Capital and Current Account Transactions: A Complete Guide

While being an entrepreneur exporting services worldwide is thrilling, navigating the complexities of foreign transactions is challenging. The constant struggle is picking a suitable payment method that does not consume your profits.

It's not just small businesses that face these problems. Even Tesla, in 2018, incurred a staggering $20 million fine from the US Securities and Exchange Commission (SEC) for misleading investors about their capital and current account transactions.

The SEC discovered how Tesla had exaggerated its cash flow from operations by a staggering $600 million while understating its net income by $300 million. Their financial statements failed to disclose its capital and current account transactions, resulting in severe consequences.

Tesla's problems with capital and current account transactions were due to a major factor: a lack of understanding of the complexity of the rules.

To safeguard your global business from such complications, let's understand capital and current account transactions in detail.

Capital Account Transactions

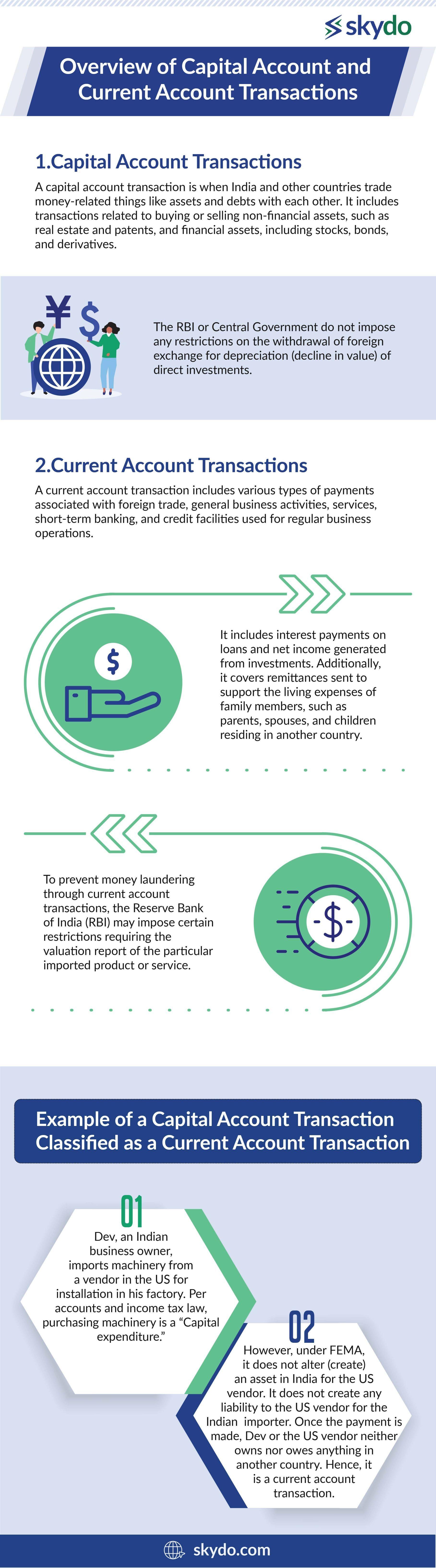

A capital account transaction meaning is when India and other countries trade money-related things like assets and debts with each other. It includes transactions related to buying or selling non-financial assets, such as real estate and patents, and financial assets, including stocks, bonds, and derivatives.

The components of a capital account include the flow of foreign capital and loans, banking activities, and other forms of investment, as well as fluctuations in the foreign exchange reserve.

However, capital account transactions are restricted to a certain limit per the relevant regulations. The RBI or Central Government do not impose any restrictions on the withdrawal of foreign exchange for depreciation (decline in value) of direct investments.

Rohit Khurana, a Chartered Accountant professional and finance lead at Skydo, clarifying the rules for capital account transactions, explains, "The business may require a valuation report in the cases where it receives money against the issuance of shares. Similarly, there are many restrictions in particular sectors in terms of shareholding so that foreign companies can not exceed the particular FDI limits."

Current Account Transactions

A current account transaction includes various types of payments associated with foreign trade, general business activities, services, short-term banking, and credit facilities used for regular business operations.

It includes interest payments on loans and net income generated from investments. Additionally, it covers remittances sent to support the living expenses of family members, such as parents, spouses, and children residing in another country.

Education-related expenses, foreign travel, and medical care for parents, spouses, and children further fall under current account transactions.

Current account transactions are much smoother than capital account transactions by regulations. According to Section 5 of the FEMA (Foreign Exchange Management Act), any individual has the authority to buy or sell foreign currency from an authorised dealer if it is for a current account transaction.

To prevent money laundering through current account transactions, the Reserve Bank of India (RBI) may impose certain restrictions requiring the valuation report of the particular imported product or service.

Example of a Capital Account Transaction Classified as a Current Account Transaction

Dev, an Indian business owner, imports machinery from a vendor in the US for installation in his factory. Per accounts and income tax law, purchasing machinery is a “Capital expenditure.”

However, under FEMA, it does not alter (create) an asset in India for the US vendor. It does not create any liability to the US vendor for the Indian importer. Once the payment is made, Dev or the US vendor neither owns nor owes anything in another country. Hence, it is a current account transaction.

Compliance and Regulatory Considerations

Indian entrepreneurs dealing with capital and current account transactions must adhere to the regulations and procedural requisites outlined by the Reserve Bank of India (RBI). They monitor capital and current account transactions through a variety of regulations. Some of the most important regulations include:

Indian entrepreneurs dealing with capital and current account transactions must adhere to the regulations and procedural requisites outlined by the Reserve Bank of India (RBI). They monitor capital and current account transactions through a variety of regulations. Some of the most important regulations include:

- The Foreign Exchange Management Act, 1999 (FEMA)

- The Foreign Exchange Management (Current Account Transactions) Rules, 2000

- The Foreign Exchange Management (Permissible Capital Account Transactions) Regulations, 2000

In addition to complying with the regulations, you must also complete the appropriate forms when engaging in capital and current account transactions. Some of the most important forms include:

- Form FC-TRS: The RBI requires the FC-TRS (Foreign Currency Transfer of Shares) for reporting capital instrument transfer between a resident in India and a non-resident of India; then, the company must report the same in the FC-TRS form.

- Form FC-GPR: When a business receives Foreign Direct Investment (FDI) through capital transactions, it must allocate shares to the foreign investor. This transaction must be reported using the Foreign Currency- Gross Provisional Return (FC-GPR) form issued by the RBI.

- Form FC-CA: Indian entrepreneurs need to use Form FC-CA (Foreign Currency - Current Account) to report their current account transactions related to their regular business operations or trade. The form should be submitted to the RBI within 30 days of the transaction's completion.

Best Practices for Navigating Capital and Current Account Transactions

You can follow several best practices to ensure smooth operations and compliance with relevant regulations. Here are some key recommendations.

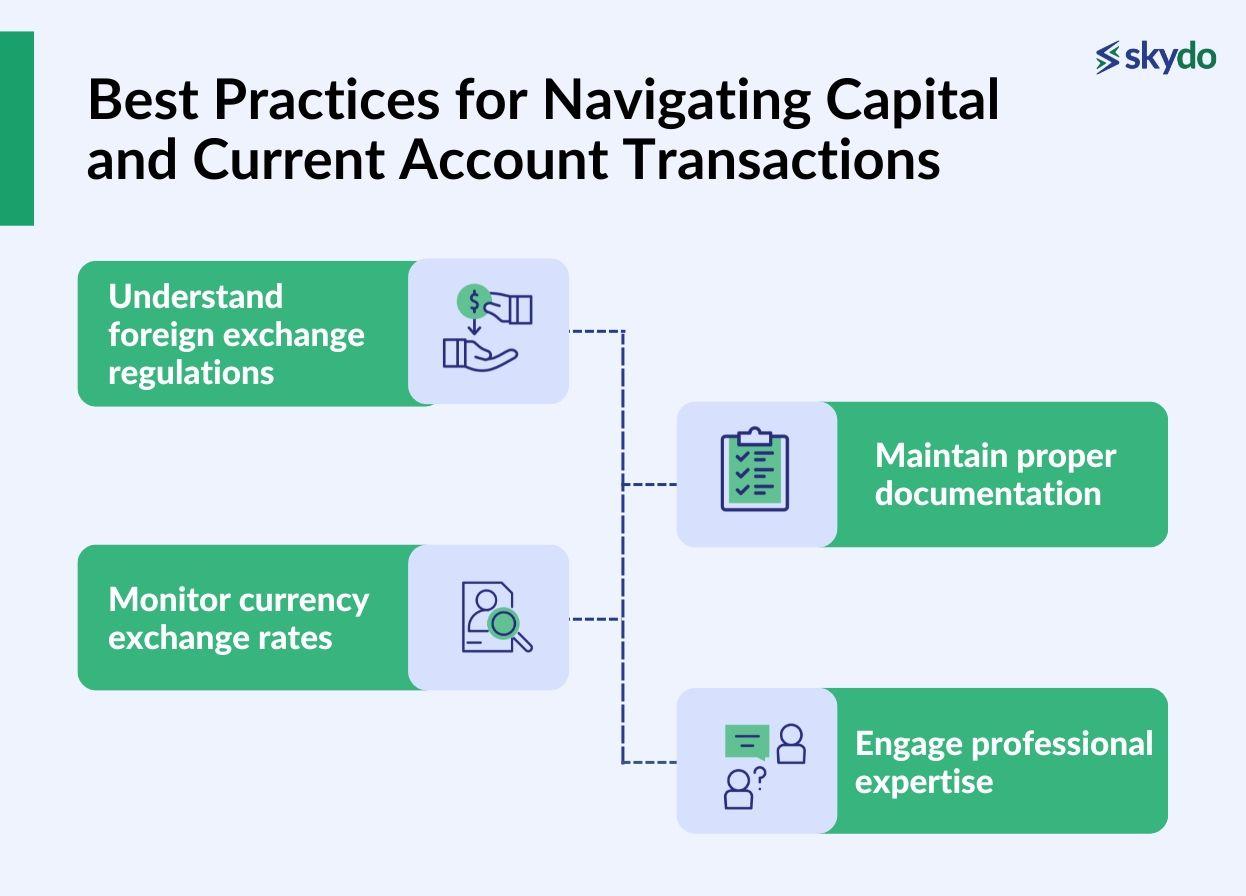

1. Understand foreign exchange regulations

Familiarise yourself with the Foreign Exchange Management Act (FEMA) and the rules and regulations set by the Reserve Bank of India (RBI) regarding capital and current account transactions. Stay updated with any amendments or changes in these regulations.

2. Maintain proper documentation

Maintain accurate and up-to-date records of all your transactions, including invoices, contracts, and FIRA documents. Ensure you have all the necessary paperwork to support your export activities.

3. Monitor currency exchange rates

Stay updated on currency exchange rates to make informed decisions regarding the timing of your transactions. Monitor the foreign exchange market and consider using appropriate hedging mechanisms to mitigate currency risks.

4. Engage professional expertise

Consult a chartered accountant to assist with regulatory compliance, taxation matters, and overall business documentation.

Final Words

In the vast world of international business, understanding the differences between capital and current account transactions is vital. Capital accounts deal with investments and transfers of assets, while current accounts handle day-to-day transactions. You can confidently navigate the financial landscape by grasping these distinctions, avoiding pitfalls and maximising opportunities.

To further enhance your global payment strategies, you can reach out to us to broaden your knowledge and embrace the power of capital and current account transactions.

Frequently Asked Questions

Q1. What is a capital account transaction?

Ans: A capital account transaction involves the exchange of money-related assets and debts between countries, including non-financial assets like real estate and financial assets such as stocks and bonds. It is subject to regulations and limits, and it encompasses investments and transfers of assets.

Q2. What type of account is a capital account?

Ans: The capital account is a component of the balance of payments and deals with transactions related to the exchange of assets and debts between countries. It includes both financial and non-financial assets and is subject to regulatory restrictions.

Q3. What is a capital account deficit?

Ans: A capital account deficit occurs when a country's capital account transactions exceed its capital account surpluses. It indicates that the country is borrowing more from foreign sources or selling more assets to foreigners than it is acquiring from them.

Q4. What are current account transactions under FEMA?

Ans: Under FEMA (Foreign Exchange Management Act), a current account transaction involves various payments related to foreign trade, business activities, services, and short-term banking. It covers items like interest payments on loans, net income from investments, and expenses such as education, foreign travel, and medical care for family members residing abroad.

Q5. What are current and capital account transactions?

Ans: Current account transactions encompass day-to-day financial activities like trade, services, and income, while capital a/c transactions involve the exchange of assets and debts between countries, including financial and non-financial assets.

Q6. What are some examples of services within the current account?

Ans: Services in the current account include–

- Income from investments

- Interest payments on loans

- Remittances for family living expenses abroad

- Education-related expenses

- Foreign travel

- Medical care for family members residing in another country

These transactions are part of a country's balance of payments in the current account.