the invoice

Another way to prevent delayed payments is to display the due date on the invoice. You can use bold, large, or coloured fonts to draw attention to the date and avoid confusion. You can also use phrases like “Due upon receipt” or “Payment required within 15 days” to emphasise the urgency of the payment.

- Send reminders immediately after the due date

If you don’t receive the payment by the due date, you should send a reminder to your client as soon as possible. You can use email, phone, or text messages to follow up with your client and ask them to pay the invoice.

Be polite, friendly, and professional in your tone, and avoid being rude, aggressive, or accusatory. Also, include the invoice number, amount, and date in your message, and attach a copy of the invoice for reference.

- Approach the client with empathy and professionalism

When communicating with clients not paying invoices, you should always be respectful and polite and try to understand their situation and perspective. Avoid making assumptions, judgments, or threats and instead focus on finding a mutually beneficial solution.

- Offer solutions to address client financial challenges

Sometimes, a client may be unable to pay the invoice due to financial difficulties, such as cash flow problems, budget cuts, or unexpected expenses. In these cases, offer some solutions to help them overcome their challenges and pay the invoice.

For example, you can offer a payment plan where the client can pay the invoice in installments over some time. You can also offer a discount, a credit, or a trade, where the client can pay less, pay later, or pay with goods or services instead of money.

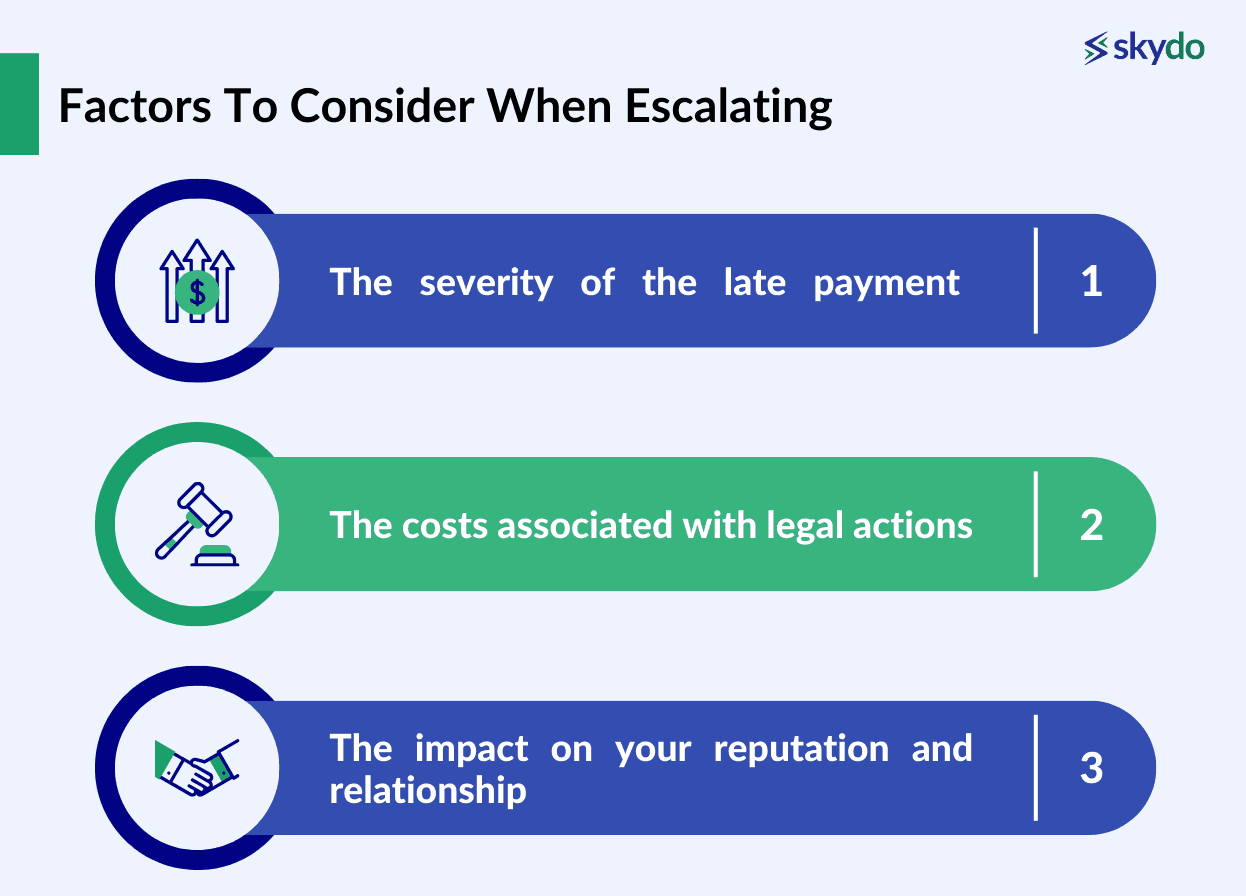

Factors To Consider When Escalating

If the client doesn’t resolve the late payment issue after following the steps above, you may need to escalate the matter and take more drastic measures. However, before you do so, you should consider the following factors.

- The severity of the late payment

How late is the payment? How much is the amount? How often does it happen? Depending on the answers, be more lenient or strict with your actions.

- The costs associated with legal actions

Taking legal actions, such as hiring a lawyer, filing a lawsuit, or hiring a collection agency for a delayed payment, can be expensive and time-consuming. You should consider the costs and benefits of these actions and whether they are worth pursuing.

- The impact on your reputation and relationship

The decision to take legal action can also hurt your reputation and relationship with the client and other potential clients. You should consider the consequences of these actions and whether they are worth risking.

For example, if the client is a valuable and long-term customer, preserve the relationship and avoid legal actions. However, if the client is a new or unreliable customer, you may want to cut ties with them and pursue legal action.

Conclusion

Late payments are a common challenge for business owners and freelancers, but you can mitigate them with proper communication and preventive measures. To deal with late payments, start by preventing them with reliable clients and clear contracts.

If payments are late, evaluate the situation, resend invoices, and consider halting work. Finally, maintain open communication, offer incentives, and escalate the issue if necessary.

FAQs

Q1. How do you tell a client they are late on payment?

Ans. By sending a friendly and polite reminder via email, phone, or text message, you can notify the client that they are late on their payment. Attach the invoice copy for reference, along with the invoice number, amount, and date. You should ask them to acknowledge receipt and inform you of the payment status.

Q2. How do I professionally ask for a late payment?

Ans. You can professionally ask for a late payment by following the communication strategies mentioned above, such as offering incentives, highlighting the due date, sending reminders, approaching the client with empathy and professionalism, and presenting solutions.

Q3. How do I assess the financial reliability of potential clients before engaging in a project?

Ans. To determine their financial stability and creditworthiness, consider using credit check services or financial analysis tools. You can also ask your network for referrals from freelancers or professionals.

Q4. How can technology and software help in managing and tracking payments efficiently?

Ans. Technology and software can enhance your ability to manage and track payments. For example, invoicing software can automate invoicing, send reminders, track payments, and generate reports.

Accounting software can help you manage your income, expenses, and cash flow. Payment gateways can facilitate online payments and provide secure and convenient payment options for your clients. Project management tools can help you track the progress of your projects and the associated payments.

Remember, dealing with late payments is a common challenge for many businesses and freelancers. However, with the right strategies and tools, you can ensure timely payments, maintain healthy client relationships, and improve your financial well-being.