Wise(Formerly TransferWise India): Features, Benefits & Pricing

Updated on 28th November 2025

TL;DR

- Wise (formerly TransferWise) works in India, but features vary by residency—use Wise’s India availability checker for the latest.

- For receiving payments, Wise can give local account details (USD routing, GBP sort code, AUD BSB, EUR IBAN), which makes it easier for international clients to pay.

- Wise also offers digital FIRA for every transfer at an additional cost of 2.50 USD

- The Wise card isn’t generally available to Indian residents per Wise’s own card availability list, but Wise has opened a Travel Card waitlist in India (Oct 2025).

- Some transfers to India have purpose restrictions (e.g., investment/charity not supported via Wise’s INR route)

Wise (formerly TransferWise) is a popular global platform known for its ease of use and intuitive interface, making it straightforward for individuals and businesses to manage international payments.

However, while Wise offers a convenient solution, it’s worth considering whether there are even more affordable and seamless ways to receive payments from abroad, especially if you’re looking to maximise your earnings and reduce hidden costs.

In this guide, we’ll explore how Wise works and also compare alternative options to help you choose the best fit for your needs.

What is Wise (Formerly TransferWise India)? Brief overview

Wise enables peer-to-peer and business-to-business money transfers worldwide. Initially, the Wise platform was a peer-to-peer (P2P) solution only that allowed individuals to send or receive money directly without intermediaries (like banks or credit card companies).

Later, Wise expanded into a business-to-business (B2B) payments solution, processing multi-currency transactions between enterprises.

Wise applies a mid-market foreign exchange rate without levying any forex markup. It charges a conversion fee that differs from country to country. For significant currencies like USD, EUR, GBP, and AUD, the conversion fee is approximately 1.78% of the transfer value.

If a client sends you $10,000 from the US to India through Wise, you will receive around ₹833,825. In this transaction, Wise will consider the mid-market exchange rate without any markup, which would be INR 85.033 (as of 28th April 2025). However, it will levy a Wise fee of USD 194.15 along with FIRA fee of USD 2.50, bringing the total to USD 164.49 (excluding GST).

In a nutshell, to receive a payment of USD 10,000 via Wise, you would need to pay a fee of USD 164.49 (excluding GST).

What are the Key Features of Wise (Formerly TransferWise India)?

Let us now assess the key features of Wise transfer:

P2P transfer

Wise’s P2P transfer feature enables individuals to transfer and receive money from friends, family, and clients residing abroad. Recipients don’t need to maintain a Wise account to receive P2P payments. They can directly receive the payment in their bank accounts.

The key benefits of the P2P transfer include:

- For P2P, Wise doesn’t charge any bank transfer fee

- Wise executes transfers at a mid-market exchange rate, the midpoint of two currencies' buy and sell prices. Wise doesn’t charge any hidden mark-ups

Wise P2P transfers are fast. 50% of these transfers are instant, and 80% of transfers are completed within 24 hours

Note that using Wise's p2p offering for business payment is not ideal, as Wise p2p doesn't offer FIRA, making compliance difficult

B2B transfer

Wise offers a comprehensive B2B payment solution with multi-currency accounts for businesses to hold and manage over 50 currencies. This feature is particularly useful for companies with global clientele, assisting them in receiving payments like a local entity.

By providing local bank details in various currencies (such as GBP, EUR, and AUD), Wise eliminates the need for multiple bank accounts across different countries. Wise B2B platform also provides a batch payment feature, helping businesses simultaneously send bulk payments to other recipients.

Wise offers API integration capabilities for companies looking to streamline their financial operations. This feature allows for automating payment processes, significantly reducing the administrative burden of managing international transactions.

Multi-currency virtual accounts

Wise multi-currency virtual accounts feature allows individuals and businesses to convert amounts between multiple currencies when engaging in international transactions. Since you can hold and manage multiple currencies, you don’t need to maintain multiple bank accounts in different locations. A single user can manage over 40 different currencies in their Wise account.

Debit Card facility

The Wise debit card is a convenient solution for businesses, travellers, or shoppers who often purchase products online from international brands. However, note that Wise debit card facility is currently not available in India. However, as of 10th October 2025, Wise opened a Travel Card waitlist in India

Digital FIRA

To ease compliance, Wise also offers digital FIRA to Indian businesses and freelancers for every international payment. However, it charges an eFIRC fee for the same, which varies across currencies. For example, for USD payments, Wise (formerly TransferWise India) charges USD 2.50 for digital FIRA.

Is Wise transfer allowed in India?

Yes, Wise transfers are allowed in India. It is a trusted financial service provider approved by the Reserve Bank of India (RBI). However, there are some specific regulations and conditions regarding sending and receiving INR that you should know. You can find the regulations right here.

Additionally, the following Wise services are unavailable in India:

- Outbound Transfers for New Customers: New customers in India cannot send money in Indian Rupees (INR) using Wise. Only existing customers who have previously used the service can make outbound transactions from India (Source)

- Wise Debit Card: The Wise debit card is not available for residents of India. Although users can use their Wise cards for spending in other countries, Indian residents cannot obtain a Wise debit card (Source). However, their travel card waitlist is currently open in India.

Wise (Formerly TransferWise India) Fees: All You Need to Know

Here’s a quick breakdown of Wise fees for receiving money from abroad as an Indian business:

| Activity | Fee Category | Amount |

| Receiving international payment | Registration fee | Free |

| Forex rate | Mid market rate without any markup | |

| Conversion fee | Varies accross currency and amount. Roughly it comes to around 1.6-1.7% of the total tramsfer amount for major currencies | |

| eFIRC Fee | Varies across currencies. For USD it is 2.5 USD |

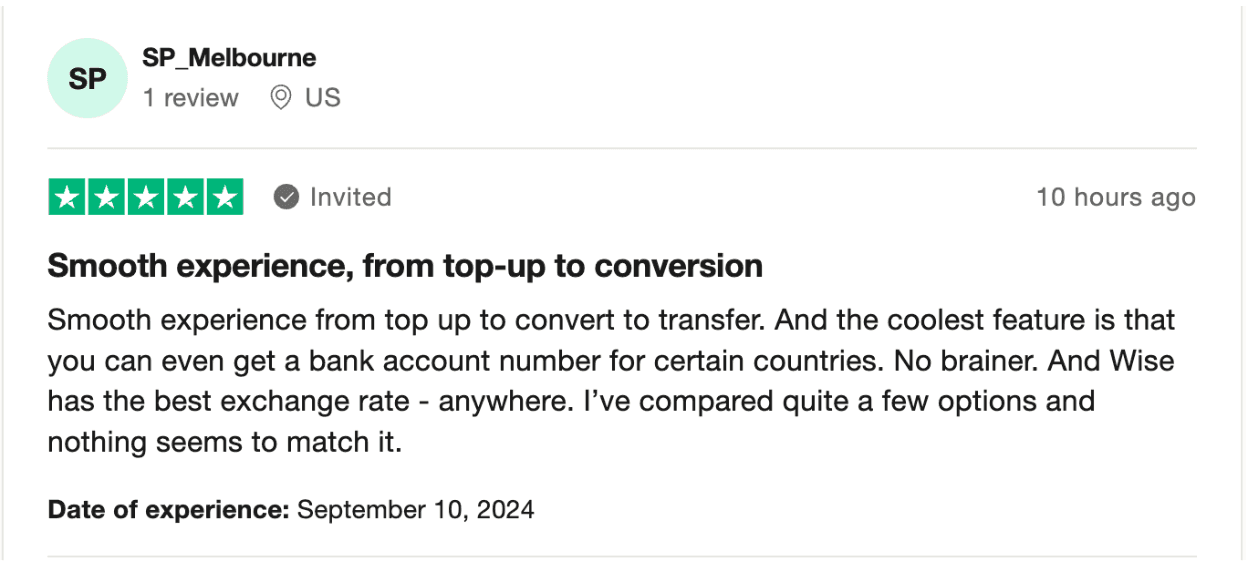

TransferWise India Review: The Good, Bad and The Ugly

Here’s how Wise customers rated the solution on different platforms like G2, Capterra and Trustpilot:

| Platform | Rating |

| G2 | 3.9/5 |

| Trustpilot | 4.2/5 |

| Capterra | 4.3/5 |

This is what users ha

The goods:

- TransferWise is easy to use, has a simple user interface, offers good exchange rates and provides bank account details for your preferred country

- Reasonable fee and faster than other international payment modes

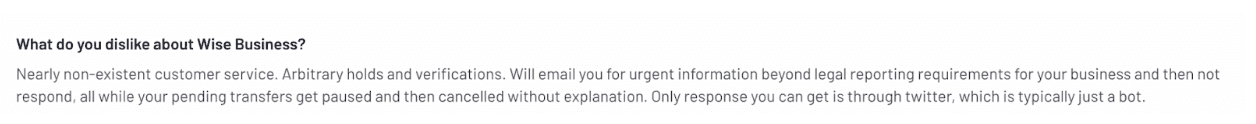

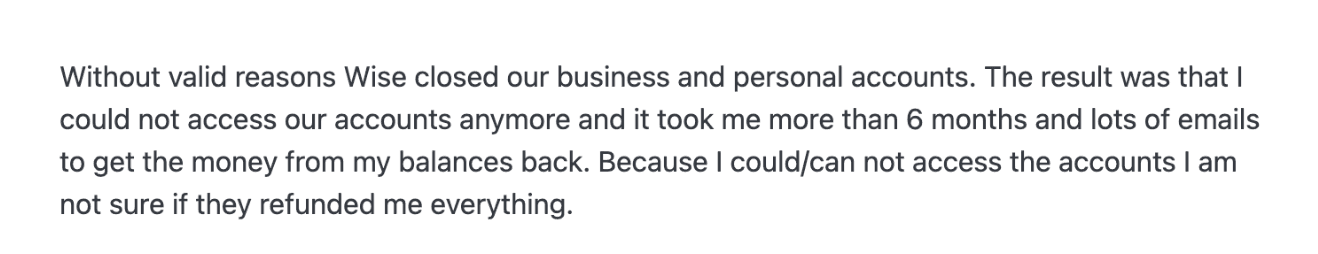

The ‘not so goods’:

- Some users have reported dissatisfaction with customer service

Please note: These insights are based on user reviews gathered from public platforms and do not reflect Skydo’s opinions.

Wise (Formerly TransferWise India) Alternatives to Note

If you’re looking for Wise alternatives to receive international payments in India, some of the most widely used platforms include PayPal, Payoneer, and Skydo.

PayPal and Payoneer are both established options, each with its own pricing structures and features. PayPal operates with a transaction fee, a flat charge per payment, and a currency conversion component, while Payoneer applies a percentage-based forex markup and an annual fee in case of account inactivity.

Skydo takes a different approach by offering a flat fee based on the transfer amount and using live forex rates without any additional markup. It also provides virtual international bank accounts and instant FIRA (Foreign Inward Remittance Advice) for every transaction, making compliance straightforward for Indian users.

It’s a good idea to review the details and consider which solution best fits your payment needs and business preferences.

To explore Skydo, sign-up today!

Does TransferWise work in India?

Yes, Wise (formerly TransferWise) works in India, but with limitations. Further, the Wise debit card is also not available for Indian residents.

Is Wise a good payment method?

Which is the best Wise alternative for receiving international payment in India?