Commercial Invoice for Export: Format, Sample & Template (2025 Guide)

“Is a commercial invoice and a bill the same?” This is a common question.

The answer is: a commercial invoice is more than just a bill. It’s a key document that your bank, tax authorities, and even regulators check. It serves as proof of export, helps you get paid, and ensures you remain legally compliant. It applies to all exporters selling physical goods, SaaS, or services, such as consulting.

In this guide, you’ll learn exactly who needs a commercial invoice, when to create one, what details to include, and how to structure it. To make things even easier, you’ll also find templates and a sample invoice you can use right away.

What Is a Commercial Invoice?

A commercial invoice is a legal document issued by an exporter to the foreign buyer. It contains transaction details, such as who sold what, for how much, and how the payment is expected.

For example, you provided IT services to a firm based in Germany. You issue a commercial invoice that mentions the company name, its address, the total fee, and how you expect to receive payment (such as via bank transfer).

Due to its comprehensiveness, it acts as a:

- Billing slip: Shows what was sold and for how much

- A compliance document: Banks check the commercial invoice to monitor foreign exchange and prevent money laundering

- A record for tax filing and audits: Your accountant relies on a commercial invoice to document foreign income, support claims for tax exemption, and use as proof during audits.

Who Needs a Commercial Invoice for Export?

If you’re a seller, you need a commercial invoice. But in this blog, we will only cover how a commercial invoice applies to various types of export business. Read on to find out the types and the category of export you belong to

Service exporters

Freelancers, agencies, and consultants exporting digital services, like marketing, design, SaaS, or IT, fall into this category. A commercial invoice is applicable for all of them.

For example, a Bangalore-based design agency working for an Australian e-commerce website must issue a commercial invoice for the project fee. The same applies to an independent freelancer.

Product exporters selling goods internationally

If you’re selling physical products via Amazon Global, Shopify, or other B2B channels, you’re an exporter. Each shipment you send out must accompany a commercial invoice.

For example, an Indian handicraft exporter sells hand-woven rugs to customers in the US through Amazon Global. For every order he receives, he creates a commercial invoice containing the buyer's details and product description, like size, quantity, and price. This also helps him get the customs clearance without any delays.

Anyone receiving foreign currency for contract work

Let’s say you provide services only under a contract or agreement to foreign clients. This means you’re earning foreign exchange, and therefore, you need a commercial invoice.

For example, an Indian IT company enters into a six-month software maintenance contract with a UK agency. The IT company generates a commercial invoice each month mentioning the nature of services provided, purpose code, amount, and bank details.

Why is a commercial invoice needed for export?

You might have observed that even when no physical shipment is involved, exporters still need a commercial invoice. Here are the reasons behind it:

- Bank documentation – Banks ask for a commercial invoice as proof of the international transaction.

- GST exemption under Letter of Undertaking (LUT) – With an LUT, a service exporter can claim exemption from paying IGST on exports. A commercial invoice is needed to create an LUT.

- Income tax & audit trail – A commercial invoice maintains an audit trail. It shows proof of export income and compliance at the time of filing taxes.

When Is a Commercial Invoice Required in the Export Journey?

The best time to send out a commercial invoice is right after delivering the service or shipping the product. Here are the reasons why we think this is the best time:

Raise a request to the client

Raising an invoice is an indicator that your job is done, and the client can initiate the payment. A commercial invoice documents the job details and the total amount the client must pay to fulfil the deal

To submit to your bank when an inward remittance is received

When your payment arrives from overseas, banks require the commercial invoice as proof of the transaction. This helps them process the remittance and comply with RBI regulations

💡Special note if you’re a freelancer: There could be cases where your client would not specifically ask for a commercial invoice. Here’s a common scenario: you could be working with a startup or a small agency for over a year now. You have a great camaraderie with your client, and they trust you with your work. When it’s time to pay, they only ask for your bank details; No commercial invoice required. However, when the payment arrives in your Indian account, say $1200, your bank might ask for the invoice for compliance purposes. Therefore, even when the client doesn’t ask for it, generate a commercial invoice and save a copy

What Should Be Included in a Commercial Invoice for Export?

Here’s a clear, easy-to-understand checklist of the key fields you should include in your commercial invoice, along with concise descriptions for each:

| Field | Description |

| Exporter name & address | Your business or personal name and registered address (add contact details if possible). |

| Client name & address | The legal name and billing address of your foreign client |

| Invoice number & date | Use a consistent, trackable format (e.g., INV2025-07) and always include the date of issue for proper bookkeeping and compliance. |

| Description of services/products | Be specific. Clearly mention what you delivered, like the scope of service and hours |

| Currency | State the currency (USD, EUR, etc.) exactly as agreed with your client to avoid payment confusion. |

| Amount | Show the total invoiced amount, with a separate breakdown if there are multiple items, services, or fees. |

| Payment terms | Mention the deadline and method for receiving payment (e.g., Net 7, Net 30, 50% advance, wire transfer |

| Bank details | Include bank account number, bank name, branch address, and SWIFT/BIC code. This will help your foreign clients to remit payment without errors. |

| Purpose Code | This is mandatory for Indian exporters. Select the correct code based on your service or product type to ensure RBI compliance |

| Declaration | Add an export declaration to confirm that the goods/services are being exported as per local and international regulations |

✅ Tips for exporters:

While there are multiple purposes linked to the type of remittance you receive, here are some of the most common ones applicable to exporters

Purpose Code: P0802

RBI Category: Computer & Information Services

RBI Description: Software implementation/consultancy (other than those covered in SOFTEX form)

When to use: This code signifies a foreign payment in exchange for software consultancy or implementation service, provided to a foreign client. It's important to note that P0802 applies specifically to software consultancy or implementation services that are not reported under the SOFTEX form. If your services fall under SOFTEX, a different code might be used.

Purpose Code: P0801

RBI category: Computer & Information Services

RBI Description: Hardware consultancy

When to Use: This code is used when exporters receive foreign payment for providing hardware consultancy or implementation services abroad.

Purpose Code: P0807

RBI Category: Computer & Information Services

RBI Description: Off-site Software Exports

When to Use: This code signifies that an Indian company is receiving payment for software development or IT services provided to a foreign client, but the work itself is done in India.

Purpose Code: P0103

RBI Category: Export (Of Goods)

RBI Description: Advance receipts against export contracts (export of goods only)

When to Use: This is used when businesses receive advance payment against the contract of the goods to be exported. In other words, here the company receives payment for goods before they are shipped.

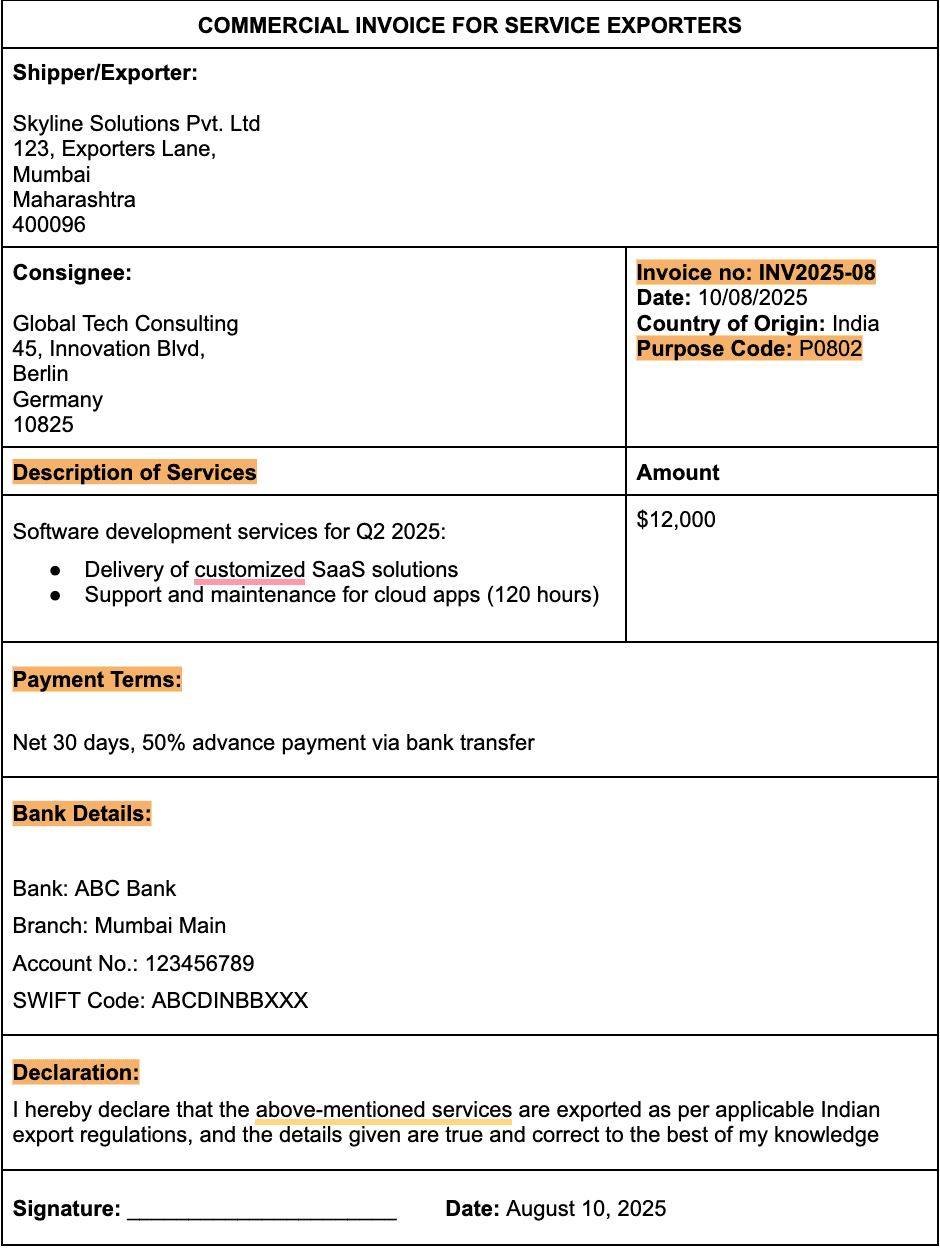

Sample Commercial Invoice for Export (Service)

Based on what we have covered so far, here’s a sample format of a commercial invoice for service exporters:

Commercial Invoice Template for Export: How to Structure Yours

You can use software to create commercial invoices for your export business. But if you’re doing it on your own, without using software, here’s what you must know:

- Use easy-to-access tools like Google Docs, Excel, Notion, or even Canva to draft your invoice. These tools have a low learning curve, so it won’t take much time to come up with a format

- Keep your fonts clear and readable, maintain a clean format, and use headers, such as Description and Payment Terms, to organize sections.

- Optionally, add your business logo and a digital signature to give your invoice a professional touch.

- Always save your final invoice as a PDF before sharing it with clients or banks to preserve the formatting and security.

Common Mistakes to Avoid in Export Invoices

Most exporters make mistakes while creating an export invoice for the first time. Often, these mistakes are small errors, but they can cause delays and frustrations later on. Here’s a quick look at a few of these common mistakes and why you must avoid them:

- Wrong or Missing Purpose Code: A purpose code classifies the type of service or product being exported. Using the wrong code or skipping it could straight away reject the payment request, leading to cancellation. You will have to redo the entire process, which is time-consuming. In case the bank processes the payment with the incorrect purpose code, it could lead to even legal troubles. If the bank finds out that you deliberately entered a wrong purpose code, they can initiate legal action against you. We suggest you contact a professional advisor to get a thorough understanding of how the purpose code works and which one is applicable to your business.

- Currency Mismatch With What Client Pays: Your commercial invoice must clearly state the currency agreed upon with your client. If the currency on the invoice doesn’t match the actual payment currency, banks and tax authorities may flag the transaction for investigation

- Forgetting to Include Bank Information or SWIFT Code: Failing to mention crucial bank details such as account number, bank name, branch, and SWIFT/BIC code causes delays in receiving payments. Without them, your client or their bank will find it difficult to send the payment

- Using “Proforma Invoice” Instead of Commercial Invoice: A proforma invoice is a preliminary bill sent before goods or services are delivered, mainly for quotation purposes. A commercial invoice is the official document used for customs, payment, and compliance. Mixing them up will confuse your client and cause significant compliance issues

- Not Saving a PDF Copy for Compliance & Audit: Always save a PDF copy of your commercial invoice. The PDF copy could be useful during audits and proving compliance with your export transactions

- Leaving Out GST Note or LUT Declaration if Applicable: If you’re exporting from India under a Letter of Undertaking (LUT) for GST exemption, your commercial invoice must clearly mention this. Leaving out the GST note or LUT declaration can lead to incorrect GST billing, making you liable for GST payments and penalties later.

Make Every Export Count with Skydo

Exporting is already challenging, your payments and compliance shouldn’t make it harder. With Skydo, you don’t just create invoices, you create confidence. Every payment is tracked in real time, every compliance document is auto-generated, and every export counts without delays or hidden costs. Whether you’re a freelancer, a fast-growing agency, or an Amazon Global seller, Skydo gives you a single platform to get paid faster, stay fully compliant, and scale globally with ease.

👉 Don’t let paperwork slow your growth. Sign up for Skydo today and make every export effortless.

What is a commercial invoice for export?

A commercial invoice is an official document issued by the exporter to the foreign buyer. It details what was sold, the price, payment terms, and serves as proof for customs, banking, and tax compliance during the export process.

What is the difference between a proforma invoice and a commercial invoice?

Is a commercial invoice valid for payment?

Can I use a proforma invoice for export?