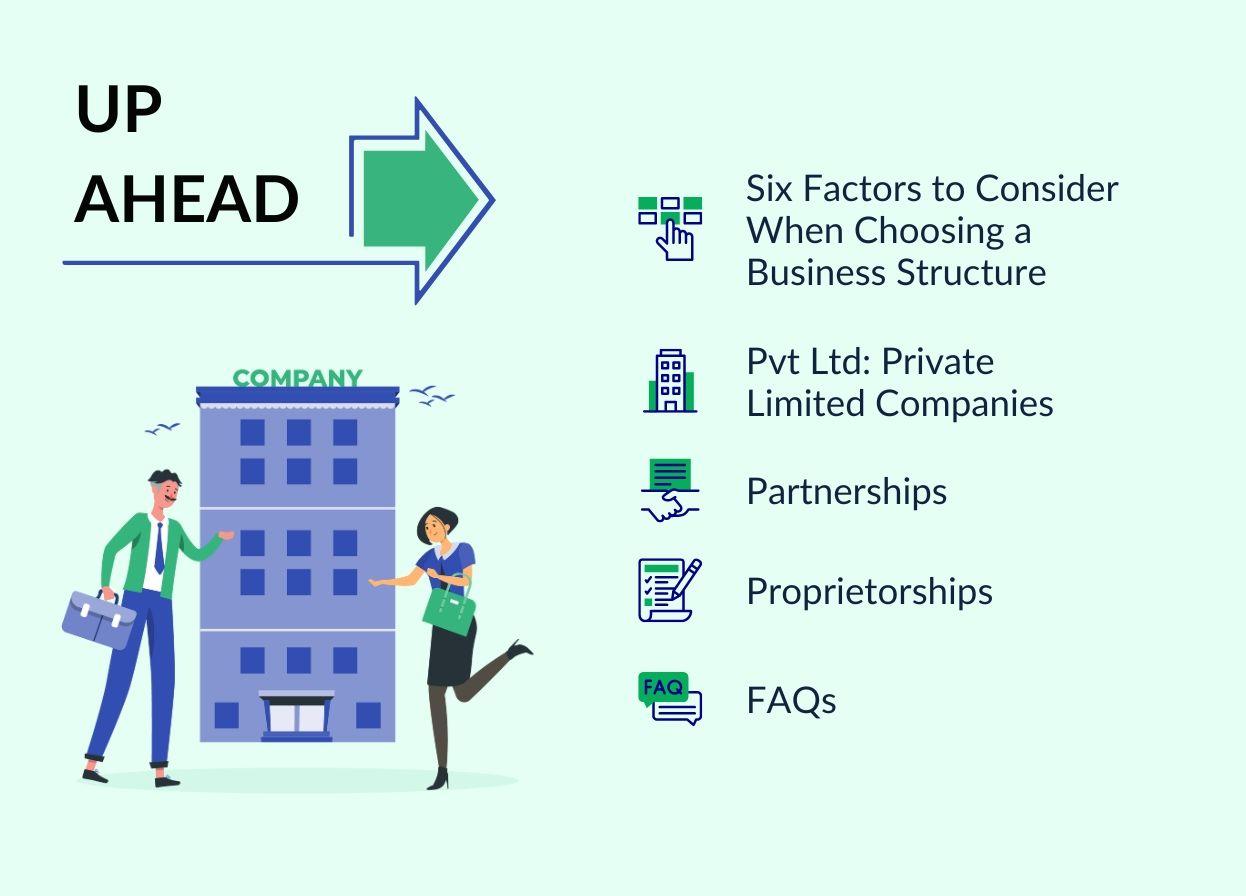

Private Ltd, Partnership or Proprietorship: What should you choose?

Selecting the right business structure is important as it can significantly affect various aspects, such as tax obligations, legal liabilities, and growth opportunities. Moreover, altering the structure down the line can prove to be a time-consuming and costly endeavor.

Therefore, it becomes crucial to carefully consider and choose a suitable legal framework from the outset.

In India, the most common business structures are:

- Private Limited Company

- Limited Liability Partnership Firm

- Partnership Firm

- Proprietorship

In the financial year 2021-22, as many as 1.67 lakh new companies registered with the Ministry of Corporate Affairs, bringing the total to 14,13,249 registered private companies and 2,52,460 limited liability partnerships, while more than 60% of all registered businesses are sole proprietorships.

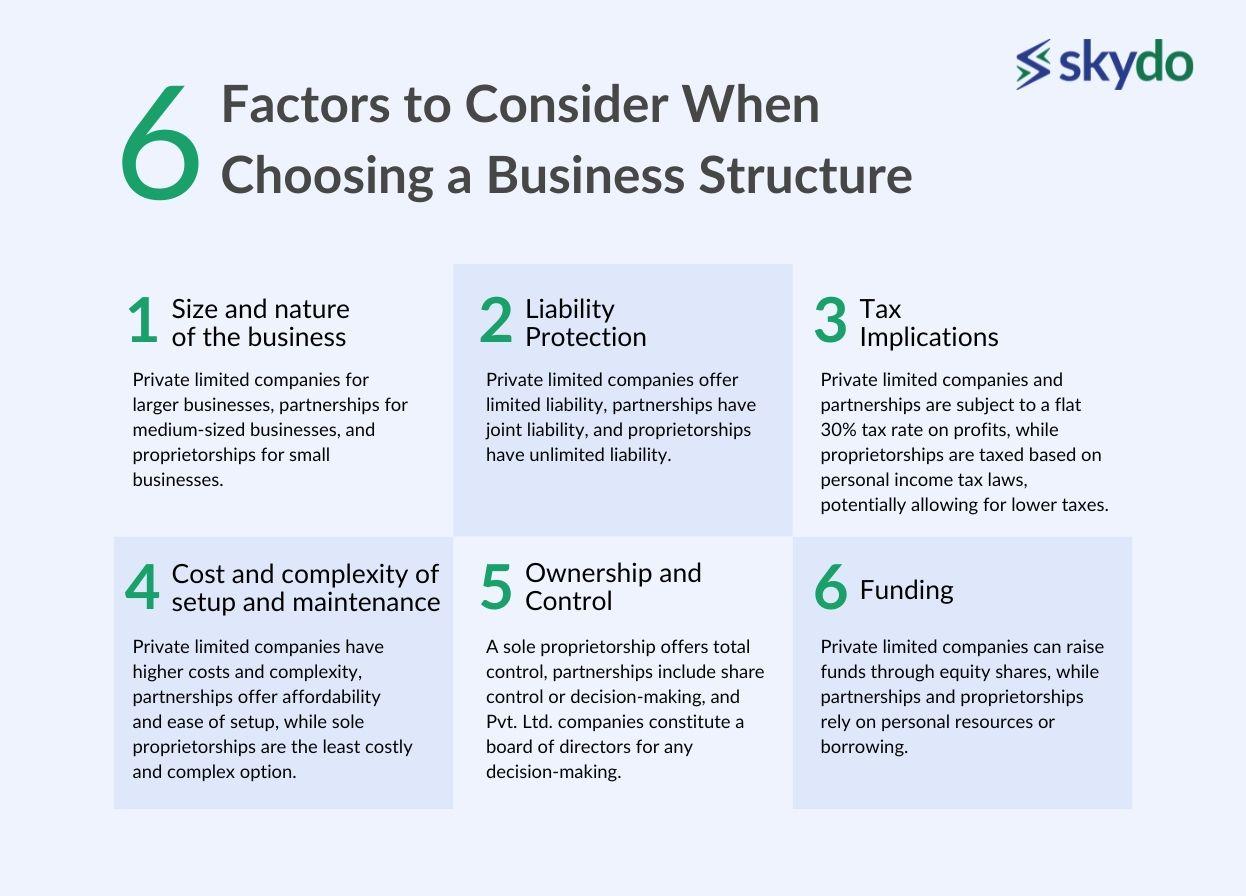

Six Factors to Consider When Choosing a Business Structure

1. Size and nature of the business

If you want to start a business, you can look towards starting a private limited company. Private limited companies can have a minimum of 2 and a maximum of 200 members. This structure suits medium to large-sized businesses requiring significant investment, infrastructure, and compliance requirements.

Partnerships involve a minimum of two and a maximum of 20 partners, making it suitable for small to medium-sized businesses that require less investment, have lower compliance requirements, and are easier to set up. Some examples are Maruti Suzuki, Mahindra and Mahindra and Hindustan Petroleum.

A single individual owns proprietorships, making them suitable for small businesses requiring minimal investment, low compliance requirements, and easy to manage.

2. Liability Protection

Liabilities include all the business's financial obligations, such as debt, which they are legally liable to repay. However, some business structures differentiate between the enterprise and the owner to protect the owners from being personally liable to compensate liabilities.

You can start a private limited company if you want to have limited liability to the extent of the share capital ie your contribution to the company. Your personal assets will be safe.

However, in the case of general partnerships, you and your partners will be jointly liable for the business’s debts and obligations. That means, your personal assets will be at risk. If you do not want unlimited liability but want to create a partnership firm, you can start a limited partnership (LLP). LLPs have at least one general partner with unlimited liability and one or more limited partners whose liability is limited to the extent of their contribution.

Here, starting a proprietorship may not be the right decision as the sole owner has unlimited liability and is personally liable to repay all the financial obligations.

3. Tax Implications

Every business is legally liable to pay tax on the profits. However, as taxes reduce the overall profits, you should choose among the three based on their tax implications. For example, if you do not want to start a business liable to pay high taxes, you can pass on starting private limited companies and partnerships as they must pay taxes on the profits at a flat 30% rate, plus surcharge and cess as applicable.

In the case of proprietorships, the sole owner personally receives the profits. Hence it is taxed per personal income tax laws as per the applicable tax slab. Sole proprietorships involve paying fewer taxes and prove an ideal choice if reducing tax liability is a vital business factor.

4. Cost and complexity of setup and maintenance

All entrepreneurs want to start a business that does not include higher costs and complex processes. If you have high capital and the efforts to start a big business, you can choose private limited companies as the business structure. Private limited companies require a minimum share capital of Rs. 1,00,000. They also require a higher initial investment for legal fees, registration fees, and other compliance requirements. The complexity of setup and maintenance is also higher than other business structures.

However, if you want a business structure which is relatively affordable and easier to set up, a partnership firm will be an apt business structure as the minimum capital required is Rs 50,000. It requires minimal legal formalities, and the cost of maintaining a partnership is also lower than a private limited company, as it has fewer compliance requirements.

The best business structure for the lowest cost and complexity is a sole proprietorship, which does not require extensive registration or legal formalities. Many proprietors don’t even register the company, running it in their name with their personal bank accounts.

5. Ownership and Control

Some entrepreneurs want total control over all business affairs, while some seek the expertise and skills of others to make mutual decisions. If you are the former, you can choose sole proprietorship as the business structure. The sole owner of the proprietorship has complete control over the management and the profits, as it is not a separate legal entity.

However, if you are the former, you can create a partnership firm, as all the partners have ownership and control based on the profit-sharing ratio determined at the time of incorporation. In the case of private limited companies, the shareholders have ownership, but the board of directors controls the entity. Hence, the decision-making is collective and requires mutual agreement on implementing business ideas.

6. Funding

Funding is an important aspect of the success of a business, allowing entrepreneurs to ensure constant cash flow into the business. Private companies are the ideal business structure to create a business that can raise funds as needed. Private limited companies are popular when choosing a business structure, as they can issue equity shares to investors. Private limited companies can raise funds through venture capital, private equity, angel investors, and even an initial public offering (IPO) if they meet specific criteria. It becomes easy to issue new shares, buy back old ones, or sell or buy them.

Partnerships can only raise funds through the personal resources of the partners, whereas proprietors leverage personal resources or borrow funds from banks and other financial institutions. Both business structures can not issue equity shares to investors or borrow funds by pledging their assets as collateral. If they want to change the partnership structure or add investors, they must dissolve the current partnership and create a new one.

Pvt Ltd: Private Limited Companies

Registered under the Companies Act 2013 with the Ministry of Corporate Affairs are legal business entities held privately by various shareholders.

Private limited companies in India need approval by the Registrar of the Company concerning their name and can have a minimum of two and a maximum of 200 members/directors. Shareholders have limited liability that extends only to their share capital. Foreigners can invest in private limited companies under the automatic route, and owners can transfer ownership through share transfer.

Advantages of Pvt Ltd

- Private Limited companies offer limited liability to shareholders, protecting their personal assets in case of losses or legal issues.

- They can issue shares to investors, making raising capital for business operations or expansion easier.

- Pvt Ltd companies are eligible for various tax benefits offered by the Indian government on R&D expenses, depreciation, and other business expenses.

Disadvantages of Pvt Ltd

- The cost of setting up and maintaining private limited companies is higher, and the process is time-consuming.

- Private limited companies are subject to various compliance requirements under the Companies Act 2013, such as maintaining statutory registers, filing annual returns, and holding annual general meetings.

- Since the board of directors control the company, shareholders have limited control over the business operations.

Examples of businesses suitable for Pvt Ltd

The business structure of a private limited company is suitable for businesses that require high investment and are large to medium size. This can include capital-intensive manufacturing, IT, real estate, retail and large-scale service enterprises.

Questions to ask yourself before you choose Pvt Ltd

Ponder upon the following questions before choosing the private limited structuring.

- Do you have the high initial capital required to set up a Pvt Ltd company?

- Do you have at least one other person to tick off the minimum member requirement? (Now, you can also create an OPC - a one-person company, which doesn’t need another director)

- Do you want the size of the business to be comparatively bigger than a small business?

- Are you ready to spend considerable time fulfilling the business's legal and compliance-related obligations?

Compliance and Role of CAs and Lawyers in Pvt Ltd Companies

Compliance is critical to running a private limited company in India. Seek the advice and guidance of qualified professionals, such as Chartered Accountants (CAs), Company Secretaries (CS) and lawyers, to ensure effective compliance with all legal and regulatory requirements.

Such professionals help with–

- The company’s incorporation and registration

- Preparing necessary documents for complying with the rules of the Companies Act, taxation and accounting

- Risk management

Government Schemes

The Indian government has established numerous schemes to support private limited companies such as:

- A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship (ASPIRE)

- Support for International Patent Protection in Electronics & Information Technology (SIP-EIT)

- Credit Guarantee Scheme for Startups (CGSS)

- Pradhan Mantri Mudra Yojana

Partnerships

Partnership firms have at least two members who agree to share profits based on a pre-defined ratio. There are two types: general partnership and limited liability partnership (LLP).

General partnerships are registered under the Partnership Act of 1932. The partners have unlimited liability with a maximum of twenty members.

LLPs are registered under the Limited Partnership Act of 2008. Partners in LLPs have limited liability and can have an unlimited number of partners.

Advantages of Partnerships

- Partnerships offer a lower cost of setting up for individuals starting a business.

- Partners report profits in their taxable income, so no income tax is paid for the business entity.

- Partnerships spread overall business risk; each partner bears the financial burden of losses.

- Partners can decide on the partnership agreement, including division of responsibilities and allocation of profits.

Disadvantages of Partnerships

- Taking all the business decisions collectively can be time-consuming and result in disputes.

- In a general partnership, all the partners have unlimited liability, where the creditors can seize the personal assets of the partners in case the business entity fails to repay the financial obligations.

- Partnerships can become unstable and may lead to dissolution if one of the partners decides to withdraw from the partnership or dies.

Examples of businesses suitable for partnerships

Compared to private limited companies, partnerships are easier to set up and do not require a high initial capital investment. This business structure is ideal for mid to small-scale businesses. Some examples are professional services such as CAs, lawyers, retail or wholesale businesses and small-scale manufacturing businesses.

Questions to ask yourself before you choose Partnerships

What makes partnerships an ideal business structure? Here are some questions to consider before starting a partnership firm.

- Will the size and nature of your business flourish under a partnership structure?

- Do you have limited capital and cash flow and require capital from a partner to start the business?

- Have you worked with the chosen partner before and know their skills and expertise will help the business succeed?

- Are you comfortable sharing profits with others for their contribution to the business?

Compliance and Role of CA and Lawyers

Partnerships in India must comply with legal and regulatory requirements. A CA or lawyer can help manage financial matters, create and manage the partnership deed, and ensure the firm obtains a PAN and TAN Card. CAs assist with bookkeeping, accounting, and relevant financial documents. Lawyers help ensure stability in case of disputes or dissolution of the firm.

Proprietorships

An individual owns, controls, and manages a proprietorship business with minimal regulatory compliance and no registration with government authorities. However, the proprietor must obtain relevant licences and tax registrations from the State/Central government based on the business's nature. Proprietorships have unlimited liability, and a person can be the company’s stakeholder.

Advantages of Proprietorships

- Proprietorships offer a simple and economical business structure with minimal legal formalities and compliance requirements.

- The proprietor is the sole owner of the entity with total control over business operations, requiring minimal initial capital.

- Proprietorships do not require annual financial statements or public disclosure, making them ideal for individuals with limited capital and cash flow.

Disadvantages of Proprietorships

- The Indian government does not recognise proprietorships as separate legal entities.

- Proprietors are personally responsible for all financial obligations and have limited options to raise funds, relying on personal assets or loans.

- Limited capital and cash flow make it challenging to compete with larger businesses or benefit from economies of scale.

Examples of businesses suitable for Proprietorships

Proprietorships as a business structure are the most sought-after for individuals who want to open a small-scale business without the hassle of extensive regulatory and registration processes.

Some examples of businesses suitable for proprietorships are freelancers and consultants for content writing, graphic design, agriculture businesses, retail shops, small-scale manufacturing and online businesses such as e-commerce stores.

Questions to ask yourself before you choose Proprietorships

Proprietorships provide the highest flexibility to run a business. However, consider the following questions before choosing the business structure.

- Do you have limited capital and cash flow but want to start a small-scale business?

- Are you comfortable with unlimited liability and willing to pledge personal assets for financial obligations?

- Can you control, manage and run the whole business without the skills and expertise of anyone else?

- Do you want to keep your business and personal finances separate?

Compliance and Role of CA and Lawyers

CAs and lawyers are limited in proprietorships as they do not require registration under the Companies Act. Proprietorship owners may engage a CA to obtain tax and business licences and file taxes. Lawyers can assist in legal disputes with creditors or third parties.

Conclusion

Choosing an ideal business structure is critical to creating an effective blueprint for the business and ensuring that the execution of business activities leads to success. However, you must consider factors such as size and nature, liability protection, tax implications, costs and complexity, ownership and control with the funding aspect before choosing among the three business structures.

It is always wise to seek professional advice from experts who analyse the objectives and goals of the business to pitch you with the right structure. Once your business has the right structure, you can move forward and execute further business activities to attain profitability, sustainability and success.

FAQs

Q1. Which is better proprietorship or partnership?

Ans: The choice between proprietorship and partnership depends on factors like individual preferences, risk tolerance, and business goals. Proprietorship offers sole control, while partnership allows shared responsibilities. You can choose one that suits your envisioned goals.

Q2. Is Pvt Ltd better than a proprietorship?

Ans: Private Limited (Pvt Ltd) companies often provide more credibility, limited liability, and potential for growth compared to proprietorship, making them generally preferable for businesses seeking formal structure and expansion.

Q3. Which is better partnership or Pvt Ltd?

Ans: The decision between a partnership and a Pvt Ltd company hinges on factors like ownership structure, liability concerns, and growth aspirations. Pvt Ltd entities usually offer a more formal structure and limited liability.

Q4. Is it better to be a partnership or a limited company?

Ans: Choosing between a partnership and a limited company depends on factors like business size, structure preferences, and liability considerations. Limited companies provide a more formal structure, limited liability, and potential for substantial growth, making them suitable for larger enterprises.