Essential Guide to TCS on Foreign Remittance

Planning any international travel or making an international purchase? You might be in for a surprise when it comes to taxes. Since the 2023 Union Budget, Tax Collection at Source (TCS) has become a crucial part of foreign remittances, impacting your tax obligations. If you’re sending money abroad or making outward money transfers, you could be facing a 20% tax under the Liberalised Remittance Scheme (LRS).

So next time you make a big foreign payment, expect to pay extra for TCS which is collected by the receiving bank or business. This blog will give a thorough understanding of TCS to help you navigate the complexities of cross-border payments.

What is TCS or tax on foreign remittance?

TCS (Tax Collected at Source) is a tax system in India where the seller collects a tax from the buyer on specific goods or services. This collected tax is then remitted to the Income Tax Department. One example is its application to transactions like sending money abroad under the Liberalised Remittance Scheme (LRS), which we'll be discussing in this blog. The primary purpose of TCS is to track large transactions and prevent tax evasion. The tax rate varies depending on the type of transaction and is added to the sale price.

Difference between TCS and TDS on foreign remittance

Given the lack of discussion on TCS, it's easy to mix it up with TDS. Let's clear the air and distinguish between the two.

TDS is the tax deducted by the payer while making certain payments from various sources. The most common instance is the TDS deducted by companies while paying salaries. TCS on the other hand, is the tax collected by the seller on the sale of certain goods. For example, when you buy alcoholic liquor, the price includes 1% TCS. In a nutshell, TDS is deducted by the payer while TCS is collected by the seller.

Let's dive deeper to understand everything about TCS on foreign remittance so that you can minimise your tax burden.

When is Tax Collected at Source (TCS) on Foreign Remittance applicable?

Tax collected at source (TCS) applies when you send over INR 7 lakhs abroad in a financial year. For instance, if you are buying foreign company stocks worth INR 9 lakhs, you need to pay 20% TCS on 2 lakh (9 lakhs - 7 lakhs).

Prior to 2023, TCS on foreign remittances under the LRS was 5%. However, in the 2023 budget, the new TCS rate was increased from 5% to 20% to boost tax revenue and promote domestic spending.

The TCS on foreign remittance for medical and educational expenses stands at 5% if the amount remitted exceeds INR 7 lakh. However, if medical and educational expenses are funded by a financial institution, 0.5% TCS will be applicable.

The new TCS rates became applicable from October 1, 2023.

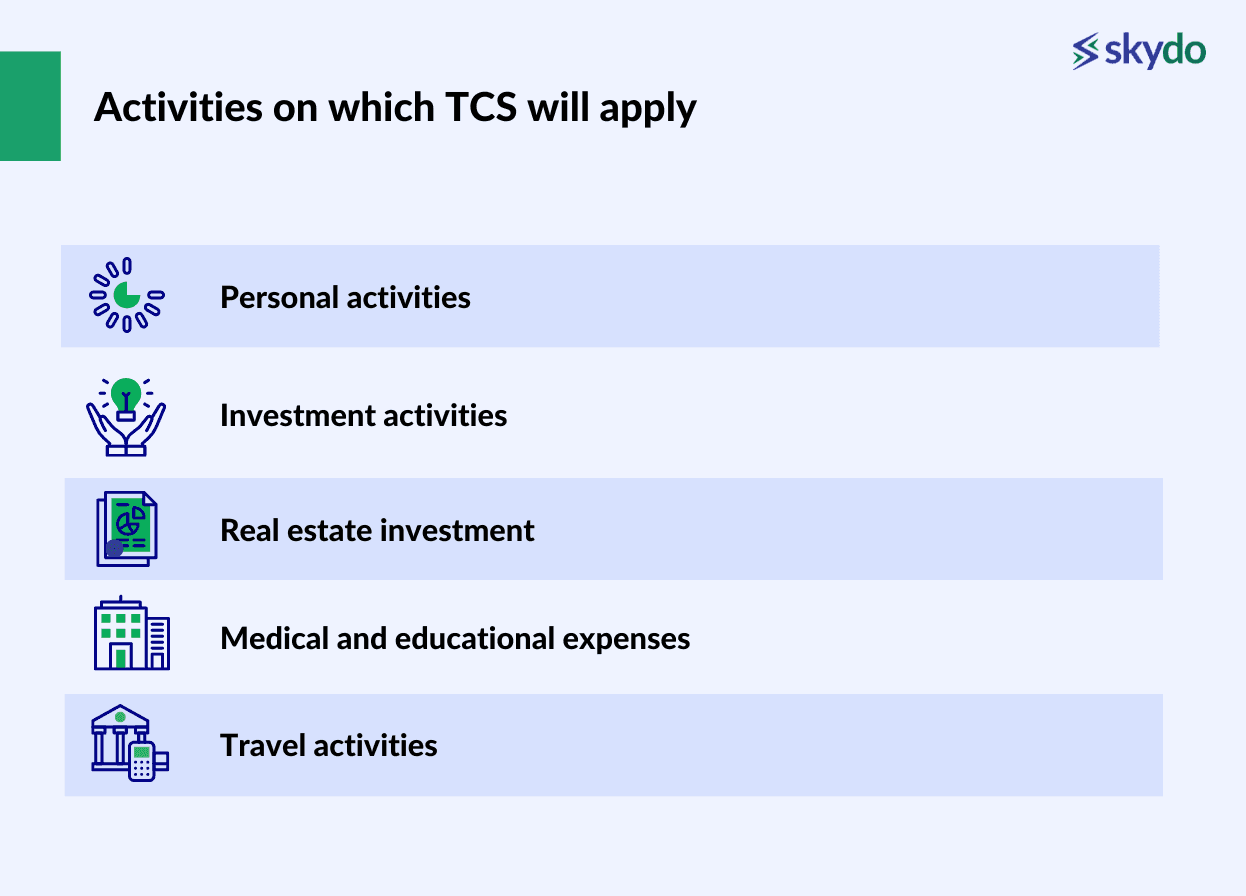

Here are the activities on which TCS will be applicable:

1. Personal Activities

- Providing loans or sending gifts to relatives living abroad

- Making online purchases from foreign websites, such as alibaba.com and pashionfootwear.com

- Remitting funds to foreign bank accounts by immigrants

2. Investment Activities

- Buying stocks of foreign companies or cryptocurrency

- Investing in foreign assets or instruments

3. Real Estate Investment

- Purchasing property in a foreign country

4. Medical and Educational Expenses

- Foreign medical treatment expenses, including the purchase of foreign flight tickets for the patient and their attendant

- Spending money abroad for education expenses

5. Travel Activities

- Purchasing foreign tour packages

Here is the breakdown for new and old TCS rates on different types of foreign remittances. Note that the new TCS rates will be applicable from 1st September 2023:

| Remittance Type | Old Rate on amount < 7 lakhs | Old Rate on amount > 7 lakhs | New Rate on amount < 7 lakhs | New Rate on amount > 7 lakhs |

| Buying stocks of foreign companies | Nil | 5% | Nil | 20% |

| Purchasing property in a foreign country | Nil | 5% | Nil | 20% |

| Sending funds for overseas education or medical expenses using a loan from a financial institution | Nil | 0.5% | Nil | 0.5% |

| Sending funds for education or medical expenses abroad without a loan. | Nil | 5% | Nil | 5% |

| Purchasing foreign tour packages | 5% | 5% | 5% | 20% |

| Other payments under LRS | Nil | 5% | Nil | 20% |

Note that the new TCS rates will be applicable from 1st September 2023.

TCS rate on Foreign Remittance Post Budget 2023

Let's try to understand the applicability of TCS via certain examples.

Example 1:

Consider buying stocks worth INR. 10 lakh in a US company. Now, since the amount remitted is greater than INR 7 lakhs, 20% TCS will be applicable.

As mentioned, TCS will be collected on the amount exceeding INR 7 lakhs, which in this case is INR 10 Lakhs - INR. 7 lakhs, which comes to INR 3 Lakhs. As mandated, 20% TCS will be collected from INR 3 Lakhs which equals to INR Rs. 60,000

So if you are investing INR 10 lakhs in US stocks, you are effectively investing only INR 9,40,000 as the rest INR 60,000 will be collected as TCS.

Example 2:

Now consider that you are sending the same INR 10 lakh to your sister studying in the US to pay her fee. Since this amount is being remitted for educational purposes, instead of 20%, 5% TCS will be applicable on the amount exceeding Rs. 7 lakh.

Therefore, the total taxable amount will stay at INR 3 lakhs (Rs. 10 Lakhs - Rs. 7 lakhs)

However this time, instead of 20%, 5% TCS will be collected bringing the total amount to INR 15,000 (5% of INR 3 lakhs).

However, note that if you are unable to prove that the money sent abroad is for educational or medical purposes, 20% will be applicable.

Example 3:

Let's say the total remittance for the year adds up to INR 8 lakh, and this amount is financed through an education loan taken from a bank approved by the Reserve Bank of India (RBI).

In this scenario, a TCS of 0.5% would be applicable only on the amount exceeding the threshold of INR 7 lakh.

So, in this case, TCS would be charged on INR 1 lakh (INR 8 lakh - INR 7 lakh) at a rate of 0.5%, which translates to INR 500 (0.5% of INR 1 lakh)

How to avoid TCS on foreign remittance?

While Tax Collected at Source (TCS) is not completely avoidable, here are some strategies you can use to minimise its impact:

#1: Adjust the TCS Against Your Final Tax Liability

If you have no or low tax liability, you can get the TCS on foreign remittance as refund while filing your ITR. Make sure to keep the following documents handy:

- Form 26AS (reflecting TCS)

- Bank transaction note for the remittance (matching the amount and TCS deducted)

For example, let's say you purchase an overseas tour program package worth Rs. 9 lakh. With the new regulations, a 20% Tax Collected at Source (TCS) applies to the amount exceeding Rs. 7 lakhs, totaling Rs. 40,000. If your total income tax liability for the year is INR 1 lakh, you can offset the Rs. 40,000 collected as TCS against your liability, reducing the total tax payable to Rs. 60,000.

Submitting an erroneous TCS return can lead to penalties as per Section 271H. The penalty for such errors can range from a minimum penalty of Rs. 10,000 to a maximum penalty of Rs. 1,00,000. It is important for tax collectors to ensure the accuracy of their TCS returns to avoid facing these penalties and maintain compliance with tax regulations.

Here’s a quick read to understand how to file your income tax return.

#2: Make Foreign Investments Through LLPs

If you're making foreign investments, consider doing so through a Limited Liability Partnership (LLP), as these entities are exempt from TCS. LLPs are permitted to invest abroad via two modes: overseas direct investments (ODI) and overseas portfolio investments (OPI). In case of overseas portfolio investments, the 20% TCS rate doesn’t apply.

#3: Use International Credit Card

TCS is not applicable to payments made through international credit cards while overseas. Therefore, you can make international credit card payments while travelling abroad to reduce TCS liability.

Visa and Mastercard are the two major payment networks that offer international credit cards through various Indian banks. Many banks like SBI Cards, HDFC Bank, ICICI Bank, and Axis Bank provide credit cards powered by Visa or Mastercard that can be used internationally.

Additionally, American Express (Amex) is another network offering international credit cards in India. You can find Amex cards through banks like IndusInd Bank and YES Bank.

Remember, if your total foreign remittances (excluding travel packages) are less than Rs 7 lakh in a year, TCS doesn't apply. Each family member can use their own Rs 7 lakh limit, so plan your foreign remittances accordingly.

Also, as we have mentioned, educational and medical expenses abroad are exempt from the 20% TCS rule. Keep the relevant documents handy to claim this benefit.

Parting Words

The introduction of TCS on foreign remittance addresses two crucial concerns: tax revenue and domestic spending. It's imperative to clarify that TCS isn't an additional tax but rather a mechanism ensuring financial transparency and compliance, particularly in cross-border payments.

Here at Skydo, we're committed to streamlining international payments while adhering to compliance and transparency standards. With Skydo, receive international payments swiftly, free from forex or conversion fees, in a secure and compliant manner.

Have further questions about TCS on foreign remittance? Join our global community, where our panel of experts assist you in navigating the ever-evolving regulatory landscape.

Q1. What comes under foreign remittance?

Ans: Foreign remittance refers to sending money from India to another country. This can include sending money for living expenses, education, investments, or gifts to relatives abroad.

Q2. Is TCS applicable if I send money to my relatives abroad?

Q3. Will TCS be applicable if I invest in US stocks?

Q4. What is the TCS on foreign remittance after Budget 2024?