How to Find the Right HSN Code or SAC for Your Business

In IT service export, success and growth hinge on more than just groundbreaking solutions and global outreach. Business compliance is a crucial aspect that can either propel a company forward or bog it down. While often considered a labyrinth of complexities, mastering compliance is key to unlocking seamless operations and untapped opportunities.

For IT service export companies seeking to flourish globally, understanding and correctly applying the Harmonized System of Nomenclature (HSN) code or the Service Accounting Code (SAC) is an indispensable pursuit.

These codes, though seemingly technical, wield substantial impact, determining the tax rates, exemptions, and adherence to regulatory frameworks for cross-border transactions.

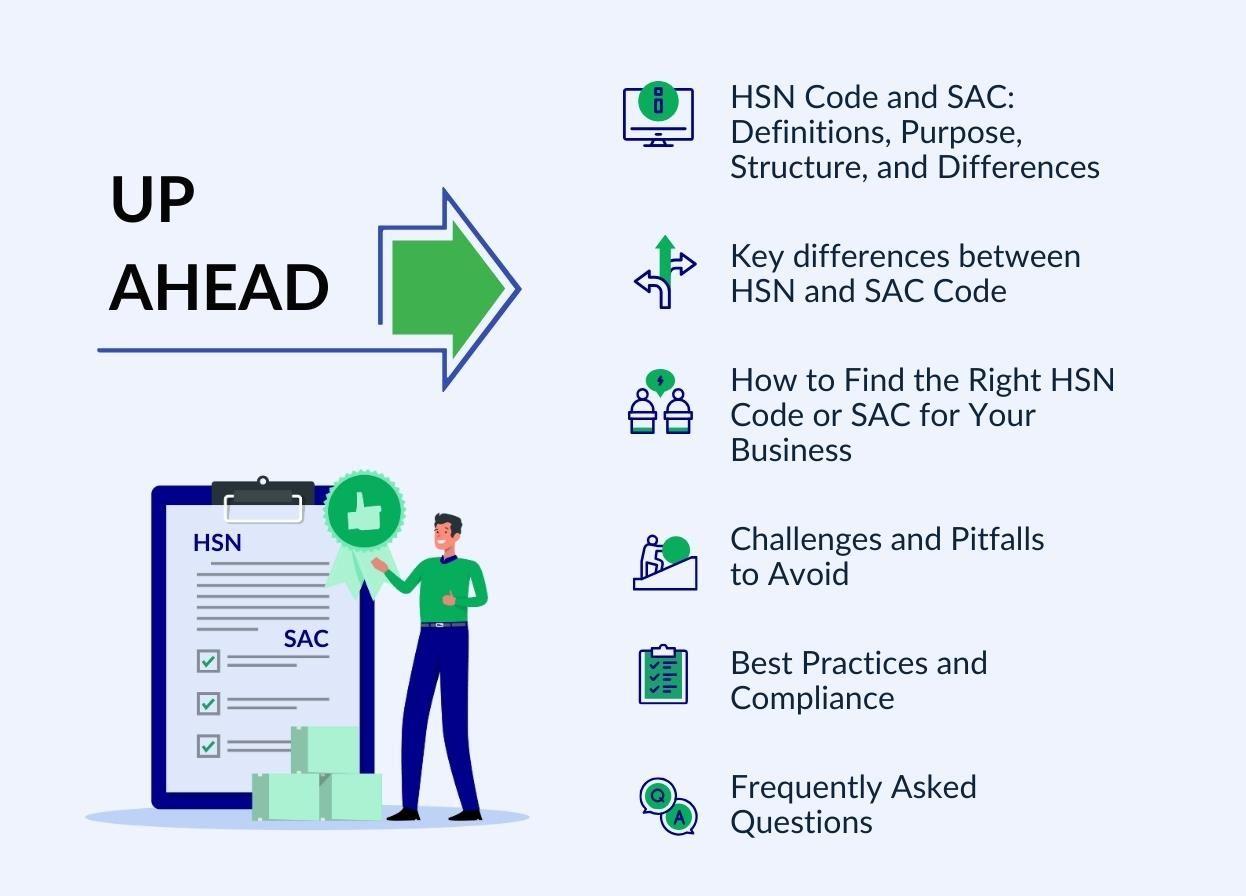

HSN Code and SAC: Definitions, Purpose, Structure, and Differences

All goods and services subject to GST in India are classified using an HSN code and SAC to enable accurate business classification.

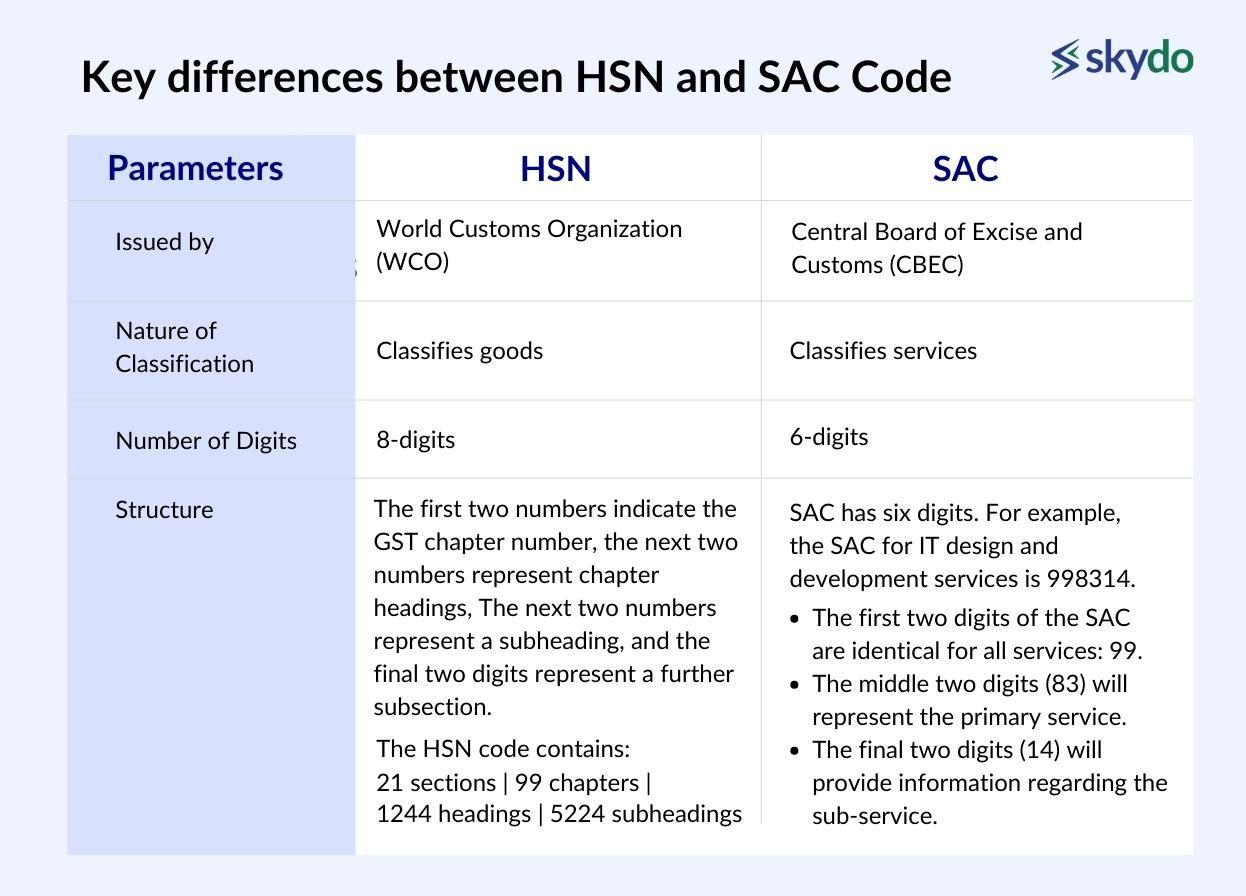

HSN (Harmonised System of Nomenclature) is an international classification system developed by the World Customs Organization (WCO). It classifies commodities into sections, chapters, headings, and subheadings, resulting in a unique 8-digit code for each commodity. Thus, the HSN code ensures that goods of similar nature are correctly classified across the globe.

SAC's full form is the Service Accounting Code (SAC), which is an official nomenclature system introduced by the Central Board of Indirect Taxes and Customs (CBIC) to identify services and determine the associated GST rates for computing tax liability. In India, SAC codes are used to classify, measure, and learn the applicability of GST on various services.

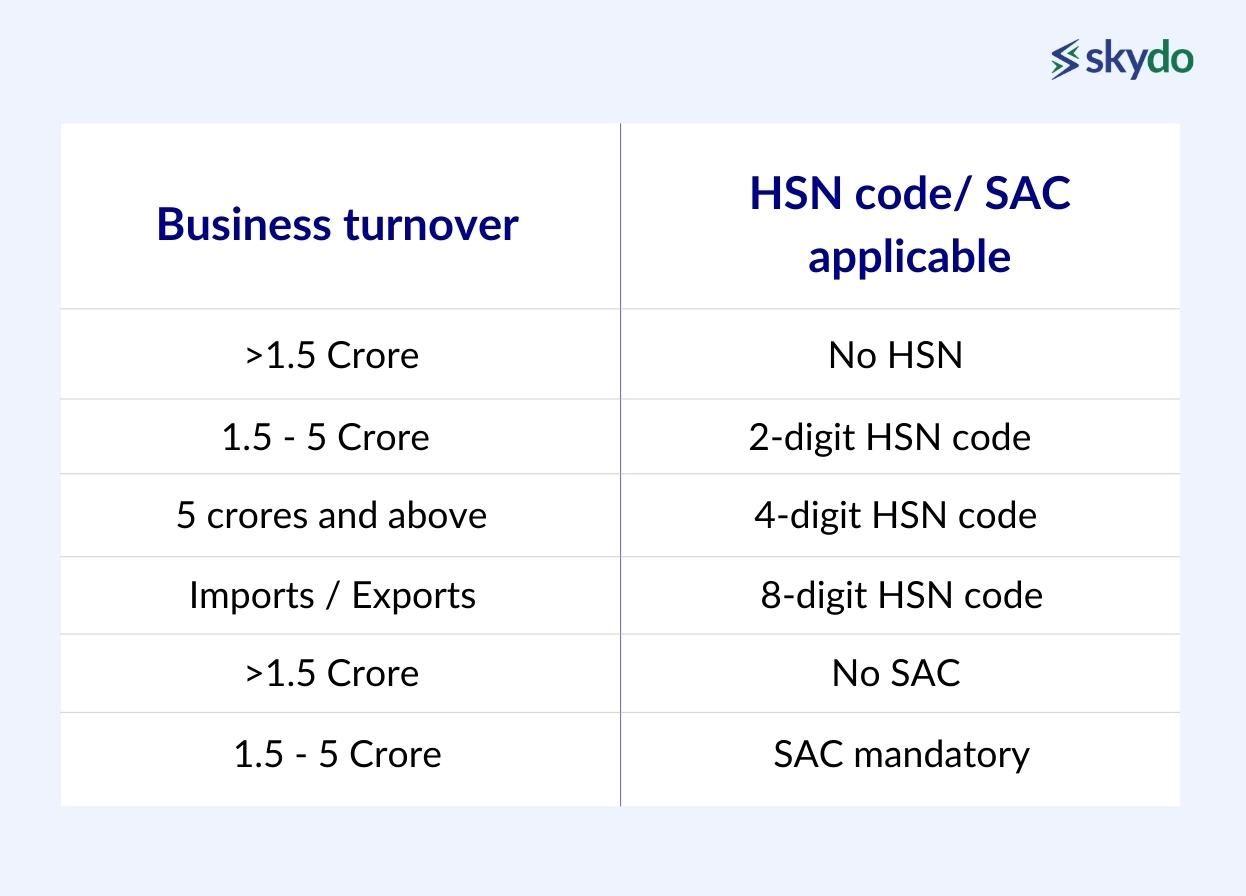

Based on the HSN (goods) or SAC (services) code in India, there are fixed GST rates in five slabs, namely 0%, 5%, 12%, 18% and 28%. Each invoice under the GST system must include the HSN code for the products sold and the SAC code for the services provided. HSN code and SAC will be determined based on the previous year's business turnovers.

Key differences between HSN and SAC Code

The table below summarises the key differences between both codes and the ones that may apply to your business.

Use SAC instead of HSN Code when dealing with mixed supply, composite supply, contracts for work, professional services, or the rental/lease of goods with associated services. But how can you determine the applicable code for your business?

How to Find the Right HSN Code or SAC for Your Business

As an IT service provider seeking to navigate the complexities of business compliance, correctly identifying the appropriate SAC or HSN code for services is a crucial step. These codes are pivotal in accurately classifying your services, understanding tax implications, and ensuring seamless cross-border transactions.

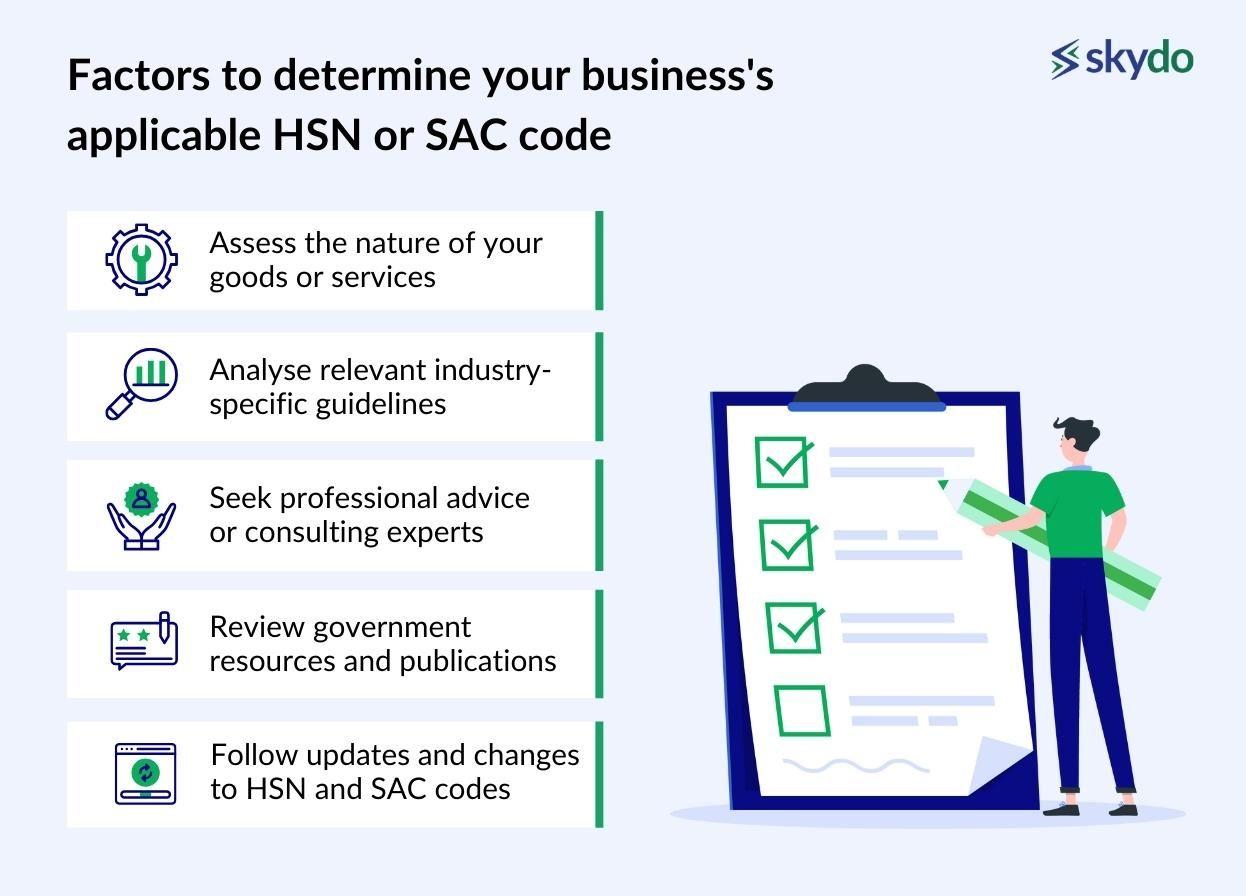

Consider the following factors to determine your business's applicable HSN or SAC code.

1. Assess the nature of your goods or services

Dive deep into the core elements and features of your services. For example, identify your primary services - software development, IT consulting, software maintenance, cloud computing, and data processing.

If your business offers software development, you should specify whether you provide web development, mobile app development, or enterprise software development.

2. Analyse relevant industry-specific guidelines

Every service may have different categorisation criteria depending on their features and applications. What are the industry-specific guidelines related to your services? Consult relevant trade groups, industry forums, or government publications connected to your services to get insights on suitable categorisation.

3. Seek professional advice or consulting experts

While knowing industry-specific norms is important, getting professional adds a degree of assurance. Consult tax advisors, chartered accountants, or other specialists savvy with GST legislation and HSN/SAC codes. They can customise their advice to your company's unique operations to help you minimise tax liability.

4. Review government resources and publications

Refer to the Central Board of Indirect Taxes and Customs (CBIC) and the GST Council to find the correct HSN code or SAC for your services with descriptions for numerous goods and services. Stay updated by reviewing these resources periodically, cross-referencing them with your business activities, and making informed decisions about code selection.

5. Follow updates and changes to HSN and SAC codes

Ensure accurate tax calculations, and avoid disputes with tax authorities and potential penalties by regularly checking the CBIC website (the “What’s New” section) for official notifications, and other GST-related publications.

Challenges and Pitfalls to Avoid

While HSN codes are essential for seamless cross-border transactions, they come with challenges that can pose significant risks if not addressed diligently.

Ambiguities and changes in HSN Codes and SACs

Considering rapidly developing technology, new services are constantly surfacing, making it difficult to search HSN code or discover exact matches within the current coding system. When choosing codes, this ambiguity may lead to doubt and possible misclassifications.

Furthermore, the government updates HSN codes and SACs regularly to reflect changes in the industry and technical developments and comply with international standards. Staying updated with these changes is crucial to ensure accurate classification.

Penalties for incorrect classification

Incorrect categorisation of goods or services under HSN or SAC could lead to serious consequences, such as penalties. When tax officials conduct audits and find misclassifications, businesses may be subject to paying the correct taxes, penalties, and interest. This can majorly impact your company’s financial health and reputation.

Best Practices and Compliance

Adhering to best practices for HSN codes and SACs is paramount. These practices promote seamless operations and safeguard businesses from potential pitfalls.

1. Maintaining accurate records of HSN Codes and SAC

Maintain accurate records to ensure GST compliance with a database of HSN codes and SACs for your goods and services. Organise these records for easy retrieval and reference whenever required.

2. Regular review and updates of HSN Code or SAC applicability

Conduct periodic HSN/SAC code audits to keep up with the changing needs of your organisation. Keep a vigilant eye on the latest government updates regarding codes and make necessary modifications as required to stay compliant.

3. Engaging professional help for HSN Code or SAC determination

Consult experts such as tax advisors or chartered accountants to figure out the proper HSN codes and SACs for your services. Professional advice can help you avoid misclassifications and ensure compliance.

4. Ensuring compliance with applicable regulations and laws

Compliance is the foundation of a thriving business. Stay well-versed in all applicable GST laws, regulations, and guidelines, especially the ones related to HSN codes and SACs. Ensure your company adheres to these rules by filing GST returns on time, issuing appropriate HSN/SAC invoices, and paying taxes on time.

Conclusion

Avoid penalties and streamline your operations by accurately classifying your products or services. With the correct HSN or SAC Code, you can simplify tax calculations, optimise inventory management, and meet government regulations effortlessly. Conduct diligent research, stay informed about updates, and seek expert advice to navigate the complexities of HSN and SACs confidently.

Frequently Asked Questions

Q1. What is UQC in GST?

Ans: In GST, UQC stands for "Unit Quantity Code." It is a code used to specify the unit of measurement for goods or services, helping in accurate classification and tax calculations.

Q2. Is the HSN Code mandatory for all service exporters?

Ans: No, HSN Codes are primarily used for classifying goods, and service exporters typically use SAC (Service Accounting Code) to categorise and determine GST rates for their services.

Q3. Why are HSN Codes important at the time of filing GST returns?

Ans: HSN Codes are essential for accurate tax calculations and enable businesses to determine GST rate exemptions and adhere to regulatory frameworks when reporting their sales of goods.

Q4. Where should the HSN/SAC code be mentioned?

Ans: The HSN code for goods and SAC code for services should be mentioned on invoices to ensure proper classification for tax purposes.

Q5. How many codes are businesses required to mention on the invoice?

Ans: For goods, businesses need to mention the HSN code, and for services, the SAC code. These codes help in tax compliance and accurate reporting.

Q6. What is the difference between an HSN code and a SAC code?

Ans: The HSN code (Harmonized System of Nomenclature) classifies goods, while the SAC code (Service Accounting Code) classifies services. They have different structures and serve distinct purposes in GST compliance.