Connect your PayPal account with Skydo

PayPal is a widely recognized platform for cross-border payments and online transactions, especially outside India where it reigns as a go-to solution. Despite its popularity, many Indian exporters are hesitant to use it owing to its relatively high fees.

However, exporters often encounter a dilemma when foreign clients insist on using PayPal, a platform they trust and are familiar with.

Understanding the needs of such Indian exporters, Skydo has introduced PayPal integration, making it easier for them to handle all cross-border payments under one roof. While Skydo can help manage your PayPal transactions, let's first understand how to open a PayPal account for yourself.

Opening a PayPal account is a straightforward process involving the following steps:

- Visit the PayPal website.

- Choose the account type (Personal/Business) and provide the necessary information.

- Link a payment method, such as a bank account or credit/debit card.

- Confirm your email address and mobile number to activate your account.

How Do You Receive Payments via PayPal?

You can share your PayPal registered email address or mobile number with the client. They will add your details in the recipient section of the PayPal app and click on send payment. Once the amount reaches your account, PayPal will notify you of the same.

Alternatively, you can create a personalised payment link and share it with the client through text messages, email, or social channels.

You can view the money you have received by logging into your PayPal account. From there, you have the option to:

- Transfer it to your local bank account or

- Keep it in your PayPal wallet to make online transactions

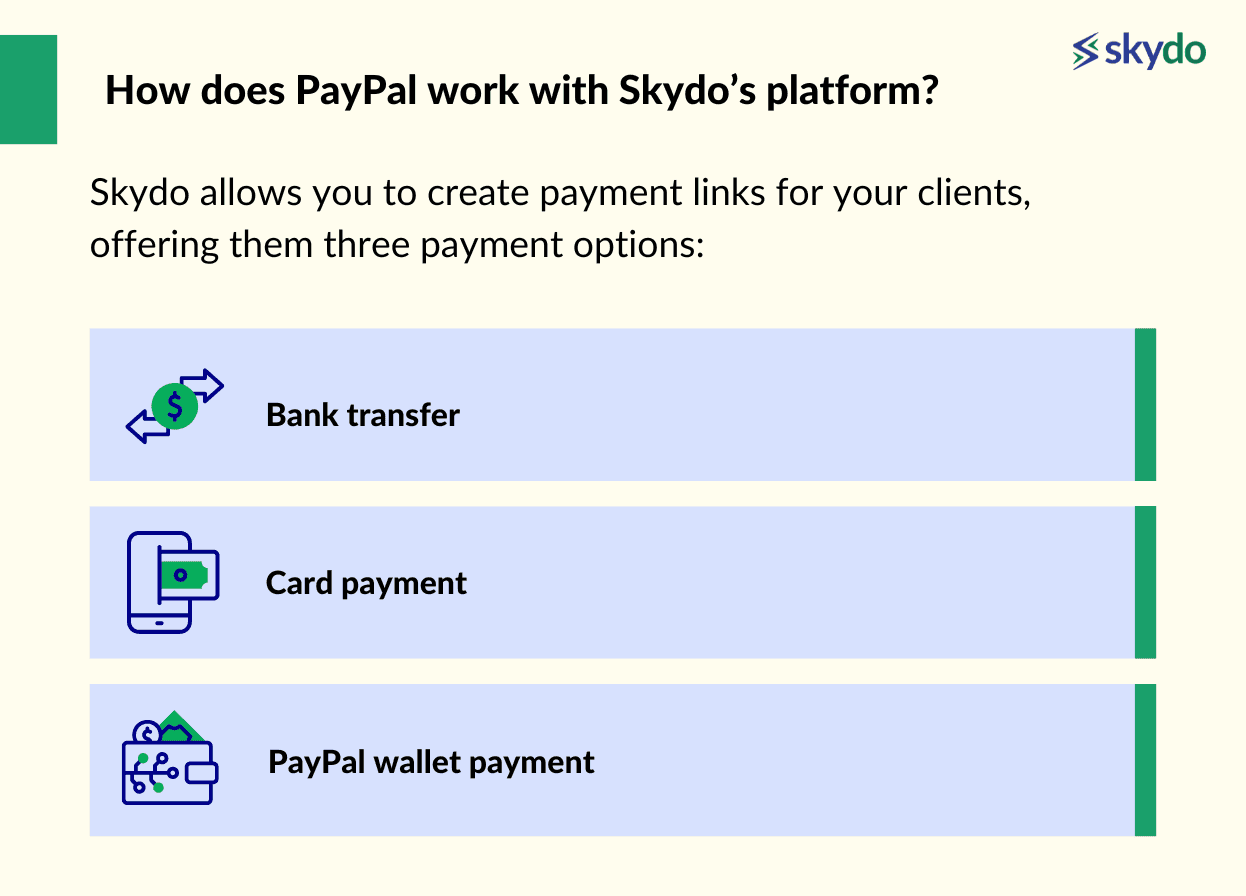

How Does PayPal Work With Skydo’s Platform?

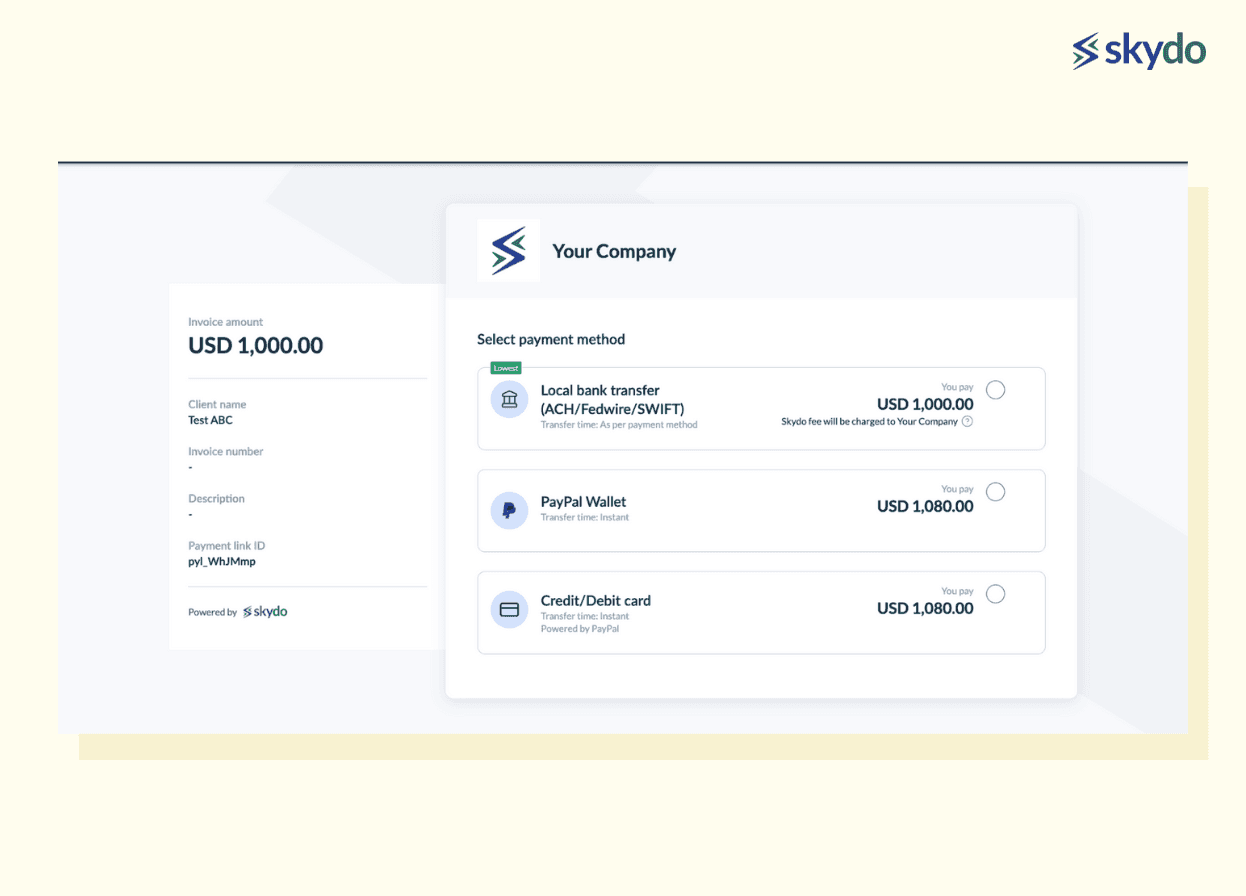

Skydo's platform takes your payment options a step further by integrating PayPal with other methods like bank transfers and card payments.

This empowers you to design payment links on Skydo that offer your clients the flexibility to choose their preferred method – bank transfer, card payment, or PayPal wallet payment.

Benefits of Using PayPal With Skydo

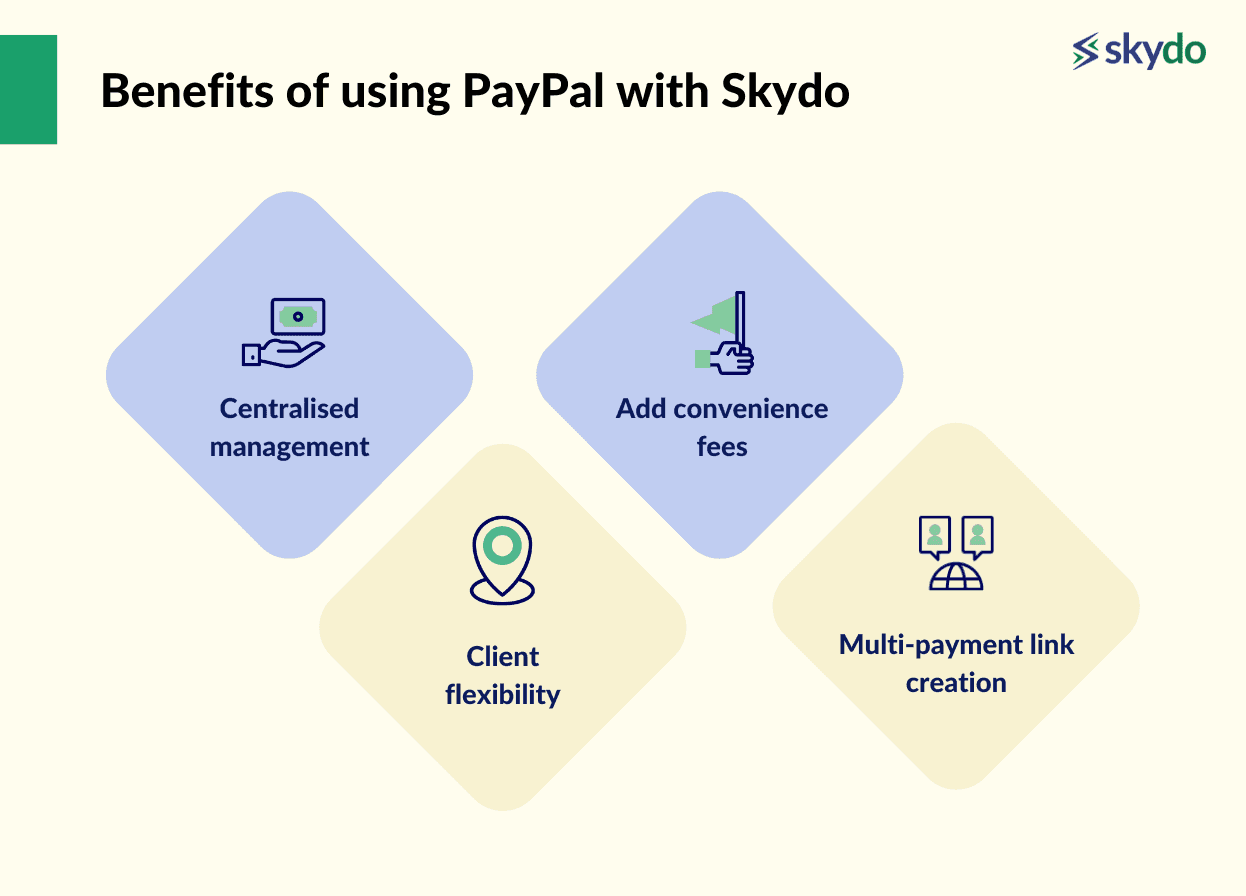

Integrating PayPal with Skydo unlocks a range of advantages:

- Centralised Management: Users can manage all transactions from their Skydo dashboard, regardless of the payment method.

- Add Convenience Fees: Skydo allows users to add convenience fees to clients to cover the processing costs, enabling transparent pricing.

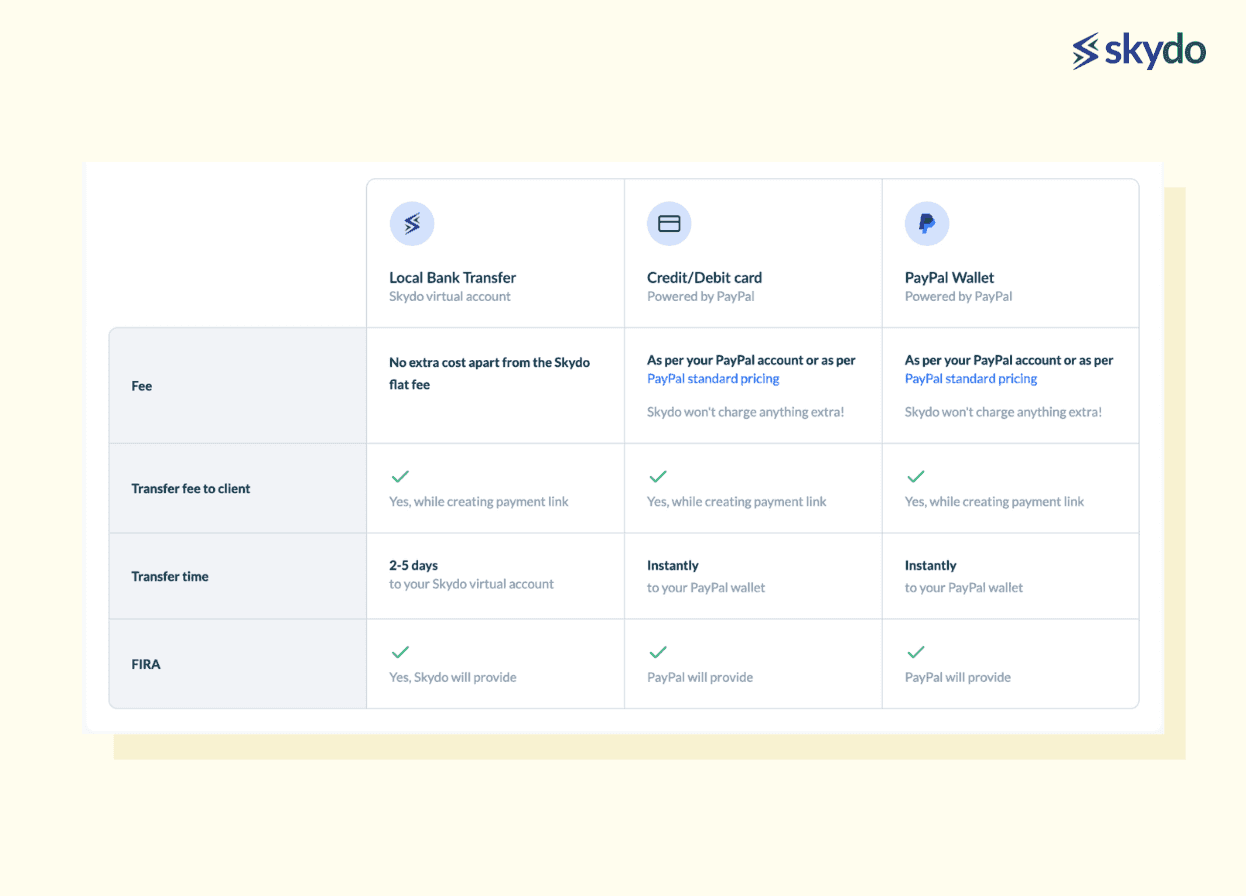

- Client Flexibility: Skydo offers three different options to receive payments—local bank transfer, credit/debit card linked with PayPal, and PayPal wallet. You can choose the most suitable method to enhance your payment experience.

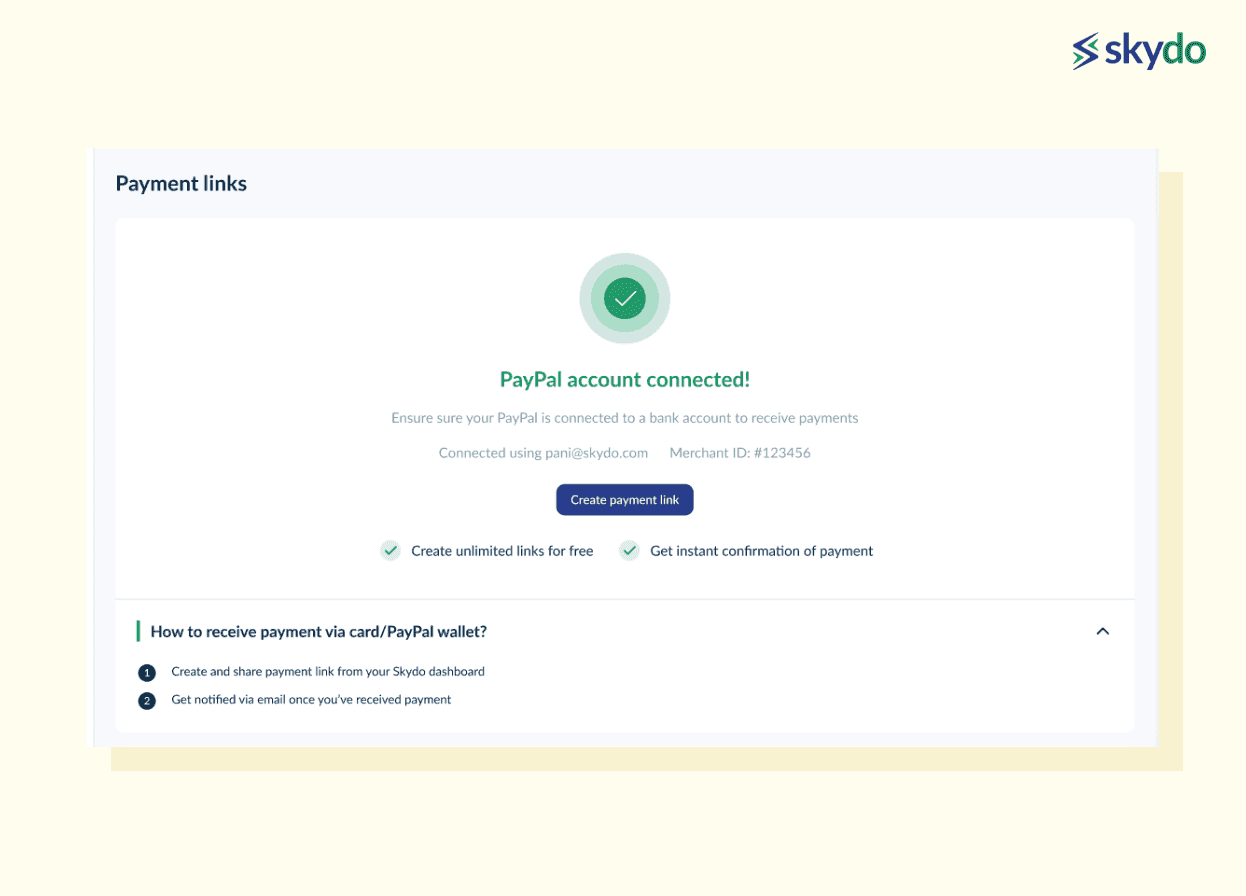

- Multi-Payment Link Creation: You can create as many links as you want; there are no limits to creating payment links.

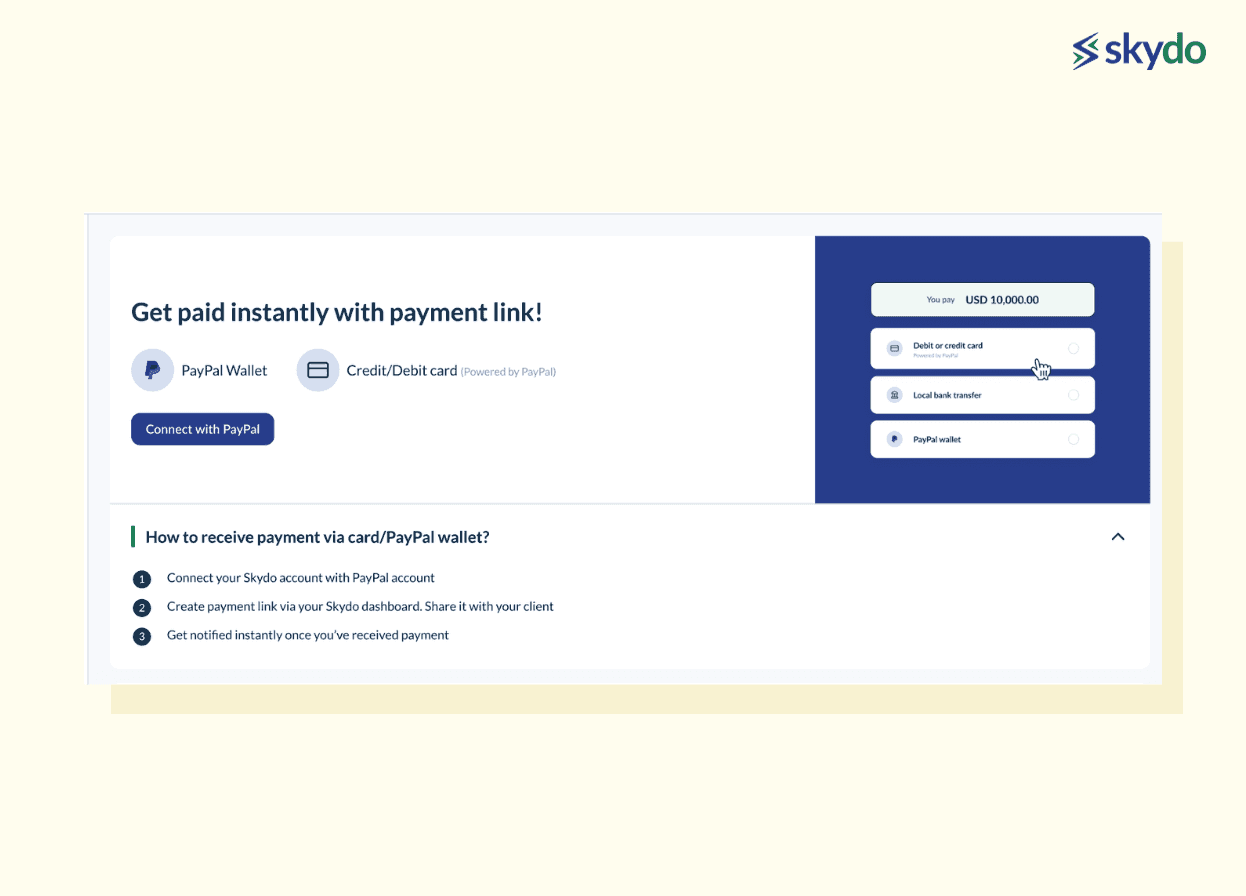

Seamlessly Link Your PayPal Account with Skydo

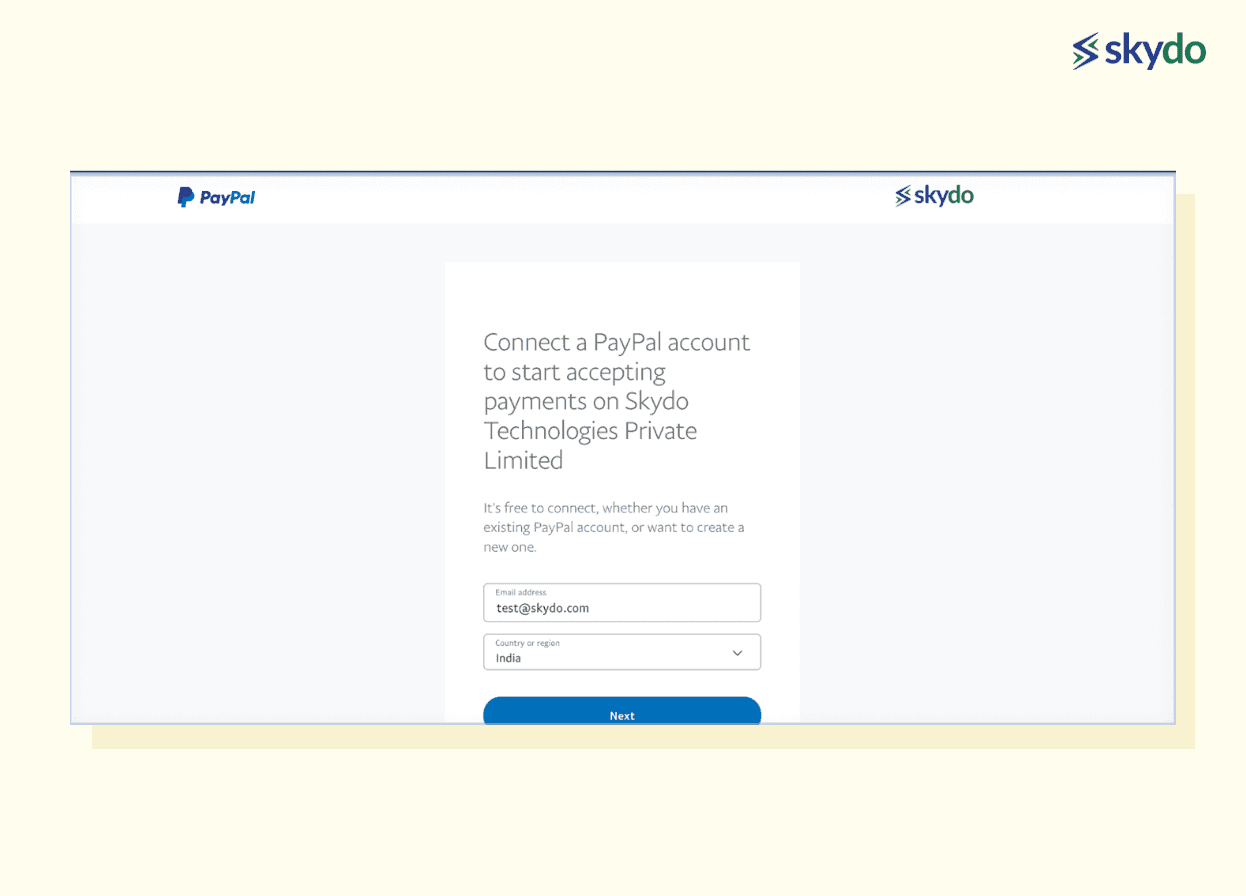

To connect your PayPal account with Skydo:

- Log in to your Skydo dashboard.

- Click on "Connect with PayPal".

- Follow the prompts to log in to your PayPal account or create a new one.

- After a successful connection, create payment links and manage payments directly from Skydo with ease.

Fee Structure and Transfer Process

As a PayPal-integrated platform, Skydo offers both cards and PayPal wallet as payment methods, with PayPal's standard pricing in effect.

For bank transfers, Skydo offers a transparent flat fee structure that is reasonable and easy to understand. The fees are set at $19 for payments up to USD 2,000 and $29 for payments between USD 2,001 and USD 10,000.

Moreover, PayPal issues the FIRA for transactions processed through PayPal wallet or card payments. Skydo platform provides instant FIRC for bank transfers. This ensures compliance with regulatory requirements and improves transparency in cross-border transactions.

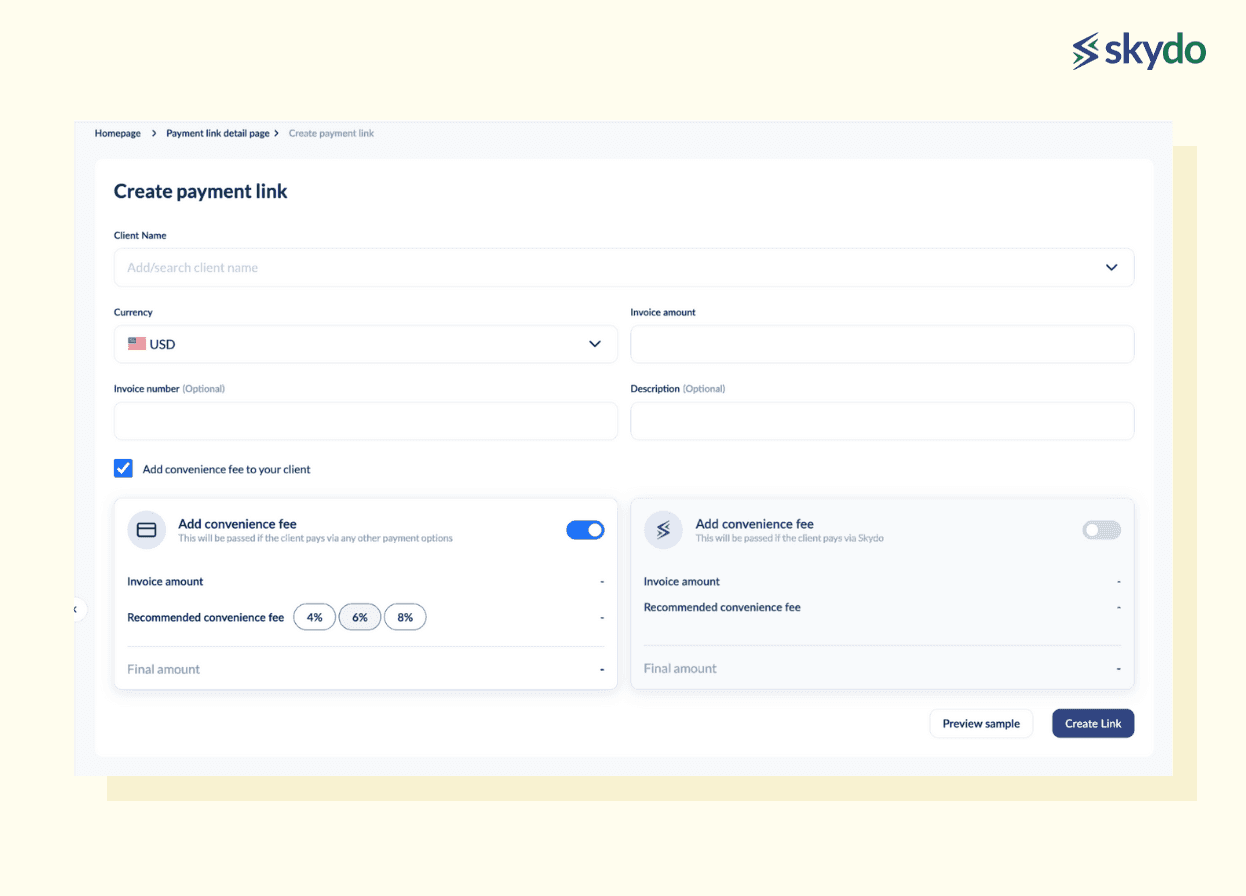

Add Convenience Fee to Cover Processing Costs

PayPal charges a convenience fee on each transaction. Therefore, to cover the processing costs, Skydo allows its users to charge convenience fees from the clients. Its percentage usually varies between 4% to 8%. Users can choose the appropriate option based on the processing costs for their preferred payment mode.

For example, let's consider a scenario where a client chooses to pay a $1000 invoice via credit card.

Now, if there is a 4% convenience fee on credit card payments, you can select a 4% convenience fee while sending the payment link to the client. They would be charged an additional $40, bringing the total payable amount to $1040. Similarly, selecting the 6% or 8% convenience fee options would result in additional charges of $60 and $80, respectively.

Conclusion

Don't let complicated payment methods or platforms hold back your business growth. Utilize Skydo's seamless integration with PayPal to provide your clients with a hassle-free experience.

Skydo empowers you to manage multiple payment options with transparent fees, so you can focus on expanding your global reach. Join Skydo today and unleash the potential of streamlined international payments!

Q1. Can I Have Two PayPal Accounts?

Ans: Yes, it is possible to have multiple PayPal accounts. However, it can be one personal account and one business account. It is necessary to ensure that each account has a distinct email address and financial information.

Q2. Is PayPal Available in India?

Q3. Do We Need Any Bank Account for PayPal?

Q4. Are There Any Limitations on the Number of Payment Links I Can Create Using Skydo?

Q5. Can I Connect My Existing PayPal Account With Skydo, or Must I Create a New One?