What is Cash Reserve Ratio (CRR) In India?

Ever wondered how the Reserve Bank of India ensures that the Indian economy remains balanced and has adequate money flow?

Among numerous financial tools RBI uses, one of the most important is the Cash Reserve Ratio (CRR). CRR is a monetary policy to regulate the amount of money banks must keep as reserves with the RBI to ensure they have enough liquidity.

In this blog, you will learn what the CRR is about—its objectives, how it works, who sets it, and why it changes regularly.

What is CRR (Cash Reserve Ratio)?

The Reserve Bank of India wants Indian Banks to have enough funds to lend and still have funds to meet the withdrawal requirements of customers. Hence, the RBI created the Cash Reserve Ratio (CRR) for banks to take a percentage of their total deposits and reserve the funds with the RBI.

By adjusting the CRR, RBI can control the amount of money banks have available for lending and control economic factors such as inflation.

How CRR Works

In cases of inflation or when there is excess money flow in the market, the RBI regulates the CRR to ensure that the demand and supply are balanced. Currently, the RBI requires Indian banks to maintain a cash balance of no less than 4.5% of the Net Demand and Time Liabilities (NDTL).

NDTL is the total demand and time liabilities (Deposits) held by Indian banks. It includes the cash balance held by the banks with other banks and the general public's deposits (Cash, FDs, etc.) in the bank’s various accounts. For example, an Indian bank with Rs 200 crore NDTL must maintain 9 crores as cash reserves.

Banks calculate their CRR based on a specified percentage of their net demand and time liabilities. Banks must maintain the prescribed CRR on a daily average. They may hold these reserves as cash in their vaults or as deposits with the central bank.

The Reserve Bank of India holds the cash reserve ratio account, and the bank transfers or withdraws the required account from this account to maintain the minimum cash reserves. Banks regularly report their reserve holdings to the central bank, and the latter may conduct audits or inspections to ensure adherence.

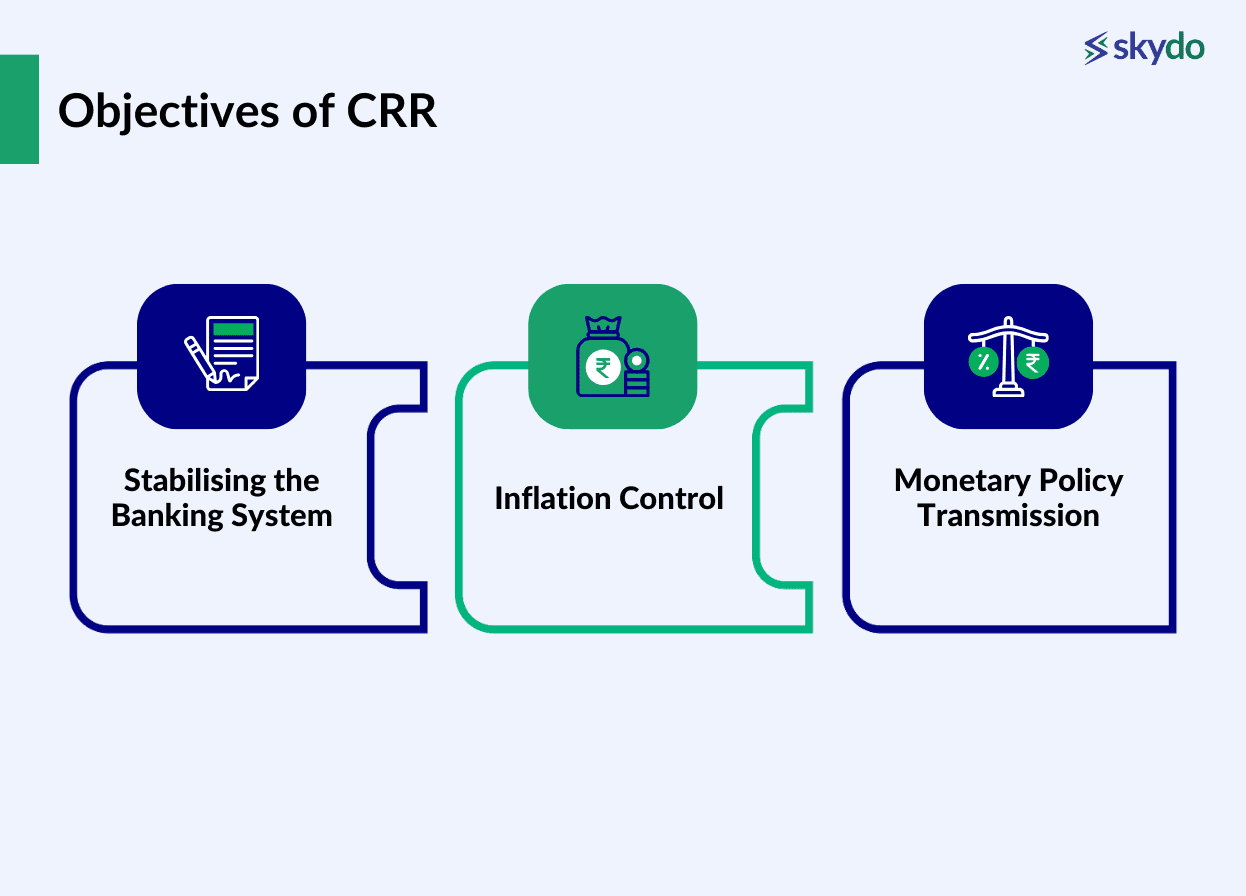

Objectives of CRR

An Indian bank’s core operation is lending money to individuals and corporations at an interest rate. Although the interest rate fluctuates regularly, it can not go lower than a base rate. The base rate sets the benchmark for the minimum rate at which a bank can lend funds. Once the RBI sets the base rate concerning the CRR, it provides transparency to individuals and corporations as to the minimum borrowing and lending rates.

Apart from being an important reference point for setting the base rate, the Cash Reserve Ratio also fulfils these objectives in the financial market.

- Stabilising the Banking System

CRR helps in stabilising the banking system by ensuring that the banks have a certain level of liquidity/funds with the RBI. This helps prevent bank failures in times of economic downturns and promotes the stability of the financial sector.

- Inflation Control

RBI uses the CRR to control inflation in India. RBI adjusts the CRR, which changes the fund requirements for banks to have with the RBI. With a lower CRR, banks charge lower interest rates as they have more money to lend and less money with the RBI, infusing money into the economy and lowering inflation.

Increasing the CRR reduces the funds available for lending, as banks have to put more money into the RBI. As a result, banks increase interest rates, decreasing the money supply and potentially lowering inflation.

- Monetary Policy Transmission

When the central bank changes the CRR, it affects the amount banks can lend. As a result, banks change the interest rates, leaving citizens with higher or lower spending amounts. The change in disposable income regulates how much money flows into the economy.

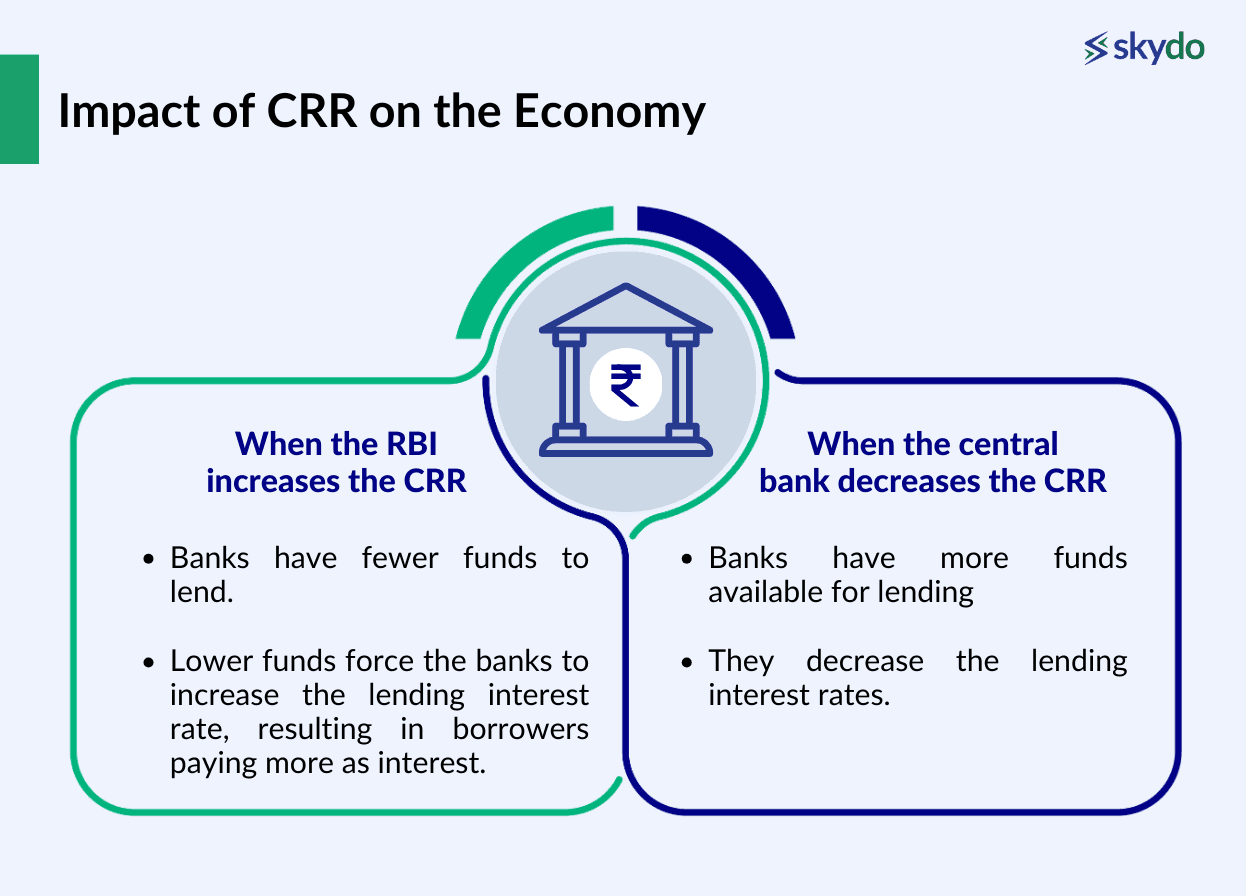

Impact of CRR on the Economy

When the RBI increases the CRR, the banks have fewer funds to lend. Lower funds force the banks to increase the lending interest rate, resulting in borrowers paying more as interest. Since they pay more, the RBI reduces the excess money flow or liquidity in the market.

On the other hand, when the central bank decreases the CRR, banks have more funds available for lending. In turn, they decrease the lending interest rates, allowing various entities to take loans by spending lower amounts on repayment. With higher disposable income left to individuals, they have more to spend, increasing the market's money supply.

Furthermore, higher interest rates resulting from an increased CRR may attract foreign capital, leading to an appreciation of the national currency against currencies such as USD. Conversely, a decrease in CRR and lower interest rates might lead to a depreciation of the national currency as investors seek higher returns elsewhere.

Why CRR is Changed Regularly

The change in CRR by the RBI is based on the lending operations of the Indian banks, which is the core factor for them to make profits. The higher the lending, the higher the profits for banks. However, rapid lending can result in banks having a low cash reserve, and an unexpected rush by bank account holders to withdraw their cash can lead to banks defaulting to meet the withdrawal requests.

Hence, the RBI ensures that it regularly maintains and adjusts the Cash Reserve Ratio (CRR) to let banks maintain a minimum liquid amount for such a scenario. The main motive behind changing CRR regularly is to ensure that the banks have enough funds to create a healthy balance between lending and meeting the withdrawal requirements of customers.

Furthermore, Central banks use adjustments in the CRR as part of their broader monetary policy framework to create an economic balance. For example, if there is inflationary pressure, the central bank might raise the CRR to reduce the money supply and curb inflation. Conversely, during economic downturns, the central bank might lower the CRR to stimulate economic activity by increasing the availability of funds for lending.

Conclusion

CRR serves as a mechanism for controlling the money supply, influencing interest rates, and contributing to the broader economic stability of a nation. Furthermore, it ensures that the customers can withdraw their funds at any time with the guarantee that the bank will be able to meet the withdrawal requirements.

Apart from using the CRR, the RBI uses metrics such as repo and reverse repo rates to regulate the money supply.

Another factor is the Statutory Liquidity Ratio (SLR), which is similar to the CRR but differs in assets to be held as reserves. In SLR, the banks are required to maintain a certain percentage of their Net Demand and Time Liabilities (NDTL) in the form of liquid assets. Here, liquid assets can include government securities, approved bonds, and other high-quality, low-risk securities.

Understanding CRR is important to understand the monetary policies RBI uses to regulate the economic equilibrium and ensure that the money supply is always balanced.

FAQs

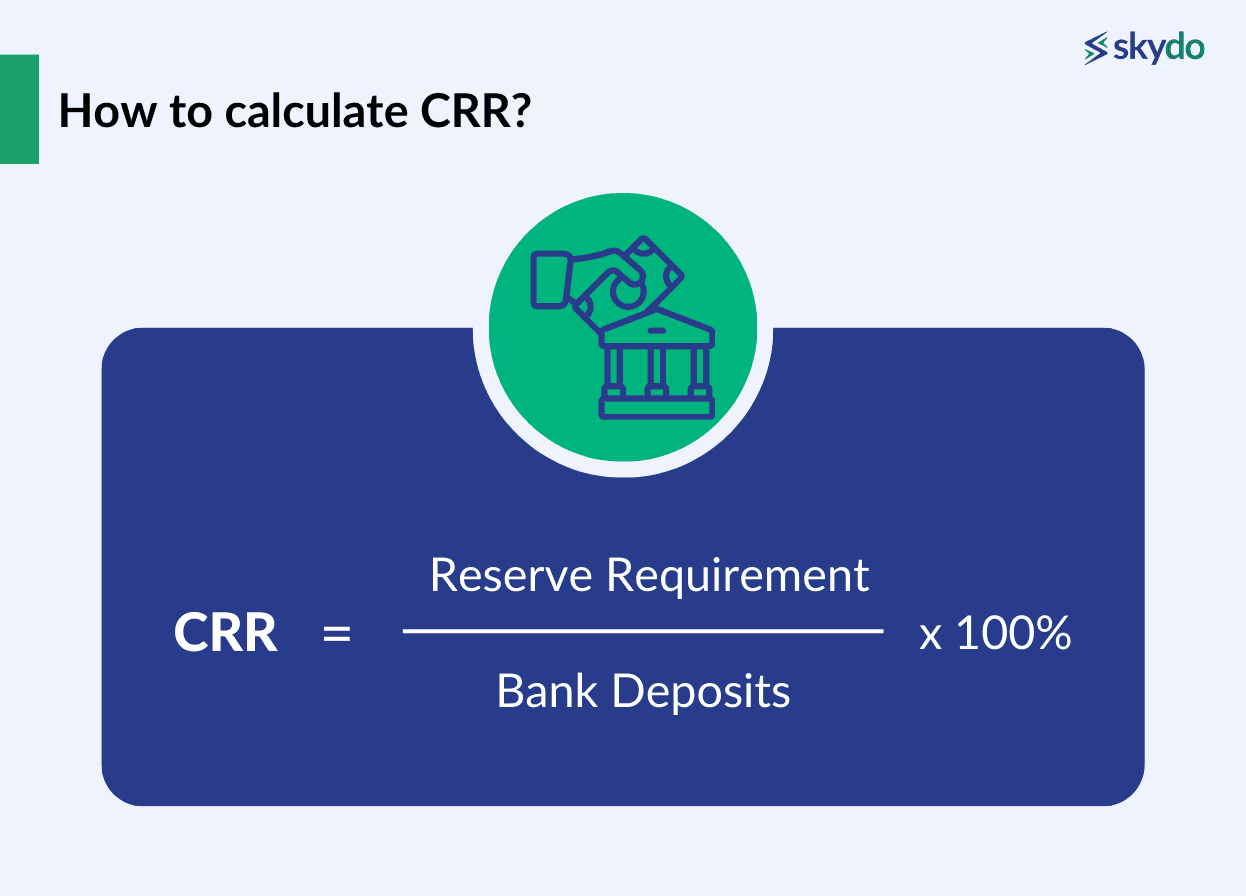

Q1. What is the formula for the Cash Reserve Ratio?

Ans: The CRR is calculated as the percentage of a specific bank's Net Demand and Time Liabilities (NDTL). The formula for CRR is as follows:

CRR = Reserve Requirement / Bank Deposits x 100%

Q2. What is the current CRR in India?

Ans: The current CRR in India set by the RBI is 4.5% of the Net Demand and Time Liabilities (NDTL).

Q3. What are repo and reverse repo rates?

Ans: The Repo Rate is the interest rate at which RBI lends money to commercial banks. It is currently 6.50%. The reverse repo rate is the interest rate at which the RBI borrows money from commercial banks. It is currently 3.35%.

Q4. What is liquidity or Cash Reserve Ratio?

Ans: It is a monetary policy tool used by RBI to regulate the liquidity in the financial system and control the money supply. CRR is a specified percentage (currently 4.5%) of a bank's total deposits that must be held in the form of cash reserves or as deposits with the RBI.