Global Payments Trends 2024

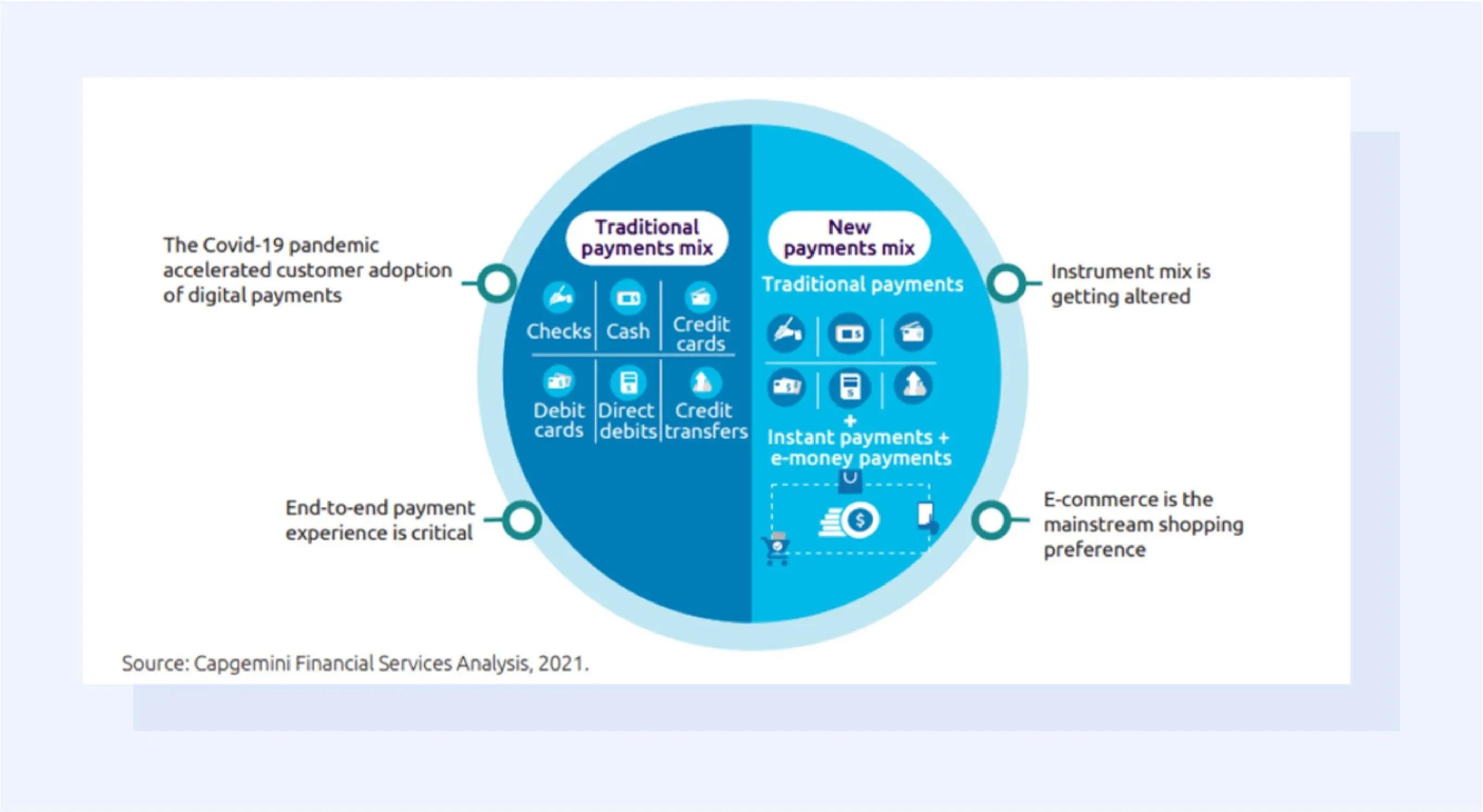

The increased adoption of digital payments has catalysed a movement towards a cashless society. Electronic payments grew by 19% in 2021, and the 2022 FIS Global Payments Report predicts that this rapid digitalisation will bring down cash usage to 9.8% in 2025 from 17.9% in 2021. The convenience, speed, and hygiene benefits of digital payments have appealed to consumers and will consequently lead to a decline in cash usage.

To reinvent themselves to the changing landscape, Payment Service Providers (PSPs), Financial institutions (FIs), merchants, and corporations are attempting a shapeshift to deliver on customer expectations through innovative and efficient solutions.

This intersection of factors has resulted in new trends emerging in the global payments landscape. This article takes a deep dive into the trends that will drive value in the future.

What are Global Payments?

Real-time payments are transactions that are processed and settled instantly, providing immediate availability of funds to the recipient. Unlike traditional payment methods that involve delays and batch processing, real-time payments enable businesses to send and receive funds in a matter of seconds, even across different financial institutions.

These payments have emerged as a growing trend in business transactions, revolutionising payment processes and enhancing the efficiency and speed of financial transactions. The Q2 of 2022 saw 15% of the total volume on The Clearing House’s RTP network going to instant payroll.

As an IT export service provider, you often operate in a dynamic environment, delivering services remotely and engaging with clients globally. Real-time payments enable you to receive payments promptly, eliminating delays and providing immediate confirmation of successful transactions. This improves cash flow and allows you to focus on delivering exceptional services without being hindered by payment processing bottlenecks.

Small businesses, especially, are finding real-time payments a boon as they enhance cyber security and fraud detection, and improve customer experience and overall financial management.

Cryptocurrencies and Blockchain in Instant Global Payments

Blockchain technology is a decentralised, distributed ledger that records transactions across multiple computers, providing transparency, stability, and security. Cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that leverage blockchain technology as a means of exchange and store of value.

Cryptocurrencies have been gaining prominence as alternative payment modes. Thousands of merchants accept Bitcoin as a payment mode today, and a few countries such as El Salvador and the Central African Republic (CAR) have accepted Bitcoin as a legal tender. Similarly, blockchain-based payments are also gaining prominence, especially in cross-border payments.

However, certain challenges and considerations for IT export service providers in using blockchain technology and cryptocurrencies for cross-border payments are regulatory compliance and cryptocurrency volatility.

- Regulatory Compliance: Cryptocurrencies operate in an evolving regulatory landscape, and adhering to legal requirements can be complex and time-consuming. You must navigate these regulations to ensure compliance and avoid potential legal issues.

- Cryptocurrency Volatility: The value of cryptocurrencies can fluctuate significantly within short periods, posing financial risks. While cryptocurrencies offer potential gains, they also carry the risk of financial losses. You must carefully manage these risks and evaluate the feasibility of accepting cryptocurrencies based on their risk tolerance and business objectives.

58% of cross-border businesses use at least one cryptocurrency, and 56% use blockchain technology. Another report finds that 61% of FIs realise the need to offer access to cryptocurrency payments, but only 10% support such decentralised payments.

Thus, while blockchain technology and cryptocurrencies can change the face of cross-border payments, it’s important to consider the challenges to making an informed payment-related decision.

Harnessing the Power of Artificial Intelligence and Machine Learning in Payment Processing

AI and ML analyse vast amounts of transactional data to identify patterns and detect emerging ones to improve security, fraud detection, and risk assessment. Chatbots for automated customer service support is another use case where AI and ML are finding utility in payments.

The FinTech industry is increasingly using AI and machine learning technologies to enhance payment processes by automating data analysis for quicker and more accurate customer insights. By leveraging AI in fintechs, organisations can efficiently improve the accuracy of the predictions for improved decision-making.

IT service exporters can develop and deploy AI-powered solutions that enhance payment security, optimize risk management, and deliver exceptional customer experiences. They can leverage these technologies to build intelligent payment systems, integrate fraud detection capabilities, and develop advanced analytics tools for risk assessment. You can also consider partnering with a payment gateway like Skydo that provides all these features and more.

By embracing AI and machine learning, IT service providers can differentiate themselves in the market, attract new clients, and provide innovative solutions to businesses in the payments industry.

The Rise of Contactless Payments

An outcome of the global pandemic is the increasing use of contactless payment facilities, where Australia was the biggest market for contactless cards at 92% market share. This shift towards a more seamless and practical payment method affects how businesses and IT service providers shape the ultimate customer experience around digital payments.

The transactions using contactless payments are quicker, safer, and more convenient. You simply need to tap your card or phone, and the transaction occurs. Besides cards, digital wallets, and online payment apps like Apple Pay, Google Pay, etc., have driven up digital payments and led to a sharp decline in cash-led payments globally.

For IT service export businesses, embracing contactless payments is crucial to stay competitive and meet customer expectations. By offering contactless payment options, you can provide a seamless and modern payment experience, attracting tech-savvy customers. Contactless payments also enable businesses to streamline operations, reduce cash handling costs, and optimize checkout efficiency.

Considering these benefits, it’s crucial to realign your business to adapt to the change by accepting contactless payments, simplifying checkout procedures, improving security measures, and utilising mobile payment applications.

Innovative P2P Payments

Innovative P2P payments are emerging as a pivotal trend in the global business landscape, driven by the increasing demand for convenience and streamlined financial transactions.

P2P payment apps like Skydo, PayPal, and Venmo have garnered widespread popularity, with 84% of consumers embracing these services. The sector's revenue has surged by over 200% in the past decade, reflecting a robust growth trajectory. Notably, the development of P2P payment apps is poised to be a lucrative venture in 2023, especially in retail, financial institutions, telecommunications, logistics, and tech sectors.

This trend encompasses diverse applications, including cryptocurrency transfers, non-commercial fundraising apps, and P2P loans, reshaping the dynamics of global transactions.

Understanding Regulatory Changes in Global Payments

Multiple changes in regulatory frameworks such as BASEL III norms, PSD2, Single Euro Payments Area (SEPA), etc., have driven the core Automated Clearing House (ACH) to the real-time payments system. 54 countries use real-time payment systems today and continue to modernise the financial and payments ecosystem led by regulatory support.

ISO 20022 was introduced by the SWIFT network in 2004 to overlook cross-border payments. However, its adoption has lagged over time and requires immediate attention to eliminate the vulnerabilities caused by the unstructured nature of data in digital payments.

Implementing ISO 20022 can enable seamless and automated reconciliation, cover payment initiation and interbank settlement, and mitigate transaction risks.

Unfortunately, only 10% of international transactions go through a compliance check, states SWIFT. IT export services businesses must realise that regulatory frameworks would only help make the system more robust and secure. Providers must comply with regulations to retain customers' trust, foster accountability and transparency, and build cost-effective solutions.

Embedded Finance: A New Frontier in IT Services

Embedded finance is a fast-growing payment trend, especially for non-financial businesses. The history of embedded finance dates back to when e-commerce sites like Amazon integrated payments into their checkout flow. Today, the concept has expanded to include innovative payment solutions like Buy Now, Pay Later (BNPL).

Lending and insurance platforms also adapt their offerings to integrate embedded finance to enhance customer experience. Embedded finance is soon going to a $700 billion-worth industry.

There are many opportunities for IT service providers to integrate financing with payments at the point of delivery to the customers. Zero-interest fees and flexible repayment plans have led to more customers seeking a convenient, secure and easy way to finance their purchases while still shopping on an e-commerce platform.

Businesses are banking on this opportunity to develop next-generation models with underwriting models to serve customers with different credit ratings. For instance, 65% of businesses planned to add BNPL as a payment method in 2022.

Some IT service providers have introduced debit and reward programs with attractive terms and conditions to encourage adoption. Other ways businesses are bringing embedded finance into play include improving customer relationships, broadening services, offering loans and brokerage accounts, and facilitating crypto payments.

The Way Ahead

IT service providers play a vital role in this evolving payments technology landscape, as they have the expertise and capabilities to support businesses in embracing these changes. They can help clients integrate real-time payment solutions, leverage blockchain technology, enhance security through AI and machine learning, and facilitate the adoption of contactless payment systems.

By staying informed about payment trends, regulatory changes, and emerging technologies, IT service providers can position themselves as trusted partners and navigate the dynamic payment landscape effectively.

For IT export service providers operating in India, the context is particularly significant. India has witnessed a rapid digital transformation in recent years as online currencies have become more common in recent years. Initiatives like the Unified Payments Interface (UPI) driving the adoption of digital payments.

You should be at the forefront of exploring innovative global payment solutions, adapting to regulatory changes such as data protection and open banking, and embracing the benefits of digital payments and emerging technologies.

In this changing landscape, the call to action for IT service providers is clear. It is essential to proactively explore and understand innovative payment solutions, regulatory requirements, and emerging trends.

If you are an IT export services provider in India, seize the opportunity to explore global payment trends, understand regulatory changes, and establish yourselves as a trusted partner in this evolving landscape.

Frequently Asked Questions

Q1. What Are Global Payments?

Ans: Global payments refer to financial transactions conducted across international borders, involving the transfer of funds or assets between parties in different countries.

Q2. How Do Global Payments Work?

Ans: Global payments work through electronic systems that facilitate the transfer of funds between individuals, businesses, or financial institutions across the world, often involving currency conversions and compliance with international regulations.

Q3.Why Do You Think There Is a Need for More Regulation of Global Payments Companies?

Ans: Increased regulation of global payments companies is essential to ensure transparency, security, and compliance with anti-money laundering laws, preventing financial crimes and protecting consumers globally.

Q4. What is a Global Payment System?

Ans: A global payment system is a network that enables the transfer of money or value between individuals, businesses, or financial institutions internationally, typically involving various payment methods and currencies.

Q5. What is a Payment Bank?

Ans: A Payment Bank is a financial institution that provides limited banking services, focusing primarily on facilitating transactions such as payments, remittances, and deposits, without offering extensive lending or credit services.