Payment Aggregators: Meaning, Example, and More

Picture this: Your customer has filled their cart and is ready to check out. They prefer using UPI, but your site only accepts credit cards.

Frustrating, right? That's a sale you might lose in seconds. In today's world, customers expect to pay how they want, when they want – whether it's through cards, digital wallets, UPI, or buy-now-pay-later options.

This is where payment aggregators step in, transforming complex payment processes into smooth, one-click experiences. Think of them as your business's payment Swiss Army knife – one tool that handles it all, making life easier for you and your customers.

Payment Aggregator Meaning

Remember when setting up online payments meant drowning in paperwork and juggling multiple bank relationships? Payment aggregators have changed all that. They're like your business's payment department, handling everything from cards to digital wallets under one roof.

A payment aggregator is like your friendly neighborhood payment expert who speaks multiple "payment languages." Whether your customer wants to pay with their trusty credit card, split the bill with EMIs, or quickly scan a UPI QR code, the aggregator makes it all possible through a single connection to your business.

But here's the important part – these aren't just any financial companies.

In India, payment aggregators need the Reserve Bank of India's stamp of approval (a special license) to operate. It's like getting a driver's license but for handling people's money. This ensures your business and your customers' cash stays safe and secure.

Leading payment aggregators and what they offer?

You've probably already used payment aggregators without realizing it. Some well-known names include:

- Razorpay: The go-to choice for many Indian startups and established businesses

- PhonePe Payment Gateway: Backed by their massive UPI success

- Paytm: One of India's earliest digital payment pioneers

- Stripe: A global player making waves in the Indian market

- Cashfree: Known for their innovative payment solutions

These companies have transformed from simple payment processors into complete payment powerhouses, offering everything from instant settlements to detailed business analytics.

How Do Payment Aggregators Work?

Let's break down the journey of a payment aggregator – from welcoming a new business to helping it grow. Imagine you're opening an online handicraft store; here's how a payment aggregator would help you every step of the way:

Getting you started (merchant onboarding)

Remember signing up for your first bank account? Merchant onboarding is similar but smoother. Instead of visiting multiple banks, you just need to:

- Share your business details and documents once

- Complete a simple KYC process

- Get verified and start accepting payments within days, not weeks

Setting up your payment system (integration)

It is like a plugging in your store's payment machine but for the digital world. Payment aggregators make it surprisingly simple:

- Add their ready-to-use payment button to your website

- Or use their APIs if you want a custom checkout experience

- Start accepting multiple payment methods instantly – from cards to UPI

Handling every transaction

This is where the magic happens. When your customer clicks "Pay":

- The aggregator securely collects payment information

- Runs quick fraud checks to keep things safe

- Routes the payment through the right channel (whether it's a card payment, UPI, or wallet transfer)

- Confirms the transaction success to both you and your customer

Getting your money (funds settlement)

Just like a responsible accountant, the aggregator makes sure you get your money on time:

- Collects payments from various sources (cards, UPI, wallets)

- Bundles them together

- Transfer them to your bank account (usually within 1-2 business days)

- Some even offer instant settlement options when you need quick access to funds

Helping your business grow (extra features)

This is where payment aggregators go beyond just processing payments:

- Provide detailed reports showing your best-selling times

- Help set up subscription payments for regular customers

- Alert you about failed transactions

- Offer insights about customer payment preferences

Picture a payment aggregator as your business's financial co-pilot – not just processing payments but helping you understand and grow your business better.

Benefits of Payment Aggregators

Let's look at what makes payment aggregators a game-changer for businesses, especially if you're just starting or looking to grow:

Quick start, less hassle

Gone are the days of endless bank visits and paperwork. With a payment aggregator, you can start accepting payments within days. It's like getting a fully furnished apartment instead of buying furniture piece by piece – everything you need is ready.

All payment methods, one stop

Whether your customer loves paying by card, prefers UPI, or wants to split their purchase into EMIs – you're covered. Consider it your universal payment translator. No need to set up each payment method separately.

Keep your money safe

Payment aggregators have built-in security features to protect you and your customers. They handle all the complex security requirements (like encryption and fraud detection) so you can focus on running your business. Think of it as having a professional security team watching your payments 24/7.

Smart insights at your fingertips

Want to know which payment methods your customers prefer? Or when you make the most sales? Payment aggregators provide detailed analytics that helps you make smarter business decisions. Picture it as having a business advisor who knows exactly how your payments perform.

Support when you need it

Are you running into payment issues at midnight? Most payment aggregators offer round-the-clock support to help solve problems quickly. They're like your tech-savvy friend who's always there to help when payments get stuck.

Pay as you grow

Most aggregators charge only when you process payments, with no heavy upfront costs. This means you can start small and scale up as your business grows – perfect for startups and small companies watching their budget.

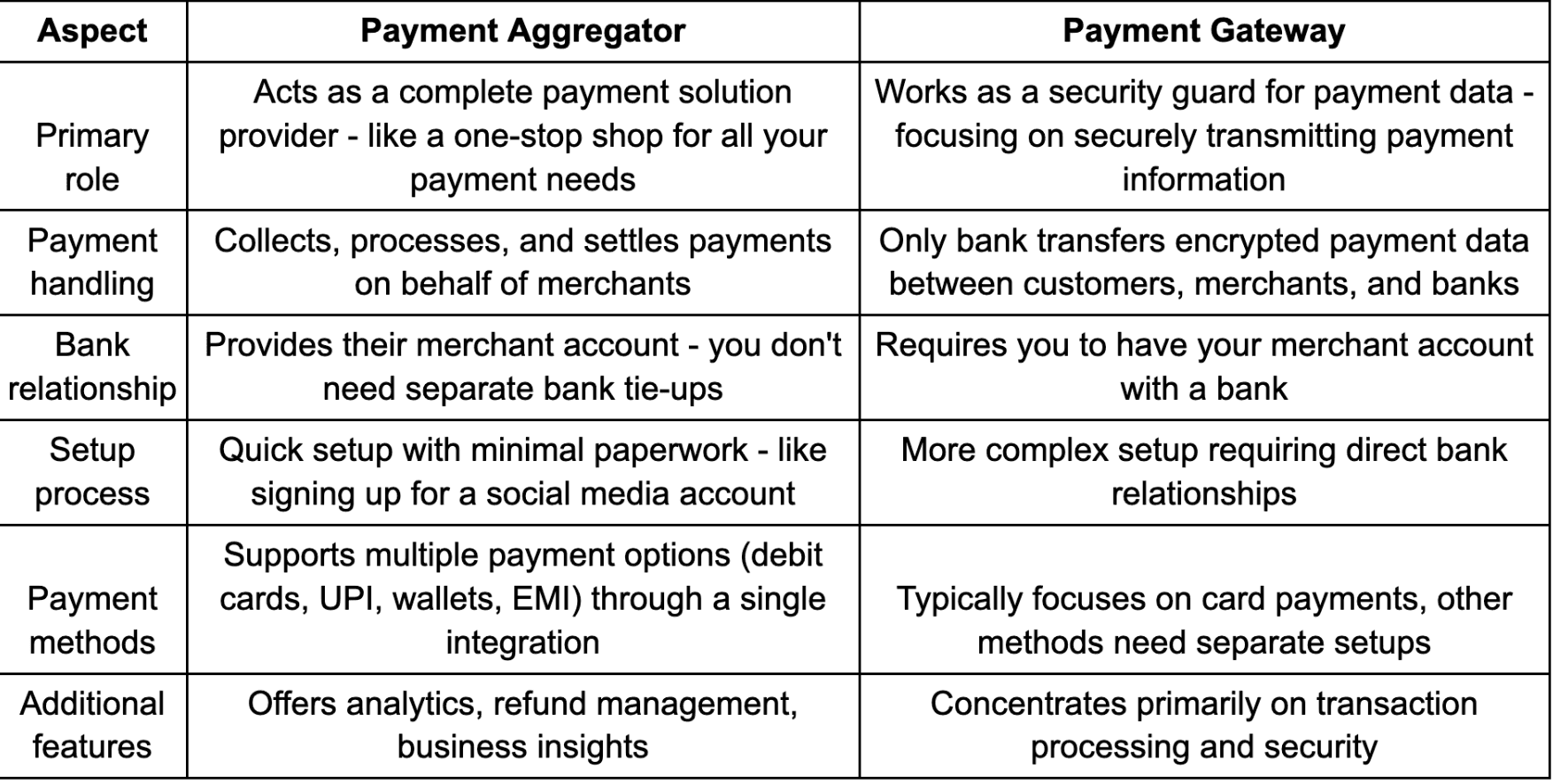

Payment Aggregator vs Payment Gateway: What Are The Differences?

If you've been exploring online payment solutions, you've probably come across both these terms and wondered if they're the same. While they help process online payments, they serve different purposes – consider them cousins in the payment family, not twins.

Let's break down the key differences in a way that's easy to understand:

Q1. What are the fees associated with using a payment aggregator?

Ans: Payment aggregators charge nominal fees ranging between 2%-3% per transaction.

Q2. What are the limitations of using a payment aggregator?