A Step-by-Step Guide for Tech Exporters on Global Compliance

TechX, a growing software company, recently expanded internationally. However, they unintentionally violated data protection and payment laws by neglecting compliance requirements. Unaware of complex regulations, their negligence enabled data theft and scrutiny from regulatory bodies. This resulted in the revocation of their license, barring further exports.

These incidents showcase the critical need for tech exporters to prioritise global compliance. Though regulations may seem like jargon. But following them is vital for smooth international trade, mitigating reputational risks, and succeeding globally.

With complicated guidelines, global compliance is tricky yet acts as a protective guard amid competitive pressures. Mastering it is essential for tech export companies.

Understanding Global Compliance

Compliance in the tech export industry refers to following the laws, regulations, and industry standards to ensure ethical and legal business practices. It encompasses various aspects, such as data protection, payment laws, and industry-specific regulations.

According to experts in the field, compliance is crucial for tech exporters as it helps build trust and credibility among stakeholders, including customers, partners, and regulatory bodies.

Compliance protects sensitive data, fosters transparency in financial transactions, and helps navigate the ever-changing regulatory landscape. This way, tech exporters can create a secure and reliable environment, mitigate risks, and establish themselves as responsible players in the industry.

Data Protection Compliance

Implementing data protection measures in India requires a proactive approach. Small businesses often handle customer data, and a failure to comply with data protection regulations can have severe consequences, especially considering limited resources and brand reputation.

Customers often choose a company that prioritises data security and respects privacy. This way, ensuring data protection compliance can provide a competitive advantage over non-compliant competitors.

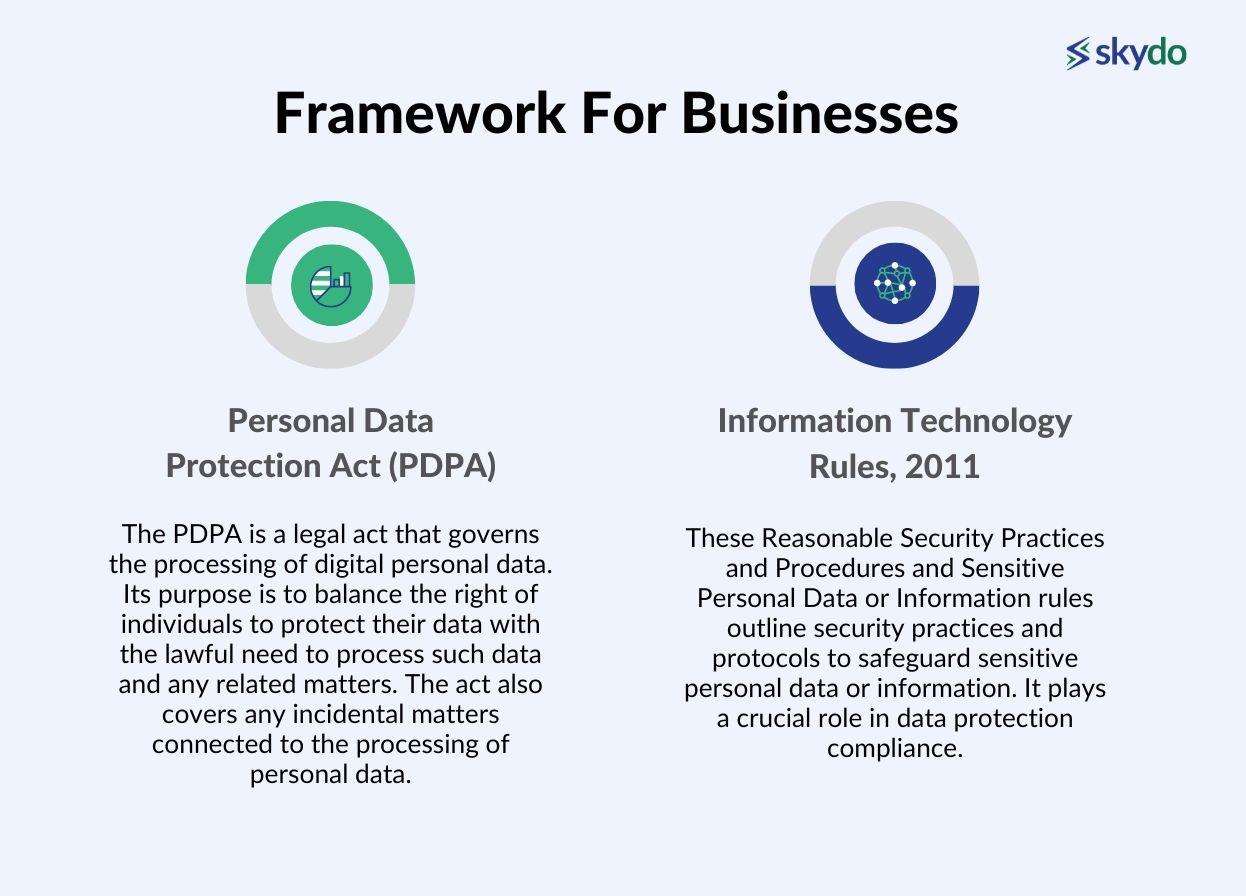

Several regulations and frameworks govern data protection practices in India, providing a framework for businesses to follow.

- Personal Data Protection Act (PDPA)

The PDPA is a legal act that governs the processing of digital personal data. Its purpose is to balance the right of individuals to protect their data with the lawful need to process such data and any related matters. The act also covers any incidental matters connected to the processing of personal data.

- Information Technology Rules, 2011

These Reasonable Security Practices and Procedures and Sensitive Personal Data or Information rules outline security practices and protocols to safeguard sensitive personal data or information. It plays a crucial role in data protection compliance.

Experts also emphasise the importance of implementing privacy policies and consent mechanisms that align with Indian data protection laws. Businesses must ensure that individuals are adequately informed about the purpose and nature of data processing and have the right to access, rectify, and delete their personal information.

Payments Laws and Compliance

The Reserve Bank of India (RBI) governs payment systems and regulates transactions in India. The Foreign Exchange Management Act (FEMA) also plays a significant role in regulating cross-border transactions and foreign exchange transactions.

Non-compliance with payment laws can have severe implications for tech exporters. The RBI and guidelines set by FEMA can initiate inquiries and impose penalties for violations. These penalties may include monetary fines, suspension of payment licenses, or even imprisonment in extreme cases. Non-compliance can disrupt business operations, cause reputation loss, and strained relationships with business partners and customers.

Tech Export Industry Regulations

A budding e-commerce brand, Company B, faces industry-specific regulations related to consumer protection, data privacy, and online transactions. They prioritise transparency by clearly outlining terms and conditions, refund and privacy policies.

Additionally, Company B invests in secure payment gateways and encryption technologies to protect customer data. They create a trustworthy user environment and build long-term customer relationships by complying with industry regulations.

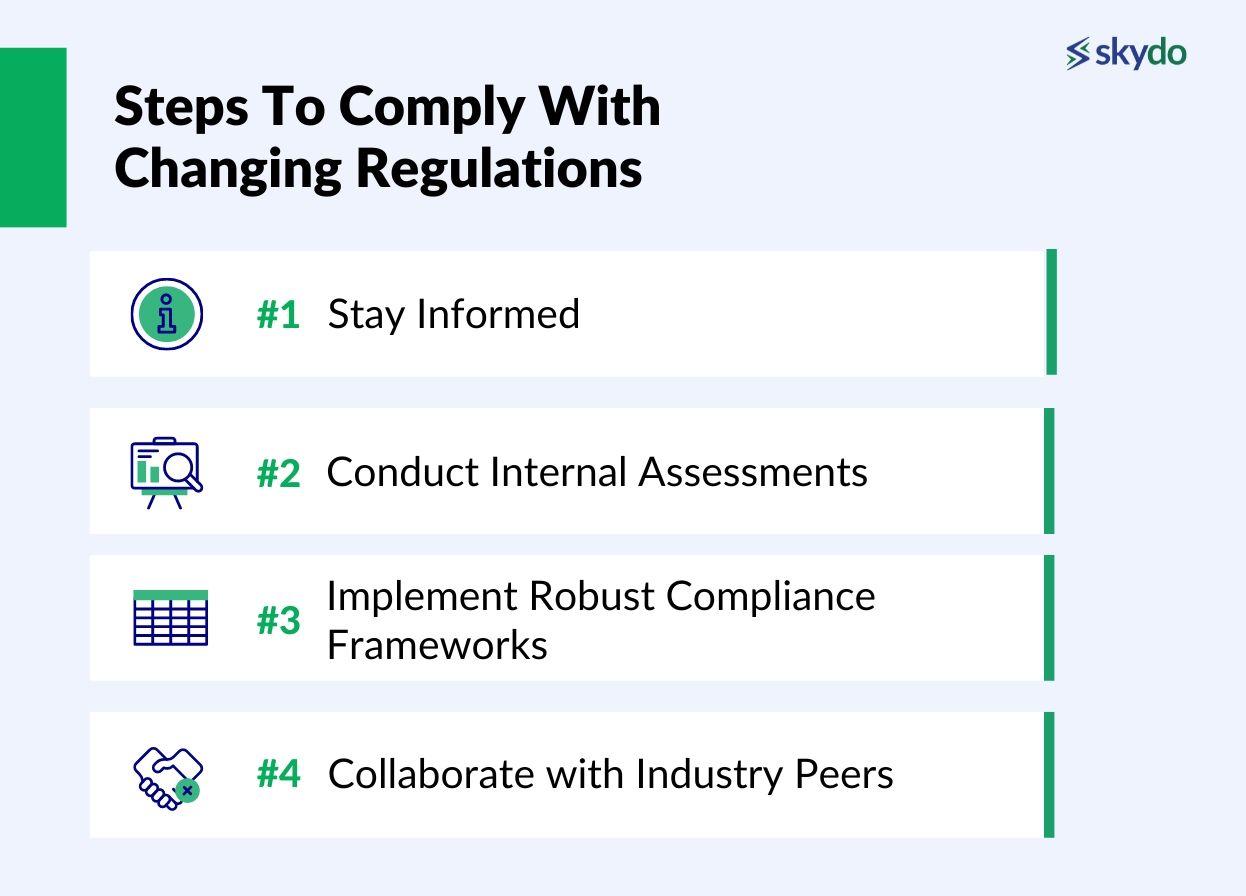

To comply with changing regulations, tech exporters can follow these steps:

- Stay Informed

Maintain awareness of industry-specific regulations by regularly monitoring updates from regulatory bodies, industry associations, and legal experts. Attend industry conferences and workshops to stay up-to-date on emerging trends and regulatory changes.

- Conduct Internal Assessments

Perform regular internal assessments to identify areas of non-compliance. It includes reviewing processes, data protection measures, export control procedures, identifying gaps and developing action plans to address them.

- Implement Robust Global Compliance Frameworks

Develop comprehensive compliance frameworks covering all relevant regulations. It includes policies, procedures, employee training programs, data protection measures, and risk management strategies.

- Collaborate with Industry Peers

Engage in industry forums and associations to collaborate with peers and exchange best practices. Sharing experiences and knowledge can help navigate complex regulations more effectively.

Tools For Global Compliance

- Legal and Compliance Expertise

Engaging legal and compliance professionals who specialise in international trade and export regulations is crucial. These experts can provide guidance, assist in understanding complex regulations and ensure compliance with applicable laws.

- Compliance Management Systems

These software solutions assist in managing and tracking compliance activities, including documentation, policy implementation, risk assessments, and audits. They provide a centralised platform to streamline compliance processes and ensure accountability.

- Training and Education

Tech export service providers should invest in training programs to educate employees about compliance obligations, industry regulations, and best practices. These programs can enhance employees' understanding of compliance requirements and foster a culture of compliance within the organisation.

- Technology Systems for Data Protection

Implementing robust technology systems and tools, such as encryption software, firewalls, intrusion detection systems, and data loss prevention solutions, can help safeguard sensitive data.

- Certifications and Approvals

Obtaining relevant certifications and approvals, such as ISO or industry-specific certifications, can demonstrate the business’ commitment to compliance and quality standards.

Using Technology for Compliance

Global compliance software and tools offer features such as automated regulatory monitoring, document management, risk assessment, and audit trails. These tools help exporters stay updated on changing regulations, maintain documentation, and ensure adherence to compliance requirements.

Expert recommendations and authoritative reviews can guide tech exporters in selecting the most appropriate compliance software and tools.

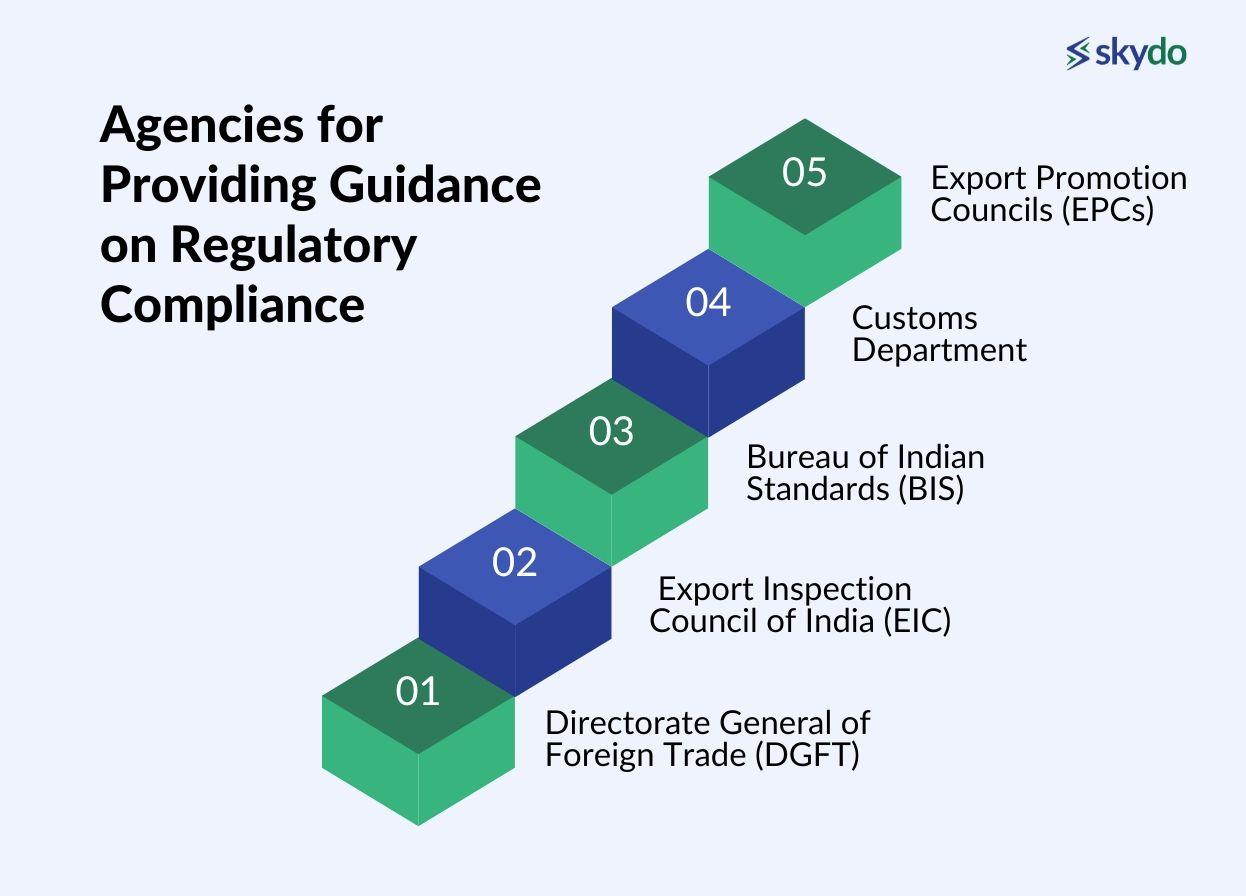

Agencies for Providing Guidance on Regulatory Compliance

Numerous local, state, and federal agencies oversee laws and regulations applicable to organisations. These entities, and occasionally additional groups, offer guidance to assist companies in comprehending and adhering to the applicable laws and regulations. This list encompasses some of these agencies and groups:

1. Directorate General of Foreign Trade (DGFT)

The DGFT is the nodal agency for administering India's foreign trade policy. They offer extensive guidance on regulatory compliance for export businesses, including:

- Import-Export Code (IEC) issuance: Mandatory for all exporters and importers.

- Export Licensing: Required for certain items.

- Foreign Trade Policy (FTP): Provides detailed guidelines and procedures.

- Export Promotion Schemes: Offers incentives and benefits.

- Trade Statistics and Data: Facilitates market research and analysis.

2. Export Inspection Council of India (EIC)

The EIC oversees the quality and standards of exported goods. They offer:

- Pre-shipment inspection and certification: Ensures compliance with international standards.

- Laboratory testing and analysis: Provides quality assurance.

- Registration and accreditation of inspection agencies: Maintains quality standards.

3. Bureau of Indian Standards (BIS)

The BIS sets national standards for various products and services. They play a vital role in:

- Compulsory BIS Certification: Mandatory for certain exports to ensure safety and quality.

- Standards Formulation and Upgradation: Enhances competitiveness and market access.

- Laboratory Testing and Calibration Services: Provides accurate and reliable testing.

4. Customs Department

The Customs Department facilitates smooth import and export clearance. They offer:

- Customs procedures and documentation: Guidance on required documentation and formalities.

- Tariff classification: Determines applicable import duties and taxes.

- Customs clearance assistance: Helps exporters navigate customs processes.

5. Export Promotion Councils (EPCs)

EPCs are industry-specific organisations that promote exports from India. They offer:

- Market research and intelligence: Provides insights into global markets and trends.

- Trade fairs and exhibitions: Facilitates networking and business opportunities.

- Guidance on regulatory compliance: Assists exporters with specific industry regulations.

- Training and workshops: Develop exporters' skills and knowledge.

Others

- Indian Trade Portal: Provides comprehensive information and resources for exporters.

- Department of Commerce: Offers various schemes and initiatives to boost exports.

- Customs House Agents (CHAs): Facilitate customs clearance and ensure compliance.

Moreover, If you're working with clients in the US, it's important to know about these local market agencies. They can have a big impact on your success and help you navigate the ins and outs of the market.

- Small Business Administration (SBA): The Small Business Administration (SBA) and Business.gov website offer extensive resources to aid businesses in comprehending and adhering to regulatory requirements.

- Federal Financial Institutions Examination Council (FFIEC): The FFIEC, comprising five financial regulatory bodies, collectively supervises the Gramm-Leach-Bliley Act. This legislation mandates financial institutions to safeguard individuals' financial information, ensuring privacy.

- Environmental Protection Agency (EPA): This agency ensures that businesses' operations do not harm the natural environment by administering relevant laws and regulations.

Final Words

Understanding regulations, seeking legal counsel, and leveraging technology tools are crucial. Compliance ensures a trustworthy environment, mitigates risks, and protects customer data. It is an ongoing requirement in a changing landscape, providing a strategic advantage for tech exporters to build credibility and achieve long-term success.

Frequently Asked Questions

Q1. What is a regulatory requirement?

Ans: Regulatory requirements are the rules, laws, and guidelines established by government authorities or regulatory bodies that businesses and individuals must adhere to in their operations. These regulations aim to ensure fair practices, protect consumers, maintain market stability, and address specific industry concerns. Failure to comply with regulatory requirements may result in legal consequences, fines, or other penalties, emphasising the importance of understanding and adhering to these standards within a given jurisdiction.

Q2. Which compliance talks about regulatory aspects?

Ans: Various laws and regulations governing specific industries or financial transactions primarily address the regulatory aspects concerning compliance. Concerning international payments, adherence to legal requirements such as import-export codes (IEC), GST regulations, and client agreements plays a crucial role.

Ensuring compliance with these measures is essential for businesses to operate transparently and within the legal framework, minimising risks and promoting financial integrity.

Q3. What is global compliance?

Ans: Global compliance refers to businesses' adherence to the diverse legal, regulatory, and ethical standards across international jurisdictions. It encompasses laws related to taxation, data protection, trade, and industry-specific regulations.

Achieving global compliance ensures that a company operates within the legal framework of each country it engages with, fostering trust, mitigating risks, and facilitating cross-border business transactions while maintaining ethical and legal standards on a global scale.

Q4. What is regulatory compliance?

Ans: Regulatory compliance refers to the adherence of individuals or organisations to laws, rules, and regulations set by governing bodies. It ensures that businesses operate ethically, transparently, and within the legal framework of their industry or jurisdiction.

Compliance may involve meeting industry-specific standards, financial reporting requirements, data protection laws, and other regulations.