Ways to Minimise TDS on Foreign Payments

Understanding TDS on Foreign Payments

When making payments to non-residents, you must deduct a certain tax percentage at the source as per Section 195 of the Income Tax Act.

Additionally, effective management of TDS is paramount for tech exporters to minimise its impact on the bottom line. By optimising tax planning strategies, such as leveraging double taxation avoidance agreements (DTAA), correctly utilising forms 15CA and 15CB, and exploring available exemptions or deductions, you can minimise TDS leakage and preserve their financial resources.

Proactive TDS management ensures compliance with tax regulations, reducing the risk of penalties or legal complications. By understanding the nuances of TDS on foreign payments and adopting effective management strategies, you can positively influence their cash flow, profitability, and overall financial stability in international transactions.

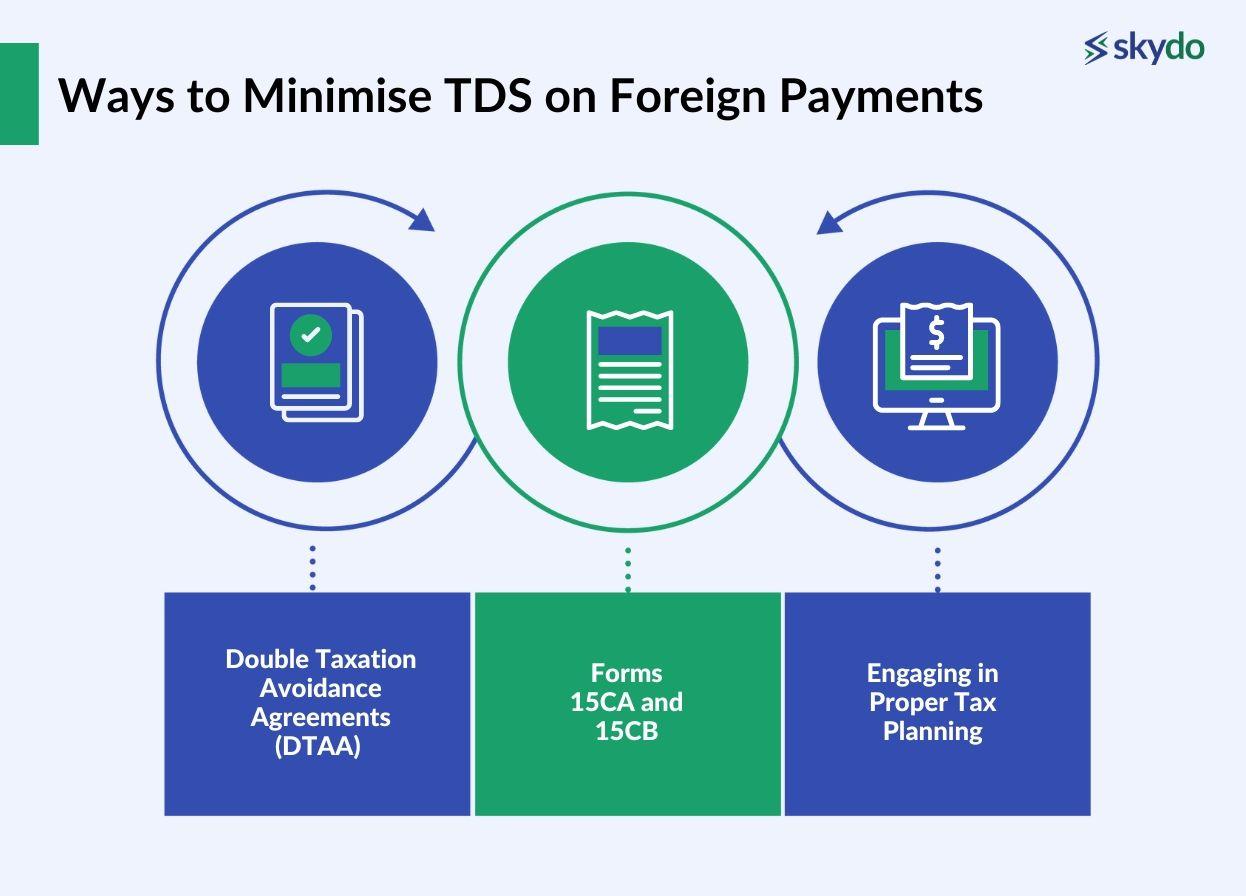

Ways to Minimise TDS on Foreign Payments

Minimising TDS on foreign payments is a key objective for tech exporters to optimise their financial outcomes. The following strategies can help reduce TDS on these transactions.

1. Double Taxation Avoidance Agreements (DTAA)

DTAA is a bilateral agreement or treaty between two countries to prevent taxpayers from being subject to taxation on the same income in both jurisdictions. DTAA reduces or eliminates taxes in one country for income already taxed in another country.

Leveraging such tax agreements is a paramount strategy for tech exporters aiming to minimise TDS on foreign payments. These international agreements often provide provisions to lower withholding tax rates, optimising financial returns for businesses engaged in cross-border transactions.

By understanding and utilising the provisions of DTAA, tech exporters can minimise their TDS liability.

2. Forms 15CA and 15CB

Form 15CA is a declaration form that provides information about the purpose and nature of the remittance. A qualified chartered accountant issues Form 15CB certifying the transaction details.

As Section 195 of the Income Tax Act prescribes, these forms ensure the proper reporting of foreign remittances and help determine the applicable TDS rates. Tech exporters should ensure accurate and timely form filing to minimise potential TDS discrepancies.

3. Engaging in Proper Tax Planning

Effective tax planning minimises TDS on foreign payments for tech exporters. By carefully structuring transactions, exploring available exemptions, and aligning business operations with tax regulations, exporters can strategically reduce the withholding tax burden.

Adopting a proactive and well-informed approach to tax planning ensures that tech exporters retain more of their earnings from international transactions, enhancing overall financial efficiency and competitiveness in the global market.

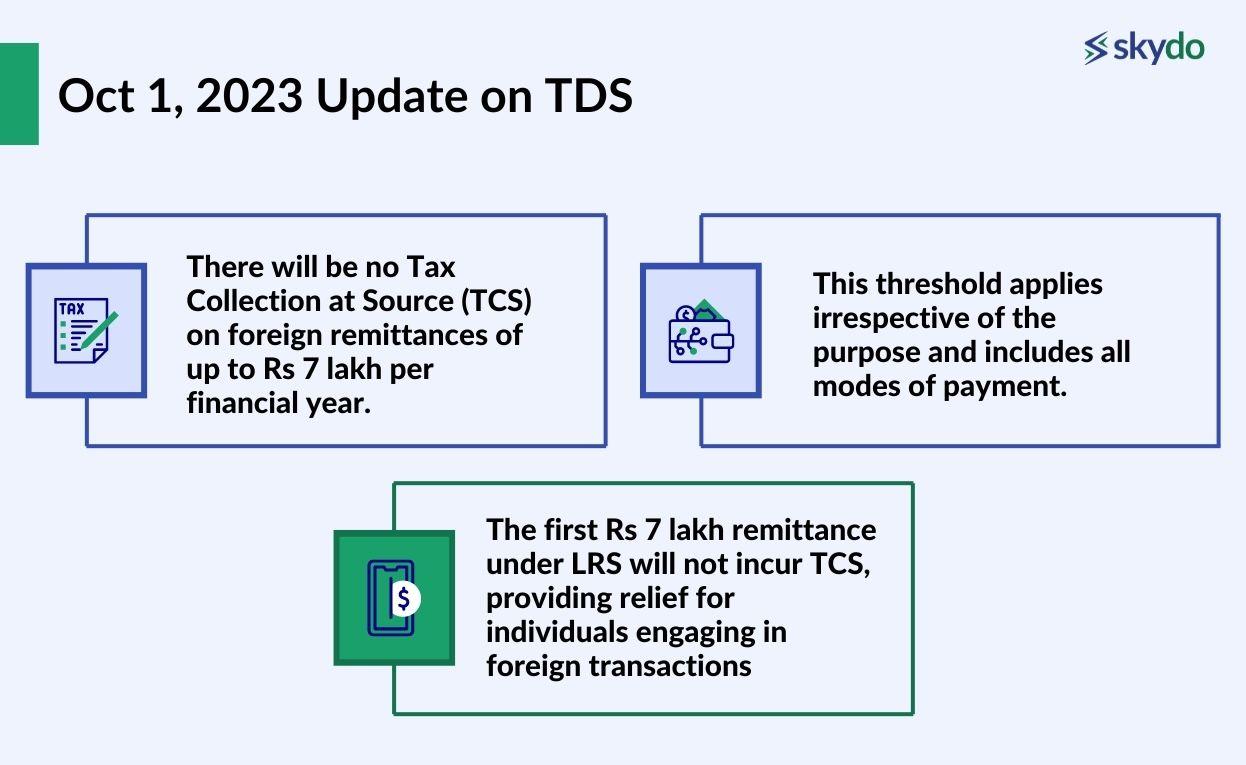

Oct 1, 2023 Update on TDS

As of October 1, 2023, a significant update has been implemented regarding Tax Deducted at Source (TDS) in India. The Ministry of Finance has introduced a notable change related to foreign remittances.

There will be no Tax Collection at Source (TCS) on foreign remittances of up to Rs 7 lakh per financial year. This update, outlined in a notification released on June 28, 2023, signifies a restoration of the Rs 7 lakh threshold per individual for TCS on all categories of Liberalised Remittance Scheme (LRS) payments.

This threshold applies irrespective of the purpose and includes all modes of payment. Therefore, the first Rs 7 lakh remittance under LRS will not incur TCS, providing relief for individuals engaging in foreign transactions.

A Practical Guide for Tech Exporters

A practical guide below features a comprehensive checklist and step-by-step approach to minimise TDS leakage.

- Understand the Relevant Tax Laws: Familiarise yourself with the Income Tax Act and its provisions related to TDS on foreign payments. Stay updated on recent changes or amendments that may impact your tax obligations.

- Determine Applicability of Double Taxation Avoidance Agreements (DTAA): Identify if there is a DTAA between your country and the recipient country of the payment. Determine the provisions under the DTAA that can help minimise TDS. Consult tax experts or legal professionals if needed.

- Assess Correct Usage of Forms 15CA and 15CB: Determine whether your remittance requires Form 15CA or 15CB. Ensure the forms are correctly filled and submitted as per the guidelines provided by the Income Tax Department. Seek assistance from a qualified chartered accountant if necessary.

- Optimise Tax Planning: Engage in strategic tax planning to maximise the benefits of deductions, exemptions, and tax credits available to tech exporters. Explore options such as research and development (R&D) tax incentives, export promotion schemes, and other tax-saving provisions specific to your industry.

- Maintain Accurate Documentation: Preserving records of all foreign transactions, invoices, agreements, and relevant supporting documents. This documentation will demonstrate compliance and substantiate any claims or deductions during tax assessments.

- Seek Professional Advice: Consult with tax professionals, chartered accountants, or tax advisors specialising in international tax matters. They can provide valuable guidance, review your tax strategies, and ensure adherence to regulatory requirements.

Minimising TDS on foreign payments requires careful consideration of legal requirements, proper documentation, and proactive tax planning. By following this practical guide and seeking professional assistance, tech exporters can effectively minimise TDS leakage, optimise their tax position, and enhance their profitability in international transactions.

Conclusion

Minimising Tax Deducted at Source (TDS) on foreign payments is a crucial aspect of financial management for individuals and businesses engaged in cross-border transactions. By understanding the intricacies of TDS regulations, exploring available exemptions and provisions, and leveraging tax treaties effectively, one can significantly reduce the impact of TDS on international payments.

Implementing proper documentation, ensuring compliance with relevant tax laws, and seeking professional advice when needed are essential steps in the journey to minimise TDS. It's not just about saving money; it's about optimising financial processes and fostering a smoother international business environment.

As the global economy continues to evolve, staying informed about changes in tax regulations and proactively adapting strategies will be key to successfully navigating the complexities of TDS on foreign payments. By adopting a proactive and informed approach, individuals and businesses can not only minimise TDS but also pave the way for more efficient and cost-effective cross-border financial transactions.

Frequently Asked Questions

Q1. What are the penalties for non-compliance with TDS rules on foreign payments?

Ans. Non-compliance penalties may include interest charges on the unpaid tax amount, penalty levies, and disallowance of expenses. The penalties vary based on the nature and severity of the non-compliance, and it is essential to adhere to TDS rules to avoid these consequences.

Q2. How does the recent change in tax laws affect TDS on foreign payments for tech exporters?

Ans. The recent change in tax laws does not affect TDS on foreign payments for tech exporters. The recent amendment pertains to TCS applicability and has no bearing on TDS.

Q3. Can I claim a refund for TDS on foreign payments? If yes, what is the process?

Ans. Yes, it is possible to claim a refund for TDS on foreign payments if the taxpayer's total tax liability is lower than the TDS amount deducted. The process involves filing an income

Q4. Does the size or nature of my tech export business affect the TDS rules applicable to me?

Ans. The size or nature of your tech export business does not generally affect the TDS rules applicable to you. TDS rules depend on the nature of the payment and the provisions outlined in the Income Tax Act. However, certain requirements or thresholds may vary depending on specific circumstances.

Q5. Are any specific TDS rules for tech exporters that differ from general businesses?

Ans. Yes, certain specific TDS rules for tech exporters may differ from general businesses, such as provisions related to software royalty payments and technical services.

Q6. How to transfer money from the USA to India without paying taxes?

Ans: Transferring money from the USA to India without paying taxes is not advisable, as tax regulations apply. Utilising legal channels, like NRE or NRO accounts, can help manage tax implications.

Q7. What is the significance of LRS?

Ans: LRS, or Liberalised Remittance Scheme, is significant as it allows Indian residents to freely remit a certain amount abroad for permissible transactions, promoting ease of foreign exchange management.

Q8. Are inward remittances taxable in India?

Ans: Inward remittances are generally not taxable in India, as they represent funds received from abroad. However, specific circumstances or types of income may have tax implications.

Q9. Who can receive tax-free foreign remittances in India?

Ans: Indian residents, such as non-resident Indians (NRIs) and those with specified exemptions, can receive tax-free foreign remittances in India, subject to certain conditions and limits.