Cooperative Banking: Meaning, Structure & Advantages

Updated on 23rd December 2025

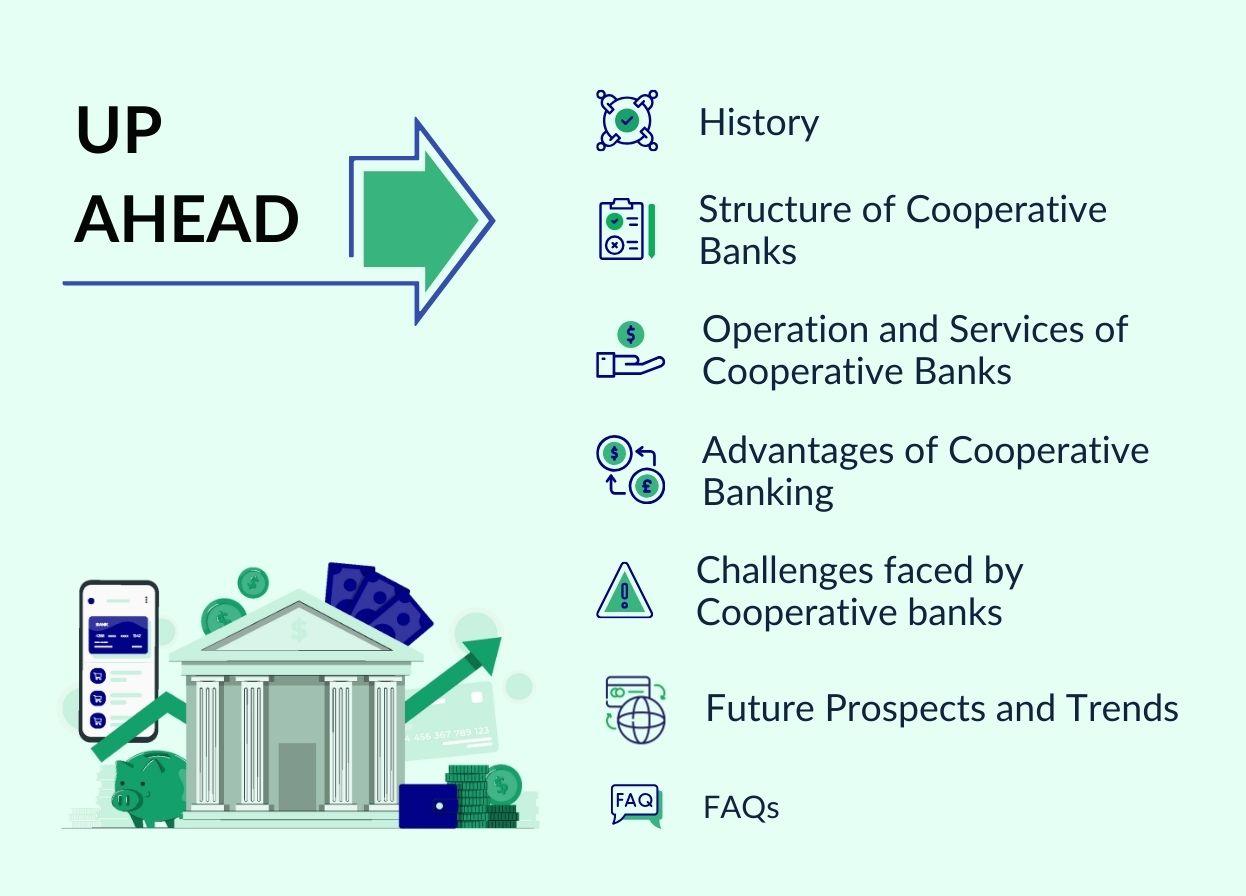

TL;DR

- A cooperative bank is a member-owned bank that runs on “one member, one vote", focusing on local credit, inclusion, and community development.

- India has a large co-op network: about 1,457 Urban Cooperative Banks, 34 State Co-operative Banks, 351 DCCBs, plus thousands of PACS under RBI/NABARD supervision (Aug 2025).

- Cooperative banks provide savings accounts, loans (incl. agri loans), remittances, and local development finance at relatively affordable rates.

- RBI has tightened and modernised regulation for co-op banks with the BR Act amendments, PCA framework for UCBs, and updated 2025 lending norms, aiming to improve safety while allowing them more flexibility.

Anyonya Sahayakari Mandali Co-operative Bank, the first one in India, was established in 1889 with 23 members and INR 73 to save Baroda’s residents from exploitation by moneylenders.

True to its name, cooperative banking is a small financial institution that operates on the principles of cooperation, mutual assistance, and shared ownership among the members. Group members commonly start cooperative banking to cater to the capital needs of a specific community.

The members own, operate, and are responsible for all the activities executed through the cooperative banks, and the board members are democratically elected to manage operations.

History

The main motive behind establishing such institutions was to address the problem of rural or local credit and cater to the capital needs of artisans, farmers, daily wage laborers, and anyone with limited means. The Indian government amended the Cooperatives Societies Act in 1912 to include organizations to audit and supervise the supply of cooperative credit. These organizations were:

- A union that consists of primary societies

- The central banks of India

- Provincial Banks of India

As per RBI & NABARD (Aug 2025), India has around 1,457 Urban Cooperative Banks (UCBs), 34 State Co-operative Banks (StCBs), 351 District Central Co-operative Banks (DCCBs) and one industrial co-operative bank, all under RBI/NABARD supervision.

Structure of Cooperative Banks

Cooperative banks differ from traditional commercial banks’ ownership structure, governance, and primary objectives.

- Membership and Ownership

Members of cooperative banks are often the people, businesses, or groups using the bank's services. Anyone can join a cooperative bank if they meet the membership requirements, typically by buying shares or making a certain deposit. Each cooperative bank customer has the same voting power regardless of how much money they have on deposit. Additionally, consumers who deposit or borrow money from cooperative banks are typically cooperative members.

- Governance and decision-making

The cooperative banks are governed by a board of members, who the members democratically elect to oversee the bank’s operation and management. However, for important decisions, all members’ opinions are considered. Final decisions are made based on mutual agreement through majority votes.

- Focus and Involvement

The primary goal of cooperative banks is to provide affordable financial services, including savings and credit facilities, to their members, thereby promoting financial inclusion and local economic development. Most cooperative banks focus on supporting local economic development initiatives. They provide credit to local businesses, farmers, and entrepreneurs, helping stimulate economic growth and job creation in the communities they serve.

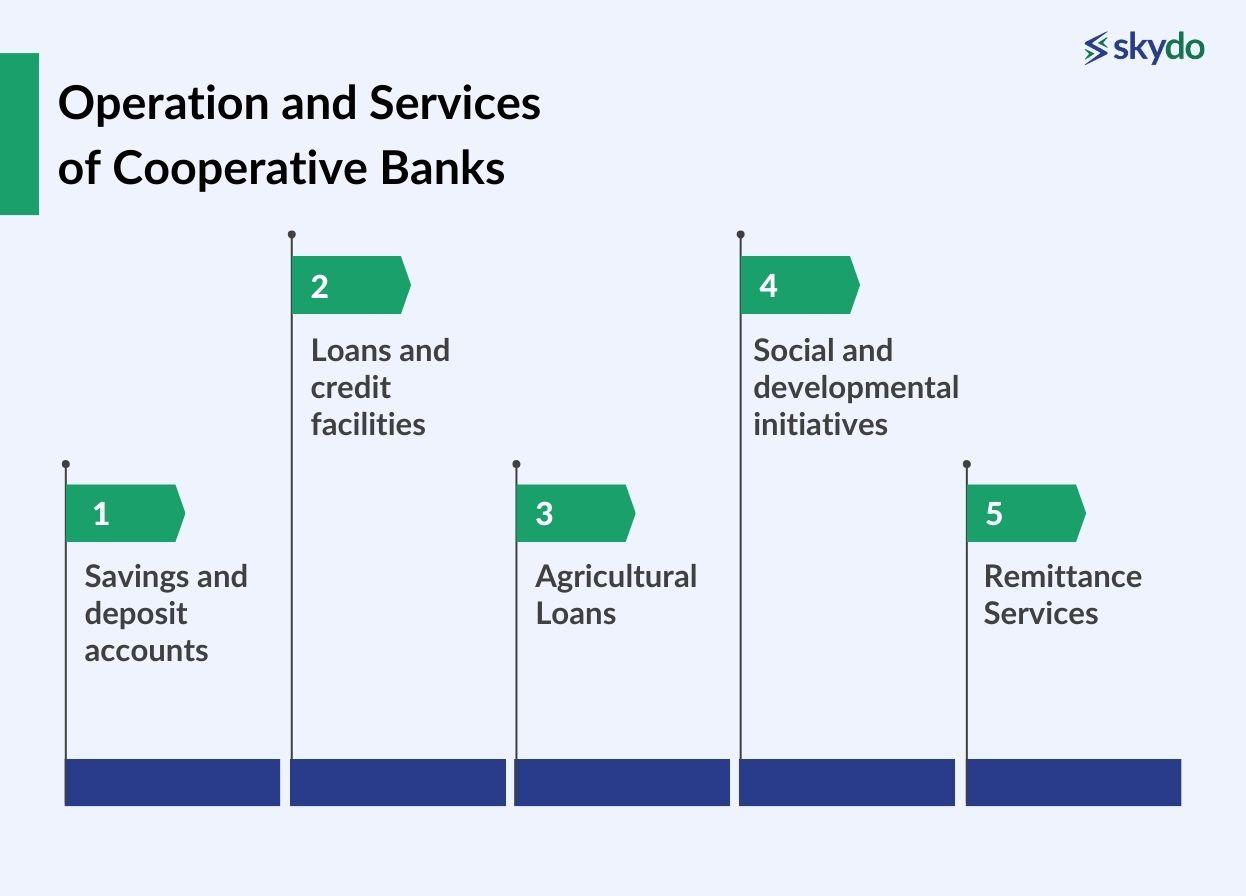

Operation and Services of Cooperative Banks

Cooperative banks strive to provide all the basic banking services a traditional bank provides but at a much more affordable rate.

- Savings and deposit accounts

Customers or members can open a savings account with cooperative banks and deposit their savings to earn interest on balances. Furthermore, businesses can open current accounts for daily business transactions.

- Loans and Credit Facilities

Cooperative banks extend credit facilities to members, including personal loans, home loans, agricultural loans, and business loans. These loans are often provided at competitive interest rates and flexible repayment terms.

- Agricultural Loans

Some cooperative banks are formed as agricultural cooperative banks, specializing in providing agricultural loans. Such loans include farm equipment loans, crop loans, seed loans, etc.

- Social and Developmental Initiatives

Cooperative banks are often a part of social and development initiatives for people's economic welfare. Cooperative banks may invest in community development projects, infrastructure development, and social welfare programs to support small businesses and the targeted communities.

- Remittance Services

Cooperative banks, through their international payment system, facilitate domestic and international remittances, allowing members to send and receive money from individuals outside India.

Advantages of Cooperative Banking

Cooperative banks generally focus on the low-income segments. Here are some of the major advantages of cooperating banks and their financial services:

- Customer-centric approach

Since cooperative banks deal with relatively few clients, they can better develop meaningful relationships and provide superior service. Such banks’ aim of minimizing charges and fees and customized plans also helps them to provide affordable financial services to the customers. The members also take in personal feedback from the customers and ensure their complete satisfaction through feedback-oriented after-sales services.

- Financial inclusion and empowerment

Cooperative banks strive to provide banking services to communities that may otherwise be deprived of such financial services because of their profession or social status. The cooperative banks' economic and social development initiatives ensure that the community members are financially self-sufficient.

- Stability and support

The local community members extend banking services to each other. Since they deposit and offer credit among a limited number of members, the risks get localized, mitigating the exposure to global banking crises. If a community member is having financial difficulties due to an economic downturn, the members of the cooperative bank can also come together to extend financial support.

- Ethical and sustainable banking

These institutions understand the ground realities. It becomes natural for them to commit to social and environmental responsibility, aligning seamlessly with community values. By prioritizing transparency, fair practices, and community engagement, cooperative banks play a pivotal role in fostering positive change and sustainable development.

Challenges faced by Cooperative banks

Their size, vision, and operations create many challenges for cooperative banks in India:

- Limited scale and resources

For a cooperative bank, deposits are limited to the amount deposited by the members. Furthermore, situations where the banks aren’t able to extend the desired amount of loans create a challenge for long-term sustainability. Ensuring sufficient capital to meet regulatory requirements and support growth is a constant challenge, especially for smaller cooperative banks.

- Governance and management issues

Cooperative banks must balance democratic principles with efficiency, which becomes challenging when making tough long-term growth or profitability decisions. Although the decisions are made democratically, differences in education, skills, and mindset may result in conflicts among the members.

- Regulatory and competitive hurdles

Changes in regulatory frameworks may require significant adjustments in operations and practices. Furthermore, cooperative banks directly face competition from larger commercial banks, digital banks, and fintech companies, making sustainability a constant challenge.

Future Prospects and Trends

Cooperative banks in India have the potential to scale and offer improved financial services to a large customer base. The current era of digital services demands integrating their banking services with new-age fintech companies to offer seamless and quick online transactions, which is currently limited The growth of cooperative banks depends on promoting financial literacy about the bank’s products, services, principles, and economic development initiatives to their members.

Cooperative banks may strengthen their cooperation and collaboration with other cooperative financial institutions at regional, national, and international levels to ensure better services, data security and customer privacy.

Conclusion

Cooperative banks are an integral part of the Indian banking ecosystem as they focus on providing banking and financial services to underserved communities. They provide most of the banking services as traditional banks but ensure the offerings at a much lower cost, promoting much-needed financial inclusion.

These banks will continue evolving and adapting to changing market dynamics and member needs as time passes. By embracing technology, fostering innovation, and staying true to their cooperative principles, they can remain competitive, financially stable, and socially responsible while continuing to serve their communities and members effectively.

Frequently Asked Questions

Q1. What is meant by the cooperative bank?

Ans: A cooperative bank is a financial institution owned and controlled by its depositors, who are also its members. They prioritize serving their members' needs over maximizing profit, fostering a community-oriented approach to banking.

Q2. Is it a cooperative bank under RBI?

Ans: Yes, cooperative banks in India are regulated by the Reserve Bank of India (RBI) under the Banking Regulation Act 1949. They adhere to the same regulations and supervision as other commercial banks.

Q3. How many types of cooperative banks are there?

Ans: There are two main types in India:

- Primary cooperative banks: Serve rural areas, focusing on agriculture and allied activities.

- Urban cooperative banks: Cater to urban areas, offering a wider range of banking services.

Additionally, there are specialized cooperative banks catering to specific sectors like industry or professions.