A Quick Guide to Forecasting Currency Exchange in 2024

Businesses and individuals that send or receive payments in foreign currencies must understand the currency trends and the affective factor to predict an ideal currency exchange rate.

Whether you're a seasoned investor, a business leader, or someone keen on understanding the evolving financial ecosystem, this blog highlights the potential trends and influences affecting the currency exchange rate, valuation, and a table with the currency exchange forecast this year.

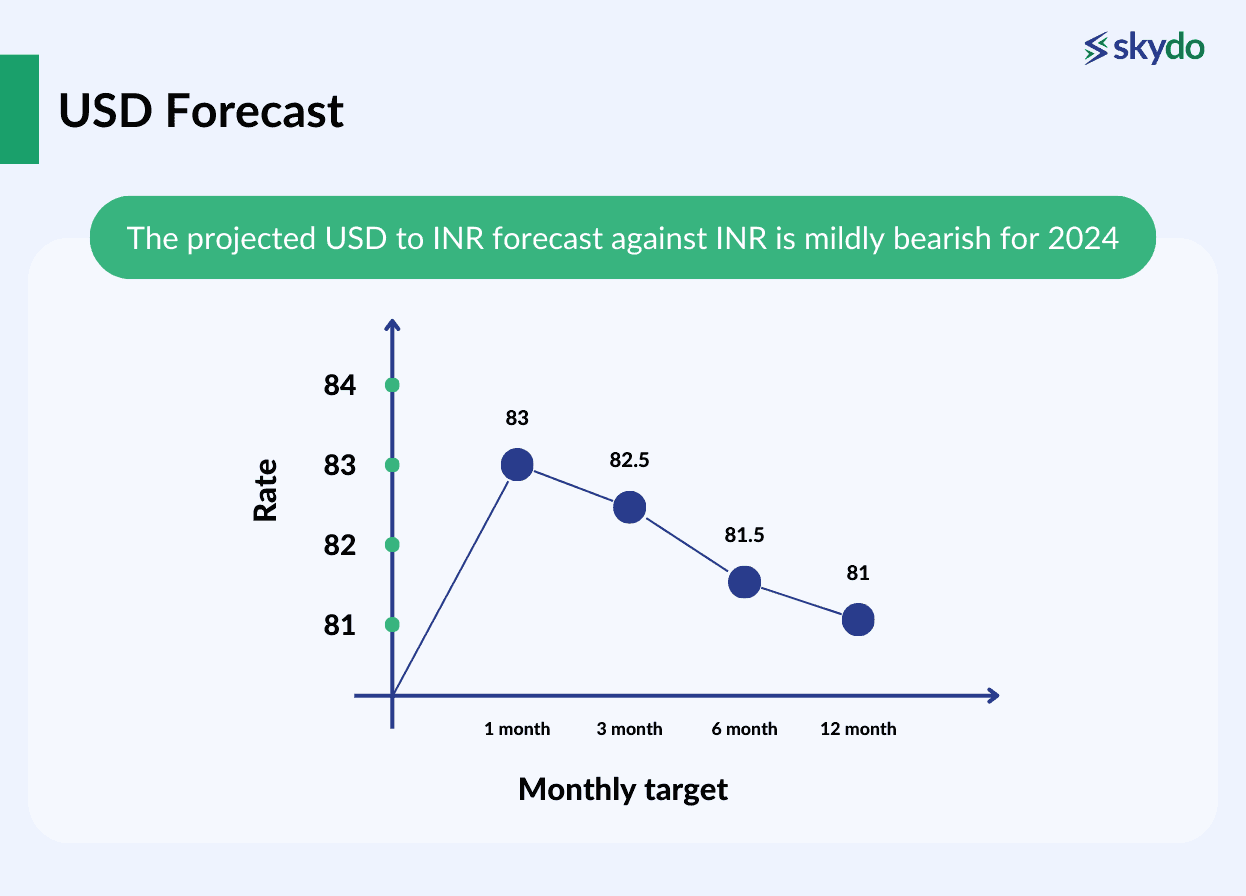

USD Forecast

The United States economy saw a drop during the COVID-19 pandemic. However, it has witnessed a strong GDP recovery as it has outperformed expectations in three key dimensions: slowing inflation, labour market resilience, and economic output.

The US GDP has increased to 6.1% in Q4 of 2023, which is the highest among all major countries. Inflation fell to 3.2% in October from 3.7% in September, below the market estimation of 3.3%.

The projected USD to INR forecast against INR is mildly bearish for 2024, as experts believe that the 1-month target is 83.00, the 3-month target is 82.50, the 6-month target is 81.50, and the 12-month target is 81.00.

| Month/Year | Low Rate | High Rate | Average Rate |

|---|---|---|---|

| Feb'24 | 83.14 | 83.2338 | 83.1869 |

| Mar'24 | 83.14 | 83.2338 | 83.1869 |

| Apr'24 | 83.14 | 83.2338 | 83.1869 |

| May'24 | 83.1114 | 83.3275 | 83.21945 |

| Jun'24 | 83.1114 | 83.3275 | 83.21945 |

| Jul'24 | 83.1114 | 83.3275 | 83.21945 |

| Aug'24 | 83.0735 | 83.4 | 83.23675 |

| Sep'24 | 83.0735 | 83.4 | 83.23675 |

| Oct'24 | 83.0735 | 83.4 | 83.23675 |

| Nov'24 | 83.27 | 83.3056 | 83.2878 |

| Dec'24 | 83.27 | 83.3056 | 83.2878 |

| Jan'25 | 83.27 | 83.3056 | 83.2878 |

Source: https://www.bookmyforex.com/currency-converter/usd-to-inr/forecast/

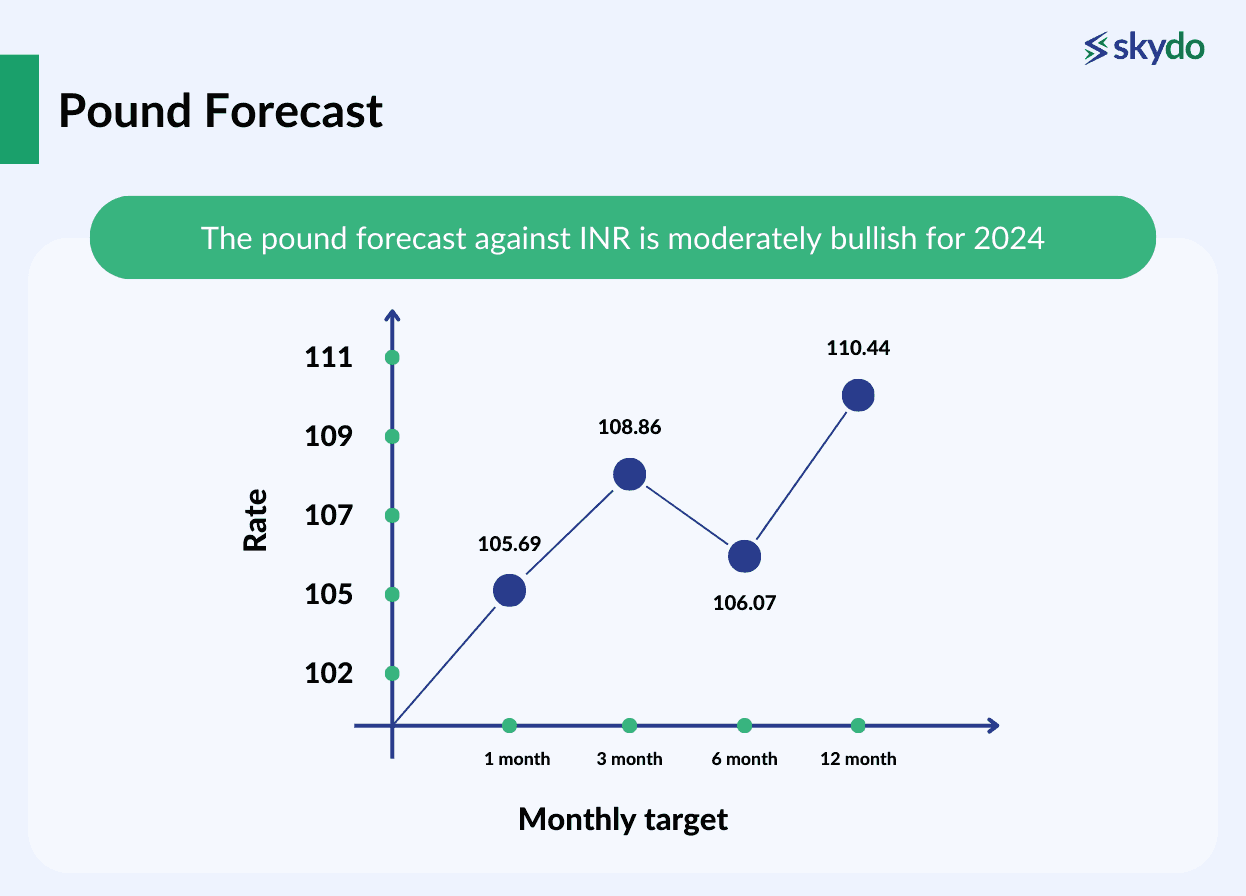

Pound Forecast

The UK economy has beat expert estimates to perform better than expected in 2023. At the start of the year, it was expected that the UK's GDP was expected to fall by 1%. However, experts now expect the GDP to grow by 0.5% by the end of 2023.

On a year-on-year basis, business investment in the UK grew by 6.3% in Q3 of 2023, and household consumption was up by 0.3%. Furthermore, the UK’s GDP is thriving based on the headline CPI inflation, which decreased to 4.6% in October.

The pound forecast against INR is moderately bullish for 2024 and can reach 105.69 in the next month, 108.86 in three months, 106.07 in six months, and 110.44 by the end of 2024.

| Month/Year | Low Rate | High Rate | Average Rate |

|---|---|---|---|

| Feb'24 | 105.977 | 105.9952 | 105.9861 |

| Mar'24 | 105.977 | 105.9952 | 105.9861 |

| Apr'24 | 105.977 | 105.9952 | 105.9861 |

| May'24 | 105.9102 | 105.9588 | 105.9345 |

| Jun'24 | 105.9102 | 105.9588 | 105.9345 |

| Jul'24 | 105.9102 | 105.9588 | 105.9345 |

| Aug'24 | 105.1548 | 106.5938 | 105.8743 |

| Sep'24 | 105.1548 | 106.5938 | 105.8743 |

| Oct'24 | 105.1548 | 106.5938 | 105.8743 |

| Nov'24 | 102.7925 | 108.4399 | 105.6162 |

| Dec'24 | 102.7925 | 108.4399 | 105.6162 |

| Jan'25 | 102.7925 | 108.4399 | 105.6162 |

Source: https://www.bookmyforex.com/currency-converter/gbp-to-inr/forecast/

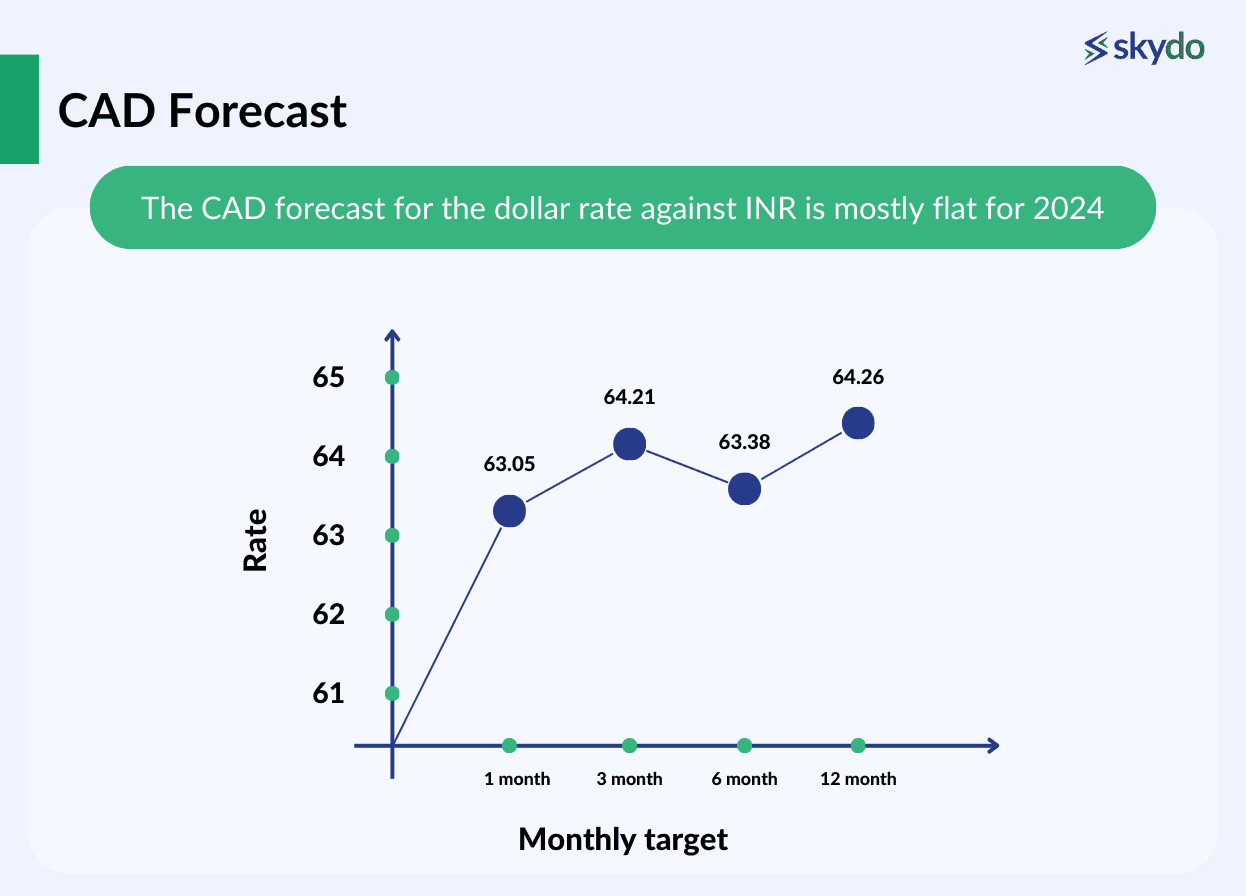

CAD Forecast

The Canadian economy showed a mild slowdown toward mid-2023 owing to higher borrowing costs. The employment rate is also declining as the labour demand is lower than last year. However, inflation eased to 3.8% in September, down from 4% in August.

As of the end of 2023, Canada's GDP is estimated to be $1.919 trillion, and the nominal GDP was approximately $2.117 trillion, making it the world's tenth-largest economy.

The CAD forecast for the dollar rate against INR is mostly flat for 2024, as experts believe that the 1-month target is 63.05, the 3-month target is 64.21, the 6-month target is 63.38, and the 12-month target is 64.26.

| Month/Year | Low Rate | High Rate | Average Rate |

|---|---|---|---|

| Feb'24 | 62.2912 | 62.3919 | 62.34155 |

| Mar'24 | 62.2912 | 62.3919 | 62.34155 |

| Apr'24 | 62.2912 | 62.3919 | 62.34155 |

| May'24 | 62.2478 | 62.4925 | 62.37015 |

| Jun'24 | 62.2478 | 62.4925 | 62.37015 |

| Jul'24 | 62.2478 | 62.4925 | 62.37015 |

| Aug'24 | 62.1528 | 65.0903 | 63.62155 |

| Sep'24 | 62.1528 | 65.0903 | 63.62155 |

| Oct'24 | 62.1528 | 65.0903 | 63.62155 |

| Nov'24 | 61.142 | 61.9921 | 61.56705 |

| Dec'24 | 61.142 | 61.9921 | 61.56705 |

| Jan'25 | 61.142 | 61.9921 | 61.56705 |

Source: https://www.bookmyforex.com/currency-converter/cad-to-inr/forecast/

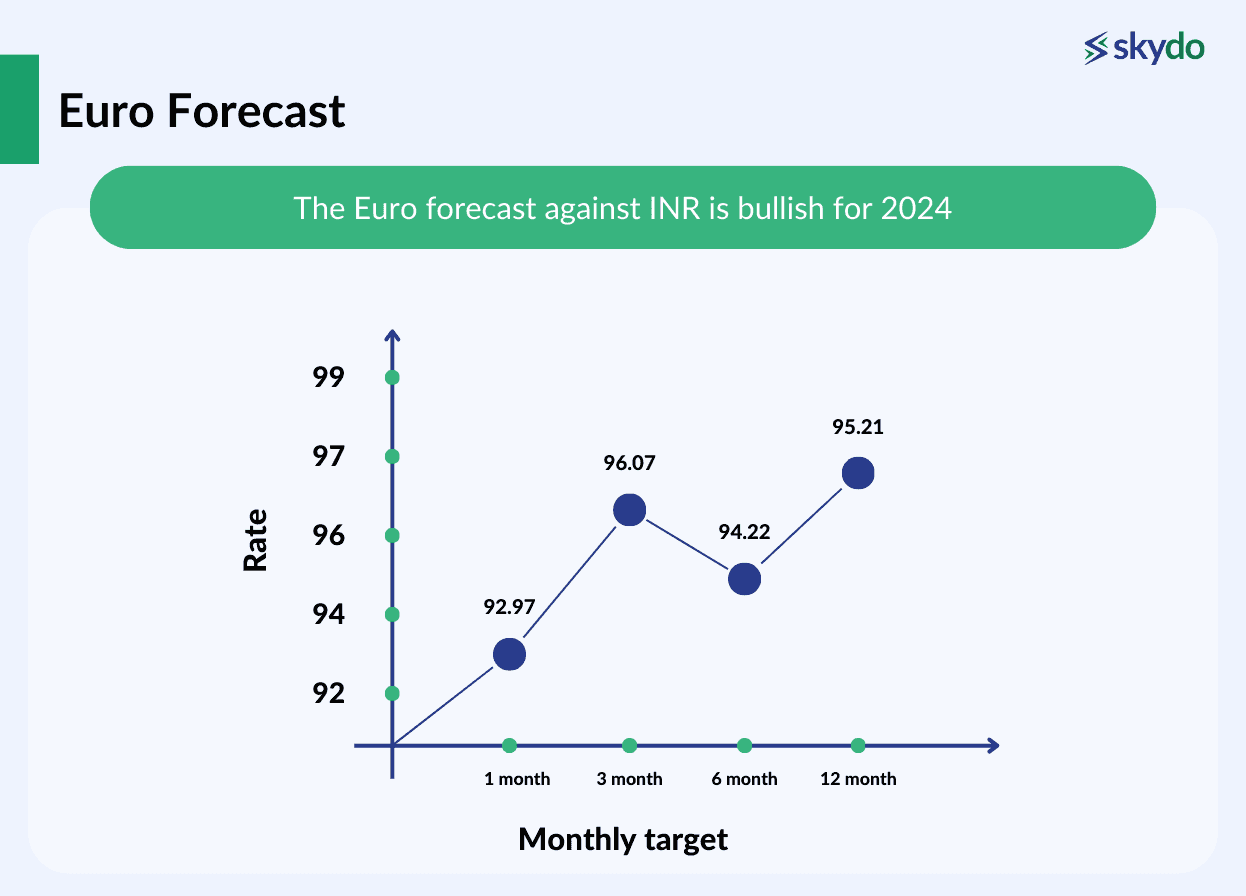

Euro Forecast

Germany’s economy is facing multiple challenges as it is witnessing a decline in industrial production along with a decreasing construction sector. Currently, as per the European Commission, Germany’s GDP is expected to shrink by 0.4% by the end of 2023. However, it expects Germany’s inflation to decrease and reach 6.4% by the end of 2023.

The Euro forecast against INR is bullish for 2024, as experts believe that the 1-month target is 92.97, the 3-month target is 96.07, the 6-month target is 94.22, and the 12-month target is 95.21.

| Month/Year | Low Rate | High Rate | Average Rate |

|---|---|---|---|

| Feb'24 | 91.0666 | 91.16 | 91.1133 |

| Mar'24 | 91.0666 | 91.16 | 91.1133 |

| Apr'24 | 91.0666 | 91.16 | 91.1133 |

| May'24 | 91.0877 | 91.2534 | 91.17055 |

| Jun'24 | 91.0877 | 91.2534 | 91.17055 |

| Jul'24 | 91.0877 | 91.2534 | 91.17055 |

| Aug'24 | 90.9217 | 94.2484 | 92.58505 |

| Sep'24 | 90.9217 | 94.2484 | 92.58505 |

| Oct'24 | 90.9217 | 94.2484 | 92.58505 |

| Nov'24 | 87.8548 | 92.4232 | 90.139 |

| Dec'24 | 87.8548 | 92.4232 | 90.139 |

| Jan'25 | 87.8548 | 92.4232 | 90.139 |

Source: https://www.bookmyforex.com/currency-converter/eur-to-inr/forecast/

Dirham Forecast

The United Arab Emirates (UAE) GDP is one of the fastest growing and is the second-largest economy in the Middle East. In 2023, the UAE witnessed a substantial rise of 3.7% in its GDP in the first half of the year.

Currently, the International Monetary Fund (IMF) expects the UAE’s economy to grow at a rate of 4.2% by the end of 2023, with the labour force participation rate expected to reach 82.7%.

The Dirham (AED) forecast against INR is mostly flat for 2024 and can reach 22.50 in the next month, 22.59 in three months, 22.86 in six months, and 22.68 by the end of 2024.

| Month/Year | Low Rate | High Rate | Average Rate |

|---|---|---|---|

| Feb'24 | 22.6385 | 22.6641 | 22.6513 |

| Mar'24 | 22.6385 | 22.6641 | 22.6513 |

| Apr'24 | 22.6385 | 22.6641 | 22.6513 |

| May'24 | 22.6307 | 22.6896 | 22.66015 |

| Jun'24 | 22.6307 | 22.6896 | 22.66015 |

| Jul'24 | 22.6307 | 22.6896 | 22.66015 |

| Aug'24 | 22.6204 | 22.7093 | 22.66485 |

| Sep'24 | 22.6204 | 22.7093 | 22.66485 |

| Oct'24 | 22.6204 | 22.7093 | 22.66485 |

| Nov'24 | 22.6739 | 22.6837 | 22.6788 |

| Dec'24 | 22.6739 | 22.6837 | 22.6788 |

| Jan'25 | 22.6739 | 22.6837 | 22.6788 |

Source: https://www.bookmyforex.com/currency-converter/aed-to-inr/forecast/

AUD Forecast

The Australian economy performed slightly positively as of September 2023, as the GDP grew to 0.2% due to higher capital investment and increased government consumption. However, the growth rate has slowed due to cost of living pressures and higher interest rates.

Currently, Australia is the 14 largest economy worldwide by nominal GDP and has shown improved performance as unemployment has been low and the industrial output is above potential.

The AUD forecast against INR is slightly bearish for 2024, as experts believe that the 1-month target is 58.64, the 3-month target is 59.62, the 6-month target is 58.26, and the 12-month target is 56.84.

| Month/Year | Low Rate | High Rate | Average Rate |

|---|---|---|---|

| Feb'24 | 55.8701 | 56.4092 | 56.13965 |

| Mar'24 | 55.8701 | 56.4092 | 56.13965 |

| Apr'24 | 55.8701 | 56.4092 | 56.13965 |

| May'24 | 55.9509 | 56.9482 | 56.44955 |

| Jun'24 | 55.9509 | 56.9482 | 56.44955 |

| Jul'24 | 55.9509 | 56.9482 | 56.44955 |

| Aug'24 | 54.8577 | 57.8151 | 56.3364 |

| Sep'24 | 54.8577 | 57.8151 | 56.3364 |

| Oct'24 | 54.8577 | 57.8151 | 56.3364 |

| Nov'24 | 53.7555 | 58.973 | 56.36425 |

| Dec'24 | 53.7555 | 58.973 | 56.36425 |

| Jan'25 | 53.7555 | 58.973 | 56.36425 |

Source: https://www.bookmyforex.com/currency-converter/aud-to-inr/forecast/

Factors Influencing Currency Trends

Analysing currency trends is vital if you have exposure to international currencies, as the currency exchange rates fluctuate in real-time, resulting in increasing or decreasing the money you send or receive. However, to analyse currency trends effectively, it is vital first to understand the factors that influence currency trends and result in real-time currency exchange rate fluctuations.

Here are the factors influencing currency trends:

1. Global economic indicators

A country with stable economic conditions witnesses a lower currency exchange rate fluctuation than a country going through an economic slowdown.

Countries with higher GDP growth rates often experience stronger currencies as they indicate a robust and expanding economy, attracting foreign investment. Factors such as manufacturing and services PMI, industrial production, and consumer confidence can also affect currency trends.

If a country has a higher unemployment rate, the local currency witnesses a weak status against other currencies of countries with a lower unemployment rate, as higher unemployment rates may indicate economic weakness.

Furthermore, currency values are affected by how well a country manages economic factors such as inflation and deflation. Here, a country’s central bank is responsible for managing both factors to ensure a stable currency value.

2. Political events and stability

The political landscape of a country influences the currency as it reciprocates with the mindset of consumers based on how they think the economy will perform. Political stability fosters investor confidence, positively impacting currency values. However, if a country is politically uncertain, the currency trend may turn negative.

Furthermore, Political events, such as elections or government instability, can lead to currency fluctuations owing to economic and geographical uncertainty. For example, foreign institutional investors refrain from investing during elections as the government may change, bringing new rules that may further add to currency fluctuations.

3. Central bank policies

A country’s central bank is the main regulatory authority that manages and regulates the money flow in the economy. For example, in India, the RBI manages the money flow by increasing or decreasing the key interest rates, such as repo or reverse repo rates. Higher interest rates attract foreign capital, increasing demand for the currency and strengthening the currency value.

However, at times of recession, the central banks can lower the key interest rates to inject money into the economy and ensure people have more disposable income. However, this can increase the supply and result in currency depreciation.

4. Technological advancements and market innovations

Currency trends are generally positive for a technologically advanced and innovative country. Technological advancements can affect a country's economic competitiveness, influencing its currency. Innovation and technological progress can attract investment and impact currency values.

For example, a country embracing new technologies such as blockchain and digital currencies can positively influence traditional currency markets, strengthening the currency valuation.

Furthermore, a country with new-age fintech innovation through fintech firms can affect the efficiency and accessibility of financial markets, potentially influencing currency trends.

Risk Factors and Uncertainties

Currency trends and forecasts, such as USD to INR history, are subject to a variety of factors, and while analysts strive to provide accurate predictions, there are always uncertainties in the global economic landscape. For example, most currency trend-affecting factors are dynamic and can change based on unforeseen economic events.

Unexpected economic developments, such as natural disasters, economic crises, or sudden changes in global demand, can disrupt currency trends. Furthermore, political instability, conflicts, or unexpected geopolitical events can significantly and suddenly impact currency values.

Businesses and investors can mitigate the negative effects of influencing factors by diversifying their portfolios across different asset classes, diligently assessing risks, and staying informed about market trends. Adopting a long-term perspective, seeking professional advice, and maintaining cash reserves provide additional tools for navigating market fluctuations.

Conclusion

International currencies trade in pairs, which means that their value is compared against another currency to determine how much one has to pay to get the desired foreign currency account. For individuals and businesses with international exposure and dealing in foreign currencies, it is vital to understand the factors that can affect the currency exchange rate.

As currency value fluctuates in real-time, it is crucial to understand the currency trends to predict if the foreign currency you hold can increase or decrease in value. Understanding these currency trends can allow you to determine the ideal time to convert the currency into INR and get the most amount for the foreign currency.

If you receive payments in foreign currencies, you can create an account on Skydo. It creates a virtual currency account, which you can use to hold foreign currencies and convert them at the best currency exchange rate.

FAQs

Q1. What are the key factors influencing the 2024 forecast for USD, Pound, CAD, Euro, Dirham, and AUD?

Ans: The factors include global economic indicators, geopolitical events, central bank policies, trade agreements, and specific regional factors impacting the USD, Pound, CAD, Euro, Dirham, and AUD.

Q2. How can investors and businesses use the 2024 currency forecast to create their strategies?

Ans: Whether you're a currency trader, investor, or business leader, understanding the forecasted trends can assist in making informed decisions and adapting strategies to the anticipated currency movements in the year ahead. Hence, understand the factors that can influence currency trends in detail and make strategies accordingly.

Q3. What are some factors other than economic factors that could affect currency movements?

Ans: Some factors are market sentiment, currency manipulation, health crisis, geological tensions, and technological advancement.