Five International Payment Problems That Entrepreneurs Need Solutions

Despite the efforts of business owners to manage their finances, they face various international payments-related problems, such as late payments, non-payment, fraudulent transactions, and fluctuating currency rates. These issues significantly impact a business's cash flow, profitability, and general operations.

Moreover, banks impose significant fees for payment-related services, including transaction, currency conversion, and processing fees. A study by Forrester found that companies lose an average of 2% of their revenue to payment processing fees.

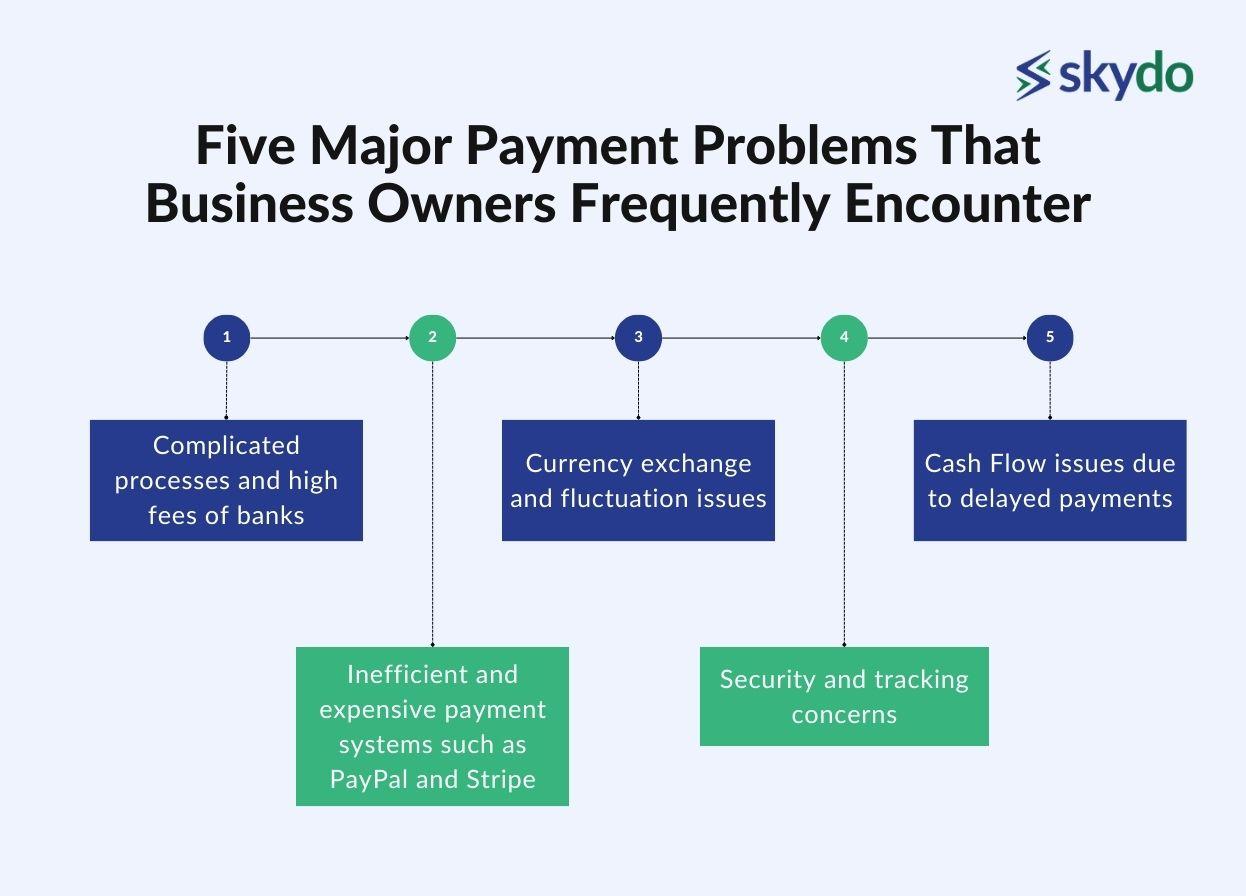

Let’s drill down five major payment problems that business owners frequently encounter.

#1: Complicated processes and high fees of banks

Banks are vital for financing, foreign exchange transactions, and international payments. However, their products and services are often not tailored to specific business needs, resulting in high fees, poor experience, and cumbersome processes.

Navigating the banking world can feel like a game of Minesweeper, where a wrong move could result in an explosion of high fees and cash flow difficulties. For instance, if you choose a bank with high foreign transaction fees, you could lose more money every time you transfer funds.

Choosing between a standard checking account and an EEFC account can be further challenging. An EEFC account allows foreign currency transactions, while a standard one allows local currency transactions exclusively. Different banks have distinct requirements for opening and maintaining an EEFC account. Choosing the right account type can help manage cash flows efficiently and minimise foreign exchange risks.

#2: Inefficient and expensive payment systems such as PayPal and Stripe

PayPal and Stripe are popular payment systems used for international payments. However, these payment systems have high transaction fees, conversion charges, and regulatory issues that may affect your profit. Additionally, they take longer to provide the FIRA document, which is proof of payment for foreign transactions.

Freelancer.com faced financial difficulties in 2018 when PayPal froze $380,000 of its funds due to restrictions on certain transactions and compliance with anti-money laundering regulations. Freelancer.com had to explore alternative payment methods to continue its global operations and mitigate the risks of relying solely on PayPal for its transactions.

Similarly, in December 2020, Patreon faced a backlash from the community when they passed on new fees from Stripe to their creators. The new fees included additional fees for international and European transactions, resulting in higher transaction costs for Patreon creators and impacting their earnings.

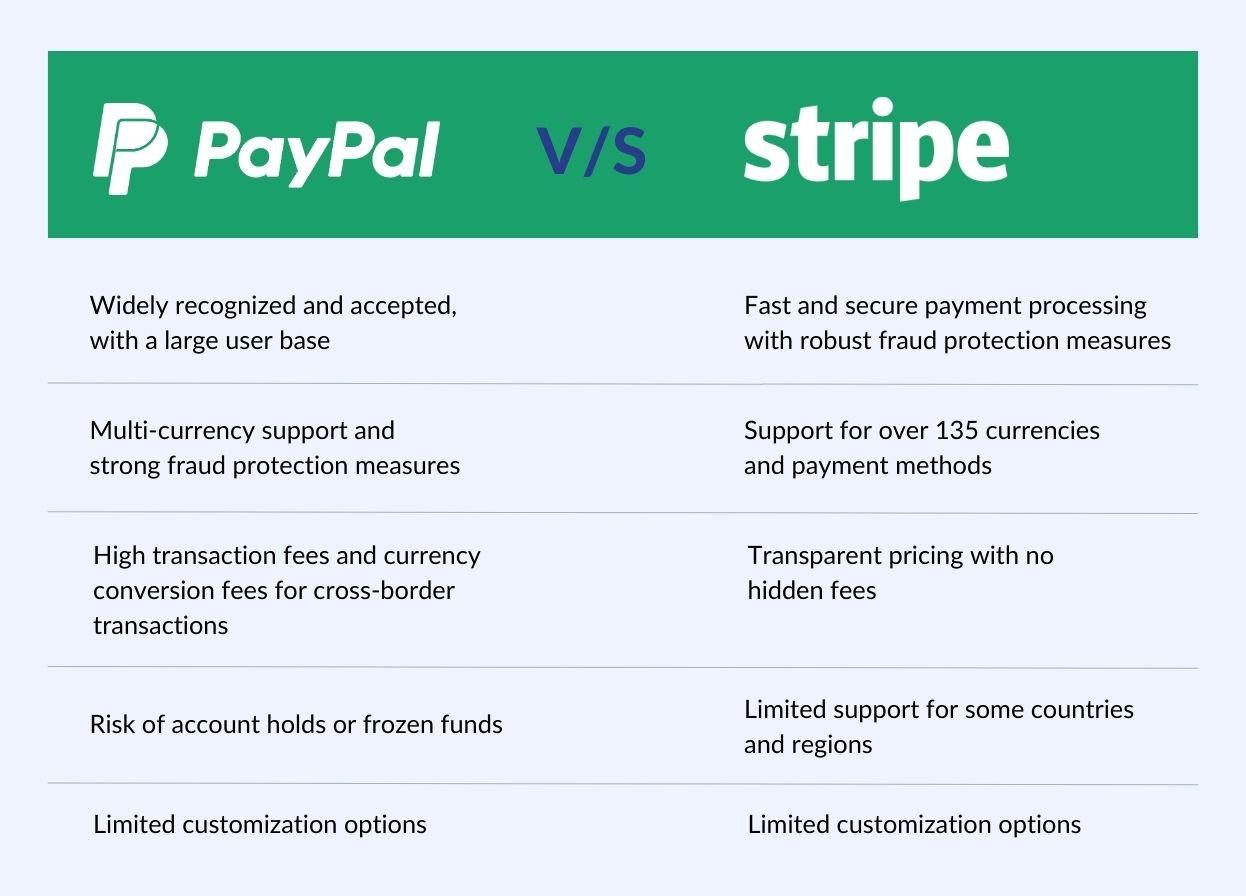

Comparison of PayPal and Stripe as payment systems–

PayPal:

- Widely recognised and accepted, with a large user base

- Multi-currency support and strong fraud protection measures

- High transaction fees and currency conversion fees for cross-border transactions

- Risk of account holds or frozen funds

- Limited customisation options

Stripe:

- Fast and secure payment processing with robust fraud protection measures

- Support for over 135 currencies and payment methods

- Transparent pricing with no hidden fees

- Limited support for some countries and regions

- Limited customisation options

#3: Currency exchange and fluctuation issues

Currency exchange rate fluctuations can significantly impact your profitability in the global market, requiring constant monitoring and adjusting prices.

Currency exchange providers add a markup to the exchange rate, an additional fee they charge for the service. By overlooking the hidden foreign exchange costs and focusing solely on the sale price, you may have unknowingly incurred losses due to FX markup.

While this cost may seem like a small percentage, it compounds over time. This markup can affect the money you receive, reducing the exchange rate and increasing the transaction cost.

Furthermore, currency exchange volatility caused by the pandemic has significantly impacted business owners, leading to the following.

- Pricing difficulties

- Reduced demand

- Increased costs

- Negative impacts on cash flow

You can take several steps to manage currency exchange and fluctuation issues, such as–

- Using financial instruments

- Diversifying their customer base and product offerings

- Maintaining healthy relationships with banks and financial institutions

#4: Security and tracking concerns

Payment security is a concern due to fraudulent transactions, inaccurate invoicing, and cybersecurity threats like phishing and hacking. 74% of companies experienced attempted or actual payment fraud in 2020, with wire transfer fraud being the most common.

Additionally, disparate payment systems and processes across different countries and currencies can create complexities and inefficiencies, further complicating payment tracking and reconciliation.

Some common security threats in export payments include the following.

- Invoice fraud, where fake invoices or altered payment instructions deceive the business owner into sending funds to fraudulent accounts

- Payment fraud, where criminals intercept or alter payment information to redirect funds to their accounts

- Fraudulent buyers who misrepresent their ability to pay or use fake bank statements or references to deceive business owners

- Chargebacks or disputes over payment terms, where buyers claim that goods were not received or damaged, leading to delayed or reduced payments

- Currency fluctuations or devaluations that impact the value of payments and affect the profitability of the business

Ensuring proper documentation, using secure payment methods, and verifying the counterparty's identity can help mitigate these risks, ensure smooth transactions, and stay vigilant against potential fraud or cyber-attacks.

#5: Cash Flow issues due to delayed payments

Delayed payments in a business are like that one friend who always promises to pay you back but never actually does. You may feel like you're constantly chasing them down for payment, but in the end, you still have to wait for the money to come in. Some common reasons for delayed payments for business owners are–

- Disputes over payment terms or delivery of goods

- Delays in processing or transferring payments due to bureaucratic or administrative issues

- Financial difficulties or cash flow problems of the buyer

- Issues with shipping or delivery, such as delays or damage to the goods

- Miscommunication or lack of clarity regarding payment expectations or procedures

64% of respondents in a related survey reported that late payments significantly impact their business operations, with 33% indicating that it affects their ability to pay suppliers. It further results in cash flow problems and affects their ability to fulfil orders, pay suppliers, and invest in future business ventures.

Additionally, you may lose customer trust and credibility if you cannot manage your finances effectively.

Common issues faced by business owners:

- Delays in payment processing due to complicated documentation procedures

- Disputes over charges and processing fees.

- Inadequate communication and poor customer service from the bank

- Currency conversion fees can be substantial and impact the profit margin

- Lack of transparency and visibility into the payment process

- Issues with compliance and regulatory requirements can lead to penalties and fines

- Limited availability of banking services that meet the business's specific needs

Then, how can you manage payments effectively?

In the highly competitive landscape of today's business world, you need a reliable partner to traverse the intricacies of international trade. Skydo assists you in managing international payments by setting up international accounts to accept payments seamlessly and unlock:

- Lowest flat fee per payment and zero markups on FX

- Instant FIRA with every transaction, downloadable at any time from your dashboard

- End-to-end payments tracking

- Easy reconciliation between your invoices and payments

- Better customer experience for payments

These let you focus on core business activities, confidently expand your operations and maximise cash flow.

Contact us today to manage your payments effectively and excel in the global marketplace.

FAQS

Q1. What steps can businesses take to mitigate currency exchange and fluctuation issues?

Ans: Businesses can use financial instruments, diversify their customer base and product offerings, and maintain strong relationships with banks and financial institutions.

Q2.How can businesses ensure payment security and tracking in international transactions?

Ans: Ensuring proper documentation, using secure payment methods, and verifying the counterparty's identity can help mitigate security risks and ensure smooth payment tracking.

Q3. How do currency exchange and fluctuation issues impact global businesses?

Ans: Currency exchange fluctuations can affect profitability. Hidden foreign exchange costs, added by providers, compound over time. Managing these issues involves using financial instruments and maintaining strong relationships.

Q4. What security concerns do business owners face in international payments?

Ans: Security issues include fraudulent transactions, invoice fraud, payment fraud, and cybersecurity threats. Mitigating risks involves proper documentation, secure payment methods, and identity verification.