How to File ITR as a Freelancer in 2024

Freelancing offers unparalleled freedom and opportunities, but it also comes with the responsibility of managing your finances and filing for taxes every year. As a freelancer, it is vital to file the ITR and comply with tax laws.

This blog will talk about the tax liabilities for freelancers, the tax rates, the GST and TDS compliance, and the detailed process of filing ITR correctly.

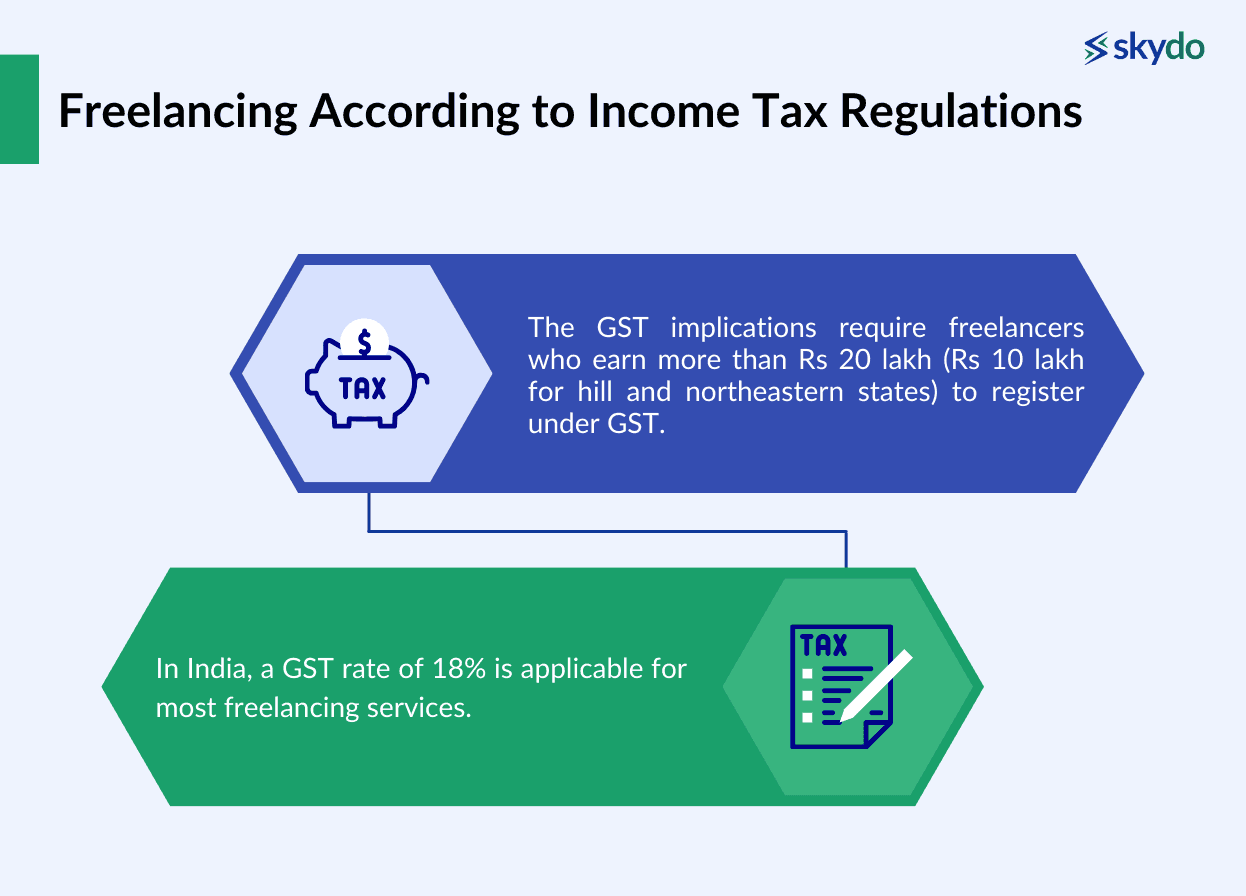

What Is Freelancing According to Income Tax Regulations?

As per the Income Tax Department, earnings from freelancing are treated as earnings from businesses and professions when filing ITR for freelancers. The Income Tax Department has categorised earning income through physical and mental abilities under the ’profit and gains from business and profession’ when considering the tax liability.

Freelancers in India must file taxes under the purview of Income Tax and Goods & Services Tax). The GST implications require freelancers who earn more than Rs 20 lakh (for intrastate; Rs 10 lakh for hill and northeastern states) to register under GST. In India, a GST rate of 18% is applicable for most freelancing services.

Rates of Income Tax Applied to Freelancers

Here is a detailed table to understand applicable freelance taxes in India for freelancers under the age of 60:

| Income Tax Slab | Old Tax Regime | New Tax Regime(until 31st March 2023) | New Tax Regime (from 1st April 2023) |

|---|---|---|---|

| Rs 0 - Rs 2,50,000 | NIL | NIL | NIL |

| Rs 2,50,000 - Rs 3,00,000 | 5% | 5% | NIL |

| Rs 3,00,000 - Rs 5,00,000 | 5% | 5% | 5% |

| Rs 5,00,000 - Rs 6,00,000 | 20% | 10% | 5% |

| Rs 6,00,000 - Rs 7,50,000 | 20% | 10% | 10% |

| Rs 7,50,000 - Rs 9,00,000 | 20% | 15% | 10% |

| Rs 9,00,000 - Rs 10,00,000 | 20% | 15% | 15% |

| Rs 10,00,000 - Rs 12,00,000 | 30% | 20% | 15% |

| Rs 12,00,000 - Rs 12,50,000 | 30% | 20% | 20% |

| Rs 12,50,000 - Rs 15,00,000 | 30% | 25% | 20% |

| More than Rs 15,00,000 | 30% | 30% | 30% |

If the freelancer earns more than Rs 1 crore as gross annual income, the freelancer is required to conduct a tax audit. Furthermore, a Tax Deducted at Source (TDS) of 10% is applicable for any amount exceeding Rs 30,000 paid by the freelancer to any professional.

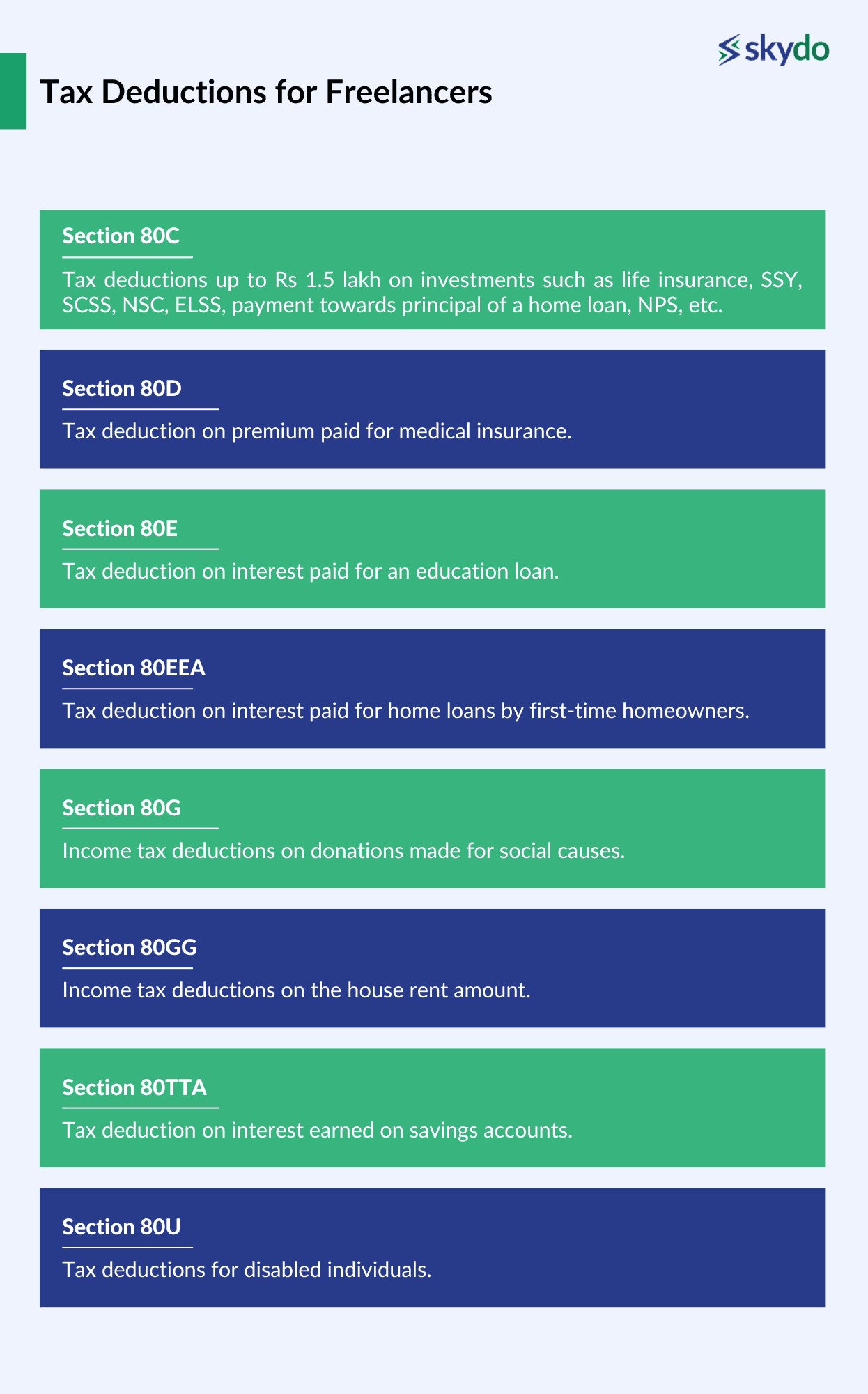

Guidelines for Freelancer Deductions

The freelancer can claim tax deductions on freelance income tax liability depending on the chosen tax regime. Freelancers can also utilise the Presumptive Taxation Scheme under Section 44ADA of the Income Tax Act 1961. The Presumptive Taxation Scheme under Section 44ADA allows freelancers to pay freelancing income tax on only half of their gross annual income if the total annual income is less than Rs 50 lakhs.

Here are the tax deductions that freelancers can claim while filing ITR for freelancers under Section 80c to 80U.

- Section 80C: Tax deductions up to Rs 1.5 lakh on investments such as life insurance, SSY, SCSS, NSC, ELSS, payment towards principal of a home loan, NPS, etc.

- Section 80D: Tax deduction on premium paid for medical insurance.

- Section 80E: Tax deduction on interest paid for an education loan.

- Section 80EEA: Tax deduction on interest paid for home loans by first-time homeowners.

- Section 80G: Income tax deductions on donations made for social causes.

- Section 80GG: Income tax deductions on the house rent amount.

- Section 80TTA: Tax deduction on interest earned on savings accounts.

- Section 80U: Tax deductions for disabled individuals.

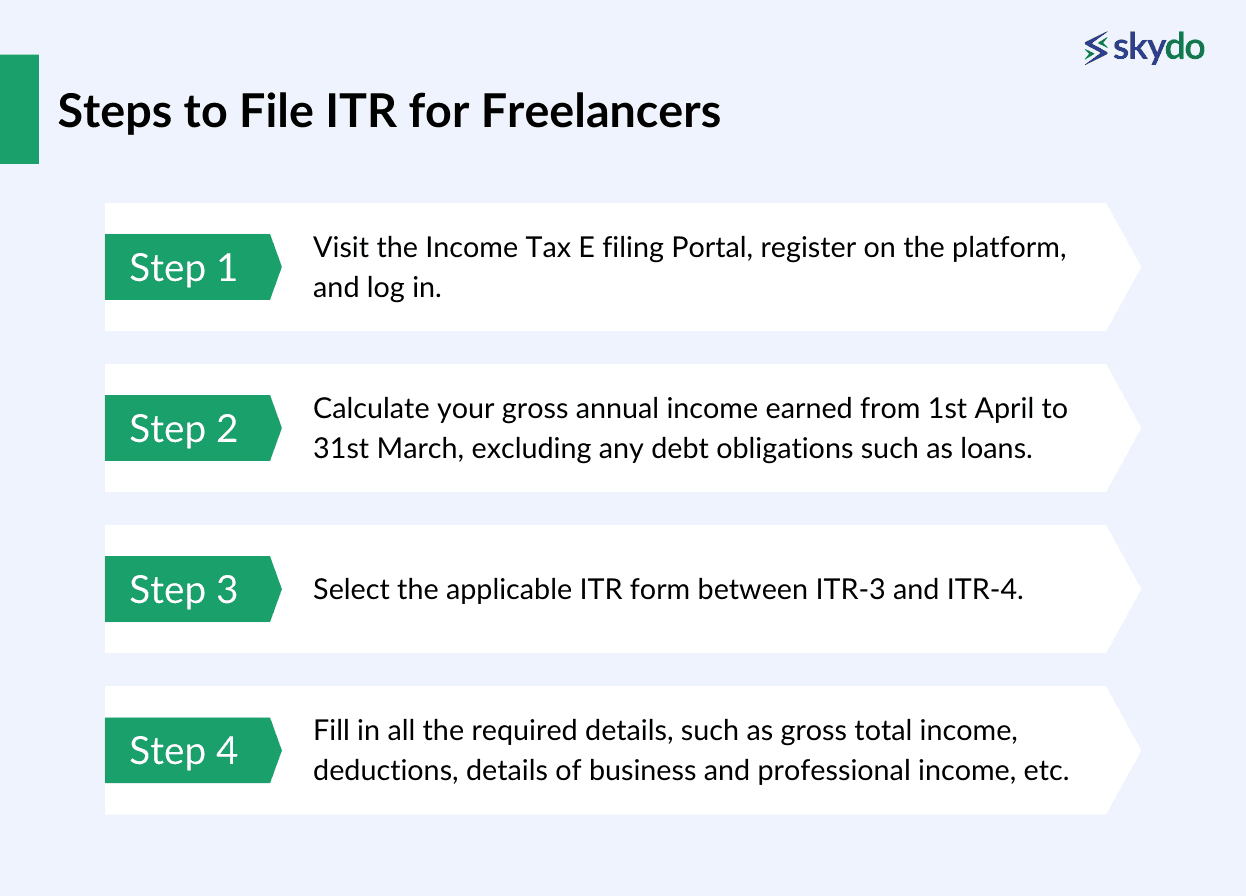

Steps to File ITR for Freelancers

The obligation to file ITR lies personally on the freelancers, and they can file ITR for freelancers by visiting the Income Tax Portal. However, before filing the income tax for freelancers, it is important to choose the right ITR form.

If you choose the Presumptive Taxation Scheme under Section 44ADA, you need to file an ITR for freelancers using ITR-4. In case you are not opting for the Presumptive Taxation Scheme, you must file your ITR using ITR-3 under the business or profession section.

Here are the steps to file ITR for freelancers in India:

- Step 1: Visit the Income Tax E filing Portal, register on the platform, and log in.

- Step 2: Calculate your gross annual income earned from 1st April to 31st March, excluding any debt obligations such as loans.

- Step 3: Select the applicable ITR form between ITR-3 and ITR-4.

- Step 4: Fill in all the required details, such as gross total income, deductions, details of business and professional income, etc.

Freelancers can fill out ITR for freelancers using the offline or online method. For offline filling, you can download the form, fill it and upload the XML file to the IT portal. Alternatively, freelancers can fill out the ITR form online and submit the relevant proofs after digital verification of the ITR.

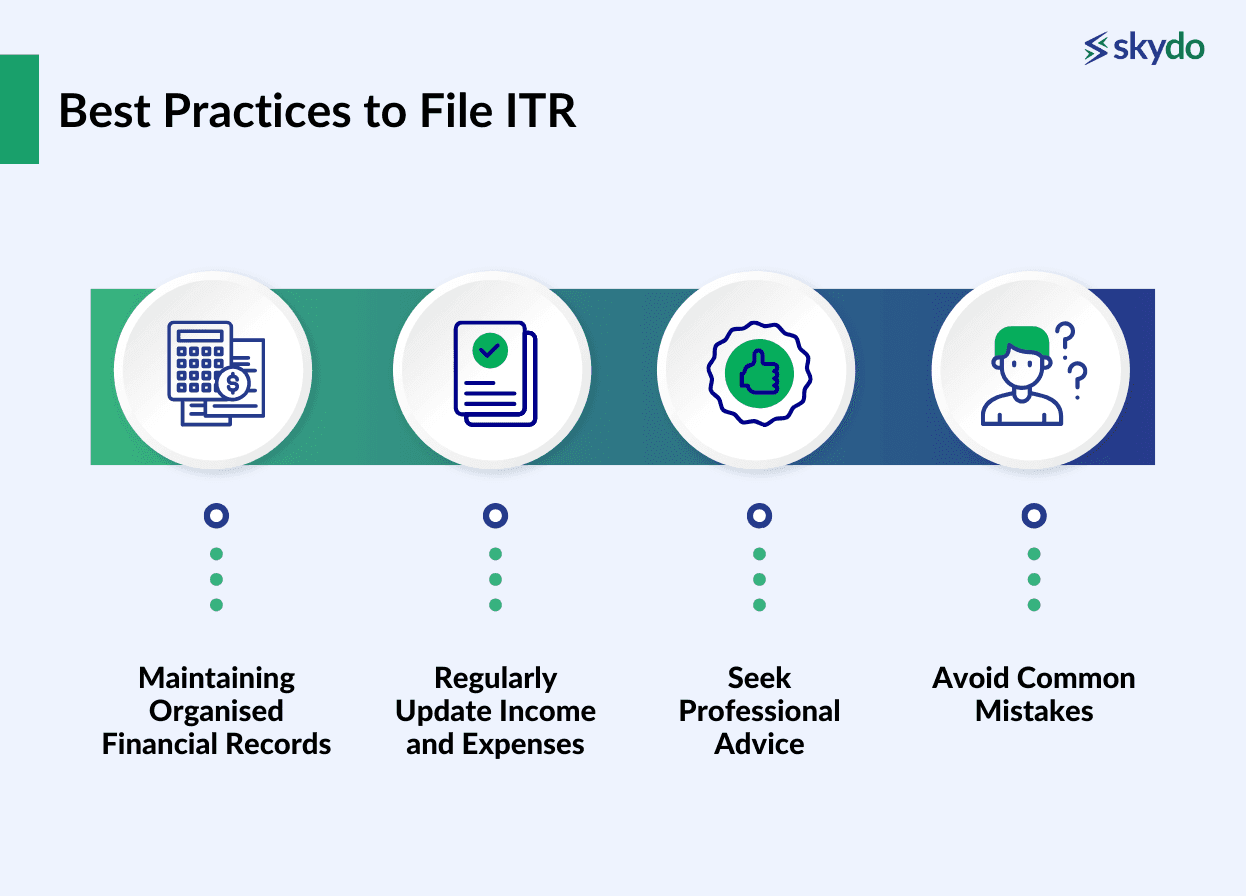

Best Practices to File ITR

Here are some best practices to follow to file ITR for freelancers correctly:

- Maintaining Organised Financial Records: Keep all your financial documents, such as income statements (Form 16/16A), bank statements, investment documents, and receipts, in one place. You will also need your PAN and Aadhar card details to file the ITR.

- Regularly Update Income and Expenses: Keep track of your income sources, including salary, freelance earnings, rental income, etc, for the financial year. Document all expenses eligible for deductions or exemptions to avoid last-minute hassle.

- Seek Professional Advice: If your financial situation is complex and you need help filing your ITR, consider consulting a tax professional or chartered accountant for advice. A tax professional can help you maximise deductions and ensure compliance with tax laws.

- Avoid Common Mistakes: While filing the ITR, ensure that you have declared all your income, including interest income, rental income, etc. Review your bank account details, PAN, and other personal information to avoid processing delays.

Conclusion

Filing Income Tax Returns (ITR) as a freelancer in India is a crucial responsibility that demands organisation, diligence, and understanding of the tax regulations. By understanding the tax implications, tax rates, the process of filing ITR, and the best practices, you can simplify the ITR filing process and adhere to all the tax laws.

Maintaining meticulous financial records, regularly updating income and expenses, seeking professional advice when needed, and avoiding common filing mistakes are fundamental steps to ensure a smooth tax filing experience.

Furthermore, it is always wise to consult a tax professional if you find the process complex to ensure the highest tax-saving and ideal compliance.

FAQs

Q1. Is it necessary for freelancers to pay Advance Tax?

Ans: If a freelancer’s total tax liability exceeds Rs 10,000, then the freelancer must pay advance tax every quarter of the financial year. It must be paid before the end of the financial year in four instalments: 15th June, 15th September, 15th December, and 15th March.

Q2. Can freelancers revise their ITR after filing?

Ans: Any Indian taxpayer can review their ITR by filing a revised ITR. It must be filed within three months of assessment year completion or completion of the assessment of the ITR return, whichever comes first.

Q3. What is the deadline for freelancers to file ITR?

Ans: If your annual turnover is less than 1 crore, you must file the ITR before 31st July. In case of annual turnover exceeding Rs 1 crore, the deadline to file ITR for freelancers is 31st September.

Q4. Can freelancers claim deductions for home office expenses?

Ans: Yes, freelancers can claim a tax deduction for home office expenses such as printer purchases, internet bills, office supplies, and conveyance expenses.