How Can the Right Chartered Accountant Help Your Tech Export Business?

Cash flow problems. Poor investment decisions.

Unplanned levels of debt. Complex international tax laws.

Inefficient operations. And inadequate financial planning.

Such risks in a tech export business are not isolated - they're interconnected and often causative. However, they have a common solution: having a good chartered accountant on your side.

With their finance, taxation, and regulatory expertise, chartered accountants can help you navigate the choppy waters of international business and ensure your enterprise stays afloat. They can help you optimise your finances, reduce your tax burden, and make strategic decisions that position your business for success.

However, it's not just about avoiding pitfalls- a chartered accountant can also help you seize opportunities and chart a course for growth.

9 Ways a Chartered Accountant Can Help Your Tech Export Business

When managing finances, you may face several daunting challenges, especially if you are unfamiliar with the intricacies of international business. While not a miracle worker, a CA can help you with many aspects of financial management or, at the very least, give you sound advice upon which you can act.

CA Ravi Mamodiya, a seasoned chartered accountant professional, explains, “Understanding the numbers in your business is essential, but interpreting them is where the real value lies. From an economic perspective, pricing has a compounding effect on your margins, and distribution costs can impact your sales. Effective communication of these numbers is crucial, and your CA can help you identify areas where your business strategy may be falling short.”

Lean towards your CA when you need assistance in the following areas.

1. Budgeting and Financial Analysis

While operating internationally, your tech export business may have to deal with multiple currencies and their highly volatile exchange rates. These fluctuations can significantly impact your bottom line, making it difficult to plan and forecast finances accurately.

A CA can help you develop a realistic budget for your business, considering factors such as cash flow, revenue projections, and capital expenditures. They analyse your financial statements and identify areas to improve your profitability. This way, the right CA can help you develop a cash flow management plan, ensuring you have enough cash to meet your financial obligations and make strategic investments in your business.

2. International Tax Laws

Every country has its tax regulations which govern domestic transactions. These can be complex and dynamic. For example, if you provide consulting services in the US, you must comply with their tax regulations, file tax returns, and withhold taxes on payments made to the Indian business. However, keeping up with tax laws in different countries is time-consuming and costly.

A CA can help you understand these laws and ensure compliance. They can help you understand the difference between withholding taxes for domestic and import/export transactions. They can also help businesses with the necessary documentation, such as Form 15CA and Form 15CB, which are required for making international payments.

3. Payment Methods and Invoicing

Exporting your services to countries with unique financial requirements, such as different payment methods and invoicing practices, is challenging.

For example, a US-based client may prefer a specific payment method that is not common in India. You need to ensure they are set up to receive payment through the client's preferred method, whether it is a wire transfer, credit card, or another method. You must be aware of any charges involved when accepting payments through these avenues.

A CA can help you navigate the invoicing and payments process and ensure they comply with all regulatory requirements.

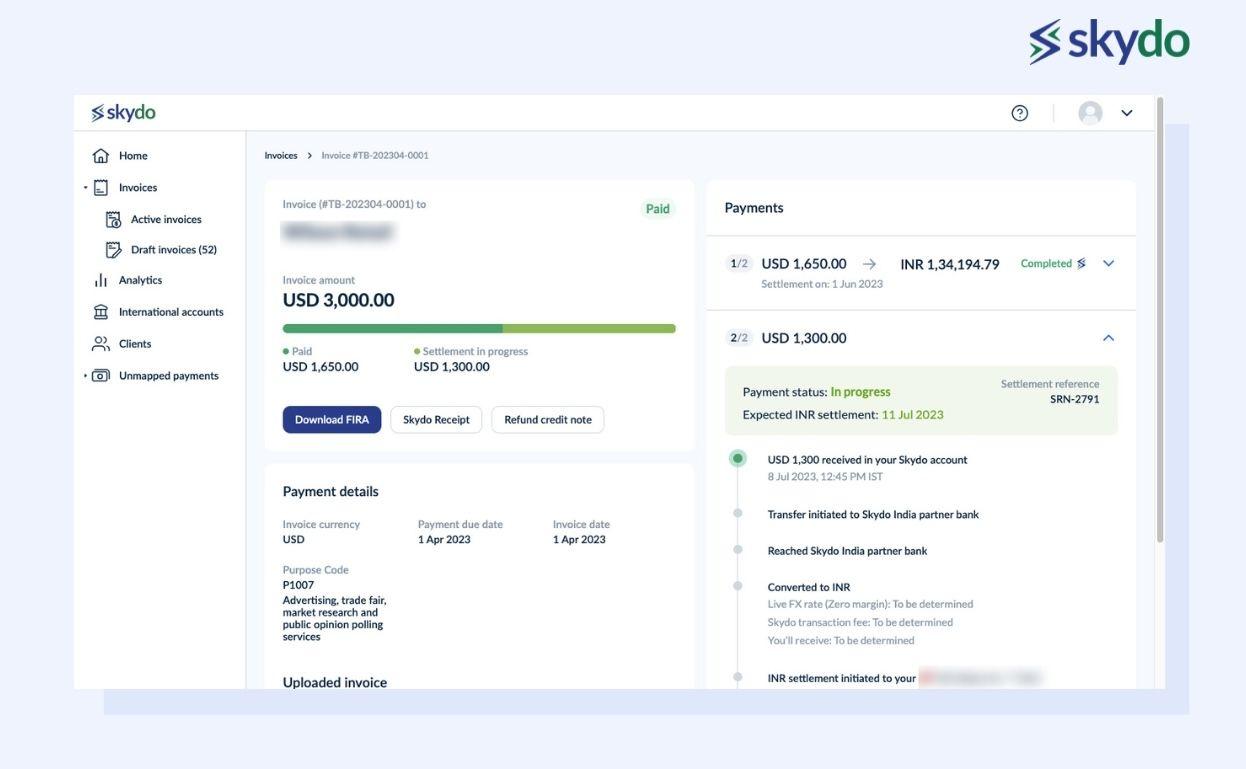

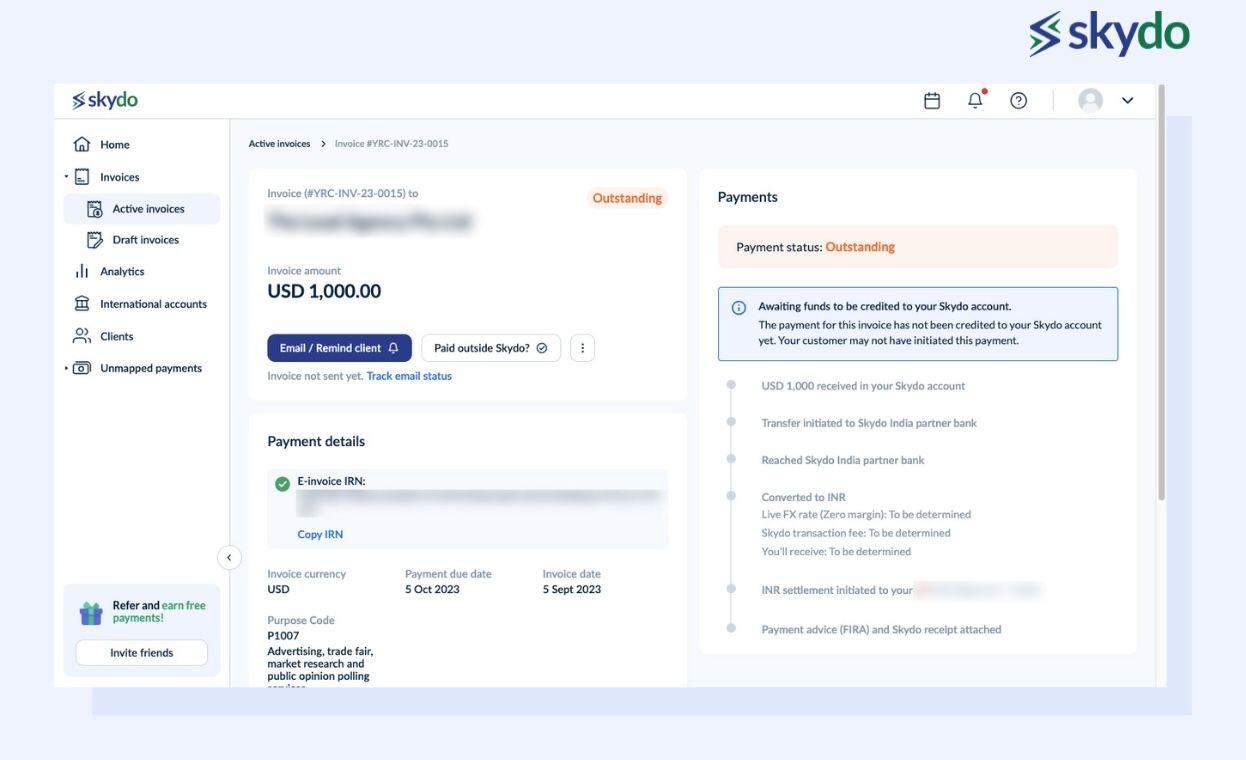

Concerning payment methods, Rohit Khurana, a Chartered Accountant professional and finance lead at Skydo, explained, “A CA can help you to understand the costs involved across the different payment methods. There are some costs that are visible and apparent, but there are some costs that are not apparent, like FX markup, etc. In payment methods, a CA can guide you to analyse regulatory mechanisms and cost comparisons.”

4. Post-Payments Compliance

After making international payments, businesses need to comply with the Foreign Exchange Management Act (FEMA) regulations. One of the key requirements under FEMA is filing the Foreign Inward Remittance Certificate (FIRC) with the bank. A Chartered Accountant (CA) can help you comply and avoid penalties.

Additionally, the Goods and Services Tax (GST) is a crucial part of business in India. All businesses, including tech export businesses, must comply with GST regulations. Although there is no GST payable on invoices denominated in foreign currency, a CA can help you understand the payments of reverse charges and how to claim refunds, among other regulations.

To avoid tax penalties, Rohit Khurana, a chartered accountant professional and finance lead at Skydo, suggests, “Any payment channel you are using needs to ensure that the channel provides you FIRC for all the foreign payments. If the Income Tax Department charges you for not paying the GST, you can provide FIRCs for all your foreign payments.”

5. Claiming Subsidies and Incentives Applicable

The Indian government offers various subsidies and incentives to promote exports. However, the challenge lies in the right way to claim them. A good CA can help you understand these and help you assert their benefits.

For example, the government offers various export promotion schemes, such as the Merchandise Exports from India Scheme (MEIS) and the Service Exports from India Scheme (SEIS).

6. Transfer Pricing

Also known as the price that one company's subsidiary charges another subsidiary for goods or services, it can be complex, especially for tech export businesses operating in multiple countries. A CA can ensure that you follow the proper transfer pricing guidelines, which helps you avoid potential penalties and get a fair price for your goods or services.

7. Entity Structuring in India

This step is crucial in setting up a tech export business. A CA helps you choose among the various legal structures available, such as Limited Liability Partnership (LLP), Private Limited Company (PLC), Sole Proprietorship, and One Person Company (OPC).

8. Drafting SOPs

CAs can help businesses develop Standard Operating Procedures (SOPs), which can help ensure that repetitive tasks are standardised, saving time and preventing human error.

9. Accounting and Bookkeeping

CAs ensure that your financial records are accurate, up-to-date, and compliant with relevant laws and regulations. It helps eliminate the need for in-house high-cost resources until your business is large enough to support a full-time team.

“It's important to bring diverse perspectives and strategies to your business, including cross-border expertise and a global mindset. With this approach, you can navigate international tax laws and other challenges and stay competitive in a global marketplace,” states CA Ravi Mamodiya.

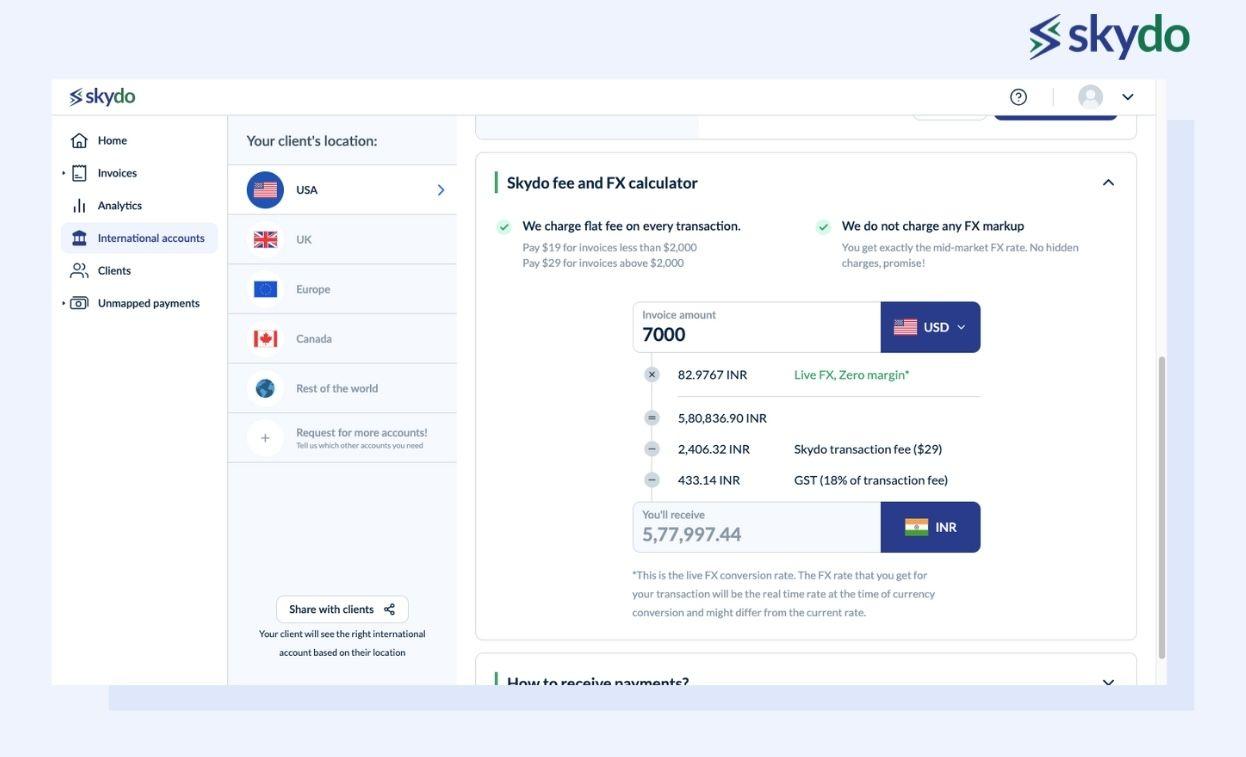

How Skydo Can Help

If you're running a business that deals with international transactions, we know how tough it can be to manage payments and currency exchange. That's where Skydo comes in.

We’re a payment partner that can help simplify things and save money.

One of the ways we can help you is by providing competitive FX rates for transactions. This means you won't have to worry about paying high conversion fees or dealing with unfavourable foreign exchange rates. We also eliminate the need for multiple bank accounts in different currencies, saving you time and hassle.

Skydo can help you streamline invoice payments and manage your cash flow so you can focus on growing your business.

With our user-friendly platform, you can track payments in real-time and stay on top of your finances.

International trade is a highly competitive arena where every opportunity counts. By working with a trusted chartered accountant, you can streamline your business’s financial operations, reduce costs, and improve profitability. Look for professionals with expertise in navigating complex financial regulations, optimising tax planning, and ensuring regulatory compliance.

Furthermore, with the right payment partner, you can automate your business’s payment processing, reduce errors and fraud, and improve cash flow. When choosing a payment partner, look for a provider offering flexible, scalable solutions tailored to your specific needs. The provider should have a proven track record of reliability and security, with robust fraud detection and prevention measures in place.

Key Takeaways

- Tech export businesses face several financial challenges, including cash flow problems, poor investment decisions, unplanned levels of debt, complex international tax laws, and inefficient operations. Inadequate financial planning can exacerbate these issues.

- Chartered accountants (CAs) can help tech export businesses navigate these challenges with their expertise in finance, taxation, and business strategy.

- Some of the ways CAs can assist include entity structuring, tax understanding and compliance, invoicing and payment processing, post-payment compliance, GST filing, and claiming subsidies and incentives.

- CAs offer a wide range of services beyond tax planning and compliance, such as drafting SOPs, budgeting, transfer pricing, financial analysis, and accounting and bookkeeping.

- Collaborating with a CA and a payment partner is crucial for the success of tech export businesses, as they can help optimise financial operations, reduce costs, and improve cash flow.

Frequently Asked Questions

Q1. Why do I need a chartered accountant for my tech export business?

Ans: A chartered accountant brings expertise in financial management, compliance, and taxation, ensuring your tech export business adheres to regulations, maximises profits, and maintains financial health.

Q2. What specific services can a chartered accountant offer to my tech export business?

Ans: Chartered accountants can provide services such as tax planning, financial audits, risk management, and advice on international transactions. They play a crucial role in ensuring compliance with complex regulations in the tech export industry.

Q3. How can a chartered accountant assist in optimising tax liabilities for my tech export business?

Ans: Chartered accountants specialise in tax planning strategies, helping your tech export business minimise tax liabilities legally. They can identify tax incentives, credits, and deductions that apply to the tech industry, ensuring you retain more of your earnings.

Q4. How does a chartered accountant help in managing cross-border transactions for my tech exports?

Ans: Chartered accountants understand the intricacies of international finance and can guide your business through the complexities of cross-border transactions, ensuring compliance with regulations, mitigating risks, and maximising financial efficiency.

Q5. Can a chartered accountant help in budgeting and financial forecasting for my tech export business?

Ans: Yes, chartered accountants play a crucial role in budgeting and financial forecasting. They analyse historical data, market trends, and business goals to create realistic financial plans, helping your tech export business make informed decisions and achieve long-term success.

Q6. How can a chartered accountant assist in risk management for my tech export business?

Ans: Chartered accountants evaluate potential risks and implement strategies to mitigate them. Whether it's currency fluctuations, regulatory changes, or market uncertainties, they help your tech export business navigate challenges and maintain financial stability.

Q7. Will a chartered accountant help in preparing financial reports for stakeholders and investors?

Ans: Absolutely. Chartered accountants are skilled in preparing accurate and comprehensive financial reports. This is vital for gaining investor confidence, meeting regulatory requirements, and providing stakeholders with a clear picture of your tech export business's financial performance.

Q8. How can a chartered accountant contribute to the overall growth and strategy of my tech export business?

Ans: Chartered accountants act as financial advisors, helping your tech export business make strategic decisions based on sound financial analysis. Their insights into financial data and market trends contribute significantly to the overall growth and success of your business.