US Cross-Border Payments: Accountant's Checklist

Expanding your business globally and catering to international customers is a significant growth opportunity. According to the Ministry of Commerce and Industry, Indian export services grew by 42% in 2022-23 from 2021-22.

Export helps diversify your business into various markets, gives you access to a wider audience, generates greater revenue, and helps you gain foreign investment opportunities. However, it has its set of challenges.

One of these challenges is receiving payments from international clients. The common issues with cross-border payments include exchange rates, hidden fees, tracking, processing fees and defaults. They affect cash flow and, by extension, business success.

This is where your accountant comes in.

An accountant plays a pivotal role in managing the financial aspects of cross-border transactions and ensuring smooth payments from US clients. Their attention to detail, financial expertise, and ability to track and manage cash flow effectively contribute significantly to avoiding financial losses and supporting business growth in international markets.

However, billing US clients and successfully receiving the payments in your company's bank account can be a long battle. You have to be careful of every step and be prepared for the next action to avoid non-payment or delays in payment. Therefore, if you’re looking to expand your service offerings to the US, it is essential to create and follow a checklist for receiving payments from them.

The purpose is to avoid financial losses and ensure business growth. Here is a step-by-step concrete checklist for your accountant on how to bill and receive payments from your US clients.

Your Accountant’s Checklist for Global Payments

1. Understanding the Business's Needs

As tech exporters, you might have to purchase hardware or software to provide services to your client. You may also have to pay suppliers and consultants working on the project and keep advance stock. It helps you prepare a defined process on how and when you want to receive money from US clients.

You can keep the following points in mind while discussing payment terms with your client.

- How long will the payment cycle be?

- Will the client make payment upfront, every month or at the end of the project? This is essential to maintain your cash flow.

- At what interest rate will the customer pay in case of default?

- In the case of contract termination, will the client pay the complete value of the pending order or services, or will it be pro rata?

- What are the remedies for delay in payments from the client's side

- What if the client finds a deficiency in the business? How much of the proportion will get reduced?

- Does your budget include paying bank transaction charges?

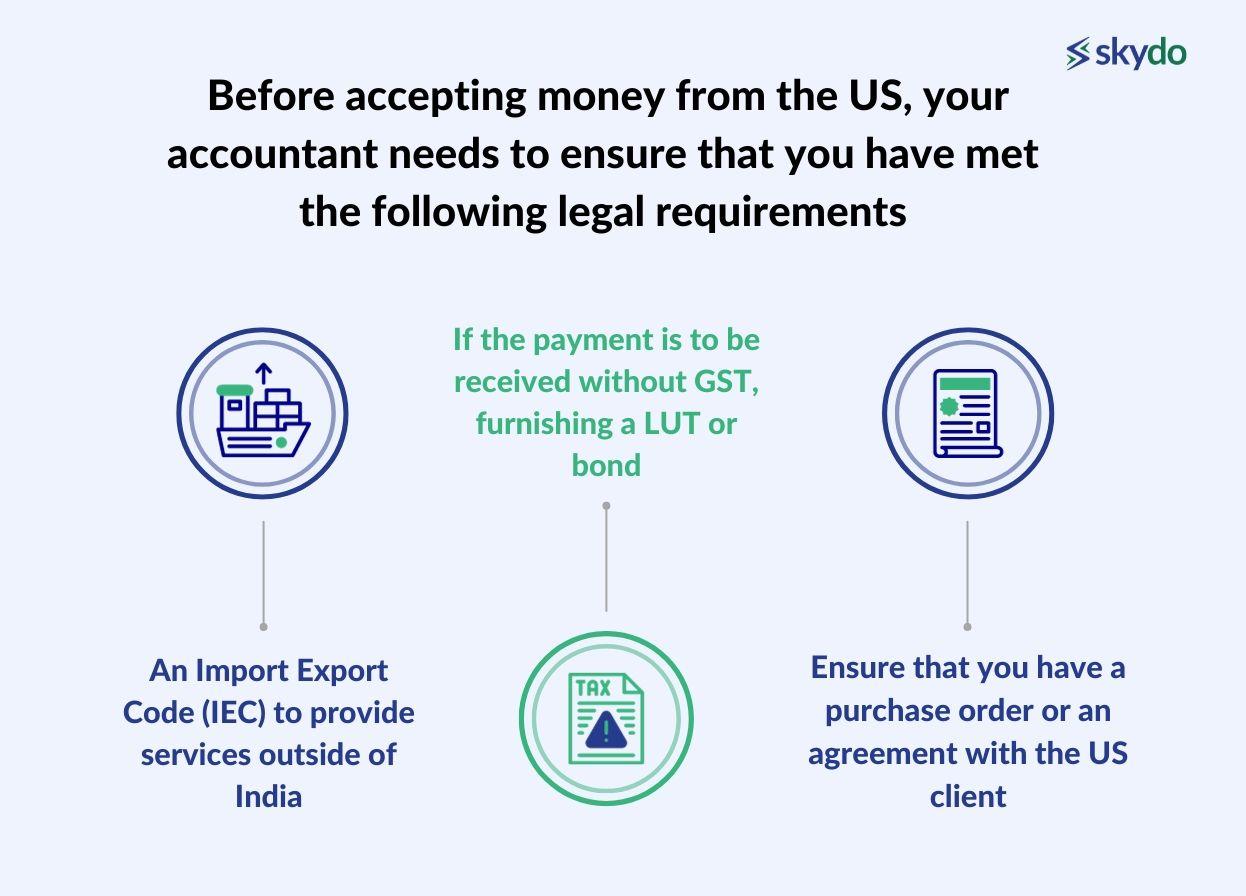

2. Compliance with Legal Requirements

Once you have defined the payment terms, you must check legal and regulatory compliances. Under the GST regime, the export of services is covered under 'zero-rated supply', which means that zero GST is charged on export.

If you receive payments in US dollars, zero GST will be applicable. However, if you receive the payment in Indian currency, 18% GST will be applicable on foreign exchange transactions. Before accepting money from the US, your accountant needs to ensure that you have met the following legal requirements:

- An Import Export Code (IEC) to provide services outside of India

- If the payment is to be received without GST, furnishing a LUT or bond

- Ensure that you have a purchase order or an agreement with the US client

Also read: Understanding GSTIN Requirements for Export Businesses in India

3. Payment Method Selection

The next step is choosing the appropriate payment method to receive money from the US. These can include:

- Wire transfer for accepting payments directly in the bank

- Receiving payment through a third-party platform that supports international payments, such as Skydo

- Payment in cryptocurrencies such as Blockchain

You can finalise the appropriate mode for receiving payment by considering the following factors:

- Foreign exchange rates

- Currency conversion charges and other processing fees

- Security measures available

- Adherence to compliance

- Ease of use

You can also read: Payment Trends to Watch Out for in the Global Business Landscape

4. Record Keeping

Another crucial step in getting money from the US or any domestic or international client is to keep proper records and documentation of all transactions, taxes withheld, bank transaction charges, and other relevant documents. This helps tally the balance sheet and perform financial audits at the end of the financial year.

5. Reporting

A crucial accounting process, it involves organising financial data in a structured manner and preparing informative reports on such data. It can include both financial and performance reporting.

While financial reporting includes identifying and recording various international transactions and preparing financial statements, performance reporting refers to analysing the financial performance of the company basis predefined objectives.

6. Reconciliation

Once you have received payment confirmation from your client, your accountant must do proper bank reconciliation to verify the payments and ensure that all payments are correctly recorded in the company's books. Bank reconciliation helps avoid any discrepancies in financial records, such as currency conversion charges.

Streamlining the Process with Skydo

Stuck international payments block cash flow and might hinder your regular business operations. Skydo streamlines the process of receiving money from US clients. Let's understand how.

There are two scenarios while receiving money from the US:

Scenario 1: The client pays in the US currency.

In such a case, the amount is immediately deducted from the client's bank account and transferred to your account, then converted into rupees from US dollars.

Currency conversion often occurs over several days, and banks charge hefty fees per transaction. Another challenge is bank reconciliation because the amount after currency conversion does not match the invoice amount. Fluctuations in exchange rates may further create a mismatch.

Scenario 2: The client remits money in INR.

In this case, the money is not immediately wired from the client's bank account. It is first converted from US dollars to Indian currency. This is a tedious process which can take up to a week before the funds are withdrawn from the client's account.

Also read: Should I Invoice in INR or Foreign Currency?

In both scenarios, the payment can take up to one week or even more to finally reach your business' bank account. Skydo aims to simplify this process, making it easier and faster to receive money from US clients by helping businesses open a local receiving bank account in the US.

The client easily transfers the payment to the local bank amount, which can be claimed as foreign inward remittances. Hence, Skydo reduces the time processing time and various charges and helps you get your money from the US without any hassle.

In addition to opening a local receiving bank account in the US, the following are some additional features of Skydo that help make the payment receiving and managing process more robust.

- It helps file GST returns easily by providing timely Foreign Inward Remittance Advice (FIRA) certificates

- Skydo automatically prepares e-invoices, reducing manual effort

- It provides advanced analytics on payment activities and cashflow, allowing you to make data-driven financial decisions

- Skydo has zero FX margin. This helps businesses save up to ₹10,00,000 per year, and this FX saving can be used for core business activities and increase profitability.

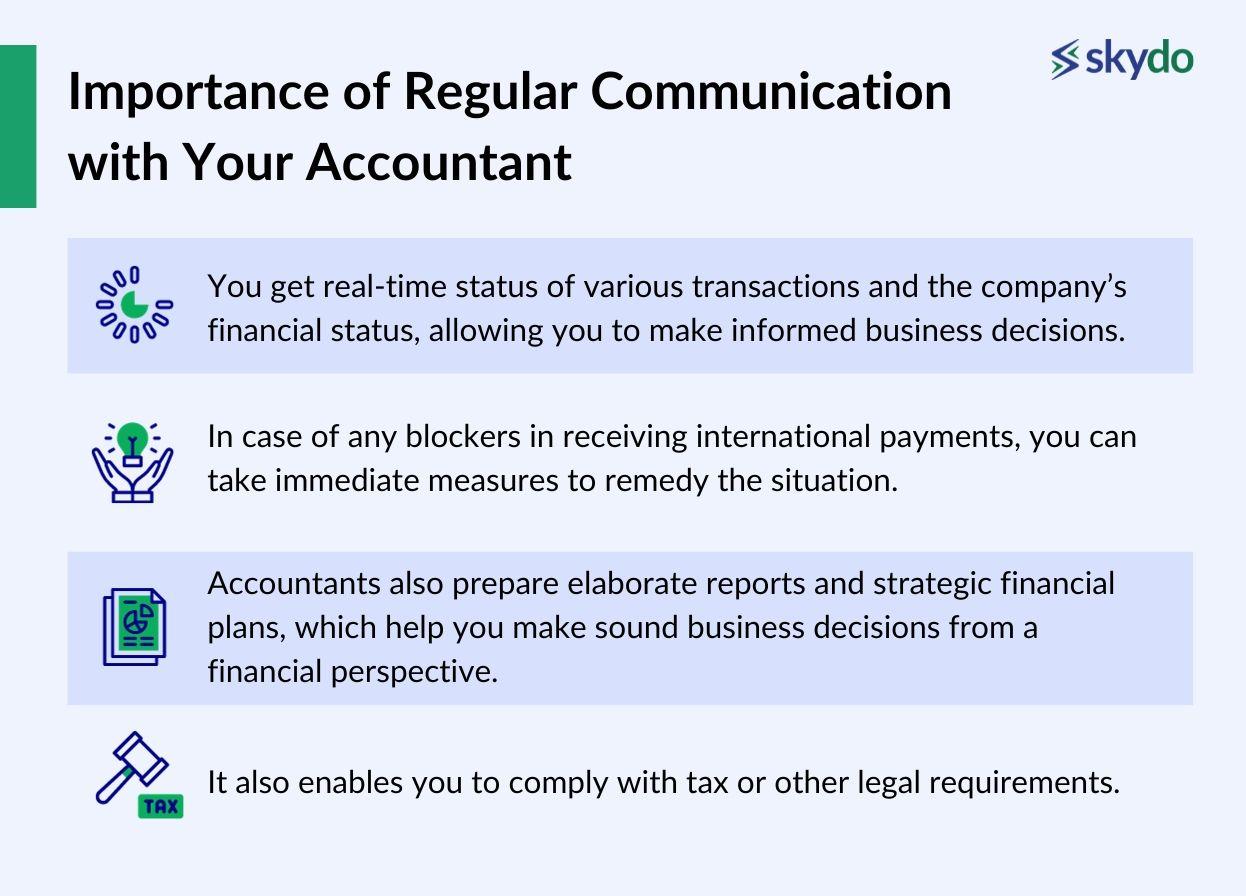

Importance of Regular Communication with Your Accountant

The role of your accountant is not restricted to receiving global payments. You need to ensure regular and clear communication with them. Here's why:

- You get real-time status of various transactions and the company’s financial status, allowing you to make informed business decisions.

- In case of any blockers in receiving international payments, you can take immediate measures to remedy the situation.

- Accountants also prepare elaborate reports and strategic financial plans, which help you make sound business decisions from a financial perspective.

- It also enables you to comply with tax or other legal requirements.

The following is a list of tools and integrations that you can leverage for effective communication with your accountant:

Also read: Top Accounting Tools for a Streamlined Bookkeeping Experience for Tech Exporters

TL;DR

Having a checklist in place to receive money from the US makes the process more effective and simpler. It gives the accountant a proper idea of the actions to be taken to receive money and how to tackle various hurdles faced while receiving payments.

Skydo provides live foreign exchange rates and charges a flat fee per transaction, thus ensuring smooth international payments. It becomes easier for you and your accountant to keep track of international payments and optimise your cash flow. This further helps your business grow and tap opportunities in the market at an early stage.

Frequently Asked Questions

Q1. How does currency conversion affect international transactions?

Ans: Currency conversion significantly impacts international transactions by introducing potential discrepancies and affecting the final amount received. Exchange rates fluctuate, leading to variations in the converted amount. This dynamic process can result in financial discrepancies, affecting the accuracy of recorded transactions.

Q2. Are there legal considerations for receiving payments from the US?

Ans: Yes, legal considerations are crucial when receiving payments from the US. Businesses must adhere to regulatory requirements and tax obligations.

In the context of international transactions, compliance with the Import Export Code (IEC), understanding GST regulations, and furnishing necessary documents, such as a Letter of Undertaking (LUT) or bond, is essential. Ensuring proper agreements with US clients and meeting legal prerequisites is vital to facilitate smooth and compliant cross-border financial transactions.

Q3. What is the difference between import LC and export LC?

Ans: Import LC (Letter of Credit) and Export LC refer to financial instruments in international trade. An Import LC is issued by the buyer's bank, ensuring payment to the seller upon receipt of specified documents.

Conversely, an Export LC is issued by the seller's bank, guaranteeing payment upon fulfilling agreed-upon conditions. Import LC protects the buyer, while Export LC safeguards the seller, providing a secure framework for global transactions and mitigating risks for both parties.