How to Choose an International Payment Gateway in 2024

As global trade continues to flourish, businesses increasingly engage in cross-border transactions. The advent of international payments has been long-standing in the financial world, facilitating commerce and trade. Furthermore, the advancements in fintech today empower many businesses and individuals to make instant payments. Businesses can experience stress-free invoicing, tax handling, and recurring billing in a few clicks.

However, without a centralised payment management system, the entire process can become inefficient, expensive, risky, and very well run into compliance issues. Managing cash flow and making strategic decisions are crucial to running a successful business effectively.

Such a need calls for a platform that helps you manage international payments efficiently, which can be trusted and transparent.

Why Do You Need an International Payment Gateway Offering More Services Than Payments?

A centralised payment management system streamlines and consolidates all financial transactions, offering real-time visibility and control. It enhances efficiency, reduces errors, and mitigates the risk of fraud.

Furthermore, it seamlessly enables businesses to adapt to evolving payment methods and regulatory requirements. In a world where financial agility is paramount, centralised payment management is not just a convenience but one place that offers numerous benefits, including increased efficiencies, cost-effectiveness, risk reduction, and improved financial management.

Here are some reasons to have an international payment gateway.

- Enhances efficiency

Consolidating international payments is a strategic move that provides numerous advantages, particularly efficiency. Businesses can significantly streamline their processes by centralising payment operations and reducing cost and time.

Businesses can consolidate their payments into a single platform or service provider instead of dealing with multiple banks, currencies, and payment systems. This simplification leads to more efficient payment processing, improving overall operational efficiency.

Centralising payment processes also enables businesses to standardise their processes, improve their control over cash flow, and ultimately enhance their overall efficiency with confidence.

- Reduces errors

Using an international payment gateway significantly reduces the risk of errors. When dealing with various banks and currencies, there is a high possibility of mistakes such as miscalculations, currency conversion errors, or discrepancies in payment information.

However, by processing all transactions through a unified gateway, businesses can enjoy the benefits of a centralised and standardised system. This minimizes the chances of human error and ensures that transactions adhere to consistent and accurate protocols, thereby fostering a more reliable and error-resistant international payment process.

- Cost-effectiveness

Centralised payment management allows businesses to negotiate better foreign exchange rates, reducing transaction costs and higher profitability. This is particularly advantageous for companies that frequently conduct large or regular international payments.

By consolidating payment activities, businesses can eliminate the need to manage multiple banking relationships and systems, resulting in lower administrative costs. This approach can contribute to improved financial performance and increased competitiveness, making it a smart choice for businesses looking to optimise their payment processes. - Mitigates the risk of fraud or risk reduction

When businesses manage international payments with multiple platforms and providers, it can be complicated and increase the risk of mistakes or fraud. To avoid these issues, a centralised payment system helps establish strong security measures and fraud detection systems.

By consolidating payment processes, businesses can monitor transactions more effectively, detect suspicious activities, and quickly take appropriate risk mitigation measures. This reduces the likelihood of fraudulent transactions, protecting businesses from financial losses and reputational damage.

- Improved financial management

Businesses engaged in cross-border B2B payments need to manage their cash flows effectively. Consolidated payment management provides real-time visibility into payment inflows across different countries.

This helps businesses forecast their cash flow requirements accurately, make informed decisions about where to allocate working capital and minimise the risk of cash shortages or excess idle funds.

12 Things to Consider When Choosing an International Payment Gateway

1. Multi-Currency Support

When selecting a platform for your international financial operations, it's crucial to ensure that it offers a comprehensive suite of services that goes beyond mere payment processing. Look for features like multi-currency support, payment tracking, and automated reporting to streamline your global financial management.

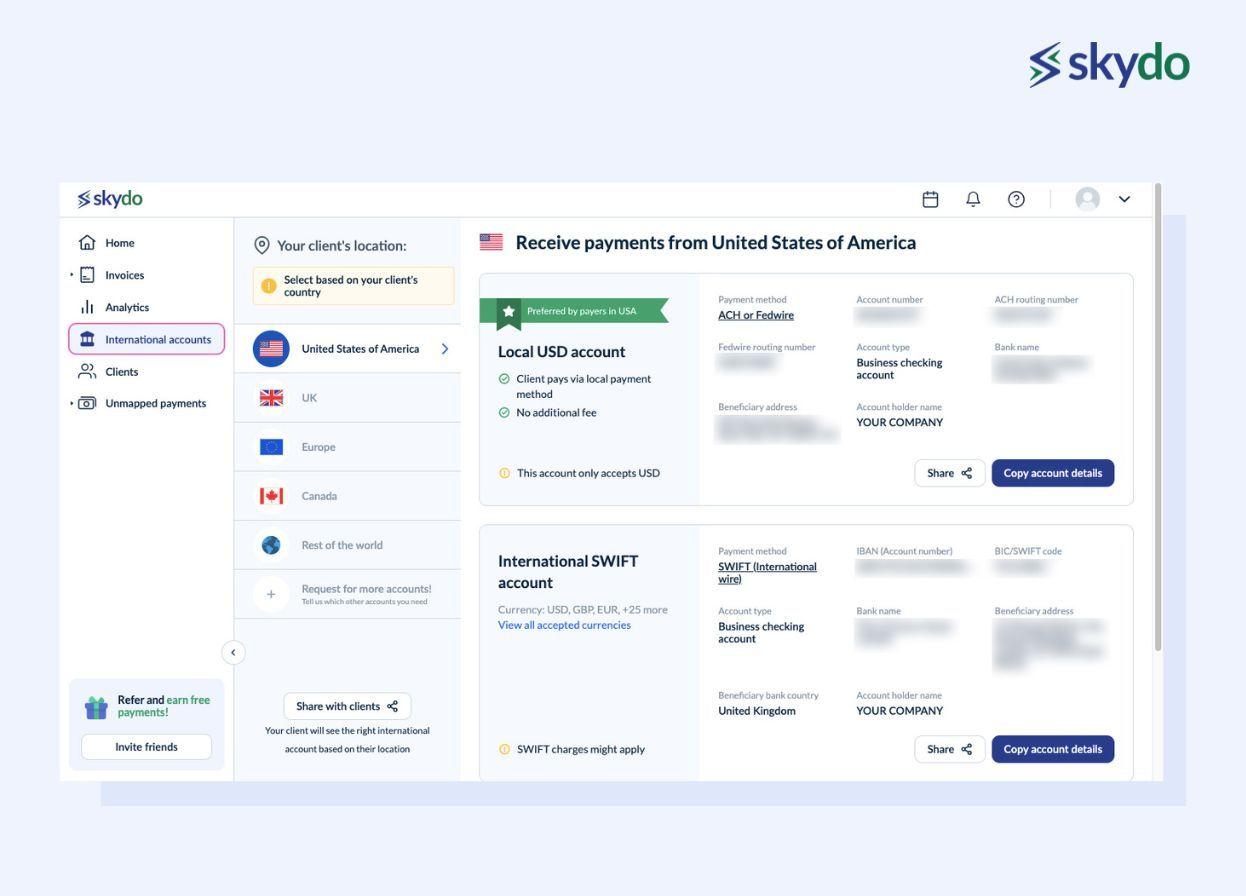

One noteworthy solution that excels in these areas is Skydo. They offer multi-currency support and take it one step further by setting up virtual foreign accounts for you.

This means you can effortlessly conduct international transactions without the hassle and compliance issues typically associated with setting up accounts abroad and obtaining FIRA, saving both time and costs.

2. Recurring Billing

Skydo simplifies your financial management with automated reporting. Receive updates on payments due, pending amounts, and more, allowing you to stay on top of your international financial affairs with ease.

3. Transaction Limits

Ensure the international payment gateway aligns with your business needs and the Reserve Bank of India's (RBI) guidelines on cross-border transactions. RBI's Operational Guidelines for Payment Gateways and Payment Aggregators (OPGSP) may stipulate a transaction limit of USD 10,000 for a single transaction.

Verify that the payment gateway adheres to these limits, providing flexibility for your business's financial requirements. Compliance with regulatory standards ensures smooth cross-border transactions within prescribed limits, preventing potential disruptions.

4. Generating Invoices

Evaluate the platform's invoicing capabilities. It should enable you to create professional, multi-currency invoices that comply with international invoicing standards. Automation features expedite the billing process.

Heads up: Skydo allows you to create invoices in multiple currencies for free, all within the platform. Discover how Skydo can transform your invoicing experience.

5. Onboarding Timeline

When you're hunting for the right international payment gateway, pay close attention to the onboarding timeline. Traditional vendors might drag you through a 4-7 day process, pausing your expansion plans.

Skydo cracked the code with a breezy onboarding journey that gets you rolling in just 5 minutes. Imagine the time saved! The streamlined onboarding ensures that your business can promptly access the international market, emphasising the significance of time in the competitive landscape of expanding enterprises.

6. Settlement Period

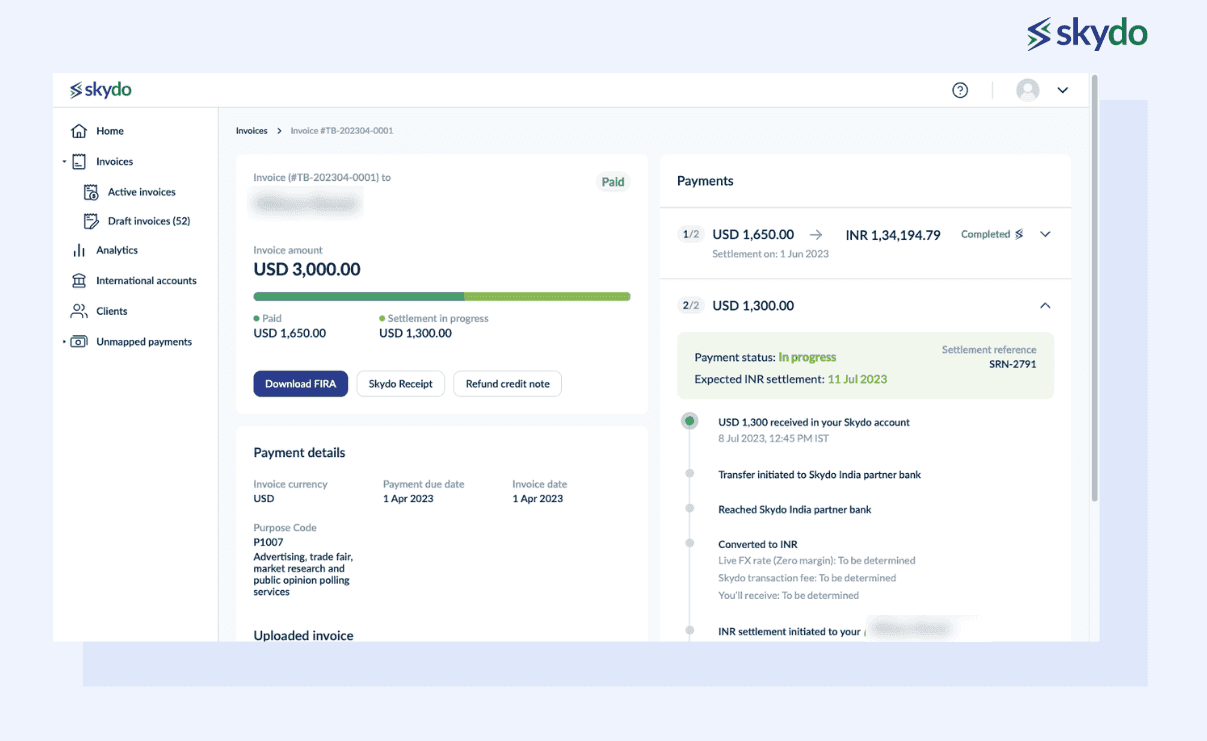

When selecting an international payment gateway, the settlement period is a crucial factor to consider. Skydo boasts a 24-hour settlement period for cross-border payments. This means that within a day, funds are credited to the designated bank account, offering swift and efficient transaction processing.

This rapid settlement period ensures timely and reliable cross-border fund transfers, enhancing the overall efficiency of international transactions. When evaluating payment gateways, the speed and transparency of settlement periods are paramount considerations for seamless global financial operations.

7. Ensuring Global Regulatory Compliance

Confirm that the platform is up-to-date with global regulatory requirements. It should automatically adapt to changes in international financial regulations, reducing compliance risks.

8. Real-time Payment Tracking

For any business, cash flow is king. Accurate financial visibility and control are important for making strategic financial decisions. A good international payments platform will allow you to track the status in real time to know when you will receive the money at any given point. Banks do not provide this facility, making it difficult for a business to operate well.

Skydo provides a transparent view of your transactions from the moment they hit the Skydo platform to the final destination in your bank account. You'll have access to live foreign exchange rates and a clear breakdown of Skydo's fees, ensuring full transparency throughout the process.

9. Low Payment Failure Ratio

Encountering payment failures in international transactions can be a frustrating and anxiety-inducing experience. The uncertainty surrounding financial transactions can lead to disruptions in business operations, customer dissatisfaction, and a loss of trust. The pain of payment failure is not just monetary; it extends to the credibility and reliability of the entire payment process, impacting both businesses and consumers.

In this landscape, Skydo emerges as a beacon of assurance. With an unwavering commitment to reliability, Skydo boasts an impressively low payment failure ratio.

Once funds are securely deposited into your Skydo account, the spectre of payment failures significantly diminishes. Skydo's dedication to seamless international transactions alleviates the pain associated with payment uncertainties and fosters a sense of confidence and trust.

10. Accessible Customer Support

Assess the accessibility and responsiveness of the platform's customer support. Multichannel support (phone, email, chat) with 24/7 availability ensures you can receive assistance whenever you need it, regardless of your location or time zone.

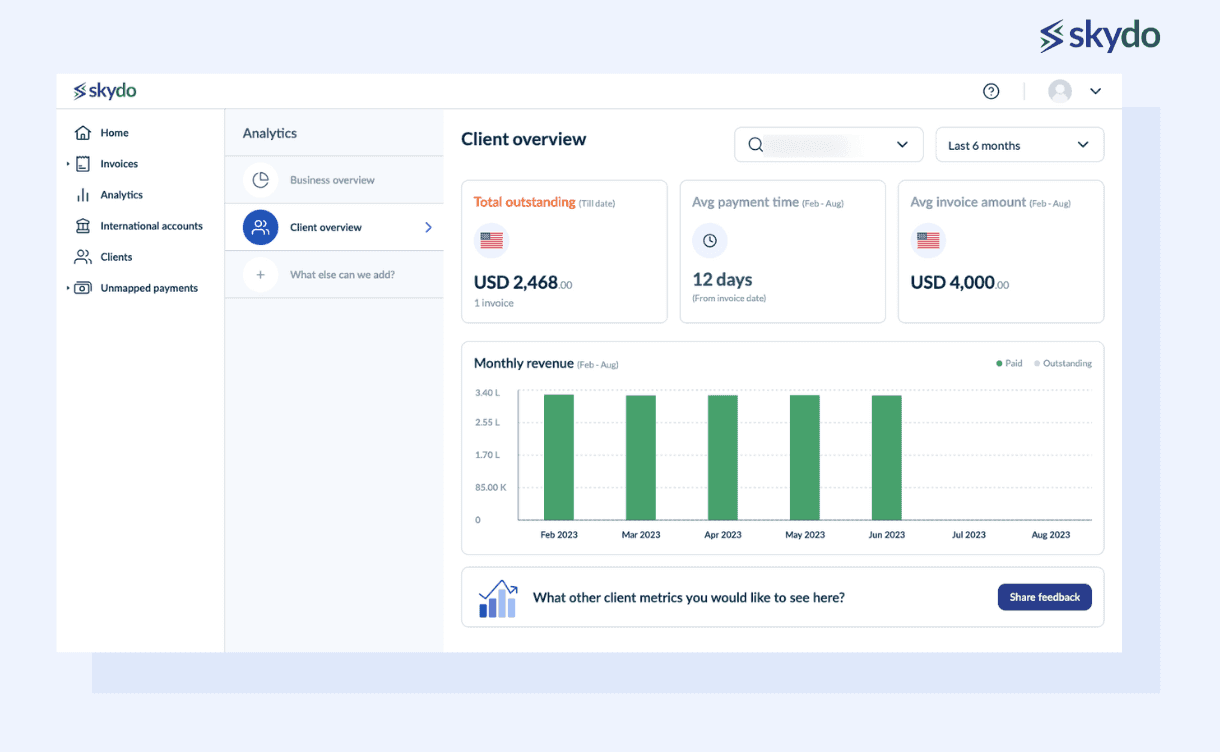

11. Track Client-Level Monthly Revenue

Look for the ability to track client-level monthly revenue within the platform. This feature can help you monitor your financial health for a specific client, identify growth opportunities, and tailor your services accordingly.

In this regard, Skydo goes the extra mile by providing a comprehensive overview of your client-level monthly revenue. The platform generates this overview based on the invoices you create, offering you a detailed and up-to-date account of your financial interactions with each client.

This feature empowers you to make informed decisions, optimise your revenue streams, and ensure that your financial relationships with clients remain on a solid footing. With Skydo, you're not just tracking numbers; you're gaining actionable insights to fuel your financial success.

12. Integration With Other Platforms

Ensure seamless business operations by prioritising an international payment gateway that offers robust integration with various platforms. Opting for a gateway like Skydo, which integrates effortlessly with platforms like Tropal, Feel, Upwork, Freelancer.com, and many more, ensures a streamlined and efficient payment process.

Skydo: The Best International Payments Platform for Growing Businesses

Skydo is a trusted and efficient solution that simplifies the complex world of global payments for Indian exporters. With a comprehensive platform that checks all the boxes on your checklist, Skydo empowers businesses to scale internationally with ease.

Here is a real transformation story: Code Matrix, a blockchain and AI/ML company in India, struggled with international payments until they discovered Skydo. With flat transaction fees of $29 per $10,000 and $19 for up to $2,000, zero FOREX fees, and a virtual bank account in each country of business, Skydo made the payment process seamless. With Skydo, Code Matrix experienced accelerated growth and complete customer satisfaction.

Streamline Your Global Payment Management

Skydo's commitment to efficiency is exemplified through its automated invoicing and payment system. It takes care of generating invoices, ensuring global regulatory compliance, and providing real-time payment tracking.

This gives businesses more time to focus on growth strategies, secure in the knowledge that their international payments are handled seamlessly.

Sign up for a demo now to witness how you can simplify your international payments with Skydo, the best payment gateway for international transactions!

FAQs

Q1: Which is the best payment gateway for international transactions?

Ans: Skydo is an optimal choice for international transactions among the options. Unlike other platforms charging variable conversion fees, Skydo ensures cost-effectiveness with a fixed transaction fee. Its FX Calculator provides transparency, helping businesses estimate earnings accurately and making Skydo a reliable payment management system for cross-border transactions.

Q2: How can you get an international payment gateway in India?

Ans: To acquire an international payment gateway in India, businesses can consider platforms like Skydo. It is an efficient international payment processor, offering features such as the FX Calculator for transparent cost estimation. Integration is seamless, enhancing the overall payment management system and making it an ideal choice for businesses and freelancers in India.

Q3: What security measures does Skydo have in place to ensure the safety of my international transactions?

Ans: Skydo, as a trusted international payment platform, prioritises security in its payment management system. It employs robust encryption and compliance measures to safeguard international online payments. Users benefit from a secure environment, ensuring the confidentiality and integrity of their transactions with this reliable international payment provider.

Q4: How does Skydo ensure compliance with international payment regulations?

Ans: Skydo ensures compliance with international payment regulations through its innovative feature of automatically generating Foreign Inward Remittance Advice (FIRA). This streamlined process and a one-click download option eliminate manual document creation, ensuring swift and precise handling of all FIRAs.

By seamlessly integrating with Indian tax regulations and adhering to guidelines set by the Reserve Bank of India and other authorities, Skydo enhances credibility and eases the burden of regulatory compliance for users.

Q5: Can I integrate Skydo with my existing financial systems?

Ans: Yes, Skydo offers seamless integration with existing financial systems, enhancing overall payment management. As a versatile international payment platform, it caters to the needs of businesses and freelancers, providing compatibility with various international payment methods online. The flexibility of Skydo's integration makes it a valuable addition to streamlining financial processes for cross-border transactions.