Top 10 Finance Terms from Shark Tank to Raise Capital Effectively

What are your monthly sales and how much gross margin do you earn? What is your company's valuation? How much cash are you burning every month? — You must be familiar with these questions if you've been binging on Shark Tank India over the past couple of months. Sharks essentially ask these questions to assess a startup's financial performance and profit potential.

Therefore, these questions are pertinent for entrepreneurs, especially if you want to seek investment in the future or expand your business.

Understanding these financial principles helps you make better decisions and negotiate with investors to maximise valuation and minimise equity dilution. Let's see the most popular terms used in Shark Tank and how they apply to your business.

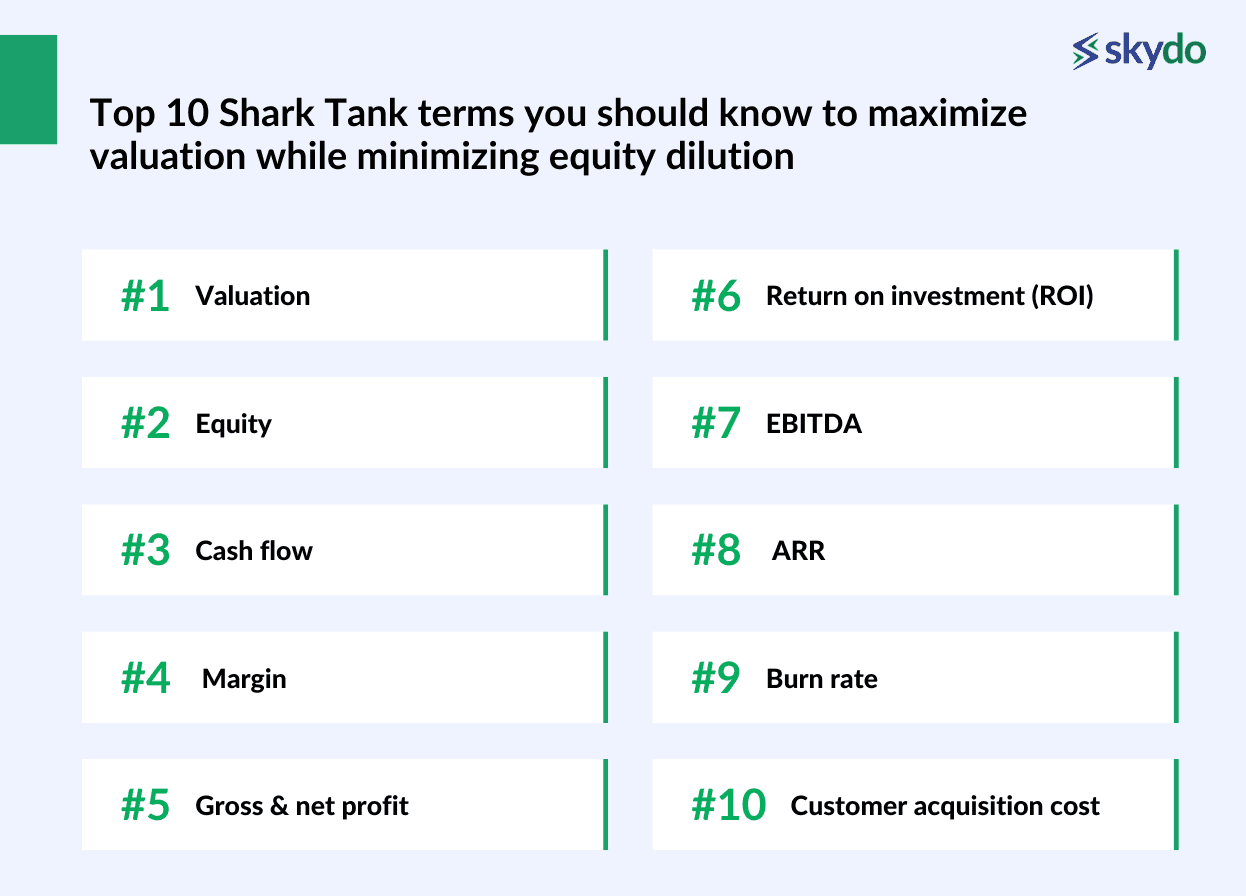

Top 10 Shark Tank terms you should know to maximize valuation while minimizing equity dilution

1. Valuation

Valuation is the true value or economic worth of your startup. Sharks invest in a startup in exchange for a certain percentage of ownership or equity. Valuation helps determine the price per share of the company and the worth of the investor’s ownership of the company.

For example, if a shark has 10% ownership in a startup whose valuation is Rs. 1 crore, they get shares worth Rs. 10,00,000.

For early-age startups that do not have sufficient financial data to show their performance, valuation is calculated via multiple means like comparing the valuation of their competitors, the company's ability to prove its potential customer base, the strength of the founding team and more such parameters.

Investors consider various factors such as market size, revenue and financial performance, intellectual property, founder’s expertise and unique selling proposition to calculate a startup's valuation.

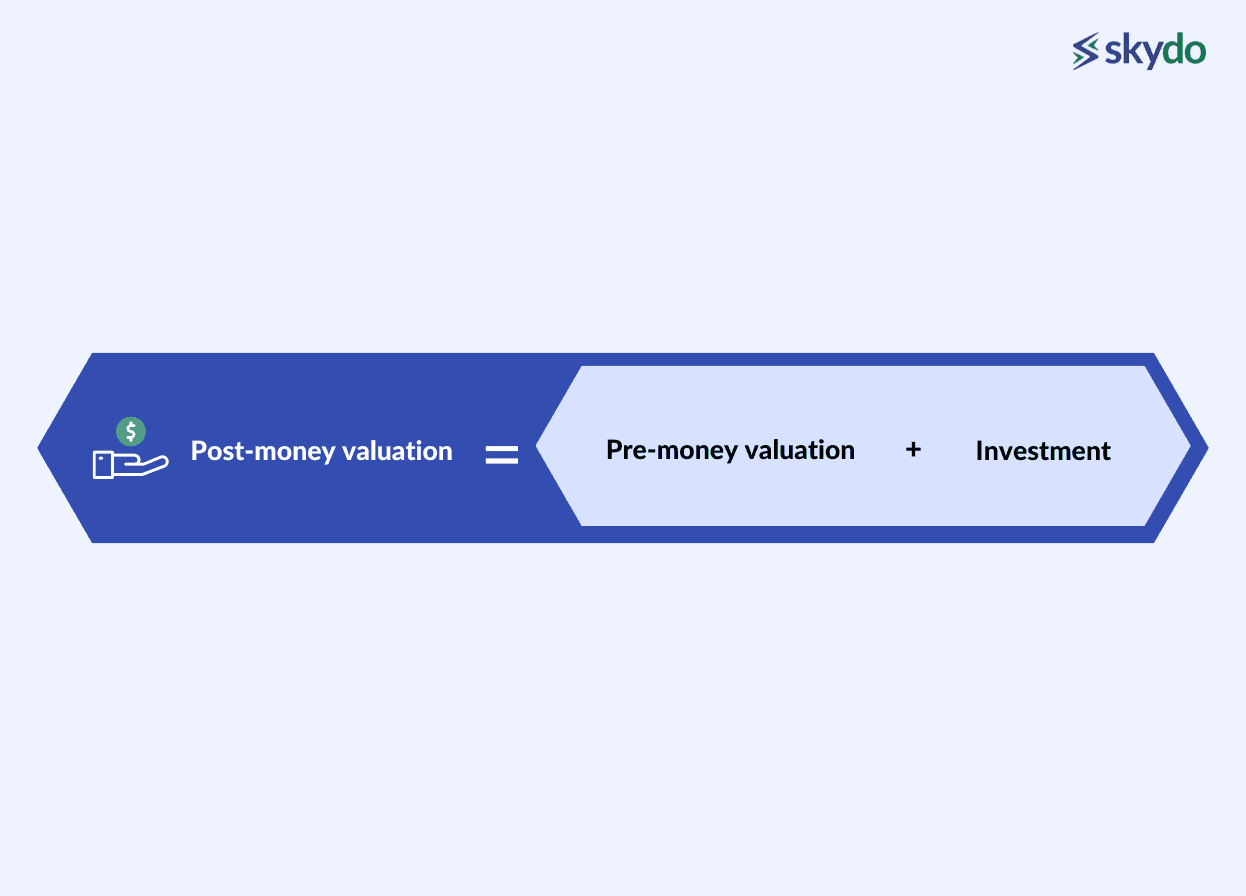

Valuation is of two types: pre-money and post-money valuation. The pre-money valuation is the value of your company before seeking investment. Once you seek outside investment, the valuation increases and is called post-money valuation.

For example, if your pre-money valuation is Rs. 1 crore and you receive an external investment of Rs. 70 lakhs, the post-money valuation will be Rs. 1,70,00,000.

2. Equity

Equity means the total ownership of your startup and is calculated in percentage. If you are a sole entrepreneur and haven’t sought outside investment, you have complete ownership or 100% equity in the company.

In the case of two co-founders, the ownership or equity is either divided equally (each founder has 50% ownership of the company) or proportionately based on capital invested, expertise and other factors.

When investors agree to invest in a company, they get a certain ownership or equity in your business. So when a shark says that they want to invest 50 lakhs in a startup for 6% equity, it means that they get 6% ownership in the company whereas the founders are left with 94% equity.

For example, Nascher Miles, a luggage brand, had initially pitched for ₹3 crore funding for 0.75% equity in Shark Tank India season 3. However, they received ₹3 crore funding at 1.5% equity and a ₹200 crores valuation. This means that sharks own 1.5% of the company.

As startups go through subsequent funding rounds, the equity gets distributed to new investors and even valuable employees as employee stock option plan (ESOP).

3. Cash Flow

Cash flow is defined as the movement of cash in (while receiving customer payments) and out of the business (for vendor payments or other expenses).

When the cash inflow is higher than the outflow (income is higher than the expenses), the cash flow is termed positive. However, when money moving out is more than the cash coming in, you have a negative cash flow.

Cash flow is different from profits which represents the balance amount after deducting all expenses. Even if your company has generated profits but the customer payments are delayed, you wouldn't have sufficient cash to manage your daily operations such as purchasing new inventory or paying rent. Therefore, a positive cash flow is important for business survival.

4. Margin

Margin is the difference between the selling price and the cost price of a product. For example, if the cost to produce a product is ₹50 and the selling price is ₹75, the gross profit margin will be 33.33%. This margin, also known as the gross operating margin, focuses solely on direct costs such as materials and labour, excluding indirect expenses like overhead or marketing

However, the net profit margin is calculated by deducting taxes, interest, and any other expense from the income.

Higher profit margins indicate a positive financial health of the company. Investors can understand how much a company can earn after deducting the expenses and whether it will have sufficient funds in the future for sustainable growth.

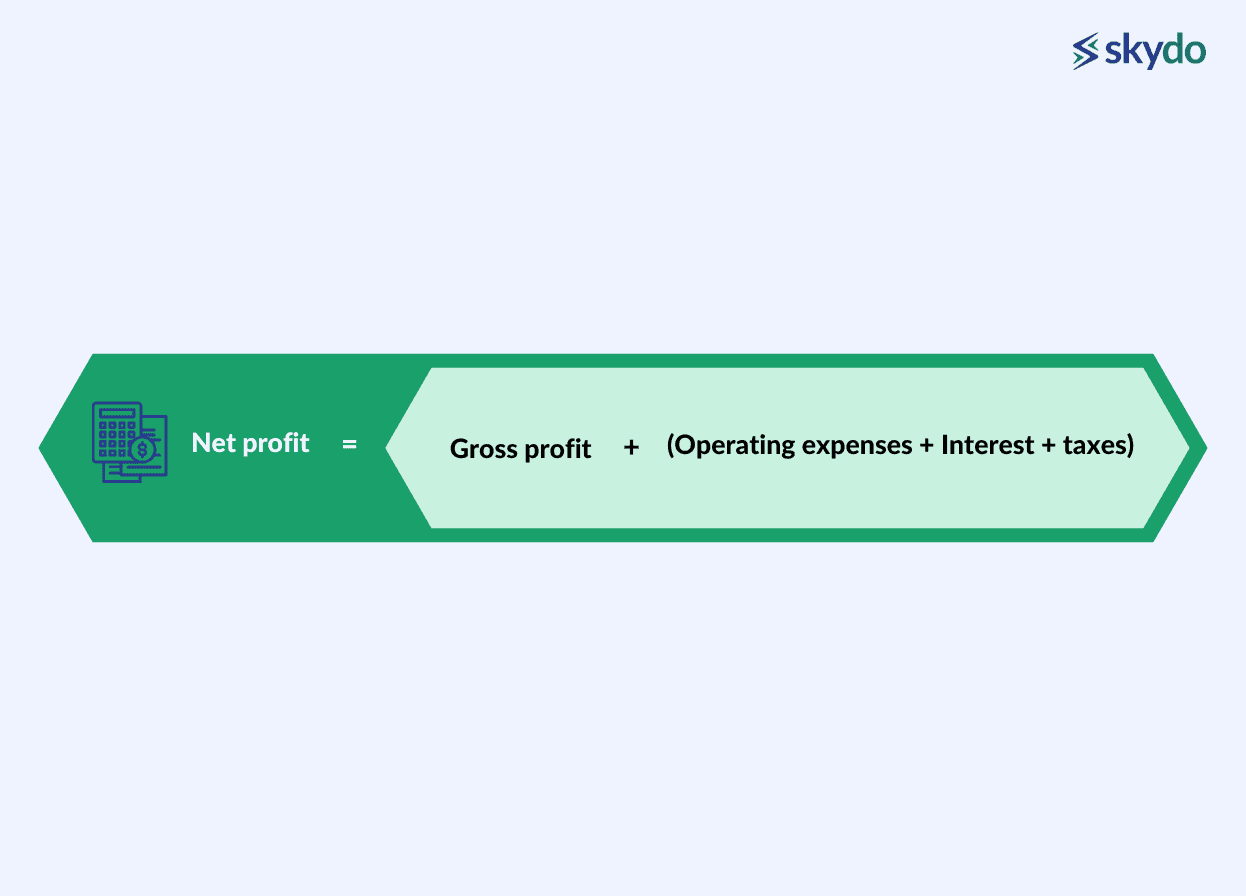

5. Gross & Net Profit

Gross profit means the profit generated after deducting the cost of goods sold from the revenue. Here the cost of goods sold includes direct expenses such as the cost of raw materials and labour costs.

Net profit means the final profit after deducting all the operating expenses, taxes and interests. While gross profits help determine the profitability of a product, net profit provides more realistic information about the overall financial health of a company.

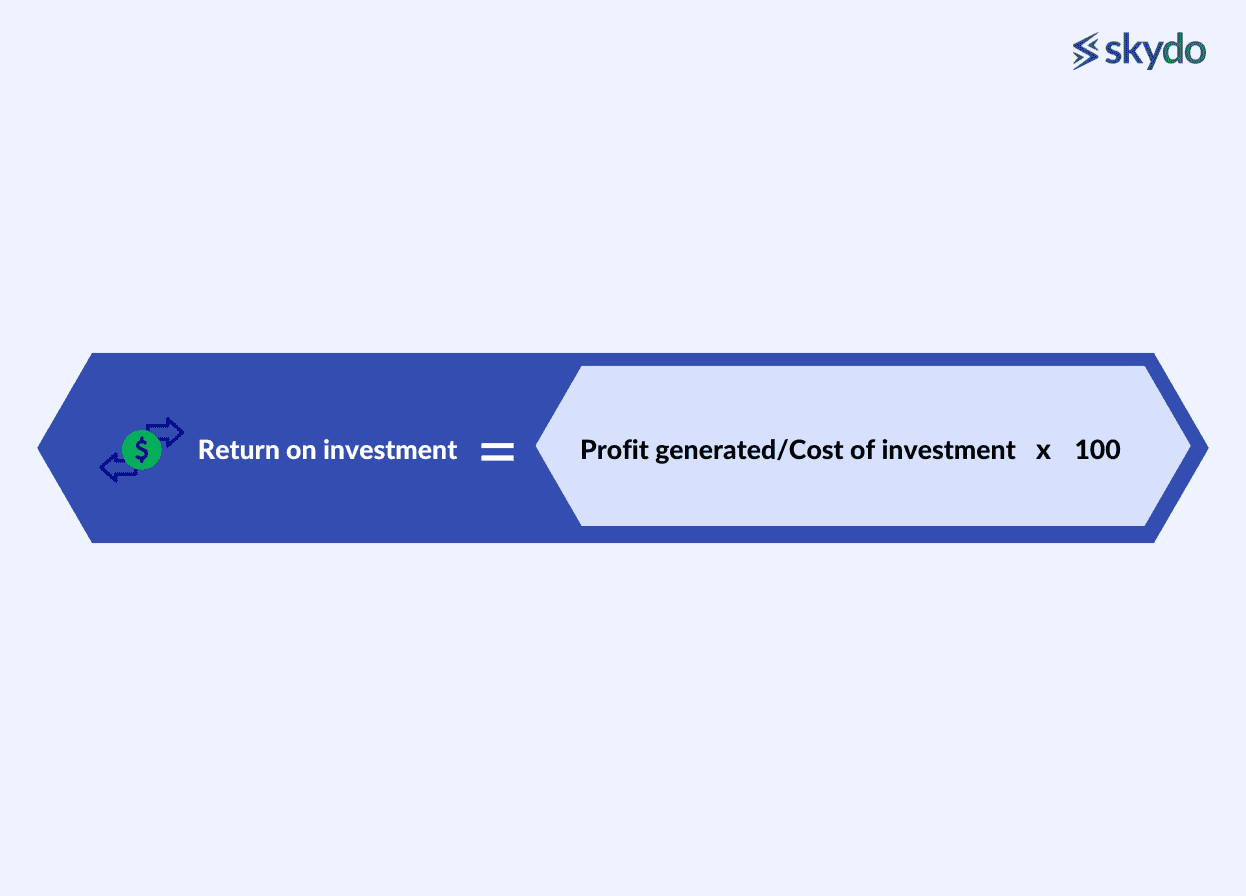

6. Return on Investment (ROI)

ROI is a performance metric to determine the profitability of an investment.

Startup founders can use this formula to calculate the effectiveness of their investment and other business decisions.

From an investor’s perspective, high ROI means that a startup is likely to generate higher profits for the investors. Investors also calculate and compare the ROI of several startups to find the most suitable startup for investment.

For example, in Shark Tank India Season 1, Aman Gupta, the co-founder of boAt invested ₹20,00,000 in Skippi, an ice popsicle brand and received ₹6 crore return. The ROI on this deal is 2900%.

Learn More: What is Your Role as a Tech Startup Founder

7. EBITDA

EBITDA full form is Earnings Before Interest, Taxes, Depreciation, and Amortization. It is used to calculate the net income after deducting the cost of goods sold excluding the money spent on taxes, depreciation, interest and amortization.

It helps investors know and compare the profitability of a company without considering the impact of a particular financing method on a business.

However, solely relying on EBITDA can sometimes show a false picture, especially for debt-funded companies because it does not consider interest payable. Investors can assess the actual revenue after deducting interest and other expenses.

8. ARR

Annual Recurring Revenue (ARR) means the projected annual revenue from existing customers. ARR is usually calculated for SaaS startups working on a subscription-based model. It helps predict future cash flow.

High ARR means better revenue predictability and helps investors understand projected revenue and potential business growth.

9. Burn Rate

Burn rate refers to the rate at which a startup spends its cash reserves or venture capital to cover its operating expenses before it starts generating revenue.

A high burn rate indicates that the company is rapidly exhausting its cash supply. It might run out of capital soon and shut down.

A few effective ways to reduce burn rate are cutting down operational expenses such as payrolls by reducing tem size, efficient budget planning, reducing payment cycles and negotiating vendor payment terms.

10. Customer Acquisition Cost

The Customer Acquisition Cost (CAC) means all the money spent by a startup to acquire new customers. It is a sum of sales and marketing expenses such as the cost of producing content, salaries, payments for marketing and sales tools, and paid advertisements’ costs.

You can calculate CAC to understand which customer segment generates the most revenue for your business and measure the effectiveness of your marketing and sales strategies.

Other Interesting Shark Tank Terms

In addition to the above popular Shark Tank terms, you must know the following financial terms for a business:

- Target ROAS (Return on Ad Spend)

ROAS or the return on ad spend means revenue generated for each rupee you spend on online advertisements such as Google Ads. For example, if you paid Rs. 10,000 for advertisements and generated a revenue of Rs. 20,000 from those advertisements, the ROAS would be 2:1. Target ROAS is an automated bidding strategy to set a particular ROAS for your advertising campaigns.

- Valuation of Shares

The valuation of shares is similar to company valuation. However, it tells the economic worth of an individual share.

- Capital

Startup capital is the money invested or raised by entrepreneurs to run a business. It is used for operational activities such as hiring employees, renting office space, or obtaining licenses and managing compliances.

- Exit Strategy

An exit strategy is part of the share purchase of an investment agreement that determines how the investors will exit from a startup after a few years by selling their ownership in the company. The most common exit strategies are the startup founder or other investor purchasing the shares from the existing investors or the investors selling their shares to the public during an Initial Public Offering (IPO).

Final Words

Understanding the terms used in Shark Tank is crucial for startup founders and entrepreneurs. It empowers you to develop strategic business plans, allocate resources efficiently, and manage financial risks effectively. By mastering these terms, you can enhance your business valuation and communicate more effectively with stakeholders.

As an entrepreneur seeking investment, prioritising financial literacy is key. You can build your knowledge of Shark Tank business terms by reading articles, financial guides, or seeking mentorship from experienced professionals. Because investing in your financial education will pay dividends in your entrepreneurial journey.

Q1. What is the formula for determining burn rate?

Ans. Burn rate refers to the monthly cash expenses of a startup. It is equal to the total monthly operational expenses. Net burn rate (calculated for revenue-generating startups) = Gross burn rate - (Monthly revenue - Cost of goods sold).

Q2. What is a good EV-to-EBITDA ratio?

Q3. Who is the richest in Shark Tank India?

Q4. Are Shark Tank angel investors?