Simplifying FIRA: Full Form, meaning and how to get it from Skydo

If you are an Indian exporter or a freelancer working with international clients, you must have come across the term 'FIRA' or 'Foreign Inward Remittance Advice.' Before we dive into how you can get your automated FIRA from Skydo, let's take a moment to understand what FIRA is and why it matters to you as an exporter or freelancer.

What is FIRA?

FIRA, or Foreign Inward Remittance Advice, is a document issued by banks as proof of receiving international payments. It is essential for exporters to obtain FIRA after each cross-border payment. Beyond serving as a payment receipt, it is also a crucial document for claiming export-related incentives, such as tax exemptions on foreign currency payments received in India.

Note that banks issue FIRA for export collections only. If you are receiving inward remittances from FDI (Foreign Direct Investment) and FII (Foreign Institutional Investors), meaning your foreign payments are accruing as returns from overseas investments, you will need an FIRC (Foreign Inward Remittance Certificate) instead of FIRA. You can read all about it here.

Who Needs FIRA?

Anyone receiving foreign payments needs a FIRA. Beyond exporters, many individuals and entities may receive international payments without realising it.

Overall, the following typically require a FIRA:

- Indian exporters receiving international payments.

- Companies in India providing services to overseas companies and receiving payment in foreign currency.

- Salaried individuals working remotely as contractors for international companies, and receiving compensation in foreign currency.

- Freelancers serving international clients and receiving compensation in foreign currency.

- Freelancers service international clients via marketplaces such as Upwork and TopTal.

Why is FIRA Required?

Beyond compliance, here’s why FIRA is crucial for exporters:

- Goods or services exported are classified as zero-rated supplies, exempt from GST. However, to claim a GST refund for input tax credit, exporters must furnish their FIRA.

- Exporters require FIRA to claim export-related incentives, including exemptions on foreign currency payments received in India.

How to get FIRA?

Receiving your export payment directly through your bank can make obtaining a FIRA a lengthy process. You need to submit a request to the bank, and the bank typically takes 7-15 days to provide the FIRA. You may also need to follow up multiple times, and banks often charge at least INR 400 to issue the FIRA, depending on the institution.

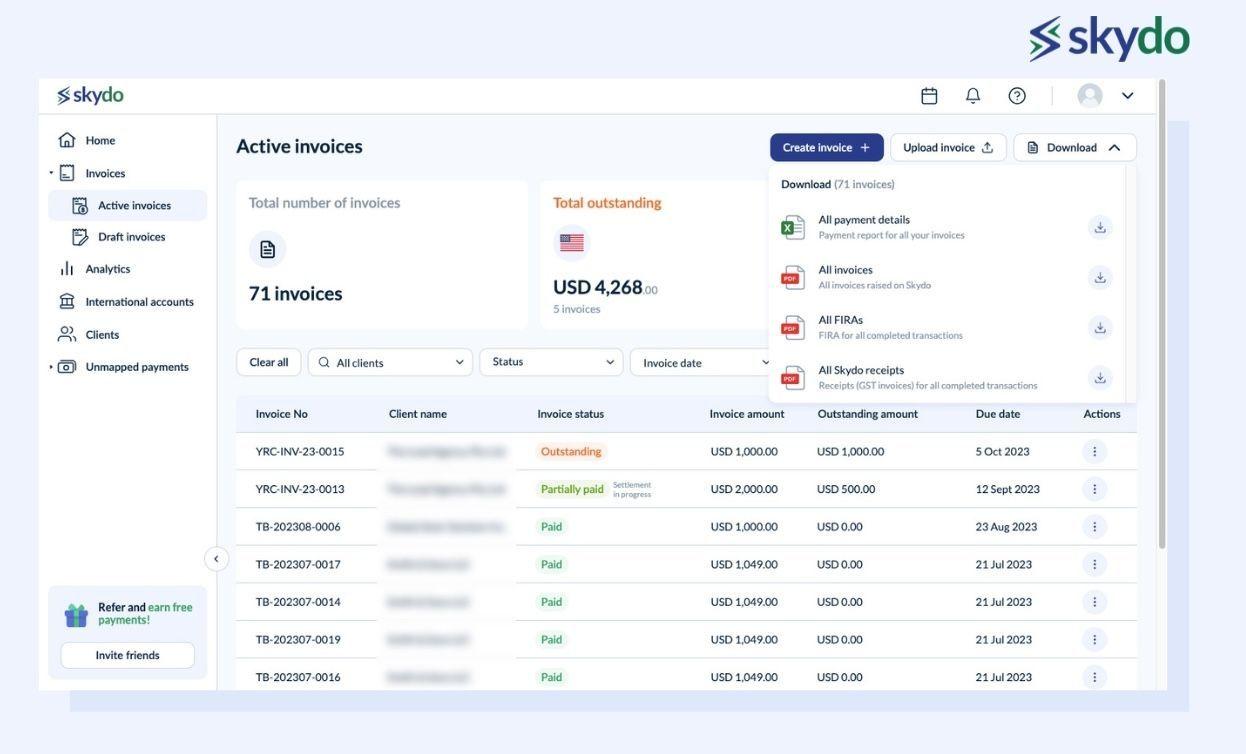

Skydo lets you bypass this laborious and borderline frustrating process with its automated FIRA! Here’s how:

When transacting through Skydo, it automatically generates FIRA for all international payments when they reach your bank account. The document details will be according to the information mentioned in the invoices and payment receipt details. You can easily go to the Skydo dashboard and download FIRA receipts for all or specific transactions.

Why Use Skydo’s Automated FIRA?

Obtaining FIRA from banks can be lengthy and cumbersome. Exporters need to provide multiple details, including account information, purpose codes, and transaction numbers. For those receiving various international payments from multiple clients, keeping track of these details can be exhausting and prone to human error. Incorrect details during bank verification can lead to delays in claiming tax benefits and adhering to compliance requirements.

Skydo simplifies this process by automatically capturing information from invoices and payment receipts, reducing manual effort and increasing document accuracy. Say goodbye to lengthy forms, long waiting periods, and additional charges for obtaining your FIRA.

When you receive an export payment through Skydo, we automatically generate the required FIRA for you at no extra cost. Simply log into our user-friendly dashboard, and you'll find your free and automated FIRA ready to download against every transaction, complete with all the necessary details.

Conclusion

Taking your business global is challenging, and the compliance requirements can make it even more challenging. That’s why at Skydo, our goal is to help you focus on growing your business, instead of grappling with compliance whereabouts.

With Skydo, enjoy seamless and compliant international payments, delivered promptly and without any hidden fees. Switch to Skydo and experience the difference.

FAQs

Q1. What is FIRA, and why is it important for exporters?

Ans: FIRA, or Foreign Inward Remittance Advice, is crucial for exporters as it serves as proof of incoming foreign funds. It ensures transparency and compliance with regulatory requirements, facilitating smooth international transactions.

Q2. How does Skydo simplify the FIRA generation process for exporters?

Ans:Skydo streamlines FIRA generation for exporters by automating the process. Through its user-friendly platform, exporters can efficiently obtain the necessary documentation, reducing time and effort in compliance.

Q3. What challenges do exporters face with the traditional FIRA generation process?

Ans:Exporters face challenges with traditional FIRC processes, including manual paperwork, delays, and complexity. Skydo addresses these issues by offering a seamless and automated solution, enhancing efficiency and accuracy.

Q4. How does Skydo facilitate compliance with GST regulations for exporters?

Ans: Skydo aids exporters in GST compliance by integrating features that ensure accurate tax reporting. Its platform automates the reconciliation of international transactions, reducing the risk of errors and facilitating smoother compliance.

Q5. What role does Skydo play in simplifying international payments for freelancers and businesses?

Ans:Skydo simplifies international payments for freelancers and businesses by providing a secure and user-friendly platform. It enables seamless cross-border transactions, offering transparency and convenience in managing global payments.

Q6. How can I request a demo of Skydo's international payments solutions?

Ans:To request a demo of Skydo's international payment solution, visit the official website and navigate to the "Demo Request" section. Fill in the required details, and a representative will contact you to schedule a demonstration.

Q7. What is the significance of Skydo's automated FIRA generation for businesses in the international payments realm?

Ans: Skydo's automated FIRA generation holds significance for businesses in international payments by ensuring accuracy, reducing manual efforts, and expediting the overall process. It enhances transparency, compliance, and efficiency, making it a valuable asset in cross-border transactions.

An appellate authority later overruled the initial claim. However, the case highlights the importance of meticulous documentation and record-keeping of FIRAs for exporters to claim refunds and comply with Indian tax laws.

Yet, recording FIRA for each foreign inward remittance is challenging. Hence, in 2017, the Foreign Exchange Dealers’ Association of India (FEDAI) discontinued physical FIRAs and notified the authorised banks to issue e-FIRC or FIRA to exporters, which is still a lengthy and challenging process. To resolve challenges for exporters, modern payment platforms like Skydo have automated the FIRA generation process.

What is the use of FIRA?

FIRA, or Foreign Inward Remittance Advice, is crucial for exporters as it serves as proof of incoming foreign funds. It ensures transparency and compliance with regulatory requirements, facilitating smooth international transactions.

What is the difference between FIRC and FIRA

Why is Fira required?