Nodal vs Escrow vs Current Account: Which One to Choose?

Today, everything from hailing a ride to shopping for groceries or signing up for classes happens online. But behind this convenience lies a crucial need: making sure money moves smoothly behind the scenes.

That's where the Current Account comes in. It's the protagonist in your business's financial story, making everyday transactions easy. However, it's not alone—special accounts like Nodal and Escrow accounts also play significant roles, handling the tricky money transfers that come with doing business online.

The blog covers the functions, advantages and framework for nodal, escrow, and current accounts. It will help you to choose the right tool to improve your financial management and ensure compliance.

What are Nodal Accounts?

Nodal accounts, mandated by the RBI, are specialised bank accounts tailored for businesses functioning as intermediaries in the online space. Its purpose is to safeguard the interests of customers and vendors, ensuring that payments are efficiently collected, processed, and disbursed to relevant vendors without unnecessary delays.

How Nodal Accounts Facilitate Fund Transfers

Nodal accounts act as temporary vaults, ensuring collected payments are processed promptly and payouts to relevant stakeholders occur without delays. For example, when a customer pays for a product online, the nodal account handles payouts to the seller and manages funds for shipping partners and payment processors. This is particularly useful in managing high-volume transactions such as Merchant Cash Advance Leads, where rapid and secure fund movement is essential.

Industries and Scenarios Where Nodal Accounts are Commonly Used

Nodal accounts are popular in industries with complex interactions between customers, vendors, and payment gateways. It includes the following business categories.

- Businesses that gather online funds from customers and act as intermediaries for vendors

- Businesses that source products without engaging in their actual manufacturing

- Businesses that refrain from upfront payments for products

- Businesses that need to maintain stocked inventory

Advantages of Nodal Accounts

- Trust Safeguard

Nodal accounts are crucial in building trust within the e-commerce ecosystem. By ensuring prompt payments, these accounts safeguard the interests of customers and vendors.

- Temporary Financial Vault

Nodal accounts act as temporary repositories, efficiently storing and distributing funds among various parties involved in online transactions. This functionality facilitates the smooth flow of financial transactions.

- Comprehensive Payouts

Nodal accounts extend their coverage beyond sellers and vendors, encompassing various entities like logistics partners, payment processors, and other intermediaries. This inclusivity ensures a comprehensive and streamlined payout process.

Disadvantages of Nodal Accounts

- Settlement Cycle Constraints

Payments through nodal accounts have a defined settlement cycle of T+3 days, where T marks the completion of the transaction. If a customer completes a transaction on Monday, the settlement cycle of T+3 days means that the funds may reach the vendor on Thursday.

- Controlled Debits

Debits go through a strict final approval process by the bank, ensuring a safe and regulated transaction process. If a customer disputes a product and asks for a refund, the nodal account's controlled debit process ensures that the bank gives the final approval for the refund.

What are Escrow Accounts?

From the Middle Ages, escrow means a deposit of trust or security. In modern times, an escrow account is a temporary financial vault managed by a trusted third party, securing funds on behalf of two parties bound by a contract.

The key characteristics of an escrow account are as follows.

- Temporary Nature

Escrow accounts are temporary repositories for funds. They hold financial assets for a specific duration, typically until the predetermined conditions outlined in a contract are fulfilled. Once these conditions are satisfied, the funds are released, completing the temporary nature of the arrangement.

- Neutral Intermediary

Escrow accounts are temporary repositories for funds. They hold financial assets for a specific duration, typically until the predetermined conditions outlined in a contract are fulfilled. Once these conditions are satisfied, the funds are released, completing the temporary nature of the arrangement.

For example, banks act as neutral intermediaries in e-commerce transactions. The funds stay temporarily in an escrow account with the bank on purchase. It allows the buyer to assess the product.

If the buyer decides to return within the specified period, the bank verifies the return conditions before releasing the funds back to the buyer. If the return period lapses without a request, the funds proceed to the seller.

Escrow Accounts in Business Transactions

Escrow accounts are common in business transactions, especially in real estate and online transactions. In real estate, a buyer deposits the total house value into an escrow account, with staged payments tied to project completion levels. For instance, 10% may be due upon laying the foundation.

Escrow is indispensable in unknown buyer-seller scenarios such as second-hand purchases. Serving as buyer protection, it ensures fund release only upon satisfactory product receipt, minimising disputes or chargebacks for the seller.

In an e-commerce transaction, the customer initiates a purchase and submits payment. When the funds reach the escrow account, the intermediary prompts the seller to dispatch the goods. Following shipment, the buyer receives the goods and verifies their satisfaction, confirming it to the intermediary.

Upon this confirmation, the intermediary transfers the funds from the escrow account to the buyer, completing the secure transaction process. The intermediary usually charges a fee to facilitate the transaction.

Legal and Regulatory Aspects of Escrow Accounts

Escrow agreements involving a buyer, seller, and escrow agent are contractual arrangements outlining terms for escrow payments. In India, specific transactions are legally bound to employ escrow accounts, emphasising the need for businesses to understand applicable laws.

- Share Issuance: The Securities and Exchange Board of India (SEBI) mandates using escrow accounts to prevent misuse of investor funds.

- Home Loans: The Reserve Bank of India (RBI) enforces escrow accounts for holding property taxes and homeowners' insurance payments, ensuring timely payments and preventing defaults.

- Real Estate: The Real Estate (Regulation and Development) Act, 2016 (RERA) mandates real estate developers to establish escrow accounts for funds collected from homebuyers, safeguarding against misappropriation.

These stringent regulations aim to protect the interests of all parties involved in escrow transactions in India.

Pros of Using Escrow Accounts for Business Operations

- Risk Mitigation

Escrow accounts mitigate financial risks by securing funds until predefined conditions are met. This safeguards buyers and sellers in transactions.

- Transaction Security

Acting as a neutral intermediary, escrow enhances transaction security, assuring parties that funds will be released only when contractual obligations are fulfilled.

- Dispute Resolution

Escrow facilitates fair dispute resolution, as the impartial third party ensures that conditions for fund release are objectively met.

For example, escrow funds might be released in a business acquisition based on mutually agreed-upon conditions, preventing disputes.

Cons of Using Escrow Accounts for Business Operations

- Costs

Engaging an escrow service may incur additional charges impacting overall business transaction expenses.

- Complexity

Escrow introduces complexity to transactions, requiring coordination with a third party and adherence to the escrow agreement.

For example, navigating diverse legal frameworks for escrow in international business deals can complicate cross-border transactions.

- Limited Control

Once funds are in escrow, direct control over their release is restricted, which may be a drawback in transactions requiring quick access to funds.

In startups, where rapid access to funds is critical, the escrow process may not align with the need for immediate capital.

What are Current Accounts?

A current account is a financial account that allows deposits, withdrawals, and daily transactions. It serves as a gateway for managing day-to-day financial activities, offering easy access to funds.

Features of Current Accounts for Businesses

- Unrestricted Transactions

Current accounts permit unlimited transactions, making them suitable for businesses with frequent financial activities. Current accounts also provide 24*7 access for payments and deposits.

- Overdraft Facilities

Businesses often enjoy overdraft facilities, allowing them to withdraw more than the available balance aiding in managing cash flow. Businesses can also avail of the direct debit facility for recurring transactions.

- Chequebook, Debit Card, Online Banking

Current accounts provide chequebook and debit card access, facilitating various payment methods for business transactions. Current accounts offer online banking services, enabling businesses to manage transactions remotely and efficiently.

Comparing with Nodal and Escrow Accounts

Nodal and Escrow accounts share the principle of involving a third party for fund holding and settlements.

- Nodal accounts, mandated by the Reserve Bank of India, are specialised for businesses acting as intermediaries. It connects multiple parties in a transaction and assures the funds never become the intermediary's property.

- Escrow account serves as a solution to financial fraud by securely holding funds and facilitating agreement-based transactions through an unbiased third party. The neutrality of the escrow ensures fair transaction processes, protecting the interests of all involved parties.

In contrast, the Current Account follows a different approach by channelling all payments through a single account. It is common for businesses to support online and offline transactions with no upper limit on daily transactions.

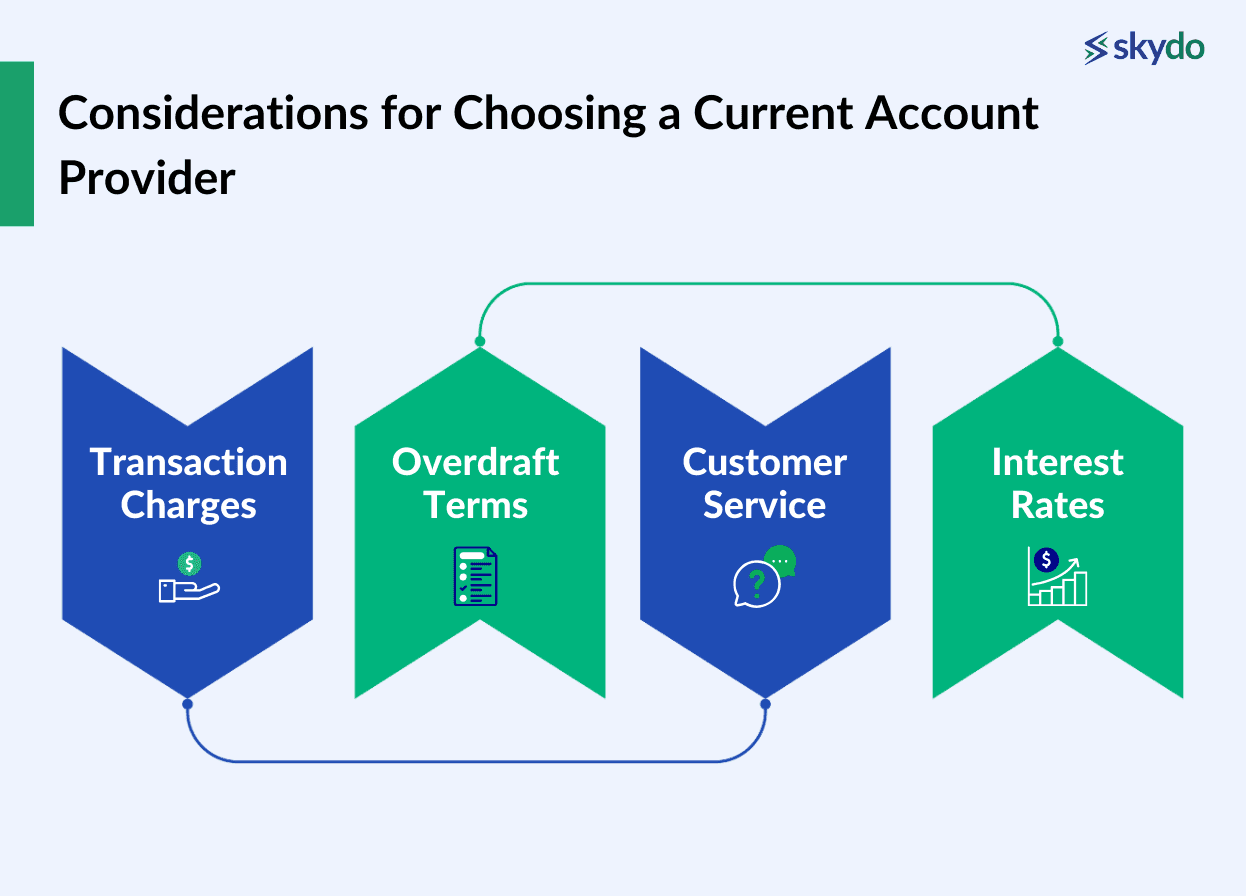

Considerations for Choosing a Current Account Provid

- Transaction Charges

Evaluate the transaction charges associated with the current account, ensuring they align with the business's transaction volume.

- Overdraft Terms

Understand the terms and conditions related to overdraft facilities, including interest rates and repayment terms.

- Customer Service

Evaluate the availability and responsiveness of customer service, as prompt assistance can be vital for addressing any account-related issues. Additionally, consider the quality of online banking services, as seamless digital access is crucial for modern businesses.

- Interest Rates

Some current accounts offer interest on balances. Consider the interest rates offered, especially if the business maintains significant funds in the account.

When to Use Nodal, Escrow, or Current Accounts

Choosing between Nodal, Escrow, or Current Accounts depends on a business's specific financial needs and operations. Each account type serves distinct purposes, addressing unique requirements in fund management and transactions.

Examples of businesses that benefit from these three types of accounts

- Nodal Accounts

Businesses acting as intermediaries, such as online marketplaces, payment aggregators, or e-commerce platforms, benefit from the specialised fund transfer functions of nodal accounts mandated by regulatory bodies like the RBI.

- Escrow Accounts

Businesses involved in international transactions require a neutral third party to securely hold and release funds based on predefined conditions, ensuring trust and security. Common in real estate, online transactions, and complex, long-term contracts.

- Current Accounts

This account is widely beneficial for businesses across various industries with routine financial operations, unrestricted daily transactions, and features like overdraft facilities.

Scenarios Where Escrow Accounts Are the Ideal Choice

In specific scenarios, opting for an escrow account is strategically sound, addressing various industries and transactions.

- Escrow in Real Estate

Real estate transactions involve substantial sums and inherent risks for buyers and sellers. The escrow agent assumes control of the property and holds the buyer's funds until all specified conditions are met, ensuring a secure and fair transaction.

- Escrow in Online Sales

Online sellers, grappling with the risk of defective products or non-delivery, often choose escrow accounts. Funds are released only upon successful delivery and verification of the product, fostering trust between vendors and marketplaces.

- Escrow in Stock Market

Shares issued in escrow, a common practice in the Indian stock market, safeguard investor interests. Funds are returned if subscription levels fall below 90%, ensuring accountability. Escrow is also employed for employee compensation or bonus plans related to stock issuance.

- Escrow in Lending

Lending transactions leverage escrow payments to protect borrowers and lenders. Funds are in escrow until the borrower fulfils the loan terms, safeguarding the interests of both parties and mitigating the risk of default.

- Escrow in Acquisitions and Business Deals

In mergers, the deal amount lies in an escrow account until the completion of mutually agreed-upon terms. Similarly, in credit sales, funds are held in escrow until the vendor fulfils their obligations, ensuring a fair and secure business transaction.

Advantages of Current Accounts in Specific Business Contexts

- Retail and E-commerce

For retail businesses and e-commerce ventures, current accounts facilitate seamless transactions, including frequent supplier payments, payroll processing, and handling a high volume of customer transactions. The businesses can earn interest on the working capital in their current account.

- Manufacturing and Production

Manufacturing businesses often deal with intricate financial transactions involving suppliers, raw materials, and distribution channels. Current accounts provide the flexibility for managing these transactions efficiently. For recurring payments, the direct debit facility is especially useful.

- Hospitality and Restaurants

In the hospitality sector, where daily transactions with suppliers, staff payroll, and guest payments are common, current accounts offer a practical solution. Some current accounts allow transactions in multiple currencies and provide round-the-clock services.

- Start-ups and Small Businesses

Start-ups and small businesses, characterised by frequent cash flow fluctuations, find value in current accounts. Overdraft facilities and operational flexibility help these enterprises navigate financial uncertainties while managing day-to-day transactions.

- Freelancers and Self-Employed Professionals

Freelancers and self-employed individuals benefit from the simplicity of current accounts in managing client payments, personal expenses, and tax-related transactions. The multi-location support is advantageous for those operating in various workspaces.

Regulatory and Compliance Considerations

Overview of regulations governing nodal accounts

The Reserve Bank of India (RBI) issues guidelines to regulate nodal accounts that primarily focus on ensuring the security, transparency, and efficiency of payments within marketplace ecosystems. Here are some key aspects.

- Customer Due Diligence (CDD): The RBI emphasises thorough customer due diligence to verify user identity.

- Fund Settlement Timelines: Guidelines stipulate specific timelines for settling funds between the various parties involved in a marketplace transaction. Businesses need to abide by these timelines.

- Security Measures: The RBI likely mandates standards, secure access controls, and regular security audits.

- Compliance Reporting: Nodal account operators must submit periodic reports to the RBI detailing their compliance with the guidelines.

- Resolution Mechanisms: The guidelines outline resolution mechanisms to address issues promptly and fairly, ensuring the smooth functioning of the marketplace.

Compliance Requirements for Businesses Using Escrow Accounts

- Account Initiation

An escrow account follows stringent Know Your Customer (KYC) procedures and requires government-issued identification and proof of address for each participant.

- Fund Deposit

Depositors must provide accurate transaction details when depositing funds—commonly through secure online platforms or check payments. In verifying fund receipts, the escrow agent ensures adherence to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

- Holding Period

Regulatory conditions, like property inspections or document verifications, are crucial throughout the holding period. Businesses must ensure compliance with the terms and conditions laid out in the escrow arrangement.

- Post-fulfillment Disbursement

The intermediary must provide transparent and detailed reports on fund movements within the escrow account. Businesses must adhere to resolution mechanisms within the escrow agreement in case of dispute.

Regulatory framework for current accounts and its impact on businesses

The regulatory framework for current accounts encompasses various aspects impacting businesses. Below are some examples.

- Interest Rate Regulations

Regulatory authorities often limit banks' interest rates on current account balances. This affects businesses by influencing the returns they earn on their idle funds and can impact their overall financial strategy.

- Transaction Limits

Businesses must adhere to current account transaction limits, affecting the volume and frequency of transactions they can conduct within a specified period.

- Compliance Reporting for International Transactions

Businesses engaged in international trade may face stringent reporting requirements for cross-border transactions. Compliance involves providing detailed information on the nature and purpose of international payments, impacting the ease and speed of conducting global business.

- Minimum Balance Requirements

Businesses must maintain specified minimum balances, and failure to do so may result in penalties or additional charges, affecting their overall financial management.

Factors to Consider When Choosing The Right Account Type

- Business size and scalability

Small businesses may prioritise simplicity and cost-effectiveness, while larger enterprises require accounts that can scale with their growth and accommodate complex financial operations.

For example, a local bakery may start with a basic current account for daily transactions. It might transition to a more scalable nodal account with online transaction capabilities and integrated financial tools as it expands.

- Transaction volumes and frequency

High-volume businesses need accounts capable of handling numerous transactions efficiently. An e-commerce giant like Amazon requires a nodal account to process millions of daily transactions efficiently.

The account should have low per-transaction fees and robust security features to handle the high frequency and volume.

- Industry-specific requirements

Different industries have unique financial needs and regulatory requirements. Choosing an account that aligns with industry-specific standards ensures compliance and supports specialised operations.

A boutique clothing store might start with a basic current account for occasional online sales. In contrast, a large pharmaceutical company needs a nodal account with stringent security features to meet pharmaceutical industry standards. In real estate transactions, escrow accounts are imperative.

- Regulatory compliance and legal considerations

Adhering to legal and regulatory standards is critical for businesses. The account choice should facilitate compliance with industry-specific regulations, international financial laws, and other legal considerations.

For example, an international financial institution needs a nodal account to comply with complex global financial regulations and anti-money laundering laws.

Conclusion

Businesses must carefully consider their financial needs when choosing between nodal, escrow, and current accounts. Nodal accounts provide centralised control for large enterprises, escrow accounts ensure secure transactions in specific situations, and current accounts offer day-to-day operational flexibility.

Key considerations include business size, transaction volumes, industry-specific requirements, and regulatory compliance. It is crucial for businesses, whether small or large, to seek professional advice to align financial tools with their specific needs.

By optimising financial management through informed decisions, businesses can pave the way for sustained success and growth.