RoDTEP Scheme: Benefits, Rates, Eligibility, and Key Features Explained (2024)

The Government of India introduced the Remission of Duties and Taxes on Exported Products, RoDTEP, on 1st January 2021, replacing the previous MEIS (Merchandise Exports from India Scheme).

Being WTO compliant, RoDTEP aims to align with international trade standards while continuing to provide essential support to exporters.

Under this scheme, exporters can claim reimbursement for various taxes and duties paid on the export of goods including GST (Goods and Services Tax), customs duties, and other levies. By reimbursing these taxes and duties, RoDTEP aims to make Indian exports more competitive globally.

This article elaborates on the RoDTEP scheme rates, the applicable industries, benefits, and how to avail of them.

What are RoDTEP scheme rates?

The Central Government notified the RoDTEP scheme rates and guidelines on 17th August 2021. These rates vary across sectors, ranging from 0.5% to 4% of the export value for which exporters can claim reimbursement. The government however, is yet to notify a fixed quantum of rebate per unit for certain export items.

The RoDTEP scheme rates are available in Appendix 4R and on the Directorate General of Foreign Trade (DGFT) website.

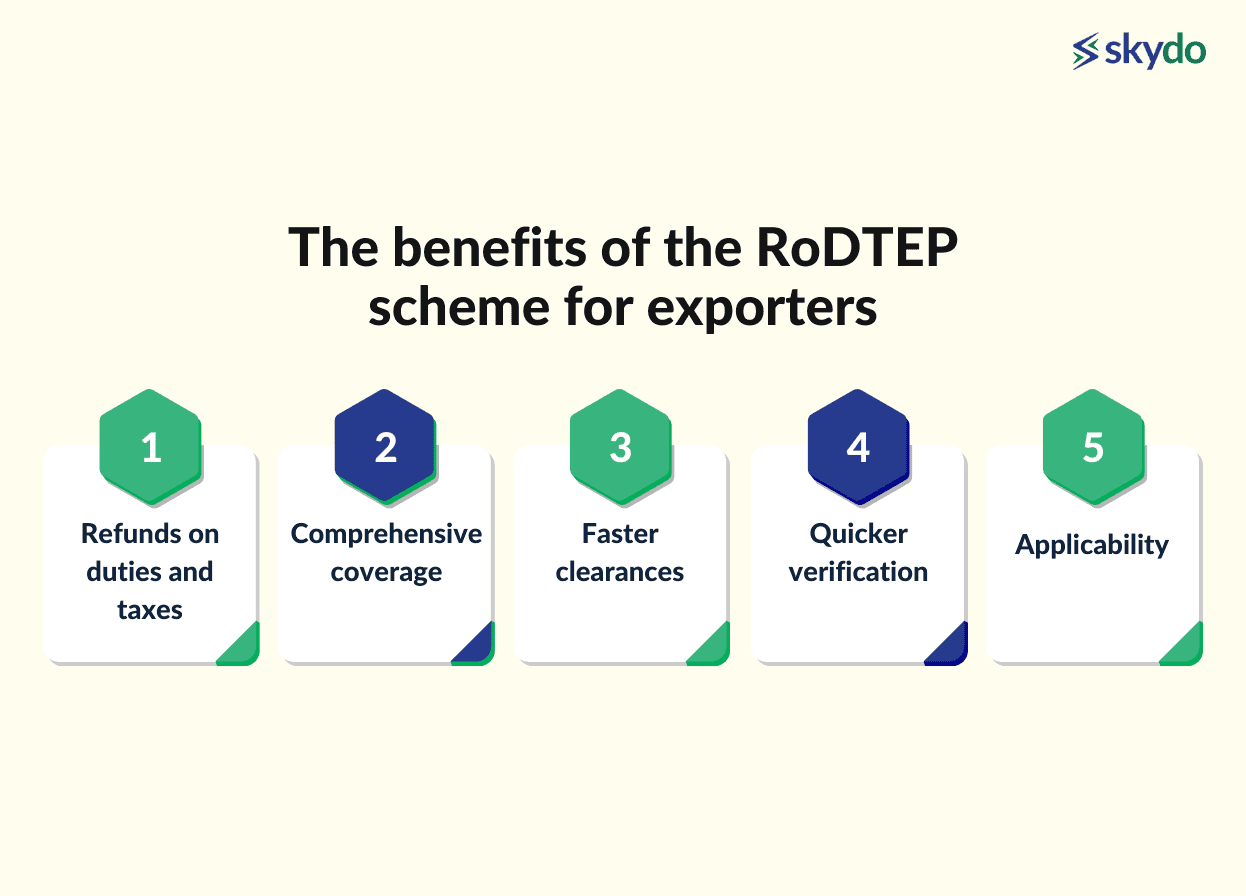

Benefits of the RoDTEP Scheme for Exporters

- Refunds on Duties and Taxes

The RoDTEP Scheme enables exporters to claim refunds on duties and taxes that were previously non-refundable. This includes Mandi tax, VAT, Coal cess, and more, providing additional financial relief to exporters.

- Comprehensive Coverage

Benefits under the RoDTEP Scheme extends to all items previously covered under the MEIS and RoSCTL (Rebate of State and Central Taxes and Levies) schemes. It ensures that a wide range of products across various industries can benefit from the scheme's incentives.

- Faster Clearances

The scheme reduces paperwork and administrative hurdles, allowing exporters to focus more on their core business activities.

Refunds will be in the form of transferable electronic scrips, ensuring a seamless process for exporters. These duty credits will be managed and tracked through an electronic ledger, providing transparency and efficiency in refund processing.

- Quicker Verification

The RoDTEP Scheme leverages an IT-based verification system, potentially reducing the time required for verification processes. It enhances efficiency and expedites the refund process for exporters.

- Applicability

Unlike previous schemes that may have been sector-specific, RoDTEP applies to all exporters of goods, including textiles, steel, pharmaceuticals, and chemicals. It ensures equal opportunities and benefits for exporters across various industries, contributing to overall sectoral growth and development.

Let’s look at the applicable industries.

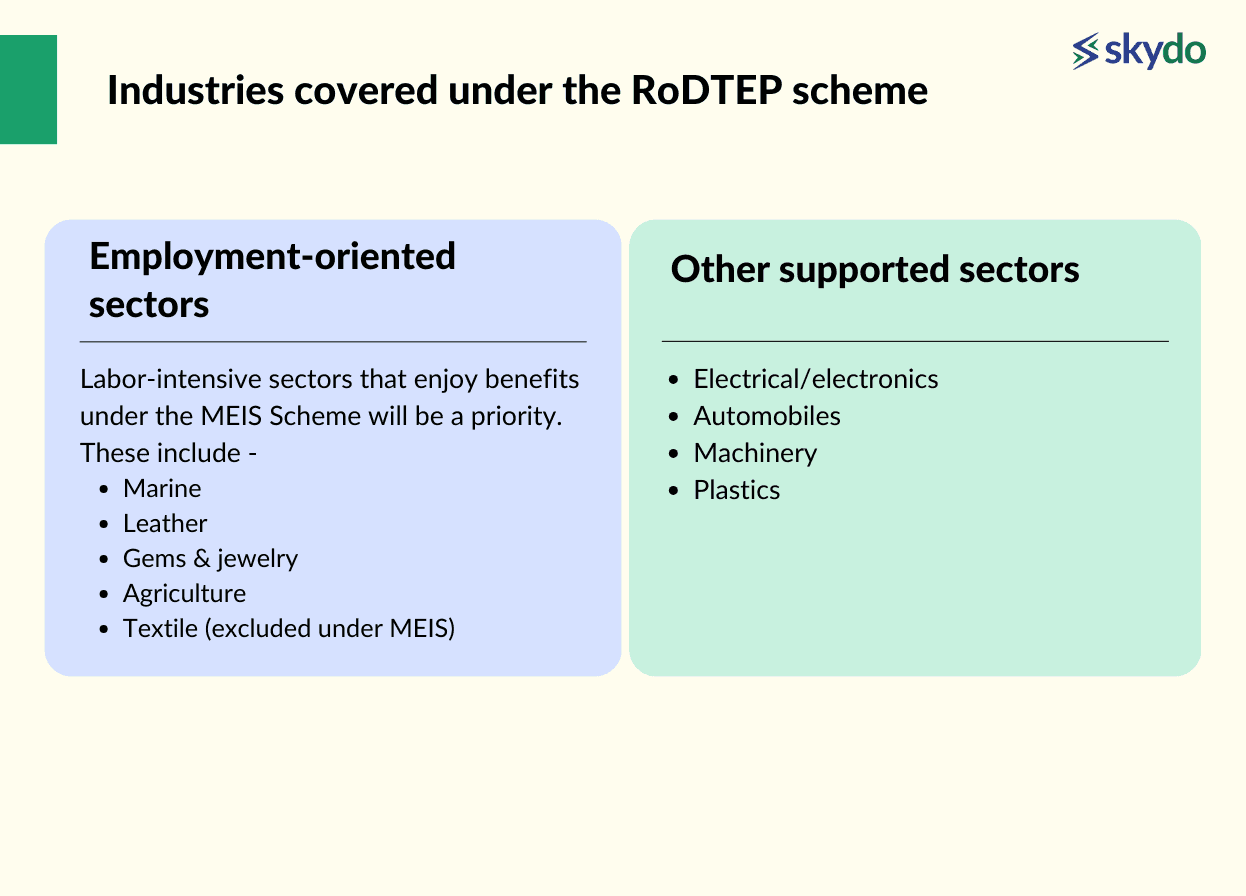

Industries covered under the RoDTEP Scheme

The Central Government last updated the RoDTEP scheme on 16th January 2023. Additionally, a specialised committee determines the scheme's rollout sequence across different sectors, the extent of benefits for each sector, and other relevant matters. The table below highlights the sectors applicable under the RoDTEP scheme.

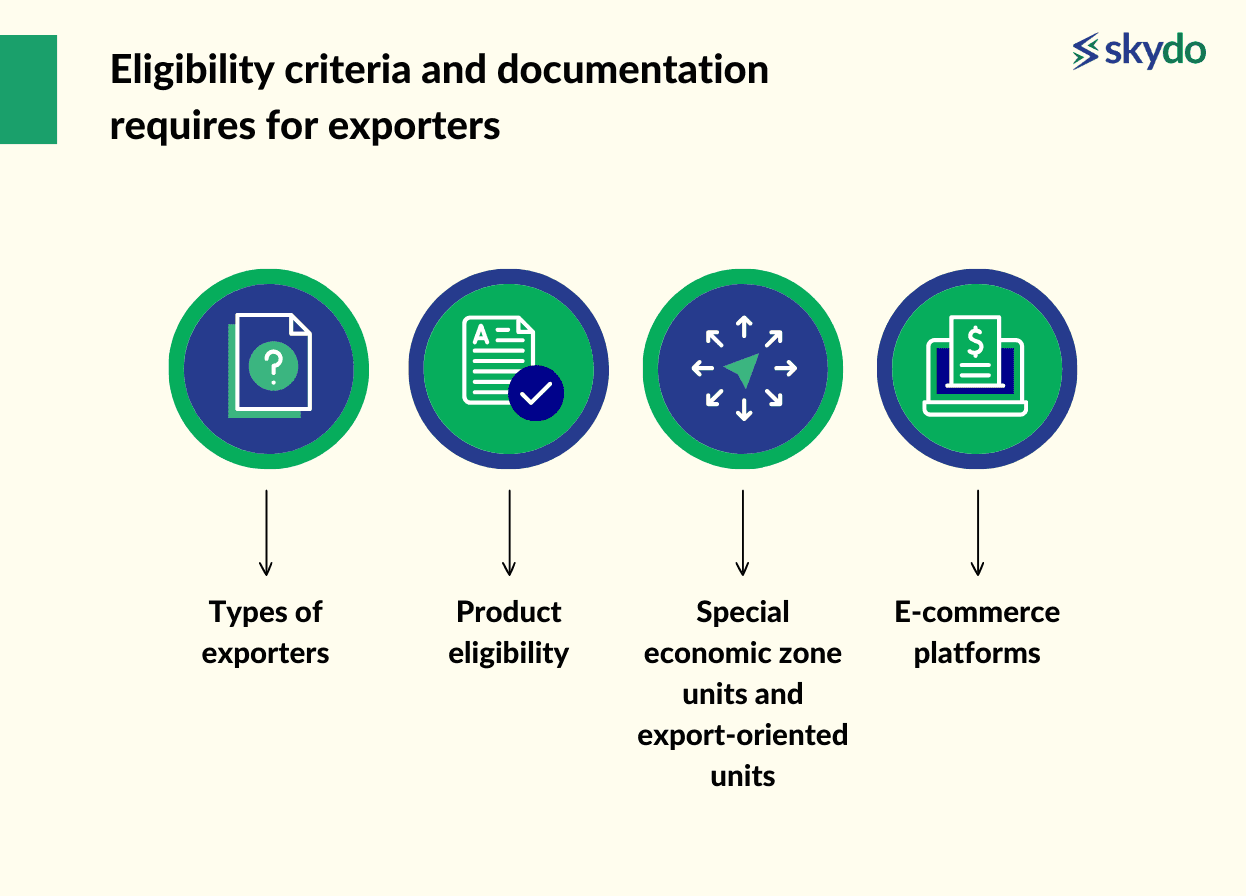

Eligibility Criteria and Documentation Required for Exporters

- Types of Exporters

Manufacturers and merchant exporters (traders) are eligible for RoDTEP benefits. Exporters must provide relevant documentation, including shipping bills and export invoices, demonstrating the export of goods from India.

- Product Eligibility

Exported products must have India as the country of origin. Re-exported products are not eligible for benefits under this scheme. Therefore, documentation confirming that the exported products have India as their origin is necessary.

- Special Economic Zone Units and Export-Oriented Units

Exporters in SEZs and EOU can claim benefits under the RoDTEP Scheme by providing documentation that proves their operating status within Special Economic Zones or Export-Oriented Units.

- E-Commerce Platforms

Goods exported through couriers via e-commerce platforms are also eligible for benefits under the RoDTEP Scheme. Documentation related to the e-commerce transactions and export processes is crucial to claim benefits.

Availing Benefits under the RoDTEP Scheme (Step-by-Step process)

The ICEGATE portal, also known as the Indian Customs Electronic Gateway, serves as a repository for information regarding the credits accessed by exporters.

When at the port, exporters must specify in the shipping bill the particulars concerning the RoDTEP benefit claim related to a specific export item and generate a credit script accordingly.

Depending on the circumstances, exporters can use these credit scrips to settle essential customs duties, assert rebates, or facilitate transfers to other importers.

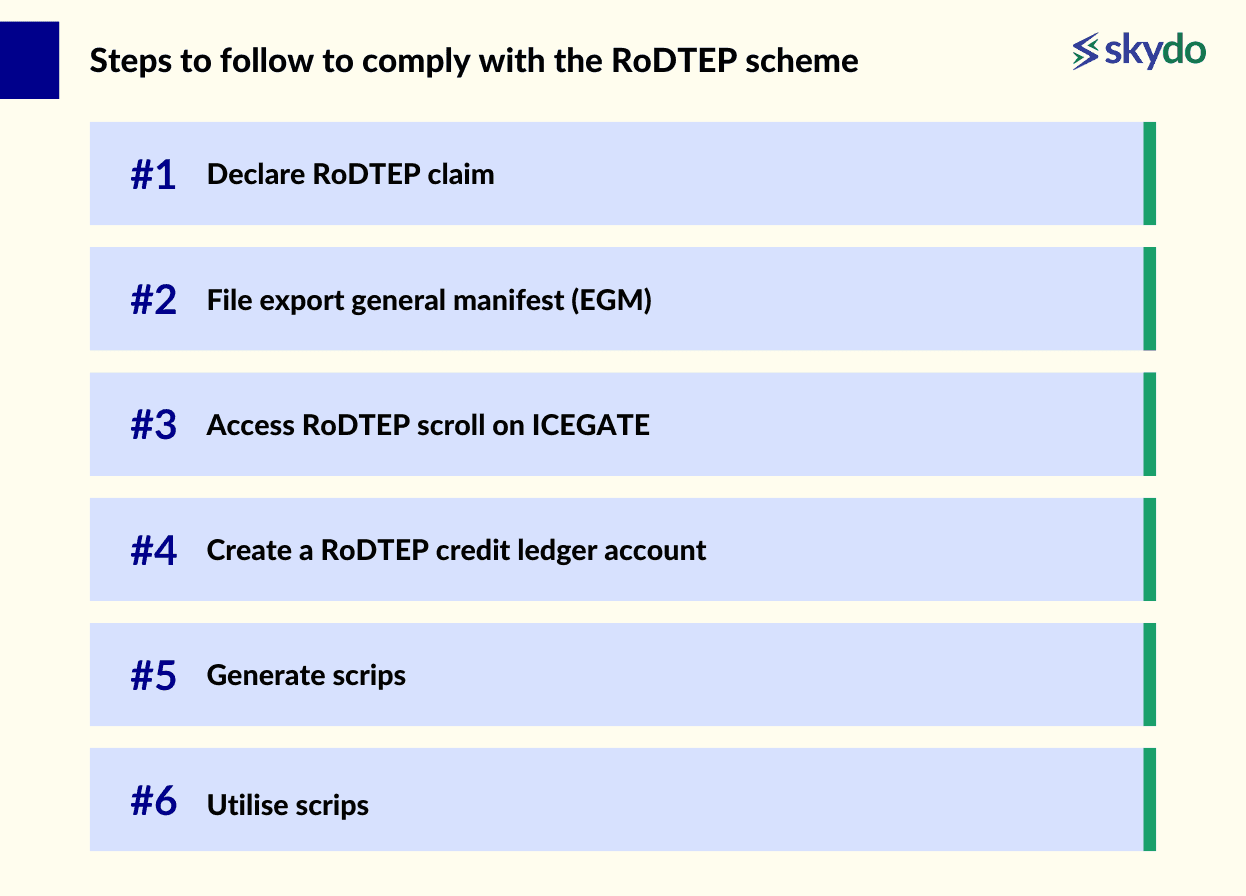

To comply with the RoDTEP scheme requirements, exporters need to follow these steps:

- Declare RoDTEP Claim: The exporter must declare their RoDTEP claim within the shipping bill.

- File Export General Manifest (EGM): File the Export General Manifest (EGM) to allow customs to process your RoDTEP claim.

- Access RoDTEP Scroll on ICEGATE: The ICEGATE portal will display a scroll with details and admissible amounts for each shipping bill.

- Create a RoDTEP Credit Ledger Account: Register on the ICEGATE portal and create a dedicated RoDTEP credit ledger account.

- Generate Scrips: Select relevant shipping bills from your account and generate electronic scrips representing your RoDTEP benefit.

- Utilise Scrips: The credited amount will be reflected in your ledger and used for various purposes, including paying customs duties, claiming rebates, or transferring to other importers.

Conclusion

The RoDTEP scheme, introduced by the government, aims to enhance the ease of doing business and extend export benefits as per international standards recommended by the WTO.

Here are some best practices for exporters to follow to make the most of the RoDTEP scheme:

- Have a thorough understanding of the eligibility criteria and requisite documentation for your products to qualify.

- Adhere to the procedural guidelines by customs, including declaring your RoDTEP claim in the shipping bill, and meticulously managing credits via the ICEGATE portal.

- Stay up-to-date on any amendments or updates about RoDTEP rates and guidelines to ensure optimal utilisation of the scheme's benefits.

The RoDTEP scheme allows exporters to enhance their competitiveness and reach new markets. So why not take the first step today and explore how it can help you achieve your export goals? Remember, help is available if you need it!

Q1. What is the current rate of the RoDTEP scheme?

Ans: The current rates for the RoDTEP scheme vary and are subject to notification by the Government of India. For the latest updates, it is advisable to check the Directorate General of Foreign Trade (DGFT) website.

Q2. Can duty drawback and RoDTEP be claimed together?

Q3. Which sectors are not included in the RoDTEP scheme?

Q4. How long will the RoDTEP scheme be in effect?

Q5. Which taxes are compensated in the RoDTEP Scheme?