How to Receive FIRC From Your Bank

Individuals and businesses operating globally often grapple with the complexities of cross-border payments. One crucial aspect that demands attention in international transactions is the Foreign Inward Remittance Certificate (FIRC), a document issued by banks that validates the receipt of funds from abroad. FIRC is also called Advice or Foreign Inward Remittance Advice (FIRA).

With a valid FIRC, individuals may avoid legal complications and encounter hurdles in conducting international business smoothly. Here’s how you can obtain this vital document.

Process of receiving FIRC from your bank

Traditionally obtaining the FIRC document is a multi-step process. The steps to get an FIRC are as follows.

Step 1: Fill the FIRC document request form to the authorised bank with the following details.

- Beneficiary’s name

- Name and address of the payee

- UTR (Unique Transaction Reference) number

- Recipients’ name

- Amount of transfer

- Purpose of remittance

- Date of transfer

- Account number

Step 2: The bank will verify all the provided details.

Step 3: Once the verification is successful, it generates an Inward Remittance Message (IRM) on the Export Data Processing and Monitoring Systems (EDPMS), i.e., the government export portal.

Step 4: After paying the fees, you will receive the FIRC in your account in a few days or weeks depending on the bank.

While this looks like a 4 step process, each step is lengthy and requires manual inputs with a scope of human error.

Introducing Skydo, the instant FIRA provider

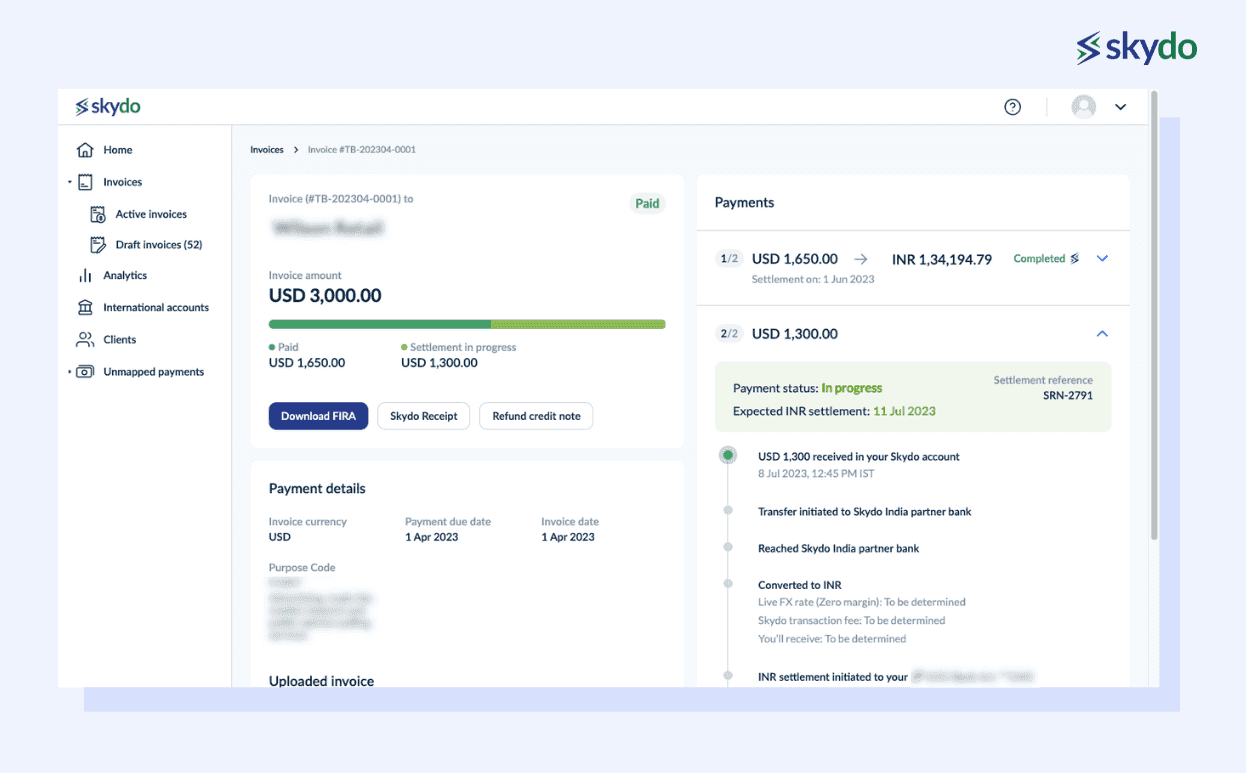

Skydo provides FIRC or FIRA instantly compared to the traditional routes, which typically take a minimum of 3-4 days. Skydo automates the entire process, eliminating the necessity for manual document creation and management, thus reducing the turnaround time for getting an FIRC from weeks to instantly.

As soon as the payment is transferred to your bank account, Skydo provides the FIRC immediately available for download. It automates the FIRC generation process, ensuring that users receive the certificate promptly upon receiving international payments.

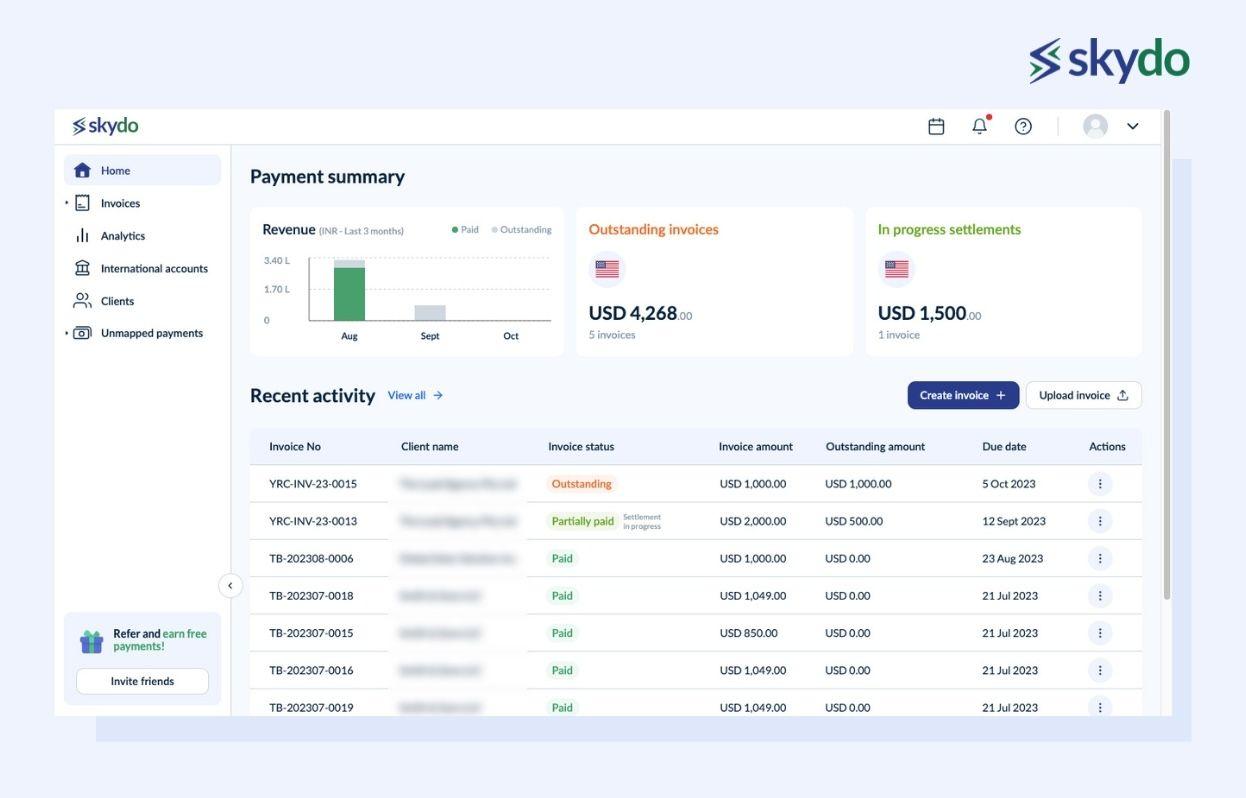

Accessing all your FIRC documents becomes effortlessly simple with just a single click through Skydo's intuitive and user-friendly dashboard.

Moreover, Skydo's automated FIRC generation ensures meticulous compliance with the Indian taxation system. Adhering to prescribed formats and guidelines, Skydo assists businesses in meeting the regulatory requirements set by the Reserve Bank of India (RBI) and other relevant authorities.

Comparison: Traditional vs. Skydo for receiving FIRC

The table below provides a comparative analysis of the traditional method and Skydo for obtaining FIRC:

| Skydo | Traditional Methods | |

|---|---|---|

| Processing Time | Instantly | Days to weeks |

| Fees | Free | High |

| Documentation | Automated | Manual |

| User Experience | Streamlined & Efficient | Complex & Time-consuming |

Conclusion

FIRC is a vital document for those involved in international transactions, and the challenges associated with obtaining it traditionally are undeniable. Skydo emerges as a beacon of efficiency, providing an instant FIRC solution that transforms the user experience. Discover the transformative power of Skydo for yourself.

Sign up with Skydo to enhance your international payment experience and streamline the FIRC issuance process.

Q1. How long does getting a FIRC from my bank typically take?

Ans: Traditionally, it can take days to weeks to get a FIRC. However, with Skydo, you can get it instantly.

Q2. What are the legal implications of not receiving a FIRC?

Q3. What information is needed to obtain a FIRC?