How to Secure Your Business Against Payment Platform Challenges

It’s no mystery that payment systems are pivotal in your business's success. From ease of collection to scale to gross margins, your payment systems influence how much you sell. If the last few years are any indication, fintech will completely transform payments in the coming decade.

How can you overcome payment challenges and ensure that your business reaches its absolute potential?

Understanding the Payment Platform Challenges and How to Navigate Them

In today's fintech landscape, four challenges demand your attention.

1. Regulatory Changes and Compliance Requirements

Every new technology will create unique risks, and regulators will construct rules to mitigate those risks. It will impact settlement days, modes, rates, and value-added services like BNPL.

“Adoption of any new such platform will come with uncertainties of regulatory changes and new compliances,” says Rohit, a seasoned Chartered Accountant well-versed in the financial seas.

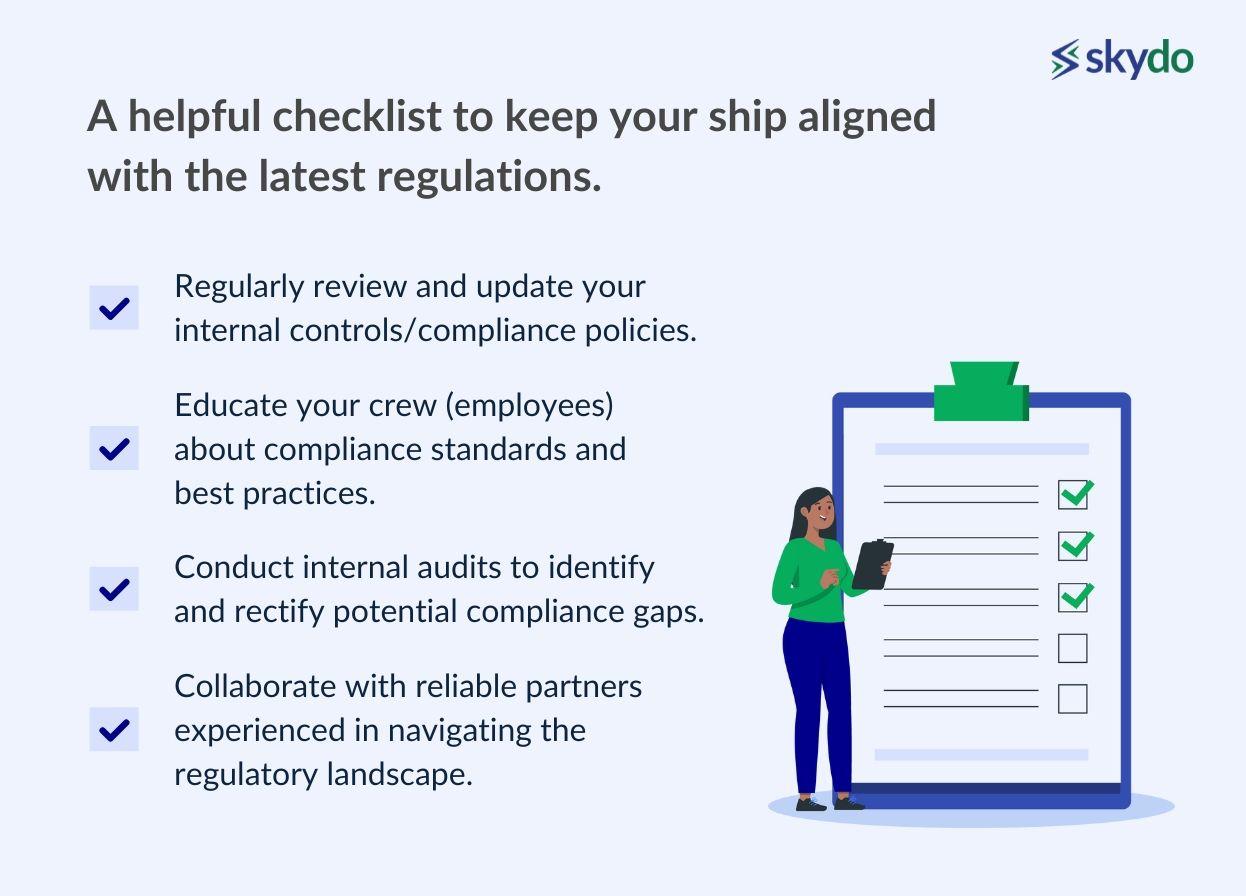

Ensuring compliance is more than meeting the minimum requirements—it is your compass to safe waters. Non-compliance can lead to costly penalties and reputation damage. To avoid such pitfalls, here’s a helpful checklist to stay aligned with the latest regulations.

- Regularly review and update your internal controls/compliance policies.

- Educate your crew (employees) about compliance standards and best practices.

- Conduct internal audits to identify and rectify potential compliance gaps.

- Collaborate with reliable partners experienced in navigating the regulatory landscape.

2. Security Concerns and Evolving Fraud Risks

The most common security concerns include the following.

- Data Breaches: Hackers may attempt to breach payment platform databases to steal sensitive customer information, including credit card details, login credentials, and personal data.

- Phishing Attacks: Phishing emails, messages, or websites deceive users into revealing their login credentials or personal information. Unsuspecting users may unknowingly provide sensitive data to attackers.

- Malware and Ransomware: Malware infects payment platforms, compromising their security. Ransomware, in particular, can encrypt critical data, demanding a ransom for its release.

- Insider Threats: Employees or individuals with access to payment platform systems may intentionally or unintentionally compromise security by leaking sensitive data or misusing their privileges.

- Card-Not-Present (CNP) Fraud: CNP fraud has become a significant concern as more transactions occur online or via mobile devices. Criminals usually use stolen card data to make unauthorised purchases without physically presenting the card.

- Man-in-the-Middle Attacks: Attackers intercept and eavesdrop on the communication between a user and the payment platform, gaining access to sensitive data and potentially altering transactions.

- Distributed Denial of Service (DDoS) Attacks: Cybercriminals overwhelm payment platforms' servers with a flood of traffic, causing disruptions and making the platform inaccessible to legitimate users.

- Unauthorised Access: Weak or compromised authentication mechanisms may allow hackers to gain access to user accounts or administrative privileges.

- Transaction Reversals and Chargebacks: Exploitation of the chargeback process to receive refunds for legitimate transactions leads to financial losses for the payment platform and merchants.

- Third-Party Vulnerabilities: Integrations with third-party services can introduce security risks if those services have vulnerabilities or lax security practices.

Therefore, safeguarding your payment platform should be a top priority.

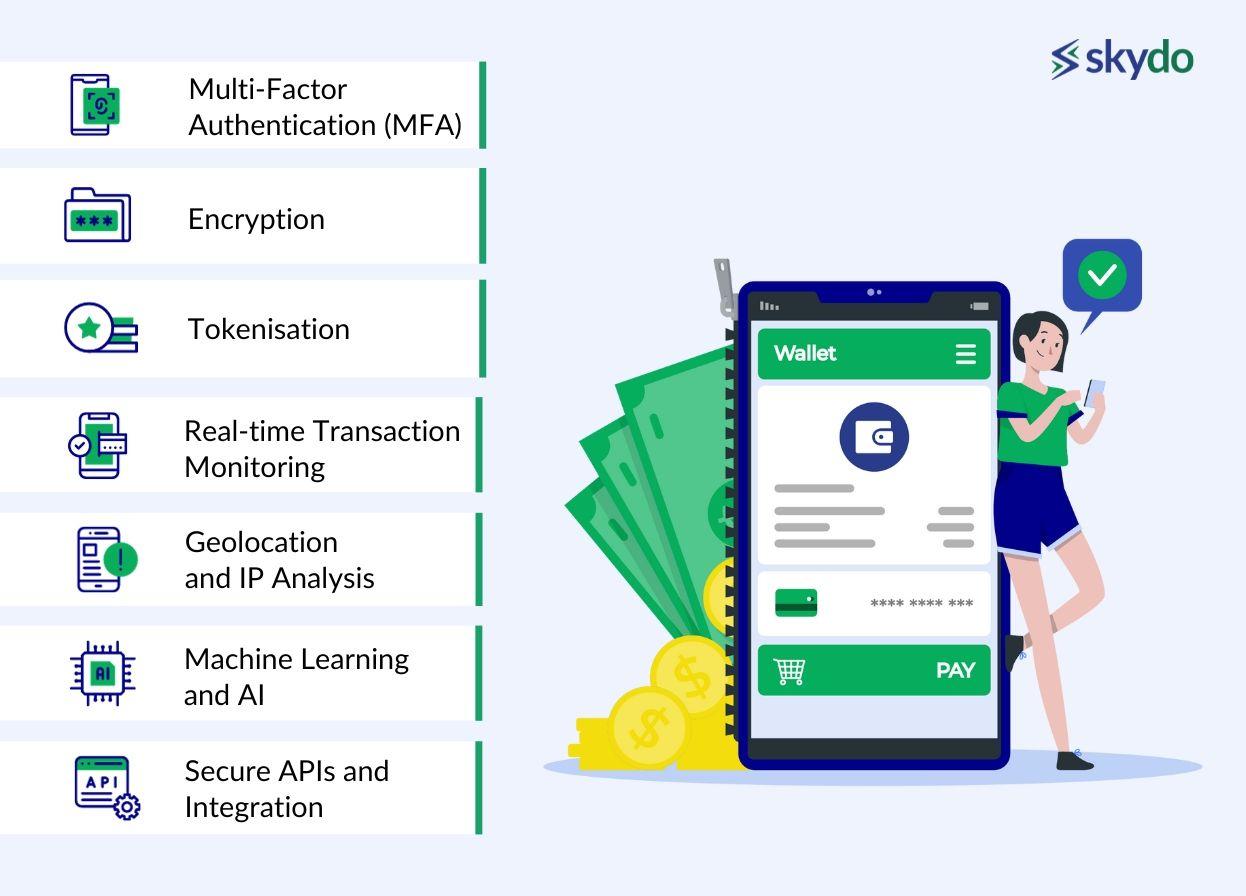

Learning from peers’ experiences in the payments space, you can choose a platform that implements the following proactive strategies.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security by directing users to provide multiple forms of identification, such as passwords (ideally generated and stored with a password manager), biometrics, or one-time verification codes, before gaining access to their accounts or processing transactions.”

- Encryption: The digital payments platform should have the best encryption system that protects sensitive data during transmission and storage. This way, the information remains unreadable and useless to unauthorised individuals even if intercepted.

- Real-time Transaction Monitoring: A payments platform forged with advanced fraud detection systems ensures continuous monitoring of real-time transactions, analyses patterns, and flags suspicious activities for immediate investigation.

- Geolocation and IP Analysis: Choose a payment gateway partner that analyses users’ geolocation and IP addresses to identify unusual or suspicious behaviour, such as login attempts from unexpected locations.

- Machine Learning and AI: They help identify unusual patterns and behaviours that may signify fraud. As the payment system learns from historical data, it becomes more adept at spotting fraudulent activities.

- Secure APIs and Integration: Attackers can exploit vulnerabilities in APIs. Ensure your payment partner’s APIs and integration with third-party services are protected.

3. Changing Customer Expectations and Demands

Satisfied customers are more likely to become repeat users and advocates for a quick, intuitive, and accessible platform. Choose a payment gateway platform for your cross-border transactions that offers the following features/perks and exceeds customer expectations.

- Streamlined Onboarding: Digital identity verification methods are both secure and user-friendly. Your ideal digital payments partner will have shortened the onboarding process and set the minimum steps required for account creation and verification.

With Skydo’s cutting-edge digital identity verification methods, you can set up your international accounts in 5 minutes and for your customers, it will be as simple as making a local transfer, and they would not need to onboard separately onto any platform. - User-Centric Design: Invest in a payment solution with user-friendly interfaces and intuitive payment processes to reduce friction. User testing, identifying pain points and optimisation of transaction flow is crucial. Skydo’s intuitive dashboard helps you easily navigate the platform and facilitate or access all the payment information.

Skydo’s dashboard not only gives you notifications to track your payment just like tracking an online shipment, it also gives you analytics to help you make data-driven decisions for your business.

- Seamless Cross-Platform Integration: Ensure the payment platform seamlessly integrates with various devices and operating systems.

- Fast and Secure Transactions: Invest in advanced payment processing systems that facilitate real-time transactions while maintaining robust security protocols. Skydo’s robust security protocols safeguard customers' sensitive information.

- Support for Multiple Payment Methods: Offer various payment options, including credit/debit cards, mobile wallets, digital currencies, and bank transfers, to ensure you never miss out on a sale.

- Transparent Fee Structure: Hidden fees lead to dissatisfaction and erode trust in the platform. Skydo is committed to transparency and charges only a flat fee per transaction.

- Proactive Customer Support: The right payment partner will offer prompt and responsive customer support through multiple channels like live chat, email, or phone. Resolving customer queries and issues contributes to a positive experience.

- Personalisation and Loyalty Programs: A good digital payments platform offers personalised recommendations and tailored promotions. Loyalty programs ensure continued use of the platform.

- Communication: Create automated email and WhatsApp surveys to seek customer feedback regularly. Use their insights to refine the payment platform's features and functionalities.

Delivering a seamless payment experience fosters trust, customer satisfaction, and long-term loyalty, positioning the platform for sustained success in the competitive fintech landscape.

4. Impact of Technological Advancements

From OTP-less logins to emerging technologies like blockchain and digital currencies, you must unlock new opportunities for your business. Yet, there are challenges to navigate in this uncharted territory.

- Scalability: Current bandwidth limitations in processing a high volume of transactions per second may hinder mass adoption.

- Regulatory Environment: Navigating global regulatory landscapes can be complex and challenging as payment methods evolve.

- User Education: Widespread adoption requires educating users to overcome the initial resistance.

Considering these hurdles, choose a payment gateway partner that offers–

- Enhanced Security: Better cryptographic encryptions, reducing the risk of data breaches and fraud

- Transparent Transactions: Real-time transaction tracking, promoting trust and accountability

- Faster Settlements: Than traditional payment clearing processes

- Lower Costs: By eliminating intermediaries

- Cross-Border Transactions: Eliminating the need for currency conversions and reducing fees and delays

- Financial Inclusion: Making services accessible to underbanked populations, fostering trust in the system

- Decentralisation: Users have greater control over their funds

Future Forecast: Emerging Trends in Payment Platforms

"The future of payments will be about interoperability between different payment systems, instant payments, and multi-currency systems (where the invoice can be raised in one currency, payment made in a different currency seamlessly). The future of payments will also be about embedded systems - where payments will be provided by technology providers who will embed payments into the workflows of various systems.” — - Srivatsan Sridhar, CEO, Skydo

Some emerging trends in payment platforms that may be important in the future include the following.

- Rise of digital wallets and mobile payments: This trend is well underway, and it will continue to grow in the years to come. Convenient and secure, they are becoming increasingly popular.

- Expansion of contactless and biometric payments: They offer a quick and easy way to pay for things without fumbling with cash or cards. Biometric payments, such as fingerprint or facial recognition, are also gaining traction.

- Peer-to-peer (P2P) payments: P2P payments allow people to send and receive money to each other quickly and easily without going through a bank or other financial institution.

- Rise of embedded payments: Embedded payments allow businesses to integrate payment functionality directly into their applications, making it easier to accept payments and provide a more seamless and convenient experience for customers.

- Multi-currency system: It can help businesses attract more overseas customers, make it easier for customers to pay in their currency, and reduce foreign exchange risk. They can use a payment gateway supporting multiple currencies or a currency converter service.

- Integration of blockchain and cryptocurrencies in mainstream transactions: While cryptocurrency is not a legal tender in India, blockchain is a distributed ledger technology that has the potential to revolutionise the way we make digital payments.

- Adoption of Central Bank Digital Currencies (CBDCs): As the e-Rupee RBI launched, CBDCs are digital currencies that central banks issue. They have an advantage over traditional fiat currencies for speed, cost, and security. Several central banks worldwide are currently exploring the possibility of issuing CBDCs.

The horizon reveals promising trends that will shape the future of payment platforms. Embrace interoperability, instant payments, and multi-currency systems to stay ahead.

Tl;Dr

Here are the actionable steps that help you navigate payment platform challenges.

- Stay up-to-date on the latest regulations: Regulatory changes can significantly impact payment platforms, so staying up-to-date on the latest requirements is important. Subscribe to industry publications, attend events, and work with a qualified payments consultant.

- Invest in security: Security is essential for any payment platform, and businesses should invest in the latest security technologies to protect their customers' data. This includes implementing multi-factor authentication, encryption, and tokenisation.

- Focus on the customer experience: The customer experience is critical for any payment platform, and businesses should focus on making the payment process as easy and convenient as possible for their customers.

Offer a variety of payment methods, provide clear and concise instructions, and offer excellent customer support.

- Be prepared for change: The payment landscape is constantly changing; you must prepare for change. Be open to new technologies and adapt your payment platforms.

Frequently Asked Questions

Q1. What are the major challenges faced by businesses in the fintech landscape?

Ans: Fintech businesses encounter challenges like regulatory compliance, cybersecurity, and customer trust. Adapting to rapidly changing technologies and maintaining seamless user experiences pose additional hurdles.

Q2. What are the common security concerns and fraud risks associated with payment platforms?

Ans: Payment platforms face security concerns such as data breaches, identity theft, and transaction fraud. Risks include phishing attacks, malware, and system vulnerabilities.

Q3.How can businesses safeguard their payment platforms against security threats?

Ans: Implementing robust encryption, multi-factor authentication, regular security audits, and staying updated on cybersecurity best practices can help businesses protect payment platforms.

Q4. What features should businesses look for in a payment gateway to meet customer expectations?

Ans: Businesses should prioritise features like secure encryption, fraud detection, seamless integration, and user-friendly interfaces in payment gateways to meet customer expectations.

Q5. What are the actionable steps to navigate payment platform challenges?

Ans: To navigate payment platform challenges, businesses must prioritise cybersecurity, comply with regulations, invest in advanced technologies, and foster customer education and trust.

Q6. What are the emerging trends in payment platforms for the future?

Ans: Emerging trends in payment platforms include blockchain technology, contactless payments, biometric authentication, and Decentralised Finance (DeFi), offering innovative and secure transaction methods.

Q7. How can businesses navigate technological advancements in the payment landscape?

Ans: Businesses can navigate technological advancements by staying agile, investing in R&D, fostering partnerships with technology providers, and regularly updating their payment systems to align with industry standards and customer preferences.