Skydo Launches Automated Digital FIRC to Simplify International Payments

When you travel internationally, you undergo various documentation verifications and security checks. Yet, the most crucial step to permit your voyage is to have a stamp on your passport.Similarly, when you receive payments from overseas entities, the GST authorities in India require the Foreign Inward Remittance Advice (FIRA) document.While your business is ready to conquer international markets, without a FIRA document–

- The GST authorities may not accept the payment: Under GST regulations, export supplies are considered zero-rated, but a key condition is receiving payment in foreign currency. FIRA serves as proof of this receipt. Without it, the GST department may not recognise your sales as zero-rated supplies, potentially leading to GST liabilities, penalties, and interest charges.

- It can lead to delays and complications: Failure to meet GST requirements may lead to penalties, and in extreme cases, it could even jeopardise your business's compliance status, risking a potential shutdown.

As CA Tanishq aptly says, "FIRA is the GPS for hassle-free global trade."

This article discusses the many obstacles you may face without a FIRA document and highlights the importance of simplifying your international payments.

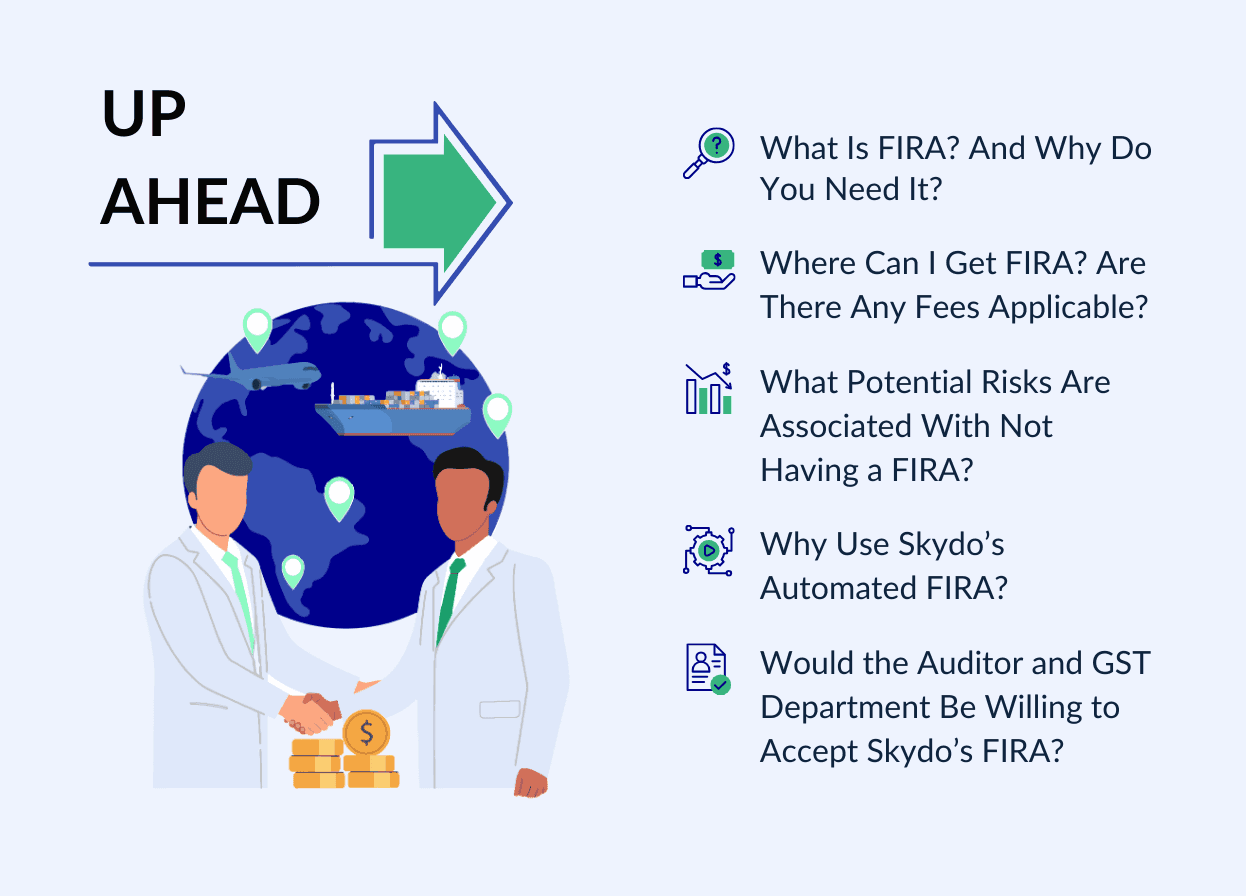

What Is FIRA? And Why Do You Need It?

FIRA (Foreign Inward Remittance Advice) is like a digital business receipt. It is proof that a business has paid another business across borders. Companies keep their FIRA as an instrumental document to cross-verify that they've done a legitimate international transaction.FIRA is proof that you or your business received money from a foreign source. It can be personal transactions, business funds, investments, or even a gift from a friend or family member living abroad.FIRA’s are your sidekick of business. It is a document that helps you keep a record of your money in both the currency you’re sending (rupees) and the one receiving (foreign).

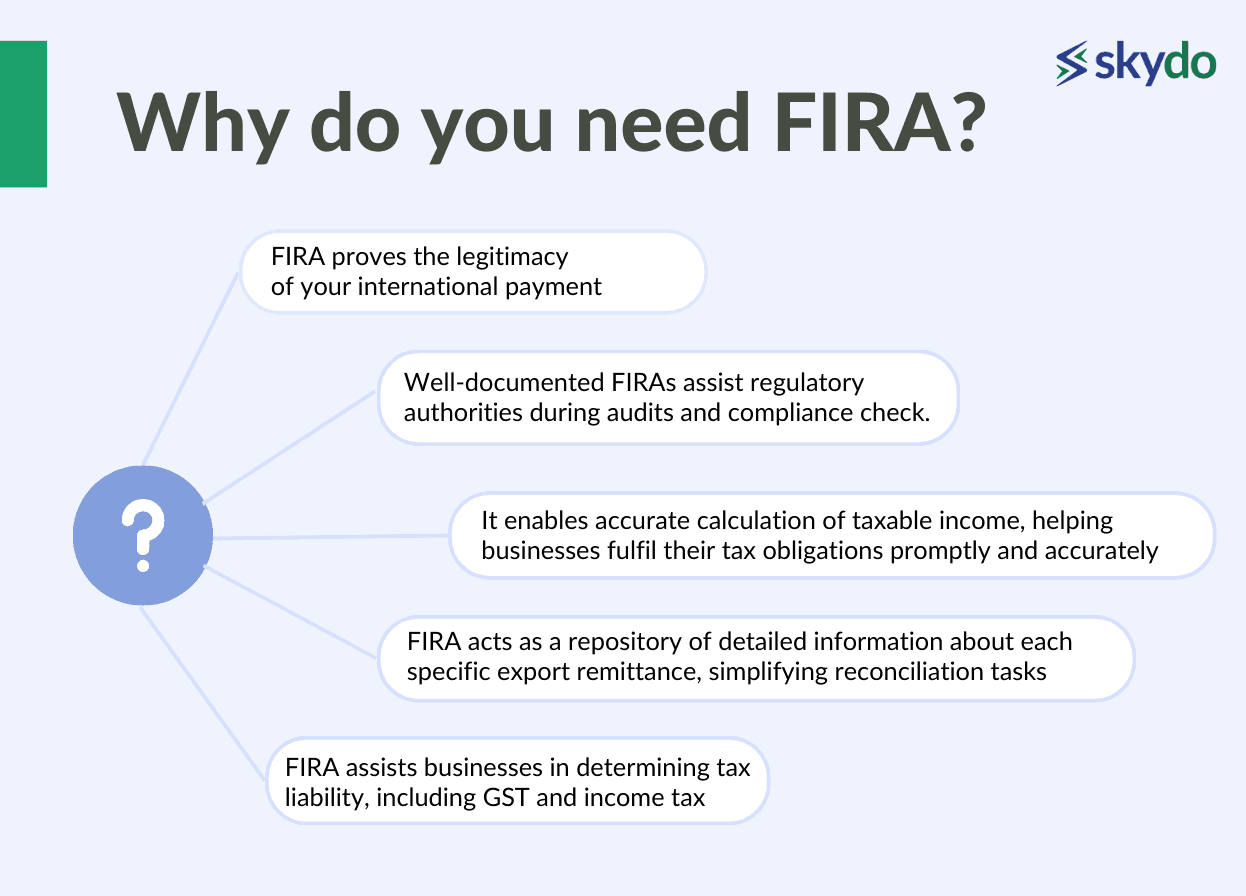

Why Do You Need FIRA?

- FIRA is your proof of the legitimacy of your international payment.

- FIRA acts as a repository of detailed information about each specific export remittance, simplifying reconciliation tasks.

- Well-documented FIRAs assist regulatory authorities during audits and compliance checks.

- FIRA assists businesses in determining tax liability, including GST and income tax.

- It enables accurate calculation of taxable income, helping businesses fulfil their tax obligations promptly and accurately.

Where Can I Get FIRA? Are There Any Fees Applicable?

Generally, banks provide a FIRA document. After your money reaches your Indian bank account, approach the bank that handles the transaction. Ask them for the FIRA, like a receipt showing the transaction's details: the amount, currencies, source, and destination.

Some banks may charge for the FIRA. The fees vary based on the transaction and services like processing and sending the document. Check with your bank for precise fee details.

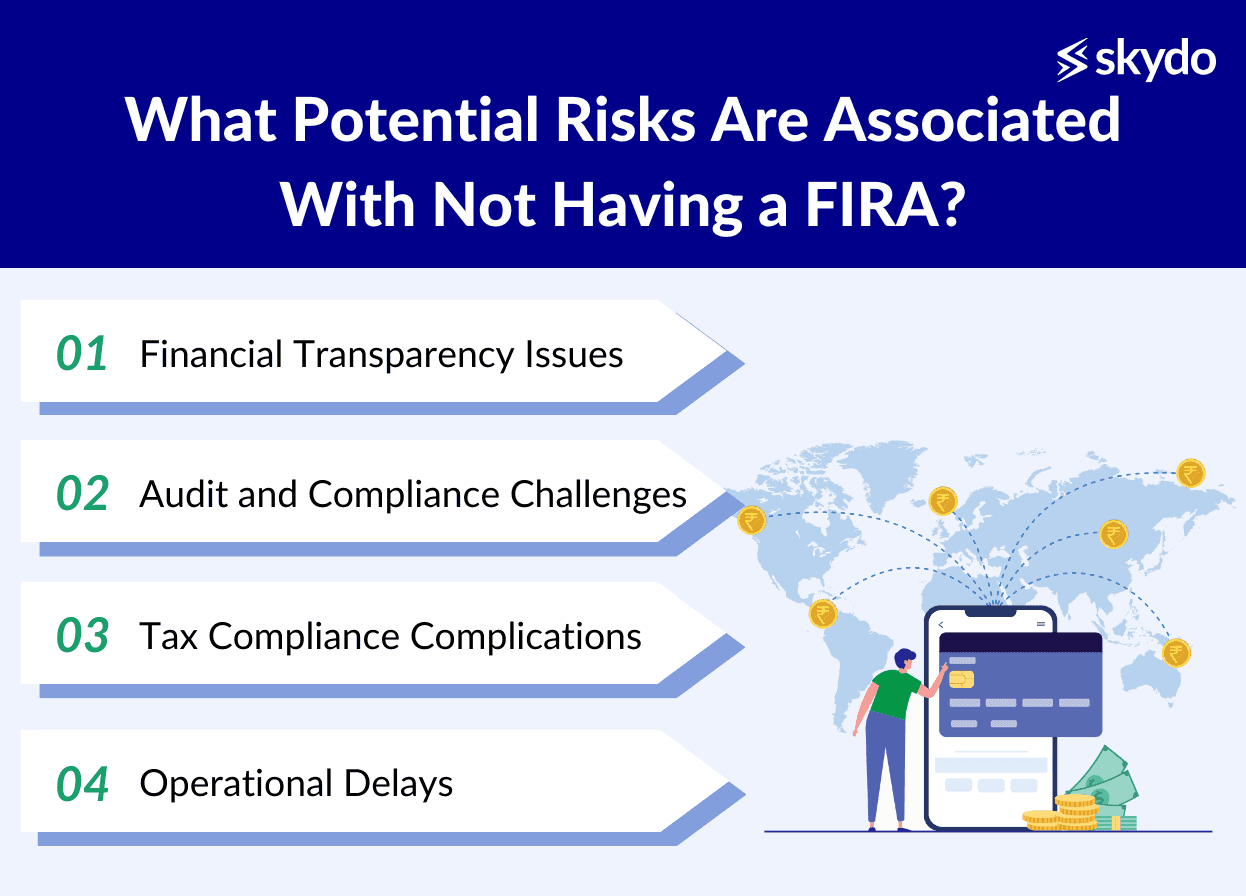

What Potential Risks Are Associated With Not Having a FIRA?

The lack of a FIRC Certificate can pose significant risks for your international business operations.

- Financial Transparency Issues

FIRA serves as a crucial document for maintaining transparency in financial transactions. Its absence may raise concerns about the legitimacy of your international remittances, potentially attracting regulatory scrutiny.

- Audit and Compliance Challenges

During regulatory audits and compliance checks, the lack of FIRA can make it difficult to prove the accuracy and legality of your export remittances. This can lead to prolonged audits, investigations, and disruptions to your business operations.

- Tax Compliance Complications

As FIRA plays a crucial role in determining tax liability, including GST and income tax it becomes harder to accurately calculate taxable income in the absence of this document. It can lead to incorrect tax reporting, penalties, and strained relations with tax authorities.

- Operational Delays

Dealing with the consequences of not having a FIRA, such as resolving regulatory issues or addressing tax liabilities, can lead to operational delays and interruptions, affecting your ability to conduct international trade smoothly.

Considering these risks and challenges, the Skydo platform provides an automated digital FIRC that enables you to overcome various risks effortlessly.

Why Use Skydo’s Automated FIRA?

Using Skydo's Automated FIRA offers several compelling reasons for streamlining your export remittance documentation.

- Efficiency

Skydo automates the FIRA generation process, eliminating the need for manual document creation and management. This efficiency saves you time and reduces the risk of human errors during manual data entry.

- Convenience

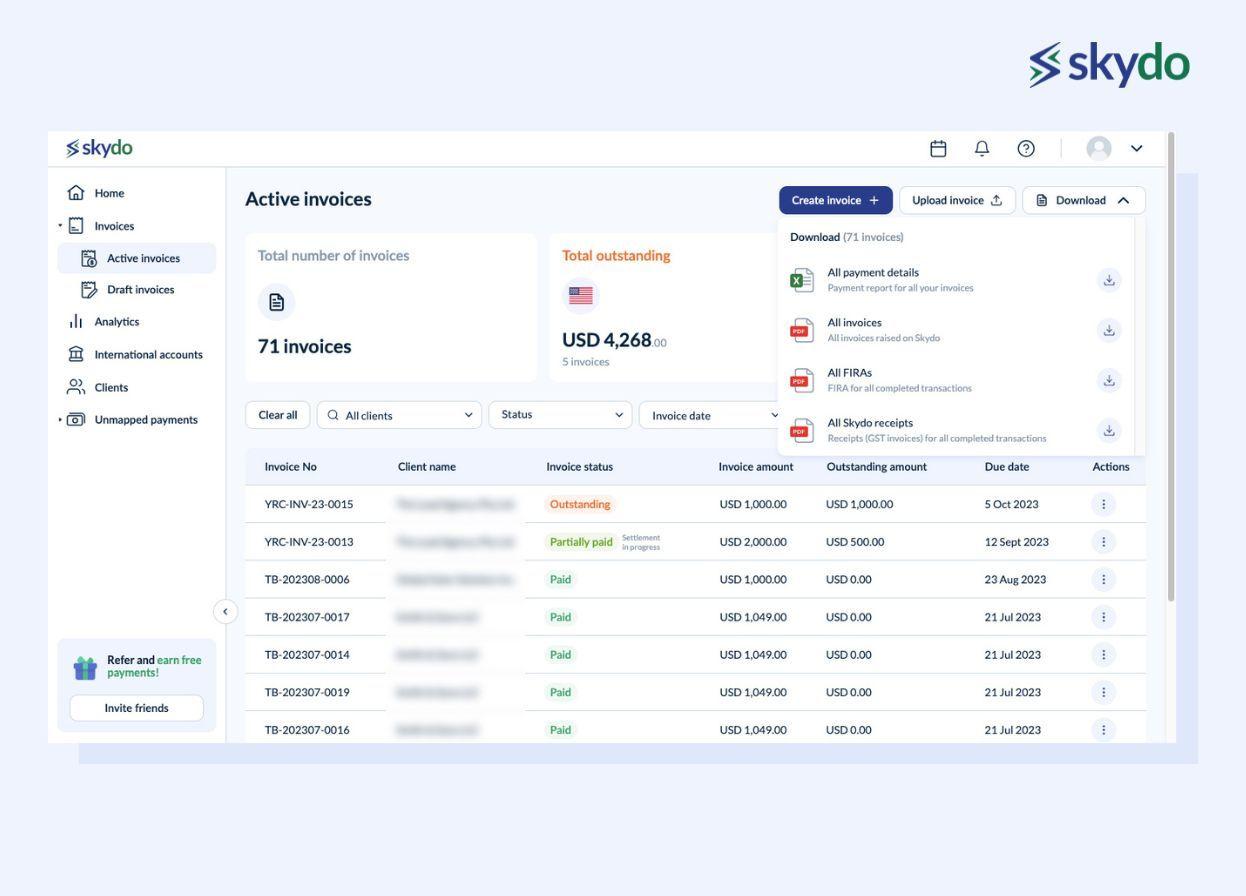

With Skydo, you can download all your FIRAs with just one click from user-friendly dashboards. This convenience simplifies access to crucial documents, making tracking and managing your export remittance documentation easier.

- Compliance

Skydo ensures compliance with Indian and international tax laws and regulatory requirements, following prescribed formats and guidelines. It reduces the burden of ensuring compliance and strengthens your credibility in the eyes of regulatory bodies like the RBI.

- Transparency

By automating FIRA generation, Skydo helps foster transparency in your global operations. You can accurately record and report foreign funds received for specific export transactions, enhancing trust and credibility with regulatory authorities and lenders.

Would the Auditor and GST Department Be Willing to Accept Skydo’s FIRA?

Auditors and the GST department will readily accept Skydo's FIRA documents. Stressing on this, Aagam Jain, a Chartered Accountant and Skydo customer, says - “The FIRA works for GST compliance & I wish every vendor gave such a detailed invoice!”

Skydo automates FIRA generation, ensuring precision and compliance with regulatory standards and streamlining auditing processes.

Additionally, the comprehensive and well-organised FIRA data provided by Skydo enhances transparency, aiding accurate tax assessments for GST departments.

Cut To The Chase–Get A Digital FIRA

Skydo takes the wheel to deliver your business the digital FIRA to receive foreign inward remittances. It redefines the complicated experience of manual tasks and paperwork, from effortless access to real-time FIRA generation and CA-approved compliance to a dashboard that gives you complete control.

Witness the magic of automated FIRA with Skydo. Sign up for a quick demo today!