What is an Overdraft Facility? Its Types, Benefits and Eligibility

Meet Mr Anshul Mehta, an IT service exporter, currently facing a cash crunch due to delayed payments from his international clients. These delayed payments have affected his liquidity, making it challenging for him to pay salaries to his staff and fulfil his tax obligations on time. In this difficult situation, Mr Mehta uses his bank's overdraft facility to address his short-term capital requirements effectively.

What Is an OD Facility?

The bank overdraft facility is a valuable tool for Mr Mehta to manage his short-term capital requirements during this period of cash crunch. It allows him to bridge the gap between delayed payments and essential financial obligations without disrupting his business operations.

In times of financial difficulty, a bank overdraft facility can be a lifesaver for businesses like Mr Mehta's. It provides a flexible and approved line of credit to address short-term capital requirements, allowing entrepreneurs to manage their financial obligations efficiently.

By judiciously utilising such facilities, businesses can navigate challenging times and ensure continuity and growth.

How Does the OD Facility Work?

The Overdraft Facility allows you to withdraw money over the amount available in your bank account within the specified limit. This means you can use an overdraft facility even if your account has zero balance. It is a short-term credit agreement to help you meet more immediate or direct capital requirements.

The scope of the overdraft facility depends on the credit limit pre-sanctioned by the bank based on its relationship with the customer. You can withdraw small amounts of money or the entire credit limit together. An overdraft facility differs from a business loan as you are charged interest only on the amount you withdraw, not the total sanctioned credit limit.

Overdraft interest rates may vary from one bank to another. Banks also levy OD charges for non-maintenance of the account. While there are no prepayment penalties, banks may charge you increased interest rates if you default on your payments.

The repayment duration is 12 months, compared to a business loan, which can extend to 10 years. You can repay in a lump sum amount or instalments, unlike loans with regular EMIs to be paid over a fixed tenure.

Mostly, all financial institutions in India provide an overdraft facility to their customers. However, the amount and rate of interest depends upon several factors, such as–

- The borrower’s profile

- Credit score rating and financial history

- Relationship with the bank

- Repayment capacity

Features of an Overdraft Facility

An Overdraft Facility includes several key features tailored to provide flexibility and financial convenience, such as–

- Approved Limit of Credit: Tailored to individual business needs, the Overdraft Facility provides an approved credit limit, ensuring businesses access funds within specified boundaries.

- Interest Rate Flexibility: The interest on the overdraft applies exclusively to the utilised amount, offering a cost-effective alternative to traditional loans.

- No Charges on Repayment: Unlike typical loans, overdrafts eliminate additional charges upon repayment, providing financial relief to borrowers.

- Repayment Anytime: The flexibility of overdrafts allows businesses to repay borrowed amounts at their convenience, without the constraints of fixed EMIs.

- Repayment Structure Variation: While no fixed EMI structure exists, some lenders may suggest specific repayment timelines, maintaining a balance between flexibility and structured financial management.

Types of OD Facilities

An overdraft facility can be secured or unsecured.

A secured overdraft can help you access additional funds if you have specific assets, such as property, fixed deposit, insurance policies, and equity investments, to offer as collateral against the overdraft. Unsecured overdrafts allow you to access your bank's sanctioned line of credit without collateral.

The interest rates on unsecured overdraft facilities are higher than secured overdrafts.

Eligibility and Application Process

1. Eligibility Criteria for OD Facility

- Age: Any person between the ages of 21 and 65 years

- Bank account: Applicant must have an account with an existing bank

- Minimum Income threshold: varies from bank to bank

- Credit score: A good credit score is an added advantage

2. Required Documents

- Duly filled-in application form with a passport-size photograph

- Identity proof such as Passport, voter ID card, PAN card, License, Aadhar card

- Address proof such as Passport, Driving License, Voter ID card, and Utility Bills

- Age proof such as a Class X certificate, Passport

- Last 12 months’ bank statement

- Any other document asked by the lender or bank

3. Application Process

If the bank does not offer a pre-approved overdraft limit, you can apply for it with the bank by filling out the official form and furnishing the required documents. You can initiate the application process via internet or mobile banking or by visiting your bank branch.

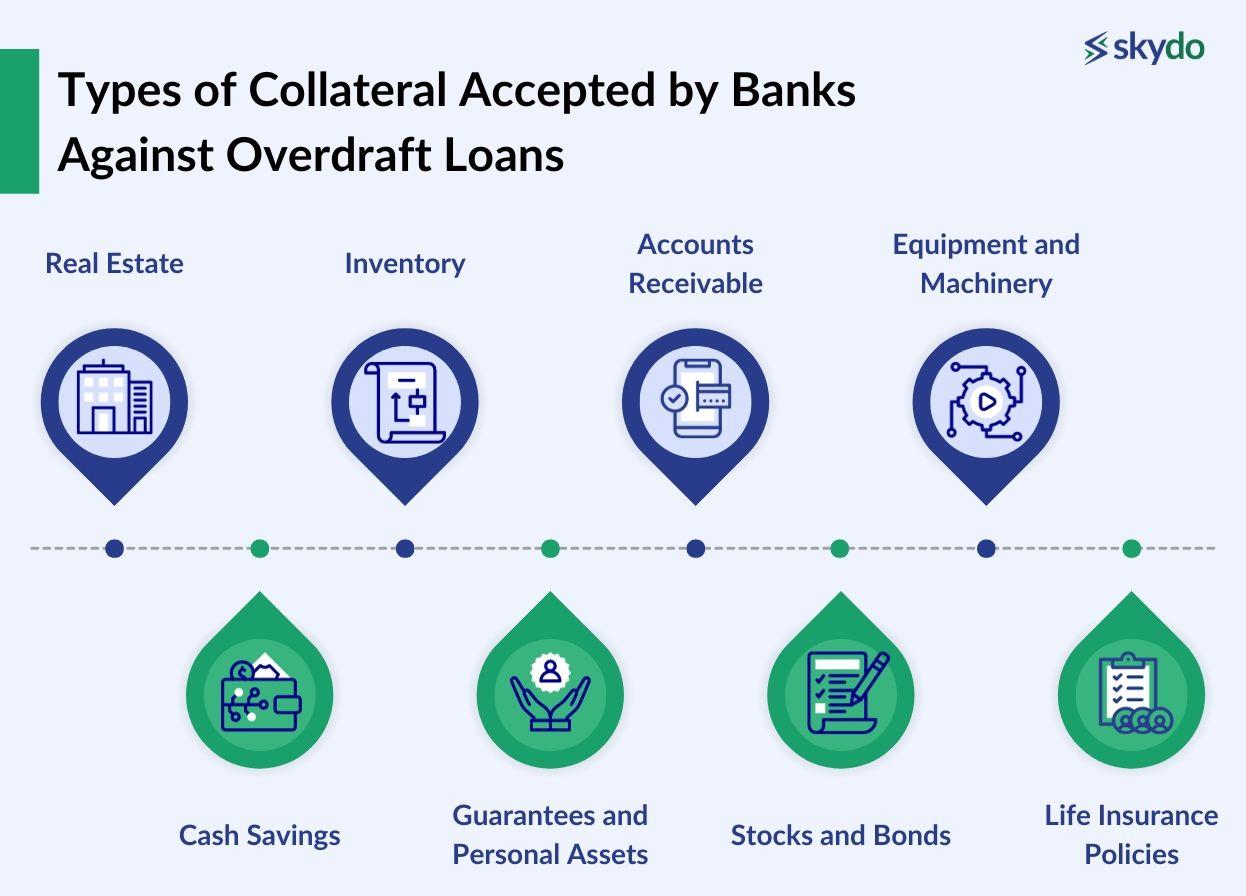

Types of Collateral Accepted by Banks Against Overdraft Loans

Banks typically accept various types of collateral against overdraft loans, providing security for the extended funds. The types of collateral may vary, and the acceptance depends on the bank's policies and the borrower's financial profile.

Here are common types of collateral accepted by banks against overdraft loans.

- Real Estate: Residential or commercial properties can serve as collateral. The bank may assess the property's value and equity to determine the credit limit.

- Inventory: Pledging inventory is common in industries where its value is relatively stable and easily appraised.

- Accounts Receivable: Banks may accept a portion of a business's accounts receivable as collateral. This process, often supported by accounts receivable automation, involves using unpaid customer invoices to secure the overdraft, streamlining collections and improving cash flow efficiency.

- Equipment and Machinery: You can pledge tangible assets such as machinery or equipment. The bank assesses the value and depreciation of these assets to determine their suitability as collateral.

- Cash Savings: Some banks allow borrowers to use their cash savings or certificates of deposit (CDs) as collateral. It provides a straightforward and liquid form of security.

- Guarantees and Personal Assets: Personal guarantees or assets, such as the borrower's personal property or investments, may be accepted as collateral, especially for small businesses or individual borrowers.

- Stocks and Bonds: Marketable securities, such as stocks and bonds, can be used as collateral. The value of these assets may influence the credit limit granted by the bank.

- Life Insurance Policies: Borrowers may pledge the cash value of their life insurance policies as collateral. This is a way to use a personal financial asset to secure business credit.

Advantages of an OD Facility

- Financial Flexibility and Convenience: An overdraft facility is a flexible way of accessing short-term credit to meet your immediate business needs. It is further convenient as you don’t need to submit tedious documentation and follow the approval processes in a business loan. The rejection ratio for loans is also higher, while the overdraft facility is readily available with most bank accounts.

- Quick Access to Funds: With an OD facility, you avoid the hassles of procuring a business loan, which can take weeks to get sanctioned and credited to your account. You can avail of the OD facility at any time if you have a bank account with the respective bank.

- Cost-Effective Borrowing Option: The interest rate charged on the overdraft facility is lower than that on a business loan. Additionally, there are no prepayment penalties involved. The interest gets charged only on the amount you withdraw from your bank account, making ODs a cost-effective option to secure quick credit.

- Improving Cash Flow Management: An overdraft facility can provide immediate liquidity to improve overall cash flow management in daily business operations.

Disadvantages of an OD Facility

While an Overdraft (OD) Facility offers financial flexibility, it has some inherent disadvantages.

- High-interest rates, making it a costly form of borrowing

- The absence of a fixed repayment structure

- The OD approval is contingent on a good credit history

- Dependency on overdrafts may mask underlying financial issues, hindering long-term financial stability.

Careful consideration and financial planning are essential to mitigate these disadvantages and maximise the benefits of an OD Facility.

Tips for Using an OD Facility Responsibly

- Understanding the Purpose of the OD Facility: An overdraft facility allows businesses and individuals to meet urgent credit needs. It is a form of a loan you need to pay with interest. You must use the OD facility only when necessary and comply with the repayments in time.

- Monitoring and Managing the Credit Limit: Banks allow you to increase or decrease the credit limit on your overdraft facility. Keep a strict eye on your credit needs and set a limit accordingly.

- Repayment Strategies: While banks don’t have an instalment system for OD repayment, you still need to repay within a fixed tenure. The interest rates are applicable daily. Therefore, the sooner you finish your OD repayments, the more you save on interest.

- Avoiding Over Utilisation: Withdraw only the required funds from your OD limit to save on interest expenses and the unnecessary hassles for repayment. Prevent clauses where banks penalise underutilisation.

Summary

Borrowing through an overdraft is similar to borrowing a loan from a bank without the formalities and paperwork. Bank accounts may come with pre-entitled credit limits, or you can avail of the facility by applying with your bank or lender.

An overdraft facility provides businesses with immediate liquidity and cash flow management to meet short-term expenses cost-effectively. However, you should use ODs responsibly to ensure you remain in good financial standing with an appropriate credit rating.

Frequently Asked Questions about OD Facilities

Q1. When is a loan better than an OD facility?

Ans: A loan is better than an overdraft when you require an extensive credit amount over a longer period. Often, companies require huge funds to finance long-term business needs, such as buying land or updating technology. In that case, business loans are a better choice than ODs.

Q2. Which bank provides an overdraft facility?

Ans: The availability of an overdraft facility depends on the policies of individual banks. Most commercial banks offer overdraft facilities, and the specific terms and conditions can vary among different financial institutions.

Q3. Are overdraft facilities good or bad?

Ans: The perception of overdraft facilities as good or bad depends on individual financial situations. While they offer flexibility, misuse can lead to high interest costs. Prudent management is essential for their adequate use.

Q4. Can I use the OD Facility for personal expenses?

Ans: You can use an overdraft facility to meet your expenses if you have a savings or salaried account. The bank will sanction the OD limit based on your account.

Q5. What happens if I cannot repay the Overdraft?

Ans: If you cannot pay your OD dues, banks report the credit bureaus, negatively impacting your credit ratings. Getting credit may be further challenging as banks put you in the high-risk borrower bracket. It can also result in increased interest rates on future loans and credits.

Q6. How is the interest calculated on an OD Facility?

Ans: Banks calculate the interest on your OD Facility by the average daily balance method on the amount you withdraw from your account.

Q7. Can I increase the limit of my OD Facility?

Ans: You can apply with your lender or bank to increase or decrease your OD limit using the internet or mobile banking or by directly visiting your bank branch.

Q8. Can I withdraw money from Overdraft?

Ans: An overdraft allows account holders to withdraw money up to the approved limit, even if the account balance is insufficient. Interest is charged on the overdrawn amount.

Q9. How long can a bank account be overdrawn?

Ans: The duration a bank account can be overdrawn depends on the terms set by the bank and the account holder's creditworthiness. It is typically subject to the agreed-upon overdraft limit.

Q10. What is the treatment of a bank overdraft on a balance sheet?

Ans: A bank overdraft is recorded as a liability on the balance sheet, reflecting the amount owed to the bank by the account holder. It appears in the current liabilities section.

Q11. What is the difference between a Term Loan and an Overdraft Facility?

Ans: A term loan provides a lump sum amount with fixed repayment terms, while an overdraft facility offers a flexible credit line with interest charged only on the amount used, allowing for intermittent repayments.

Q12: Can the Overdraft facility be availed through Internet Banking?

Ans: Many banks allow account holders to manage and avail of overdraft facilities through Internet banking, providing convenience and accessibility.

Q13. How many salary credits are required in my existing account to qualify for Overdraft?

Ans: The criteria for qualifying for an overdraft vary among banks. Typically, a regular salary credit history and a good financial profile enhance eligibility.

Q14. Overdraft facility is available on which type of account?

Ans: Overdraft facilities are commonly available on savings accounts, current accounts, and sometimes on specific business accounts, depending on the bank's policies.

Q15. What is the overdraft facility on FD?

Ans: Overdraft against Fixed Deposit allows account holders to borrow against the value of their fixed deposit, offering a secured credit facility with the FD as collateral.

Q16. What is the difference between cash credit and an overdraft facility?

Ans: While both involve borrowing against a credit limit, cash credit is usually linked to specific business purposes, and interest is paid on the entire credit limit. Overdraft charges interest only on the amount used.

Q17. What are the disadvantages of an overdraft?

Ans: Disadvantages of overdrafts include high interest rates, potential undisciplined financial practices, dependence masking financial issues, and limited accessibility for those with poor credit.

Q18. What are the foreclosure charges on the overdraft facility?

Ans: Foreclosure charges on an overdraft facility vary among banks. They typically involve a fee for repaying the overdraft before the agreed-upon tenure and should be clarified with the respective bank.