LUT: Full Form, Eligibility, Process and More

Updated on 28th November

TL;DR

- LUT lets you export services without paying IGST upfront (file RFD-11 before export).

- LUT is typically valid for the full financial year

- Not eligible if prosecuted for tax evasion ₹2.5Cr+; then you may need a Bond route.

- File on GST portal → ARN + acknowledgement; can be deemed approved in 3 working days.

- For service exports, ensure payment realisation timelines are met to avoid tax/interest exposure.

- If you forgot to file LUT before export, CBIC allows possible condonation (ex post facto LUT) depending on facts.

LUT full form is Letter of Undertaking. An Indian exporter can use a LUT to ship goods and services outside India or Special Economic Zones (SEZs) without paying the Integrated Goods and Services Tax (IGST) upfront which otherwise applies to the export of goods and services.

This blog answers all the questions about LUT including LUT full form, definition, eligibility, application, and renewal process.

What Is LUT in GST?

Exports fall under the zero-rate supply category meaning they are exempt from Goods and Services Tax (GST). However, for this to work, exporters have to pay IGST upfront and claim a refund later.

This is a time-consuming and complex process. They must fill out multiple forms online and upload supporting documents like export invoices and shipping bills. Additionally, if certain information is missing or there is a mismatch, the claim could be rejected.

LUT is a formal declaration submitted to GST authorities by exporters through which they can export goods and services without paying IGST. It’s a digital process, quick, and hassle-free, and exporters won't face a liquidity crunch.

Eligibility for Filing LUT Under GST

To be eligible for availing the benefits of a Letter of Undertaking (LUT), an exporter must meet the following criteria.

- Whether you export goods or provide services, you are eligible to file GST LUT

- You must be a registered taxpayer under the GST regime. No GST registration results in non-compliance with the GST regulations

- If you have been prosecuted in the past for any offence under the GST law, you cannot file an LUT

- There must be no outstanding GST payment dues

- Your compliance history must indicate your dedication towards tax obligations. If you have filed GST returns timely, your LUT could be approved without issues.

According to the CGST Rules of 2017, a registered individual can provide a LUT in the GST RFD 11 form to export goods or services without paying integrated tax as long as they meet all the eligibility requirements.

How to apply for an LUT?

Till 2020, the LUT filing process was manual. Exporters had to fill out the LUT application form on the business letterhead and submit one copy to the jurisdictional GST commissioner positioned in their principal place of business. Another copy had to be submitted to the customs clearing authority along with other export documents.

The online process is much smoother and exporters can get their LUT by following these exact steps:

Here are step-by-step instructions on how to apply for an LUT.

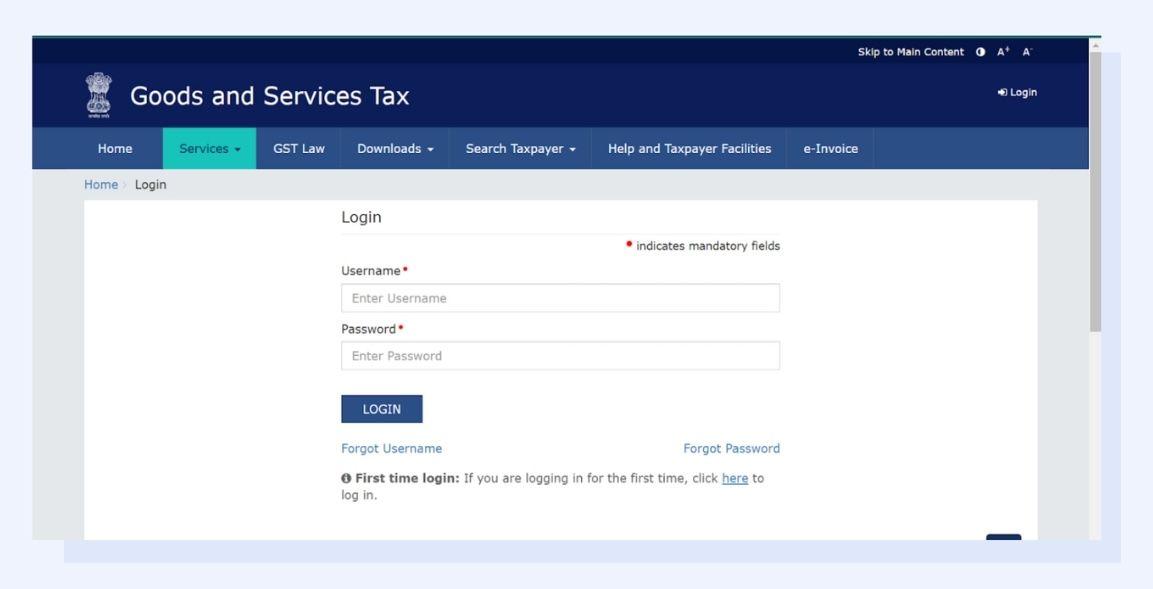

Step 1: Log in to the GST Portal using credentials

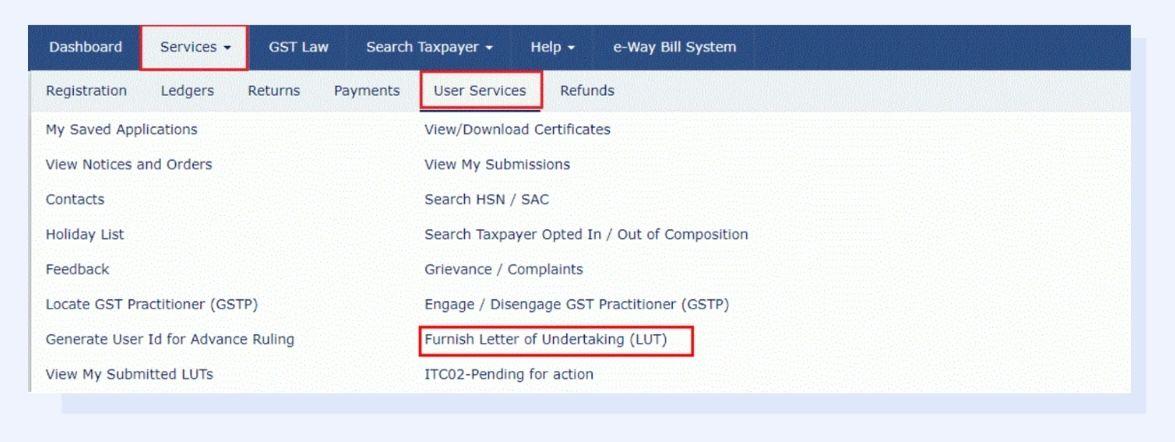

Step 2: Navigate to the 'Services' tab and click 'User Services'. From there, you can select 'Furnish Letter of Undertaking(LUT)'.

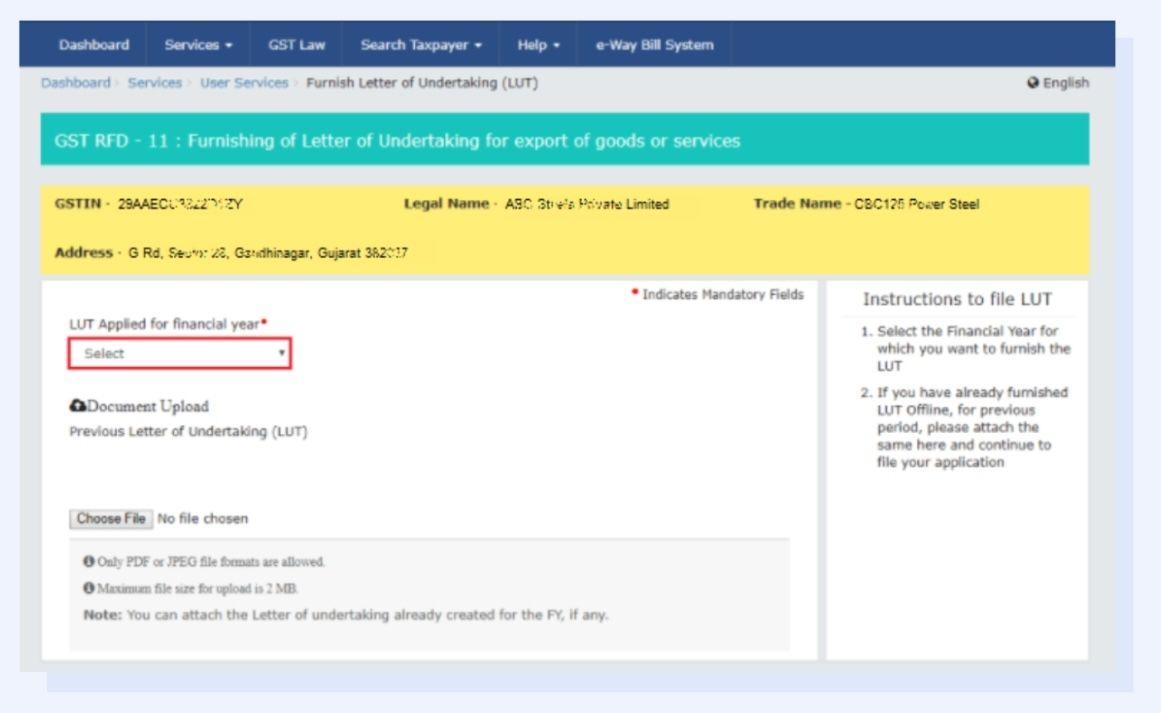

Step 3: Choose the financial year for which you are applying for the LUT from the 'LUT Applied for Financial Year' drop-down menu. For instance, you can select 2024-25.

Exporters can also upload a Letter of Undertaking prepared manually. Click on "Choose File" to select it from your computer if used it in the previous financial years. The document must be in PDF or JPEG file formats and 2 MB maximum file size.

Step 4:

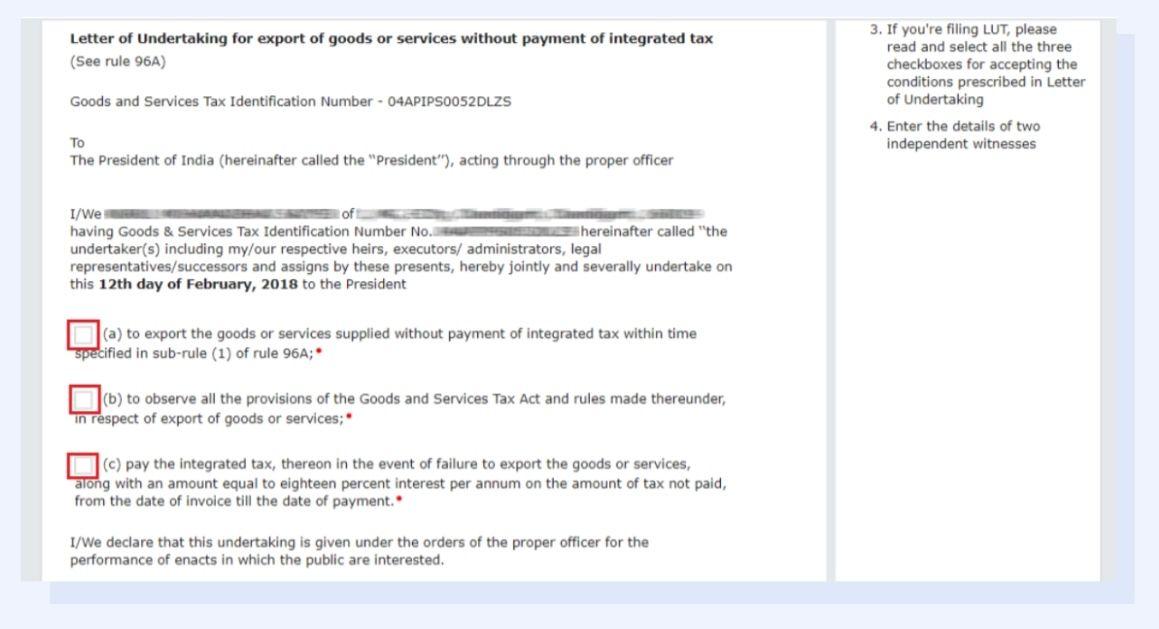

In the next screen, tick on the self-declaration checkboxes on the GST RFD-11 LUT application form to proceed. Here's what the three points are:

a) To export the goods or services within three months from the date of issue of the export invoice

b) To observe all the rules of the GST Act for the export of goods and services

c) To pay IGST plus interest of 18% per annum from the date of invoice to the date of payment if they do not export

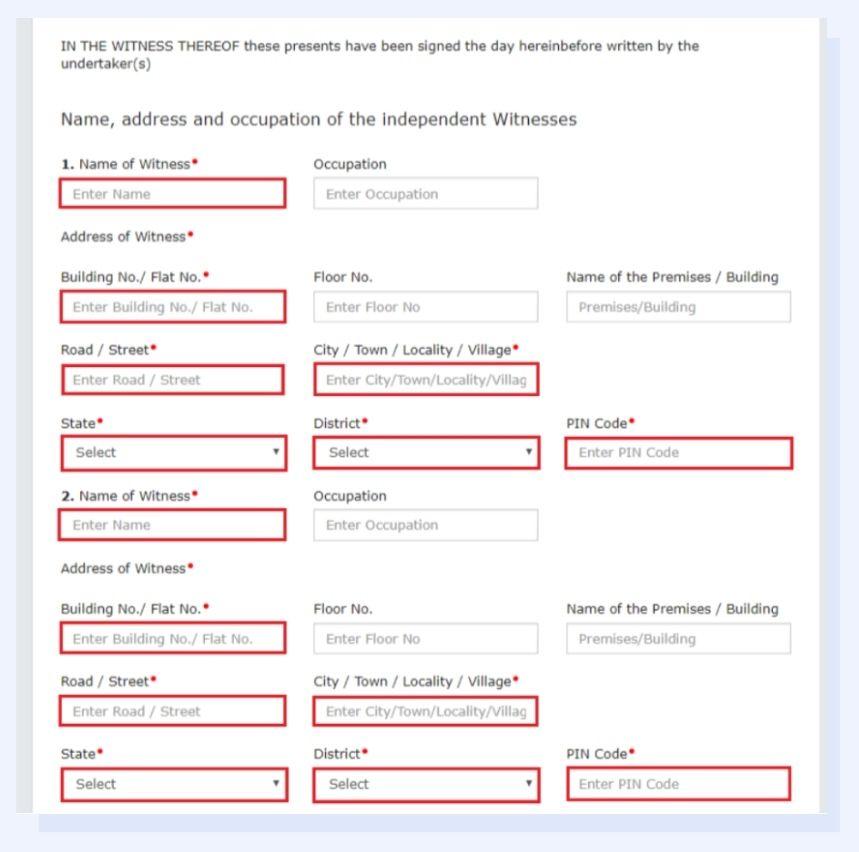

Step 5: Next, you must provide the names, occupations, and addresses of two independent witnesses in the boxes. This information is mandatory.

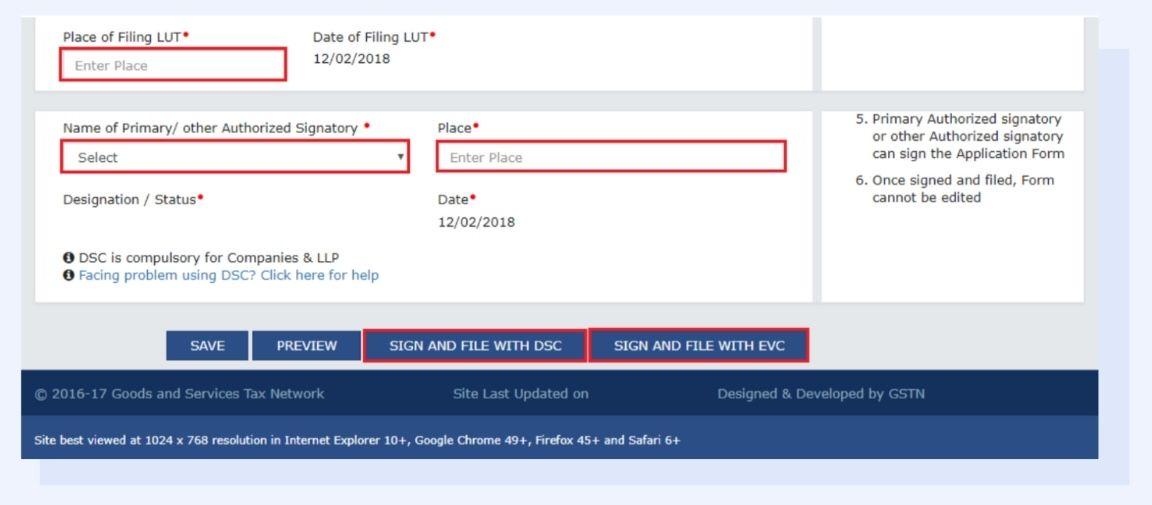

Step 6: Enter the place of business in the "Place of Filing LUT" textbox and enter the name and place of the authorized signatory. An authorized signatory can be the proprietor of the company, the managing director or the company secretary.

Click on "Save." After the form is saved, click on the "Preview" button to ensure the form is filled correctly.

Step 7: On the same screen, there is an option to sign and file the form using either DSC or EVC.

If they have a registered Digital Signature Certificate (DSC), choose the "SIGN AND FILE WITH DSC" option. Use the DSC of the selected authorized signatory to sign the form. A warning message box will appear, click on "Proceed." The system will automatically generate a unique Application Reference Number (ARN).

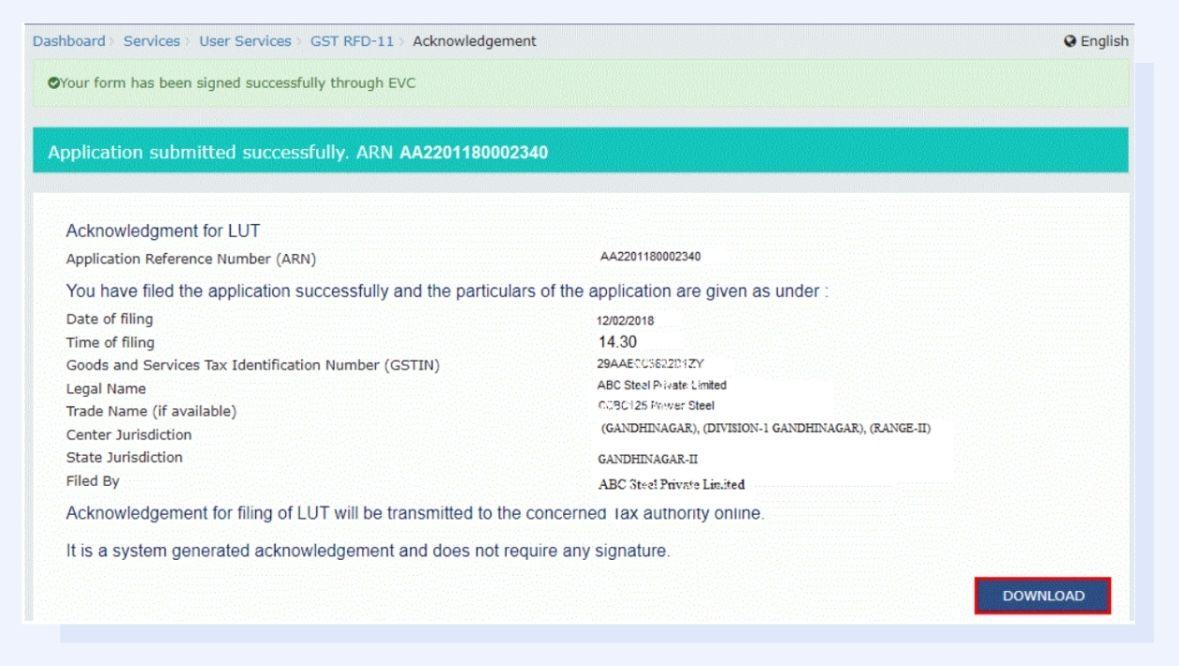

The other option to file the form is to use an Electronic Verification Code (EVC). So if they don't have a DSC, they can choose this method to furnish LUT. Click on "SIGN AND FILE WITH EVC," and a One-Time Password (OTP) will be sent to the registered mobile number and email address of the authorized signatory. Use the OTP to sign the form, a warning message appears, and click "Proceed." Next step, the system automatically generates a unique Application Reference Number (ARN).

After submission, a confirmation message appears on the screen with a DOWNLOAD button to save the acknowledgement on their device. The GST Portal also sends the ARN via SMS and email to the registered mobile phone number and email address respectively. You can click on the DOWNLOAD button to download the acknowledgement.

How to Renew the LUT on the GST Portal?

LUT is valid for one financial year meaning if an exporter wants to continue taking advantage of zero-rated supplies under GST, they must renew their LUT annually. If they do not renew LUT, they must pay IGST upfront when you export the next time.

The process to renew LUT is similar to the steps above. Here's a quick walkthrough:

- Visit the online GST Portal

- Log in to the account using the credentials

- Click on "Services" on the top bar, choose "User Services" from the drop-down menu, and click "Furnish Letter of Undertaking"

- Choose the financial year from the drop-down list

- Upload the previous LUT in PDF or JPEG format (less than 2 MB size)

- Provide declaration by ticking in the three checkboxes

- Submit the name, occupation, and address of two witnesses

- Enter the name of the authorized signatory

- Enter the place under the "Place of Filing LUT," click "Save," and "Preview" to verify the details in the application form

- In the last step, Sign and File using DSC or EVC.

After the authorities verify the application successfully, the Application Reference Number (ARN) will be sent to the authorized signatory's mobile number and email address.

What Documents are Required for LUT Registration and Renewal?

If you, as an exporter are filing LUT for the first time, you must complete the LUT registration first. Here is the list of documents required for registration:

- GST Registration Certificate: This is needed to prove that the business is registered under GST

- PAN Card: The company’s PAN Card will be needed for registration

- IEC Certificate: This is important for the Importer Exporter Code

- KYC of authorized person: The authorized person in the export company must produce their ID and address proof

- Letter: This letter must be signed by the authorized person requesting LUT registration

- A Cancelled Cheque: This must be from the company’s bank account

- Authorized letter: This letter proves that the authorized signatory has been appointed to represent the company by the Board of Directors or a managing committee.

After successfully registering for the LUT, you can fill out the GST RFD-11 form to file LUT.

From the next year, you can renew the LUT by following the same process above. You only have to upload a copy of the previous LUT as an additional step.

Receive Seamless Export Payments with Skydo

With a Letter of Undertaking (LUT), exporters don't have to bear tax payments on exports. This way they save money in an easy manner and can use the funds for other business operations. While LUT helps them save money, Skydo helps them get paid by overseas clients on time. Skydo creates virtual accounts where their clients can transfer money instantly. These accounts are linked to their bank account in India where the money gets credited automatically.

When they use a virtual account to accept payments, they don't have to pay SWIFT fees which are levied on international bank transfers. Moreover, they don't have to bear hidden charges as Skydo follows a transparent pricing policy. Skydo is the perfect partner to expand an exporter’s international trade. Sign up for free and start accepting payments now!

What documents are required for LUT filing?

No documents are required for LUT filing. However, when you are renewing LUT, you must upload the LUT from the previous financial year.

How long is LUT valid and when should I renew it?

What happens if I export without an LUT?

What should I do if my LUT application is rejected?