Tax Slabs in 2023-24: Plan Ahead for Next Year Tax Savings

India taxes individuals based on a system of income slabs. Different tax rates are assigned to different ranges of income.

Understanding tax slabs is crucial for several reasons.

- It empowers individuals to manage their finances strategically

- Helps in making informed decisions about tax-efficient investments

- Avoid unforeseen tax liabilities

As a person earns more, the tax liability also increases, creating a fair and progressive tax system in the country. To achieve this, the government regularly updates and announces changes to tax slabs in the Union Budget.

The income tax slabs differ between the old and new tax regimes. Let's explore the specific slab rates applicable to Individuals for FY 2022-23 (AY 2023-24) and FY 2023-24 (AY 2024-25).

Income Tax Slab Rates For FY 2023-24 (AY 2024-25)

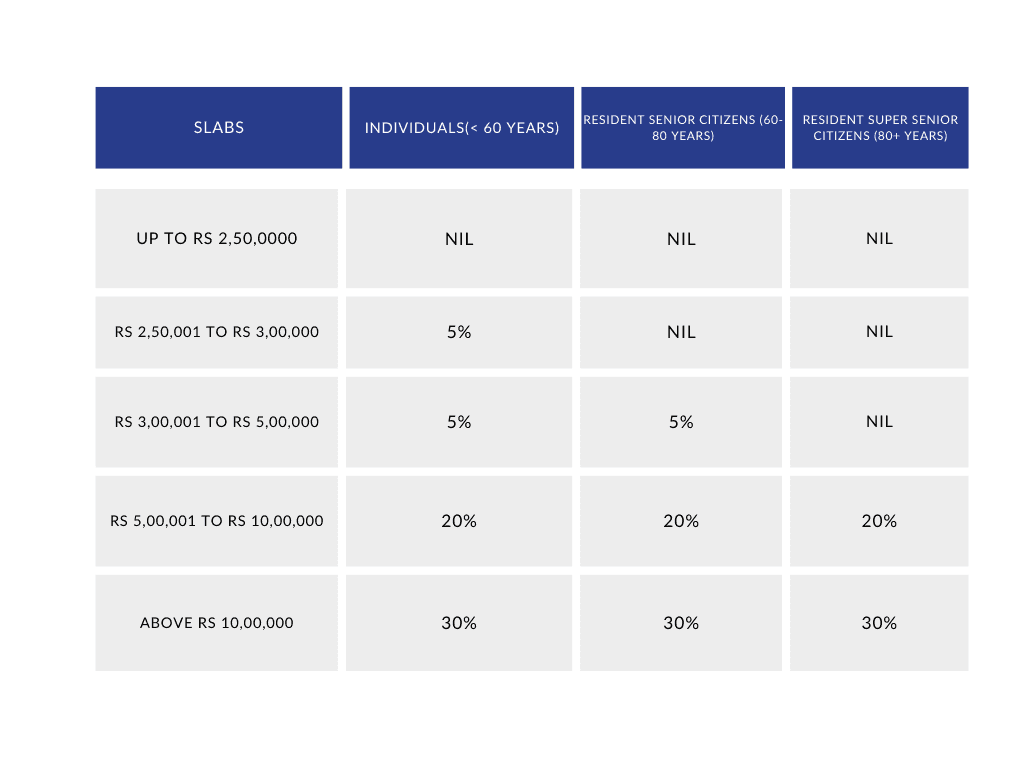

Under the Old Tax regime

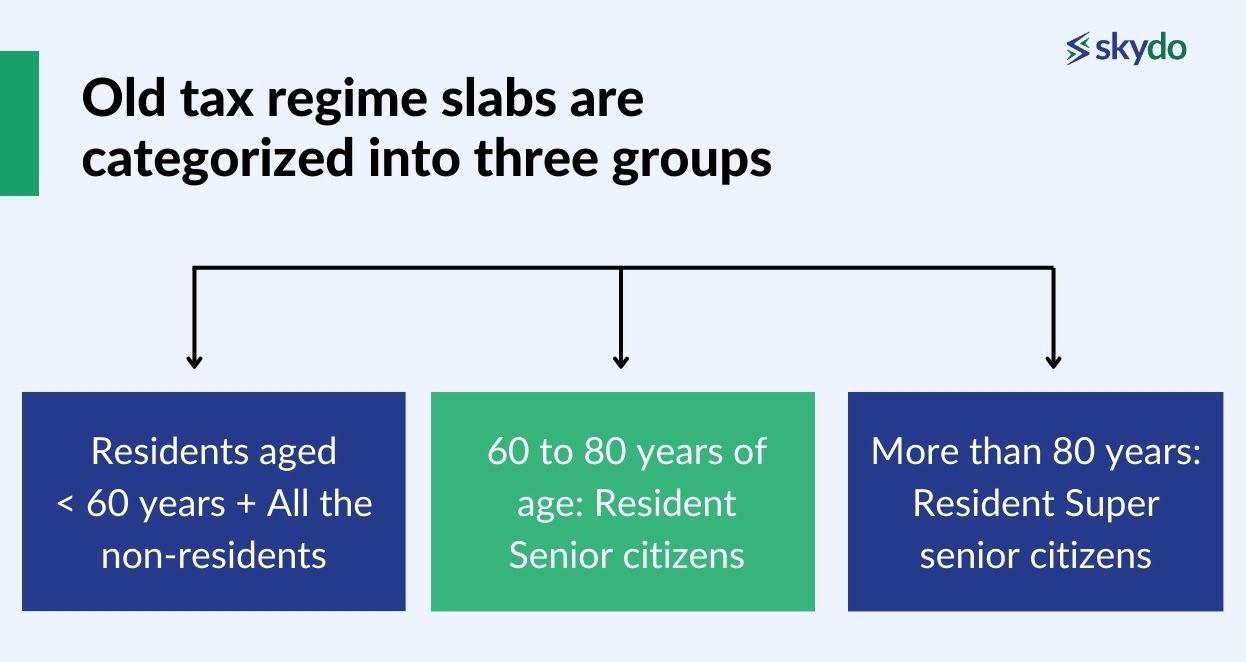

Rates of the old tax regime slabs are categorized into three groups:

- Residents aged < 60 years + All the non-residents

- 60 to 80 years of age: Resident Senior citizens

- More than 80 years: Resident Super senior citizens

Under the New Tax regime

The new tax regime applies uniform tax rates to all individuals, eliminating the age-based distinctions in the old system. The new tax regime slabs 2023-24 are outlined below.

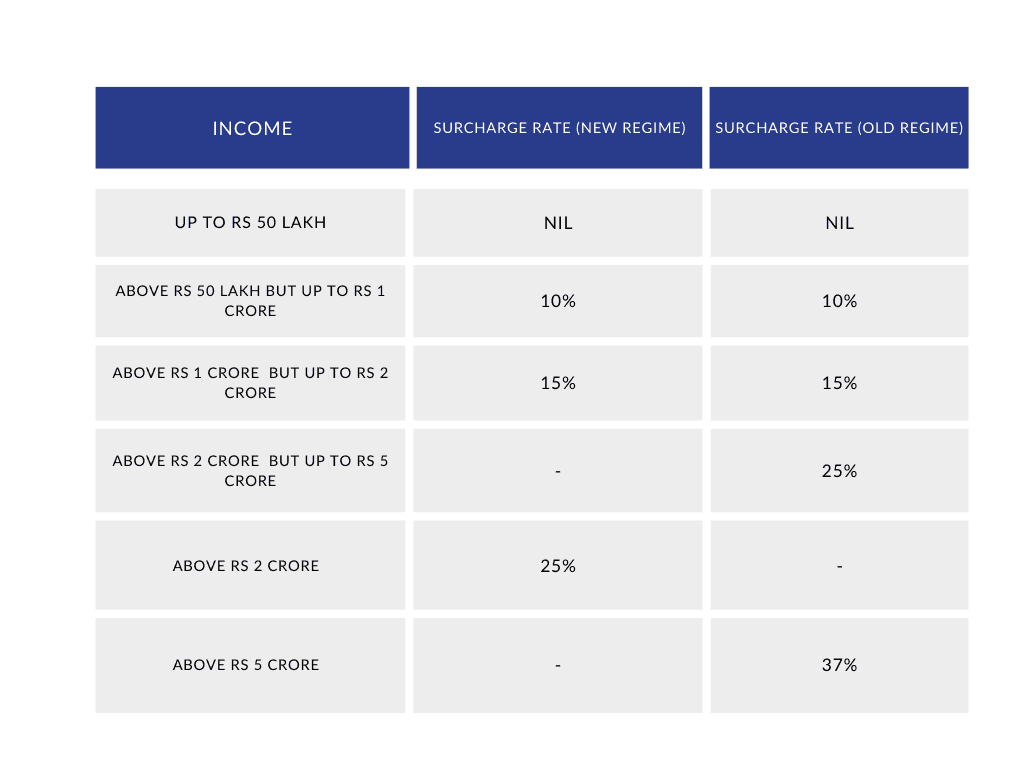

Applicability of Surcharge for FY 2023-24 (AY 2024-25)

The income tax surcharge is an extra fee imposed on top of the regular income tax. An additional tax is applied to individuals with higher income earnings in a specific financial year. Let’s look at the applicable surcharge rate under the Old and New tax regime.

However, 25% or 37% surcharge rates will not apply to income under the following sections.

Consequently, the highest surcharge rate on the tax payable for such incomes will be 15%.

Starting from the Assessment Year 2023-24, the maximum surcharge rate on tax payable for dividend income or capital gain specified in Section 112 will be capped at 15%.

A 4% Health and Education cess will be applied to all cases’ total income tax liability and surcharges.

Comparison of tax rates under the New tax regime and the Old tax regime for FY 2022-23 (AY 2023-24)

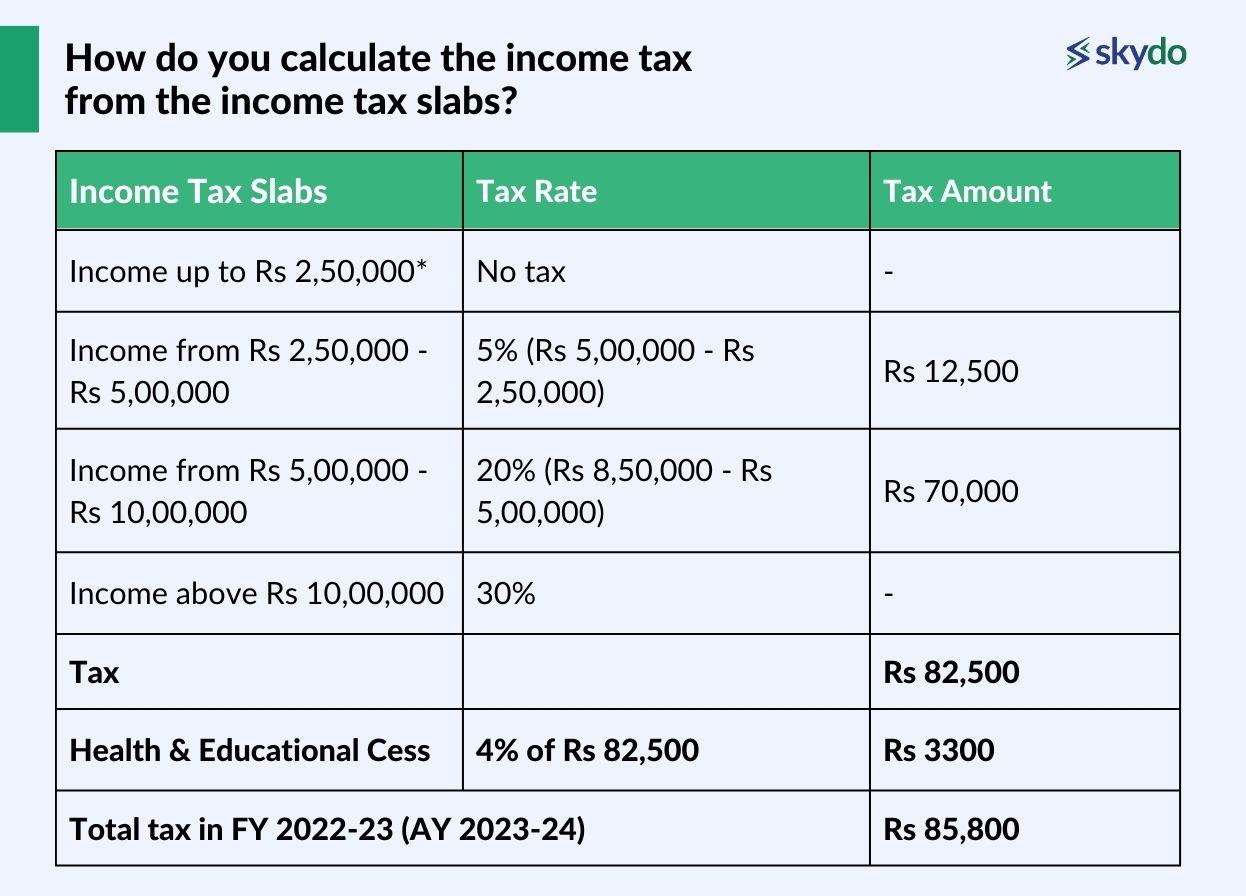

How do you calculate the income tax from the income tax slabs?

Let’s understand the calculation with an example.

Sanjana, aged 35, has a total taxable income of Rs. 8,50,000. She has opted for the old tax regime. Her income includes income from salary, interest and rental income. Deductions under section 80 have been reduced. Now, Sanjana wants to know her tax liability for FY 2022-23 (AY 2023-24).

*Sanjana, an individual taxpayer under the age of 60, enjoys an income exemption limit of up to Rs 2,50,000. Other taxpayers, i.e., senior and super senior citizens, have higher income tax exemption thresholds of Rs 3,00,000 and Rs 5,00,000, respectively.

Please be aware that the tax rates in the New Tax Regime are uniform for all categories of individuals, including regular individuals, senior citizens, and super senior citizens.

Individuals with a net taxable income of up to Rs 5 lakh qualify for a tax rebate under section 87A, resulting in zero tax liability in both the New and Old tax regimes. It's important to note that in Budget 2023, the rebate under the new regime has been extended, making income up to Rs 7 lakh tax-free from the FY 2023-24 onward.

Tax-efficient funds and strategies

Let's delve into effective strategies to maximize your investments while minimizing the associated tax burdens.

1. Equity Linked Savings Schemes (ELSS)

ELSS mutual funds provide a dual benefit of potential capital appreciation and tax savings under Section 80C of the Income Tax Act. Investing in ELSS reduces taxable income and offers a path for long-term wealth growth.

2. Explore tax-efficient investment avenues

- National Pension System (NPS): NPS allows deductions of up to Rs. 1.5 lakh under Section 80C, with an additional Rs. 50,000 under Section 80CCD(1B), making it a tax-savvy choice for retirement planning.

- Tax-Saving Fixed Deposits: Various banks offer tax-saving fixed deposit schemes with a compulsory 5-year lock-in period. While interest earnings are taxable, they qualify for deductions under Section 80C.

- Public Provident Fund (PPF): PPF is a popular long-term savings option. It falls under the Exemption- Exemption- Exemption (EEE) category, allowing tax exemption on the investment, interest rate, and withdrawal amount.

3. Health Insurance

Health insurance qualifies for tax benefits under Section 80D. You can claim tax benefits on premiums paid - up to Rs 20,000 for senior citizens and Rs 15,000 for others. For example, if you pay Rs 15,000 for your policy and Rs 20,000 for your senior citizen parent, you can claim a total tax benefit of Rs 35,000.

Maturity value is tax-free for sums received under critical illness insurance policies.

4. Tax-loss harvesting

This strategy entails selling loss-making assets to realize the capital loss and using it to offset the gains earned by profit-making assets.

For instance, if you have a loss of Rs. 20,000 in Stock A and a gain of Rs. 30,000 from Stock B, you can sell Stock A during a market downturn to offset the gains. This way, you can reduce your taxable income. The saved amount can be reinvested for portfolio growth.

Ensure that tax loss harvesting aligns with your overall financial goals and plan by considering a discussion with a financial professional or tax advisor.

Expert Tips for Next Year's Tax Planning

Consult financial professionals or tax advisors for effective tax planning and strategic advice. Their expertise can provide tailored insights aligned with your financial goals and ensure a well-informed approach to optimize your tax situation.

If you need help deciding what is right for you, we will connect you with our panel of Indian and US-based CA / CPAs. Feel free to reach out to us.

FAQs

Q1. How is a taxpayer's income categorized?

Ans: A taxpayer's income falls into five categories outlined in Section 14 of the Income Tax Act. These include Income from salary, Profits from a business or profession, Income from House Property, Capital Gains, and Income from Other Sources.

Q2. Is it possible to avail of 80C deductions while choosing the new tax slabs 2023-24?

Ans: No, under the new tax regime, several deductions and exemptions, including those under section 80C, are not permitted. Opting for the new tax regime means foregoing the ability to claim deductions under section 80C.

Q3. What do "Previous Year" and "Assessment Year" mean?

Ans: We have two important terms in income tax provisions: (i) Previous Year and (ii) Assessment Year. Previous Year is when you earn income, typically from April 1st to March 31st. The year right after the Previous Year, from April 1st to March 31st, is called the 'Assessment Year.'

For example, the Previous Year is from April 1, 2023, to March 31, 2024 (FY 2023-24). The corresponding Assessment Year is from April 1, 2024, to March 31, 2025 (AY 2024-25).

Q4. What is the tax exemption limit for calculating income tax rebate under section 87A?

Ans: For FY 2023-24 (AY 2024-25), the rebate limit has been increased to Rs. 7,00,000 under the new tax regime. This means a resident individual with taxable income up to Rs 7,00,000 will receive Rs 25,000 or the amount of tax payable (whichever is lower) as tax relief. However, the old tax regime's threshold limit will remain the same, i.e., Rs 12,500 if taxable income is up to Rs 5,00,000.

Q5. How much is the standard deduction for FY 2023-24?

Ans: You can claim a standard deduction of ₹50,000 to the income taxable under the head ‘Salaries.’ The standard deduction is a tax benefit that can be claimed irrespective of the amount spent on Transport or Medical Allowance. It applies to individuals earning a salary or pension income.