Service Export Essentials: A Comprehensive SEIS Guide

India’s service export industry is booming and how. As of 2023, India's service exports soared by an impressive 11.4%, outpacing China and hitting a remarkable $345 billion!

A major driver of this exponential growth is the Indian government's proactive strategy to boost exports. Recognizing the potential of the services sector, the government launched initiatives like the Service Exports from India Scheme (SEIS) to give Indian service exporters a competitive edge in the global market. So, without much ado, let’s dive into the what, why, and who of SEIS.

Understanding SEIS and Its Importance for Service Exports

SEIS, or its full form, Service Exports from India Scheme, was introduced by the Directorate General of Foreign Trade (DGFT) on April 1, 2015. It's a reward-based incentive program designed to boost India's service exports. In this blog, we will be breaking down the details of what these rewards and incentives are, what are the eligibility criteria for availing SEIS, how you can apply for the scheme, and more. You can also find the detailed guidelines for this scheme in Chapter 3 of the Free Trade Policy 2015-20.

Exploring the Benefits of SEIS

The Service Exports from India Scheme (SEIS) supports service exporters by granting them Duty Credit Scrips. These scrips are certificates issued by the government that exporters can use to pay various taxes and duties associated with exporting services from India. The value of these scrips is 3% or 5% of the exporter’s net foreign exchange earnings—the total foreign exchange earned by an exporter minus all expenses incurred.

For example, if a service exporter’s net earnings are Rs. 10,00,000 for a particular order, they can receive Duty Credit Scrips worth Rs. 30,000 to Rs. 50,000, depending on the type of export services.

These Duty Credit Scrips can significantly reduce the cost of exporting services by covering various customs duties and taxes, thereby boosting profit margins. Since the scrips are based on foreign exchange earnings, they also provide a buffer against foreign exchange risks and uncertainties in international trade.

Eligibility Criteria for SEIS Participation

Here are the eligibility criteria for exporters to register themselves for the SEIS scheme:

- Minimum Earnings

To qualify for SEIS, companies must have foreign exchange earnings of at least USD 15,000 per year. For individual exporters and sole proprietorships, the required earnings are USD 10,000 per year.

- IEC

The exporter (service provider) must have a valid and active Import Export Code (IEC) at the time of application and when the export activities took place. It is a unique 10-digit alphanumeric number required for export activities.

- Deemed Foreign Exchange

RBI has mandated that if a service provider has received payment for specified services in INR, the payment is recorded as being received in the deemed foreign exchange. For example, if an exporter has received funds in INR for exporting goods in the US, the payment will be considered in USD. The list of specified services is mentioned in Appendix 3E.

- Manufacturer of Goods

If the service provider is also the manufacturer of the goods exported, then the net foreign exchange earnings are considered for the service sector only.

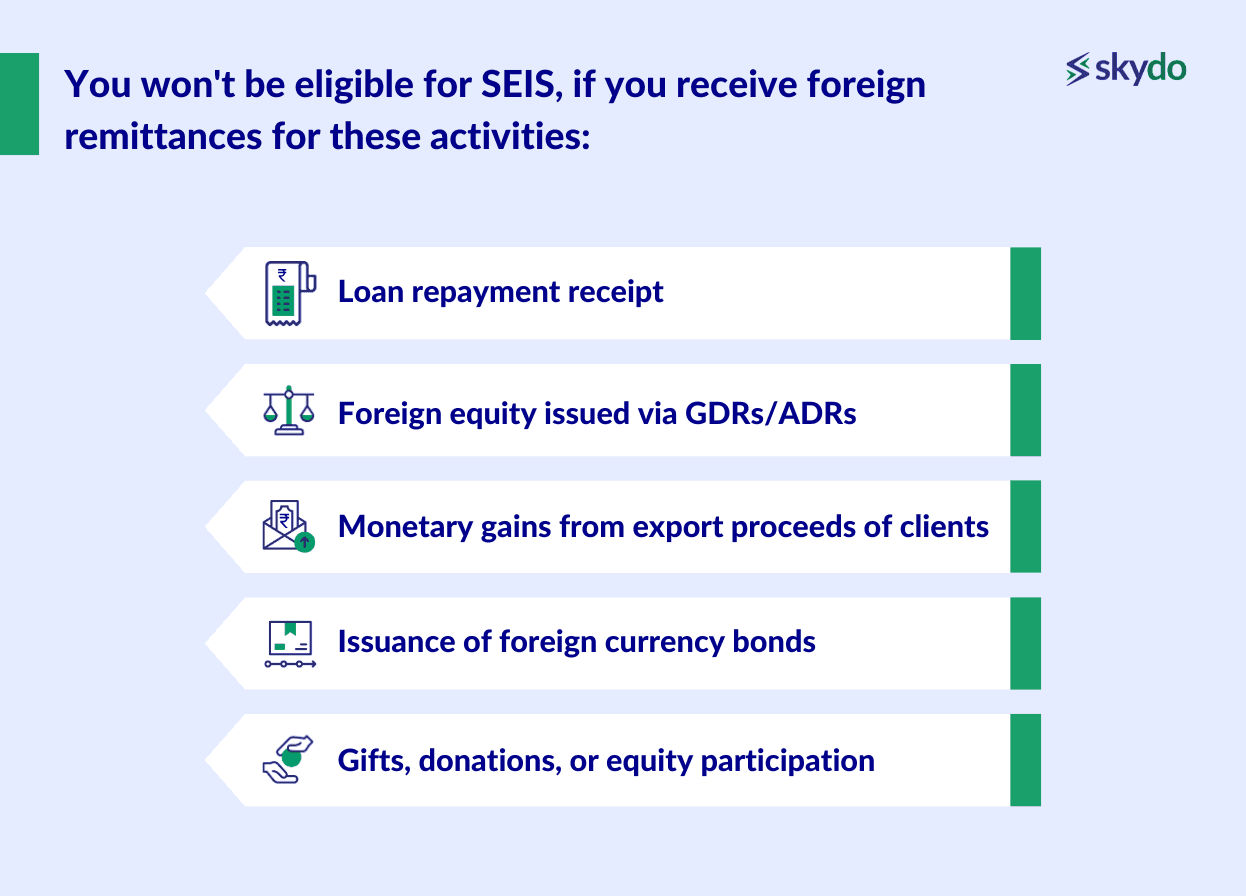

Note that if you receive foreign remittances against the following activities, you will not be eligible for SEIS:

- Loan repayment receipt

- Foreign equity issued via GDRs/ADRs

- Monetary gains from export proceeds of clients

- Issuance of foreign currency bonds

- Gifts, donations, or equity participation

Here is a detailed table with major services and rates of rewards under the SEIS scheme:

Major Services and Rate of Reward

| Serial Number | SECTORS | Admissible Rate |

|---|---|---|

| 1 | BUSINESS SERVICES | |

| A | Professional Services:Accounting, auditing, legal, bookkeeping, taxation, architectural, engineering, medical, dental, paramedical, etc. | 5% |

| B | Research and Development Services:Social sciences, natural sciences, humanities, and interdisciplinary services. | 5% |

| C | Rental/Leasing Services Without Operators:Ships, aircraft, machinery, equipment, etc. | 5% |

| D | Other Business Services:Market research, advertising, hunting, forestry, mining, fishing, printing, publishing, etc. | 3% |

| 2 | COMMUNICATION SERVICESAudiovisual, videotape production, motion picture, radio, television, sound recording, etc. | 5% |

| 3 | CONSTRUCTION AND RELATED ENGINEERING SERVICESGeneral construction work for civil engineering, installation, assembly, building completion and finishing work, etc. | 5% |

| 4 | EDUCATIONAL SERVICESPrimary, secondary, higher, and adult educational services. | 5% |

| 5 | ENVIRONMENTAL SERVICESSewage, refuse disposal, sanitation, and similar services. | 5% |

| 6 | HEALTH-RELATED AND SOCIAL SERVICESHospital services | 5% |

| 7 | TOURISM AND TRAVEL-RELATED SERVICES | |

| A | Hotels and Restaurants | |

| a. | Hotel | 3% |

| b. | Restaurants (including catering) | 3% |

| B | Tour operation and travel agencies | 5% |

| C | Tourist guide services | 5% |

| 8 | RECREATIONAL, CULTURAL, AND SPORTING SERVICESEntertainment services, libraries, museums, sporting, recreational services, etc. | 5% |

Application Process for SEIS Benefits

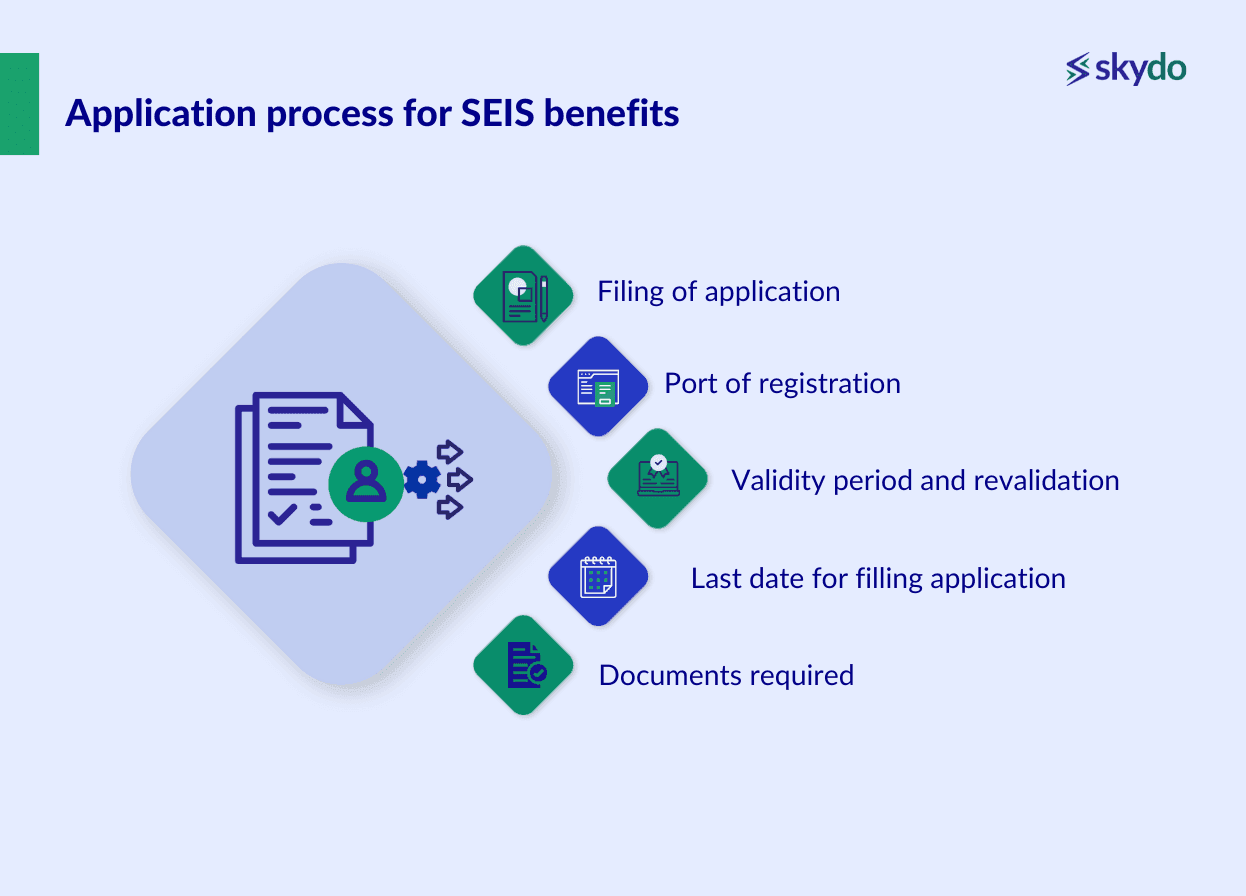

If you're a service exporter aiming to avail of benefits under the SEIS scheme, here's a breakdown of the application process:

1. Filing of Application

- Complete an online application using a digital signature. The relevant forms, such as ANF3B and Annexures to ANF3B, can be found on DGFT’s website.

- You'll need to select a Jurisdictional Regional Authority (RA) based on the address listed on your valid and active Importer-Exporter (IE) Certificate.

- The selected RA will review and process the application after submission.

2. Port of Registration

- You must choose a single registration port, or port of export when filling out the application form. The RA will then issue the subsequent scrips with the respective port, after which you can utilise the duty credit.

- Once registered, you can use the scrips at any Electronic Data Interchange (EDI) port and any manual port within the framework under the Telegraphic Release Advise (TRA) procedure.

3. Validity Period and Revalidation

- After completing the application for Duty Credit Scrips and receiving approval from the RA, the issued scrips will be valid for 18 months from the date of issuance.

- Once a Duty Credit Scrip has expired, revalidation is not allowed. However, revalidation is permitted only if the scrip expires while in the custody of the RA.

4. Last Date For Filling Application

- The application for Duty Credit Scrips under SEIS must be filed within 12 months from the end of the financial year of the claim period.

5. Documents Required

- You will need a Chartered Account or a Company Secretary to sign some of the annexures attached to ANF-3B, ANF-3C, and ANF-3D.

- These documents must be submitted physically to the Jurisdictional Regional Authority.

Parting Words

There’s no doubt that it is only onwards and upwards for Indian exporters from hereon. However, despite government initiatives, service exporters often lose a chunk of their earnings due to hefty bank and forex charges on international payments.

At Skydo, we're dedicated to helping exporters retain more of their hard-earned money. With a flat, minimal transaction fee and zero forex or hidden charges, Skydo ensures that receiving international payments is both cost-effective and seamless. Make the switch to Skydo today and feel the difference.

Q1. How do we calculate the Net Foreign Exchange (NFE) Earnings?

Ans: The formula to calculate net foreign exchange earnings is:

Net Foreign Exchange Earnings = Gross Foreign Exchange Earnings - Total expenses/remittances/payment of foreign exchange.

Q2. Are payments in Indian rupees eligible for SEIS incentive?

Q3. Are all remittances received in Foreign Exchange eligible for the SEIS Incentive?