Stop Negotiating for FX: Get Real-Time FX Rates With Zero Hidden Fees

A foreign client pays $2000, but you get ~$1700 in your bank account, less than what you expected.

Now, you are trying to calculate the foreign transaction fee and foreign exchange rate (FX rate) and understand what other hidden charges have been levied but are facing a hard time doing so.

Many small businesses lose money because of a lack of transparency in foreign payments and hidden fees charged by banks and other payment platforms.

How can you overcome this challenge? Switch to transparent payment solutions like Skydo that tell the live FX rates. Let’s understand how you can check real-time FX rates with Skydo and reduce unnecessary deductions.

Introducing Skydo's Real-time FX Rates

According to a report by SWIFT, the three primary reasons that frustrate small business owners while using an international payment platform are:

- Lack of clarity on FX rates during currency exchange

- Hidden fees

- Foreign payments delivery failure

Skydo aims to resolve these issues. It provides live FX rates on its dashboard and charges zero-margin on currency exchange so you don’t end up paying extra costs. Moreover, Skydo charges flat foreign transaction fees, thus ensuring complete transparency in foreign payments.

Here is how understanding live FX rates on Skydo can help your business.

1. Eliminate the Need for Negotiation

Bank FX rates are usually different from the live FX rates. For example, if the $1 amounts to ₹83 as per the prevailing market rate, banks offer ₹80 for every $1. This is called the forex markup fee.

Businesses have to negotiate the FX rates with banks to ensure maximum earnings. However, Skydo offers live FX rates and converts the currency as per the prevailing market rate. This boosts your earnings.

Moreover, many businesses try to negotiate a fixed payment in INR with foreign clients to reduce the FX rate fluctuation risk.

2. Mitigate Risk

Rapid fluctuations in the foreign exchange market increase business risk. However, by viewing live FX rates, you can analyse when to apply hedging strategies to secure your earnings.

Moreover, you can calculate your exact earnings based on the real-time FX rates and optimise your cash flow accordingly.

3. Set Competitive Prices

Staying updated with currency fluctuations is extremely important for businesses to adjust their pricing.

For example, if the value of the domestic currency increases against the foreign currency, the price of your goods and services will become higher for foreign customers. This will result in low demand.

Therefore, you should track live FX rates to set competitive pricing and boost revenue.

Ensuring Financial Transparency with Skydo

Tracking foreign payments is hard for businesses. Banks and foreign payment platforms make it harder by gatekeeping various costs involved.

But, Skydo offers complete transparency.

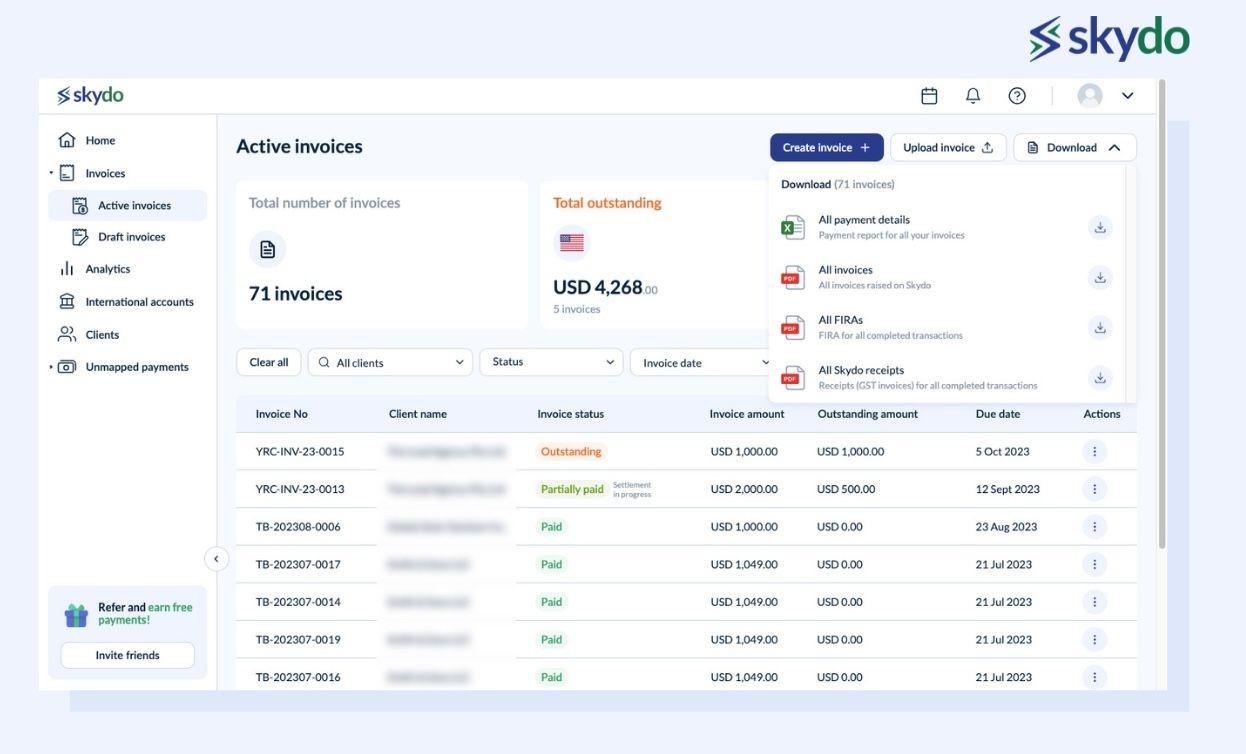

1. Robust Payment Tracking System

You can open an international bank accounts account with Skydo within five minutes and receive payments from foreign clients in international bank accounts.

You can view the live FX rate before transferring the money to your domestic bank account. If the international market is volatile, you can hold the money in your foreign bank account to avoid currency conversion losses.

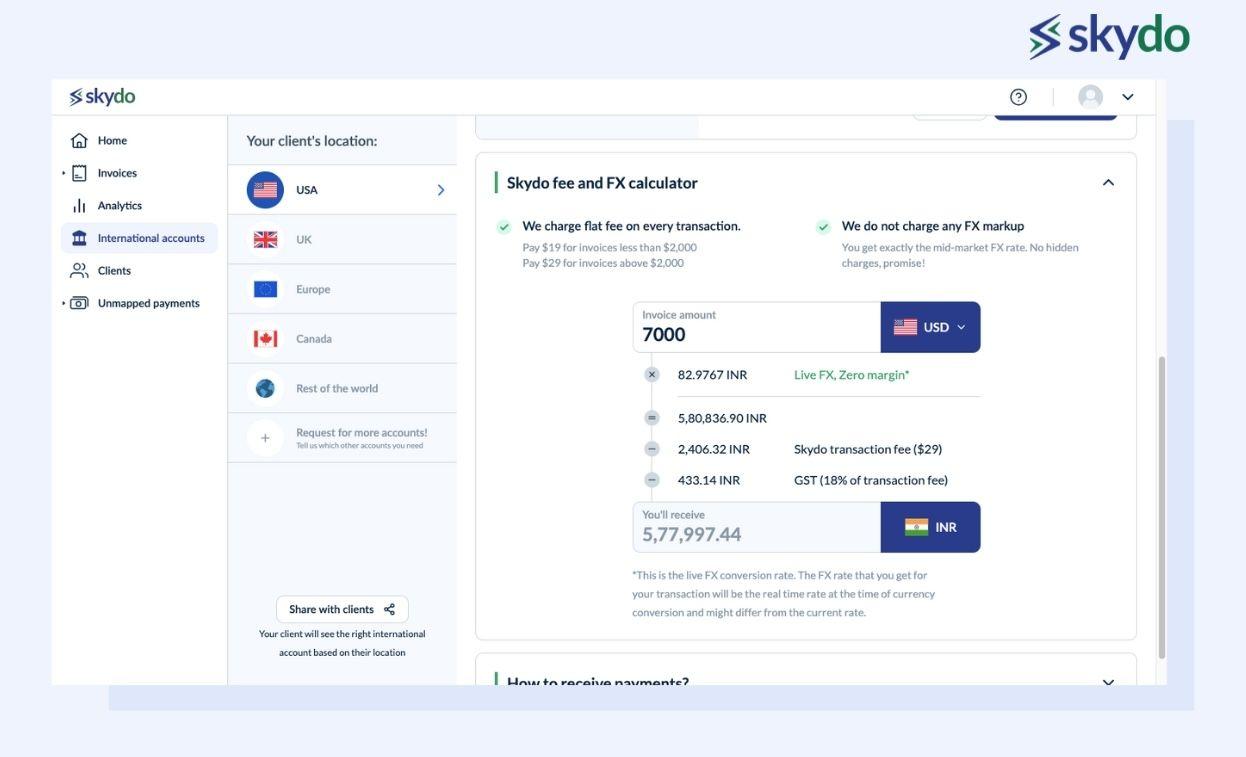

Use Skydo's FX calculator to see how much money you can save on your FX rates based on your monthly revenue.

2. View a Clear Breakdown of Exchange Rates and Associated Costs

With Skydo, you are always updated on why your money is being deducted. You can view a clear breakdown of the flat transaction fee levied, the GST application to the transaction fee, and the FX rates for each invoice.

Moreover, Skydo also marks a date and time stamp during currency conversion to ensure that the money is converted as per prevailing market rates.

3. Zero Margin on Currency Conversion

Most payment platforms like PayPal and Payoneer charge a 3-5% currency conversion fee on top of the foreign transaction fee. Moreover, banks also charge forex fees on every transaction.

These additional costs reduce your earnings significantly, especially if you deal with many foreign clients.

However, Skydo charges zero margin for currency conversion. It converts the total amount based on the prevailing market rate without changing any forex fee. This increases your FX savings by up to 50%.

3. Pay Zero Fees to Download FIRA Receipts

FIRA is a mandatory document for exporters for GST compliance. Banks charge ₹500 or more on every foreign transaction to generate FIRA.

However, Skydo automatically generates FIRA receipts for each invoice without charging an additional fee. Therefore, it helps you maximise FX savings.

Conclusion

Expanding your business globally helps you increase earnings and scale your business. However, high forex fees, foreign transaction fees and hidden fees charged by payment platforms impact your earning potential and slow down business growth.

Therefore, you can track live FX rates through Skydo to maximise your FX savings.

Sign up on Skydo today to receive foreign payments at low costs!

Q1. How do changes in FX rates impact my business?

Ans. High FX rates impact your profitability by reducing the actual amount you earn from a foreign transaction. It impacts business cash flow and overall financial performance.

Q2. How can I check live FX rates on Skydo?

Q3. How can I reduce the risk of currency conversion?