Wire Transfers - What Details to Provide

Wire transfers are a popular and convenient way to pay for goods and services, send money to friends and family, or make donations and contributions. However, wire transfers require information and preparation to ensure a smooth and successful transaction.

This blog will guide you through the basics of what wire transfers are, the details you need to provide for domestic and international transfers, and the tips and tricks to avoid common pitfalls and security risks. Let’s dive in!

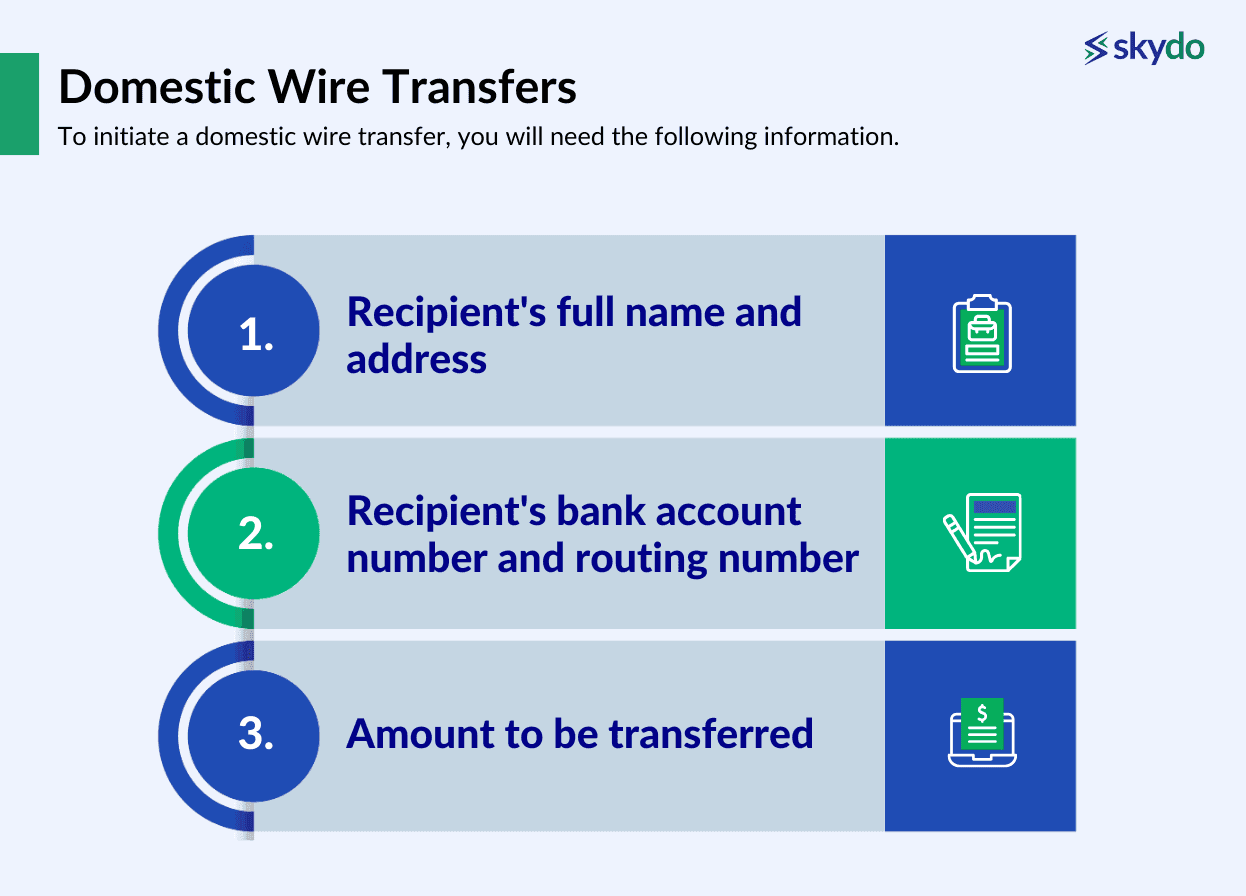

Domestic Wire Transfers

A domestic wire transfer means moving funds from one bank account to another within the same country. To initiate a domestic wire transfer, you will need the following information.

- Recipient's full name and address

This is the person or entity that you are sending money to. Make sure to spell the name correctly and include any relevant details such as apartment number or company name.

- Recipient's bank account number and routing number

These are the unique identifiers of the recipient's bank account for money wire transfers. The account number is a series of digits that can be found on the recipient's bank statement or chequebook.

The routing number is a nine-digit code that indicates the bank and branch where the account is located. You can find the routing number on the bottom left corner of a cheque or the bank's website.

- Amount to be transferred

This wire detail means the amount of money that you want to send, usually in the local currency. Be aware of any hidden fees or charges that may apply to your transfer, such as service fees, exchange rates, or taxes.

Additional Tips for Wiring Money Domestically

Some other tips to keep in mind before you wire money domestically.

- Verify information with the recipient before initiating the wire payment

This can help avoid errors, delays, or fraud.

- Double-check all entered details

A small mistake can cause the transfer to fail or go to the wrong account. If you notice any errors, contact your bank or service provider immediately to cancel or amend the transfer.

- Be aware of fees associated with domestic wire money transfers

These fees can vary depending on the amount, the destination, and the speed of the transfer. Some banks may also charge a fee for incoming wire transfers, so check with your bank before accepting a transfer.

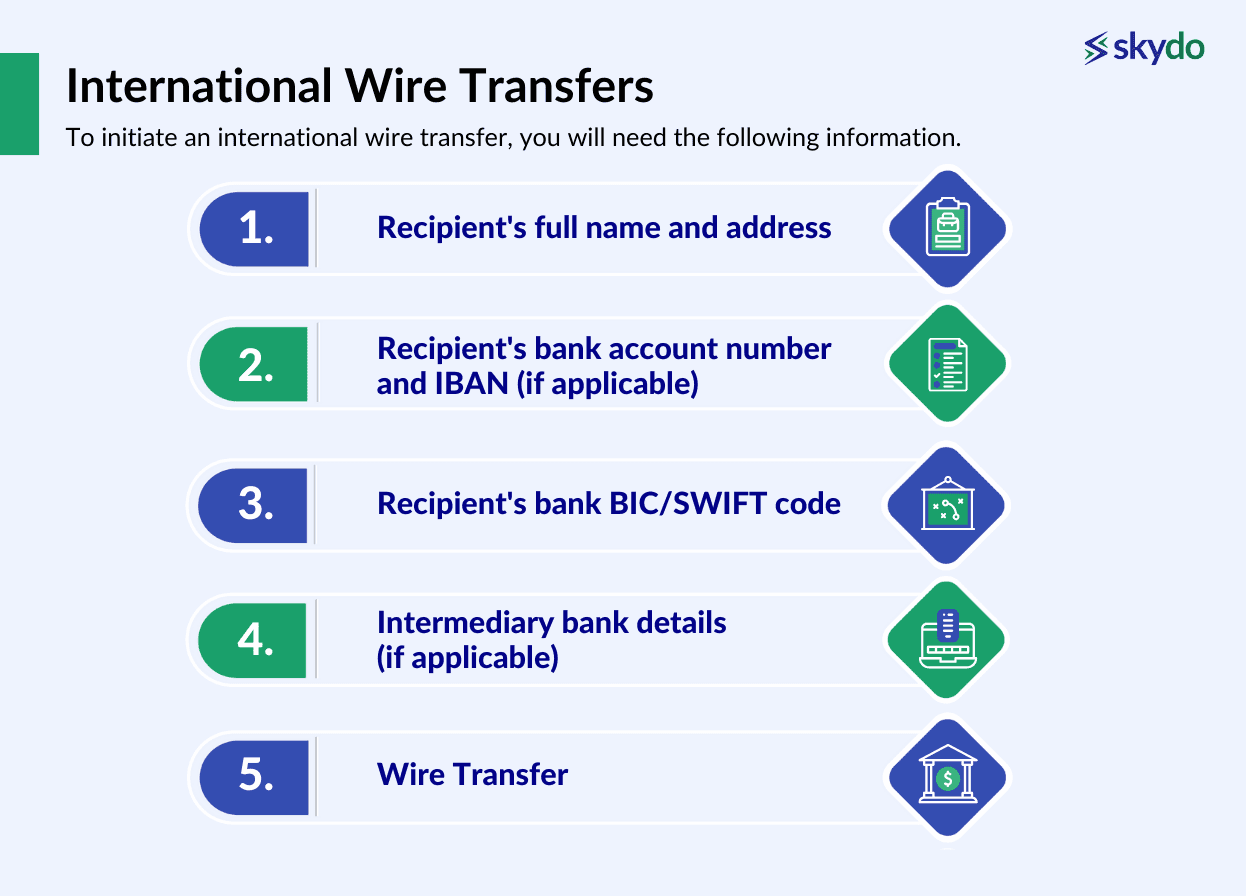

International Wire Transfers

International wire transfers are more complex and may require additional information than domestic transfers. To initiate an international wire transfer, you will need the following information.

- Recipient's full name and address

This is the same as for domestic transfers, but you may also need to include the country and the postal code of the recipient.

- Recipient's bank account number and IBAN (if applicable)

Some countries may also use an International Bank Account Number (IBAN) to identify the account to wire transfer money. The IBAN is a standardised code that consists of up to 34 alphanumeric characters. You can find the IBAN on the recipient's bank statement or ask the recipient to provide it.

- Recipient's bank BIC/SWIFT code

This is a unique code that identifies the recipient's bank and its location. The BIC (Bank Identifier Code) or SWIFT (Society for Worldwide Interbank Financial Telecommunication) code is usually an eight- or 11-character code that can be found on the bank's website or by contacting the bank.

- Intermediary bank details (if applicable)

Some international wire transfers may involve an intermediary bank that acts as a middleman between the sender's and the recipient's bank.

If this is the case, you will need to provide the name, address, account number, and BIC/SWIFT code of the intermediary bank. You can obtain this information from your bank or service provider.

- Wire Transfer

This wire payment method is the same as for domestic transfers, but you may need to specify the currency of the transfer. Be aware of the exchange rate and any fees or charges that may apply to your transfer, such as service fees, exchange rates, or taxes.

Additional Tips for Wiring Money Internationally

Some additional tips for international wire transfers in banking include the following.

- Carefully review currency exchange rates

Exchange rates can fluctuate depending on market conditions, supply and demand, and other factors. Some banks or service providers may charge a margin on top of the market rate, which means you will get less money for your transfer.

- Understand intermediary bank fees

The bank fee for international wire transfers is usually deducted from the amount that reaches the recipient, which means the recipient will receive less money than you sent.

Avoid or reduce this fee by choosing a service provider that does not use intermediary banks or by paying the fee upfront.

- Allow additional processing time for international transfers

Generally, international transfer wire can take a few hours to a few days to process. You can track the status of your transfer by using the reference number or confirmation code provided by your bank or service provider.

Security Considerations to Keep in Mind for Wire Transfers

Wire transfers are generally safe and secure, but they are also vulnerable to fraud and scams. Here are some security considerations to keep in mind when sending or receiving wire transfers.

1. Phishing scams

Phishing is a type of fraud that involves sending fake emails or messages that appear to be from legitimate sources, such as banks, service providers, or trusted contacts. The goal of phishing is to trick you into providing your personal or financial information, such as your bank account details, passwords, or PINs.

Phishing emails or messages may also contain links or attachments that can infect your device with malware or viruses. To avoid phishing scams in wire bank transfers, never click on links or open attachments from unknown or suspicious sources.

Always verify the identity and authenticity of the sender before responding or providing any information. If you receive a request for a wire transfer that seems unusual or urgent, contact the sender directly by phone or in-person to confirm the request.

2. Data encryption

Data encryption is a process that converts your information into a code that can only be read by authorised parties. It can protect your information from being intercepted or accessed by hackers or other malicious actors.

When initiating wire transactions online, use a secure platform that encrypts your data. You can tell if a platform is secure by looking for a padlock icon or an "https" prefix in the browser’s address bar.

3. Confidentiality

When sending or receiving a wire transfer, never share your wire transfer details, such as your account number, routing number, BIC/SWIFT code, or confirmation code, with anyone who is not directly involved in the transaction. This can expose you to fraud, identity theft, or unauthorised transactions.

If you suspect your wire transfer details have been compromised, contact your bank or service provider immediately to report the issue and take appropriate action.

Conclusion

Wire transfers offer a quick way to send money worldwide, but getting them right requires attention to detail and security. By providing accurate information, understanding fees and processing times, and staying alert to security risks, you can ensure smooth and safe transactions.

FAQ

Q1. Is a wire transfer the same as a bank transfer (ACH)?

Ans. No, a wire transfer and a bank transfer (ACH) are distinct. A wire transfer is a fast and secure way of sending money electronically between banks, usually within the same day. A bank transfer (ACH) is a slower and cheaper method of transferring money between bank accounts, taking 2-3 business days.

Q2. What information is needed for a wire transfer?

Ans. The information needed for a wire transfer depends on whether it is a domestic or international transfer.

For a domestic wire transfer, you will need the recipient’s full name and address, bank account number and routing number, and the amount to be transferred.

For an international wire transfer, you will also need IBAN (if applicable), bank BIC/SWIFT code, intermediary bank details (if applicable), and the currency to be transferred.

Q3. What are the types of wire transfers?

Ans. There are two main types of wire transfer: bank wire transfer and non-bank wire transfer. A bank wire transfer is initiated and processed by banks or other financial institutions, while a non-bank wire transfer is initiated and processed by non-bank service providers, such as money transfer operators, online platforms, or mobile apps.