Differences Between NEFT and RTGS: Limit, Charges, Timings

With the introduction of online payments, both you and your clients have become more comfortable with digital payments in the last few years. But if you have to pay Rs. 5 lakh to a supplier today, what payment mode should you use: NEFT or RTGS?

You frequently encounter two seemingly similar yet distinctly important methods in the complex web of financial dealings. But are they just interchangeable acronyms, or do they streamline your financial operations?

This question is best answered by understanding the difference between NEFT and RTGS.

NEFT (National Electronic Funds Transfer)

National Electronic Funds Transfer (NEFT) is an Indian nationwide payment system that allows individuals to transfer funds online from one NEFT-enabled bank to another. The Reserve Bank of India introduced the payment system in November 2005 as a digital alternative to depositing money in someone else’s bank account at a bank branch.

Previously, there were several restrictions on the timings of money transfers through NEFT, which the RBI removed by updating the payment system in November 2019. Now, individuals can transfer money through NEFT 24x7 and 365 days a year.

Details needed for RTGS and NEFT

We need some basic information to conduct any RTGS or NEFT transaction

- Amount to be remitted

- Remitting customer's account number which is to be debited

- Name of the beneficiary bank

- Name of the beneficiary

- Account number of the beneficiary

- Indian Financial System Code (IFSC) - which is unique to each bank branch

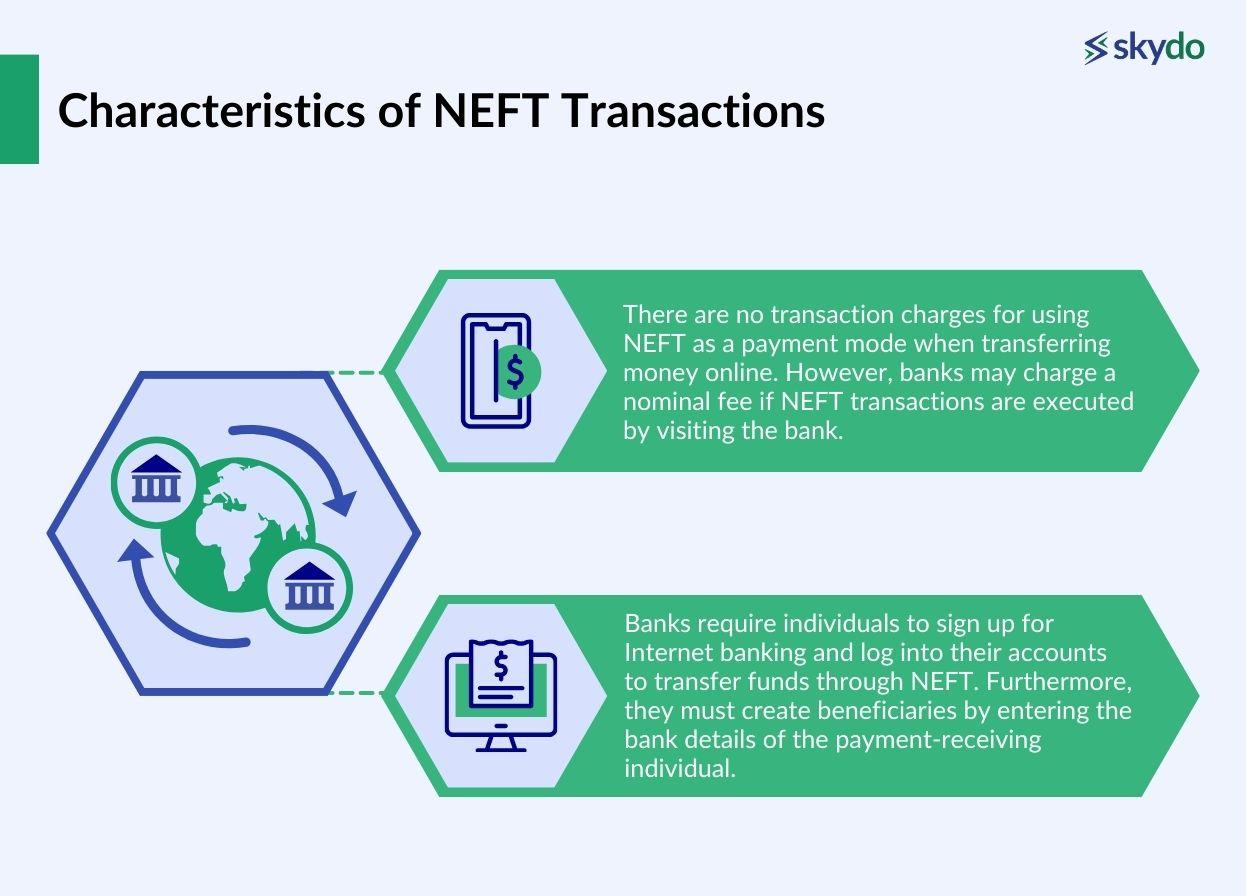

Characteristics of NEFT Transactions

Here are some features and characteristics of financial transactions executed through NEFT:

- There are no transaction charges for using NEFT. However, banks may charge a nominal fee if NEFT transactions are executed by visiting the bank.

- Banks require individuals to sign up for Internet banking and log into their accounts to transfer funds through NEFT. Furthermore, they must create beneficiaries by entering the bank details of the payment-receiving individual.

NEFT Transaction Limits

Financial transactions made through NEFT have a minimum transfer limit of Rs 1. RBI has not set any maximum limit for NEFT transactions but a per-transaction limit of Rs 50,000 for cash transactions. However, there is no upper limit on the total amount individuals can transfer using the NEFT facility.

This means you can transfer as much money as you want, but you must limit the amount to Rs 50,000 per transaction and use multiple transactions to transfer money above Rs 50,000. However, few banks have set their own maximum daily limit on the amount you can transfer using the NEFT facility.

NEFT Cost Implications for Users

There are no transaction charges for the recipient of funds sent through the NEFT facility. Individuals who execute financial transactions through NEFT online also don’t have to incur any money transfer fee. However, if you are initiating an NEFT fund transfer offline by visiting the bank, it may charge the following (these costs vary depending on the bank and type of account:

- Rs 2.50 (+ GST) for transfers up to Rs. 10,000

- Rs 5 (+ GST) for transfers above Rs. 10,000 and less than R. 1 Lakh

- Rs. 15 (+ GST) for transfers above Rs. 1 Lakh and less than Rs. 2 Lakh

- Rs. 25 (+ GST) for transfers above Rs. 2 Lakh

RTGS (Real-Time Gross Settlement)

Real-Time Gross Settlement (RTGS) is a nationalized electronic fund transfer system used by Indian banks and financial institutions to execute time-sensitive and high-value transactions. Financial transactions executed through RTGS are considered the safest among payment systems as the transactions are done in real-time and in full rather than in batches.

The term ‘gross’ in Real-Time Gross Settlement (RTGS) signifies the payment execution process done individually without offsetting and netting against other transactions. Individuals can transfer money through RTGS 24x7 and 365 days a year. The real-time payment process ensures that the financial transactions are highly secure and independent of other financial transactions.

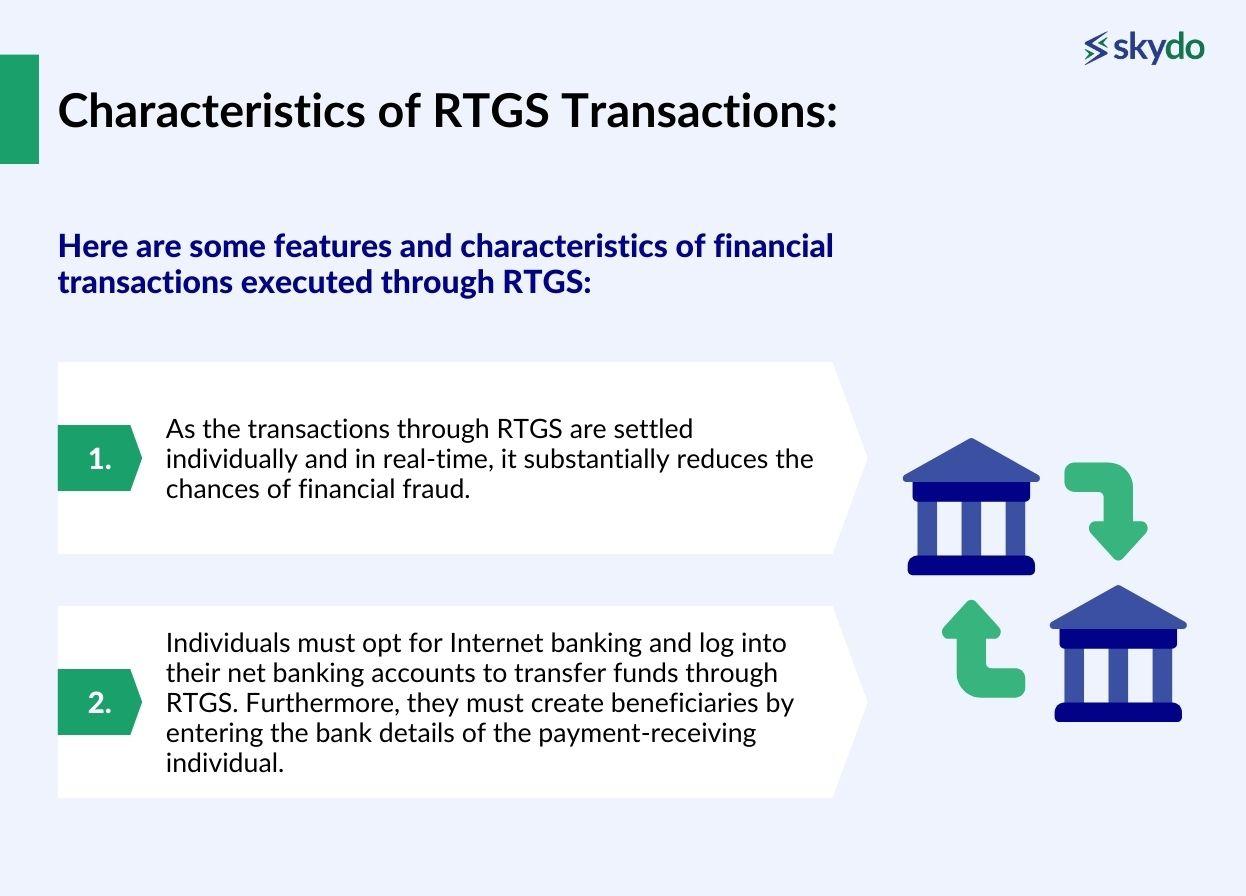

Characteristics of RTGS Transactions

Here are some features and characteristics of financial transactions executed through RTGS:

- As the transactions through RTGS are settled individually and in real-time, it substantially reduces the chances of financial fraud.

- Individuals must opt for Internet banking and log into their net banking accounts to transfer funds through RTGS. Furthermore, they must create beneficiaries by entering the bank details of the payment-receiving individual.

RTGS Transaction limits

RTGS transactions are meant for high-value transactions, and the RBI has set the minimum RTGS limit to initiate a transaction at Rs 2 lakh. RBI has not set any maximum limit for financial transactions that individuals can make through RTGS. However, banks may set their own upper limit for the maximum funds that can be transferred through RTGS in a single day.

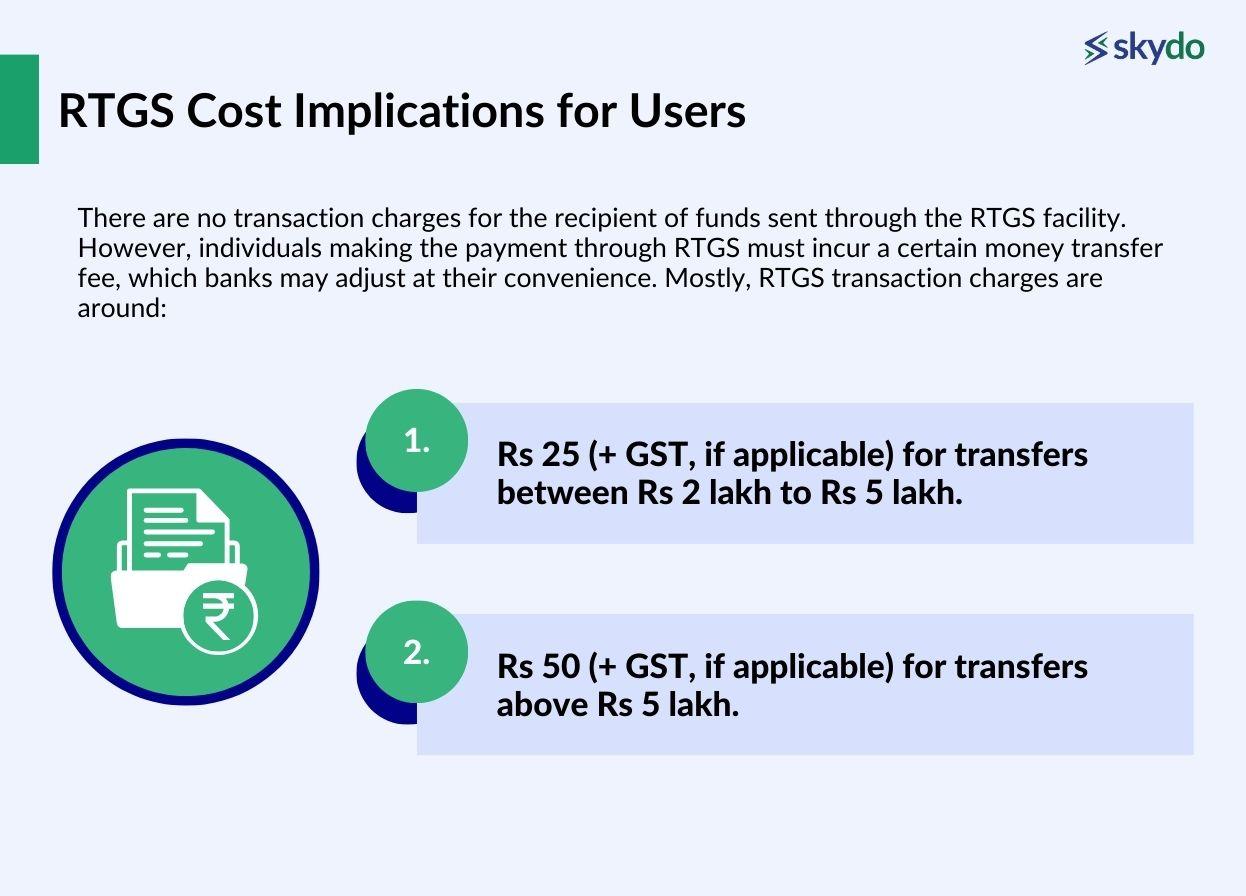

RTGS Cost Implications for Users

There are no transaction charges for the recipient of funds sent through the RTGS facility. However, individuals making the payment through RTGS must incur a certain money transfer fee, which banks may adjust at their convenience. Mostly, RTGS transaction charges are around:

- Rs 25 (+ GST, if applicable) for transfers between Rs 2 lakh to Rs 5 lakh.

- Rs 50 (+ GST, if applicable) for transfers above Rs 5 lakh.

Key Differences Between NEFT and RTGS

There are numerous differences between NEFT and RTGS based on their transaction processing speeds, minimum and maximum transaction limits, applicability for different types of transactions, etc.

The major difference is the settlement type. Let’s say you have to transfer Rs. 2,50,000 to your supplier. If you send it by RTGS, your bank A will send it to their bank B, and they will receive it almost immediately.

However, if you send it through NEFT, then Bank A will block these funds from your account. At the end of the settling window, they will check if Bank B owes them any money. If Bank B has to pay them Rs. 1,00,000, Bank A will only transfer Rs. 1,50,000 to them. This ‘netting’ of what one bank must give vs what they have to get is the core mechanism of an NEFT transaction.

Here are the key differences between NEFT and RTGS:

| Parameter | NEFT | RTGS |

|---|---|---|

| Minimum transferable amount | Rs 1 | Rs 2 lakh |

| Maximum transferable amount | There is no upper limit, but it is subject to daily transfer limits set by banks | There is no upper limit, but it is subject to daily transfer limits set by banks |

| Settlement type | The amount is settled in batches (as per the windows defined by the RBI) | The amount is settled instantly and in full |

| Settlement time | Within 30 minutes | Instantly |

| Transfer Timings | 24X7, all 365 days | 24X7, all 365 days |

| Transfer Mode | Online and offline | Online and offline |

When to Use NEFT or RTGS

Understanding the key differences between NEFT and RTGS is the best way to understand which payment mode suits you best.

If you want to transfer money lower than Rs 2 lakh without the urgency of instant settlements, you can use NEFT online as it offers a free-of-cost way. For example, if you are a freelancer and want to transfer or receive fees of Rs 40,000, you can opt for NEFT as a cost-effective way.

On the other hand, if you want to make high-value transactions higher than Rs 2 lakh, it is beneficial to ensure that the payment is settled instantly and in full. You can opt for RTGS as the payment mode in such a case. For example, if you want to execute a business transaction, which is generally high-value and above Rs 2 lakh, you can opt for RTGS, as it will instantly confirm a fund transfer. It is deemed that on such a large amount, you will be comfortable incurring the cost of RTGS payments.

Conclusion

Money transfers are one of the most critical aspects for any business, whether as a freelancer or an entrepreneur. Facilities such as NEFT and RTGS have made it easier for customers nationwide to send and receive payments anytime and with the utmost security.

It is common for individuals making payments lower than Rs 2 lakh to use NEFT, while individuals looking to transfer funds higher than Rs 2 lakh choose RTGS. However, it entirely depends on your business type and the urgency of financial transactions’ settlement to make an informed choice between NEFT and RTGS. That being said, if you want to receive international funds in foreign currencies, look no further than Skydo. With a Skydo payment platform, you can open an international bank account in just five minutes.

FAQs

Q1. Which mode of payment, NEFT or RTGS, is faster?

Ans: When compared based on their settlement speeds, RTGS is a faster mode of payment as it settles the funds in full and instantly. On the other hand, NEFT takes around 30 minutes for payment settlement and settles them in batches.

Q2. Is it compulsory to have an Indian bank account to transfer funds through NEFT and RTGS?

Ans: Yes, you need to open a bank account with an Indian bank and opt for Internet banking to transfer funds through NEFT and RTGS online.

Q3. What security measures are in place for NEFT and RTGS transactions?

Ans: The Reserve Bank of India has made it mandatory to create a beneficiary before making payments through NEFT and RTGS for extensive security. The bank requires you to enter the recipient's bank account details, such as the recipient's name, bank and branch name, account number, and IFSC code. The bank matches and cross-checks the details for utmost security.

Q4. Can I reverse a transaction made through NEFT or RTGS?

Ans: No, you can not stop or reverse a payment once made through NEFT and RTGS. However, you can inform the bank immediately if you have sent the money to the wrong recipient. In fact, if the bank finds some mismatch in the account name and number details, they shall reverse the transaction by themselves, too.