How to Reduce TDS on International Payments

Tax Deducted at Source (TDS) on international payments in India is applicable when payments are made to non-residents. The rates of TDS and the specific provisions governing international payments are outlined in Section 195 of the Income Tax Act.

However, certain factors can allow you to reduce the TDS, which you will learn in this blog.

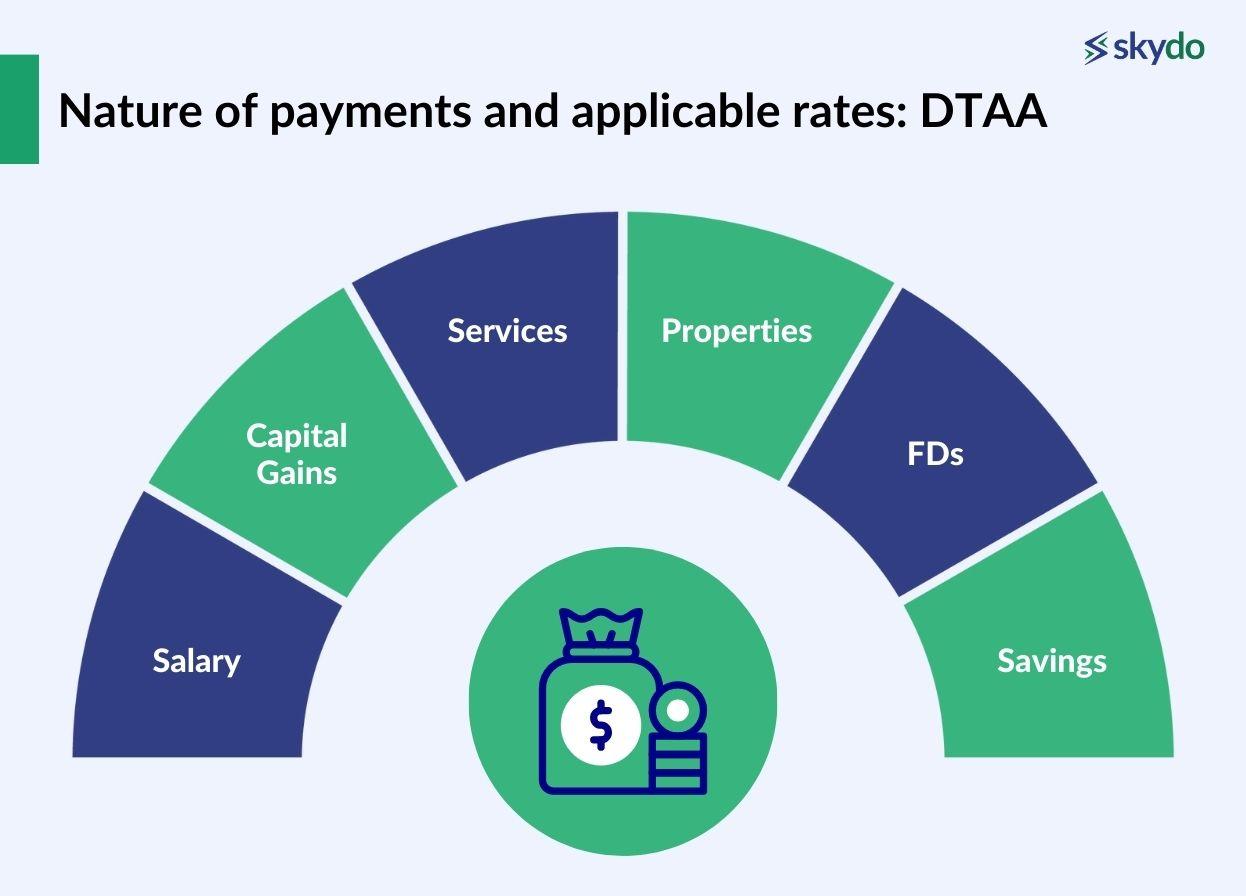

Nature of payments and applicable rates: DTAA

DTAA is particularly relevant in international transactions, where income may be subject to taxation in both the source countries. DTAA covers the following categories:

- Salary

- Capital Gains

- Services

- Properties

- Savings

- FDs

The rates depend on the tax treaties agreed upon by the two countries. The TDS rates on interest earned range from 7.50% TO 15%.

What is the TDS return for foreign payments?

Under section 195, it is mandatory for any person making foreign payments to a non-resident to obtain a TAN and deduct tax at applicable rates. Once deducted, the payer must deposit the tax with the government against the payee's PAN.

Furthermore, the payer must also fill out a TDS return using Form 27Q, which is a declaration of TDS deducted on payments other than salary to non-residents.

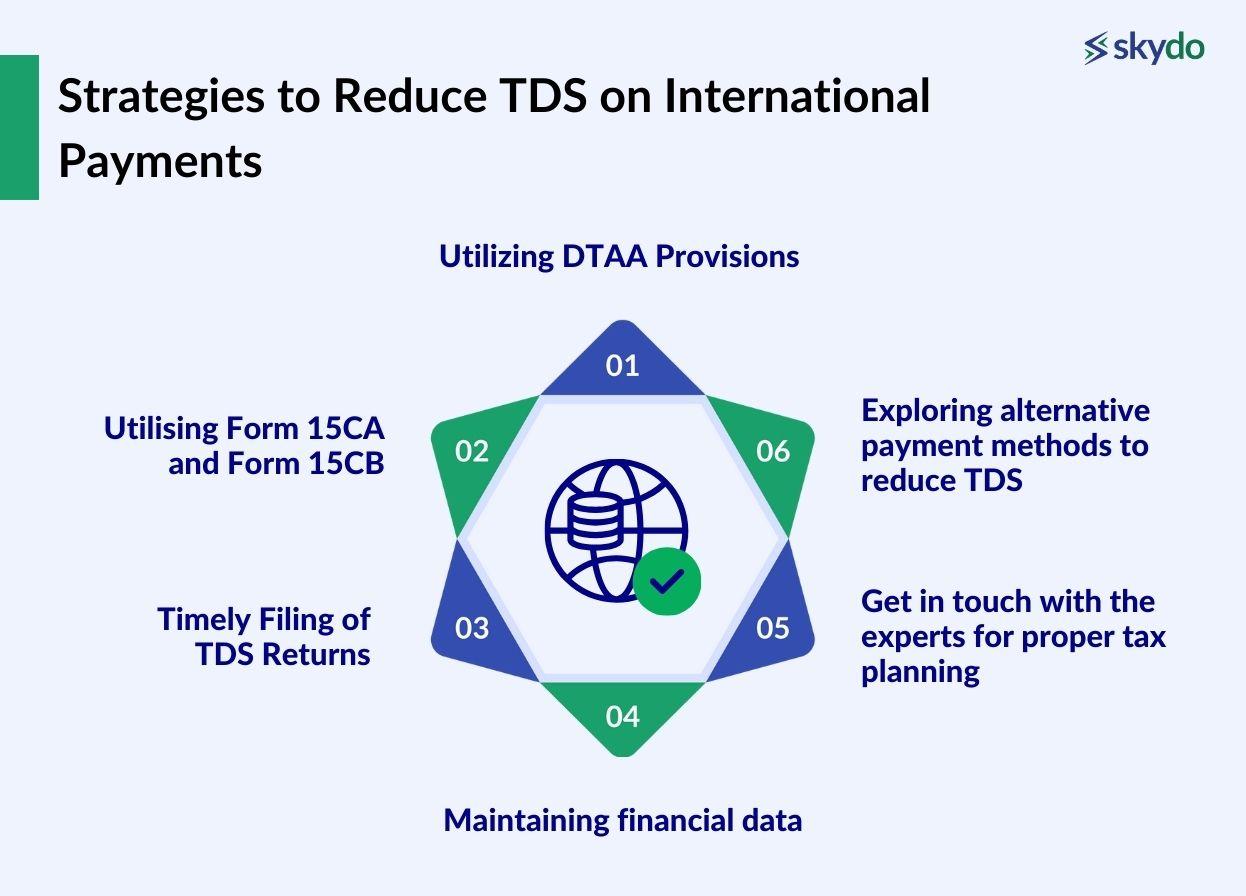

Strategies to Reduce TDS on International Payments

Here are the strategies to reduce TDS on international payments and ensure that you decrease the cost of international payments:

- Utilizing DTAA Provisions

India’s tax treaties with other countries include the DTAA provision, a bilateral agreement or treaty between two countries to prevent taxpayers from being subject to taxation on the same income in both jurisdictions.

India has signed comprehensive DTAA provisions with 94 countries and limited DTAA provisions with eight countries. You can utilise the provision to reduce TDS when making international payments to any of the DTAA countries.

- Utilising Form 15CA and Form 15CB

As a freelancer or a business owner, you can utilise Form 15CA and Form 15CB to reduce TDS. Form 15CA is a declaration form that details all the information about the nature and purpose of the foreign payment.

Form 15CB is similar to Form 15CA, but here, a qualified CA examines the information about the foreign payment and then furnishes a Tax Determination Certificate.

- Timely Filing of TDS Returns

TDS deductions need to be deposited to the government within specific due dates. The due dates vary based on the nature of payments and the quarter in which the deductions are made.

Timely filing of Tax Deducted at Source (TDS) payments is crucial to ensure compliance with tax regulations and avoid penalties.

- Maintaining financial data

TDS payments include numerous financial data points that should be managed to ensure an effective return process. Maintain comprehensive documentation, including invoices, agreements, and certificates, to support any claims for reduced TDS rates or exemptions.

- Get in touch with the experts for proper tax planning

TDS payments and reducing them through various measures can be time-consuming and complex. Seek professional advice from tax experts or legal advisors with expertise in international taxation. They can help navigate the complexities of tax laws and ensure compliance while minimizing TDS implications.

- Exploring alternative payment methods to reduce TDS

Freelancers or business owners can use alternative payment methods, such as third-party payment platforms, to reduce the liability of TDS payments, if applicable. For example, the fee charged by PayPal doesn't fall under any category liable for tax deduction at source.

Payment of TDS under Section 195

Section 195 of the Income Tax Act Of 1961 details the TDS provisions in case of an Indian resident making a payment by way of interest or any other amount to an NRI or foreign company. Here, the payment amount should be other than salary, and there is no threshold limit to deduct TDS under the section.

TDS is deducted at either of the following rates:

- Rates as per the Finance Act: Ranging between 20%-30%.

- Rates as per the DTAA agreement between India and the non-resident's country of residence.

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) Changes from 1st July 2023

- TCS rate on foreign remittance and overseas tour packages is now 20% (excluding medical and education purposes), eliminating the Rs 7 lakh threshold limit.

- Introduction of TDS on Net Winnings from Online Gaming. The TDS rate is 30% under Section 194BA of the Income-tax Act.

Compliance and Risk Management

It is important to check the latest notifications and updates from the tax authorities to stay informed about any changes to due dates or procedures related to TDS filings. Compliance with TDS regulations is critical for avoiding penalties and maintaining a smooth relationship with tax authorities.

The Income Tax authority can levy a minimum penalty of Rs 10,000 and a maximum penalty of Rs 1,00,000 for non-payment of TDS in a timely manner.

Conclusion

In conclusion, managing Tax Deducted at Source (TDS) on international payments requires financial efficiency and a nuanced understanding of the Income Tax Act, Double Taxation Avoidance Agreements (DTAA), and relevant tax provisions. If you have any confusion, it is better to contact a tax professional.

FAQs

Q1. Is TDS applicable for foreign payments?

Ans: Under section 195, TDS applies to foreign payments to non-residents.

Q2. How do you deduct TDS for international contractors?

Ans: Although it is mandatory to deduct TDS on international payments Under Section 195, there are some conditions when it comes to deducting TDS for international contractors. If you are making payments to foreign entities, such as individuals/companies located outside India, you are not required to deduct their TDS.

In such a case, the foreign entities are required to register on the income tax portal as "others" and file form 10F online along with their tax residency certificate. Once it is filed, they must share the form with you for further reference.

Q3. What are the potential consequences of non-compliance with TDS regulations on global transactions?

Ans: Non-payment of timely TDS can result in a minimum penalty of Rs 10,000, which can go up to Rs 1 lakh.

Q4. Are there industry-specific considerations for reducing TDS on international payments?

Ans: Yes, as TDS rates depend on the nature of payment, different industries may have specific types of transactions, revenue models, and contractual arrangements that can influence the approach to managing TDS.

Q5. Can businesses or individuals leverage specific thresholds or exemptions to reduce TDS?

Ans: There are numerous thresholds and exemptions available under section 195 that can be utilized to reduce TDS.