Secure Finances: 5 Tips to Achieve Business Compliance

A powerful empire crumbles, not from external forces, but from within. Like the parasite that silently multiplies and destroys, unchecked financial non-compliance can undermine even the mightiest businesses.

A survey report found that 67% of firms believe business compliance is becoming more complex. With recession looming over the global economy, businesses cannot afford to take any risks when complying with financial regulations. The fallout from non-compliance can be severe, resulting in hefty fines, legal action, and damage to a company's reputation.

To avoid this, staying current with financial regulations and requirements is important. Let's drill down the five ways to make your business financially compliant this year.

Tip 1: Stay Updated With Existing Laws + Regulatory Changes

A recent study conducted by PwC revealed that 40% of CEOs are worried about the constant changes impacting their organisation, as they fear it may result in non-compliance with laws and regulations.

The utilisation of compliance calendars is a valuable asset in such circumstances. These calendars are frequently offered at no cost and serve the purpose of aiding individuals in monitoring important dates and obligations, such as tax deadlines, financial report filings, and various regulatory business compliance requirements including registering GST online.

Moreover, you can access different resources like government websites ( such as the RBI, Securities and Exchange Commission, Federal Trade Commission, MCA and SEBI), professional organisations, and industry newsletters to stay informed and updated. Your proactive approach saves you from potential fines and disruptions in your supply chain, and your customers appreciate your reliable and compliant business practices.

Tip 2: Implement Robust Financial Management Systems

Have you heard the story of the Roman Empire? They had lots of money from winning wars, but when they stopped winning, things got bad. They spent too much and messed up their money, which caused lots of problems and helped lead to their downfall. This shows us the importance of being careful and managing money well.

Like the Romans, we must also understand our money situation, especially when things change. Financial management systems can help us do just that. They give us a clear picture of how we're doing and help us make better money decisions. Believe me. We don't want to end up like the Romans!

As Deep Shah, Co-founder of The Wise Idiot, explained - “The three major benefits of using financial management systems are: time-saving (since it's directly linked to my bank account, enabling faster payments and reconciliation or even GST filing), ease of use (with intuitive UI and cloud-based technology), and easy analysis (almost every report I need is already templated and ready).”

But the foundation of any effective financial management system rests upon the fundamental accounting process. Here are some basic steps of accounting:

- Recording transactions: Documenting all financial transactions, including sales, purchases, and expenses, systematically.

- Classifying transactions: Categorizing transactions into relevant accounts such as revenue, assets, liabilities, and expenses.

- Compiling data: Compiling and organising transaction data into financial statements like the balance sheet, income statement, and cash flow statement.

- Analysing financial data: Assessing financial statements to understand the company's financial health, profitability, and liquidity.

- Preparing reports: Regular financial reports for internal and external stakeholders, including shareholders, investors, and regulatory authorities.

To automate the above process, you can use standard accounting software. This tool allows for streamlined financial record-keeping, reducing the likelihood of errors and improving efficiency. With accounting software like ZohoBooks, and Xero, businesses can easily track expenses, manage accounts payable and receivable, and reconcile bank statements.

Kevin Singh, Founder of Viral Inbound, described - “Using popular accounting software has been essential for our business to operate smoothly and make informed financial decisions. It's a valuable investment that has helped us save time, reduce errors, and focus on growing our business. And for us, ZohoBooks has been a great choice for our accounting needs.”

Another key component of the financial management systems is financial audits. These audits are important to ensure accuracy and business compliance. They identify errors and areas for improvement, build trust with investors, and demonstrate a commitment to transparency.

Tip 3: Ensure Proper Record-Keeping

Just as a seatbelt is vital for safety and protection in an accident, accurate financial records are essential for protection and accountability in an audit or investigation.

While explaining the importance of record-keeping, CA Kanan Bahl, Founder of Fingrowth Media, describes, "It is a famous saying in the CA Practice lobby - Compliance is costly, but non-compliance is far more costly. If applicable, one must keep appropriate financial records per the relevant statutes.

There are many penalties under GST and Income tax laws. Just to name one small cost of non-compliance - ₹25,000 is the penalty u/s 271A of the Income Tax Act, 1961 for not keeping book-keeping records u/s 44AA."

Accurate financial records clearly show a company's financial activities, ensuring transparency and accountability. Therefore, it's essential to prioritise the accuracy and completeness of financial records to ensure business compliance with regulations and maintain the company's reputation and financial stability.

Here are some tips for proper record-keeping for your business:

- Organise records logically and consistently based on your foreign transactions. This can be done by grouping records by date, category, or project.

- Use digital tools to store and manage financial records, such as cloud-based storage or specialised record-keeping software (like ZohoBooks). It will help to all financial records in a single centralised location.

- Regularly reconcile bank statements to ensure the accuracy of financial records. You can use automatic cash management software to auto-reconcile all your bank statements in a real-time dashboard.

- Ensure to keep a Foreign Inward Remittance Certificate (FIRC) for every payment to prove the payment was made in foreign currency.

- Always keep backup financial records to protect against data loss or corruption.

- Review your financial records and reports regularly to identify any discrepancies or areas for improvement.

Tip 4: Engage a Professional Financial Advisor

Embarking on international business can be exciting, but many financial challenges exist, including cash flow problems due to long payment terms. The production, technical expenses, and maintenance costs can be challenging to manage upfront. Moreover, the fallout from non-compliance can have serious consequences, including significant financial penalties, adding another layer of complexity to the business.

With a wealth of knowledge and expertise in finance, taxation, and regulations, a financial advisor can help you successfully navigate the challenges of conducting business internationally and ensuring your company remains financially stable. Here are some more benefits of having the right professional financial advisor.

- Time-saving: Managing finances can be time-consuming, and a financial advisor can take on these tasks, freeing up time for business owners to focus on running their businesses.

- Risk management: A qualified accountant can assist businesses in managing financial risks by identifying potential financial threats and offering guidance on avoiding them.

- Financial planning: Financial advisors can help businesses develop long-term financial plans, including forecasting revenue, managing cash flow, and creating budgets.

- Compliance: Businesses can reduce the risk of penalties and fines by seeking guidance from financial advisors or accountants who can ensure business compliance with relevant financial regulations and requirements.

- Objective advice: Financial advisors can provide unbiased advice, as they have no personal stake in the business's financial decisions.

However, when seeking to engage the services of a financial advisor or accountant, assessing their performance becomes imperative by examining specific Key Performance Indicators (KPIs). This is essential to guarantee that their services align with your business's long-term objectives. Consider the following significant KPIs when evaluating potential candidates:

- Relevant qualifications: Look for financial advisors or accountants with relevant certifications or degrees, such as a CPA or CFA.

- Experience: Consider the advisor's or accountant's experience in working with businesses in a similar industry or size.

- Communication skills: A good financial advisor or accountant should be able to communicate complex financial information clearly and concisely.

- Analytical skills: Look for an advisor or accountant with strong analytical skills who can provide insightful financial analysis and advice.

- Client references: Consider asking for client references to gain insight into the advisor's or accountant's track record and client satisfaction.

As per business requirements and need, companies can also hire an in-house financial expert. This person can manage the day-to-day financial operations of the business, provide strategic financial advice, and ensure compliance with relevant regulations.

Rohit Khurana, a Chartered Accountant professional and finance lead at Skydo, gives insights on hiring a full-time financial expert “Despite the business needs, if your turnover is more than ten core, then you have hired a full-time CS or CA as per Govt. law”. An in-house financial expert can also work closely with other departments within the business to develop financial plans and budgets.

Tip 5: Provide Ongoing Employee Training

To mitigate the risks associated with financial compliance, businesses should collaborate with a financial advisor and provide ongoing employee training. This will effectively ensure that employees stay up-to-date with the latest financial compliance requirements and possess the knowledge to comply.

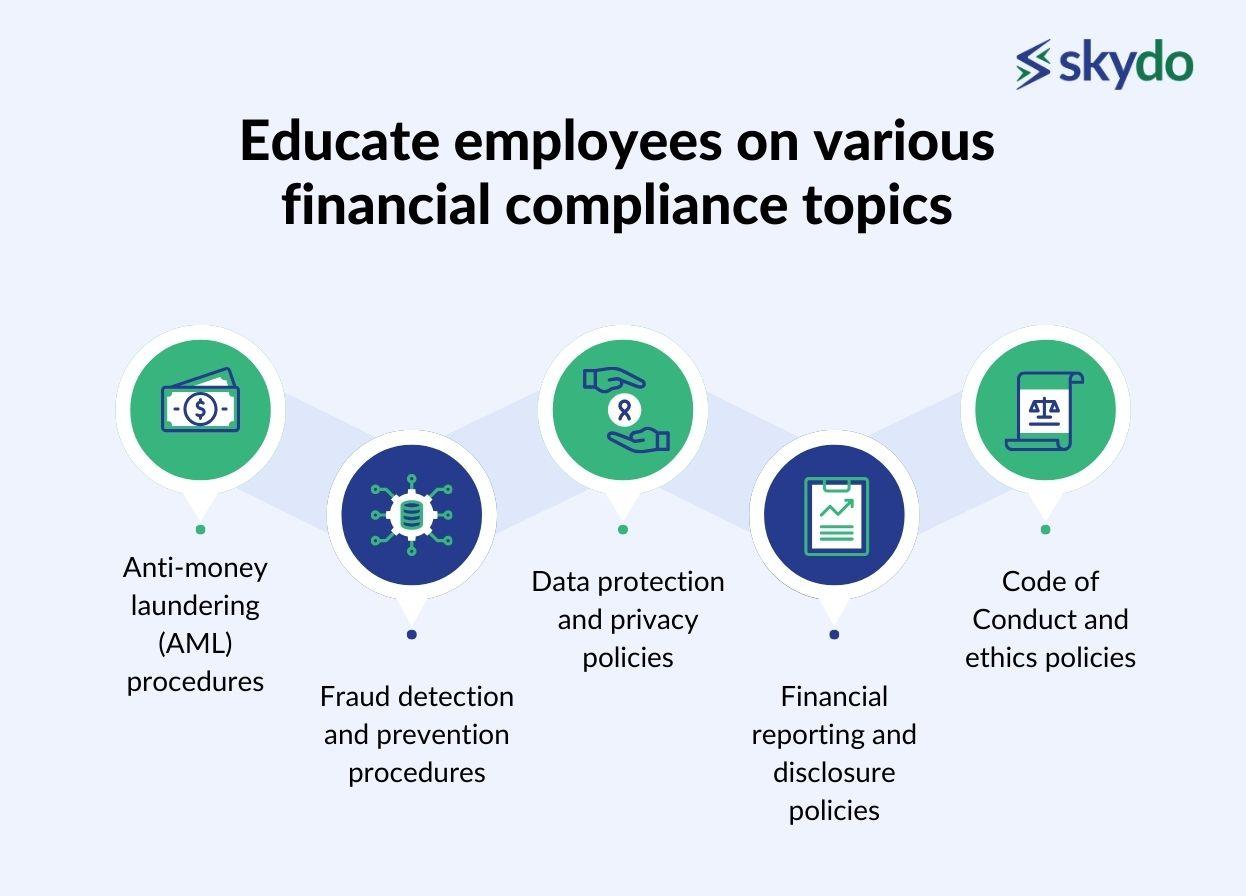

Regular training sessions can be offered to employees to inform them about changes to financial compliance rules and procedures. Standard operating procedures (SOPs) can also be created to educate employees on various financial compliance topics, such as:

- Anti-money laundering (AML) procedures

- Fraud detection and prevention procedures

- Data protection and privacy policies

- Financial reporting and disclosure policies

- Code of Conduct and ethics policies

Moreover, a C-suite executive can act as a compliance officer to establish and maintain a culture of compliance in the organisation. This includes setting compliance objectives, monitoring compliance activities, and regularly training employees. Businesses can protect their financial stability and uphold a favourable reputation by prioritising financial compliance and offering continuous support and training to employees.

Final Thoughts

Maintaining financial compliance is not an option. It is necessary for any business that wants to succeed in today's world. Navigating the complex web of financial regulations and requirements can be daunting. Still, with the right mindset and tools, it is possible to make your business financially compliant this financial year.

Start prioritising your financial compliance today to minimise the risk of financial non-compliance and keep your business running smoothly in the long run!

Frequently Asked Questions

Q1: Why is financial compliance important for businesses?

Ans: Financial compliance is crucial for businesses as it ensures adherence to laws and regulations, preventing hefty fines, legal action, and damage to the company's reputation. Non-compliance can lead to severe consequences, making it essential for businesses to stay current with financial regulations.

Q2: How can businesses stay updated with existing financial laws and regulatory changes?

Ans: Businesses can stay updated by utilizing compliance calendars, accessing government websites (such as RBI, SEC, FTC, MCA, and SEBI), following professional organizations, and subscribing to industry newsletters. Proactive monitoring helps prevent non-compliance and ensures reliable business practices.

Q3: What are the benefits of implementing robust financial management systems?

Ans: Implementing financial management systems provides benefits such as time-saving, ease of use, and easy analysis of financial data. Standard accounting software like ZohoBooks and Xero can automate processes, streamline record-keeping, and improve overall efficiency.

Q4: Why is proper record-keeping essential for financial compliance?

Ans: Accurate record-keeping is vital for transparency, accountability, and compliance with regulations. It helps in demonstrating financial activities, ensuring accuracy, and protecting a company from potential penalties and fines.

Q5: How can businesses mitigate financial challenges and ensure compliance when operating internationally?

Ans: Engaging a professional financial advisor can help businesses navigate international challenges. Financial advisors assist in managing finances, identifying and mitigating financial risks, developing long-term financial plans, ensuring compliance with regulations, and providing objective advice.