Complete Guide to Bill of Exchange

Every business wants speed and convenience. It is the mantra In the contemporary world of commerce, and cash transactions have naturally taken a backseat. Even outside the capital markets, we see the reign where credit and trust are a currency. Transactions of all sizes are hinging on a fundamental pledge—the buyer commits to settling the bill later.

Today, physical currency only changes hands with this financial choreography, the bill of exchange.

Understanding Bill of Exchange

A bill of exchange is a written, unconditional commitment by one party, known as the drawer, to another party, the drawee, to pay a certain sum of money to a third party, the payee, either on demand or at a specific future date. This financial instrument serves as a guarantee of payment for goods or services provided.

The bill of exchange has been a fundamental legal instrument in global trade, binding the exporter and the importer and enabling smooth transactions between parties across international borders.

Key Terminology

- Drawer: The drawer is the party that issues the bill of exchange, directing the drawee to make a specified payment to the payee. This is usually the seller/ creditor entitled to receive the payment.

- Drawee: The drawee is the entity that must make the payment to the payee. The drawee is the buyer/ debtor.

- Payee: The payee is the payment recipient. The party is entitled to receive the amount mentioned in the bill and is often the seller/ creditor. It may also be a third party.

How Bill of Exchange Works

- Creating a Bill of Exchange: The process begins with the drawer signing the bill, filling in essential details such as the date, amount, and parties involved, and ensuring the inclusion of specific payment instructions and references to the underlying transaction.

- Presentation to the Drawee: The payee presents the bill to the drawee for payment on the due date or upon demand, as per the terms outlined in the bill.

- Acceptance or Rejection: The drawee acknowledges the bill by accepting it, thereby confirming the commitment to make the payment, or rejects it, indicating the refusal to honor the payment obligation.

- Negotiation and Endorsement: The payee can transfer the bill to a third party through negotiation and endorsement, enabling the bill to change hands in the secondary market.

- Payment Process: Upon acceptance, the drawee pays the payee on the due date or demand, ensuring the fulfillment of the financial obligation.

- Dishonour of a Bill: If the drawee fails to honor the bill, it is dishonored, potentially leading to legal repercussions and affecting the parties' creditworthiness.

In case of dishonor, the payee can seek legal recourse to enforce payment, utilizing the legal provisions outlined in the governing framework to ensure the settlement of the outstanding amount and any associated damages or penalties.

Let's consider a scenario where a Bengaluru-based software company (Exporter) is providing software services to a Silicon Valley company (Importer). The Bengaluru company, acting as the exporter, creates a Bill of Exchange. This document includes details such as the total amount due, the due date, and other relevant terms.

The Bengaluru company is the drawer, the Silicon Valley company is the drawee, and the bank may be involved as a financial intermediary. The Silicon Valley company reviews the document and, if satisfied, accepts the Bill of Exchange, acknowledging its commitment to pay the specified amount on the due date.

On the due date specified in the Bill of Exchange, the Silicon Valley company makes the payment to the Bengaluru company or through the bank. The transaction is considered complete, and the Bengaluru company delivers the software services as agreed.

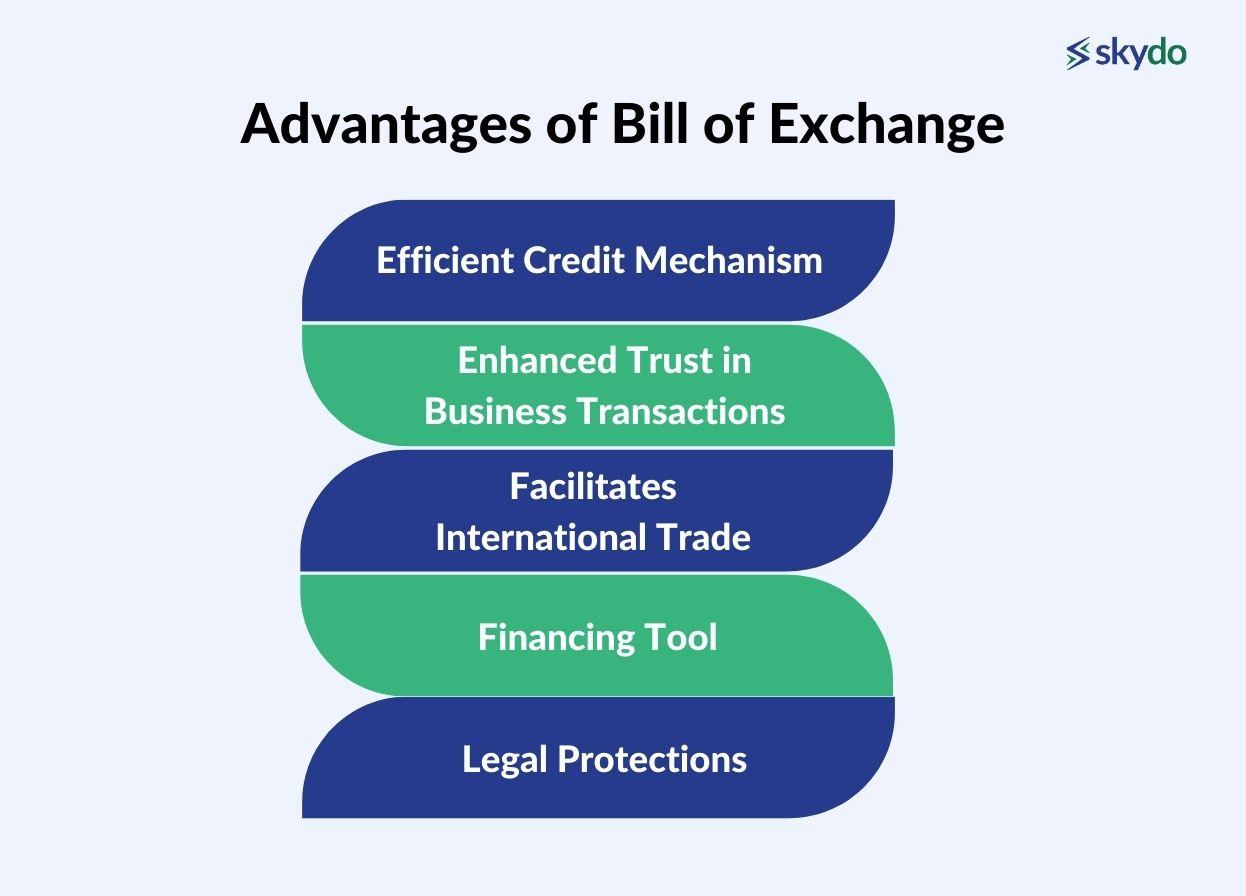

Advantages of Bill of Exchange

A bill of exchange offers several key advantages, making it a valuable tool in commercial transactions and international trade.

- Efficient Credit Mechanism: An effective credit instrument allows parties to defer payment obligations, thereby managing cash flows and improving financial flexibility.

- Enhanced Trust in Business Transactions: The bill of exchange fosters trust between transacting parties by providing a written commitment to payment, reducing the risk of non-payment and disputes.

- Facilitates International Trade: Its standardized format and recognition in international trade practices make it an indispensable tool for conducting cross-border transactions, minimizing the complexities.

- Financing Tool: It can be used as collateral or security for obtaining financing from banks and financial institutions, enabling businesses to access capital for operational and expansion needs.

- Legal Protections: It offers legal protections to parties involved, providing a formal recourse in case of non-payment, ensuring that contractual obligations are enforceable, and protecting the stakeholders' interests in the transaction.

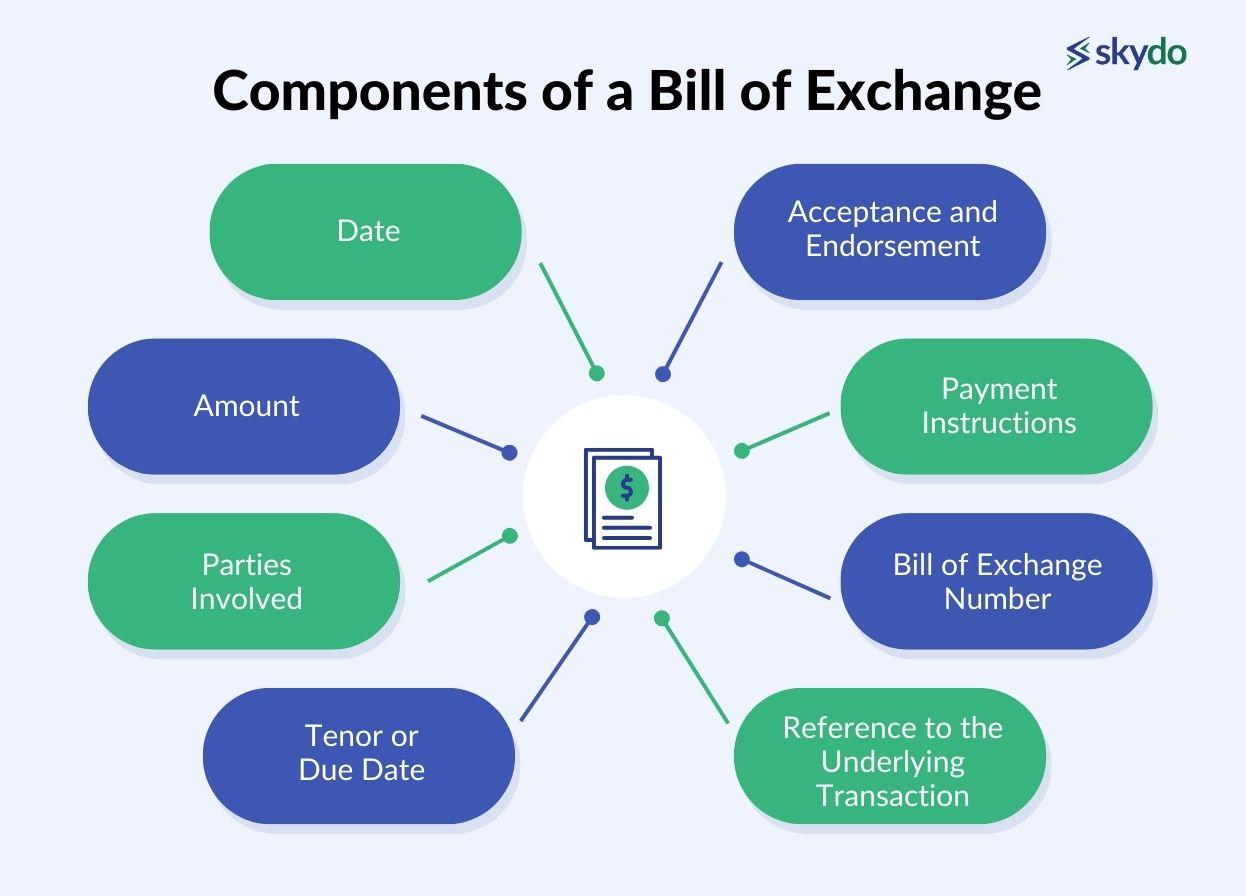

Components of a Bill of Exchange

A bill of exchange comprises several key components that define its structure and functionality, ensuring clarity and enforceability within commercial transactions.

- Date: The bill must include a specified date indicating its issuance date. It provides a reference point for payment timelines and legal validity.

- Amount: The bill clearly states the exact monetary value the drawee must pay the payee upon its maturity, ensuring transparency in financial obligations.

- Parties Involved: It identifies the three primary parties - the drawer, the drawee, and the payee - specifying their roles and responsibilities in the transaction.

- Tenor or Due Date: This indicates the maturity date or the specific period within which the drawee must honor the bill, ensuring a clear understanding of the payment timeline.

- Acceptance and Endorsement: The bill may require the drawee's acceptance, demonstrating their commitment to fulfilling the payment obligation, while endorsement signifies the transfer of the bill's ownership, enabling its negotiation in the secondary market.

- Payment Instructions: It outlines the specific conditions and instructions for payment, ensuring that the transaction proceeds smoothly and without ambiguity.

- Bill of Exchange Number: Each bill is assigned a unique identification number, facilitating easy tracking, referencing, and record-keeping for accounting and auditing purposes.

- Reference to the Underlying Transaction: The bill includes a reference to the underlying transaction, providing context and ensuring that the bill is linked to the goods or services exchanged, reinforcing the bill's legitimacy and purpose.

Types of Bills of Exchange

- Promissory Note: This is a two-party instrument where one party makes an unconditional promise in writing to pay a determined sum of money to the other party.

- Sight Bill: A sight bill is payable immediately upon presentation to the drawee for payment or acceptance. The payee can demand payment on bill presentation.

- Time Bill: A time bill specifies a definite period after it becomes payable. It allows the drawee a specific period, usually from days to months, to make the payment.

Bill of Exchange vs. Promissory Note

A bill of exchange involves three parties: the drawer, drawee, and payee, where the drawee must pay the payee. In contrast, a promissory note is a two-party instrument in which one party unconditionally promises to pay a specified sum to the other party.

A bill of exchange is suitable for commercial transactions involving the sale of goods or services on credit, providing a structured framework for payment and trade. On the other hand, a promissory note is more appropriate for individual lending arrangements, personal loans, or informal credit agreements, facilitating clear repayment terms between the lender and the borrower.

Legal Framework

- Indian Negotiable Instruments Act 1881 in India: Negotiable instruments can be anything that has a monetary value and is transferable. It enlists cheques, exchange bills, and promissory notes but excludes hundis, the original bill of exchange used in ancient India.

- UCC (Uniform Commercial Code) in the United States: The UCC, established in the 1950s, governs commercial transactions and trade practices across all U.S. states. It provides regulations for using bills of exchange, ensuring uniformity in business dealings, including rules on issuance, negotiation, and enforcement of these financial instruments.

- Bills of Exchange Act in the United Kingdom: The Bills of Exchange Act 1882, along with subsequent amendments, provides the legal framework for using bills of exchange in the UK. It outlines the rights and obligations of parties involved in the exchange, governing aspects such as presentment, acceptance, and dishonor, and ensuring the smooth functioning of these financial instruments within the British legal system.

- Other International Regulations: Apart from country-specific regulations, international bodies like the International Chamber of Commerce (ICC) and the United Nations Commission on International Trade Law (UNCITRAL) have developed frameworks and guidelines for international trade, including provisions for bills of exchange. These frameworks aim to harmonize laws and practices concerning bills of exchange across different jurisdictions, facilitating smoother global trade transactions.

Regulatory Compliance

Regulatory compliance is essential when handling bills of exchange formats involving stringent legal requirements and documentation practices.

- Legal Requirements: Comply with the legal provisions outlined in the relevant bills of exchange acts and international trade regulations, ensuring the validity and enforceability of the financial instrument.

- Documentation and Record-Keeping: Accurate records of all bill-related transactions, including issuance, acceptance, and payments, are important to maintain to facilitate transparency and audit trails.

- Reporting Obligations: Fulfill reporting obligations as mandated by regulatory authorities, providing timely and accurate information related to bill transactions and financial dealings.

- Non-Compliance: Non-compliance can lead to legal penalties, financial liabilities, and reputational damage, jeopardizing business relationships and impeding future transactions.

Conclusion

The bill of exchange is crucial for managing credit, fostering trust, facilitating international trade, providing financing opportunities, and offering legal protections. Thus, it streamlines complex financial transactions and contributes to the smooth functioning of global trade networks.

By integrating a bill of exchange into their operations, businesses can enhance their financial flexibility, minimize risks, and foster stronger relationships with their trade partners, thereby ensuring a seamless and secure exchange of goods and services on a global scale.

Frequently Asked Questions

Q1. What do you mean by a bill of exchange?

Ans: A bill of exchange is a written order from one party to another, directing the second party to pay a specific sum of money to a third party on a specific date or demand.

Q2. What are the legal provisions regarding bills of exchange?

Ans: The negotiable instruments law of a specific country typically governs the legal provisions for bills of exchange.

Q3. Who is an acceptor of a bill of exchange?

Ans: An acceptor of a bill of exchange is the individual or entity formally agreeing to honour the obligation stated in the bill. The acceptor assumes the primary liability for paying the specified amount indicated in the bill, either on a fixed date or upon demand.