Which Payment Processor Is Cheaper than Stripe and PayPal?

If you're a freelancer or a business owner working with international clients, you need an efficient and cost-effective payment processor for your global payments.

While PayPal and Stripe are popular payment solutions, they might not be the best fit for every business. Choosing the wrong payment gateway costs you money and your valuable time.

It's essential to be mindful of their drawbacks, including high transaction fees, substantial conversion charges, and regulatory complexities.

The problem with Stripe or PayPal

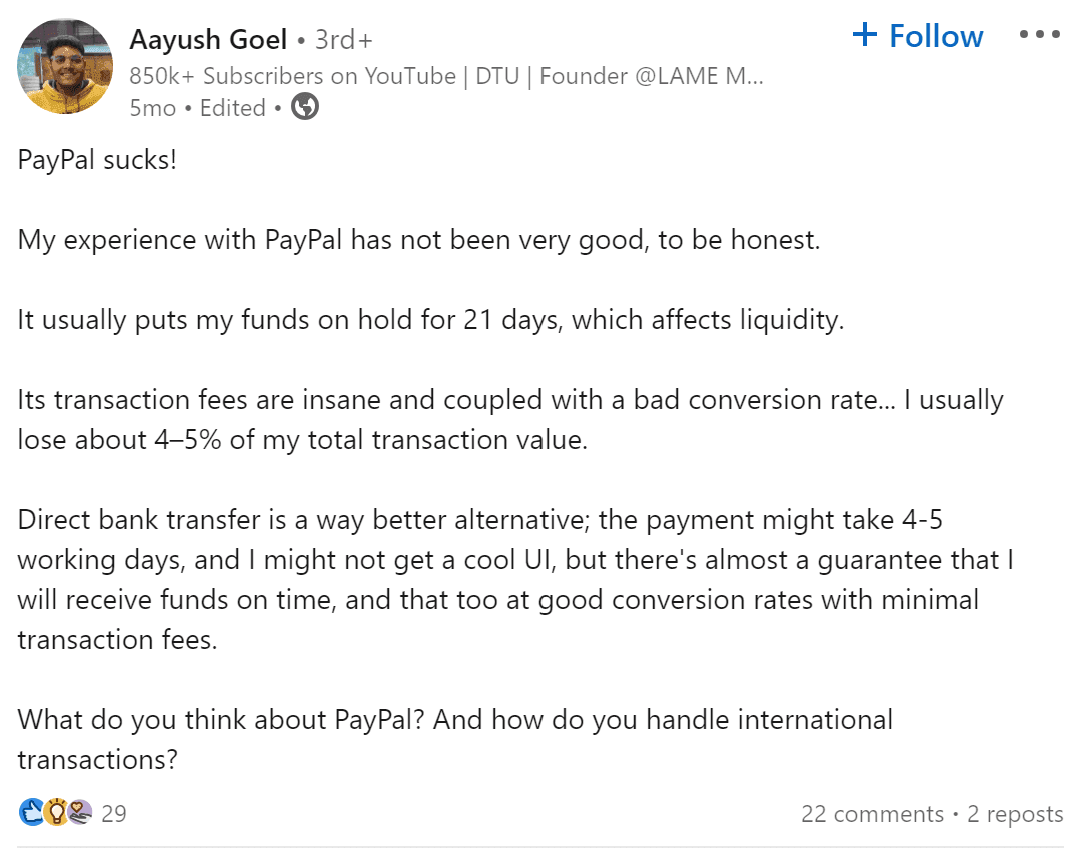

Despite their widespread usage, Stripe and PayPal charge high transaction fees, typically ranging from 1% to 4% of the transferred amount, in addition to currency conversion fees based on the payer's country. This complex fee structure poses challenges in accurately estimating overall costs beforehand.

Moreover, for Indian merchants, obtaining Foreign Inward Remittance Advice (FIRA) documents from Stripe and PayPal can be cumbersome, often taking several days to process. These delays in FIRA document processing lead to transaction delays, causing frustration and potentially hindering business growth.

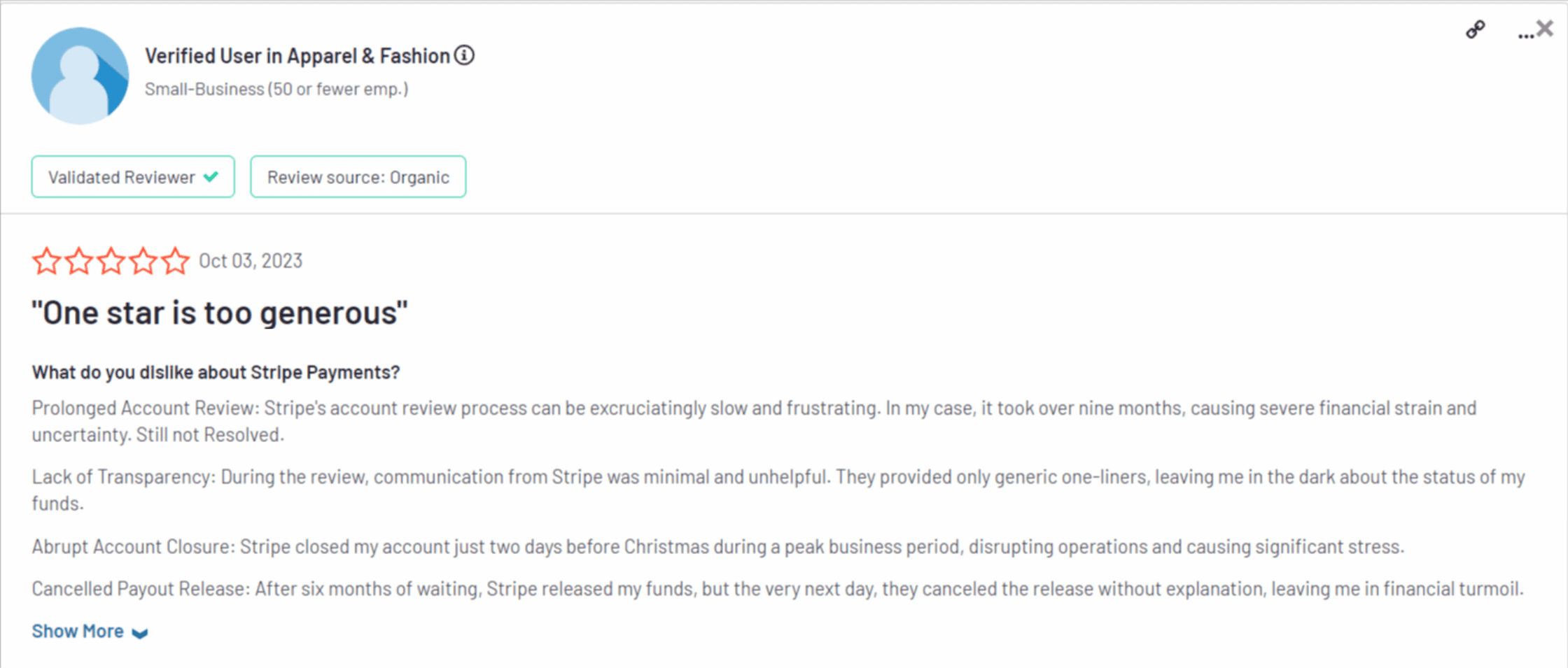

These collective factors can hinder your profitability and growth. Numerous users of these platforms for digital payments have reported experiencing payment delays.

Here are some excerpts from unsatisfied customers highlighting their experiences.

Skydo: A cost-effective and more efficient alternative

Skydo is a cutting-edge international payment processor designed to streamline international transactions, offering you the best value for your money. It's designed to empower you to expand your business globally stress-free.

Why you should choose Skydo for your international payments

1. Lowest flat fee

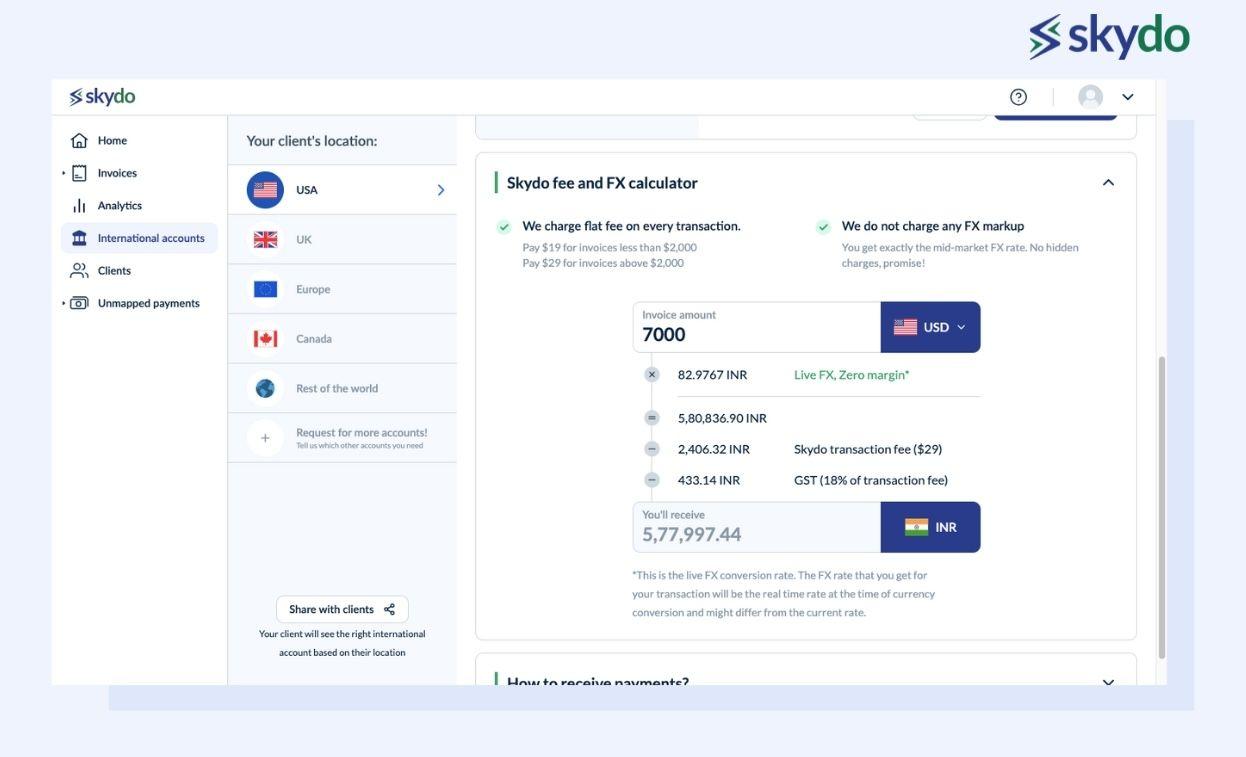

Skydo charges a flat fee of 19 USD for transactions up to 2,000 USD and 29 USD for transactions above 2,000 up to 10,000 USD. That's it – no hidden charges, no percentage games.

2. Live FX rates and zero markups

Skydo uses real-time exchange rates, offering an entirely transparent pricing model. Unlike Stripe and PayPal, there are no processing fees or FX markups. You receive the maximum value of your online payment and know your cost before transferring funds.

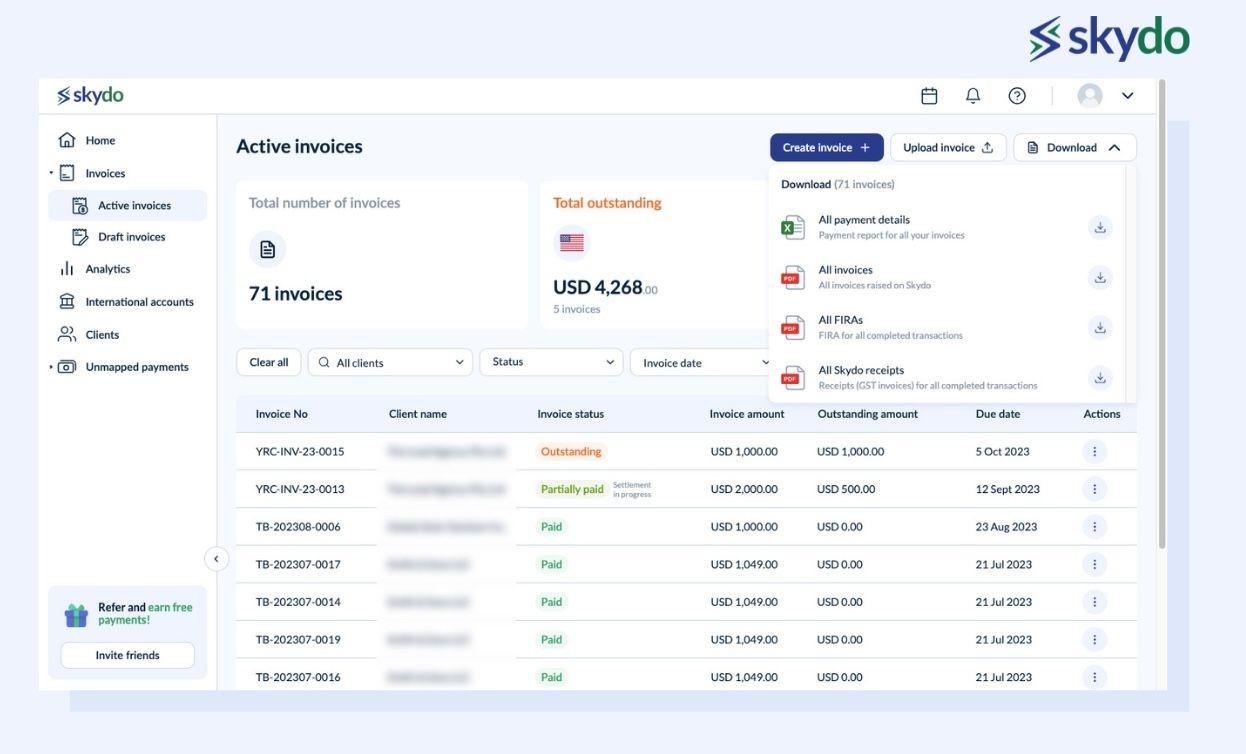

3. Instant FIRA documents

With Skydo, you can download all your FIRCs instantly with just one click. It eliminates delays and ensures compliance.

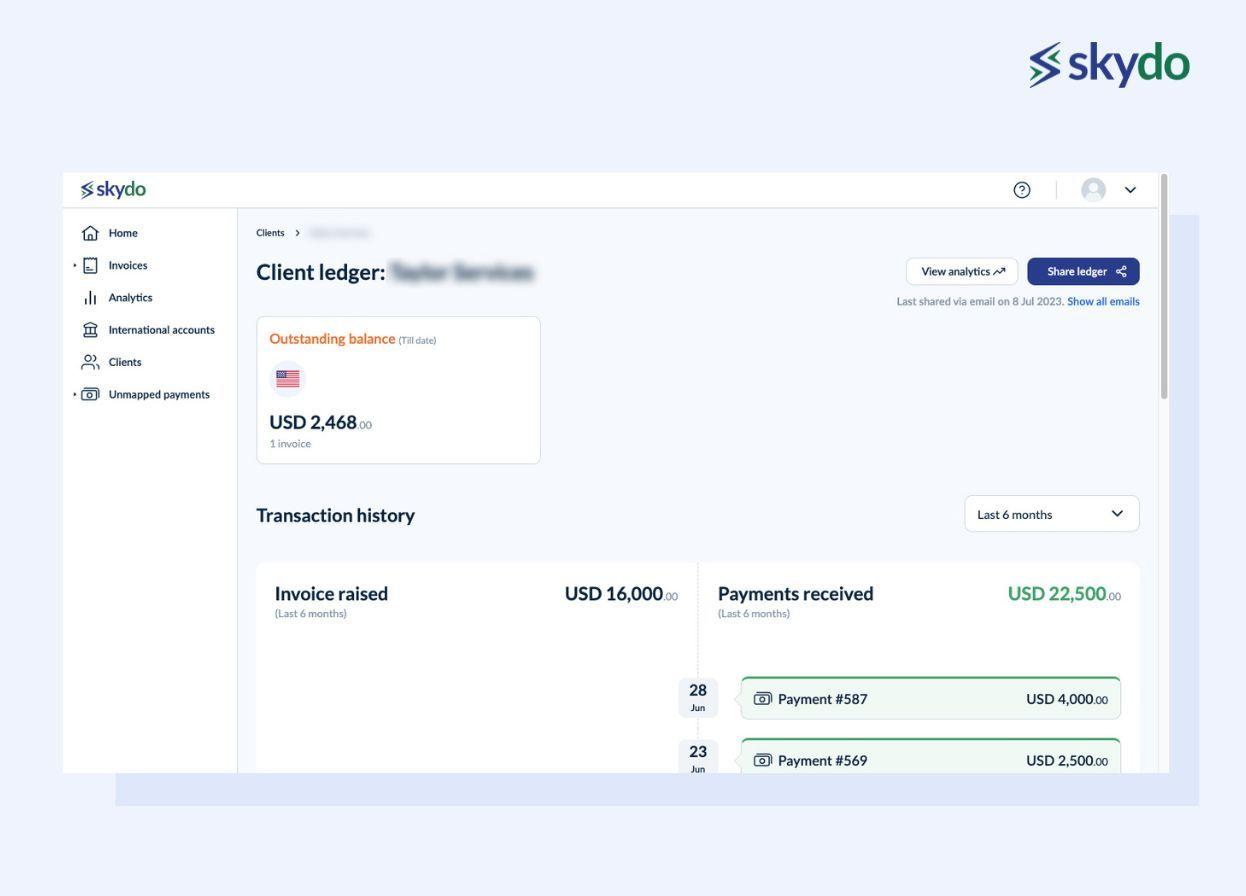

4. End-to-end payment tracking

We believe in complete transparency. With our real-time tracking feature, you can monitor the status of your funds anytime you want.

5. A seamless experience

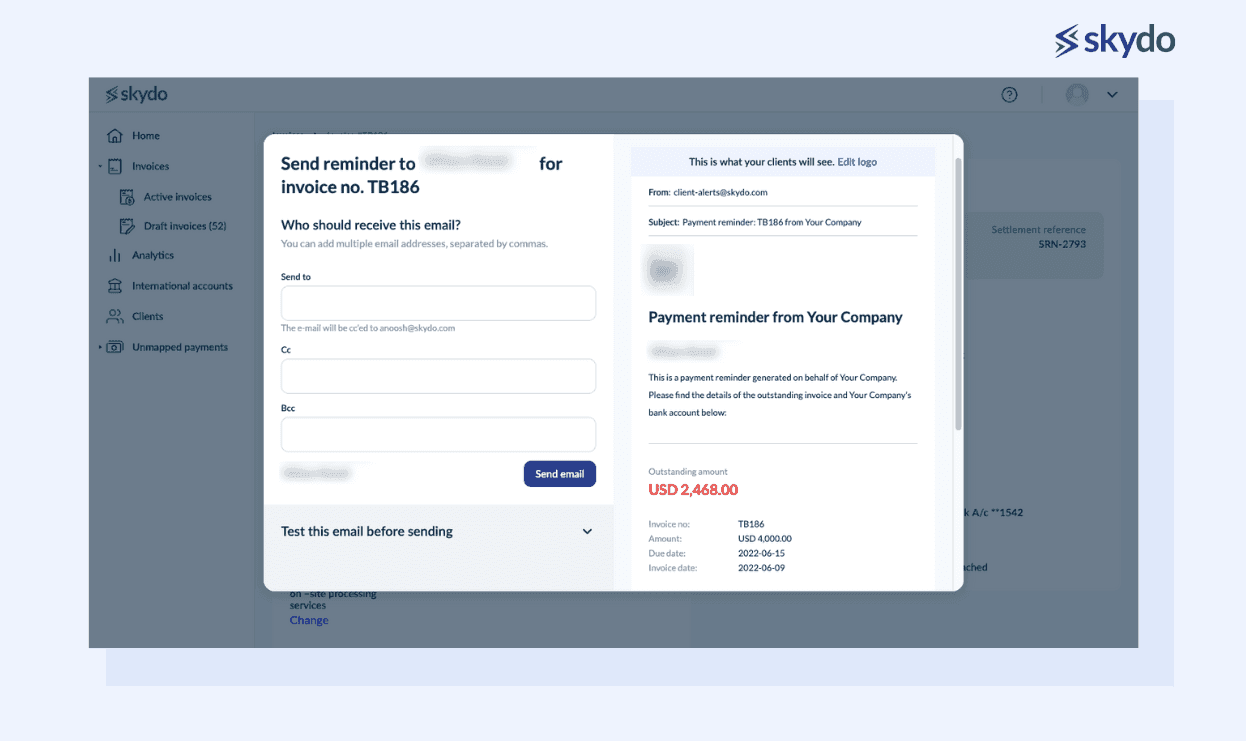

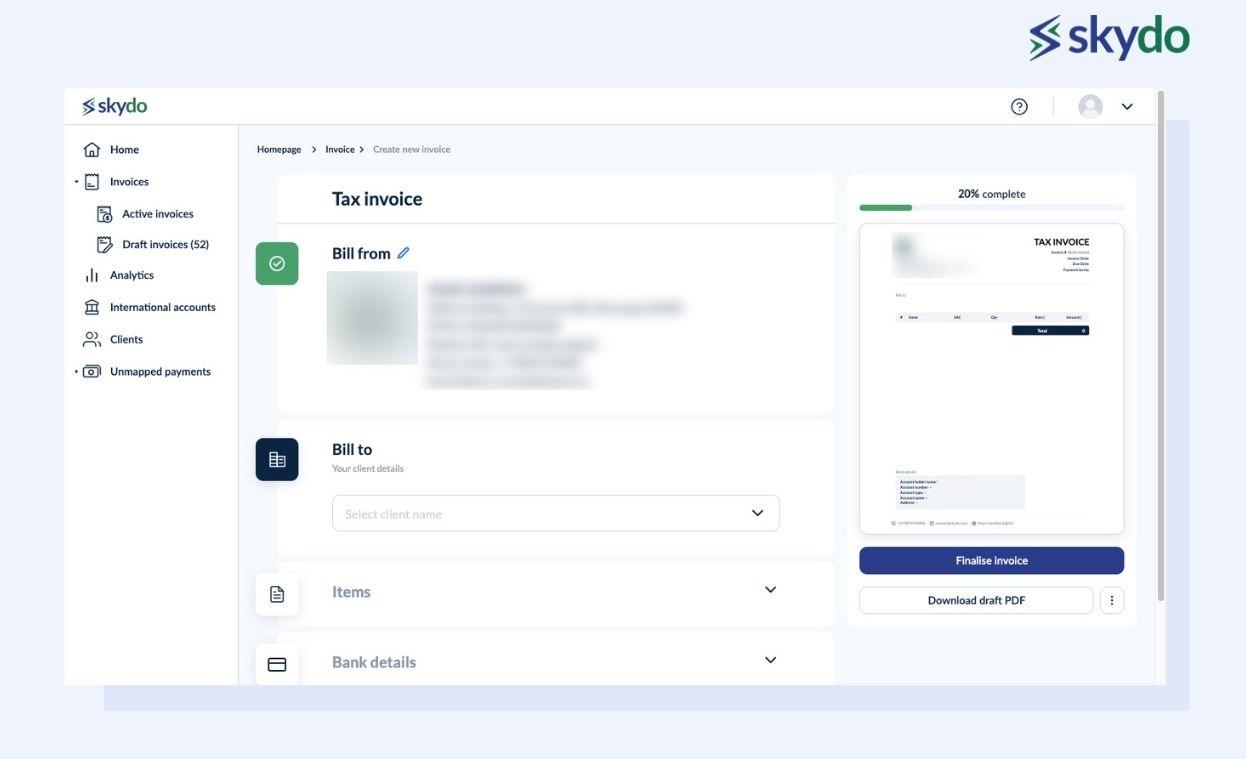

You can check, generate, and send invoices, reminders for recurring payments, and up-to-date ledgers.

6. Efficient and secure transfers

Using efficient payment solutions like SWIFT and NEFT, Skydo ensures your funds move promptly and securely. You can expect the funds in your virtual bank account to reach your Indian bank account in 18-24 hours.

Our customers endorse us for our transparency.

“Skydo is a fintech platform which brings transparency, speed & efficiency to B2B cross-border payments. We, at Primathon, recently started using it. We made a USD 50k net worth of transactions so far and the experience is just wow 😍 ! From the onboarding process to transactions, everything is as optimised as it could be with added transparency. Folks in the B2B industry should learn from them! Other fellow founders in the services industry, give them a shot!” - Sagar Patidar, Founder & CEO, Primathon on LinkedIn.

See the difference with Skydo

| Feature | Stripe | PayPal | Skydo |

|---|---|---|---|

| Transaction Fee | 1 -2% + Variable Processing Fee | 3-4% + Variable Processing Fee | 19 USD for payments up to 2000 USD, and 29 USD for payments above 2000 USD |

| Instant FIRA | ❌ | ❌ | ✅ |

| Free Online Invoicing | ❌ | ❌ | ✅ |

| Real-time payment tracking | ❌ | ❌ | ✅ |

| Live FX rate | ❌ | ❌ | ✅ |

| Zero FX margin | ❌ | ❌ | ✅ |

| Fast Onboarding | ❌ | ❌ | ✅ |

| Reconciliation | Manual work required | Manual work required | Easy and automated |

Skydo emerges as the best alternative to Stripe and PayPal in cost, transparency, and speed. You also get free online invoicing, instant FIRC and custom payment reminders.

Conclusion

With its transparent pricing structure, Skydo stands out from other payment processing companies. You can unlock substantial savings of up to Rs. 10 lakh per annum with Skydo.

Focus on your business as Skydo takes care of your global payments. It is secure, efficient, affordable, and reliable.

Start your free trial today and grow globally with Skydo!

Disclaimer: Please note that the information provided is accurate as of February 2024.

Q1. Does my client need to register on Skydo, too?

Ans. Your clients need not register on Skydo separately. They can pay you through their local banking system.

Q2. What are the charges for using Skydo?

Q3. Is Skydo safe?