Built from India, for the World: Skydo’s Series A Fuels Cross-Border Growth

A New Chapter Begins

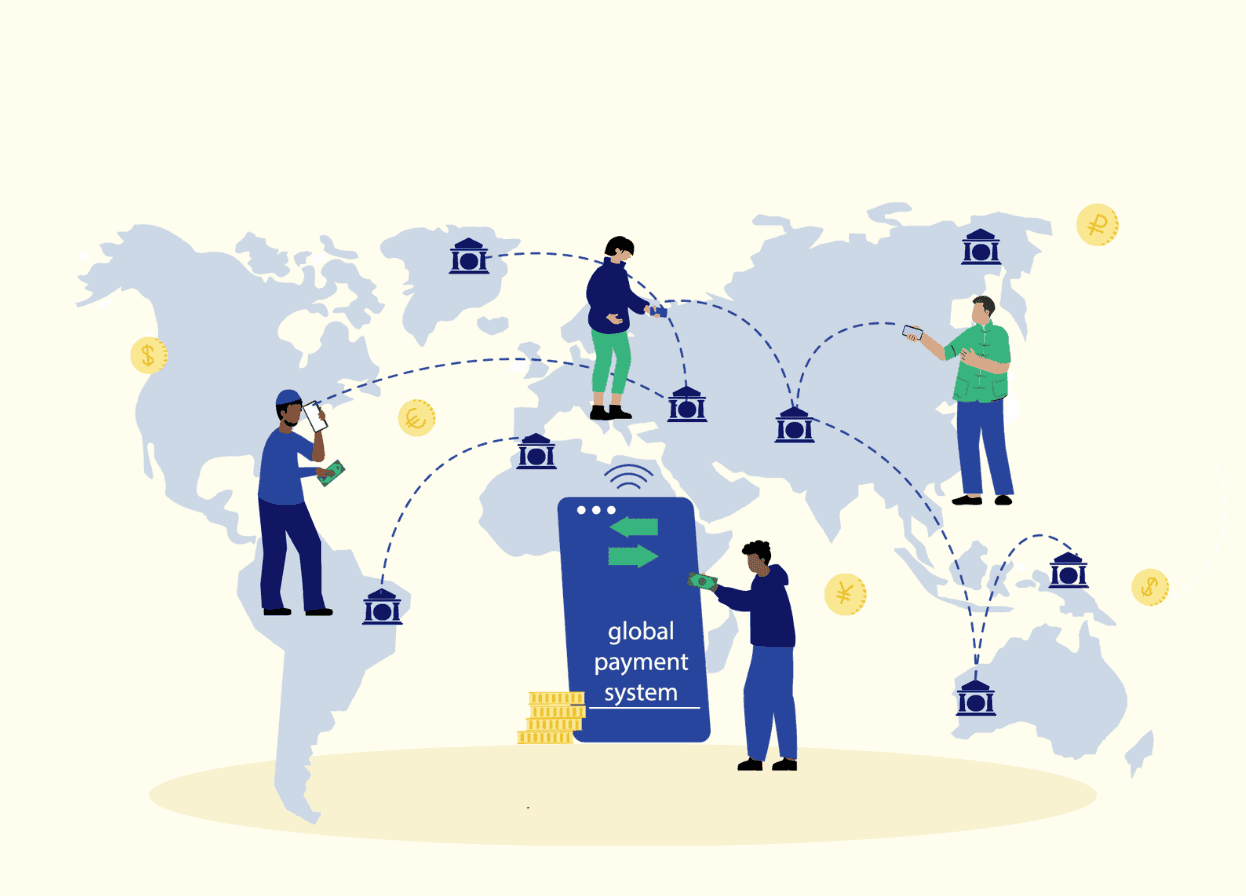

We’ve always believed that the next generation of global businesses will be built from India. But for that to happen, cross-border money movement has to be as simple as sending an email: fast, easy, and predictable. That’s why we built Skydo: not just to move payments, but to unlock global growth for the thousands of Indian businesses that are ready to compete on the world stage.

Today, we’re excited to share that Skydo has raised a Series A round led by Susquehanna Asia Venture Capital, with participation from Elevation Capital and Eximius Ventures. This milestone enables us to double down on our mission, serve our customers better, and expand the capabilities of our cross-border platform for the future.

Skydo now serves over 30,000 MSMEs, freelancers, and startups across 50+ cities in India, processing payments in 32+ currencies. We’re on track to reach USD 5 billion in annualised payment volume by 2027 and were among the first to receive the Reserve Bank of India's In-Principle authorisation as a Payment Aggregator - Cross Border (PA-CB).

The Cross-Border Payments Challenge

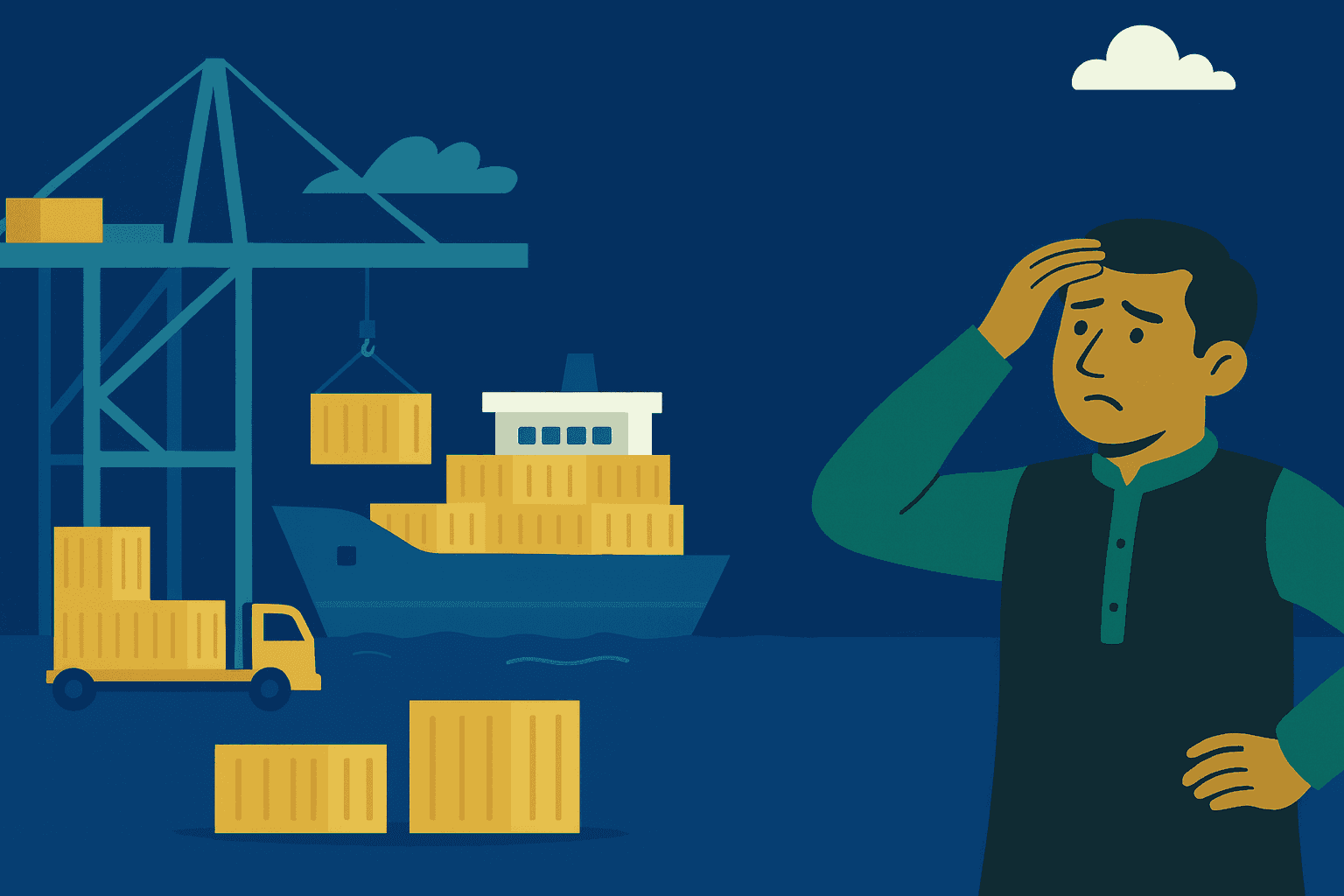

India is poised for an export boom, with an ambition to reach $2T in annual exports by 2030, powered by hundreds of thousands of MSMEs, freelancers, and startups taking Indian talent and products global. But payments have remained a persistent bottleneck. Hidden forex mark-ups and opaque fees can shave off 3–7% of revenue per transaction, and a single international payment can take days (sometimes weeks) to arrive. Then comes the grind: paperwork, compliance documents, bank visits, and long email chains that can stretch for months. While exporters move fast, cross-border payments have kept slowing them down.

For years, Indian businesses had two imperfect choices: traditional banks or expensive global fintech platforms/gateways. Banks often come with unclear charges, unfavourable exchange rates, and manual compliance steps. Global platforms can take steep commissions, sometimes up to 10% of the invoice value, and still aren’t designed for the realities and regulations Indian exporters operate under. We kept hearing the same stories: margins getting eaten up by fees, and cash flow getting stuck mid-transfer or in compliance limbo. Indian exporters deserve a world-class payment experience built for their needs. That’s why we built Skydo.

Skydo’s Solution: A Financial OS for Exporters

Our aim with Skydo is to give Indian exporters a financial operating system for cross-border commerce, one place to manage international receivables end-to-end. In practice, Skydo lets you collect payments from clients across 20+ countries as easily as a domestic transfer. Your customer in New York or London pays into a local bank account (via virtual accounts in USD, EUR, GBP and more), and Skydo takes it from there.

Funds are brought into India at mid-market rates (zero forex markup) with a transparent flat fee, and are typically settled into your INR account within 24 hours. No hidden charges eating into margins. What you invoice is what you receive, minus the clearly disclosed fee. Every transfer also includes instant compliance documentation like FIRA, generated automatically, so you don’t have to chase banks for weeks.

Beyond payments, Skydo also includes accounts receivable tools, invoicing, reminders, real-time tracking, and accounting integrations, so managing international client payments becomes truly hassle-free.

In short, Skydo makes cross-border receivables fast, predictable, and compliant by default, removing the 3–7% “tax” of hidden spreads and wire fees many businesses have learned to tolerate. Built in India, for the world, Skydo combines RBI-authorised, compliance-first infrastructure with modern fintech execution and that’s how we’ve earned the trust of thousands of businesses that rely on us every day.

Until now, the only options were either banks or costly global platforms, which just didn’t work for us. Skydo has simplified our cross-border payments and cut our finance costs dramatically. Their fixed fees and mid-market rates give us full predictability and better value than any bank we’ve worked with.

Series A: Fueling the Next Phase of Growth

With our Series A fundraise, we now have additional firepower to accelerate our roadmap and bring even more value to our users. This $10 million in new funding will be invested in scaling Skydo into the comprehensive, one-stop cross-border platform our customers need. Here’s a glimpse of what this funding will help unlock:

- Geographic Expansion: We will enable local payment collections in 20+ new countries across Latin America, Africa, Southeast Asia, and the Middle East. This means your clients in even more countries can pay you in their local currency and method, and Skydo will seamlessly settle the funds back to India.

- Global Licensing: We’re pursuing regulatory licenses in key international markets to ensure our services are compliant, secure, and accessible globally. This will strengthen Skydo’s network and reliability as we expand into new corridors.

- Card Payment Infrastructure: We’ll be scaling up Skydo InstaLinks, our solution for card acceptance, so that Indian exporters can accept international credit/debit card payments with half the cost and friction of legacy payment gateways. This will open up new avenues for you to get paid, especially from global customers who prefer paying by card.

- Deeper Compliance & Automation: We are doubling down on our compliance suite with enhanced reconciliation and reporting tools. By further automating paperwork and back-office workflows, we aim to reduce your overhead – so exporters spend less time on admin and more on growth.

- Developer Platform: To support SaaS companies, marketplaces, and fintech partners, we will roll out developer-friendly APIs and webhooks. This will allow other platforms to embed Skydo’s global payment rails and compliance features into their products, extending our reach and making cross-border payments even more ubiquitous and easy to access.

This funding helps us move faster on our core mission: building a financial operating system for global commerce. Whether it’s a freelance designer in Jaipur getting paid by a client in Brazil, a startup in Bengaluru selling across Europe, or an SME in Surat exporting to the Middle East, we want Skydo to quietly power those cross-border transactions end-to-end. We’re investing heavily in product and infrastructure so exporters can stay focused on their busines, while we handle the complexity of international payments and compliance.

We’re also excited about the ecosystem that can grow around Skydo. By opening up our APIs and working closely with regulators, banking partners, and fintech innovators, we aim to help build stronger cross-border rails for everyone. From here, it’s about scaling what works and continuing to innovate based on user feedback, and we now have the resources to do exactly that.

Thank You to Our Customers and Community

Reaching this milestone would not have been possible without our customers’ unwavering trust and support. From the early adopters who took a chance on us when we were an unknown startup, to the thousands who have since joined, you have been the driving force of Skydo’s growth. Your feedback has shaped our product at every step. When you told us about problems with banking paperwork or unexpected fees, we went back to the drawing board to build better solutions. When you needed a feature, whether it was simpler invoicing or status tracking, our team hustled to make it happen. This customer-obsessed culture is core to who we are, and it will remain our North Star going forward.

We are incredibly humbled by the kind words and success stories you’ve shared with us.

One of our early users, Abhishek Agarwalla (Co-founder & CEO of Fabric), recently said:

Ever since I started using Skydo shortly after their launch, I’ve been a fan. Skydo saved me from haggling with banks on FX rates every time I received a payment, and we’ve saved thousands of hard-earned dollars since switching. What really stands out, though, is how customer-obsessed they are. I still remember the entire Skydo team, including Movin and Srivatsan, showing up at our office to listen to our problems firsthand. Most products make money, but Skydo has earned something far rarer: customer trust. I wish them continued success in their journey.

Hearing this validates every long night and every tough problem we’ve tackled. Customer trust is the most valuable currency for us, and we’re committed to earning it anew every day.

To all our customers, thank you for partnering with us, pushing us to improve, and believing in our vision. This Series A is as much your victory as it is ours. We also extend our gratitude to our amazing team (the Skydo family) who work tirelessly to turn our vision into reality, and to our investors for their faith and guidance. Together, we’ve built something special, and together we will take it to greater heights.

Onwards to a One-Stop Cross-Border Future

As we celebrate this funding news, we see it not as an endpoint but as the start of an exciting new chapter. We’re more energised than ever to pursue our ambition of making Skydo the one-stop shop for everything cross-border. That means continuing to simplify global collections and payouts, expanding into new features and markets, and always staying one step ahead in compliance and technology. Our mission is to help Indian businesses go global without borders or barriers – to ensure that an entrepreneur in India can transact with the world effortlessly, confidently, and on fair terms.

The road to $2 trillion in exports by 2030 will be paved with the success stories of thousands of small and mid-sized Indian businesses. We’re honored to play a part in those stories by providing the financial infrastructure that lets our users concentrate on what they do best. With this new funding and the ongoing support of our community, Skydo is gearing up to serve you even better and innovate even faster.

Thank you for joining us on this journey. Here’s to empowering Indian exporters, to building the future of cross-border finance, and to reaching new horizons together. We couldn’t be more excited for what’s to come, and we’re grateful to have you with us as we build the cross-border future from India, for the world.

Sincerely,

The Skydo Team