Ensure RBI Guidelines for Cross-Border Transactions with Skydo

In recent news, the Income Tax Department has flagged 89 high-value foreign remittance transactions on grounds of tax evasion. Such instances are not uncommon in India. Transfer of black money, tax evasion, and fraud in cross-border transactions are highly prevalent in India and globally.

While RBI creates many rules to mitigate such activities, here is some information on what they are and how you can comply with them.

To curb tax evasion and money laundering through foreign remittances, the Reserve Bank of India (RBI) has issued various guidelines for foreign remittances. Exporters and importers must provide purpose codes for foreign exchange transactions starting 31st May 2021.

These purpose codes are unique codes that help authorized dealer (AD) banks verify the purpose of cross-border transactions and determine the service the exporter provides.

Through the exporter’s self-declaration they understand whether the money received is a return earned from investments in foreign securities, forex receipts from transferring patents, or any other intellectual property sold to a non-resident Indian.

Foreign Inward Remittance Advice (FIRA)

In addition to the purpose codes, RBI has also made it mandatory for exporters to submit Foreign Inward Remittance Advice (FIRA) receipts for each forex receipt. Although this helps in reconciling financial statements and adhering to tax compliances, ensuring compliance with purpose codes and FIRA processes is cumbersome.

Since non-compliance or procedural errors can cause delay or cancellation of forex payments, there is additional fear of stuck cash flow and negative impact on business operations.

Skydo: Simplifying RBI Compliance

Skydo, a modern payment solution for receiving cross-border payments smoothly, tech exporters and freelancers can simplify their compliances and easily adhere to RBI guidelines. This blog explains Skydo’s unique and autosaved purpose code, automated GST-compliant FIRA features that help businesses easily adhere to RBI guidelines and mitigate compliance risks.

Skydo's Solution: Simplifying the Purpose Code Process

RBI has released a long list of 126 purpose codes for inward remittance transactions. Exporters must mention the purpose codes for inward remittance based on the type of foreign transaction.

When you send invoices created on MS Excel or use any other customizable template, adding the purpose code for inward remittance for every invoice may seem manageable initially. However, as your business scales, manually adding codes for several transactions and verifying them is lengthy and costly.

Moreover, in the case of incorrect/missing purpose codes, banks reject the transaction and/or flag it as a fraudulent transaction for tax evasion. Once the transaction fails, you go through a long process: clarify the purpose code, request your client to resend the payment, and even pay a hefty non-compliance fee.

Skydo saves you the hassle of manually entering the purpose codes each time you prepare an invoice for a client. Instead, here is how the autosave purpose code for the inward remittance feature works:

- Add the Purpose Code Once

The Skydo payment platform requires users to enter the purpose codes once according to specific services. Once you register on Skydo, the platform checks the services described by you and exports respective purpose codes from the RBI database.

- Purpose Code Gets Saved

The purpose codes are automatically saved in Skydo’s dashboard.

- Prefill the Purpose Code

The next time you create an invoice, you just have to click on the space to enter the purpose code, and all the saved codes become visible. You can select the appropriate purpose code from the dropdown without entering it manually or verifying it. It promotes seamless invoice reconciliation.

- Send e-invoices

Once the purpose code is added, you can complete drafting the invoice and send it online through Skydo. Thus, Skydo allows real-time tracking of cross-border transactions and sending online reminders to clients, making their payment processes more efficient and hassle-free.

Ultimately, Skydo is a modern payment platform that offers the following benefits by automating the purpose code process:

- Reduces risk of error and non-compliance

- Ensures timely receipt of payments through accuracy

- Reduces manual labor and enhances efficiency

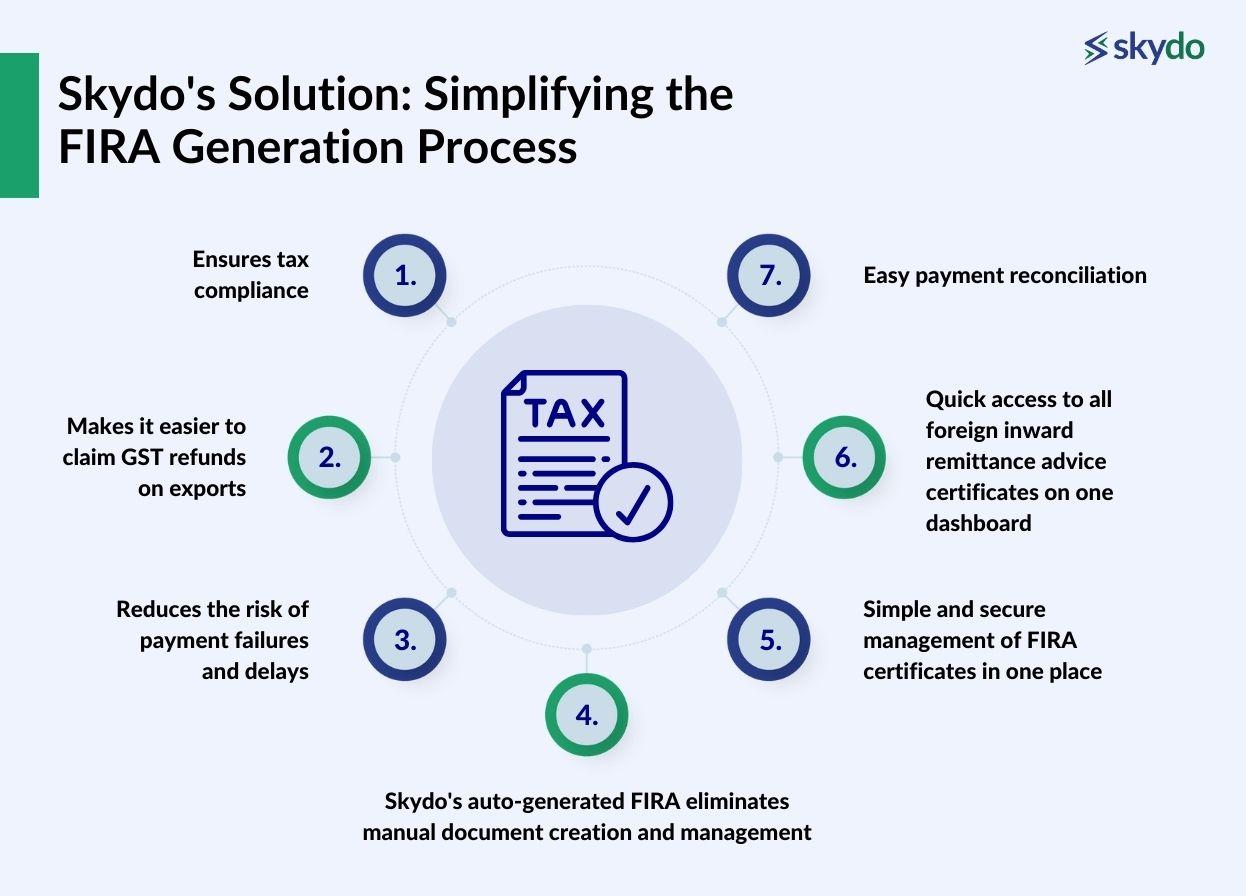

Skydo's Solution: Simplifying the FIRA Generation Process

FIRA is a document generated by authorized banks to provide complete details of a forex transaction. It is necessary for tax compliance and to get GST refunds. However, banks take around 7-15 days to generate FIRA receipts for cross-border transactions. Moreover, you must download and keep each FIRA certificate securely in a folder for each transaction. Now, imagine repeating the process a thousand times every year.

It creates a huge hassle for businesses. However, Skydo helps organizations manage this challenge by automatically generating FIRA certificates for each cross-border payment added to your dashboard. All the certificates are stored online in your Skydo account. You can view FIRA receipts for particular transactions within a few seconds through Skydo's intuitive dashboard. Moreover, Skydo allows users to download all the foreign inward remittance advice certificates in just a single click.

The following are some of the most significant advantages of using Skydo for simplifying the foreign inward remittance advice process:

- Ensures tax compliance

- Makes it easier to claim GST refunds on exports

- Reduces the risk of payment failures and delays

- Skydo's auto-generated FIRA eliminates manual document creation and management

- Simple and secure management of FIRA certificates in one place

- Quick access to all foreign inward remittance advice certificates on one dashboard

- Easy payment reconciliation

Conclusion

The RBI has imposed strict guidelines for cross-border transactions by enforcing purpose codes for inward remittances and issuing FIRA. Such measures play a significant role in curbing tax evasion and other fraudulent activities. However, it also creates a hassle for businesses because non-compliance with purpose codes and FIRA guidelines can cause delay or cancellation of cross-border transactions, ultimately posing business risk.

Skydo eliminates this hassle by automatically filling purpose codes in invoices after the first entry. It also automatically generates FIRA certificates that enable businesses to receive timely payments and claim tax refunds smoothly.

Join Skydo today and scale your business by automating payment compliances and minimizing risk!